CBSE Class 12-commerce Answered

All membership fees collected by a non trading concern must be entered on the assists side of a balance sheet . Justify

Asked by anujbajpai44 | 15 Mar, 2019, 07:57: PM

In case of a not for profit organisation, following is the treatment of the various fees received:

- Life Membership Fee: It is not accounted as an income because a life member makes a one-time payment and avails life time services. Therefore, it is accounted as a Capital Receipt and added to Capital Fund on the liabilities side of the Balance Sheet.

- Entrance or Admission Fee: It is an amount that is paid by a person to become a member of a Not-for-Profit organisation. Since, it is received by the NPO from its potential members, it is treated as a revenue receipt which is shown on the credit side of the Income and Expenditure Account.

- Subscriptions:

i. It is a source of income for an NPO.

ii. It is paid by the members periodically which can be quarterly or half yearly so that their membership remains alive.

iii. The total amount of subscription relating to the current year, whether received or not are to be shown on the credit side of the Income and Expenditure Account.

Answered by Surabhi Gawade | 18 Mar, 2019, 12:39: PM

Application Videos

Concept Videos

CBSE 12-commerce - Accountancy

Asked by joymotibarman | 15 Jan, 2024, 02:15: PM

CBSE 12-commerce - Accountancy

Asked by divyanshmaheshwari2003 | 04 Nov, 2023, 05:06: PM

CBSE 12-commerce - Accountancy

Asked by deepamonidas1234 | 21 Sep, 2023, 09:14: PM

CBSE 12-commerce - Accountancy

Asked by officialpaperio.man | 31 Jan, 2022, 09:14: AM

CBSE 12-commerce - Accountancy

Asked by swapnil292001 | 08 Nov, 2020, 11:22: AM

CBSE 12-commerce - Accountancy

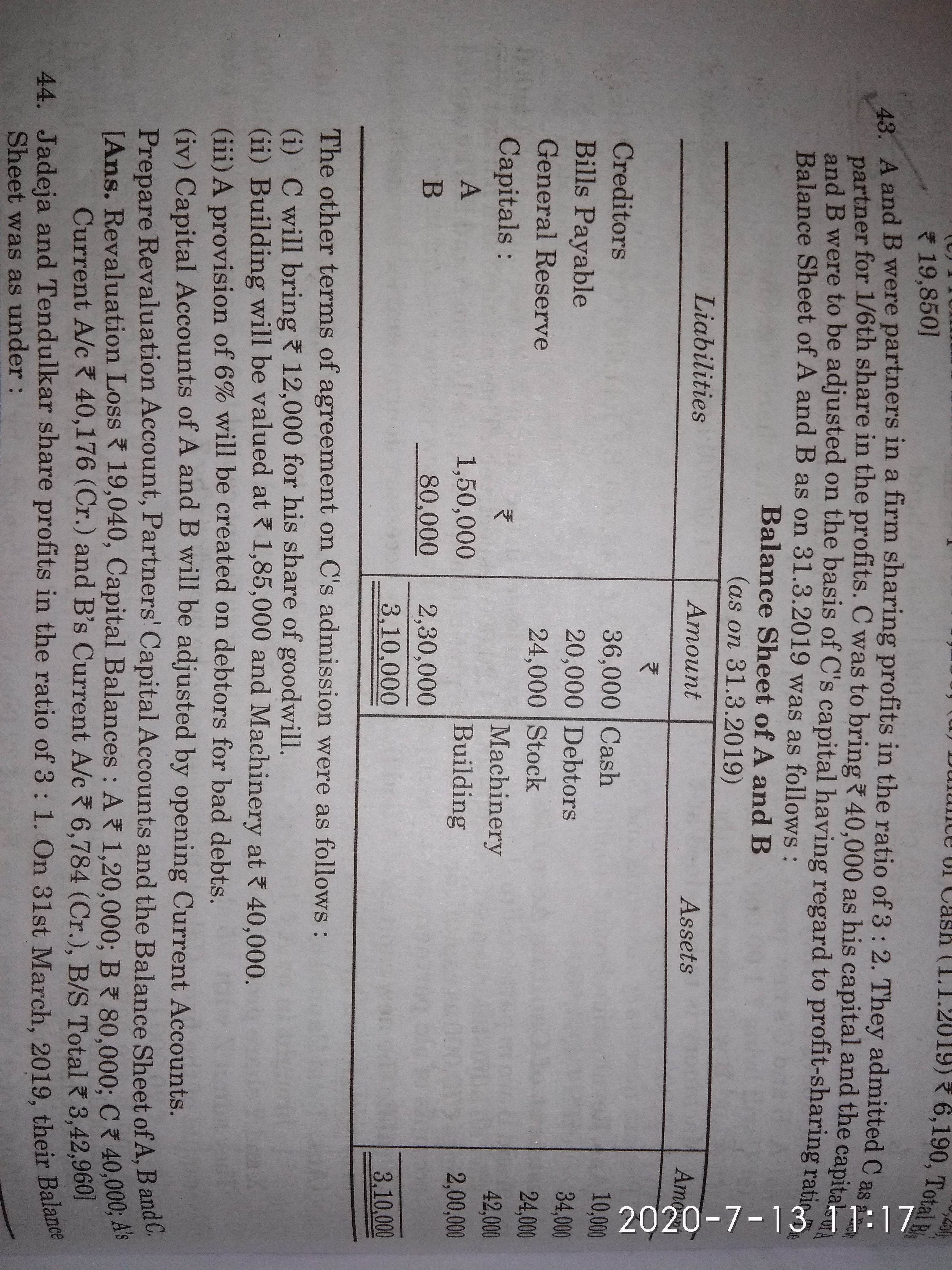

Asked by raksha2sanubth | 13 Jul, 2020, 11:22: AM

CBSE 12-commerce - Accountancy

Asked by raksha2sanubth | 13 Jul, 2020, 11:19: AM

CBSE 12-commerce - Accountancy

Asked by sonowalabhilash | 02 Jul, 2020, 09:46: AM

CBSE 12-commerce - Accountancy

Asked by simarjiv10 | 24 Jun, 2020, 11:25: PM