CBSE Class 12-commerce Answered

How to pass the entry

Under fixed capital method interest on capital is

Asked by raju_salgaonkar | 19 Jan, 2020, 08:20: PM

Important provisions relating to Interest on Capital:

- If there is no Partnership Deed or there is no clause in the deed as to interest on capital: Interest on Capital is not allowed.

- If the Partnership Deed provides for interest on capital but is silent as to the treatment of interest as a charge or appropriation: Interest on capital is treated as appropriation of profit. Such interest is payable only if the firm is making profits. Following are possible situations:

- In case of loss: No interest is allowed.

- In case of profit, where profit before interest is equal to or more than the interest: Interest is allowed at the agreed rate.

- In case of profit, where profit before interest is less than the interest: Interest is allowed only to the extent of profit in the ratio of interest on capital of each partner.

- If the Partnership Deed provides for interest as a charge (i.e., to be allowed whether there are profits or loss): Interest on capital is allowed whether there is profit or loss.

Journal Entries for recording Interest on Capital:

In case of Fixed Capital Accounts:

Interest on Capital A/c …Dr.

To Partners’ Current A/cs

(Being the interest on capital allowed to partners)

Profit and Loss Appropriation A/c …Dr.

To Interest on Capital A/cs

(Being the interest on capital transferred to Profit and Loss Appropriation Account)

Alternatively: only one entry can be passed in place of above 2 entries as follows:

Profit and Loss Appropriation A/c …Dr.

To Partners’ Current A/c

(Being the interest on capital allowed to partners)

Answered by Surabhi Gawade | 20 Jan, 2020, 10:52: AM

Application Videos

Concept Videos

CBSE 12-commerce - Accountancy

Asked by joymotibarman | 15 Jan, 2024, 02:15: PM

CBSE 12-commerce - Accountancy

Asked by divyanshmaheshwari2003 | 04 Nov, 2023, 05:06: PM

CBSE 12-commerce - Accountancy

Asked by deepamonidas1234 | 21 Sep, 2023, 09:14: PM

CBSE 12-commerce - Accountancy

Asked by officialpaperio.man | 31 Jan, 2022, 09:14: AM

CBSE 12-commerce - Accountancy

Asked by swapnil292001 | 08 Nov, 2020, 11:22: AM

CBSE 12-commerce - Accountancy

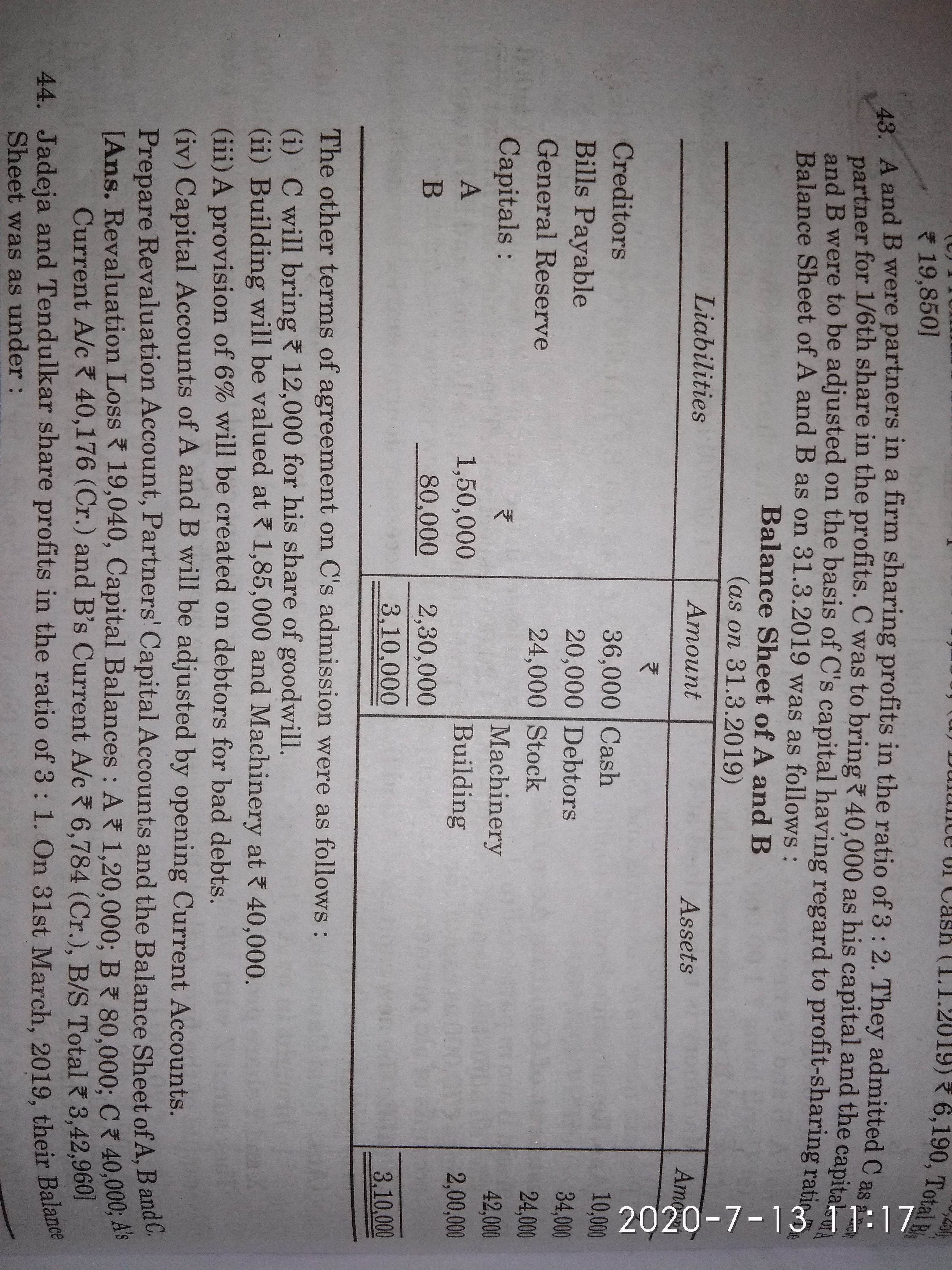

Asked by raksha2sanubth | 13 Jul, 2020, 11:22: AM

CBSE 12-commerce - Accountancy

Asked by raksha2sanubth | 13 Jul, 2020, 11:19: AM

CBSE 12-commerce - Accountancy

Asked by sonowalabhilash | 02 Jul, 2020, 09:46: AM

CBSE 12-commerce - Accountancy

Asked by simarjiv10 | 24 Jun, 2020, 11:25: PM