CBSE Class 12-commerce Answered

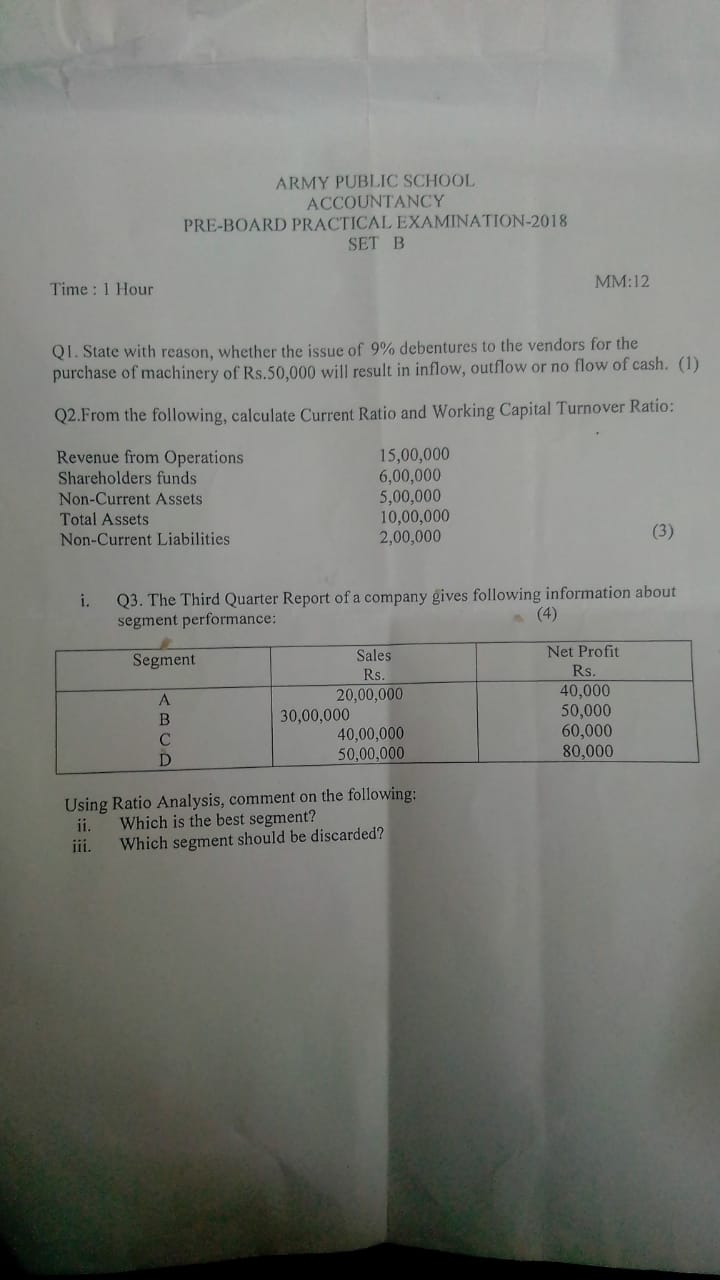

Question in the image

Asked by 7678672735s | 10 Feb, 2019, 05:02: PM

1. Since debentures are issued to vendors for machinery being purchased, amount of machinery is paid in the form of debentures issued.Therefore, there is no cash paid to vendors for machinery purchased and no cash received for debentures issued. Hence, there is no cash flow.

2. From the information given,

Current Assets = Total Assets- Non-Current Assest = 10,00,000 - 5,00,000 = 5,00,000.

Current Liabilities = (Total Liabilities+Shareholders funds) - Non-Current Liabilities;

As per the accounting equaion: Total Assets= Total Liabilties + Shareholders funds therefore, 10,00,000 = Total Liabilities + 6,00,000, Total Liabiliies= 4,00,000

Also, Total Liabilities= Non-current + Current Liabilities. 4,00,000 = 2,00,000 + CUrrent Liabilities, Therefore, Current Liabitlies = 2,00,000

From the above information, Current Assets =5,00,000 and Current Liabilities = 2,00,000

Current Assets = Total Assets- Non-Current Assest = 10,00,000 - 5,00,000 = 5,00,000.

Current Liabilities = (Total Liabilities+Shareholders funds) - Non-Current Liabilities;

As per the accounting equaion: Total Assets= Total Liabilties + Shareholders funds therefore, 10,00,000 = Total Liabilities + 6,00,000, Total Liabiliies= 4,00,000

Also, Total Liabilities= Non-current + Current Liabilities. 4,00,000 = 2,00,000 + CUrrent Liabilities, Therefore, Current Liabitlies = 2,00,000

From the above information, Current Assets =5,00,000 and Current Liabilities = 2,00,000

Current Ratio = Current Assets / Current Liabilities = 5,00,000 / 2,00,000 = 2.5:1

Working Capital Turnover Rartio = Revenue from Operations / Working Capital

= 15,00,000/(Current Assets - Current Liabilities)

= 15,00,000/ (5,00,000-2,00,000)

= 15,00,000/3,00,000 = 5:1

Answered by Surabhi Gawade | 11 Feb, 2019, 09:54: AM

Application Videos

Concept Videos

CBSE 12-commerce - Accountancy

Asked by joymotibarman | 15 Jan, 2024, 02:15: PM

CBSE 12-commerce - Accountancy

Asked by divyanshmaheshwari2003 | 04 Nov, 2023, 05:06: PM

CBSE 12-commerce - Accountancy

Asked by deepamonidas1234 | 21 Sep, 2023, 09:14: PM

CBSE 12-commerce - Accountancy

Asked by officialpaperio.man | 31 Jan, 2022, 09:14: AM

CBSE 12-commerce - Accountancy

Asked by swapnil292001 | 08 Nov, 2020, 11:22: AM

CBSE 12-commerce - Accountancy

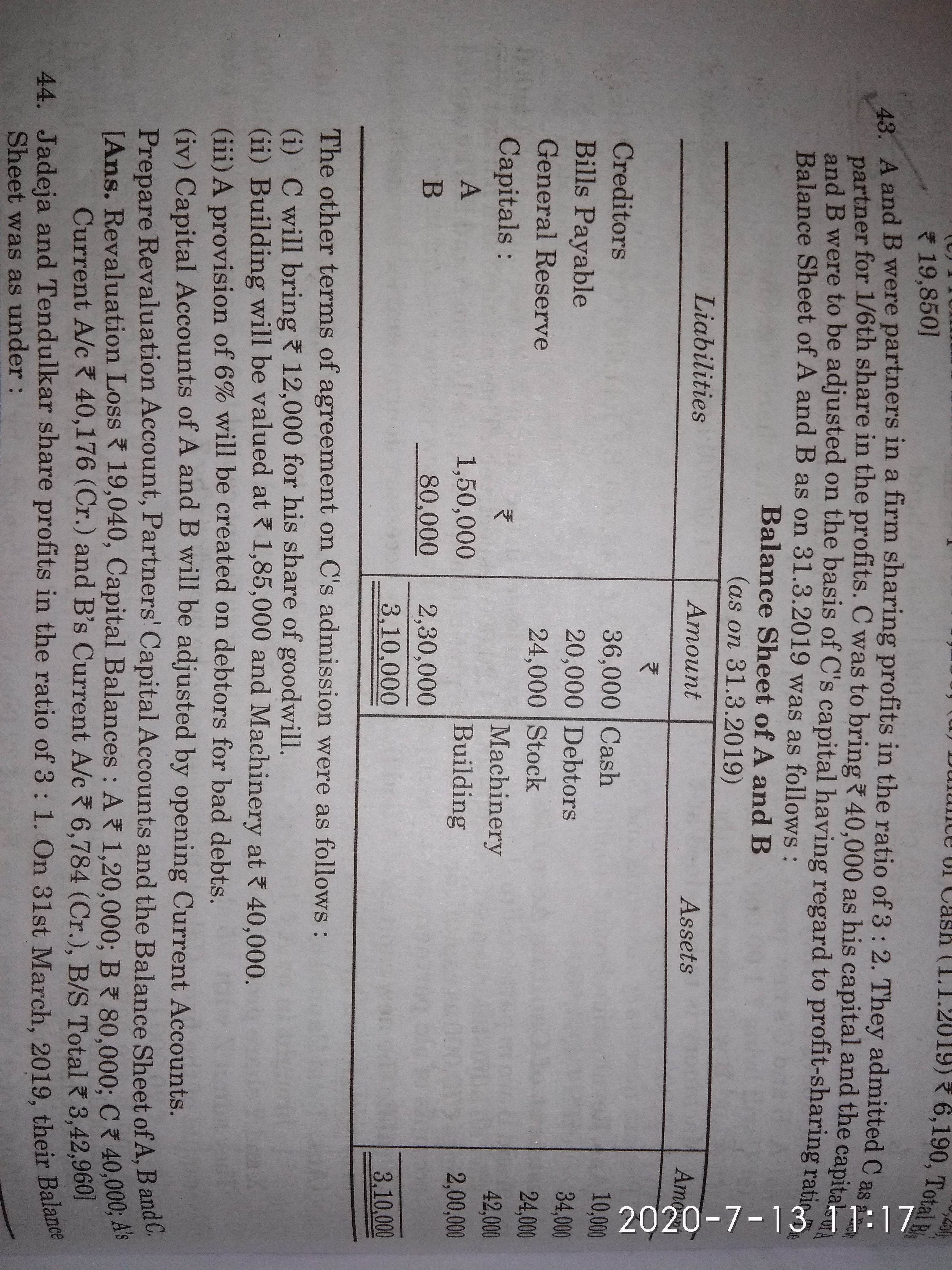

Asked by raksha2sanubth | 13 Jul, 2020, 11:22: AM

CBSE 12-commerce - Accountancy

Asked by raksha2sanubth | 13 Jul, 2020, 11:19: AM

CBSE 12-commerce - Accountancy

Asked by sonowalabhilash | 02 Jul, 2020, 09:46: AM

CBSE 12-commerce - Accountancy

Asked by simarjiv10 | 24 Jun, 2020, 11:25: PM