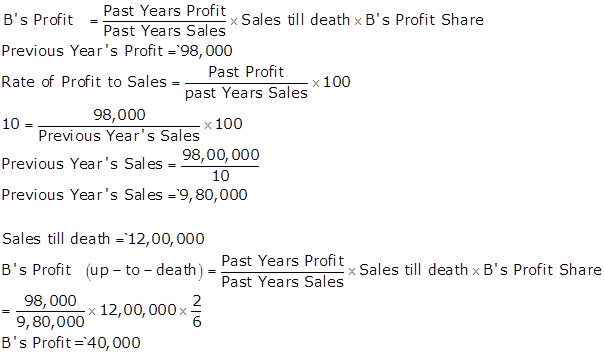

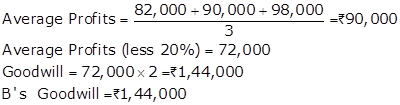

Class 12-commerce T S GREWAL Solutions Accountancy Chapter 6: Retirement/Death of a Partner

Retirement/Death of a Partner Exercise 6.77

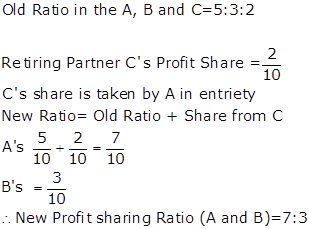

Solution Ex. 1

![]()

As we can see, no information is given as to how A and B are acquiring C's profit share after his retirement, so the new profit sharing ratio between A and B is calculated just by crossing out the C's share.

That is,

∴ New Profit Ratio A and B = 5:4

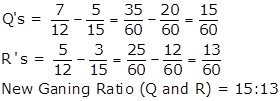

Solution Ex. 2

Since, no information is given as to how Q and R are acquiring P's profit after his retirement, therefore the new profit sharing ratio between Q and R is calculated simply by crossing out P's share.

∴ New profit Ratio (Q and R ) =4:1

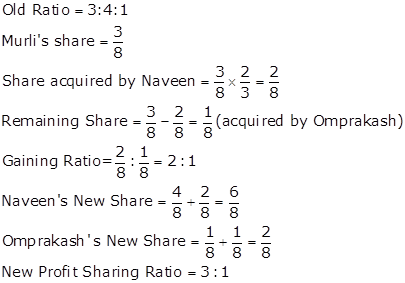

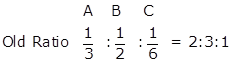

Solution Ex. 3

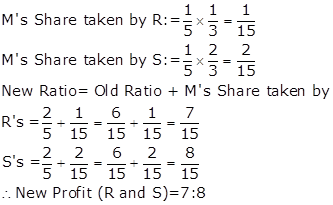

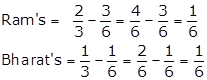

Old Ratio R, S and M = 2:2:1

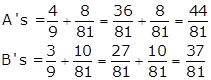

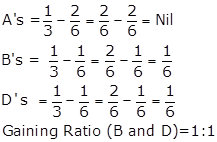

![]()

M's after retires in the firm. His share taken by R and S = 1:2

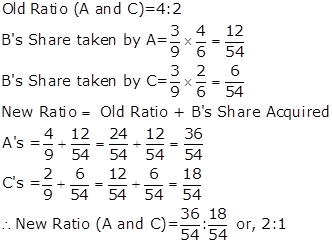

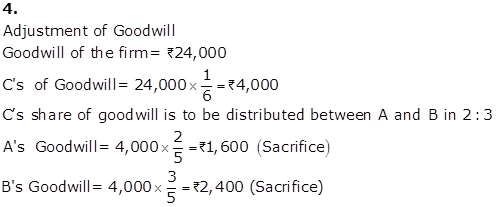

Solution Ex. 4

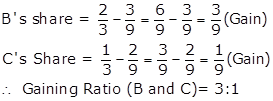

Old Ratio (A,B and C) =4:3:2

New Ratio (B and C)=2:1

Gaining Ratio = New Ratio - old Ratio

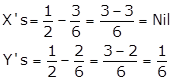

Solution Ex. 5

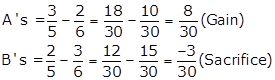

Solution Ex. 6

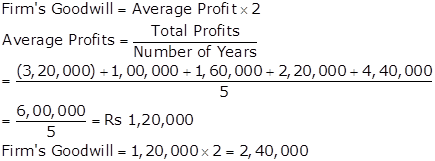

(a)

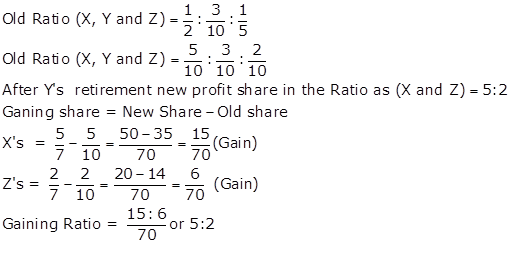

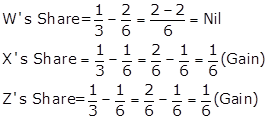

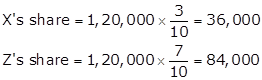

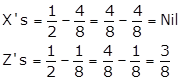

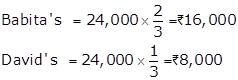

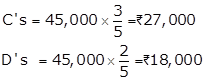

![]()

New Ratio (W, X and Z)= 1:1:1

New Ratio = New Ratio - Old Ratio

∴ New Ratio= 0:1:1

(b)

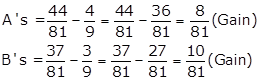

Old Ratio (A,B and C)=4:3:2

C's Profit Share =2/9

A get by 4/9 of C's Share and remaining Share is get by B.

New profit share= Old Profit share +share get from C

∴ New Profit Ratio (A and B)=44:37

Gaining Ratio= New Ratio - Old Ratio

∴ Gaining Ratio=![]() or 4:5

or 4:5

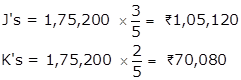

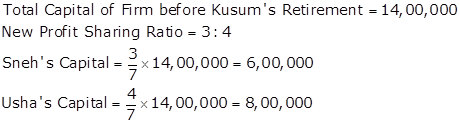

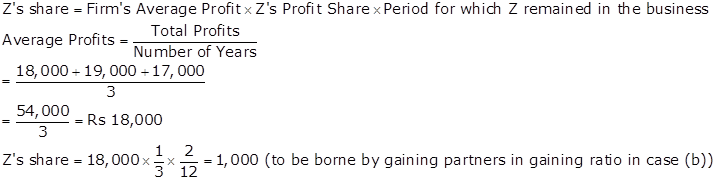

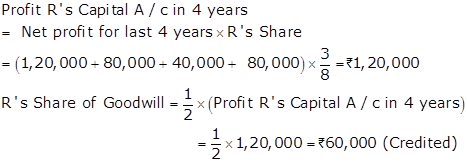

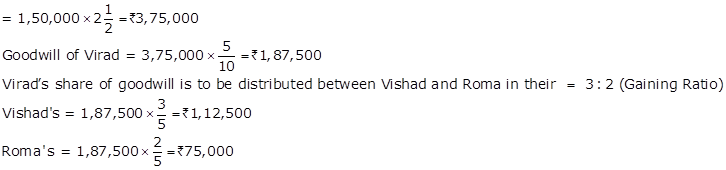

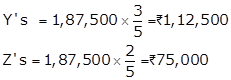

Retirement/Death of a Partner Exercise 6.78

Solution Ex. 7

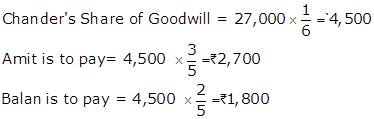

Gaining Ratio = 3:2 (as given in the question)

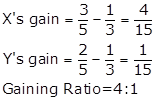

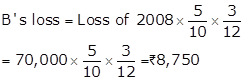

Solution Ex. 8

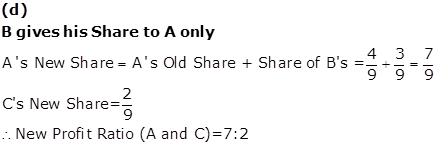

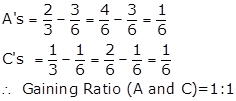

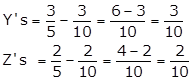

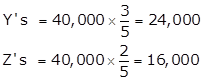

Old Ratio (A, B and C)= 8:4:3

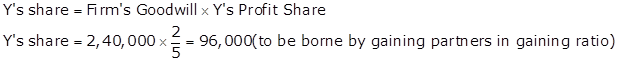

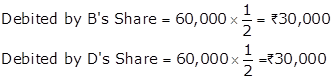

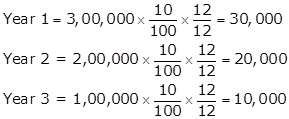

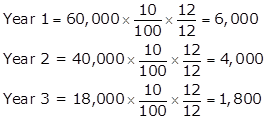

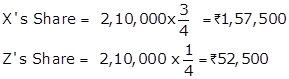

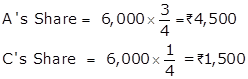

![]()

![]()

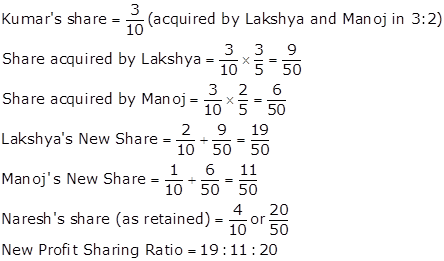

Solution Ex. 9

Solution Ex. 10

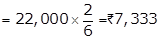

Calculation of Gaining Ratio

P: Q: R = 7:5:3 (Old Ratio)

Q: R=7:5 (New Ratio)

Gaining Ratio = New Ratio - Old Ratio

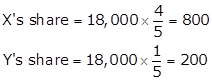

Solution Ex. 11

Solution Ex. 12

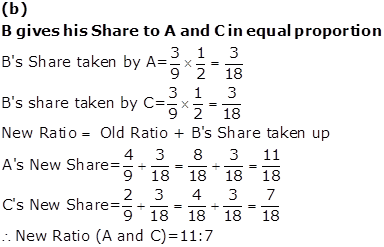

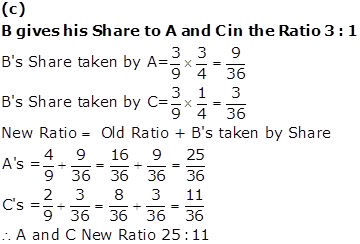

Old Ratio (A, B and C )=4:3:2

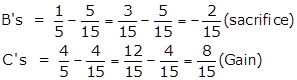

![]()

(a)

B gives his share in the original ratio to A and C.

Solution Ex. 13

|

Journal |

|||||

|

Date |

Particulars

|

|

L.F. |

Debit Rs. |

Credit Rs. |

|

|

L's Capital A/c |

Dr. |

|

13,000 |

|

|

|

O's Capital A/c |

Dr. |

|

11,000 |

|

|

|

-----------To M's Capital A/c |

|

|

|

24,000 |

|

|

(Being adjustment of M's Share of goodwill made) |

|

|

|

|

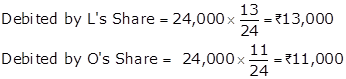

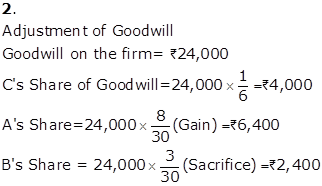

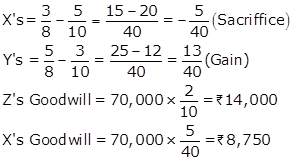

Working Notes:

1.

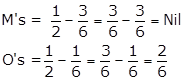

Calculation of Gaining Ratio

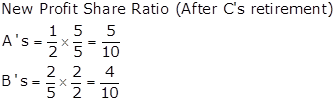

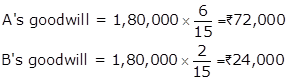

![]()

M's retires from the firm

![]()

Gaining Ratio=New Ratio - Old Ratio

2.

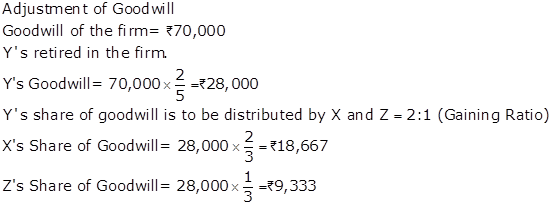

Adjustment of Goodwill

Goodwill of the firm= Rs.72,000

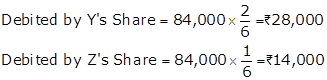

![]()

This share of goodwill is to be debited to remaining partners' Capital A/c in their Gaining ratio (L and O) = 13:11

Solution Ex. 14

|

Journal |

|||||

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

R's Capital A/c |

Dr. |

84,000 |

|||

|

----To P's Capital A/c |

42,000 |

||||

|

----To S's Capital A/c |

42,000 |

||||

|

(Goodwill adjusted) |

|||||

Working Notes:

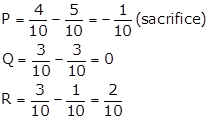

Gaining Ratio = New Ratio - Old Ratio

Solution Ex. 15

|

Journal |

||||||

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

||

|

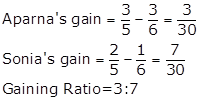

Aparna's Capitals A/c |

Dr. |

18,000 |

||||

|

Sonia's Capital A/c |

Dr. |

42,000 |

||||

|

----To Manisha's Capital A/c |

60,000 |

|||||

|

(Manisha's share of goodwill adjusted to Aparna's and Sonia's Capital Account in their gaining ratio ) |

||||||

Working Notes:

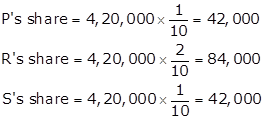

WN1: Calculation of Manisha's Share in Goodwill

WN2: Calculation of Gaining Ratio

Gaining Ratio = New Ratio - Old Ratio

Solution Ex. 16

|

Journal |

|||||

|

Date |

Particulars |

|

L.F. |

Debit Rs. |

Credit Rs. |

|

|

A's Capital A/c |

Dr. |

|

15,000 |

|

|

|

C's Capital A/c |

Dr. |

|

15,000 |

|

|

|

-----------To B's Capital A/c |

|

|

|

30,000 |

|

|

(Being adjustment M's Share of goodwill made) |

|

|

|

|

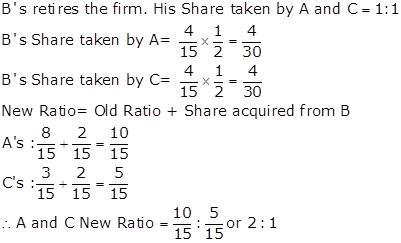

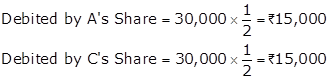

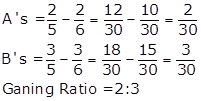

Working Notes:

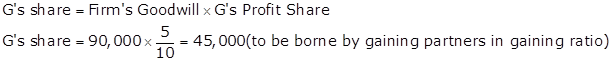

1.

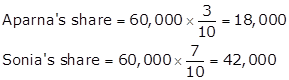

Calculation of gaining Ratio

![]()

B's partner is retirement from the firm.

![]()

Gaining Ratio=New Ratio - Old Ratio

2.

Adjustment of Goodwill

Goodwill of the firm=Rs. 90,000

![]()

B's share of goodwill is to be debited to remaining partners Capital A/c in their Gaining ratio A and C = 1:1

Retirement/Death of a Partner Exercise 6.79

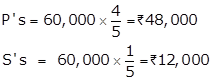

Solution Ex. 20

|

Journal Entry |

|||||

|

Date |

Particulars |

|

L.F. |

Debit Rs. |

Credit Rs. |

|

|

|

|

|

|

|

|

|

O's Capital A/c |

Dr. |

|

20,000 |

|

|

|

----- To N's Capital A/c |

|

|

|

20,000 |

|

|

(Being adjustment of N's share of goodwill) |

|

|

|

|

|

|

|

|

|

|

|

Working Notes:

1.

Calculation of Gaining Ratio

![]()

![]()

Gaining Ratio = New Ratio - Old Ratio

![]()

2.

Calculation of Retiring Partner's share of Goodwill

![]()

Thus, only O's Share Capital A/c would be debited with Rs.20,000

Solution Ex. 17

|

Journal |

|||||

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

|

|

|

|

|

|

|

|

Hanny's Capital A/c |

Dr. |

|

30,000 |

|

|

|

Pammy's Capital A/c |

Dr. |

|

20,000 |

|

|

|

Sunny's Capital A/c |

|

|

10,000 |

|

|

|

-----To Goodwill A/c |

|

|

|

60,000 |

|

|

(Old goodwill written-off in old ratio) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Hanny's Capital A/c |

Dr. |

|

14,000 |

|

|

|

Sunny's Capital A/c |

Dr. |

|

14,000 |

|

|

|

-----To Pammy's Capital A/c |

|

|

|

28,000 |

|

|

(Adjustment for goodwill in gaining ratio) |

|

|

|

|

Working Notes:

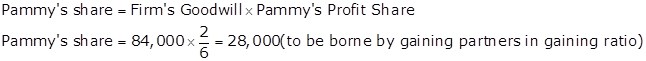

WN1: Calculation of Pammy's Share in Goodwill

WN2: Calculation of Gaining Ratio

Gaining Ratio = New Ratio - Old Ratio

Solution Ex. 18

|

Journal Entry |

|||||

|

Date |

Particulars |

|

L.F. |

Debit Rs. |

Credit Rs. |

|

|

|

|

|

|

|

|

|

X's Capital A/c |

Dr. |

|

30,000 |

|

|

|

Y's Capital A/c |

Dr. |

|

20,000 |

|

|

|

Z's Capital A/c |

Dr. |

|

10,000 |

|

|

|

--------To Goodwill A/c |

|

|

|

60,000 |

|

|

(Being goodwill written off) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Goodwill A/c |

Dr. |

|

84,000 |

|

|

|

---- To X's Capital A/c |

|

|

|

42,000 |

|

|

---- To Y's Capital A/c |

|

|

|

28,000 |

|

|

---- To Z's Capital A/c |

|

|

|

14,000 |

|

|

(Being before Y's retired distributed of goodwill) |

|

|

|

|

|

|

|

|

|

|

|

|

|

X's Capital A/c |

Dr. |

|

56,000 |

|

|

|

Z's Capital A/c |

Dr. |

|

28,000 |

|

|

|

---- To Goodwill A/c |

|

|

|

84,000 |

|

|

(Being after Y's retired distributed of goodwill) |

|

|

|

|

|

|

|

|

|

|

|

Working Notes :

1.

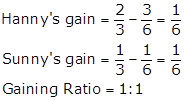

Calculation of Gaining Ratio

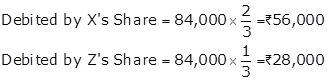

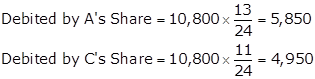

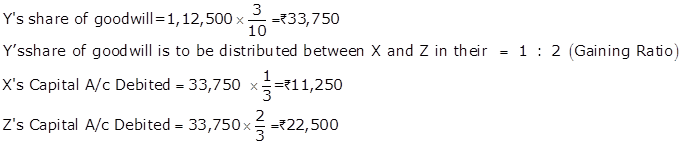

![]()

![]()

Gaining Ratio = New Ratio - Old Ratio

Gaining Ratio (X and Z) = 1:1

2.

Calculation of Partner's share of Goodwill (3:2:1)

![]()

3.

Calculation of Partner's share of Goodwill after Y retried (2:1)

Solution Ex. 19

|

Journal |

|||||

|

Date |

Particulars |

|

L.F. |

Debit Rs. |

Credit Rs. |

|

|

A's Capital A/c |

Dr. |

|

5,850 |

|

|

|

C's Capital A/c |

Dr. |

|

4,950 |

|

|

|

-----------To B's Capital A/c |

|

|

|

10,800 |

|

|

(Being adjustment B's Share of goodwill made) |

|

|

|

|

Working Notes:

1.

Calculation of B's share of goodwill

![]()

B retires from the firm.

Remaining partners A's and C's agreed to pay =Rs.1,50,000

B's Capital after adjustment = Rs.1,39,200

Hidden Goodwill is = Rs.1,50,000 - Rs.1,39,200 =Rs.10,800

2.

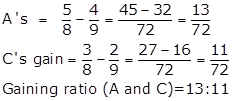

Calculation of Gaining Ratio

![]()

Gaining Ratio = New Ratio - old Ratio

B's share of goodwill is to be debited to remaining partners Capital A/c in their Gaining ratio A and C = 13:11

![]()

Solution Ex. 21

|

Journal Entry |

|||||

|

Date |

Particulars |

|

L.F. |

Debit Rs. |

Credit Rs. |

|

|

|

|

|

|

|

|

|

B's Capital A/c |

Dr. |

|

30,000 |

|

|

|

D's Capital A/c |

Dr. |

|

30,000 |

|

|

|

---- To C's Capital A/c |

|

|

|

60,000 |

|

|

(Being adjustment of C's share of goodwill) |

|

|

|

|

|

|

|

|

|

|

|

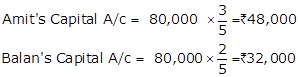

Working Notes :

1.

Calculation of Gaining Ratio

![]()

![]()

C's retires from the firm.

Gaining Ratio = New Ratio - Old Ratio

2.

Calculation of Retiring Partner's Share of goodwill

![]()

C's share of

goodwill is to be debited to remaining partners Capital A/c in their Gaining

ratio B and D = 1:1

Solution Ex. 22

|

Journal Entry |

|||||

|

Date |

Particulars |

|

L.F. |

Debit Rs. |

Credit Rs. |

|

|

|

|

|

|

|

|

|

C's Capital A/c |

Dr. |

|

96,000 |

|

|

|

----- To A's Capital A/c |

|

|

|

72,000 |

|

|

------ To B's Capital A/c |

|

|

|

24,000 |

|

|

(Being adjustment of A's and B's share of goodwill made) |

|

|

|

|

|

|

|

|

|

|

|

Working Notes:

1.

Calculation of Gaining Ratio

![]()

![]()

A's retires from the firm. Gaining Ratio = New Ratio - Old Ratio

2.

Calculation of Retiring Partner's share of Goodwill

A's and B's share of goodwill be brought by C only.

C's Capital A/c debited=72,000 + 24,000 = Rs.96,000.

Solution Ex. 23

|

Revaluation A/c |

|||||

|

Dr. |

|

Cr. |

|||

|

Particulars |

|

Rs. |

Particulars |

Rs. |

|

|

To Stock A/c |

|

10,000 |

By Furniture A/c |

12,000 |

|

|

To Machinery A/c |

|

5,000 |

By Investment A/c |

10,000 |

|

|

To Provision for D. Debts A/c |

|

2,000 |

By Bills Payable A/c |

1,000 |

|

|

To Profit transferred to: |

|

|

|

|

|

|

|

X's Capital A/c |

3,000 |

|

|

|

|

|

Y's Capital A/c |

1,800 |

|

|

|

|

|

Z's Capital A/c |

1,200 |

6,000 |

|

|

|

|

|

23,000 |

|

23,000 |

|

|

Journal |

|||||

|

Sr. No. |

Particulars |

|

L.F. |

Debit Rs. |

Credit Rs. |

|

i. |

Furniture A/c |

Dr. |

|

12,000 |

|

|

|

----------To Revaluation A/c |

|

|

|

12,000 |

|

|

(Being increase in value transferred to Revaluation Account) |

|

|

|

|

|

|

|

|

|

|

|

|

ii. |

Revaluation A/c |

Dr. |

|

10,000 |

|

|

|

----------To Stock A/c |

|

|

|

10,000 |

|

|

(Being decrease in stock transferred to Revaluation) |

|

|

|

|

|

|

|

|

|

|

|

|

iii. |

Revaluation A/c |

Dr. |

|

5,000 |

|

|

|

----------To Machinery A/c |

|

|

|

5,000 |

|

|

(Being decrease in value of machinery transferred to Revaluation Account) |

|

|

|

|

|

|

|

|

|

|

|

|

iv. |

Revaluation A/c |

Dr. |

|

2,000 |

|

|

|

----------To Provision for Doubtful debts A/c |

|

|

|

2,000 |

|

|

(Being increase in liabilities to Revaluation Account) |

|

|

|

|

|

|

|

|

|

|

|

|

v. |

Investment A/c |

Dr. |

|

10,000 |

|

|

|

----------To Revaluation A/c |

|

|

|

10,000 |

|

|

(Being increase in value transferred to Revaluation Account) |

|

|

|

|

|

|

|

|

|

|

|

|

vi. |

Bills Payable A/c |

Dr. |

|

1,000 |

|

|

|

----------To Revaluation A/c |

|

|

|

1,000 |

|

|

(Being decrease in liabilities transferred to Revaluation Account) |

|

|

|

|

|

|

|

|

|

|

|

|

vii. |

Revaluation A/c |

Dr. |

|

6,000 |

|

|

|

----------To X's Capital A/c |

|

|

|

3,000 |

|

|

----------To Y's Capital A/c |

|

|

|

1,800 |

|

|

----------To Z's Capital A/c |

|

|

|

1,200 |

|

|

(Being Revaluation Profit transferred to Partners' Capital Account) |

|

|

|

|

|

|

|

|

|

|

|

Retirement/Death of a Partner Exercise 6.80

Solution Ex. 24

|

Revaluation Account |

|||||

|

Dr. |

|

Cr. |

|||

|

Particulars |

|

Rs. |

Particulars |

Rs. |

|

|

To Plant and Machinery A/c (40,000×10%) |

|

4,000 |

By Building A/c (1,00,000×20%) |

20,000 |

|

|

To Provision for Doubtful Debts A/c |

|

1,000 |

By Stock of finished Goods A/c |

5,000 |

|

|

To Stock of Raw Material A/c |

|

2,000 |

By Computer A/c |

2,000 |

|

|

To Workmen's Compensation Claim A/c |

|

5,000 |

|

|

|

|

To Profit transferred to: |

|

|

|

|

|

|

|

A's Capital A/c |

6,000 |

|

|

|

|

|

B's Capital A/c |

6,000 |

|

|

|

|

|

C's Capital A/c |

3,000 |

15,000 |

|

|

|

|

|

27,000 |

|

27,000 |

|

|

Journal |

|||||

|

Date |

Particulars |

|

L.F. |

Debit Rs. |

Credit Rs. |

|

|

Building A/c |

Dr. |

|

20,000 |

|

|

|

Stock of Finished Good A/c |

Dr. |

|

5,000 |

|

|

|

Computer A/c |

Dr. |

|

2,000 |

|

|

|

---------To Revaluation A/c |

|

|

|

27,000 |

|

|

(Being increase in value Assets transferred to Revaluation Account) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Revaluation A/c |

Dr. |

|

12,000 |

|

|

|

---------To Plant and Machinery A/c |

|

|

|

4,000 |

|

|

---------To Provision for Doubtful Debts A/c |

|

|

|

1,000 |

|

|

---------To Stock of Raw Material A/c |

|

|

|

2,000 |

|

|

---------To Workmen's Companion Claim A/c |

|

|

|

5,000 |

|

|

(Being increase in value Assets transferred to Revaluation Account) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Revaluation A/c |

Dr. |

|

15,000 |

|

|

|

---------To A's Capital A/c |

|

|

|

6,000 |

|

|

---------To B's Capital A/c |

|

|

|

6,000 |

|

|

---------To C's Capital A/c |

|

|

|

3,000 |

|

|

(Being Revaluation Profit transferred to Partners' Capital account) |

|

|

|

|

Solution Ex. 25

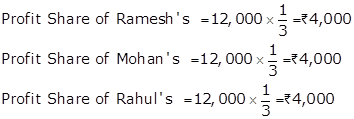

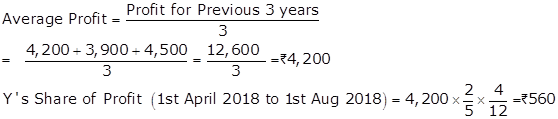

Revaluation of assets and liabilities is made at the time of Ramesh's retirement and not after his retirement. Therefore, profits on revaluation will be distributed among all the partners in their old profit sharing ratio or equally in absence of partnership deed.

|

Journal |

||||

|

Particulars |

|

L.F. |

Debit Rs. |

Credit Rs. |

|

Revaluation A/c |

Dr. |

|

12,000 |

|

|

----------To Ramesh's Capital A /c |

|

|

|

4,000 |

|

----------To Mohan's Capital A/c |

|

|

|

4,000 |

|

----------To Rahul-s Capital A/c |

|

|

|

4,000 |

|

(Being Revaluation profit distributed among all the partners in their old ratio) |

|

|

|

|

|

|

|

|

|

|

Solution Ex. 26

|

Journal |

||||

|

Particulars |

|

L.F. |

Debit Rs. |

Credit Rs. |

|

General Reserve A/c |

Dr. |

|

1,80,000 |

|

|

Workmen Compensation Reserve A/c |

Dr. |

|

24,000 |

|

|

----------To X's Capital A/c |

|

|

|

1,02,000 |

|

----------To Y's Capital A/c |

|

|

|

68,000 |

|

----------To Z's Capital A/c |

|

|

|

34,000 |

|

(Being Accumulated Profit distributed among partners in old ratio) |

|

|

|

|

|

|

|

|

|

|

|

X's Capital A/c |

Dr. |

|

15,000 |

|

|

Y's Capital A/c |

Dr. |

|

10,000 |

|

|

Z's Capital A/c |

Dr. |

|

5,000 |

|

|

----------To Profit and Loss A/c |

|

|

|

30,000 |

|

(Being Debit balance in profit and Loss account distributed among partners in old ratio) |

|

|

|

|

|

|

|

|

|

|

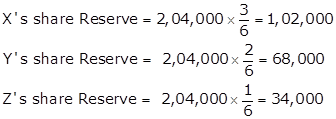

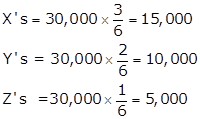

Working Notes:

1.

Total Credit Balance of Reserves

= General Reserve + Workmen Compensation Reserve

=1,80,000+24,000

=2,04,000

Distribution of Reserves

2.

Distribution of Debit Balance of Profit and Loss A/c

Note: Employees' Provident fund being a liability will not be distributed.

Solution Ex. 27

|

Journal |

||||

|

Particulars |

|

L.F. |

Debit Rs. |

Credit Rs. |

|

Asha's Capital A/c |

Dr. |

|

40,000 |

|

|

Naveen's Capital A/c |

Dr. |

|

24,000 |

|

|

Shalini's Capital A/c |

Dr. |

|

16,000 |

|

|

---------To Goodwill A/c |

|

|

|

80,000 |

|

(Being Existing goodwill written off amongst existing partners in old ratio) |

|

|

|

|

|

|

|

|

|

|

|

General Reserve A/c |

Dr. |

|

40,000 |

|

|

----------To Asha's Capital A/c |

|

|

|

20,000 |

|

----------To Naveen's Capital A/c |

|

|

|

12,000 |

|

----------To Shalini's Capital A/c |

|

|

|

8,000 |

|

(Being General Reserve distributed among all partners in old ratio) |

|

|

|

|

|

|

|

|

|

|

|

Shalini's Capital A/c |

Dr. |

|

48,000 |

|

|

---------To Asha's Capital A/c |

|

|

|

12,000 |

|

---------To Naveen's capital A/c |

|

|

|

36,000 |

|

(Being Goodwill adjusted by debiting gaining partners and crediting sacrificing and retiring partner) |

|

|

|

|

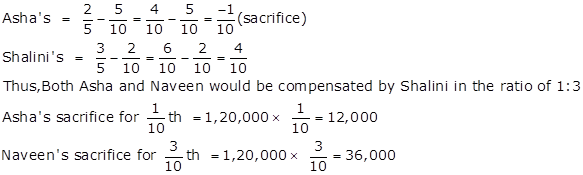

Calculation of Gaining Ratio

Gaining Ratio =New share - Old Share

Retirement/Death of a Partner Exercise 6.81

Solution Ex. 28

|

Journal |

|||||

|

Date |

Particulars |

|

L.F. |

Debit Rs. |

Credit Rs. |

|

|

|

|

|

|

|

|

|

Ram's Capital A/c |

Dr. |

|

90,000 |

|

|

|

Laxman's Capital A/c |

Dr. |

|

60,000 |

|

|

|

Bharat's Capital A/c |

Dr. |

|

30,000 |

|

|

|

--- To Goodwill A/c |

|

|

|

1,80,000 |

|

|

(Being goodwill written off) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Ram's Capital A/c |

Dr. |

|

42,000 |

|

|

|

Bharat's Capital A/c |

Dr. |

|

42,000 |

|

|

|

--- - To Laxman's Capital A/c |

|

|

|

84,000 |

|

|

(Being adjustment of Laxman's share of goodwill) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Profit and Loss Appropriation A/c |

Dr. |

|

1,20,000 |

|

|

|

------- To Ram's Capital A/c |

|

|

|

80,000 |

|

|

-- To Bharat's Capital A/c |

|

|

|

40,000 |

|

|

(Being profit on revaluation transferred to 'Partners Capital A/c) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

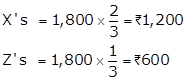

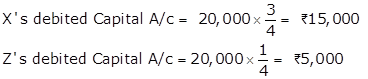

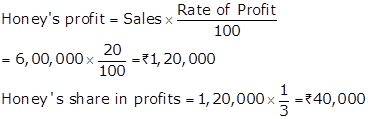

Working Notes :

1.

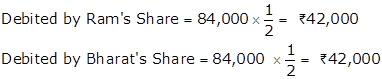

Calculation of Gaining Ratio

Old Ratio (Ram, Laxman and Bharat) = 3:2:1

New Ratio (Ram and Bharat) = 2:1

Gaining Ratio = New Ratio - Old Ratio

Gaining Ratio (Ram and Bharat) = 1:1

2.

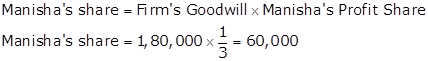

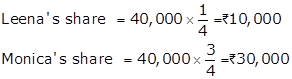

Calculation of Retiring Partner's share of goodwill

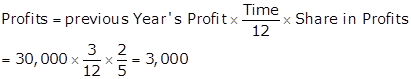

![]()

Laxman's share of goodwill is to be debited to remaining partners Capital A/c in their Gaining ratio (Ram, Bharat) = 1:1

Solution Ex. 29

|

C's Capital Account |

|||

|

Dr. |

Cr. |

||

|

Particulars |

Rs. |

Particulars |

Rs. |

|

To C's Loan A/c |

7,700 |

By Balance b/d |

6,000 |

|

|

|

By C's Current A/c |

1,700 |

|

|

|

|

|

|

|

7,700 |

|

7,700 |

|

C's Current Account |

|||

|

Dr. |

Cr. |

||

|

Particulars |

Rs. |

Particulars |

Rs. |

|

To Balance b/d |

500 |

By Profit and Loss Suspense A/c

|

550 |

|

To C's Capital A/c (Balancing fig.) |

1,700 |

By D's Current A/c |

1650 |

|

|

|

|

|

|

|

2,200 |

|

2,200 |

Working Notes:

Solution Ex. 30

|

Revaluation Account |

|||||

|

Dr. |

Cr. |

||||

|

Particulars |

Rs. |

Particulars |

|

Rs. |

|

|

To Bad Debts A/c |

2,000 |

By Loss Transferred to: |

|

|

|

|

To Patents A/c |

9,000 |

|

X's Capital A/c |

4,400 |

|

|

|

|

|

Y's Capital A/c |

4,400 |

|

|

|

|

|

Z's Capital A/c |

2,200 |

11,000 |

|

|

11,000 |

|

|

11,000 |

|

|

Partners Capital Account |

|||||||

|

Dr. |

|

|

|

|

|

|

Cr. |

|

Particulars |

X |

Y |

Z |

Particulars |

X |

Y |

Z |

|

To Revaluation A/c (Loss) |

4,400 |

4,400 |

2,200 |

By Balance b/d |

82,000 |

60,000 |

75,500 |

|

To Y's Capital A/c (Goodwill) |

18,667 |

|

9,333 |

By Reserve A/c (Old Ratio) |

7,400 |

7,400 |

3,700 |

|

To Y's Loan A/c |

|

91,000 |

|

By X's Capital A/c (Goodwill) |

|

18,667 |

|

|

To Balance c/d |

66,333 |

|

67,667 |

By Z's Capital A/c (Goodwill) |

|

9,333 |

|

|

|

|

|

|

|

|

|

|

|

|

89,400 |

95,400 |

79,200 |

|

89,400 |

95,400 |

79,200 |

|

Balance Sheet |

|||||

|

as on 1st April 2019 (after Y's Retirement) |

|||||

|

|

|

|

|||

|

Liabilities |

|

Rs. |

Assets |

Rs. |

|

|

Creditors |

|

49,000 |

Cash |

8,000 |

|

|

Y's Loan |

|

91,000 |

Debtors (19,000-2,000) |

17,000 |

|

|

Capital |

|

|

Stock |

42,000 |

|

|

|

X |

66,333 |

|

Building |

2,07,000 |

|

|

Z |

67,667 |

1,34,000 |

|

|

|

|

|

2,74,000 |

|

2,74,000 |

|

Working Note:

1.

|

Journal |

||||

|

Particulars |

|

L.F. |

Debit Rs. |

Credit Rs. |

|

X's Capital A/c |

Dr. |

|

18,667 |

|

|

Z's Capital A/c |

Dr. |

|

9,333 |

|

|

---------To Y's Capital A/c |

|

|

|

28,000 |

|

(Being adjustment of goodwill made on Y's retirement) |

|

|

|

|

|

|

|

|

|

|

Retirement/Death of a Partner Exercise 6.82

Solution Ex. 31

|

Revaluation Account |

||||||

|

Dr. |

Cr. |

|||||

|

Particulars |

Rs. |

Particulars |

Rs. |

|||

|

Revaluation Profit |

Fixed Assets |

60,000 |

||||

|

Kanika's Capital |

40,000 |

|

Stock |

20,000 |

||

|

|

Disha's Capital |

20,000 |

|

|

|

|

|

Kabir's Capital |

20,000 |

80,000 |

||||

|

80,000 |

80,000 |

|||||

|

Partners' Capital Account |

||||||||

|

Dr. |

Cr. |

|||||||

|

Particulars |

Kanika |

Disha |

Kabir |

Particulars |

Kanika |

Disha |

Kabir |

|

|

Profit and Loss A/c |

10,000 |

5,000 |

5,000 |

Balance b/d |

2,00,000 |

1,00,000 |

80,000 |

|

|

Kanika's Capital A/c |

35,000 |

35,000 |

Disha's Capital A/c |

35,000 |

|

|

||

|

Kanika's Loan A/c |

3,00,000 |

|

|

Kabir's Capital A/c |

35,000 |

|

||

|

Balance c/d |

|

80,000 |

60,000 |

Revaluation |

40,000 |

20,000 |

20,000 |

|

|

3,10,000 |

1,20,000 |

1,00,000 |

3,10,000 |

1,20,000 |

1,00,000 |

|||

|

Balance Sheet as on March 31, 2016 |

||||||

|

Liabilities |

Rs. |

Assets |

Rs. |

|||

|

Employees' Provident Fund |

47,000 |

Bank |

|

60,000 |

||

|

Trade Creditors |

53,000 |

Sundry Debtors |

60,000 |

|||

|

Kanika's Loan A/c |

3,00,000 |

Stock |

|

1,20,000 |

||

|

Capitals |

Fixed Assets |

3,00,000 |

||||

|

Disha |

80,000 |

|

||||

|

Kabir |

60,000 |

1,40,000 |

|

|

|

|

|

|

5,40,000 |

|

|

5,40,000 |

||

|

|

|

|

|

|

||

Working Notes:

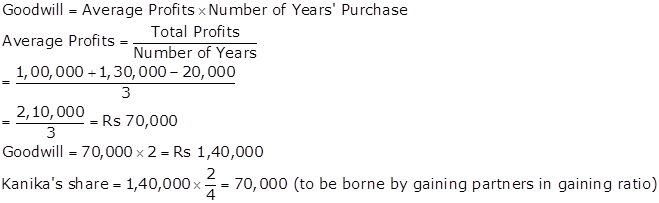

WN1: Calculation of Goodwill

Note: Since no information is given about the share of gain, it is assumed that the old partners are gaining in their old profit sharing ratio.

Solution Ex. 32

|

Journal |

||||

|

Particulars |

|

L.F. |

Debit Rs. |

Credit Rs. |

|

Revaluation A/c |

Dr. |

|

4,300 |

|

|

----------To Provision for Doubtful Debts A/c |

|

|

|

300 |

|

----------To Provision for Outstanding Repairs Bills A/c |

|

|

|

4,000 |

|

(Being Provision transferred to Revaluation Account) |

|

|

|

|

|

|

|

|

|

|

|

Prepaid Insurance A/c |

Dr. |

|

1,500 |

|

|

Land and Building A/c |

Dr. |

|

10,000 |

|

|

----------To Revaluation A/c |

|

|

|

11,500 |

|

(Being Increase in value of Assets transferred to Revaluation Account) |

|

|

|

|

|

|

|

|

|

|

|

Revaluation A/c |

Dr. |

|

7,200 |

|

|

----------To X's Capital A/c |

|

|

|

3,600 |

|

----------To Y's Capital A/c |

|

|

|

2,400 |

|

----------To Z's Capital A/c |

|

|

|

1,200 |

|

(Being Revaluation Profit distributed among X, Y and Z in their old Ratio) |

|

|

|

|

|

|

|

|

|

|

|

X's Capital A/c |

Dr. |

|

5,400 |

|

|

Z's Capital A/c |

Dr. |

|

1,800 |

|

|

----------To Y's Capital A/c |

|

|

|

7,200 |

|

(Being Y's Share of Goodwill adjusted) |

|

|

|

|

|

|

|

|

|

|

|

Y's Capital A/c |

Dr. |

|

39,600 |

|

|

---------To Y's loan A/c |

|

|

|

39,600 |

|

(Being Y's Capital balance after all adjustment transferred to his Loan Account) |

|

|

|

|

|

|

|

|

|

|

|

Balance Sheet |

||||||

|

as on 1st April 2019 (after Y's Retirement) |

||||||

|

Liabilities |

|

Rs. |

Assets |

|

Rs. |

|

|

Sundry Creditors |

|

13,800 |

Cash at Bank |

|

11,000 |

|

|

Provision for Outstanding Repair Bills |

|

4,000 |

Sundry Debtors |

10,000 |

|

|

|

Y's Loan |

|

39,600 |

Less: Provision for Doubtful Debts |

(500) |

9,500 |

|

|

Capital |

|

|

Stock |

|

16,000 |

|

|

|

X |

43,200 |

|

Prepaid Insurance |

|

1,500 |

|

|

Z |

14,400 |

57,600 |

Plant and Machinery |

|

17,000 |

|

|

|

|

Land and Building |

|

60,000 |

|

|

|

|

1,15,000 |

|

|

1,15,000 |

|

Working Notes:

1.

|

Revaluation Account |

|||||

|

Dr. |

|

Cr. |

|||

|

Particulars |

|

Rs. |

Particulars |

Rs. |

|

|

To Provision for Doubtful debts A/c |

|

300 |

By Prepaid Insurance A/c |

1,500 |

|

|

To Provision for Outstanding Repairs Bills A/c |

|

4,000 |

By Land And Building A/c (50,000 ×20%) |

10,000 |

|

|

To Profit transferred to: |

|

|

|

|

|

|

|

X's capital A/c |

3,600 |

|

|

|

|

|

X's capital A/c |

2,400 |

|

|

|

|

|

Y's capital A/c |

1,200 |

7,200 |

|

|

|

|

|

11,500 |

|

11,500 |

|

Provision for Doubtful debts = New Doubtful debts - Old Doubtful debts

Provision for Doubtful debts = 500 - 300 = 200

2.

|

Partners Capital Account |

|||||||

|

Dr. |

|

|

|

|

|

|

Cr. |

|

Particulars |

X |

Y |

Z |

Particulars |

X |

Y |

Z |

|

To Y's Capital A/c |

5,400 |

|

1,800 |

By Balance b/d |

45,000 |

30,000 |

15,000 |

|

To Y's Loan A/c |

|

39,600 |

|

By Revaluation A/c |

3,600 |

2,400 |

1,200 |

|

To Balance c/d |

43,200 |

|

14,400 |

By X's Capital A/c |

|

5,400 |

|

|

|

|

|

|

By Z's Capital A/c |

|

1,800 |

|

|

|

|

|

|

|

|

|

|

|

|

48,600 |

39,600 |

16,200 |

|

48,600 |

39,600 |

16,200 |

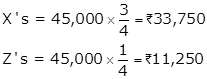

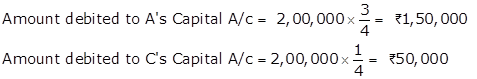

3.

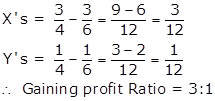

Calculation of Ratio

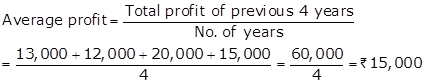

![]()

Capital Ratio (X, Y and Z) = 45,000 : 30,000 : 15,000 = 3:2:1

Y's retired in the firm.

X : Z= 3:1 (New Ratio)

Gaining Ratio= New Ratio- Old Ratio

4.

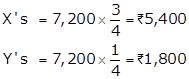

Adjustment of Goodwill

Goodwill on the firm=21,600

![]()

Y's share of goodwill is to be distributed between X and Z in their gaining ratio 3:1.

Retirement/Death of a Partner Exercise 6.83

Solution Ex. 33

|

Journal |

|||||

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

General Reserve A/c |

Dr. |

90,000 |

|||

|

------To N's Capital A/c |

18,000 |

||||

|

------To S's Capital A/c |

27,000 |

||||

|

------To G's Capital A/c |

45,000 |

||||

|

(Balance in reserve distributed among all partners in old ratio) |

|||||

|

|

|

|

|

|

|

|

N's Capital A/c |

Dr. |

15,000 |

|||

|

S's Capital A/c |

Dr. |

22,500 |

|||

|

G's Capital A/c |

Dr. |

37,500 |

|||

|

------To Profit and Loss A/c |

75,000 |

||||

|

(Debit balance PandL A/c written off among all partners in old ratio) |

|||||

|

|

|

|

|

|

|

|

N's Capital A/c |

Dr. |

18,000 |

|||

|

S's Capital A/c |

Dr. |

27,000 |

|||

|

------ To G's Capital A/c |

45,000 |

||||

|

(Goodwill adjusted in gaining ratio) |

|||||

|

|

|

|

|

|

|

|

Revaluation A/c |

Dr. |

1,65,000 |

|||

|

------To Patent A/c |

90,000 |

||||

|

------To Stock A/c |

7,500 |

||||

|

------To Machinery A/c |

22,500 |

||||

|

------To Building A/c |

15,000 |

||||

|

------To Creditors A/c |

30,000 |

||||

|

(Decrease in assets and increase in liabilities debited to Revaluation A/c) |

|||||

|

|

|

|

|

|

|

|

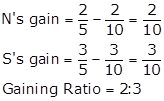

Provision for Doubtful Debts A/c |

Dr. |

2,550 |

|||

|

To Revaluation A/c |

2,550 |

||||

|

(Excess provision written back) |

|||||

|

|

|

|

|

|

|

|

N's Capital A/c |

Dr. |

32,490 |

|||

|

S's Capital A/c |

Dr. |

48,735 |

|||

|

G's Capital A/c |

Dr. |

81,225 |

|||

|

------To Revaluation A/c |

1,62,450 |

||||

|

(Loss on revaluation debited to partners' capital accounts in old ratio) |

|||||

|

|

|

|

|

|

|

|

G's Capital A/c |

Dr. |

4,21,275 |

|||

|

------To G's Loan A/c |

4,21,275 |

||||

|

(Amount due to G transferred to his loan A/c) |

|||||

Working Notes:

WN1: Calculation of G's Share of Goodwill

WN2: Calculation of Gaining Ratio

Gaining Ratio = New Ratio - Old Ratio

WN2: Calculation of Excess/Deficit Provision for Doubtful Debts

WN3: Calculation of G's Loan Balance

Amount due to G = Opening Capital + Credits - Debits

= 4,50,000 + (45,000 + 45,000) - (37,500 + 81,225)

= Rs.4,21,275

Solution Ex. 34

|

Journal |

||||

|

Particulars |

|

L.F. |

Debit Rs. |

Credit Rs. |

|

Profit and Loss Adjustment A/c |

Dr. |

|

6,000 |

|

|

----------To Plant and machinery A/c |

|

|

|

4,000 |

|

----------To Provision for Doubtful Debts A/c |

|

|

|

1,500 |

|

----------To Furniture A/c |

|

|

|

500 |

|

(Being decrease in value of Assets and provision for doubtful debts transferred to profit and Loss adjustment Account) |

|

|

|

|

|

|

|

|

|

|

|

Stock A/c |

Dr. |

|

3,750 |

|

|

Factory Building A/c |

Dr. |

|

5,000 |

|

|

----------To Profit and Loss Adjustment A/c |

|

|

|

8,750 |

|

(Being increases in value of Assets transferred to Profit and Loss Adjustment Account) |

|

|

|

|

|

|

|

|

|

|

|

Profit and Loss Adjustment A/c |

Dr. |

|

2,750 |

|

|

----------To A's Capital A/c |

|

|

|

917 |

|

----------To B's Capital A/c |

|

|

|

1,375 |

|

----------To C's Capital A/c |

|

|

|

458 |

|

( Being profit distributed among A, B and C in their old ratio) |

|

|

|

|

|

|

|

|

|

|

|

A's Capital A/c |

Dr. |

|

6,400 |

|

|

---------To B's Capital A/c |

|

|

|

2,400 |

|

---------To C's Capital A/c |

|

|

|

4,000 |

|

(Being C's Share of goodwill and B's gain in goodwill adjustment) |

|

|

|

|

|

|

|

|

|

|

|

C's Capital A/c |

Dr. |

|

32,125 |

|

|

---------To C's Loan A/c |

|

|

|

32,125 |

|

(Being loan from bank) |

|

|

|

|

|

|

|

|

|

|

|

Reserve Fund A/c |

Dr. |

|

16,000 |

|

|

---------To A's Capital A/c |

|

|

|

5,333 |

|

---------To B's Capital A/c |

|

|

|

8,000 |

|

---------To C's Capital A/c |

|

|

|

2,667 |

|

(Being Reserve Fund distributed among partners in their old ratio) |

|

|

|

|

|

Profit and Loss Adjustment Account |

|||||

|

Dr. |

|

Cr. |

|||

|

Particulars |

|

Rs. |

Particulars |

Rs. |

|

|

To Plant and machinery A/c (40,000×10%) |

|

4,000 |

By Stock A/c (25,000×15%) |

3,750 |

|

|

To Furniture A/c (10,000×5%) |

|

500 |

By Factory building A/c (50,000×10%) |

5,000 |

|

|

To Provision for Doubtful Debts A/c (2,000-500) |

|

1,500 |

|

|

|

|

To Profit transferred to: |

|

|

|

|

|

|

|

A's Capital A/c |

917 |

|

|

|

|

|

B's Capital A/c |

1,375 |

|

|

|

|

|

C's Capital A/c |

458 |

2,750 |

|

|

|

|

|

8,750 |

|

8,750 |

|

|

Partners Capital Account |

|||||||

|

Dr. |

|

|

|

|

|

|

Cr. |

|

Particulars |

A |

B |

C |

Particulars |

A |

B |

C |

|

To B's Capital A/c (Goodwill) |

2,400 |

|

|

By Balance b/d |

30,000 |

40,000 |

25,000 |

|

To C's Capital A/c (Goodwill) |

4,000 |

|

|

By Reserve fund A/c |

5,333 |

8,000 |

2,667 |

|

To C's Loan A/c |

|

|

32,125 |

By Revaluation A/c (Profit) |

917 |

1,375 |

458 |

|

To Balance c/d |

29,850 |

51,775 |

|

By A's Capital A/c (goodwill) |

|

2,400 |

4,000 |

|

|

|

|

|

|

|

|

|

|

|

36,250 |

51,775 |

32,125 |

|

36,250 |

51,775 |

32,125 |

|

Balance Sheet |

|||||||

|

as on 1st April 2019 (after C's Retirement) |

|||||||

|

|

|

|

|

||||

|

Liabilities |

|

Rs. |

Assets |

|

Rs. |

||

|

Sundry Creditors |

|

25,000 |

Factory Building |

|

55,000 |

||

|

Loan Payable |

|

15,000 |

Plant and Machinery |

|

36,000 |

||

|

C's Loan |

|

32,125 |

Furniture |

|

9,500 |

||

|

Capital |

|

|

Stock |

|

28,750 |

||

|

|

A |

29,850 |

|

Debtors |

18,000 |

|

|

|

|

B |

51,775 |

81,625 |

|

Less: Provision for Doubtful Debts |

(2,000) |

16,000 |

|

|

|

|

Cash in Hand |

|

8,500 |

||

|

|

|

1,53,750 |

|

|

1,53,750 |

||

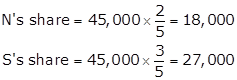

Working Notes:

1.

Calculation of Gaining Ratio

C's retired on the firm.

A : B =3:2 (New Ratio)

Gaining Ratio =New Ratio - Old Ratio

|

Partners Capital Account |

|||||||

|

Dr. |

|

|

|

|

|

|

Cr. |

|

Particulars |

A |

B |

C |

Particulars |

A |

B |

C |

|

To C's Capital A/c (Goodwill) |

1,600 |

2,400 |

|

Balance b/d |

30,000 |

40,000 |

25,000 |

|

To B's Loan A/c |

|

|

32,125 |

By Reserve Fund |

5,333 |

8,000 |

2,667 |

|

To Balance c/d |

34,650 |

46,975 |

|

By Revaluation A/c (Profit) |

917 |

1,375 |

458 |

|

|

|

|

|

By A's Capital A/c (Goodwill) |

|

|

4,000 |

|

|

36,250 |

49,375 |

32,125 |

|

36,250 |

49,375 |

32,125 |

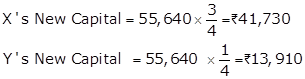

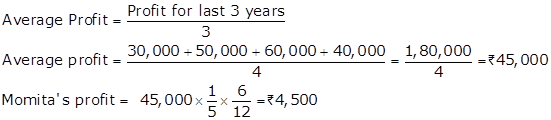

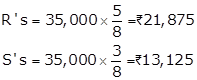

3.

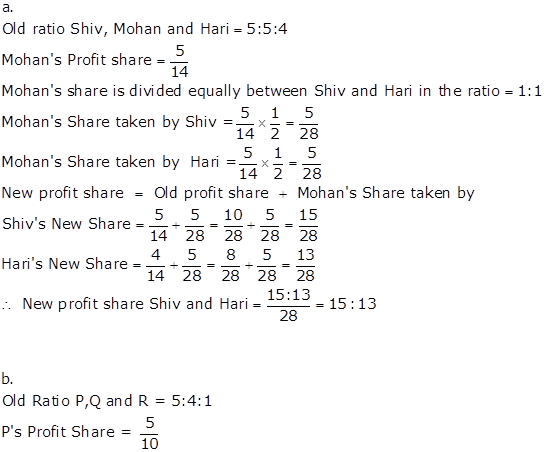

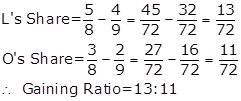

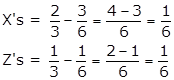

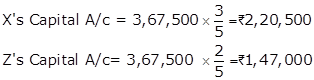

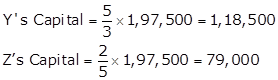

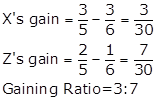

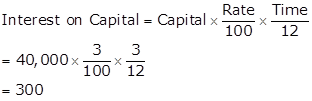

Calculation of Gaining Ratio

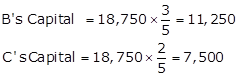

![]()

C retired from the firm.

A : B = 2:3(New Ratio)

Gaining Ratio = New Ratio - Old Ratio

Retirement/Death of a Partner Exercise 6.84

Solution Ex. 35

|

Revaluation Account |

|||||

|

Dr. |

|

Cr. |

|||

|

Particulars |

|

Rs. |

Particulars |

Rs. |

|

|

To Machinery A/c (8,000×10%) |

|

8,000 |

By Expenses Owing A/c (45,000 - 37,500) |

7,500 |

|

|

To Loose Tools A/c (4,000× 10%) |

|

4,000 |

By Factory Premises A/c (2,43,000 -2,25,000) |

18,000 |

|

|

To Profit transferred to: |

|

|

|

|

|

|

|

X's Capital A/c |

6,750 |

|

|

|

|

|

Y's Capital A/c |

4,500 |

|

|

|

|

|

Z's Capital A/c |

2,250 |

13,500 |

|

|

|

|

|

2,550 |

|

2,550 |

|

|

Partners Capital Account |

|||||||

|

Dr. |

|

|

|

|

|

|

Cr. |

|

Particulars |

X |

Y |

Z |

Particulars |

X |

Y |

Z |

|

To Y's Capital A/c (Goodwill) |

33,750 |

|

11,250 |

By Balance b/d |

1,50,000 |

1,50,000 |

1,50,000 |

|

To Y's Loan A/c |

|

24,450 |

|

By Reserve Fund A/c |

67,500 |

45,000 |

22,500 |

|

To balance c/d |

1,90,500 |

|

1,63,500 |

By Revaluation A/c |

6,750 |

4,500 |

2,250 |

|

|

|

|

|

By X's Capital A/c (Goodwill) |

|

33,750 |

|

|

|

|

|

|

By Z's Capital A/c (Goodwill) |

|

11,250 |

|

|

|

|

|

|

|

|

|

|

|

|

2,24,250 |

2,44,500 |

1,74,750 |

|

2,24,250 |

2,44,500 |

1,74,750 |

|

Balance Sheet |

||||||

|

As on 1st April 2019 (after Y's Retirement) |

||||||

|

Liabilities |

|

Rs. |

Assets |

|

Rs. |

|

|

Trade Creditors |

|

30,000 |

Cash in Hand |

|

15,000 |

|

|

Bills Payable |

|

45,000 |

Cash at Bank |

|

75,000 |

|

|

Expenses Owing |

|

37,500 |

Debtors |

|

1,50,000 |

|

|

Y's Loan |

|

2,44,500 |

Stock |

|

1,20,000 |

|

|

Capital |

|

|

Factory Premises |

|

2,43,000 |

|

|

|

X |

1,90,500 |

|

Machinery (80,000-8,000) |

|

72,000 |

|

|

Z |

1,63,500 |

3,54,000 |

Loose tools (40,000-4,000) |

|

36,000 |

|

|

|

7,11,000 |

|

|

7,11,000 |

|

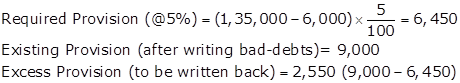

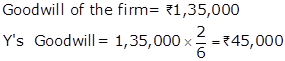

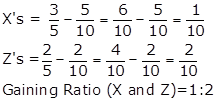

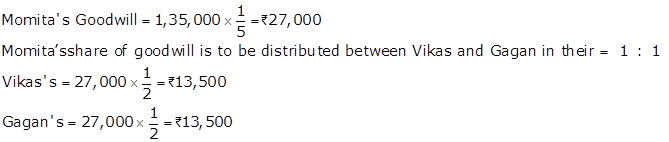

Working Notes:

1.

Calculation of Gaining Ratio

X : Y : Z=3:2:1(Old Ratio)

Y's retires from the firm.

∴ Gaining Ratio (X and Z)= 3:1

2.

Adjustment of Goodwill

Solution Ex. 36

|

Revaluation Account |

||||||

|

Dr. |

Cr. |

|||||

|

Particulars |

Rs. |

Particulars |

Rs. |

|||

|

Stock |

900 |

Premises |

16,000 |

|||

|

Provision for Legal Damages |

1,200 |

Provision for Doubtful Debts |

100 |

|||

|

Revaluation Profit |

Furniture |

4,000 |

||||

|

Pankaj's Capital A/c |

9,000 |

|||||

|

Naresh's Capital A/c |

6,000 |

|||||

|

Saurabh's Capital A/c |

3,000 |

18,000 |

||||

|

20,100 |

20,100 |

|||||

|

Partners' Capital Accounts |

|||||||||

|

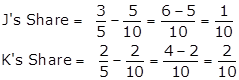

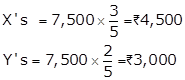

Dr. |

Cr. |

||||||||

|

Particulars |

Pankaj |

Naresh |

Saurabh |

Particulars |

Pankaj |

Naresh |

Saurabh |

||

|

Naresh's Capital A/c |

14,000 |

Balance b/d |

46,000 |

30,000 |

20,000 |

||||

|

Naresh's Loan A/c |

26,000 |

General Reserve |

6,000 |

4,000 |

2,000 |

||||

|

Bank |

28,000 |

Revaluation (Profit) |

9,000 |

6,000 |

3,000 |

||||

|

Balance c/d |

47,000 |

25,000 |

Pankaj's Capital A/c |

14,000 |

|||||

|

61,000 |

54,000 |

25,000 |

61,000 |

54,000 |

25,000 |

||||

|

Bank Account |

||||

|

Dr. |

Cr. |

|||

|

Particulars |

Rs. |

Particulars |

Rs. |

|

|

Balance b/d |

7,600 |

Naresh's Capital A/c |

28,000 |

|

|

Bank Loan (Balancing Figure) |

20,400 |

|||

|

28,000 |

28,000 |

|||

|

Balance Sheet as on March 31, 2019 |

||||||

|

Liabilities |

Rs. |

Assets |

Rs. |

|||

|

Sundry Creditors |

15,000 |

Debtors |

6,000 |

|||

|

Bills Payable |

12,000 |

Less: Provision for Doubtful Debts |

300 |

5,700 |

||

|

Bank Loan |

20,400 |

Stock |

8,100 |

|||

|

Outstanding Salaries |

2,200 |

Furniture |

45,000 |

|||

|

Provision for Legal Damages |

7,200 |

Premises |

96,000 |

|||

|

Naresh's Loan |

26,000 |

|||||

|

Capitals: |

||||||

|

Pankaj |

47,000 |

|||||

|

Saurabh |

25,000 |

72,000 |

||||

|

1,54,800 |

1,54,800 |

|||||

Retirement/Death of a Partner Exercise 6.85

Solution Ex. 37

|

Revaluation Account |

|||||

|

Dr. |

|

|

Cr. |

||

|

Particulars |

Rs. |

Particulars |

Rs. |

||

|

To Profit transferred to: |

|

|

By Land and building A/c (15,000×10%) |

1,500 |

|

|

|

X's Capital A/c |

1,140 |

|

By Provision for Doubtful Debts A/c |

105 |

|

|

Y's Capital A/c |

855 |

|

By Stock A/c (4,800 × 20%) |

960 |

|

|

Z's Capital A/c |

570 |

2,565 |

|

|

|

|

|

2,565 |

|

2,565 |

|

|

Partners Capital Account |

|||||||

|

Dr. |

|

|

|

|

|

|

Cr. |

|

Particulars |

X |

Y |

Z |

Particulars |

X |

Y |

Z |

|

To Y's Capital A/c |

1,200 |

|

600 |

By Balance b/d |

12,000 |

9,000 |

6,000 |

|

To X's Capital A/c (Rectification) |

|

420 |

|

By Revaluation A/c (profit) |

1,140 |

855 |

570 |

|

To Z's Capital A/c (Rectification) |

|

390 |

|

By X's Capital A/c (Goodwill) |

|

1,200 |

|

|

To Y's Loan A/c |

|

10,845 |

|

By Z's Capital A/c (Goodwill) |

|

600 |

|

|

To Balance c/d |

12,360 |

|

6,360 |

By Z's Capital A/c (Rectification) |

420 |

|

390 |

|

|

13,560 |

11,655 |

6,960 |

|

13,560 |

11,655 |

6,960 |

|

Balance Sheet |

|||||

|

as on 1st April 2019 (after Y's Retirement) |

|||||

|

Liabilities |

|

Rs. |

Assets |

Rs. |

|

|

Creditors |

|

24,140 |

Cash at Bank |

3,300 |

|

|

Capital |

|

|

Sundry Debtors |

3,045 |

|

|

Y |

12,360 |

|

Stock (4,800 +960) |

5,760 |

|

|

Z |

6,360 |

18,720 |

Plant and Machinery |

5,100 |

|

|

|

|

|

|

Land and Building (15,000 +1,500) |

16,500 |

|

|

|

|

|

Y's Loan* |

9,155 |

|

|

|

42,860 |

|

42,860 |

|

*Y's Loan Settle = 20,000 - 10,845=9,155

Working Note:

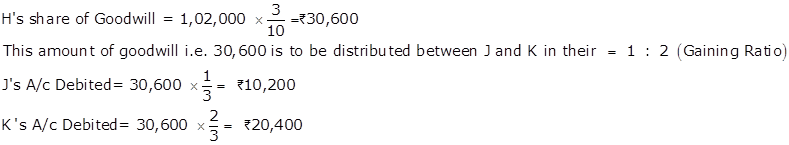

Adjustment of Goodwill

X :Y : Z= 4 : 3 : 2 (Old Ratio)

Y retires from the firm.

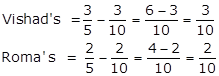

![]() Gaining Ratio = 4 : 2 = 2 : 1

Gaining Ratio = 4 : 2 = 2 : 1

Goodwill of the firm = Rs. 5,400

![]()

Y's share of goodwill is to be distributed between X and Z in their = 2:1 (Gaining Ratio)

Retirement/Death of a Partner Exercise 6.86

Solution Ex. 38

|

Revaluation Account |

|||||

|

Dr. |

|

|

Cr. |

||

|

Particulars |

Rs. |

Particulars |

Rs. |

||

|

To Plant and

Machinery A/c (28,000 |

2,800 |

By Stock A/c (20,000 |

2,000 |

||

|

To Electronic

Typewriter A/c (8,000 |

800 |

By Land and Building A/c (36,000 |

3,600 |

||

|

To Outstanding Salary A/c |

|

2,000 |

By Provision for Doubtful Debts A/c |

2,000 |

|

|

To Profit transferred to: |

|

|

|

|

|

|

|

A's Capital A/c |

800 |

|

|

|

|

|

B's Capital A/c |

600 |

|

|

|

|

|

C's Capital A/c |

600 |

2,000 |

|

|

|

|

7,600 |

|

7,600 |

||

|

Partners Capital Account |

|||||||

|

Dr. |

|

|

|

|

|

|

Cr. |

|

Particulars |

A |

B |

C |

Particulars |

A |

B |

C |

|

To B's Capital A/c |

2,400 |

|

1,800 |

By Balance b/d |

32,000 |

24,000 |

20,000 |

|

To B's Loan A/c |

|

34,800 |

|

By Reserves A/c |

8,000 |

6,000 |

6,000 |

|

To Balance c/d |

38,400 |

|

24,800 |

By Revaluation A/c |

800 |

600 |

600 |

|

|

|

|

|

By A's Capital A/c |

|

2,400 |

|

|

|

|

|

|

By C's Capital A/c |

|

1,800 |

|

|

|

40,800 |

34,800 |

26,600 |

|

40,800 |

34,800 |

26,600 |

|

Balance Sheet |

||||

|

as on 1st April 2019 (after B's retirement) |

||||

|

Liabilities |

Rs. |

Assets |

Rs. |

|

|

Creditors |

7,000 |

Land and Building (36,000+3,600) |

39,600 |

|

|

Bills Payable |

3,000 |

Plant and Machinery (28,000-2,800) |

25,200 |

|

|

B's Loan |

34,800 |

Electronic Typewriter (8000-800) |

7,200 |

|

|

Capital |

|

Stock (20,000+2,000) |

22,000 |

|

|

|

A |

38,400 |

Sundry Debtors |

14,000 |

|

|

C |

24,800 |

Bank |

2000 |

|

Outstanding Salary |

2,000 |

|

|

|

|

|

1,10,000 |

|

1,10,000 |

|

Working Note:

Adjustment of Goodwill

A: B :C= 4 : 3 : 3 (Old Ratio)

As B has retired from the firm, so the Gaining Ratio between A and C is 4 : 3

Goodwill of the firm = Rs.14,000

B's of Goodwill =![]()

B's share of goodwill is to be distributed between A and C in their Gaining Ratio.

![]()

![]()

Solution Ex. 39

|

Revaluation Account |

|||||

|

Dr. |

|

|

Cr. |

||

|

Particulars |

Rs. |

Particulars |

Rs. |

||

|

To Stock A/c |

|

12,000 |

By Fixed Assets A/c (3,00,000 |

30,000 |

|

|

To Provision for Doubtful Debts A/c (6,000-4,000) |

|

2,000 |

|

|

|

|

To Profit transferred to: |

|

|

|

|

|

|

|

X's Capital A/c |

6,000 |

|

|

|

|

|

Y's Capital A/c |

6,000 |

|

|

|

|

|

Z's Capital A/c |

4,000 |

16,000 |

|

|

|

|

30,000 |

|

30,000 |

||

|

Partners Capital Account |

|||||||

|

Dr. |

|

|

|

|

|

|

Cr. |

|

Particulars |

X |

Y |

Z |

Particulars |

X |

Y |

Z |

|

To Profit and Loss A/c |

1,500 |

1,500 |

1,000 |

By Balance b/d |

1,00,000 |

60,000 |

50,000 |

|

To Advertise Suspense A/c |

6,000 |

6,000 |

4,000 |

By General Reserve |

30,000 |

30,000 |

20,000 |

|

To Y's Capital A/c |

18,000 |

|

12,000 |

By Revaluation A/c |

6,000 |

6,000 |

4,000 |

|

To Y's Loan A/c |

|

1,18,500 |

|

By X's Capital A/c |

|

18,000 |

|

|

To Balance c/d |

1,10,500 |

|

57,000 |

|

|

|

|

|

|

|

|

|

By Z's Capital A/c |

|

12,000 |

|

|

|

1,36,000 |

1,26,000 |

74,000 |

|

1,36,000 |

1,26,000 |

74,000 |

|

Balance Sheet |

||||||

|

as on 1st April 2019 (after Y's Retirement) |

||||||

|

Liabilities |

Rs. |

Assets |

Rs. |

|||

|

Sundry creditors |

|

2,50,000 |

Cash at Bank |

|

50,000 |

|

|

X's Loan |

|

50,000 |

Bills Receivable |

|

60,000 |

|

|

Y's Loan |

|

1,58,500 |

Debtors |

80,000 |

|

|

|

Y's Capital |

|

|

|

Less: Provision for D. Debts |

(6,000) |

74,000 |

|

X |

1,10,500 |

|

Stock (1,24,000-12,000) |

|

1,12,000 |

|

|

Z |

57,000 |

1,67,500 |

Fixed Assets (3,00,000+30,000) |

|

3,30,000 |

|

|

|

6,26,000 |

|

|

6,26,000 |

||

|

Y's Loan Account |

|||

|

Dr. |

Cr. |

||

|

Particulars |

Rs. |

Particulars |

Rs. |

|

To Balance c/d |

1,58,500 |

By Balance b/d |

40,000 |

|

|

|

By Y's Capital A/c |

1,18,500 |

|

|

1,58,500 |

|

1,58,500 |

Working Note:

1.

Adjustment of Goodwill

Old Ratio (X, Y and Z) = 3 : 3 : 2

Y's retired from the firm.

Gaining Ratio (X and Z) = 3: 2

Y's Share of Goodwill = 80,000![]() = Rs.30,000

= Rs.30,000

Y's share of goodwill is to be distributed between X and Z in their = 3 : 2 (Gaining Ratio)

X's = 30,000![]() = Rs.18,000

= Rs.18,000

Z's = 30,000![]() = Rs.12,000

= Rs.12,000

2.

Distribution of General Reserve (Old Ratio)

X's =

80,000![]() = Rs.30,000

= Rs.30,000

Y's =

80,000![]() = Rs.30,000

= Rs.30,000

Z's =

80,000![]() =Rs.20,000

=Rs.20,000

3.

Writing-off Advisement Suspense (Old Ratio)

X's = 16, 000![]() = Rs.6,000

= Rs.6,000

Y's =16,000![]() = Rs.6,000

= Rs.6,000

Z's =16,000![]() =Rs.4,000

=Rs.4,000

4.

Writing-off Profit and Loss (Loss) in Old Ratio

X's = 4,000 ![]() =Rs.1,500

=Rs.1,500

Y's = 4,000![]() =Rs.1,500

=Rs.1,500

Z's = 4,000![]() =Rs.1,000

=Rs.1,000

Retirement/Death of a Partner Exercise 6.87

Solution Ex. 40

|

Journal |

|||||

|

Date |

Particulars |

|

L.F. |

Debit Rs. |

Credit Rs. |

|

2016 |

|

|

|

|

|

|

1st April |

X's Capital A/c |

Dr. |

|

3,000 |

|

|

|

Y's Capital A/c |

Dr. |

|

2,000 |

|

|

|

Z's Capital A/c |

Dr. |

|

1,000 |

|

|

|

------To Goodwill A/c |

|

|

|

6,000 |

|

|

(Being existing Goodwill Written off) |

|

|

|

|

|

|

|

|

|

|

|

|

1st April |

X's Capital A/c |

Dr. |

|

3,480 |

|

|

|

Y's Capital A/c |

Dr. |

|

2,320 |

|

|

|

------To Z's Capital A/c |

|

|

|

5,800 |

|

|

(Being Z's share of goodwill credited to him and gaining partners debited in gaining ratio) |

|

|

|

|

|

|

|

|

|

|

|

|

Revaluation Account |

|||||

|

Dr. |

|

|

|

Cr. |

|

|

Particulars |

Rs. |

Particulars |

|

Rs. |

|

|

To Patents A/c |

2,000 |

By Investments A/c(17,600-15,000) |

|

2,600 |

|

|

To Machinery A/c |

5,000 |

By Creditors A/c |

|

4,000 |

|

|

To Provision For D. Debts A/c |

400 |

By Loss on Revaluation transferred: |

|

|

|

|

|

|

|

X's Capital A/c |

400 |

|

|

|

|

|

Y's Capital A/c |

267 |

|

|

|

|

|

Z's Capital A/c |

133 |

800 |

|

|

7,400 |

|

|

7,400 |

|

|

Partners' Capital Account |

|||||||

|

Dr. |

|

|

|

|

|

|

Cr. |

|

Particulars |

X |

Y |

Z |

Particulars |

X |

Y |

Z |

|

To Goodwill A/c |

3,000 |

2,000 |

1,000 |

By Balance b/d |

68,000 |

32,000 |

21,000 |

|

To Revaluation A/c |

400 |

267 |

133 |

By X's Capital A/c |

|

|

3,480 |

|

To Z's Capital A/c |

3,480 |

2,320 |

|

By Y's Capital A/c |

|

|

2,320 |

|

To Advertisement expenditure A/c |

2,625 |

1,750 |

875 |

By Workmen Compensation Reserve A/c |

5,625 |

3,750 |

1,875 |

|

To Investment A/c |

|

|

17,600 |

By Investment Fluctuation Reserve A/c |

3,000 |

2,000 |

1,000 |

|

To Bank A/c |

|

|

5,067 |

|

|

|

|

|

To Z's Loan A/c |

|

|

2,500 |

|

|

|

|

|

To Bills payable A/c |

|

|

2,500 |

|

|

|

|

|

Balance c/d |

67,120 |

31,413 |

|

|

|

|

|

|

|

76,625 |

37,750 |

29,675 |

|

76,625 |

37,750 |

29,675 |

|

Balance Sheet |

||||||

|

as on 1st April 2019 after Z's retirement |

||||||

|

Liabilities |

Rs. |

Assets |

Rs. |

|||

|

Creditors |

|

17,000 |

Cash at Bank (5,750 - 5,067) |

|

683 |

|

|

Workmen Compensation Claim |

|

750 |

Stock |

|

30,000 |

|

|

Bills payable |

|

2,500 |

Patents |

|

8,000 |

|

|

Capital |

|

|

Debtors |

40,000 |

|

|

|

X |

67,120 |

|

|

Less: prov. for Doubtful Debts |

(2,400) |

37,600 |

|

Y |

31,413 |

98,533 |

Machinery |

|

45,000 |

|

|

Z's Loan |

|

2,500 |

|

|

|

|

|

|

|

1,21,283 |

|

1,21,283 |

||

Working Note:

Amount due to Z's

= (21,000 + 3,480 + 2,320 + 1,875 + 1,000) -(1,000 + 133+ 875 + 17,600)

= 10,067

Amount paid on Retirement immediately : Rs.5,067

Amount paid within 1 year : (5000 × 50%) = Rs.2,500

Amount payable by Bills of Exchange (50% of Balance) = Rs.2,500

Solution Ex. 41

Dr. Y's Loan Account Cr.

|

Date |

Particulars |

Rs. |

Date |

Particulars |

Rs. |

|

31.03.2017 31.03.2017 |

To Bank A/c To Balance c/d |

1,30,000 2,00,000 |

01.04.2016 31.03.2017 |

By Y's Capital A/c By Interest A/c |

3,00,000 30,000 |

|

|

|

3,30,000 |

|

|

3,30,000 |

|

31.03.2018 3103.2018 |

To Bank A/c To Balance c/d |

1,20,000 1,00,000 |

01.04.2017 31.03.2018 |

By Balance c/d By Interest A/c |

2,00,000 20,000 |

|

|

|

2,20,000 |

|

|

2,20,000 |

|

31.03.2019 |

To Bank A/c |

1,10,000 |

01.04.2018 31.03.2019 |

By Balance c/d By Interest A/c |

1,00,000 10,000 |

|

|

|

1,10,000 |

|

|

1,10,000 |

Workings:

1. Calculation of Interest:

Solution Ex. 42

Dr. Rakesh's Loan Account Cr.

|

Date |

Particulars |

Rs. |

Date |

Particulars |

Rs. |

|

Year 1 |

To Bank A/c To Balance c/d |

26,000 40,000 |

Year 1 |

By Rakesh's Capital A/c By Interest A/c |

60,000 6,000 |

|

|

|

66,000 |

|

|

66,000 |

|

Year 2 |

To Bank A/c To Balance c/d |

26,000 18,000 |

Year 2 |

By Balance c/d By Interest A/c |

40,000 4,000 |

|

|

|

44,000 |

|

|

44,000 |

|

Year 3 |

To Bank A/c |

19,800 |

Year 3 |

By Balance c/d By Interest A/c |

18,000 1,800 |

|

|

|

19,800 |

|

|

19,800 |

Workings:

1. Calculation of Interest:

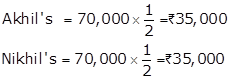

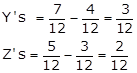

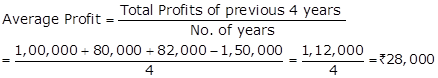

Solution Ex. 43

X : Y : Z = 3 :2 :1 (Old Ratio)

Y's retires from the firm.

![]()

Total capital of the New Firm = Rs.2,10,000

Y's share of goodwill is to be distributed between X and Z in their = 3 : 1 (Gaining Ratio)

Computation of Actual Cash to be brought in or to be paid to the partners

|

Particulars |

X |

Z |

|

New Capital |

1,57,500 |

52,500 |

|

Less: Existing Capital |

(1,45,000) |

(63,000) |

|

Cash Paid /Brought in |

12,500 (Brought In) |

(10,500) (Paid Out) |

Retirement/Death of a Partner Exercise 6.88

Solution Ex. 44

|

Revaluation Account |

|||||

|

Dr. |

|

|

Cr. |

||

|

Particulars |

Rs. |

Particulars |

Rs. |

||

|

To Provision for D. Debts A/c (500 200) |

|

300 |

By Prepaid Insurance A/c |

1,000 |

|

|

To Machinery A/c (24,000 |

|

1,200 |

By Freehold

Premises A/c (50,000 |

5,000 |

|

|

To Outstanding Workman's C. A/c |

|

1,500 |

|

|

|

|

To Profit transferred to: |

|

|

|

|

|

|

|

A's Capital A/c |

1,500 |

|

|

|

|

|

B's Capital A/c |

1,000 |

|

|

|

|

|

C's Capital A/c |

500 |

3,000 |

|

|

|

|

|

6,000 |

|

6,000 |

|

|

Partners' Capital Account |

|||||||

|

Dr. |

|

|

|

|

|

|

Cr. |

|

Particulars |

A |

B |

C |

Particulars |

A |

B |

C |

|

To B's Capital A/c |

4,500 |

|

1,500 |

By Balance b/d |

45,000 |

30,000 |

15,000 |

|

To Bank A/c |

|

5,000 |

|

By Revaluation A/c (profit) |

1,500 |

1,000 |

500 |

|

To B's Loan A/c |

|

32,000 |

|

By A's Capital A/c (Goodwill) |

|

4,500 |

|

|

To Balance c/d |

42,000 |

|

14,000 |

By C's Capital A/c (Goodwill) |

|

1,500 |

|

|

|

46,500 |

37,000 |

15,500 |

|

46,500 |

37,000 |

15,500 |

|

To Balance c/d |

45,000 |

|

15,000 |

By Balance b/d |

42,000 |

|

14,000 |

|

|

|

|

|

By Cash A/c |

3,000 |

|

1,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

45,000 |

|

15,000 |

|

45,000 |

|

15,000 |

|

Balance Sheet |

|||||||

|

as on 31st March 2019 (after B's retirement) |

|||||||

|

Liabilities |

Rs. |

Assets |

Rs. |

||||

|

Creditors |

|

10,800 |

Cash at Bank |

|

12,000 |

||

|

Bills Payable |

|

5,000 |

Debtors |

10,000 |

|

||

|

Outstanding Workmen Compensation |

|

1,500 |

|

Less : Provision for D. Debts |

(500) |

9,500 |

|

|

B's Loan |

|

32,000 |

Stock |

|

9,000 |

||

|

Capital A/c's: |

|

|

Machinery (24,000-1,200) |

|

22,800 |

||

|

|

A |

45,000 |

|

Freehold Premises (50,000+5,000) |

|

55,000 |

|

|

|

C |

15,000 |

60,000 |

Prepaid Insurance |

|

1,000 |

|

|

|

|

1,09,300 |

|

1,09,300 |

|||

|

Bank Account |

|||

|

Dr. |

Cr. |

||

|

Particulars |

Rs. |

Particulars |

Rs. |

|

To Balance b/d |

13,000 |

By B's Capital A/c |

5,000 |

|

To A's Capital A/c |

3,000 |

By Balance c/d |

12,000 |

|

To C's Capital A/c |

1,000 |

|

|

|

|

17,000 |

|

17,000 |

Working Notes:

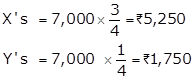

1.

Calculation of Profit Sharing Ratio

Capital Ratio (A, B and C)=45,000 : 30,000 :15,000

Old ratio (A, B and C)=3 : 2 :1

B retires from the firm.

![]() New/Gaining Ratio (A : C) = 3: 1

New/Gaining Ratio (A : C) = 3: 1

2.

Adjustment of Goodwill

Goodwill of the firm = Rs.18,000

B's Share of Goodwill = 18,000 ![]() = Rs.6,000

= Rs.6,000

B's share of goodwill is to be distributed between A and C in their = 3 : 1 (Gaining Ratio)

3.

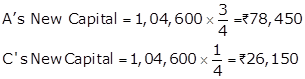

Adjustment of Partners' Capital after B's Retirement

Total Capital of the New Firm (after B's retirement) = Rs.60,000

New Ratio = 3 : 1

A's New Capital = 60,000 ![]() Rs.45,000

Rs.45,000

C's New Capital = 60,000 ![]() =Rs.15,000

=Rs.15,000

Solution Ex. 45

|

Revaluation A/c |

|||||

|

Dr. |

|

|

Cr. |

||

|

Particulars |

|

Rs. |

Particulars |

Rs. |

|

|