CBSE Class 11-commerce Questions and Answers

CBSE 11-commerce - Accountancy

pass the journal entry for salman sold goods for rs 500000

Asked by angelkasar22 | 21 Jul, 2024, 19:43: PM

CBSE 11-commerce - Accountancy Part I

what are accounting equations

Asked by kajalmahajan1978 | 05 Jul, 2024, 16:54: PM

CBSE 11-commerce - Accountancy

journal entry for prepaid salary and paid rent in advance

Asked by yogeshbadhwar | 25 May, 2024, 19:33: PM

CBSE 11-commerce - Business Studies

cf= below30,30-39,40-49,50-59,60&above.

f= 17,3,5,15,10 so, find the geometric of the following data above ?

Asked by papunpattanayak143 | 04 May, 2024, 01:46: AM

CBSE 11-commerce - Accountancy

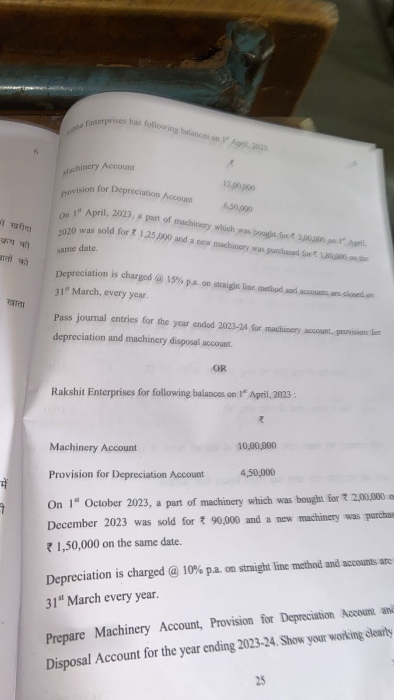

solve this question

Asked by amodkumar964374 | 20 Apr, 2024, 10:44: AM

CBSE 11-commerce - Accountancy

Prepare trial balance from following information

Rawat's capital Rs 60,000, Rohan (creditor) Rs 20,000, Rahul (debtors) Rs

82,000,sales Rs 70,000, goodwill Rs 17,000, bills receivable Rs 5,000, cash in

hand Rs 3,000, stock (opening balance) Rs 43,000

Asked by hydrogamerz.piyush | 17 Apr, 2024, 14:18: PM

CBSE 11-commerce - Accountancy

nhi smj aa rha h

Asked by yaseenkhanfeb55 | 27 Mar, 2024, 22:03: PM

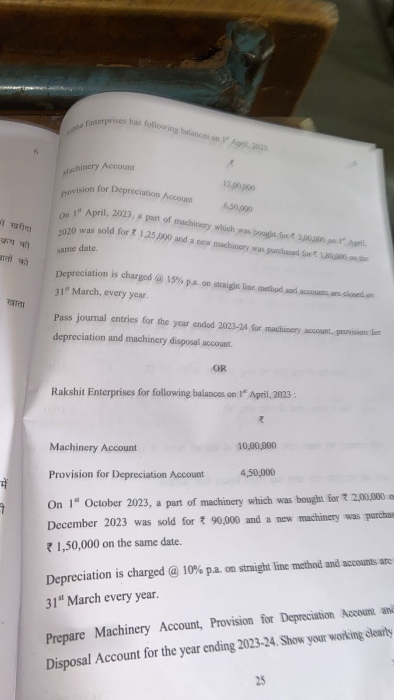

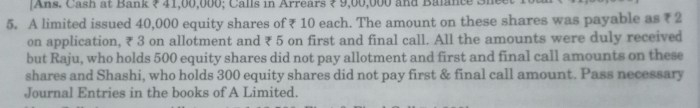

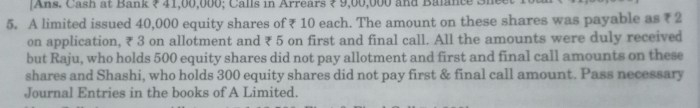

CBSE 11-commerce - Accountancy

A limited issued 40000 equity shares of rupees 10 each the amount on these shares was payable as rupees 2 on Application rupees 3 on allotment rupees 5 on first and final call all amounts were duly received but Raju who holds 500 equity shares did not pay allotment and first and final call amounts on these shares and Shashi who holds 300 equity shares did not pay first and final call amounts pass journal entries

Asked by guptaaastha926 | 02 Mar, 2024, 18:43: PM

CBSE 11-commerce - Maths

The result of a certain survey showed that out of 50 ordinary shops of small size, 35 are managed by

men of which 17 are in cities. 12 shops in village are run by women. Prepare the contingency table

and also find ?

2

Asked by tulsikedar98 | 29 Feb, 2024, 01:24: AM

CBSE 11-commerce - Accountancy Part II

From the following Trial Balance of Ms. March 2019, prepare Trading and Profit & Loss Account and Balance Sheet

[8]

Particulars

(1)

Particulars

(?)

Office expenses

300 Stock (opening)

9,000

Selling expenses General expenses

11,100

Plant & Machinery (1.4.2018) Plant & Machinery (addison 1.10.2018)

20,000

1,000

5.000

Rent, Rates and taxes Sundry creditors Sales Furniture and Fixtures Return inwards Printing and stationery

Return outwards

1,000

Cash at Bank

Purchases

90,000

Sundry debtors.

13,000

Reserve for doubtful debts

400 Rent for Promises Sublet

4,600

Insurance charges.

15,000

Administrative expenses Cash in hand

1,31,000

20,600

Drawings

6,000

6,000

Capital L_{m}

75,000

800

1,600

700

11,000

8,500

18,200

Adjustments: (i)

Stock in

hand

at the end 14,000.

(ii) Write off 600 as bad debts.

(iii) Create 5% provision for bad and doubtful debts.

(iv) Depreciate furniture and fixtures at 5% p.a. and Plant & Machinery at 20% p.a

(v) Insurance prepaid was ?100.

(vi) A fire occurred in the godown and stock of the value of ? 5,000 was destroyed. It was insured and the insurance company admitted full claim

Asked by jaingaman68 | 24 Feb, 2024, 18:25: PM