ICSE Class 10 Answered

hh

Asked by 16032 | 11 May, 2023, 21:00: PM

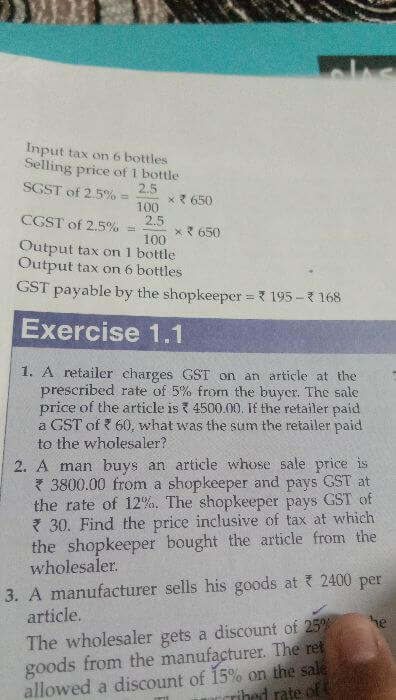

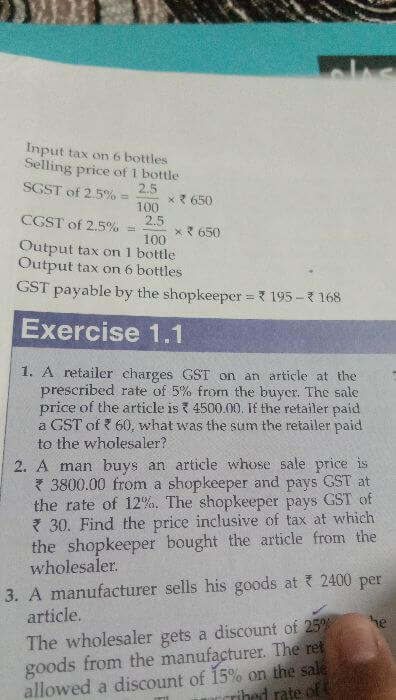

SP of an article = Rs. 4500

GST = 5% of Rs. 4500 = Rs. 225 = GST received by retailer

GST paid by retailer = Rs. 60

Therefore, GST = GST received by retailer - GST paid by retailer = Rs. 225 - Rs. 60 = Rs. 165

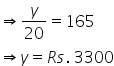

Let the wholesaler sale article to retailer for Rs. y.

Then, GST = 5% of y

Now,

GST charged by wholesaler to retailer = Input tax credit

Answered by Rashmi Khot | 12 May, 2023, 10:53: AM

Concept Videos

ICSE 10 - Maths

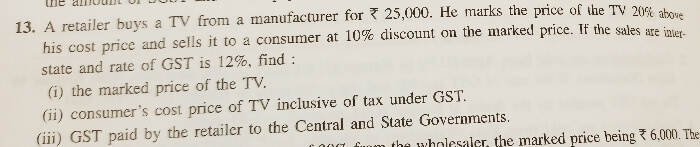

Asked by kabitanjalibehera5 | 20 Dec, 2023, 17:46: PM

ICSE 10 - Maths

Asked by sagarmishra | 25 May, 2023, 09:08: AM

ICSE 10 - Maths

Asked by varma.renu9481 | 05 Apr, 2023, 11:57: AM

ICSE 10 - Maths

Asked by varma.renu9481 | 05 Apr, 2023, 11:56: AM

ICSE 10 - Maths

Asked by varma.renu9481 | 03 Apr, 2023, 11:18: AM

ICSE 10 - Maths

Asked by varma.renu9481 | 03 Apr, 2023, 11:15: AM

ICSE 10 - Maths

Asked by nishkamiglani | 28 Mar, 2023, 22:09: PM

ICSE 10 - Maths

Asked by anupamakanojia12 | 18 Mar, 2023, 17:49: PM