CBSE Class 11-commerce Answered

goods costing rs100000 were destroyed by fire.These goods were purchased within delhi.Pass journal entry

Asked by akkdsdsd4 | 12 Feb, 2019, 05:46: PM

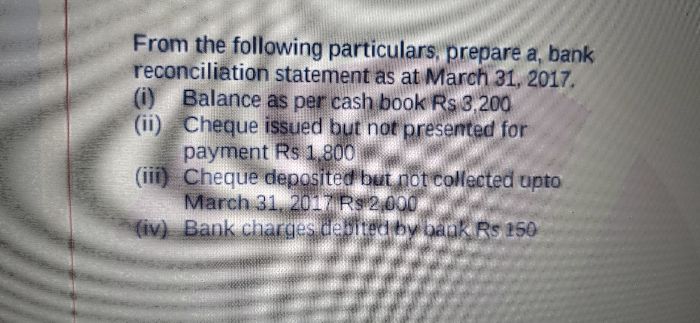

Goods destroyed by fire will result into loss therefore loss by fire is debited to the Income Statement. If goods lost were purchased by paying GST, the same has to be reversed by crediting the GST amounts. It is mentioned that the goods were purchased within Delhi, therefore we can consider that the goods were subject CGST 6% and SGST 6% which is now to be reversed. Following entry is to be passed:

Loss of Stock by fire A/c ...Dr. 112000

To Purchases A/c 100000

To Input CGST A/c 6000

To Input SGST A/c 6000

Answered by Surabhi Gawade | 13 Feb, 2019, 09:29: AM

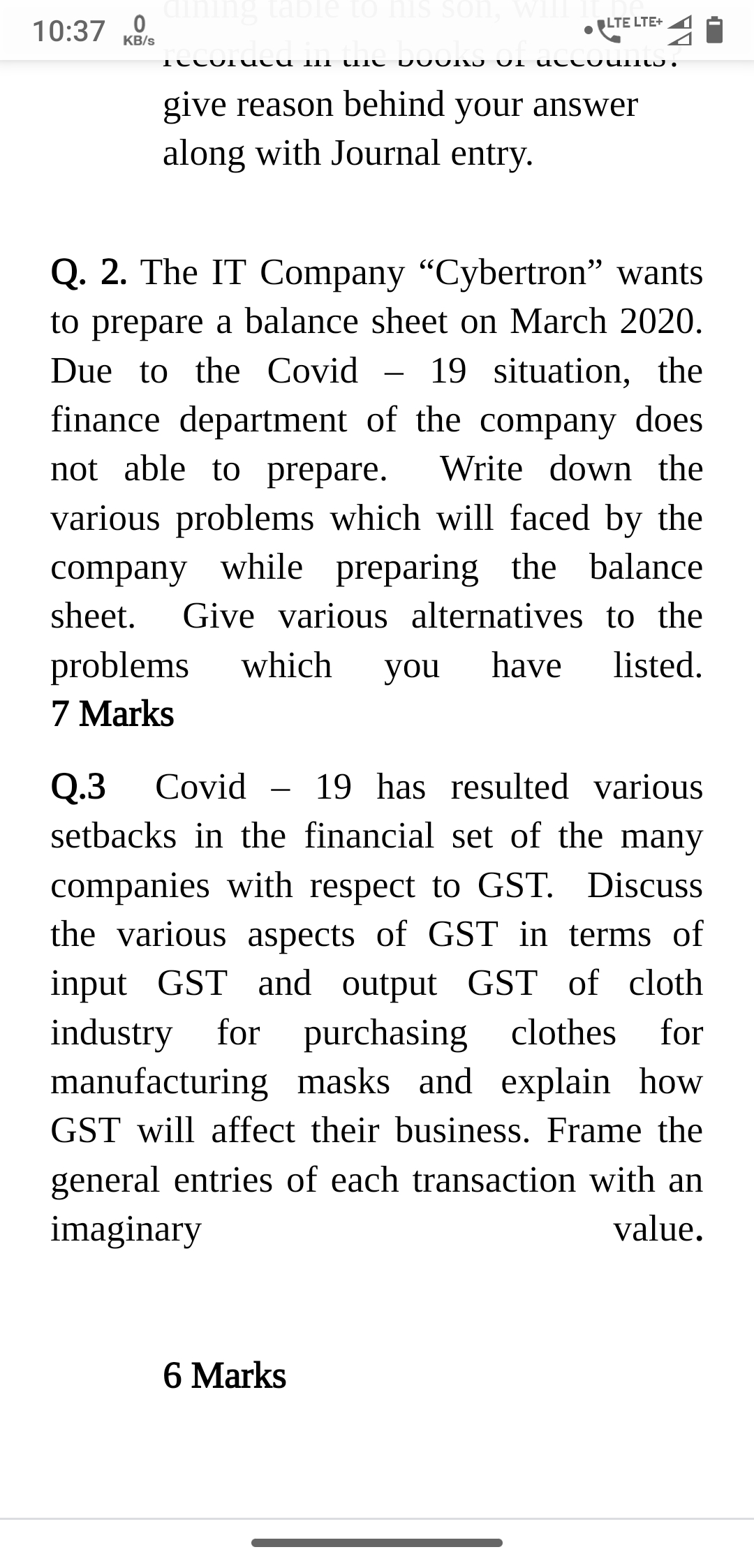

CBSE 11-commerce - Accountancy

Asked by pradyumnaagrawal2957 | 10 Jun, 2021, 10:59: AM

CBSE 11-commerce - Accountancy

Asked by kumarimanisha.9767 | 21 Jul, 2020, 10:32: AM

CBSE 11-commerce - Accountancy

Asked by tussharpoddar7 | 08 Jul, 2020, 11:30: PM

CBSE 11-commerce - Accountancy

Asked by lovermahakal942004 | 08 Jul, 2020, 01:51: PM

CBSE 11-commerce - Accountancy

Asked by tyagiji2511 | 24 Jun, 2020, 10:45: AM

CBSE 11-commerce - Accountancy

Asked by pdas93679 | 23 Jun, 2020, 08:22: AM

CBSE 11-commerce - Accountancy

Asked by agrawalgaurav441 | 12 Jun, 2020, 01:55: PM

CBSE 11-commerce - Accountancy

Asked by boparaijaideep23 | 05 Jun, 2020, 11:07: AM

CBSE 11-commerce - Accountancy

Asked by Lashmibasra | 18 May, 2020, 04:10: PM

CBSE 11-commerce - Accountancy

Asked by himanshu2002tejas | 16 Apr, 2020, 11:16: PM