Class 10 SELINA Solutions Maths Chapter 1 - GST [Goods and Services Tax]

GST [Goods and Services Tax] Exercise Ex. 1(A)

Solution 1(a)

Correct Option: (ii) Rs. 1,416

Marked price = Rs. 1500

Discount = 20% on Rs. 1500 = Rs. 300

Then, discounted price = Rs. (1500 – 300) = Rs. 1200

GST = 18% on Rs. 1200 = Rs. 216

Hence, money paid for the article = Rs. 1200 + Rs. 216 = Rs. 1,416

Solution 1(b)

Correct Option: (iii) Rs. 3290

For article A,

Marked price = Rs. 1000

GST = 5% on Rs. 1000 = Rs. 50

Then, money paid for the article A = Rs. 1000 + Rs. 50 = Rs. 1,050

For article B,

Marked price = Rs. 2000

GST = 12% on Rs. 2000 = Rs. 240

Then, money paid for the article B = Rs. 2000 + Rs. 240 = Rs. 2,240

Hence, total amount to be paid for the bill = Rs. 1,050 + Rs. 2,240 = Rs. 3,290

Solution 1(c)

Correct Option: (iii) 0%

It is a case of inter-state transaction as goods are supplied from one state (Rajasthan) to another state (Punjab).

Hence, SGST = Nil = 0%

Solution 1(d)

Correct Option: (iv) 18%

In case of inter-state sales of goods or services, if GST is 18%, then IGST = 18%.

Solution 1(e)

Correct Option: (ii) Rs. 1,680

Marked price = Rs. 2000

Discount = Rs. 500

Then, discounted price = Rs. (2000 – 500) = Rs. 1500

GST = 12% on Rs. 1500 = Rs. 180

Hence, total amount to be paid = Rs. 1500 + Rs. 180 = Rs. 1,680

Solution 2

MRP = Rs. 12,000, Discount % = 30%, GST = 18%

Discount = 30% of 12,000 = ![]()

Selling price (discounted value) = 12000 - 3600 = Rs. 8400

CGST = 9% of 8400 = Rs. 756

SGST = 9% of 8400 = Rs. 756

IGST = 0

Amount of Bill = Selling price + CGST + SGST = 8400 + 756 + 756 = Rs. 9912

Solution 3

MRP = Rs. 50,000, Discount % = 20%, GST = 28%

Discount = 20% of 50,000 = ![]()

Selling price (discounted value) = 50,000 - 10,000 = Rs. 40,000

CGST = 0

SGST = 0

IGST = 28% of 40,000 = ![]()

Amount of Bill = Selling price + IGST = 40,000 + 11,200 = Rs. 51,200

Solution 4

|

Name of the person |

Repairing cost (in Rs.) |

Discount % |

Discount |

Selling price |

CGST (9%) |

SGST (9%) |

|

A |

5500 |

30 |

1650 |

3850 |

346.5 |

346.5 |

|

B |

6250 |

40 |

2500 |

3750 |

337.5 |

337.5 |

|

C |

4800 |

30 |

1440 |

3360 |

302.4 |

302.4 |

|

D |

7200 |

20 |

1440 |

5760 |

518.4 |

518.4 |

|

E |

3500 |

40 |

1400 |

2100 |

189 |

189 |

|

Total |

|

|

|

18,820 |

1693.8 |

1693.8 |

The total money (including GST) received by the mechanic is 18,820 + 1693.8 + 1693.8 = Rs. 22,207.6

Solution 5

|

Quantity |

MRP |

Total MRP |

Discount % |

Discounted price |

Selling price |

CGST 2.5% |

SGST 2.5% |

|

36 |

450 |

16200 |

10 |

1620 |

14580 |

364.5 |

364.5 |

|

48 |

720 |

34560 |

20 |

6912 |

27648 |

691.2 |

691.2 |

|

60 |

300 |

18000 |

30 |

5400 |

12600 |

315 |

315 |

|

24 |

360 |

8640 |

20 |

1728 |

6912 |

172.8 |

172.8 |

|

Total |

|

|

|

|

61740 | 1543.5 | 1543.5 |

Amount of bill = Selling price + GST

= Rs. 61740 + Rs. 1543.5 + Rs. 1543.5

= Rs. 64827

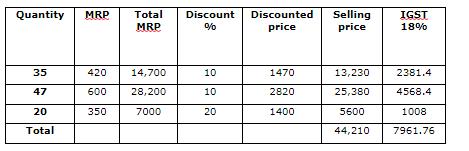

Solution 6

Amount of bill = Selling price + IGST

= 44,210 + 7961.76

= Rs. 52,167.8

Solution 7

|

MRP (in Rs.) |

Discount % |

CGST % |

Discounted value |

Selling price |

CGST |

SGST |

|

12,000 |

30 |

6 |

3600 |

8400 |

504 |

504 |

|

15,000 |

20 |

9 |

3000 |

12,000 |

1080 |

1080 |

|

9500 |

30 |

14 |

2850 |

6650 |

931 |

931 |

|

18,000 |

40 |

2.5 |

7200 |

10,800 |

270 |

270 |

|

|

|

|

|

37,850 |

2785 |

2785 |

Amount of bill = Selling price + CGST + SGST

= 37,850 + 2785 + 2785 = Rs. 43,420

Solution 8

|

MRP (in Rs. ) |

Discount |

Discounted value |

Selling price |

IGST |

IGST |

|

12,000 |

30 |

3600 |

8400 |

12 |

1008 |

|

15,000 |

20 |

3000 |

12,000 |

18 |

2160 |

|

9500 |

30 |

2850 |

6650 |

28 |

1862 |

|

18,000 |

40 |

7200 |

10,800 |

5 |

540 |

|

|

|

|

37,850 |

|

5570 |

Amount of bill = Selling price + GST

= 37,850 + 5570

= Rs. 43,420

Solution 9

|

Rate per piece (in Rs.) |

Quantity (no. of pieces) |

Discount % |

MRP |

Selling price |

IGST @18% |

|

180 |

10 |

Net |

1800 |

1800 |

324 |

|

260 |

20 |

20 |

5200 |

4160 |

748.8 |

|

310 |

30 |

Net |

9300 |

9300 |

1674 |

|

175 |

20 |

30 |

3500 |

2450 |

441 |

|

|

|

|

|

17,710 |

3187.8 |

Amount of bill = Selling price + IGST

= 17,710 + 3187.8

= Rs. 20,897.8

Solution 10

|

Number of services |

Cost of each service (in Rs.) |

GST % |

MRP |

IGST |

|

8 |

680 |

5 |

5440 |

272 |

|

12 |

320 |

12 |

3840 |

460.8 |

|

10 |

260 |

18 |

2600 |

468 |

|

16 |

420 |

12 |

6720 |

806.4 |

|

|

|

|

18,600 |

2007.2 |

Amount of bill = Selling price + IGST

= 18,600 + 2007.2

= Rs. 20,607.2

Solution 11

According to the question,

GST = 18% of 750

= ![]()

The amount of bill = 750 + 135 = Rs. 885

Solution 12

Let the total annual premium paid by Ms. Pratima be Rs. x.

According to the question, 18% of x = SGST + CGST

18% of x = 1800 (![]() SGST = CGST)

SGST = CGST)

![]()

x = Rs. 10,000

Hence, total annual premium including GST = Rs. (10000 + 1800) = Rs. 11800

Solution 13

According to the question,

The amount of bill = 5000 × 2 + 1000 + 1000

= 10,000 + 2000

= Rs. 12,000

GST = 28% of 12,000

= ![]()

GST charged by Mr. Malik Rs. 3360.

GST [Goods and Services Tax] Exercise Ex. 1(B)

Solution 1(a)

Correct Option: (iii) expenses plus profit

Under GST ‘value addition’ refers to expenses plus profit.

Solution 1(b)

Correct Option: (ii) output tax

Input tax credit shall only be allowed against output tax.

Solution 1(c)

Correct Option: (iv) tax on value addition

Input tax credit means tax on value addition.

Solution 1(d)

Correct Option: (iii) Rs. (y – x)

Input tax credit = Output tax – Input tax = Rs. (y – x)

Solution 1(e)

Correct Option: (iii) Rs. 1,680

Cost price = Rs. 2000

Discount = 20% on Rs. 2000 = Rs. 400

Then, discounted price = Rs. (2000 – 400) = Rs. 1600

GST = 5% on Rs. 1600 = Rs. 80

Selling price for John = Rs. 1600 + Rs. 80 = Rs. 1680

Solution 2

When the goods/services are sold for Rs. 15,000 under intra-state transaction from station A to station B and the rate of GST is 12%.

As per GST System

- S.P. (excluding GST) at station A = Rs. 15,000

- CGST = 6% of 15,000 = Rs. 900

SGST = 6% of 15,000 = Rs. 900 - C.P. (excluding GST) at station B = Rs. 15,000

- If profit = Rs. 5000

S.P. at station B = 15,000 + 5000 = Rs. 20,000

Now the same goods/services are moved under inter-state transaction from station B to station C and the b rate of tax is 12%. - GST = 12% of 20,000 = Rs. 2400

- C.P. (excluding GST) at station C = Rs. 20,000

Solution 3

When the product is sold from Agra to Kanpur (intra-state transaction)

For the dealer in Agra :

S. P. in Agra = Rs. 20,000

CGST = 9% of Rs. 20,000 = ![]()

SGST = 9% of Rs. 20,000 = ![]()

When product is sold from Kanpur to Jaipur (inter-state transaction)

For the dealer in Kanpur

Input-tax credit = 1800 + 1800 = Rs. 3600

C. P. = Rs. 20,000 and Profit = Rs. 5000

S.P. = 20,000 + 5000 = Rs. 25,000

IGST = 18% of 25,000 = Rs. 4500

Net GST paid by the dealer at Kanpur

= Output GST - Input GST

= 4500 - 3600

= Rs. 900

Solution 4

For the dealer in Mumbai (inter-state transaction)

CP = Rs. 20,000

IGST = 12% of Rs. 20,000 = ![]()

Profit = Rs. 5000

SP = Rs. 25,000

For the dealer in Pune (intra-state transaction)

CP = Rs. 25,000

CGST = 6% of 25,000 = Rs. 1500

SGST = 6% of 25,000 = Rs. 1500

GST payable by the end user at Pune = 1500 + 1500 = Rs. 3000

Solution 5

For the dealer A (intra-state transaction)

SP = Rs. 8,000

For the dealer B (intra-state transaction)

CP = Rs. 8,000

CGST = 9% of 8,000 = Rs. 720

SGST = 9% of 8,000 = Rs. 720

Profit = Rs. 1,200

SP = Rs. 9,200

For the dealer C (inter-state transaction)

CP = Rs. 9,200

IGST = 18 % of Rs. 9,200 = ![]()

Input Tax = Rs. 1,656

Since, the dealer in Patna does not sell the product.

Output GST (tax on sale) = Rs. 0

Solution 6

For A (case of inter-state transaction)

S.P. in Meerut = Rs. 15,000

For B (case of inter-state transaction)

C.P.= Rs. 15,000

IGST = 18% of 15,000 = ![]()

Input tax for B = Rs. 2,700

S.P. in Ratlam = 15,000 + 3000 = Rs. 18,000

For C (case of intra-state transaction)

C.P.= Rs. 18,000

CGST = 9% of 18,000 = ![]()

SGST = ![]()

Out put tax for B = Rs. 1620 + Rs. 1620 = Rs. 3240

Net GST payable by the dealer B

= Output tax - Input tax

= 1620 + 1620 - 2700

= Rs. 540

Cost for the dealer C in Jabalpur

= S.P. for the dealer in Ratlam + GST

= 18,000 + 1620 + 1620

= Rs. 21,240

Solution 7

For the dealer X (intra-state transaction)

SP = Rs. 50,000

For the dealer Y (intra-state transaction)

CP = Rs. 50,000

CGST = 14% of 50,000 = Rs. 7,000

SGST = 14% of 50,000 = Rs. 7,000

Input tax for dealer Y = Rs. 14,000

Profit = Rs. 20,000

SP = Rs. 70,000

For the dealer Z (inter-state transaction)

CP = Rs. 70,000

IGST = 28 % of Rs. 70,000 = ![]()

∴ Input Tax = Rs. 19,600 which is the output tax for dealer Y.

Net GST payable for Y

= Output tax for Y - Input tax for Y

= 19,600 - 14,000

= Rs. 5600

Solution 8

- Output tax in Delhi (interstate) :

IGST = 9% of 50,000 = Rs. 9000

Output tax in Delhi = Rs. 9000 - Output tax in Kolkata :

C.P. in Kolkata = Rs. 50,000 and Profit = Rs. 20,000

S.P. in Kolkata = 50,000 + 20,000 = Rs. 70,000

IGST = 18% of 70,000 = Rs. 12,600

Output tax in Kolkata = Rs. 12,600 - Since, the dealer in Nainital does not sell the product.

Output GST (tax on sale) = Rs. 0

Solution 9

Initial marked price by manufacturer A is Rs. 6000

B bought the T.V. at a discount of 20%.

Cost price of B = 80% of 6000 = Rs. 4800 ….(i)

GST paid by B for purchase = 18% of 4800 = Rs. 864 ….(ii)

B sells T.V. at discount of 10% of market Price

Selling price for B = 6000 - 10% of 6000 = Rs. 5400 …(iii)

GST charged by B on selling of T.V. = 18% of 5400

= Rs. 972 …(iv)

GST paid by B to the government

= GST charged on selling price - GST paid against purchase price

= 972 - 864

= Rs. 108

Solution 10

Initial marked price by manufacturer A is Rs. 75,000

B bought the T.V. at a discount of 30%.

Cost price of B = 70% of 75,000 = Rs. 52,500 ….(i)

GST paid by B for purchase = 5% of 52,500 = Rs. 2625 ….(ii)

B sells T.V. by increasing marked price by 30%.

Selling price for B = 75,000 + 30% of 75,000 = Rs. 97,500 …(iii)

GST charged by B on selling of T.V. = 5% of 97,500

= Rs. 4875 …(iv)

GST paid by B to the government

= GST charged on selling price - GST paid against purchase price

= 4875 - 2625

= Rs. 2250

Solution 11

Marked price = Rs. 15,680

GST = 12% of 15,680 = Rs. 1881.6

Total price including GST = Rs. 17561.6

Price Gagan willing to pay including GST = Rs. 15,680

Let the reduced price be Rs. x, then

x + 12% of x = 15,680

x = Rs. 14000

Hence reduction in marked price = 15,680 - 14000 = Rs. 1,680

GST [Goods and Services Tax] Exercise TEST YOURSELF

Solution 1(a)

Correct Option: (ii) Rs. 920

Cost price = Rs. 8000

Profit = 15% on Rs. 8000 = Rs. 1200

Then, selling price = Rs. (8000 + 1200) = Rs. 9200

CGST = 5% on Rs. 9200 = Rs. 460

SGST = 5% on Rs. 9200 = Rs. 460

IGST = Nil

GST = Rs. (460 + 460) = Rs. 920

Solution 1(b)

Correct Option: (ii) Rs. 920

Cost price = Rs. 8000

Profit = 15% on Rs. 8000 = Rs. 1200

Then, selling price = Rs. (8000 + 1200) = Rs. 9200

IGST = 10% on Rs. 9200 = Rs. 920

CGST = Nil

SGST = Nil

GST = Rs. 920

Solution 1(c)

Correct Option: (iii) 18%

Let GST = x%

Then, x% on Rs. 10,000 = Rs. 1800

![]()

Then x = 18%

Solution 1(d)

Correct Option: (iii) Rs. 90

Cost price = Rs. 2000, Selling price = Rs. 2500

Tax liability on Manu = 18% on Rs, 2500 – 18% on Rs. 2000

= 18% on Rs. (2500 – 2000)

= 18% on Rs. 500

= Rs. 90

Solution 1(e)

Correct Option: (iv) Rs. 00

Ashok is the end user of the product, that is, Ashok does not sell the product.

Therefore, Output GST for Ashok (tax on sale) = Nil = Rs. 00

Note: Back answer is incorrect.

Solution 2

| Items | Marked Price | Discount | Discounted value | Rate of GST | GST |

| Face-cream | Rs. 350 | 12% | 88% on Rs. 350 = Rs. 308 | 12% | 12% on Rs. 308 = Rs. 36.96 |

| Hair oil | Rs. 720 | - | Rs. 720 | 5% | 5% on Rs. 720 = Rs. 36 |

| Telecom powder | Rs. 225 | 18% | 82% on Rs. 225 = Rs. 184.50 | 18% | 18% on Rs. 184.50 = Rs. 33.21 |

i. Total GST paid = Rs. (36.96 + 36 + 33.21) = Rs. 106.17

ii. Total bill amount including GST = Rs. (308 + 720 + 184.50) + Rs. 106.17

= Rs. 1212.50 + Rs. 106.17

= Rs. 1318.67

Solution 3

According to the question,

GST on ticket of Rs. 80 = 18% of 80 = ![]()

GST on ticket of Rs. 120 = 28% of 120 = ![]()

Difference between both GST = 33.60 - 14.40 = Rs. 19.20

Solution 4

Let the selling price of an A.C. = Rs. x

∴ x + 28% of x = 31200

⇒ x = Rs. 24375

⇒ Price of an A.C. without GST = Rs. 24375

(i)

GST = 28%

Total amount of GST = 28% of 24375 = Rs. 6825

(ii)

Taxable value of A.C. = Rs. 24375

(iii)

Amount of CGST = GST/2 = Rs. 3412.5

(iv)

Amount of SGST = GST/2 = Rs. 3412.5

Solution 5

For the wholesaler:

Marked price = Rs. 45000

Discount = 10% = Rs. 4500

S.P. = M.P. - Discount

= 45000 - 4500

= Rs. 40500

For the dealer:

C.P. = Rs. 40500

Discount = 4% of 45000 = Rs. 1800

S.P. = M.P. - Discount

= Rs. 45000 - Rs. 1800

= Rs. 43200

(i)

Tax paid by the dealer under GST

= Output tax - Input tax

= Tax on S.P. - Tax on C.P.

= 18% of 43200 - 18% of 40500

= 7776 - 7290

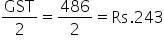

= Rs. 486

Since, the transaction is intra-state,

Tax paid by the dealer to the central and state government = CGST = SGST =

(ii)

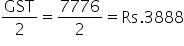

GST paid by the dealer = 18% of 43200 = Rs. 7776

∴ GST received by government = 7776

Since, the transaction is intra-state, GST received by the central and state government = CGST = SGST =

(iii)

For the consumer:

C.P. = S.P. for dealer = Rs. 43200

GST paid by the consumer = 18% of 43200 = 7776

∴ Total amount paid by the consumer = Rs. (43200 + 7776) = Rs. 50976

Solution 6

For Rohit:

Input tax = Rs. 10,400

Output tax = Rs. 11,000

GST paid by Rohit = Output tax - Input tax = Rs. 600

SGST = CGST = Rs. 300

For Manish:

Input tax = Rs. 11000

Output tax = Rs. 11800

∴ GST paid by Manish = 11800 - 11000 = Rs. 800

∴ SGST = CGST = Rs. 400

Solution 7

(i)

Marked price of T.V. = 25000 + 20% of 25000 = Rs. 30000

(ii)

Marked price = Rs. 30000

Discount = 10% = Rs. 3000

∴ Cost price for consumer without tax = 30000 - 3000 = Rs. 27000

GST paid by the consumer = 12% of 27000 = Rs. 3240

∴ Consumer's cost price of TV inclusive of tax under GST = Rs. (27000 + 3240) = Rs. 30240

(iii)

For the retailer:

Input tax = 12% of 25000 = Rs. 3000

Output tax = 12% of 27000 = Rs. 3240

GST paid by the retailer to the Central and State Governments = Output tax - Input tax

= Rs. (3240 - 3000)

= Rs. 240

Solution 8

Marked price of an article = Rs. 6000

For the dealer:

Discount = 30%

C.P. = M.P. - 30% of M.P. = Rs. 4200

(i)

For the consumer:

M.P. = Rs. 6,000

Discount = 10%

C.P. = M.P. - 10% of M.P. = Rs. 5400

GST paid by the consumer = 5% of 5400 = Rs. 270

∴ The total amount paid by the consumer for the article = 5400 + 270 = Rs. 5670

(ii)

For the dealer:

Input tax = tax on purchase = 5% of 4200 = Rs. 210

Output tax = GST paid by consumer = Rs. 270

Tax under GST paid by the dealer to the central and state governments

= Output tax - Input tax

= Rs. (270 - 210)

= Rs. 60

So, tax under GST paid by the dealer to the state government is Rs. 30.

(iii)

GST received by the state and central governments = GST paid by the consumer

= Rs. 270

∴ Amount of tax under GST received by the central government is Rs. 135.

Solution 9

Marked price of an article = Rs. 20,000

(i)

For the dealer:

Cost price = Rs. 20,000

GST = 18% of Rs. 20,000 = Rs. 3600

So, the price of the article (inclusive of GST) for the shopkeeper is Rs. 23600.

(ii)

GST paid by the shopkeeper = Rs. 3600

For consumer:

Cost price = 20000 + 25% of 20000 = Rs. 25000

GST paid by the consumer = 18% of 25000 = Rs. 4500

∴ Input tax for the shopkeeper = Rs. 3600

Output tax for the shopkeeper = Rs. 4500

Tax paid by the shopkeeper to the government = Output tax - Input tax = Rs. 900.

Thus, the amount of tax, under GST, paid by the shopkeeper to the Government is Rs. 900.

Solution 10

Marked price of an A.C. = Rs. 64,000

(i)

For the distributor:

S.P. of A.C. without GST = 64000 - 25% of 64000 = Rs. 48000

GST paid = 18% of 48000 = Rs. 8640

S.P. of A.C. including GST, for the distributor = Rs. (48000 + 8640) = Rs. 56640

(ii)

GST paid by the distributor = 18% of 48000 = Rs. 8640

∴ Tax paid by the distributor to the State Government = GST/2 = Rs. 4320

(iii)

For the shopkeeper:

C.P. = S.P. for the distributor = Rs. 48000

Input tax = 18% of 48000 = Rs. 8640

Output tax = Tax paid by the consumer

C.P. for the consumer = Rs. 64000

GST paid by the consumer = 18% of 64000 = Rs. 11520

∴ Output tax = Rs. 11520

∴ Tax paid by the shopkeeper to the government = 11520 - 8640 = Rs. 2880

∴ The tax, under GST paid by the shopkeeper to the central government is Rs. 1440.

(iv)

Tax received by the state government = SGST paid by the consumer = Rs. ![]() = Rs. 5760

= Rs. 5760

(v)

The price including tax under GST of the A.C. paid by the customer

= C.P. for the consumer + GST paid by the consumer

= 64000 + 18% of 64000

= Rs. 75520