CBSE Class 12 Commerce Free Doubts and Solutions

CBSE - XII Commerce - Accountancy

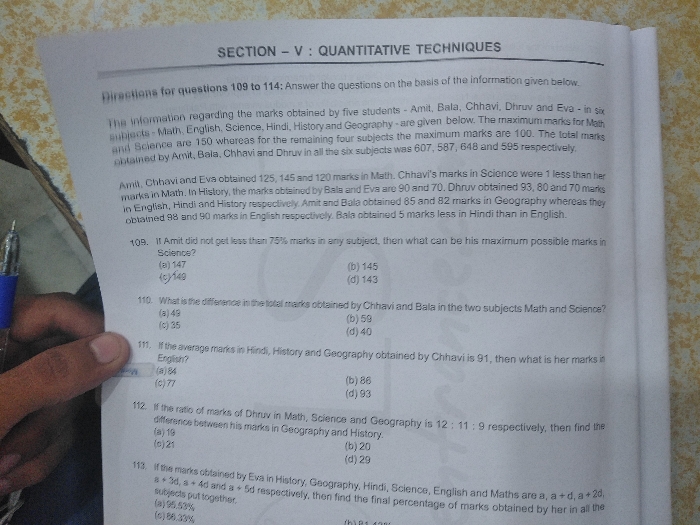

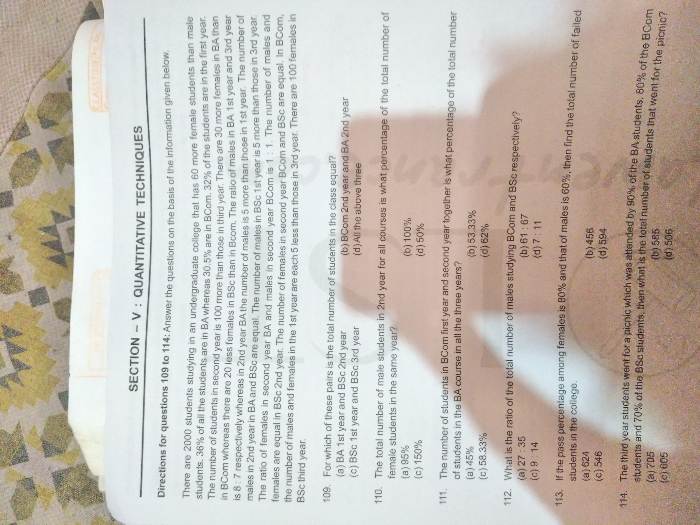

solve the problem

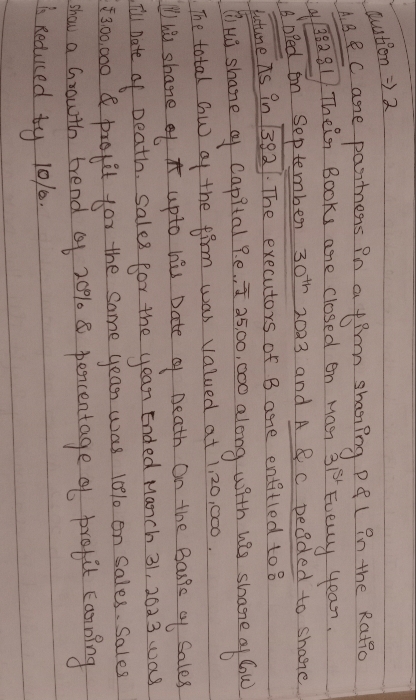

CBSE - XII Commerce - Accountancy

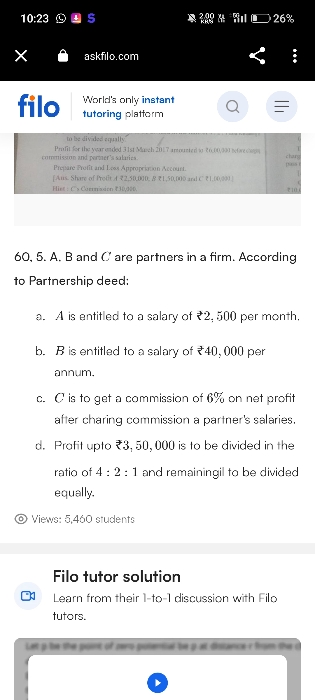

how the intrest on drawing is calculated in this question

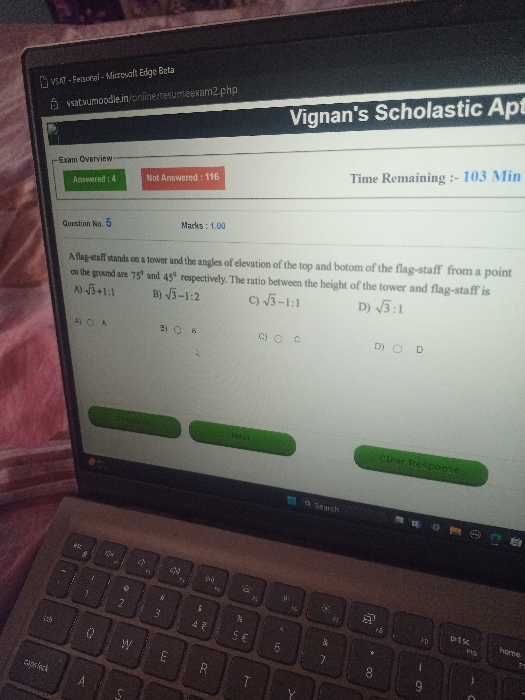

CBSE - XII Commerce - Maths

pls solve it will would be a big help

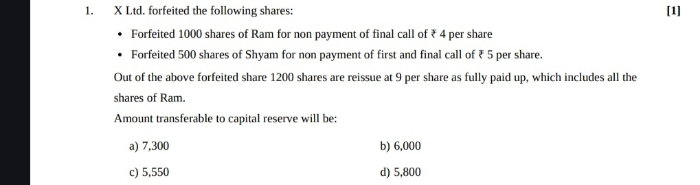

CBSE - XII Commerce - Accountancy

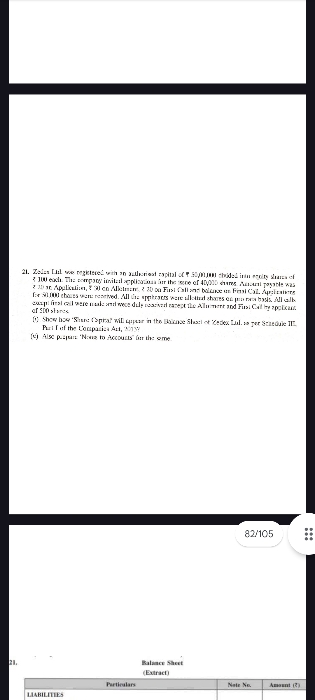

21. Zedex Ltd. was registered with an authorised capital of₹ 50,00,000 divided into equity shares of 100 each. The company invited applications for the issue of 40,000 shares. Amount payable was 20 an Application, 30 on Allotment, 20 on First Call and balance on Final Call. Applications for 50,000 shares were received. All the applicants were allotted shares on pro rata basis. All calls except final call were made and were duly received except the Allotment and First Call by applicant of 500 shares. (i) Show how 'Share Capital' will appear in the Balance Sheet of Zedex Ltd. as per Schedule III, Part I of the Companies Act, 2013? (ii) Also prepare 'Notes to Accounts' for the same.