ICSE Class 10 Maths ITC

-

Q 15 from ICSE 10 Selina book Exercise 1(B)

A shopkeeper in Punjab buys an article at a printed price of rs 20000 from a wholesaler in Delhi. The shopkeeper sells the article to a customer in Punjab at a profit of 25% on the cost price.

- gst

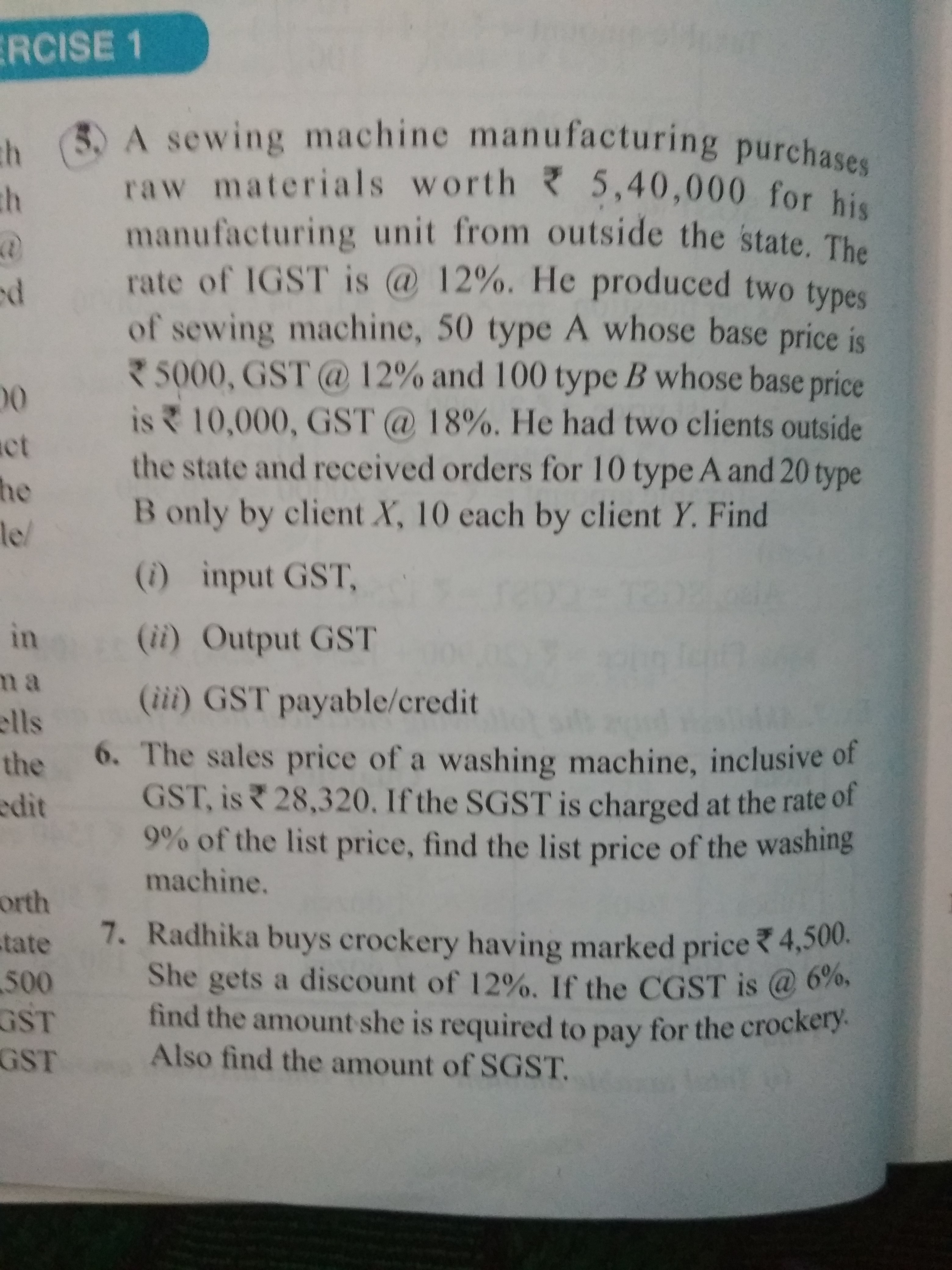

- A shopkeeper buys tea leaves worth Rs3000 and sells it at profit of 20% in the same state GSTIS charged at 5%find the selling price. CGST. SYSTEM. and . total amount paid by the costomer standard

-

- M/s men beauty products paid 18%GST on cosmetics worth RS.8000 and sold to the customer for rs.11500. What are the amounts of CGST and SGST charged in the tax invoice issued?