CBSE Class 12-commerce Answered

Shalu and Manish are sharing profits and losses in the ratio of 2:3. Their capitals were 3,00,000 and 4,00,000 respectively and their drawings were 60,000 and 40,000 during the year. After the books were closed it was discovered that interest on capital @ 12% p.a and interest on drawings @6%p.a have been omitted. Pass journal entry to rectify the mistake in the books of Shalu and Manish. Please answer today itself

Asked by Shruti | 18 Jan, 2018, 05:20: PM

The above question is simple calculation based upon logic that was discussed in class. Try to relate it to the logic learnt in class of Past Adjustments, the case where Interest on Capital and Interest on Drawings is omitted.

If IOC is omitted, it clearly means the Interest on Capital that was to provided has been omitted and the same profits have been actually distributed amongst partners in their PSR. In this case, IOC was to provided at the rate of 12%, viz. 36,000 to Shalu and 48,000 to Manish, that totals to 84,000. This 84,000 must have been distributed in PSR which is 33,600 to Shalu and 50,400 to Manish. So, for taking this into effect, we need to debit Shalu and Manish with the said amount and actually credit Shalu with 36,000 and Manish with 48,000. The rectifying entry for this case would be crediting Shalu with 2,400 and debiting Manish with 2,400.

Now, if IOD is omitted, it means the Interest on Drawings that was to provided has been omitted and the profits for the firm are lesser and have not been distributed amongst partners in their PSR. In this case, IOD was to provided at the rate of 6%, viz. 3,600 from Shalu and 2,400 from Manish, that totals to 6,000. This 6,000 must have been credited in PSR which is 2,400 to Shalu and 3,600 to Manish. So, for taking this into effect, we need to debit Shalu with 1,200 and credit Manish with 1,200.

Hope this clarifies your doubt and we feel, you can easily frame the net rectifying entry for the same, i.e.

Manish's A/c Dr. 1,200

To Shalu's A/c 1,200

(Being Adjustment Entry Passed)

Answered by | 19 Jan, 2018, 10:04: AM

Application Videos

Concept Videos

CBSE 12-commerce - Accountancy

Asked by joymotibarman | 15 Jan, 2024, 02:15: PM

CBSE 12-commerce - Accountancy

Asked by divyanshmaheshwari2003 | 04 Nov, 2023, 05:06: PM

CBSE 12-commerce - Accountancy

Asked by deepamonidas1234 | 21 Sep, 2023, 09:14: PM

CBSE 12-commerce - Accountancy

Asked by officialpaperio.man | 31 Jan, 2022, 09:14: AM

CBSE 12-commerce - Accountancy

Asked by swapnil292001 | 08 Nov, 2020, 11:22: AM

CBSE 12-commerce - Accountancy

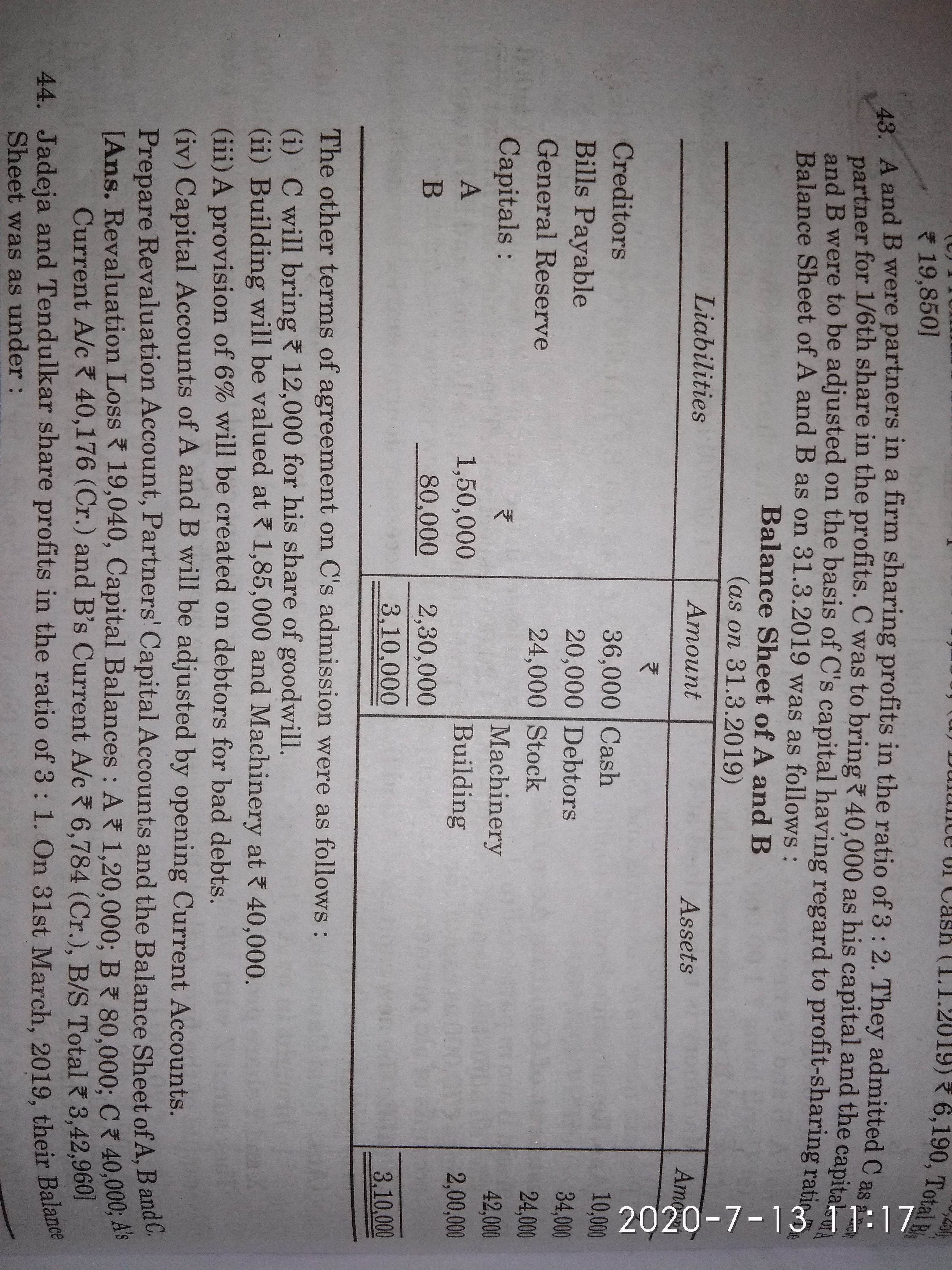

Asked by raksha2sanubth | 13 Jul, 2020, 11:22: AM

CBSE 12-commerce - Accountancy

Asked by raksha2sanubth | 13 Jul, 2020, 11:19: AM

CBSE 12-commerce - Accountancy

Asked by sonowalabhilash | 02 Jul, 2020, 09:46: AM

CBSE 12-commerce - Accountancy

Asked by simarjiv10 | 24 Jun, 2020, 11:25: PM