CBSE Class 12-commerce Answered

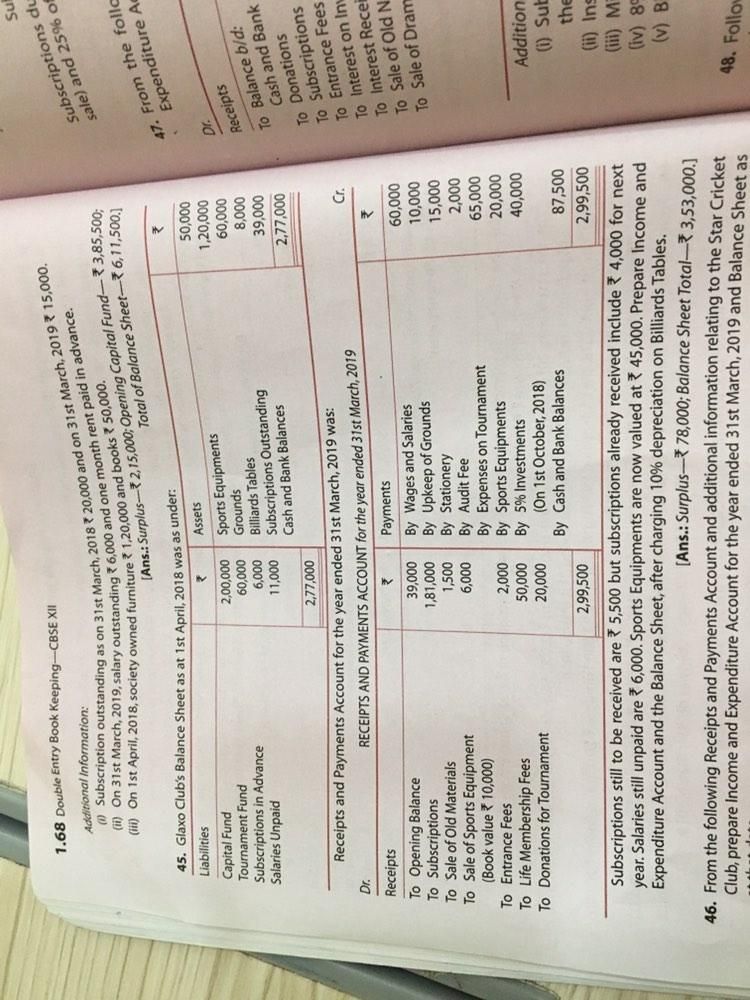

Following are the steps which are to be followed to prepare necessary statements for an NPO based on Receipts and Payments Account with additional information:

Step 1: Determine Opening Capital Fund: This is required to be computed in case where no information is given with respect to opening capital fund. Such opening capital fund is therefore computed taking opening cash and bank balance as given in Receipts and Payments Account and all other assets and liabilities given in the additional information. Once this is done, capital fund is determined by taking difference between the total assets and liabilities.

Step 2: Identify Incomes from Receipts and Payments Account: Since, Receipts and Payments Account shows all the amounts received during the year whether they relate to current, previous or future years, it is necessary to identify revenue receipts of current accounting period only which are actually required to be shown in the Income and Expenditure Account. Capital receipts are shown in the Balance Sheet.

Step 3: Identify Expenses from Receipts and Payments Account: Since, Receipts and Payments Account shows all the amounts spent during the year whether they relate to current, previous or future years, it is necessary to identify revenue payment of current accounting period only which are actually required to be shown in the Income and Expenditure Account. Capital payments are shown in the Balance Sheet.

Step 4: Identify the items not in Receipts and Payments Account but are to be shown in the Income and Expenditure Account: These amounts are mostly non-cash items and therefore not recorded in the Receipts and Payments Account but are to be shown in the Income and Expenditure Account. Example of items are as follows:

- Depreciation on fixed assets;

- Gain or loss on sale of fixed assets.