ICSE Class 10 - GST Videos

Goods and Services Tax

This video explains the concept of GST and an application based on it.

More videos from this chapter

View All- a dealer in Bhopal (MD) say x supply good and services worth rs.8000 to y a person in Indore (MD) . if the of GST is 28% find CGST SGST IGST

-

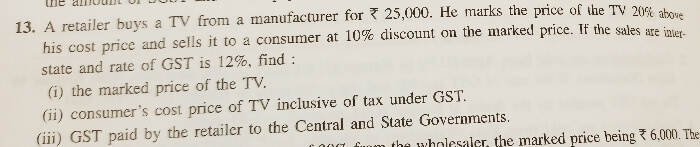

Answer question 13 from ICSE 10 Selina book Exercise 1(B)

A retailer buys a TV from a manufacturer for rs 25000. he marks the price of the tv 20% above his cost price and sells it to a customer at 10% discount on the marked price.

-

hh

- WHAT IS GST?

- Rohit purchased an article and paid GST of Rs. 10,400. He sold the article to Manish and collected GST of Rs. 11,000. Geeta purchased the same article from Manish and paid GST of Rs. 11,800. Find the amount of SGST and CGST payable at each stage if each transaction is intra state.

- A wholesaler dealing in electric goods, sells an article at its printed price of Rs. 45,000 to a dealer at 10% discount. The dealer sells the same article to a customer at a discount of 4% on its printed price. If the sales are inter-state and the rate of GST is 18%, find : (i) the amount of tax, under GST, paid by the dealer to the central and state governments. (ii) the amount of tax, under GST, received by central and state governments. (iii) the total amount, inclusive of tax, paid by the consumer for the article.

- A shopkeeper sella an A.C. to Ms. Alka for rs 31200 including GST at the rate of 28%. If the shopkeeper and Ms. Alka both are from the same city, find for the shopkeeper: (i) total amount of GST (ii) taxable value of A.C. (iii) amount of CGST (iv) amount of SGST

-

Please answer...

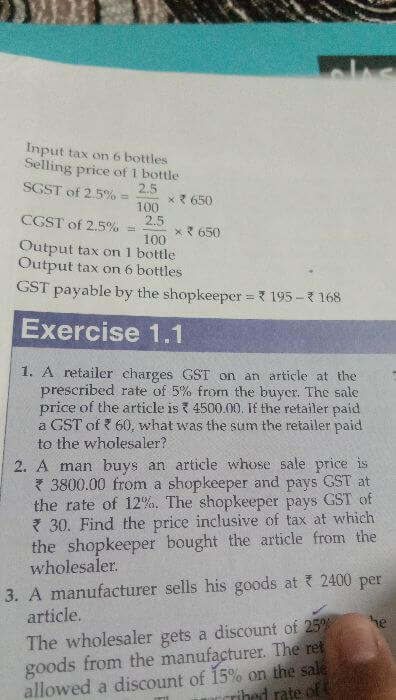

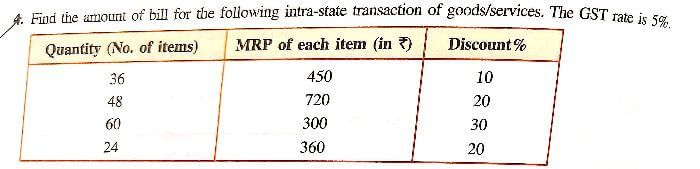

Find the amount of bill for the following intra-state transaction of goods/services. The GST rate is 5%

- A wholesaler buys a TV from a manufacturer for ?25,000. He marks the price of the TV 20% above his CP and sells it to a retailer at a 10% discount on the MP. If the rate of GST is 28%. Find: (i) MP (ii) retailer's CP inclusive of tax. (ii) the GST paid by the wholesaler to the government.

- How to calculate CGST?