ICSE Class 10 Answered

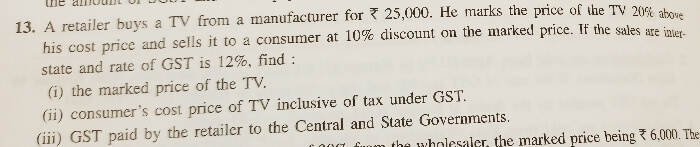

Question 13:

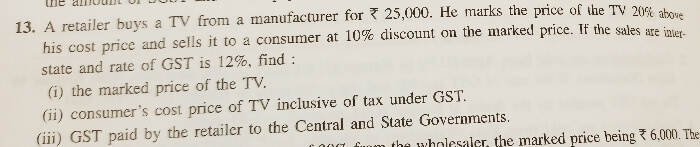

A retailer buys a TV from a manufacturer for rs 25000. he marks the price of the tv 20% above his cost price and sells it to a customer at 10% discount on the marked price. If the sales are inter-state and rate of GST is 12%, find:

(i) the marked price of the TV

(ii) consumer's cost price of TV inclusive of tax under GST

(iii) GST paid by the retailer to the Central and State Governments.

Solution:

(i)

Marked price of T.V. = 25000 + 20% of 25000 = Rs. 30000

(ii)

Marked price = Rs. 30000

Discount = 10% = Rs. 3000

∴ Cost price for consumer without tax = 30000 – 3000 = Rs. 27000

GST paid by the consumer = 12% of 27000 = Rs. 3240

∴ Consumer’s cost price of TV inclusive of tax under GST = Rs. (27000 + 3240) = Rs. 30240

(iii)

For the retailer:

Input tax = 12% of 25000 = Rs. 3000

Output tax = 12% of 27000 = Rs. 3240

GST paid by the retailer to the Central and State Governments = Output tax – Input tax

= Rs. (3240 – 3000)

= Rs. 240