ICSE Class 10 Answered

A calculator manufacturer's manufacturing cost of calculator is Rs 900. GST is 18%. He manufactured 120 such calculators. He marked up each by 50% and sold to a dealer at a discount of 10%. Find the final price dealer paid for the calculators, also find the total GST received by the central government.

Asked by nidhisingh200418 | 09 Sep, 2019, 12:53: PM

Manufacturing cost=900

GST = 18%=18/100 x 900=162

Cost price of calculator = Rs. 1062

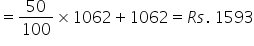

He marked price of each calculator 50% more than the cost price

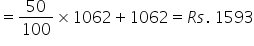

Marked price of 1 calculator

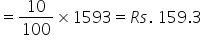

Discount offered

Selling price = 1593 - 159.3 = Rs. 1433.7

Price without GST = 1433.7/1.18 = Rs. 1215

GST paid for one calculator = 1433.7 - 1215 = Rs 218.7

Price paid by dealer for 120 calculators = 120 x 1433.7 = Rs 172044

GST paid for 120 calculators = 218.7 x 12 Rs 26244

Answered by Renu Varma | 11 Sep, 2019, 11:04: AM

Application Videos

Concept Videos

ICSE 10 - Maths

Asked by bhagvantingre | 24 Apr, 2024, 03:05: PM

ICSE 10 - Maths

Asked by shaikafridi860 | 21 Apr, 2024, 11:22: PM

ICSE 10 - Maths

Asked by aritramalakar4 | 13 Apr, 2024, 08:33: PM

ICSE 10 - Maths

Asked by ashwanikaler9 | 11 Apr, 2024, 01:50: PM

ICSE 10 - Maths

Asked by sagarmishra | 15 Mar, 2024, 03:22: PM

ICSE 10 - Maths

Asked by jesnamariaroy2626 | 10 Mar, 2024, 11:28: AM

ICSE 10 - Maths

Asked by vrj.parmar369 | 07 Mar, 2024, 11:27: AM