Class 12-commerce T S GREWAL Solutions Accountancy Chapter 1: Financial Statements of Not-for-Profit Organisations

Financial Statements of Not-for-Profit Organisations Exercise 1.55

Solution EX. 1

|

In the books of Railway Club Receipts and Payments Account for the year ended March 31,2019 |

|||

|

Dr. |

|

|

Cr. |

|

Particulars |

Amount (Rs.) |

Particulars |

Amount (Rs.) |

|

To Balance b/d |

4,390 |

By Electricity Charges |

3,440 |

|

To Subscription |

37,600 |

By Taxes |

490 |

|

To Donations |

8,000 |

By Salaries |

21,500 |

|

To Entrance Fees |

4,300 |

By Honorarium to Secretary |

2,500 |

|

To Rent Received |

5,250 |

By Printing and Stationery |

350 |

|

To Interest on Investments |

2,950 |

By Petty Cash Expenses |

900 |

|

|

|

By Insurance Premium Paid |

310 |

|

|

|

By Balance c/d |

33,000 |

|

|

62,490 |

|

62,490 |

Solution EX. 2

|

In the books of Bengal Cricket Club Receipts and Payments Account for the year ended March 31,2019 |

|||

|

Dr. |

|

|

Cr. |

|

Particulars |

Amount (Rs.) |

Particulars |

Amount (Rs.) |

|

To Balance b/d |

- |

By Rent |

15,000 |

|

To Subscriptions |

60,000 |

By Postages |

1,000 |

|

To Donations |

10,000 |

By Newspapers and Magazines |

8,000 |

|

To Entrance Fees |

10,000 |

By Investments |

30,000 |

|

|

|

By Printing and Stationery |

4,000 |

|

|

|

By Entertainment Expenses |

3,000 |

|

|

|

By Miscellaneous Expenses |

2,000 |

|

|

|

By Balance c/d |

17,000 |

|

|

80,000 |

|

80,000 |

Financial Statements of Not-for-Profit Organisations Exercise 1.56

Solution EX. 3

|

In the books of Delhi Club Receipts and Payments Account for the year ended March 31,2019 |

|||

|

Dr. |

|

|

Cr. |

|

Particulars |

Amount (Rs.) |

Particulars |

Amount (Rs.) |

|

To Donation for Building and Library |

2,00,000 |

By Purchase of Land |

10,000 |

|

To Entrance Fees |

17,000 |

By Purchase of Furniture |

1,30,000 |

|

To Subscription |

19,000 |

By Salaries |

4,800 |

|

To Lockers Rent |

1,660 |

By Maintenance of Play Grounds |

1,000 |

|

To Refreshment Receipts |

16,000 |

By Rent |

8,000 |

|

To Government Grant |

25,000 |

By Refreshment Payments |

8,000 |

|

To Bank Overdraft |

83,140 |

By Library Books |

25,000 |

|

(Balancing figure) |

|

By Purchase of 9% Government Bonds |

1,60,000 |

|

|

|

By Term Deposit with Bank |

15,000 |

|

|

|

|

|

|

|

2,78,660 |

|

2,78,660 |

Solution EX. 4

|

In the books of Longtown Sports Club Receipts and Payments Account for the year ended March 31,2019 |

|||

|

Dr. |

|

|

Cr. |

|

Particulars |

Amount (Rs.) |

Particulars |

Amount (Rs.) |

|

To Balance b/d |

|

By Furniture Purchased |

70,000 |

|

Cash in Hand |

50,000 |

By Charity Given |

10,000 |

|

Cash at Bank |

60,000 |

By Match Expenses |

30,000 |

|

To Subscription: |

|

By Salaries |

63,600 |

|

2017-18 |

4,000 |

By Honorarium |

4,000 |

|

2018-19 |

1,40,000 |

By 12% Investment Purchased |

60,000 |

|

2019-20 |

8,000 |

By Balance c/d |

|

|

To Entrance Fees |

4,000 |

Cash in Hand |

24,000 |

|

To General Donations |

20,000 |

Cash at Bank (Balancing Figure) |

70,400 |

|

To Donations for Tournament |

40,000 |

|

|

|

To Interest on Investments |

6,000 |

|

|

|

|

|

|

|

|

|

3,32,000 |

|

3,32,000 |

Solution EX. 5

|

In the books of Evergreen Club Receipts and Payments Account for the year ended March 31,2019 |

|||||

|

Dr. |

|

|

|

|

Cr. |

|

Receipts |

|

Rs. |

Payments |

|

Rs. |

|

To Balance b/d |

|

|

By Investments Purchased |

|

5,00,000 |

|

-----Cash in Hand |

50,000 |

|

By Rent Paid |

|

50,000 |

|

---- Cash at Bank |

3,40,000 |

3,90,000 |

By General Expenses |

|

2,30,000 |

|

To Subscription Received |

|

15,70,000 |

By Postage and Stationery |

|

25,000 |

|

To Donation Received |

|

2,80,000 |

By Newspapers and Magazines |

|

87,000 |

|

To Sale of Old Newspapers |

|

12,000 |

By Books Purchased |

|

3,40,000 |

|

To Interest on Investments Received |

|

50,000 |

By Sports Material Purchased |

|

4,70,000 |

|

|

|

|

By Honorarium to Coacher |

|

1,50,000 |

|

|

|

|

By Balance c/d |

|

|

|

|

|

|

----Cash in Hand |

30,000 |

|

|

|

|

|

----Cash at Bank (Balancing Fig.) |

4,20,000 |

4,50,000 |

|

|

|

23,02,000 |

|

|

23,02,000 |

|

|

|

|

|

|

|

Financial Statements of Not-for-Profit Organisations Exercise 1.57

Solution EX. 6

|

Balance Sheet (Extract) |

|||||

|

Liabilities |

|

Rs. |

Assets |

|

Rs. |

|

Tournament Fund |

50,000 |

|

|

|

|

|

Add : Tournament Receipts |

20,000 |

|

|

|

|

|

Less : Tournament Expenses |

(15,000) |

55,000 |

|

|

|

|

|

|

|

|

|

|

Solution EX. 7

Case 1

|

Balance Sheet (Extract) |

|

|||||

|

Liabilities |

|

Rs. |

Assets |

|

Rs. |

|

|

Prize Fund |

50,000 |

|

|

|

|

|

|

Less : Prize Paid |

(12,000) |

38,000 |

|

|

|

|

|

|

|

|

|

|

|

|

Note: Prize Fund is maintained to meet the expenses related to the Prize. Thus, Match Expenses of Rs.15,000 are not deducted from the Prize Fund. However, it will be debited to the Income and Expenditure Account as no specific fund is maintained to meet such expenses.

Case 2

|

Balance Sheet (Extract) |

|||||

|

Liabilities |

|

Rs. |

Assets |

|

Rs. |

|

Match Fund |

1,00,000 |

|

Match fund Investments |

|

60,000 |

|

Less : Match Expenses |

(35,000) |

|

|

|

|

|

Add : Interest on Investment of Match Fund |

3,000 |

68,000 |

|

|

|

|

|

|

|

|

|

|

Note: Match Fund is maintained to meet the expenses related to the Match. Therefore, Prizes paid worth Rs.19,000 are not deducted from the Match fund. However, it will be debited to the Income and Expenditure Account as no specific funds maintained for distributing the prizes. Also, the interest on investment of Match Fund will be added to Match Fund because it is an income related to this particular fund.

Solution EX. 8

|

Balance Sheet (Extract) |

||||

|

Liabilities |

|

Rs. |

Assets |

Rs. |

|

Match Fund |

80,000 |

|

Match Fund Investments |

72,000 |

|

Add : Interest on Match Fund Investment |

2,880 |

|

Match Fund Bank Balance |

3,500 |

|

Less : Match Expenses |

(5,500) |

77,380 |

|

|

|

|

|

|

|

|

Solution EX. 9

|

Balance Sheet (Extract) |

|||||

|

Liabilities |

|

Rs. |

Assets |

|

Rs. |

|

Match Fund |

24,000 |

|

|

|

|

|

Add : Donation For Match Fund |

40,000 |

|

|

|

|

|

Add : Proceed from Sale of Tickets |

15,000 |

|

|

|

|

|

Less: Match Expenses (Note) |

(79,000) |

NIL |

|

|

|

|

|

|

|

|

|

|

|

Income and Expenditure Account (Extract) |

|||

|

Dr. |

|

|

Cr. |

|

Expenditure |

Rs. |

Income |

Rs. |

|

To Match Expenses (Note) |

23,000 |

|

|

Note: The Total Match Fund is Rs.79,000 (i.e. Rs.24,000 + Rs.40,000 +Rs.15,000) whereas the total Match Expenses amounts to Rs.1,02,000. It means that expenses of Rs.79,000 will be met through the Fund and the remaining expenses of Rs.23,000 (i.e., Rs.1,02,000 - Rs.79,000) will be debited to the Income and Expenditure Account.

Solution EX. 10

Case 1

|

Balance Sheet (Extract) as on March 31,2019 |

|||

|

Liabilities |

Rs. |

Assets |

Rs. |

|

Capital Fund |

20,00,000 |

Pavilion Work - in - Progress |

6,00,000 |

|

|

|

|

|

Case 2

|

Balance Sheet (Extract) as on March 31,2019 |

||||

|

Liabilities |

|

Rs. |

Assets |

Rs. |

|

Pavilion Fund |

10,00,000 |

|

Pavilion Work - in Progress |

6,00,000 |

|

Less : Expenditure on Construction of Pavilion |

(6,00,000) |

4,00,000 |

|

|

|

Capital Fund |

20,00,000 |

|

|

|

|

Add : Pavilion Work - in - Progress |

6,00,000 |

26,00,000 |

|

|

|

|

|

|

|

|

Case 3

|

Balance Sheet (Extract) as on March 31,2019 |

||||

|

Liabilities |

|

Rs. |

Assets |

Rs. |

|

Pavilion Fund |

10,00,000 |

|

Pavilion Work - in Progress |

6,00,000 |

|

Add: Donation |

5,00,000 |

|

|

|

|

Less : Expenditure on Construction of Pavilion |

(6,00,000) |

9,00,000 |

|

|

|

Capital Fund |

20,00,000 |

|

|

|

|

Add : Pavilion Work - in - Progress |

6,00,000 |

26,00,000 |

|

|

|

|

|

|

|

|

Financial Statements of Not-for-Profit Organisations Exercise 1.58

Solution EX. 11

Case 1

|

Income and Expenditure Account (Extract) for the year ended March 31, 2019 |

|||

|

Dr. |

|

|

Cr. |

|

Expenditure |

Rs. |

Income |

Rs. |

|

|

|

By Entrance fees |

1,00,000 |

|

Balance Sheet (Extract) as on March 31, 2019 |

||||

|

Liabilities |

Rs. |

Assets |

Rs. |

|

|

Capital Fund |

NIL |

|

|

|

|

Add : Entrance Fees |

1,00,000 |

1,00,000 |

|

|

Case 2

|

Income and Expenditure Account (Extract) |

|||

|

Dr. |

|

|

Cr. |

|

Expenditure |

Rs. |

Income |

Rs. |

|

|

|

By Entrance fees (1,00,000 - 25,000) |

75,000 |

Solution EX. 12

|

Income and Expenditure Account (Extract) for the year ended March 31, 2019 |

||||

|

Dr. |

|

|

|

Cr. |

|

Expenditure |

Rs. |

Income |

|

Rs. |

|

|

|

By Subscription |

4,20,000 |

|

|

|

|

Less : Outstanding for 31st March 18 |

(14,000) |

|

|

|

|

Add : Outstanding for 31st March 19 |

10,000 |

4,16,000 |

|

|

|

|

|

|

Solution EX. 13

|

Income and Expenditure Account (Extract) for the year ended March 31, 2019 |

|||

|

Dr. |

|

|

Cr. |

|

Expenditure |

Rs. |

Income |

Rs. |

|

|

|

By Subscription (450 Members × Rs.200 each) |

90,000 |

Solution EX. 14

|

Statement of Subscription for the year ended March 31, 2019 |

|

|

Particulars |

Rs. |

|

Subscription received during the year 2018 -19 |

4,09,000 |

|

Add : Outstanding for 2018 - 19 (Current year) |

15,000 |

|

Less : Received for 2017 - 18 (Previous year) |

(5,000) |

|

Add : Advance received in 2017 - 18(Previous year) |

18,000 |

|

Less : Advance received for 2019 - 20 (Next year) |

(10,000) |

|

Subscriptions to be credited to Income and Expenditure Account |

4,27,000 |

|

|

|

Solution EX. 15

|

Statement of Subscription for the year ended March 31, 2019 |

|

|

Particulars |

Rs. |

|

Subscription received during the year 2018- 19 |

3,00,000 |

|

Less : Subscription-in-Arrears for 2017 - 18 |

(50,000) |

|

Add : Subscription-in-Arrears for 2018 -19 |

25,000 |

|

Add : Subscription-in-Advance for 2018 - 19 |

30,000 |

|

Less : Subscription-in advance for 2019 -20 |

(70,000) |

|

Subscriptions to be credited to Income and Expenditure Account |

2,35,000 |

|

|

|

Financial Statements of Not-for-Profit Organisations Exercise 1.59

Solution EX. 16

Case 1

|

Statement of Subscription for the year ended March 31, 2019 |

|

|

Particulars |

Rs. |

|

Subscriptions received during the year 2018 - 19 |

2,50,000 |

|

Add : Subscriptions -in -arrears for the year 2018 - 19 |

6,000 |

|

Less : Subscriptions received in advance for the year 2019 - 20 |

(5,000) |

|

Subscriptions Income for the year 2018 - 19 |

2,51,000 |

|

|

|

Case 2

|

Statement of Subscription for the year ended March 31, 2019 |

|

|

Particulars |

Rs. |

|

Subscriptions received during the year 2018 - 19 |

49,000 |

|

Add : Subscriptions collected for 2018 - 19 in 2017 - 18 |

3,000 |

|

Add : Subscriptions unpaid for the year 2018-19 |

2,000 |

|

Subscriptions Income for the year 2018-19 |

54,000 |

|

|

|

Case 3

|

Statement of Subscription for the year ended March 31, 2019 |

|

|

Particulars |

Rs. |

|

Subscriptions received during the year 2018-19 |

25,000 |

|

Less : Subscriptions outstanding in the beginning of 2018 - 19 |

(3,000) |

|

Add : Subscriptions yet not collected for 2018 - 19 |

5,000 |

|

Subscriptions Income for the year 2018 - 19 |

27,000 |

|

|

|

Case 4

|

Statement of Subscription for the year ended March 31, 2019 |

|

|

Particulars |

Rs. |

|

Subscriptions received during the year 2018 - 19 |

80,000 |

|

Less : Subscriptions Outstanding in the beginning of 2018 - 19 |

(5,000) |

|

Add : Subscriptions yet not Collected for 2018 - 19 |

8,000 |

|

Less : Subscriptions for 2019 - 20 received in advance |

(2,000) |

|

Subscriptions Income for the year 2018 - 19 |

81,000 |

|

|

|

Case 5

|

Statement of Subscription for the year ended March 31, 2019 |

|

|

Particulars |

Rs. |

|

Subscriptions received during the year 2018 - 19 |

90,000 |

|

Less : Subscriptions Outstanding at the end of 2017 - 18 |

(5,000) |

|

Add : Subscriptions received in advance on March 31, 2018 |

3,000 |

|

Less : Subscriptions received in advance on March 31, 2019 |

(4,000) |

|

Add : Subscriptions not yet collected for 2018 - 19 |

6,000 |

|

Subscriptions Income for the year 2018 - 19 |

90,000 |

Solution EX. 17

|

Statement of Subscription for the year ended March 31, 2019 |

|

|

Particulars |

Rs. |

|

Subscriptions received during the year 2018- 19 |

35,400 |

|

Less : Subscriptions-in-arrears received for 2017 -18 |

(400) |

|

Less : Subscriptions received-in-advance for 2019-20 |

(1,200) |

|

Less : Subscriptions received-in-advance for 2019-20 |

(300) |

|

Add : Subscriptions Outstanding for 2018-19 |

400 |

|

Add : Subscriptions received in 2017-18 for 2018-19 |

1,100 |

|

Subscriptions to be credited to Income and Expenditure Account |

35,000 |

Solution EX. 18

|

Income and Expenditure Account (Extract) For the year ended March 31, 2019 |

||||

|

Dr. |

|

|

|

Cr. |

|

Expenditure |

Rs. |

Income |

|

Rs. |

|

|

|

By Subscriptions |

3,58,500 |

|

|

|

|

Add: Outstanding at the end |

37,500 |

|

|

|

|

Add: Advance in the beginning |

22,500 |

|

|

|

|

Less: Outstanding in the beginning |

(30,000) |

|

|

|

|

Less: Advance at the end |

(13,500) |

3,75,000 |

|

|

|

|

|

|

|

Balance Sheet (Extract) as on March 31,2018 |

|||

|

Liabilities |

Rs. |

|

Rs. |

|

Subscriptions received in Advance |

2,2,500 |

Subscriptions Outstanding |

30,000 |

|

|

|

|

|

|

Balance Sheet (Extract) as on March 31,2019 |

|||

|

Liabilities |

Rs. |

Assets |

Rs. |

|

Subscriptions received in Advance |

13,500 |

Subscriptions Outstanding |

37,500 |

|

|

|

|

|

Financial Statements of Not-for-Profit Organisations Exercise 1.60

Solution EX. 19

|

Subscriptions Account |

|||

|

Dr. |

|

|

Cr. |

|

Particulars |

Rs. |

Particulars |

Rs. |

|

To Income and Expenditure (200 members × Rs.100 each) |

2,00,000 |

By Bank (Subscriptions Received) |

2,05,000 |

|

To Outstanding Subscriptions in the beginning |

30,000 |

By Advance Subscriptions in the beginning |

14,000 |

|

To Advance Subscriptions at the end |

40,000 |

By Outstanding Subscriptions at the end (Balancing Figure) |

51,000 |

|

|

2,70,000 |

|

2,70,000 |

|

|

|

|

|

Solution EX. 20

|

Subscriptions Account for the year ended 31st March, 2019 |

|||

|

Dr. |

|

|

Cr. |

|

Particulars |

Rs. |

Particulars |

Rs. |

|

To Income and Expenditure A/c (Balancing Figure) |

2,14,000 |

By Bank A/c (Subscription received during year) |

2,10,000 |

|

To Outstanding Subscriptions in the beginning A/c |

20,000 |

By Advance Subscriptions in the beginning A/c |

13,000 |

|

To Advance Subscriptions at the end A/c |

11,000 |

By Outstanding Subscriptions at the end A/c By Subscription Written Off (Income and Expenditure A/c) |

18,000 4,000 |

|

|

2,45,000 |

|

2,45,000 |

Solution EX. 21

|

Statement of Medicine Consumed during the year 2018-19 |

|

|

Particulars |

Rs. |

|

Medicine Purchased during the year 2018 - 19 |

60,80,700 |

|

Add : Stock in the beginning (as on April 01, 2018) |

1,75,750 |

|

Less : Stock at the end (as on March 31, 2019) |

(1,44,650) |

|

|

|

|

Medicine to be debited to Income and Expenditure Account |

61,11,800 |

|

|

|

Solution EX. 22

|

Statement of Medicine Consumed For the year ending March 31, 2019 |

|

|

Particulars |

Rs. |

|

Cash Purchases of medicine during the year |

3,00,000 |

|

Add : Opening Stock of Medicines |

1,00,000 |

|

Less : Closing Stock of Medicines |

(1,50,000) |

|

Add : Closing Creditors of Medicines |

1,30,000 |

|

Less : Opening Creditors of Medicines |

(90,000) |

|

Medicines Consumed during the year 2018 - 19 |

2,90,000 |

|

|

|

Solution EX. 23

a.

|

Statement of Stationery Consumed at the end of 31st March 2019 |

|

|

Particulars |

Rs. |

|

Amount paid for Stationery during the year ended 31st March 2019 |

5,400 |

|

Less : Closing Stock ( as on 31st March 2019) |

(250) |

|

Stationery to be posted to Income and Expenditure Account |

5,150 |

|

|

|

b.

|

Statement of Stationery Consumed at the end of 31st March 2019 |

|

|

Particulars |

Rs. |

|

Payment made for Stationery during the year ended 31st March 2019 |

5,400 |

|

Add : Opening Stock (as on 1st April 2018) |

1,500 |

|

Less : Closing Stock (as on 31st March 2019) |

(250) |

|

Stationery to be posted to Income and Expenditure Account |

6,650 |

c.

|

Statement of Stationery Consumed at the end of 31st March 2019 |

|

|

Particulars |

Rs. |

|

Amount paid for Stationery during the year ended 31st March 2019 |

5,400 |

|

Add : Opening Stock (as on 1st April 2018) |

1,500 |

|

Less : Closing Stock (as on 31st March 2019) |

(250) |

|

Less: Creditors for Stationery in the beginning (as on 1st April 2018) |

(1,000) |

|

Stationery to be posted to Income and Expenditure Account |

5,650 |

|

|

|

Financial Statements of Not-for-Profit Organisations Exercise 1.61

Solution EX. 24

|

Statement of Stationery Consumed for the year ended March 31, 2019 |

|

|

Particulars |

Rs. |

|

Amount paid for Stationery during the year 2018 - 19 |

1,40,000 |

|

Add : Opening Stock (as on April 01, 2018) |

12,000 |

|

Less : Closing Stock (as on March 31, 2019) |

(23,200) |

|

Add : Creditors at the end ( as on March 31, 2019) |

24,000 |

|

Less : Creditors in the beginning (as on April 01, 2018) |

(25,600) |

|

Rs.Stationery be shown in Income and Expenditure Account |

1,27,200 |

|

|

|

Solution EX. 25

|

Statement of Stationery for the year ended March 31,2019 |

|

|

Particulars |

Rs. |

|

Amount paid for Stationery during the year 2018-19 |

1,08,000 |

|

Add : Opening Stock (as on April 01, 2018) |

30,000 |

|

Less : Closing Stock (as on March 31, 2019) |

(5,000) |

|

Less: Creditors in the beginning (as on April 01, 2018) |

(20,000) |

|

Add: Creditors at the end (as on March 31, 2019) |

13,000 |

|

Add: Advance in the beginning (as on April 01, 2018) |

2,000 |

|

Less: Advance at the end (as on March 31, 2019) |

(3,000) |

|

Amount to be posted to Income and Expenditure Account |

1,25,000 |

|

|

|

Solution EX. 26

Statement for Calculation of Sports Material transferred to Income and Expenditure Account for the year ended on 31st March, 2018

|

Particulars |

Amount (Rs.) |

|

Amount paid to creditors of Sports Material Add: Creditors at the end of the period Less: Creditors at the beginning of the period Add: Cash purchases of Sports Material |

91,000 45,000 (37,000) 40,000 |

|

Total Purchases |

1,39,000 |

|

Less: Sale of Sports Material during the year (Book Value) Add: Opening Stock of Sports Material Less: Closing Stock of Sports Material |

(50,000) 50,000 (55,000) |

|

Amount transferred to Income and Expenditure Account |

84,000 |

Solution EX. 27

|

Income and Expenditure Account for the year ended March 31, 2019 (Extract) |

||||

|

Dr. |

|

|

|

Cr. |

|

Expenditure |

|

Rs. |

Income |

Rs. |

|

To Sports : Material |

1,40,000 |

|

|

|

|

Add : Opening Stock |

8,000 |

|

|

|

|

Less: Closing Stock |

(22,000) |

|

|

|

|

Less: Creditors in the beginning |

(6,000) |

1,20,000 |

|

|

|

|

|

|

|

|

|

Balance Sheet as on March 31, 2019 (Extract) |

|||

|

Liabilities |

Rs. |

Assets |

Rs. |

|

|

|

Stock of Sport Materials |

22,000 |

|

|

|

|

|

Solution EX. 28

|

Income and Expenditure Account for the year ended March 31, 2019 (Extract) |

||||

|

Dr. |

|

|

|

Cr. |

|

Expenditure |

|

Rs. |

Income |

Rs. |

|

To Medicine |

1,50,000 |

|

|

|

|

Add : Opening Stock |

50,000 |

|

|

|

|

Less: Closing Stock |

(75,000) |

|

|

|

|

Less : Creditors in the beginning |

(40,000) |

|

|

|

|

Add : Creditors at the end |

60,000 |

1,45,000 |

|

|

|

|

|

|

|

|

|

Balance Sheet as on March 31,2018 (Extract) |

|||

|

Liabilities |

Rs. |

Assets |

Rs. |

|

Creditors for Medicines |

40,000 |

Stock of Medicines |

50,000 |

|

|

|

|

|

|

Balance Sheet as on March 31,2019 (Extract) |

|||

|

Liabilities |

Rs. |

Assets |

Rs. |

|

Creditors for Medicines |

60,000 |

Stock of Medicines |

75,000 |

|

|

|

|

|

Financial Statements of Not-for-Profit Organisations Exercise 1.62

Solution EX. 29

|

Income and Expenditure Account (Extract) for the year ended March 31, 2019 |

||||

|

Dr. |

Cr. |

|||

|

Expenditure |

Rs. |

Income |

Rs. |

|

|

To Payment for Sports Material |

71,000 |

|

By Profit on Sale of Sports Material |

6,000 |

|

Add: Opening Stock |

20,000 |

|

(26,000 - 20,000) |

|

|

Less: Closing Stock |

(25,000) |

|

|

|

|

Less: Creditors in the beginning |

(7,000) |

|

|

|

|

Add: Creditors at the end |

15,000 |

|

|

|

|

Less: Book Value of Material Sold |

(20,000) |

54,000 |

|

|

|

|

|

|

|

|

|

Balance Sheet (Extract) |

|||

|

as on March 31, 2018 |

|||

|

Liabilities |

Rs. |

Assets |

Rs. |

|

Creditors for Sport Materials |

7,000 |

Stock of Sport Materials |

20,000 |

|

Balance Sheet (Extract) |

|||

|

as on March 31, 2019 |

|||

|

Liabilities |

Rs. |

Assets |

Rs. |

|

Creditors for Sport Materials |

15,000 |

Stock of Sport Materials |

25,000 |

Solution EX.30

|

Extract of Income and Expenditure Account for the year ended March 31, 2019 (Extract) |

|||

|

Dr. |

|

|

Cr. |

|

Expenditure |

Rs. |

Income |

Rs. |

|

To Sports Material Consumed |

92,800 |

|

|

|

|

|

|

|

|

Balance Sheet as on March 31, 2018 (Extract) |

|||

|

Liabilities |

Rs. |

Assets |

Rs. |

|

Creditors of Sports Materials |

9,800 |

Stock of Sports Materials |

6,200 |

|

|

|

Advance paid for Sports Materials |

11,000 |

|

Balance Sheet as on March 31, 2019 (Extract) |

|||

|

Liabilities |

Rs. |

Assets |

Rs. |

|

Creditors of Sports Materials |

7,200 |

Stock of Sports Materials |

4,800 |

|

|

|

Advance paid for Sports Materials |

19,000 |

|

Working Note: Calculation of Sports Material Consumed |

|

|

Particulars |

Rs. |

|

Sports Material |

1,02,000 |

|

Add : Opening Stock |

6,200 |

|

Less : Closing Stock |

(4,800) |

|

Less: Opening Creditors |

(9,800) |

|

Add : Closing Creditors |

7,200 |

|

Less : Advance at the end |

(19,000) |

|

Add : Advance in the beginning |

11,000 |

|

|

92,800 |

Solution EX. 31

|

Furniture Account |

||||||

|

Dr. |

Cr. |

|||||

|

Date |

Particulars |

Rs. |

Date |

Particulars |

Rs. |

|

|

2018 |

|

|

|

2018 |

|

|

|

Apr 01 |

To Balance b/d |

|

|

Sep 30 |

By Depreciation A/c (Furniture I) (6 Months) |

1,500 |

|

|

(Furniture I) |

30,000 |

|

|

|

|

|

|

(Furniture II) |

30,000 |

60,000 |

Sep 30 |

By Bank A/c (Sale) (Furniture I) |

20,000 |

|

|

|

|

|

Sep 30 |

By Income and Expenditure A/c (Loss on Sale) |

8,500 |

|

|

|

|

|

2019 |

|

|

|

|

|

|

|

Mar 31 |

By Depreciation A/c (Furniture I) |

3,000 |

|

|

|

|

|

Mar 31 |

By Balance c/d (30,000 - 3,000) |

27,000 |

|

|

|

|

60,000 |

|

|

60,000 |

|

Income and Expenditure Account for the year ended March 31, 2019 (Extract) |

|||

|

Dr. |

|

|

Cr. |

|

Expenditure |

Rs. |

Income |

Rs. |

|

To Depreciation on Furniture (1,500 + 3,000) |

4,500 |

|

|

|

To Loss on Sale of Furniture |

8,500 |

|

|

|

Working Note : Calculation of Profit or Loss on Sale of Furniture |

|

|

Particulars |

Rs. |

|

Book Value of Furniture Sold as on April 01, 2018 |

30,000 |

|

Less : Depreciation (6 Months) (30,000 × 10% × 6/12) |

(1,500) |

|

Book Value of Furniture as on Sep 30, 2018 |

28,500 |

|

Less : Sale Value |

(20,000) |

|

Loss on Sale of Furniture |

8,500 |

Financial Statements of Not-for-Profit Organisations Exercise 1.63

Solution EX. 32

|

Furniture Account |

|||||||

|

Dr. |

|

Cr. |

|||||

|

Date |

Particulars |

|

Rs. |

Date |

Particulars |

|

Rs. |

|

2018 |

|

|

|

2018 |

|

|

|

|

Apr 01 |

To Balance b/d |

|

|

Dec 31 |

By Depreciation A/c |

|

|

|

|

(Furniture I) |

2,00,000 |

|

|

(Furniture II) (9 Months) |

|

1,500 |

|

|

(Furniture II) |

20,000 |

2,20,000 |

Dec 31 |

By Bank A/c |

|

|

|

Oct 01 |

To Bank A/c |

|

|

|

(Furniture II) (Sale) |

|

14,800 |

|

|

(Furniture III) |

|

1,50,000 |

Dec 31 |

By Income and Expenditure A/c |

|

|

|

|

|

|

|

|

(Loss on Sale) |

|

3,700 |

|

|

|

|

|

2019 |

|

|

|

|

|

|

|

|

Mar 31 |

By Depreciation A/c |

|

|

|

|

|

|

|

|

(Furniture I) |

20,000 |

|

|

|

|

|

|

|

(Furniture III) (6 Months) |

7,500 |

27,500 |

|

|

|

|

|

Mar 31 |

By Balance c/d |

|

|

|

|

|

|

|

|

(Furniture I) |

1,80,000 |

|

|

|

|

|

|

|

(Furniture III) |

1,42,500 |

3,22,500 |

|

|

|

|

3,70,000 |

|

|

|

3,70,000 |

|

Working Note : Calculation of Profit or Loss on Sale of Furniture |

|

|

Particulars |

Rs. |

|

Book Value of Furniture I as on April 01, 2018 |

20,000 |

|

Less : Depreciation (9 months) (20,000 × 10% × 9/12) |

(1,500) |

|

Book Value on December 31, 2018 |

18,500 |

|

Less: Loss on Sale of Furniture (18,500 × 20%) |

(3,700) |

|

Sale value of Furniture |

14,800 |

Solution EX. 33

|

Statement of Salaries for the year ended March 31, 2019 |

|

|

Particulars |

Rs. |

|

Amount paid for Salaries |

2,04,000 |

|

Add : Prepaid Salaries as on March 31, 2018 |

24,000 |

|

Less : Prepaid Salaries as on March 31, 2019 |

(12,000) |

|

Less : Outstanding Salaries as on March 31, 2018 |

(18,000) |

|

Add : Outstanding Salaries as on March 31, 2019 |

15,000 |

|

Salaries chargeable to Income and Expenditure Account |

2,13,000 |

Solution EX. 34

|

Income and Expenditure Account (Extract) |

||||

|

Dr. |

|

|

|

Cr. |

|

Expenditure |

Rs. |

Income |

|

Rs. |

|

|

|

By Locker Rent Received |

52,000 |

|

|

|

|

Add : Outstanding at the end |

6,300 |

|

|

|

|

Add : Advance in the beginning |

3,000 |

|

|

|

|

Less : Outstanding in the beginning |

(4,600) |

|

|

|

|

Less : Advance at the end |

(4,000) |

52,700 |

|

|

|

|

|

|

Solution EX. 35

|

Income and Expenditure Account for the year ended 31st March 2019 |

|||

|

Dr. |

|

|

Cr. |

|

Expenditure |

Rs. |

Income |

Rs. |

|

To Salaries |

4,80,000 |

By Subscriptions |

9,00,000 |

|

To Rent |

50,000 |

By Donation |

10,000 |

|

To Stationery |

20,000 |

|

|

|

To Loss on Sale of Old Furniture |

10,000 |

|

|

|

To Surplus (Balancing Fig.) |

3,50,000 |

|

|

|

|

9,10,000 |

|

9,10,000 |

Solution EX. 36

|

In the books of Delhi Nursing Society Income and Expenditure Account for the year ended 31st March 2019 |

|||||

|

Dr. |

|

|

|

|

Cr. |

|

Expenditure |

|

Rs. |

Income |

|

Rs. |

|

To Salaries of Nurses |

|

65,600 |

By Subscriptions |

1,11,500 |

|

|

To Board, Laundry and Domestic Help |

|

38,000 |

Less : Donation for Building |

(10,000) |

1,01,500 |

|

To Rent Rates and Taxes |

|

20,000 |

By Fess from Non-members |

|

27,000 |

|

To Expenses of Car |

|

84,000 |

By Municipal Grant |

|

1,00,000 |

|

To Drugs and Incidental |

67,000 |

|

Interest |

|

3,800 |

|

Add : Outstanding Expenses |

12,800 |

79,800 |

By Deficit (Balancing Fig.) |

|

55,100 |

|

|

|

2,87,400 |

|

|

2,87,400 |

|

|

|

|

|

|

|

Financial Statements of Not-for-Profit Organisations Exercise 1.64

Solution EX. 37

|

Books of You Bee Forty Club Income and Expenditure Account for the year ended 31st March 2019 |

|||||

|

Dr. |

|

|

|

|

Cr. |

|

Expenditure |

|

Rs. |

Income |

|

Rs. |

|

To Salaries and Wages |

1,60,000 |

|

By Subscriptions |

3,50,000 |

|

|

Add : Outstanding |

40,000 |

2,00,000 |

Add : Outstanding for 2018-19 |

55,000 |

4,05,000 |

|

To Office Expenses |

|

35,000 |

By Donations |

|

50,000 |

|

To Telephone Charges |

|

24,000 |

By Entrance Fees |

|

80,000 |

|

To Electricity Charges |

|

32,000 |

|

|

|

|

To Travelling Expenses |

|

65,000 |

|

|

|

|

To Depreciation on Sports |

|

|

|

|

|

|

Equipments (34,000 × 25%) |

|

85,000 |

|

|

|

|

To Surplus (Balancing Fig.) |

|

94,000 |

|

|

|

|

|

|

5,35,000 |

|

|

5,35,000 |

|

|

|

|

|

|

|

Solution EX. 38

|

Books of Jaipur Sports Club Income and Expenditure Account for the year ended 31st March 2019 |

|||||

|

Dr. |

|

|

|

|

Cr. |

|

Expenditure |

|

Rs. |

Income |

|

Rs. |

|

To Rent |

60,000 |

|

By Entrance Fees (2018 - 19) |

|

50,000 |

|

Less : For 2017 - 18 |

(15,000) |

45,000 |

Subscription 2018 - 19 |

90,000 |

|

|

|

|

|

Add : Outstanding for 2018 -19 (90,000 × 10/9) |

10,000 |

1,00,000 |

|

To Insurance Premium |

60,000 |

|

By Donations |

|

1,20,000 |

|

Less : For 2019 - 20 |

(15,000) |

45,000 |

By Interest on Fixed Deposit |

2,400 |

|

|

To Printing and Stationery |

|

20,000 |

Add : Accrued Interest |

2,400 |

4,800 |

|

To Loss on Sale of Sports Material (1,200 - 500) |

|

700 |

By Sale of Old Sports Materials |

|

300 |

|

To Surplus (Balancing Fig.) |

|

1,70,600 |

By Locker Rent |

6,800 |

|

|

|

|

|

Less : For 2017 - 18 |

(600) |

6,200 |

|

|

|

2,81,300 |

|

|

2,81,300 |

|

|

|

|

|

|

|

Working Note :

Calculation of Interest Accrued on investment

|

Interest on Investments for 6 Months (1,20,000 × 8% × 6/12) |

4,800 |

|

Less : Interest Received |

(2,400) |

|

Amount of Accrued Interest on Investments |

2,400 |

Financial Statements of Not-for-Profit Organisations Exercise 1.65

Solution EX. 39

|

Income and Expenditure Account for the year ending March 31, 2019 |

|||

|

Dr. |

|

Cr. |

|

|

Expenditure |

Amount (Rs.) |

Income |

Amount (Rs.) |

|

|

|

Interest on General Fund Investments |

80,000 |

|

|

|

|

|

|

Balance Sheet as on March 31, 2019 |

|||

|

Liabilities |

Amount (Rs.) |

Assets |

Amount (Rs.) |

|

Sports Fund |

4,00,000 |

Sports Fund Investment |

3,50,000 |

|

General Fund |

8,00,000 |

General Fund Investment |

8,00,000 |

Working Notes:

WN1: Calculation of Sports Fund Balance

|

Particulars |

Amount (Rs.) |

|

Sports Fund as on April 01, 2018 |

3,50,000 |

|

Interest on Sports Fund Investments |

40,000 |

|

Donation for Sports Fund |

1,50,000 |

|

Sports Prizes Awarded |

(1,00,000) |

|

Expenses on Sports Events |

(40,000) |

|

Balance of Sports Fund |

4,00,000 |

Solution EX. 40

|

In the books of Youth Club Income and Expenditure Account for the year ended 31st March 2018 |

|||||

|

Dr. |

|

|

|

|

Cr. |

|

Expenditure |

|

Rs. |

Income |

|

Rs. |

|

To Salaries |

|

31,500 |

By Subscriptions |

60,000 |

|

|

To Postage To Rent To Printing and Stationery |

|

1,250 9,000 14,000 |

Add: Outstanding By Entrance Fees By Sale of Old Magazines |

15,000 |

75,000 1,100 450 |

|

To Consumption of Sports Material |

|

10,000 |

By Interest on Investment |

|

3,500 |

|

To Depreciation on Furniture To Miscellaneous Expenses To Surplus |

|

1,000 3,100 10,200 |

|

|

|

|

|

|

80,050 |

|

|

80,050 |

Working Notes:

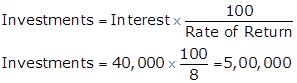

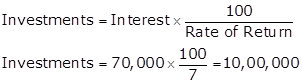

i. ![]()

ii. ![]()

iii. ![]()

Financial Statements of Not-for-Profit Organisations Exercise 1.66

Solution EX. 41

|

In the books of Delhi Football Club Income and Expenditure Account for the year ended 31st March 2019 |

|||||

|

Dr. |

|

|

|

|

Cr. |

|

Expenditure |

|

Rs. |

Income |

|

Rs. |

|

To Salaries |

70,000 |

|

By Subscriptions (550 members × Rs.100 each) |

|

55,000 |

|

Add : Outstanding at the end |

5,000 |

|

By Entrance Fees |

|

50,000 |

|

Less : Outstanding in the beginning |

(10,000) |

65,000 |

By General Donation (5,00,000 × 10%) |

|

50,000 |

|

To Insurance |

|

3,500 |

By Locker Rent |

|

4,000 |

|

To Sundry Expenses |

|

4,700 |

By Profit on Sale of Furniture(1,00,000 - 80,000) |

20,000 |

|

|

To Match Expenses |

90,000 |

|

By Interest on Investment |

10,000 |

|

|

Less : Match Fund |

(80,000) |

10,000 |

Add : Accrued Interest |

2,000 |

12,000 |

|

To Surplus (Balancing Fig.) |

|

1,07,800 |

|

|

|

|

|

|

1,91,000 |

|

|

1,91,000 |

Calculation of Interest Accrued on Investment

|

Interest on Investment for 9 Months (1,60,000 × 10% × 9/12) |

12,000 |

|

Less : Interest Received |

(10,000) |

|

Amount of Accrued Interest on Investment |

2,000 |

Solution EX. 42

|

Books of Royal Club Income and Expenditure Account for the year ended 31st March 2019 |

|||||

|

Dr. |

|

|

|

|

Cr. |

|

Expenditure |

|

Rs. |

Income |

|

Rs. |

|

To Rent and Taxes |

16,800 |

|

By Entrance Fees |

|

25,500 |

|

Less : Outstanding Rent in the beginning |

(6,000) |

|

By Subscriptions |

1,60,000 |

|

|

Add: Outstanding Rent at the end |

6,000 |

16,800 |

Less : Outstanding in the beginning |

(3,500) |

|

|

|

|

|

Add : Outstanding at the end |

4,500 |

1,61,000 |

|

To Wages |

|

24,500 |

By Donations |

|

16,500 |

|

To Lighting Charge |

|

7,200 |

By Profit on Entertainment |

|

5,600 |

|

To Lecturer's Fee |

|

43,500 |

By Interest Accrued on Fixed Deposits (80,000 × 3% × 6/12) |

1,200 |

|

|

To Office Expenses |

|

45,000 |

|

|

|

|

To Depreciation on : |

|

|

|

|

|

|

----Books |

11,300 |

|

|

|

|

|

----Furniture |

5,000 |

16,300 |

|

|

|

|

To Surplus (Balancing Fig.) |

|

56,500 |

|

|

|

|

|

|

2,09,800 |

|

|

2,09,800 |

|

|

|

|

|

|

|

|

Balance Sheet as on 01st April 2018 |

|||

|

Liabilities |

Rs. |

Assets |

Rs. |

|

Outstanding Rent |

6,000 |

Books |

2,00,000 |

|

Capital Fund (Balancing Fig.) |

3,14,400 |

Furniture |

85,000 |

|

|

|

Subscriptions Outstanding |

3,500 |

|

|

|

Cash and Bank |

31,900 |

|

|

|

|

|

|

|

3,20,400 |

|

3,20,400 |

|

Balance Sheet as on 31st March 2019 |

|||||

|

Liabilities |

|

Rs. |

Assets |

|

Rs. |

|

Rent Outstanding |

|

6,000 |

Subscriptions Outstanding |

|

4,500 |

|

Capital Fund |

3,14,400 |

|

Books |

2,00,000 |

|

|

Add : Life Membership Fees |

25,000 |

|

Add : Purchases

|

21,300 |

|

|

Add : Surplus |

56,500 |

3,95,900 |

Less : Deprecation |

(11,300) |

2,10,000 |

|

|

|

|

Furniture |

85000 |

|

|

|

|

|

Less : Depreciation |

(5,000) |

80,000 |

|

|

|

|

Fixed Deposits |

80,000 |

|

|

|

|

|

Add : Accrued interest |

1,200 |

81,200 |

|

|

|

|

Cash at Bank |

|

24,200 |

|

|

|

|

Cash in hand |

|

2,000 |

|

|

|

4,01,900 |

|

|

4,01,900 |

|

|

|

|

|

|

|

Financial Statements of Not-for-Profit Organisations Exercise 1.67

Solution EX. 43

|

In the books of New City Club Income and Expenditure Account for the year ended 31st March 2019 |

|||||

|

Dr. |

|

|

|

|

Cr. |

|

Expenditure |

|

Rs. |

Income |

|

Rs. |

|

To Salaries |

28,000 |

|

By Subscription (50 members × Rs.500 each) |

|

25,000 |

|

Add : Outstanding for 2019 |

2,000 |

|

By Rent Received from the use of hall |

|

14,000 |

|

Less: Outstanding for 2018 |

(6,000) |

24,000 |

By Profit from Entertainment |

|

8,000 |

|

To General Expenses |

|

6,000 |

By Sale of Old Newspapers |

|

2,000 |

|

To Electricity Charges |

|

4,000 |

|

|

|

|

To Newspaper |

|

8,000 |

|

|

|

|

To Depreciation on Furniture (20,000 × 10%) |

2,000 |

|

|

|

|

|

To Surplus (Balancing Fig.) |

|

5,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

49,000 |

|

|

49,000 |

|

|

|

|

|

|

|

|

Balance Sheet as on 01st April 2018 |

|||

|

Liabilities |

Rs. |

Assets |

Rs. |

|

Salaries Outstanding |

6,000 |

Subscriptions Outstanding |

6,000 |

|

Capital Fund |

2,47,000 |

Building |

2,00,000 |

|

(Balancing Fig.) |

|

Furniture |

20,000 |

|

|

|

Books |

20,000 |

|

|

|

Cash at Bank |

7,000 |

|

|

2,53,000 |

|

2,53,000 |

|

|

|

|

|

|

Balance Sheet as on 31st March 2019 |

|||||

|

Liabilities |

|

Rs. |

Assets |

|

Rs. |

|

Advance Subscription |

|

4,000 |

Subscription Outstanding |

|

|

|

Salaries Outstanding |

|

2,000 |

For 2018-19 (25,000 - 20,000) |

5,000 |

|

|

Capital Fund |

2,47,000 |

|

For 2017-18 (6,000 - 5,000) |

1,000 |

6,000 |

|

Add : Surplus |

5,000 |

2,52,000 |

Building |

|

2,00,000 |

|

|

|

|

Furniture |

20,000 |

|

|

|

|

|

Less : 10 % Depreciation |

(2,000) |

18,000 |

|

|

|

|

Books |

20,000 |

|

|

|

|

|

Add : Purchases |

10,000 |

30,000 |

|

|

|

|

Cash and Bank |

|

4,000 |

|

|

|

2,58,000 |

|

|

2,58,000 |

|

|

|

|

|

|

|

Solution EX. 44

|

Income and Expenditure Account for the year ending March 31, 2019 |

|||||

|

Dr. |

|

Cr. |

|||

|

Expenditure |

Amount (Rs.) |

Income |

Amount (Rs.) |

||

|

Electricity |

30,000 |

Subscription |

2,65,000 |

|

|

|

Newspaper |

18,500 |

Add: Current O/s |

7,000 |

2,72,000 |

|

|

Loss on Sale of Furniture |

13,000 |

Government Grant |

1,20,000 |

||

|

Salary |

36,000 |

|

Sale of Old News Paper |

12,500 |

|

|

Add: Outstanding |

6,000 |

42,000 |

Interest on Fixed Deposit |

9,000 |

|

|

Rent |

65,000 |

|

(18,000 @ 10% for 6 months) |

|

|

|

Less: Prepaid |

5,000 |

60,000 |

|

|

|

|

General Expenses |

32,000 |

|

|

||

|

Postage Charges |

3,000 |

|

|

||

|

Surplus |

2,15,000 |

|

|

||

|

|

4,13,500 |

|

4,13,500 |

||

|

|

|

|

|

||

|

Balance Sheet as on March 31, 2019 |

|||||

|

Liabilities |

Amount (Rs.) |

Assets |

Amount (Rs.) |

||

|

Capital Fund |

|

Books |

50,000 |

|

|

|

Opening Balance |

3,85,500 |

|

Add: Purchases |

70,000 |

1,20,000 |

|

Add: Surplus |

2,15,000 |

6,00,500 |

Subscriptions Outstanding |

15,000 |

|

|

Subscription Received in Advance |

5,000 |

Furniture |

1,20,000 |

|

|

|

Salary Outstanding |

6,000 |

Add: Purchases |

1,05,000 |

|

|

|

|

|

Less: Sale |

50,000 |

1,75,000 |

|

|

|

|

Fixed Deposit |

1,80,000 |

|

|

|

|

|

Add: Accrued Interest |

4,500 |

1,84,500 |

|

|

|

|

Prepaid Rent |

5,000 |

||

|

|

|

Cash |

30,000 |

||

|

|

|

Bank |

82,000 |

||

|

|

6,11,500 |

|

6,11,500 |

||

|

|

|

|

|

||

Working Notes

WN1: Ascertainment of Capital Fund

|

Balance Sheet as on March 31, 2019 |

|||

|

Liabilities |

Amount (Rs.) |

Assets |

Amount (Rs.) |

|

Capital Fund |

3,85,500 |

Subscriptions Outstanding |

20,000 |

|

|

|

Books |

50,000 |

|

|

|

Furniture |

1,20,000 |

|

|

|

Cash |

40,000 |

|

|

|

Bank |

1,55,500 |

|

|

3,85,500 |

|

3,85,500 |

Financial Statements of Not-for-Profit Organisations Exercise 1.68

Solution EX. 45

|

Income and Expenditure Account for the year ended 31st March 2019 |

|||||

|

Dr. |

Cr. |

||||

|

Expenditure |

Rs. |

Income |

Rs. |

||

|

To Loss on Sale of Sports Material (10,000 - 6,000) |

|

4,000 |

By Subscription |

1,81,000 |

|

|

To Wages and Salaries |

60,000 |

|

Add: Subscriptions Outstanding for 2018-19 |

5,500 |

|

|

Add: Outstanding in 2018-19 |

6,000 |

|

Less: Subscription Outstanding for 2017-18 |

(8,000) |

|

|

Less: Outstanding in 2017-18 |

(11,000) |

55,000 |

Add: Advance received for 2018-19 |

6,000 |

|

|

To Stationery |

|

15,000 |

Less: Advance Received for 2019-20 |

(4,000) |

1,80,500 |

|

To Audit Fee |

|

2,000 |

By Sale of Old Materials |

|

1,500 |

|

To Expenses on Terms |

|

65,000 |

By Entrance Fees |

|

2,000 |

|

To Depreciation on Billiards Tables (60,000×10%) |

|

6,000 |

By Interest accrued on Investments (40,000×5%×6/12) |

|

1,000 |

|

To Consumption of Sports Equipment (50,000 + 20,000 - 10,000 - 45,000) |

|

15,000 |

|

|

|

|

To Upkeep of Grounds |

|

10,000 |

|

|

|

|

To Surplus (Balancing Fig.) |

|

13,000 |

|

|

|

|

|

|

1,85,000 |

|

|

1,85,000 |

|

|

|

|

|

|

|

|

Balance Sheet |

|||||

|

as on 31st March 2019 |

|||||

|

Liabilities |

Rs. |

Assets |

` |

||

|

Capital Fund |

2,00,000 |

|

Subscriptions Outstanding |

|

5,500 |

|

Add: Surplus |

13,000 |

|

Sports Equipment |

50,000 |

|

|

Add: Life Membership Fees |

50,000 |

2,63,000 |

Add: Purchases |

20,000 |

|

|

Tournament Fund |

60,000 |

|

Less: Book Value of Sold Equipment |

(10,000) |

|

|

Add: Donations |

20,000 |

80,000 |

|

60,000 |

|

|

Salaries Unpaid |

|

6,000 |

Less: Consumption |

(15,000) |

45,000 |

|

Subscriptions in Advance |

|

4,000 |

Grounds |

|

1,20,000 |

|

|

|

|

Billiards Tables |

60,000 |

|

|

|

|

|

Less: 10% Depreciation |

(6,000) |

54,000 |

|

|

|

|

Cash and Bank Balances |

|

87,500 |

|

|

|

|

Investments |

40,000 |

|

|

|

|

|

Add: Accrued interest |

1,000 |

41,000 |

|

|

|

3,53,000 |

|

|

3,53,000 |

|

|

|

|

|

|

|

*as per the book, the value of surplus is Rs 78,000 against our computed value of Rs 13,000.

Solution EX. 46

|

In the books of Ganesh Cricket Club Income and Expenditure Account for the year ended 31st March 2019 |

||||

|

Dr. |

Cr. |

|||

|

Expenditure |

Rs. |

Income |

Rs. |

|

|

To Upkeep of Fields |

20,000 |

By Members' Subscriptions |

50,000 |

|

|

To Rates and Insurance |

2,000 |

Add: Outstanding for 2018-19 |

7,500 |

|

|

To Telephone |

500 |

Less: Outstanding for 2017-18 |

(5,000) |

52,500 |

|

To Printing and Stationery Consumed |

750 |

By Admission Fee |

|

3,000 |

|

To General Charges |

500 |

By Sale of Old Bats, etc. |

|

500 |

|

To Secretary's Honorarium |

2,000 |

By Hire of Ground |

|

3,000 |

|

To Depreciation on Bats, Balls, etc. (22,000×50%) |

11,000 |

By Donations |

|

1,00,000 |

|

To Surplus (Balance Fig.) |

1,22,250 |

|

|

|

|

|

1,59,000 |

|

|

1,59,000 |

|

Balance Sheet as on 01st April 2018 |

|||

|

Liabilities |

Rs. |

Assets |

Rs. |

|

Capital Fund (Balancing Fig.) |

52,000 |

Stock of Bats and Balls |

15,000 |

|

|

|

Printing and Stationery |

2,000 |

|

|

|

Subscriptions Outstanding |

5,000 |

|

|

|

Cash at Bank |

30,000 |

|

|

52,000 |

|

52,000 |

|

Balance Sheet |

|||||

|

as on 31st March 2019 |

|||||

|

Liabilities |

Rs. |

Assets |

Rs. |

||

|

Subscription for Tournament |

10,000 |

|

Subscriptions |

|

7,500 |

|

Less: Tournament Expenses |

(7,000) |

3,000 |

Outstanding Bats and Balls |

15,000 |

|

|

Capital Fund |

52,000 |

|

Add: Purchases |

7,000 |

|

|

Add: Surplus |

1,22,250 |

1,74,250 |

|

22,000 |

|

|

|

|

|

Less: 50% Written-off |

(11,000) |

11,000 |

|

|

|

|

Printing and Stationery |

2,000 |

|

|

|

|

|

Add: Purchases |

1,000 |

|

|

|

|

|

|

3,000 |

|

|

|

|

|

Less: 25% Written-off |

(750) |

2,250 |

|

|

|

|

Bank |

|

1,56,500 |

|

|

|

1,77,250 |

|

|

1,77,250 |

Financial Statements of Not-for-Profit Organisations Exercise 1.69

Solution EX. 47

|

In the books of Mumbai Club Income and Expenditure Account for the year ended 31st March 2019 |

|||||

|

Dr. |

Cr. |

||||

|

Expenditure |

|

Rs. |

Income |

Rs. |

|

|

To Salary |

|

20,000 |

By Subscriptions |

1,20,000 |

|

|

To Repair Expenses |

|

5,000 |

Add: Outstanding |

9,000 |

|

|

To Miscellaneous Expenses |

5,000 |

|

Less: Advance |

(3,500) |

1,25,500 |

|

Less: Prepaid |

(900) |

4,100 |

By Entrance Fee |

|

10,000 |

|

To Insurance Premium |

2,000 |

|

By Interest on Investment |

1,000 |

|

|

Add: Outstanding |

400 |

2,400 |

Add: Accrued interest (60,000×8%×5/12) |

2,000 |

3,000 |

|

To Paper, Ink, etc. |

|

1,500 |

By Donation |

|

50,000 |

|

To Surplus (Balancing Figure) |

|

1,66,500 |

By Interest received from Bank |

|

4,000 |

|

|

|

|

By Sale of Old Newspapers |

|

1,500 |

|

|

|

|

By Receipt from Sale of Drama Tickets |

10,500 |

|

|

|

|

|

Less: Drama Expenses |

(5,000) |

5,500 |

|

|

|

1,99,500 |

|

|

1,99,500 |

|

Balance Sheet as on 01st April 2018 |

|||

|

Liabilities |

Rs. |

Assets |

Rs. |

|

Creditors for Billiard Table |

80,000 |

Billiard Table |

3,00,000 |

|

Capital Fund (Balancing Fig.) |

3,60,000 |

Cash in hand |

40,000 |

|

|

|

Cash at bank |

1,00,000 |

|

|

4,40,000 |

|

4,40,000 |

|

Balance Sheet as on 31st March 2019 |

|||||

|

Liabilities |

Rs. |

Assets |

Rs. |

||

|

Advance Subscriptions |

|

3,500 |

Subscriptions Outstanding |

|

9,000 |

|

Insurance Premium Outstanding |

|

400 |

Prepaid Miscellaneous Expenses |

|

900 |

|

Capital Fund |

3,60,000 |

|

Investments |

60,000 |

|

|

Add: Surplus |

1,66,500 |

5,26,500 |

Add: Accrued Interest |

2,000 |

62,000 |

|

|

|

|

Billiard Table |

|

3,00,000 |

|

|

|

|

Furniture |

|

60,000 |

|

|

|

|

Cash in hand |

|

26,500 |

|

|

|

|

Cash at bank |

|

72,000 |

|

|

|

5,30,400 |

|

|

5,30,400 |

Solution EX. 48

|

Income and Expenditure Account for the year ending March 31, 2019 |

||||

|

Dr. |

|

Cr. |

||

|

Expenditure |

Amount (Rs.) |

Income |

Amount (Rs.) |

|

|

Charity |

1,15,000 |

Subscription |

4,28,000 |

|

|

Advertisement |

45,000 |

|

Donation |

90,000 |

|

Add: Outstanding |

10,000 |

55,000 |

Sale of Old Newspapers |

2,000 |

|

Insurance |

20,000 |

|

Interest on Investments |

56,000 |

|

Less: Prepaid |

5,000 |

15,000 |

(45,000 + 11,000) |

|

|

Salary |

60,000 |

|

|

|

|

Add: Outstanding |

9,000 |

69,000 |

|

|

|

Rent |

32,000 |

|

|

|

|

Add: Outstanding |

6,000 |

38,000 |

|

|

|

Printing |

6,000 |

|

|

|

|

Postage |

3,000 |

|

|

|

|

Surplus |

2,75,000 |

|

|

|

|

|

5,76,000 |

|

5,76,000 |

|

|

|

|

|

|

|

|

Balance Sheet as on March 31, 2019 |

|||||

|

Liabilities |

Amount (Rs.) |

Assets |

Amount (Rs.) |

||

|

Capital Fund |

|

Cash |

99,000 |

||

|

Opening Balance |

2,41,000 |

|

Bank |

1,60,000 |

|

|

Add: Legacy |

1,80,000 |

|

Prepaid Insurance |

5,000 |

|

|

Add: Surplus |

2,75,000 |

6,96,000 |

Furniture |

2,16,000 |

|

|

Rent Outstanding |

6,000 |

Investment |

2,30,000 |

|

|

|

|

|

Add: Accrued Interest |

11,000 |

2,41,000 |

|

|

|

|

|

|

||

|

|

|

|

|

||

|

|

|

|

|

||

|

|

7,21,000 |

|

7,21,000 |

||

|

|

|

|

|

||

Working Notes

WN1: Ascertainment of Capital Fund

|

Balance Sheet as on March 31, 2018 |

|||

|

Liabilities |

Amount (Rs.) |

Assets |

Amount (Rs.) |

|

Capital Fund |

2,41,000 |

Cash |

1,15,000 |

|

|

|

Bank |

1,26,000 |

|

|

2,41,000 |

|

2,41,000 |

Financial Statements of Not-for-Profit Organisations Exercise 1.70

Solution EX. 49

|

In the books of Mayur Club Income and Expenditure Account for the year ended 31st March 2019 |

|||||

|

Dr. |

Cr. |

||||

|

Expenditure |

|

Rs. |

Income |

Rs. |

|

|

To Municipal Taxes |

4,000 |

|

By Subscription (500members × Rs.500) |

|

2,50,000 |

|

Add: Prepaid in 2017-18 |

1,000 |

|

By Interest Accrued on Investment |

|

5,000 |

|

Less: Prepaid in 2018-19 |

(1,000) |

4,000 |

|

|

|

|

To Salaries |

60,000 |

|

By Profit from Drama: |

|

|

|

Add: Outstanding |

5,000 |

65,000 |

Proceeds |

95,000 |

|

|

To Expenses |

|

7,500 |

Less: Drama Expenses |

(45,000) |

50,000 |

|

To Newspapers |

|

15,000 |

By Sale of Waste Paper |

|

4,500 |

|

To Charity |

|

35,000 |

By Donations |

|

54,000 |

|

To Electricity Charges |

|

14,500 |

|

|

|

|

To Surplus (Balancing Fig.) |

|

2,22,500 |

|

|

|

|

|

|

3,63,500 |

|

|

3,63,500 |

|

Balance Sheet as on 01st April 2018 |

|||

|

Liabilities |

Rs. |

Assets |

Rs. |

|

|

|

Subscription Outstanding (4,000+5,000) |

9,000 |

|

Capital Fund (Balancing Fig.) |

6,12,500 |

Municipal Taxes Prepaid |

1,000 |

|

|

|

Building |

5,00,000 |

|

|

|

Cash and Bank |

1,02,500 |

|

|

6,12,500 |

|

6,12,500 |

|

Balance Sheet as on 31st March 2019 |

|||||

|

Liabilities |

Rs. |

Assets |

Rs. |

||

|

Advance Subscriptions |

|

6,000 |

Subscriptions Outstanding |

|

|

|

Salaries Outstanding |

|

5,000 |

2018-19 (2,50,000-2,05,000) |

4,5000 |

|

|

Capital Fund |

6,12,500 |

|

2017-18 |

5,000 |

50,000 |

|

Add: Surplus |

2,22,500 |

8,35,000 |

Prepaid Municipal Taxes |

|

1,000 |

|

|

|

|

Building |

|

5,00,000 |

|

|

|

|

Investments |

2,00,000 |

|

|

|

|

|

Add: Accrued Interest |

5,000 |

2,05,000 |

|

|

|

|

Cash at Bank |

|

90,000 |

|

|

|

8,46,000 |

|

|

8,46,000 |

Solution EX. 50

|

Books of Kapil Dev Club Income and Expenditure Account for the year ended 31st March 2019 |

|||||

|

Dr. |

Cr. |

||||

|

Expenditure |

|

Rs. |

Income |

Rs. |

|

|

To Salaries |

3,30,000 |

|

By Subscription |

6,60,000 |

|

|

Add: Outstanding |

30,000 |

3,60,000 |

Add: Advance in the beginning |

20,000 |

6,80,000 |

|

To Sports Materials Consumed |

|

50,000 |

By Interest on Investments |

|

40,000 |

|

To Surplus (excess of income over expenditure) |

3,10,000 |

|

|

|

|

|

|

|

7,20,000 |

|

|

7,20,000 |

|

Balance Sheet as on 31st March 2019 |

|||||

|

Liabilities |

Rs. |

Assets |

Rs. |

||

|

Outstanding Salaries |

|

30,000 |

Investments |

|

5,00,000 |

|

Capital Fund |

9,70,000 |

|

Stock of sports Material |

|

6,50,000 |

|

Add: Surplus |

3,10,000 |

12,80,000 |

Cash |

|

1,60,000 |

|

|

|

13,10,000 |

|

|

13,10,000 |

Working Notes:

1.

|

Calculation of amount of Sports Material Consumed |

|

|

Sports Material Purchased |

4,00,000 |

|

Add: Opening Stock of Sports Material |

3,00,000 |

|

Less: Closing Stock of Sports Material |

(6,50,000) |

|

Amount of Sports Material Consumed |

50,000 |

2.

Calculation of Capital Fund

|

Balance Sheet as on 1st April 2018 |

|||

|

Liabilities |

Rs. |

Assets |

Rs. |

|

Advance Subscription |

20,000 |

Investments |

5,00,000 |

|

Capital Fund (Balancing Fig.) |

9,70,000 |

Stock of sports Material |

3,00,000 |

|

|

|

Cash |

1,90,000 |

|

|

9,90,000 |

|

9,90,000 |

3.

Calculation of Outstanding Salaries

Outstanding Salaries = 3,30,000 ![]() = Rs.30,000

= Rs.30,000

4.

Calculation of Amount of Investments

Financial Statements of Not-for-Profit Organisations Exercise 1.71

Solution EX. 51

|

In the books of Delhi Medical Society Income and Expenditure Account for the year ended 31st March 2019 |

|||||

|

Dr. |

Cr. |

||||

|

Expenditure |

|

Rs. |

Income |

Rs. |

|

|

To Rent |

16,800 |

|

By Entrance Fees |

|

5,500 |

|

Add: Advance in the beginning |

4,200 |

|

By Subscriptions |

1,80,000 |

|

|

Less: Advance at the end |

(4,200) |

16,800 |

Add: Arrears at the end |

5,500 |

|

|

To Wages |

|

24,500 |

Less: Arrears in the beginning |

(3,500) |

1,82,000 |

|

To Lighting Charges |

|

7,200 |

By Donations |

|

16,500 |

|

To Office Expenses |

|

45,000 |

By Interest on Deposits |

2,400 |

|

|

To Depreciation on: |

|

|

Add: Accrued Interest |

2,400 |

4,800 |

|

----Furniture |

8,500 |

|

By Profit from Tournament: |

|

|

|

----Books |

22,480 |

30,980 |

----Proceeds |

23,200 |

|

|

To Surplus (Balancing Fig.) |

|

87,320 |

----Less: Expenses |

(20,200) |

3,000 |

|

|

|

2,11,800 |

|

|

2,11,800 |

|

Balance Sheet as on 01st April 2018 |

|||

|

Liabilities |

Rs. |

Assets |

Rs. |

|

Capital Fund (Balancing Fig.) |

3,24,600 |

Advance Rent |

4,200 |

|

|

|

Subscriptions-in-Arrears |

3,500 |

|

|

|

Books |

2,00,000 |

|

|

|

Furniture |

85,000 |

|

|

|

Cash and Bank |

31,900 |

|

|

3,24,600 |

|

3,24,600 |

|

Balance Sheet as on 31st March 2019 |

|||||

|

Liabilities |

Rs. |

Assets |

Rs. |

||

|

|

|

|

Subscription-in-Arrears |

|

5,500 |

|

Capital Fund |

3,24,600 |

|

Advance Rent |

|

4,200 |

|

Add: Surplus |

87,320 |

|

Books |

2,00,000 |

|

|

Add: Life Membership |

25,000 |

4,36,920 |

Add: Purchase |

24,800 |

|

|

Polio Eradication Fund |

|

|

|

2,24,800 |

|

|

Govt. Grant |

2,00,000 |

|

Less: 10% Depreciation |

(22,480) |

2,02,320 |

|

Less: Medicines |

1,00,000 |

|

Furniture |

85,000 |

|

|

Less: Salaries to Doctors |

80,000 |

20,000 |

Less: 10% Depreciation |

(8,500) |

76,500 |

|

|

|

|

Cash in Hand |

|

26,000 |

|

|

|

|

Cash at Bank |

|

20,000 |

|

|

|

|

8% Fixed Deposit |

1,20,000 |

|

|

|

|

|

Add: Accrued Interest |

2,400 |

1,22,400 |

|

|

|

4,56,920 |

|

|

4,56,920 |