CBSE Class 12-commerce Answered

Divya purchased Jyoti's business with effect from 1st April, 2019. Profits shown by Jyoti's business for the last three financial years were:

2016-17: ₹1,00,000 (including an abnormal gain of ₹ 12,500).

2017-18: ₹1,25,000 (after charging an abnormal loss of ₹ 25,000)

2018-19: ₹1,12,500 (excluding ₹ 12,500 as insurance premium on firm's property - now to be insured).

Calculate the value of firm's goodwill on the basis of two years' purchase of the average profit of the last three years

Asked by doshid10 | 15 Mar, 2019, 12:29: AM

The information given in the question related to the past years' profits are to be adjusted for the non-operating or abnormal items before calculating the value of goodwill:

Adjusted Profits are as follows:

2016-17 = 100000 - 12500 (abnormal gain included is now removed) = 87500

2017-18 = 125000 + 25000 (abnormal loss charged now added) = 150000

2018-19 = 112500 - 12500 (insurance premium being an expense will now be reduced from the profits) = 100000

Average of Profits = (87500 + 150000 + 100000) / 3 = 112500

Goodwill = Average Profits x No. of years' purchase

= 112500 x 2

= 225000

Answered by Surabhi Gawade | 15 Mar, 2019, 10:14: AM

Application Videos

Concept Videos

CBSE 12-commerce - Accountancy

Asked by joymotibarman | 15 Jan, 2024, 02:15: PM

CBSE 12-commerce - Accountancy

Asked by divyanshmaheshwari2003 | 04 Nov, 2023, 05:06: PM

CBSE 12-commerce - Accountancy

Asked by deepamonidas1234 | 21 Sep, 2023, 09:14: PM

CBSE 12-commerce - Accountancy

Asked by officialpaperio.man | 31 Jan, 2022, 09:14: AM

CBSE 12-commerce - Accountancy

Asked by swapnil292001 | 08 Nov, 2020, 11:22: AM

CBSE 12-commerce - Accountancy

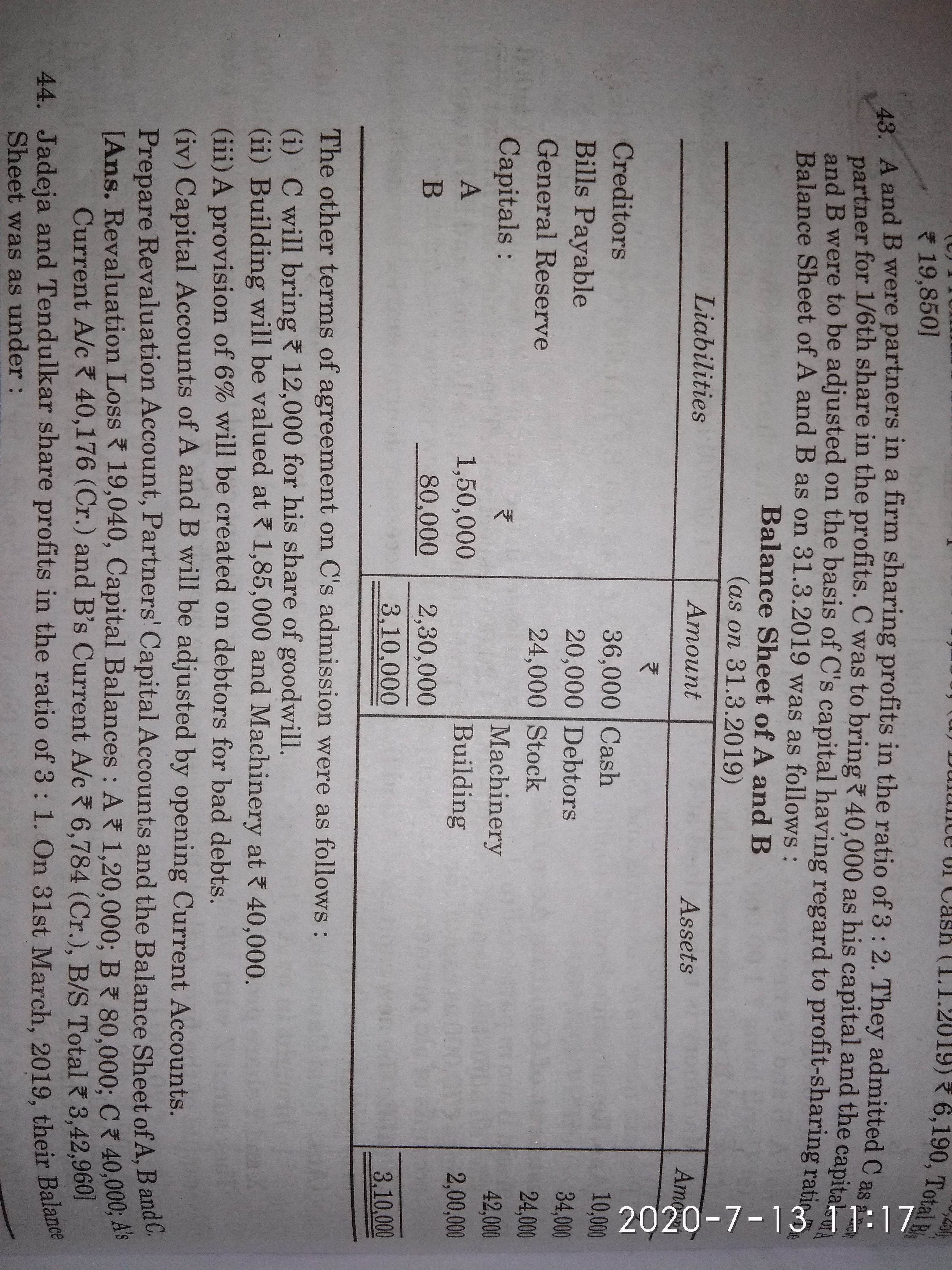

Asked by raksha2sanubth | 13 Jul, 2020, 11:22: AM

CBSE 12-commerce - Accountancy

Asked by raksha2sanubth | 13 Jul, 2020, 11:19: AM

CBSE 12-commerce - Accountancy

Asked by sonowalabhilash | 02 Jul, 2020, 09:46: AM

CBSE 12-commerce - Accountancy

Asked by simarjiv10 | 24 Jun, 2020, 11:25: PM