CBSE Class 12-commerce Answered

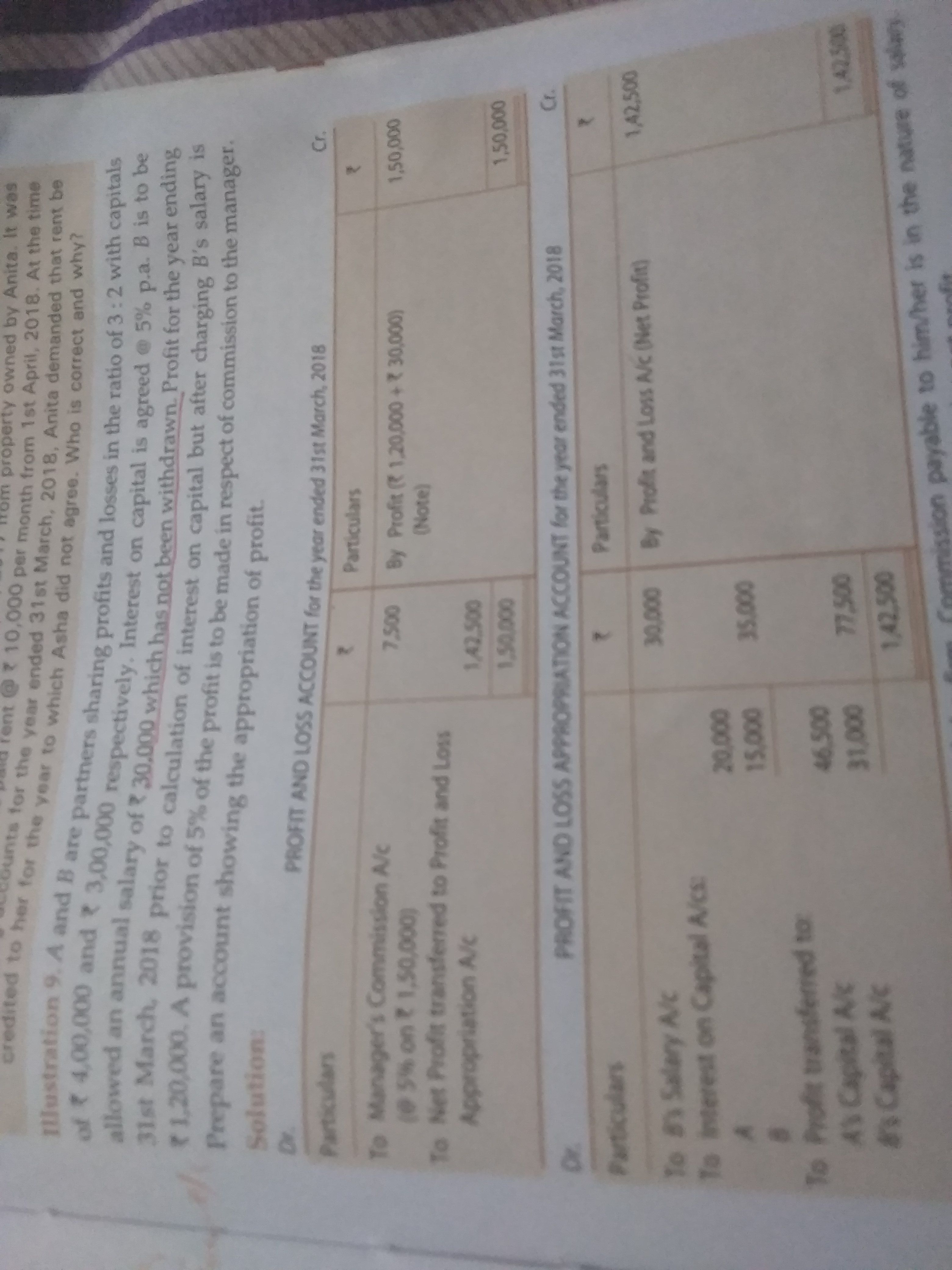

Why salary of 30,000 will be add in profit in profit and loss a/c.And according to the rules salary is charge against profit so why will take it in appropriation a/c

Asked by Smitakhadayate20 | 17 Mar, 2019, 07:52: AM

In a normal business entity, amount of salaries paid to the employees are debited to the profit and loss account and are therefore, is a charge against profits. On the other hand, in case of partnership accounts, any amount of remuneration paid to the partners in the form of salary, commission, etc., is an appropriation out of profits and not a charge against profits.

Accordingly, if the amounts are paid as remuneration to the partners, they are treated as appropriation and not a charge against profits.

Answered by Surabhi Gawade | 18 Mar, 2019, 09:32: AM

Application Videos

Concept Videos

CBSE 12-commerce - Accountancy

Asked by joymotibarman | 15 Jan, 2024, 02:15: PM

CBSE 12-commerce - Accountancy

Asked by divyanshmaheshwari2003 | 04 Nov, 2023, 05:06: PM

CBSE 12-commerce - Accountancy

Asked by deepamonidas1234 | 21 Sep, 2023, 09:14: PM

CBSE 12-commerce - Accountancy

Asked by officialpaperio.man | 31 Jan, 2022, 09:14: AM

CBSE 12-commerce - Accountancy

Asked by swapnil292001 | 08 Nov, 2020, 11:22: AM

CBSE 12-commerce - Accountancy

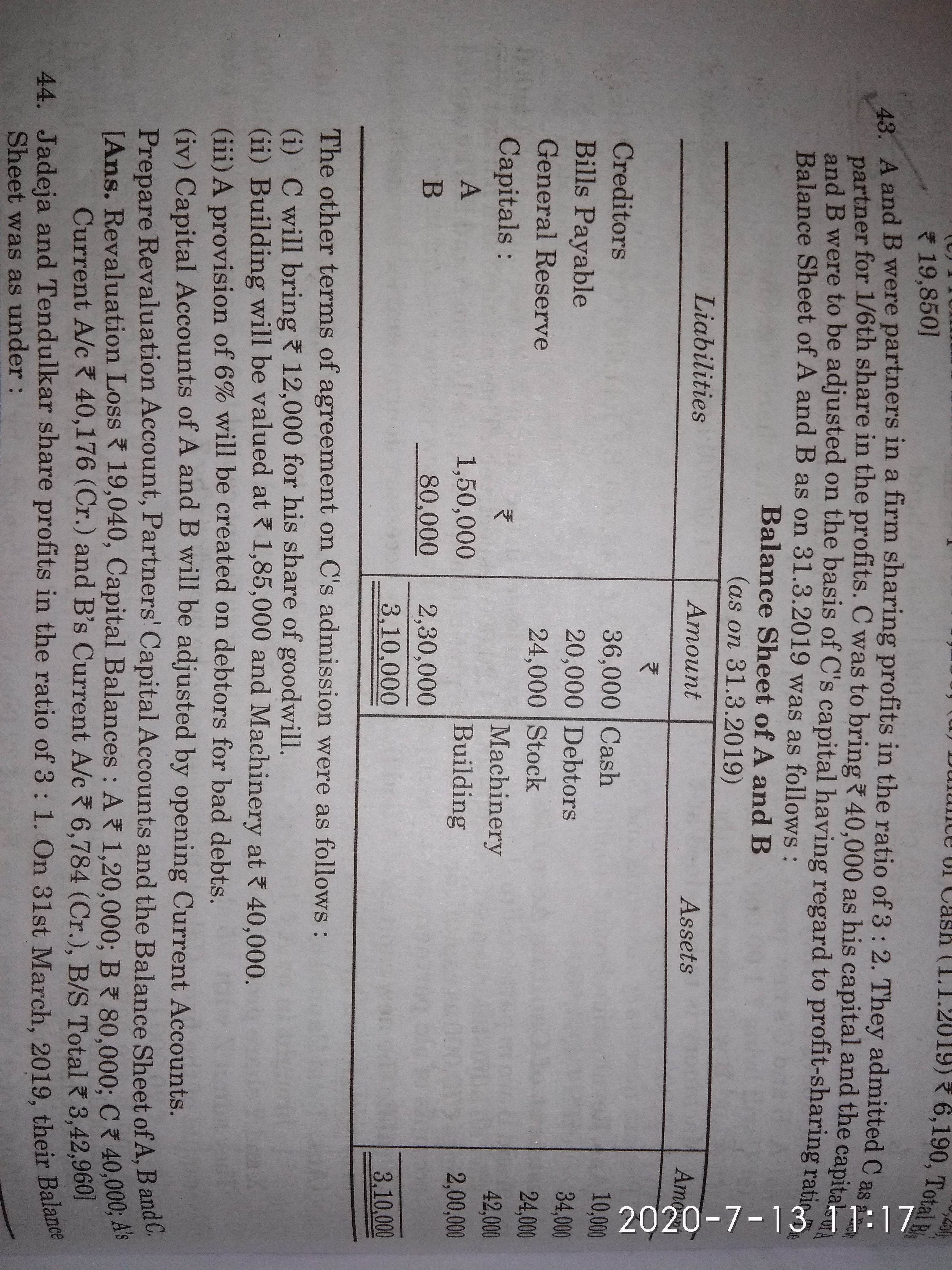

Asked by raksha2sanubth | 13 Jul, 2020, 11:22: AM

CBSE 12-commerce - Accountancy

Asked by raksha2sanubth | 13 Jul, 2020, 11:19: AM

CBSE 12-commerce - Accountancy

Asked by sonowalabhilash | 02 Jul, 2020, 09:46: AM

CBSE 12-commerce - Accountancy

Asked by simarjiv10 | 24 Jun, 2020, 11:25: PM