CBSE Class 12-commerce Answered

Why income tax refund is subtracted from

1.tax paid

2.provision for tax

In cash flow statement?

Asked by ravimundrakd | 10 Apr, 2020, 12:54: AM

While preparing a Cash Flow Statement, Income Tax Refund is deducted from Profits in Operating Activities and Deducted from Income Tax Paid.

Such Income Tax relates to the operating activities of a business and therefore, any refund towards such Income Tax should also be treated as an operating activity.

The amount of refund reduces the amount of total tax liability paid and therefore, is deducted from the tax paid as well.

Answered by Surabhi Gawade | 10 Apr, 2020, 10:22: AM

Application Videos

Concept Videos

CBSE 12-commerce - Accountancy

Asked by joymotibarman | 15 Jan, 2024, 02:15: PM

CBSE 12-commerce - Accountancy

Asked by divyanshmaheshwari2003 | 04 Nov, 2023, 05:06: PM

CBSE 12-commerce - Accountancy

Asked by deepamonidas1234 | 21 Sep, 2023, 09:14: PM

CBSE 12-commerce - Accountancy

Asked by officialpaperio.man | 31 Jan, 2022, 09:14: AM

CBSE 12-commerce - Accountancy

Asked by swapnil292001 | 08 Nov, 2020, 11:22: AM

CBSE 12-commerce - Accountancy

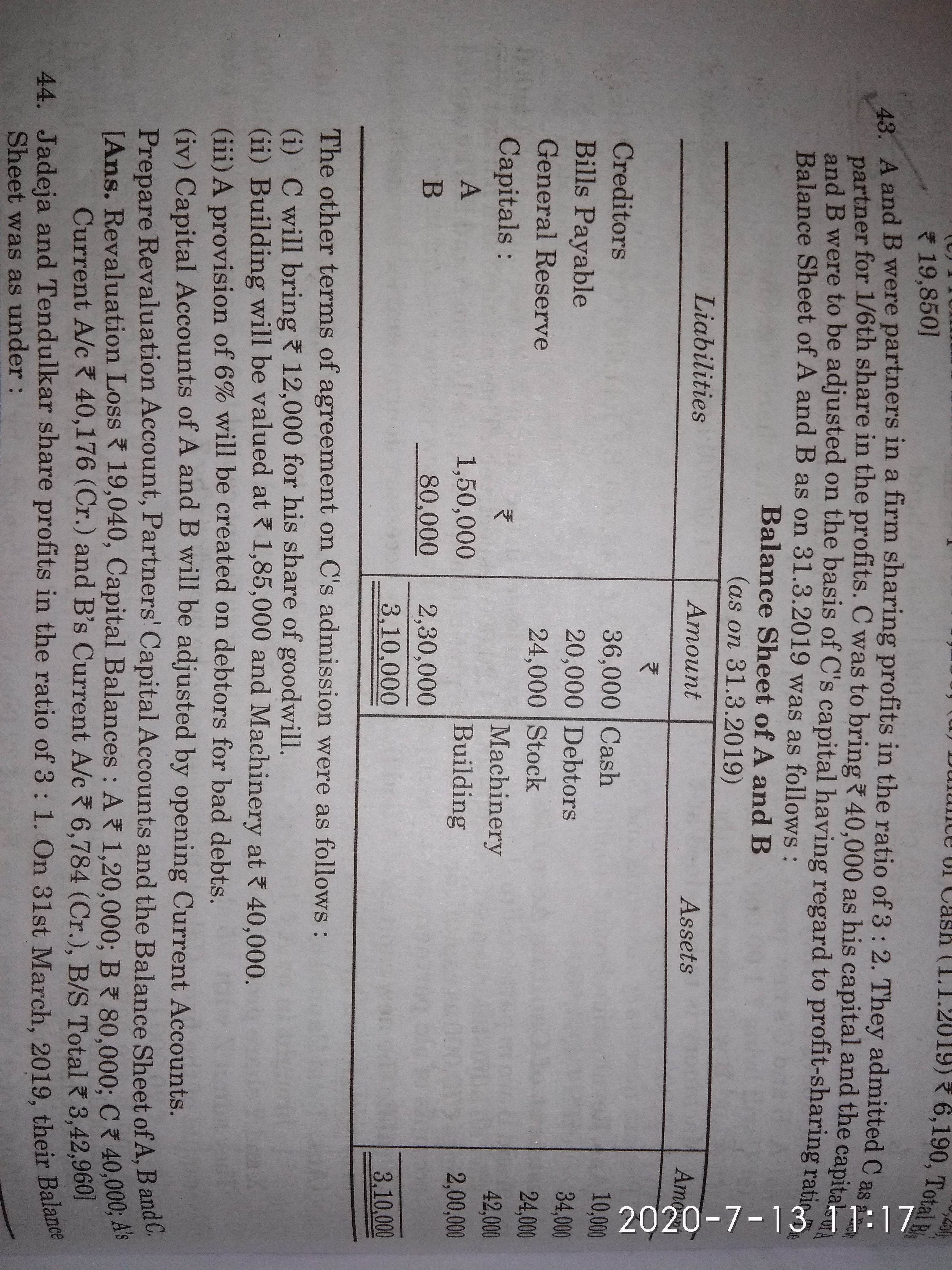

Asked by raksha2sanubth | 13 Jul, 2020, 11:22: AM

CBSE 12-commerce - Accountancy

Asked by raksha2sanubth | 13 Jul, 2020, 11:19: AM

CBSE 12-commerce - Accountancy

Asked by sonowalabhilash | 02 Jul, 2020, 09:46: AM

CBSE 12-commerce - Accountancy

Asked by simarjiv10 | 24 Jun, 2020, 11:25: PM