ICSE Class 10 Answered

For the wholesaler:

Marked price = Rs. 45000

Discount = 10% = Rs. 4500

S.P. = M.P. – Discount

= 45000 – 4500

= Rs. 40500

For the dealer:

C.P. = Rs. 40500

Discount = 4% of 45000 = Rs. 1800

S.P. = M.P. – Discount

= Rs. 45000 – Rs. 1800

= Rs. 43200

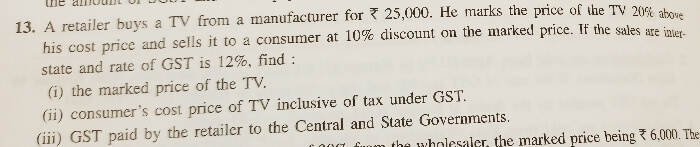

(i)

Tax paid by the dealer to the central government

= Output tax – Input tax

= Tax on S.P. – Tax on C.P.

= 18% of 43200 – 18% of 40500

= 7776 – 7290

= Rs. 486

Tax paid by the dealer to the state government = Rs. 0

(ii)

GST paid by the dealer = 18% of 43200 = Rs. 7776

∴ GST received by the central government = 7776

Since, the transaction is inter-state.

So, GST received by the state government = Rs. 0

(iii)

For the consumer:

C.P. = S.P. for dealer = Rs. 43200

GST paid by the consumer = 18% of 43200 = 7776

∴ Total amount paid by the consumer = Rs. 50976