Class 10 SELINA Solutions Maths Chapter 2 - Banking (Recurring Deposit Accounts)

Banking (Recurring Deposit Accounts) Exercise Ex. 2

Solution 1(a)

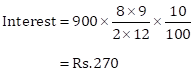

Correct Option: (i) Rs. 270

P = Rs. 900, n = 8 and R = 10%

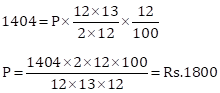

Solution 1(b)

Correct Option: (ii) Rs. 1800

I = Rs. 1404, n = 12 and R = 12%

Solution 1(c)

Correct Option: (ii) Rs. 24000

P = Rs. 1000, n = 2 years = 24, R = 10%

Total sum deposited by Manish = Rs. 1000 × 24 = Rs. 24000

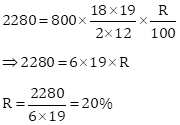

Solution 1(d)

Correct Option: (i) 20%

P = Rs. 800, n = one and half years = 18, I = Rs. 2280

Note: Back answer is incorrect.

Solution 2

For A

Installment per month(P) = Rs 1,200

Number of months(n) = 3 × 12 = 36

Rate of interest(r)= 10% p.a.

The amount that A will get at the time of maturity

=Rs (1,200 x 36)+ Rs 6,660

=Rs 43,200+ Rs 6,660

= Rs 49,860

For B

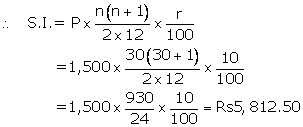

Installment per month(P) = Rs 1,500

Number of months(n) = 2.5 × 12 = 30

Rate of interest(r)= 10% p.a.

The amount that B will get at the time of maturity

=Rs(1,500 x 30)+ Rs 5,812.50

=Rs 45,000+ Rs 5,812.50

= Rs 50,812.50

Difference between both amounts= Rs 50,812.50 - Rs 49,860

= Rs 952.50

Then B will get more money than A by Rs 952.50 Ans.

Solution 3

Let Installment per month(P) = Rs y

Number of months(n) = 12

Rate of interest(r)= 11%p.a.

Maturity value= Rs (y x 12) + Rs 0.715 y = Rs 12.715 y

Given maturity value= Rs 12,715

Then Rs 12.715 y = Rs 12,715

![]() Ans.

Ans.

Solution 4

Let Installment per month(P) = Rs y

Number of months(n) = 3.5 × 12 = 42

Rate of interest(r) = 12% p.a.

Maturity value= Rs(y x 42) + Rs 9.03y = Rs 51.03y

Given maturity value = Rs 10,206

Then Rs 51.03y = Rs 10206

![]() Ans.

Ans.

Solution 5

(a)

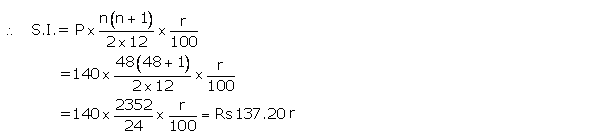

Installment per month(P) = Rs 140

Number of months(n) = 4 × 12 = 48

Let rate of interest(r)= r %p.a.

Maturity value= Rs (140 x 48) + Rs (137.20)r

Given maturity value= Rs 8,092

Then Rs(140 x 48)+Rs (137.20)r = Rs 8,092

![]() 137.20r = Rs 8,092 - Rs 6,720

137.20r = Rs 8,092 - Rs 6,720

![]() r =

r = ![]()

(b)

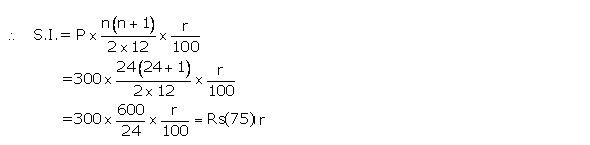

Installment per month(P) = Rs 300

Number of months(n) = 4 × 12 = 24

Let rate of interest(r)= r %p.a.

Maturity value= Rs (300 x 24)+Rs(75)r

Given maturity value = Rs 7,725

Then Rs(300 x 24) + Rs(75)r = Rs 7,725

![]() 75 r = Rs 7,725 - Rs 7,200

75 r = Rs 7,725 - Rs 7,200

![]() r =

r = ![]()

Solution 6

Installment per month(P) = Rs 150

Number of months(n) = 8

Rate of interest(r)= 8% p.a.

The amount that Manish will get at the time of maturity

=Rs (150 x 8)+ Rs 36

=Rs 1,200+ Rs 36

= Rs 1,236 Ans.

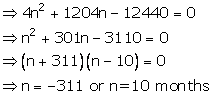

Solution 7

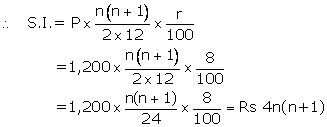

Installment per month(P) = Rs 1,200

Number of months(n) = n

Let rate of interest(r)= 8 %p.a.

Maturity value= Rs (1,200 x n) + Rs 4n (n + 1)= Rs (1200n + 4n2 + 4n)

Given maturity value= Rs 12,440

Then 1200n + 4n2 + 4n = 12,440

Then number of months = 10 Ans.

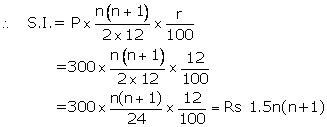

Solution 8

Installment per month(P) = Rs 300

Number of months(n) = n

Let rate of interest(r)= 12 %p.a.

Maturity value= Rs (300 x n) + Rs 1.5n(n + 1)

= Rs (300n + 1.5n2 + 1.5n)

Given maturity value = Rs 8,100

Then 300n + 1.5n2 + 1.5n = 8,100

Then time = 2 years

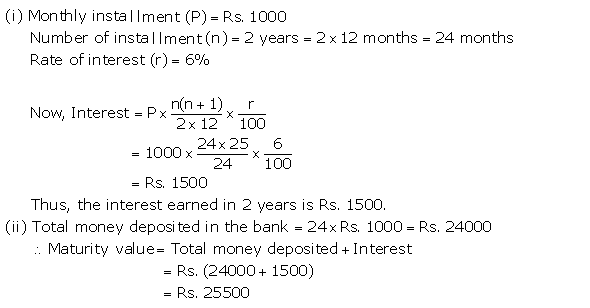

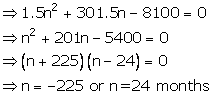

Solution 9

(i)

Maturity value = Rs 67,500

Money deposited = Rs 2,500 x 24 = Rs 60,000

Then total interest earned = Rs 67,500 - Rs 60,000 = Rs 7,500 Ans.

(ii)

Installment per month(P) = Rs 2,500

Number of months(n) = 24

Let rate of interest(r)= r %p.a.

Then 625 r = 7500

![]()

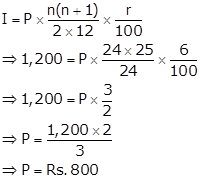

Solution 10

Interest, I = Rs. 1,200

Time, n = 2 years = 2 × 12 = 24 months

Rate, r = 6%

(i) To find: Monthly installment, P

Now,

So, the monthly installment is Rs. 800.

(ii) Total sum deposited = P × n = Rs. 800 × 24 = Rs. 19,200

∴ Amount of maturity = Total sum deposited + Interest on it

= Rs. (19,200 + 1,200)

= Rs. 20,400

Banking (Recurring Deposit Accounts) Exercise TEST YOURSELF

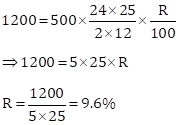

Solution 1(a)

Correct Option: (ii) 9.6%

P = Rs. 500, n = 24,

Total sum deposited = Rs. 500 × 24 = Rs. 12000

![]()

Solution 1(b)

Correct Option: (iv) Rs. 1087.50

P = Rs. 50, n = 20 and R = 10%

Total sum deposited = Rs. 50 × 20 = Rs. 1000

![]()

Maturity Value = Total sum deposited + Interest on it

= Rs. (1000 + 87.50)

= Rs. 1087.50

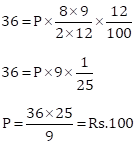

Solution 1(c)

Correct Option: (iii) Rs. 100

I = Rs. 36, n = 8 and R = 12%

Solution 1(d)

Correct Option: (iv) Rs. 7,500

Total sum deposited = Rs. 5000 × 12 = Rs. 60,000

Maturity Value = Total sum deposited + Interest on it

Therefore, interest = Maturity Value – Total sum deposited

= Rs. 67,500 – Rs. 60,000

= Rs. 7,500

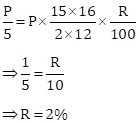

Solution 1(e)

Correct Option: (ii) 2%

Let sum = P

n = 15,

![]()

Solution 2

Installment per month(P) = Rs 600

Number of months(n) = 4 × 12 = 48

Rate of interest(r)= 8%p.a.

_21Maynewformat_files/20140521155159_image015.gif)

The amount that Manish will get at the time of maturity

=Rs (600 x 48)+ Rs 4,704

=Rs 28,800+ Rs 4,704

= Rs 33,504 Ans.

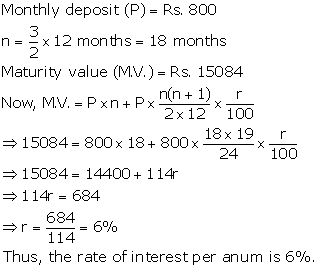

Solution 3

Installment per month(P) = Rs 80

Number of months(n) = 18

Let rate of interest(r)= r % p.a.

_21Maynewformat_files/20140521155159_image017.gif)

Maturity value= Rs (80 x 18) + Rs (11.4r)

Given maturity value= Rs 1,554

Then Rs (80 x 18)+Rs (11.4r) = Rs 1,554

![]() 11.4r = Rs 1,554 - Rs 1,440

11.4r = Rs 1,554 - Rs 1,440

![]()

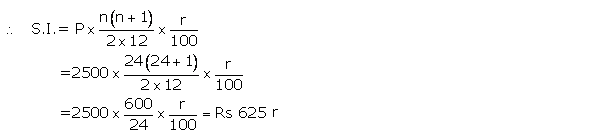

Solution 4

Installment per month(P) = Rs 400

Number of months(n) = n

Let rate of interest(r)= 8 %p.a.

_21Maynewformat_files/20140521155159_image024.gif)

Maturity value= Rs (400 x n)+![]()

Given maturity value= Rs 16,176

Then Rs (400 x n)+![]() = Rs 16,176

= Rs 16,176

![]() 1200n + 4n2 + 4n = Rs 48,528

1200n + 4n2 + 4n = Rs 48,528

![]() 4n2 + 1204n = Rs 48,528

4n2 + 1204n = Rs 48,528

![]() n2 + 301n - 12132 = 0

n2 + 301n - 12132 = 0

![]() (n + 337)(n - 36)=0

(n + 337)(n - 36)=0

![]() n = -337 or n = 36

n = -337 or n = 36

Then number of months = 36 months = 3 years Ans.

Solution 5

Let installment per month = Rs P

Number of months(n) = 2 × 12 = 24

Rate of interest = 8%p.a.

_21Maynewformat_files/20140521155159_image035.gif)

Maturity value= Rs (P x 24) + Rs 2P = Rs 26P

Given maturity value = Rs 30,000

_21Maynewformat_files/20140521155159_image037.gif)

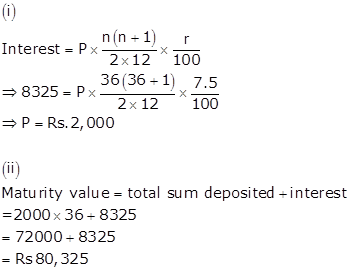

Solution 6

Let the monthly instalment be P

Interest = Rs. 8,325

Rate of interest = 7.5%

Time = 3 years = 36 months

Solution 7

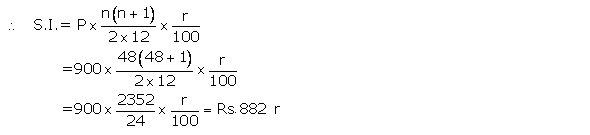

Installment per month(P) = Rs 900

Number of months(n) = 48

Let rate of interest(r) = r %p.a.

Maturity value= Rs (900 x 48) + Rs (882)r

Given maturity value = Rs 52,020

Then Rs (900 x 48) + Rs(882)r = Rs 52,020

![]() 882r = Rs 52,020 - Rs 43,200

882r = Rs 52,020 - Rs 43,200

![]() r =

r = ![]()

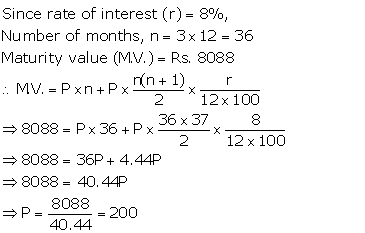

Solution 8

Let the value of the monthly installment be Rs. P.

Thus, the value of his monthly installment is Rs. 200.

Solution 9

Solution 10