ICSE Class 10 Answered

Rohit purchased an article and paid GST of Rs. 10,400. He sold the article to Manish and collected GST of Rs. 11,000. Geeta purchased the same article from Manish and paid GST of Rs. 11,800. Find the amount of SGST and CGST payable at each stage if each transaction is intra state.

Asked by varma.renu9481 | 05 Apr, 2023, 11:57: AM

For Rohit:

Input tax = Rs. 10,400

Output tax = Rs. 11,000

GST paid by Rohit = Output tax – Input tax = Rs. 600

SGST = CGST = Rs. 300

For Manish:

Input tax = Rs. 11000

Output tax = Rs. 11800

∴ GST paid by Manish = 11800 – 11000 = Rs. 800

∴ SGST = CGST = Rs. 400

Answered by Rashmi Khot | 05 Apr, 2023, 15:57: PM

Concept Videos

ICSE 10 - Maths

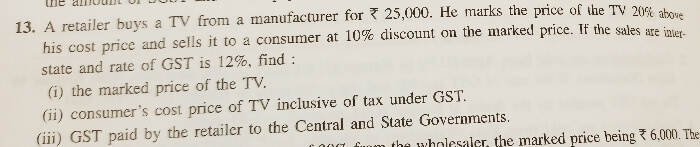

Asked by kabitanjalibehera5 | 20 Dec, 2023, 17:46: PM

ICSE 10 - Maths

Asked by sagarmishra | 25 May, 2023, 09:08: AM

ICSE 10 - Maths

Asked by varma.renu9481 | 05 Apr, 2023, 11:57: AM

ICSE 10 - Maths

Asked by varma.renu9481 | 05 Apr, 2023, 11:56: AM

ICSE 10 - Maths

Asked by varma.renu9481 | 03 Apr, 2023, 11:18: AM

ICSE 10 - Maths

Asked by varma.renu9481 | 03 Apr, 2023, 11:15: AM

ICSE 10 - Maths

Asked by nishkamiglani | 28 Mar, 2023, 22:09: PM

ICSE 10 - Maths

Asked by anupamakanojia12 | 18 Mar, 2023, 17:49: PM