Class 12-commerce T S GREWAL Solutions Accountancy Chapter 7: Dissolution of Partnership Firm

Dissolution of Partnership Firm Exercise 7.51

Solution Ex. 1

Journal

|

Date |

Particulars |

|

L.F. |

Debit (Rs.) |

Credit(Rs.) |

|

|

Cash A/c |

Dr. |

|

2,94,000 |

|

|

|

---------To Realisation A/c |

|

|

|

2,94,000 |

|

|

(Being asset sold at the time of dissolution of the firm and broker's commission paid @2% on the realisable value) |

|

|

|

|

Solution Ex. 2

|

Journal |

|||||

|

S. No. |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

(a) |

Realisation |

Dr. |

1,500 |

||

|

----------To Cash A/c |

1,500 |

||||

|

(Being realisation expenses paid) |

|||||

|

(b) |

Realisation A/c |

Dr. |

600 |

||

|

----------To Mohan's Capital A/c |

600 |

||||

|

(Being realisation expenses paid by Mohan) |

|||||

|

(c) |

Realisation A/c |

Dr. |

2,000 |

||

|

--------To Mohan Capital A/c |

2,000 |

||||

|

(Being commission allowed to Mohan on dissolution of the firm) |

|||||

|

(d) |

No Entry |

Dr. |

|||

|

(No journal entry to be passed as motor car and creditors have already been transferred to Realization A/c) |

|||||

Solution Ex. 3

|

Journal |

|||||

|

S. No. |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

(a) |

Rahul Capital A/c |

Dr. |

15,000 |

||

|

----------To Cash A/c |

15,000 |

||||

|

(Being realisation expense paid by rahul) |

|||||

|

(b) |

Realisation A/c |

Dr. |

25,000 |

||

|

----------To Ramesh Capital A/c |

25,000 |

||||

|

(Being remuneration allowed to ramesh on account of taking responsibility of dissolution) |

|||||

|

(c) |

Realisation A/c |

Dr. |

20,000 |

||

|

----------To Anju Capital A/c |

20,000 |

||||

|

(Being remuneration allowed to Anju Capital A/c) |

|||||

|

Anju's Capital A/c |

Dr. |

5,000 |

5,000 |

||

|

----------To Bank A/c |

|||||

|

(Being remuneration expenses paid by the firm on behalf of Anju) |

|||||

Solution Ex. 4

|

Journal |

|||||

|

S. No. |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

(a) |

Realisation A/c |

Dr. |

7,500 |

||

|

----------To Alok's Capital A/c |

7,500 |

||||

|

(Being realisation allowed to alok capital A/c) |

|||||

|

Alok's Capital A/c |

Dr. |

10,000 |

|||

|

----------To Bank A/c |

10,000 |

||||

|

(Being expenses paid by the firm on behalf of Alok) |

|||||

|

OR |

|||||

|

Realisation A/c |

Dr. |

7,500 |

|||

|

Alok's Capital A/c |

Dr. |

2,500 |

|||

|

----------ToBank A/c |

10,000 |

||||

|

(Being realisation expense paid) |

|||||

|

(b) |

Realisation A/c |

Dr. |

5,000 |

||

|

----------To Ravinder's Capital A/c |

3,000 |

||||

|

----------To Bank A/c |

2,000 |

||||

|

(Being realisation expense paid) |

|||||

|

(c) |

Realisation A/c |

Dr. |

10,000 |

||

|

----------To Amit Capital A/c |

10,000 |

||||

|

(Being realisation expense paid by Amit on behalf of the firm ) |

|||||

Dissolution of Partnership Firm Exercise 7.52

Solution Ex. 5

|

Journal |

|||||||

|

|

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|||

|

(a) |

Realisation A/c |

Dr. |

40,000 |

||||

|

----To Cash A/c |

40,000 |

||||||

|

(Creditors worth Rs.85,000 accepted 40,000 as cash and investment worth Rs.43,000 in full settlement) |

|||||||

|

(b) |

No Entry |

||||||

|

(Creditors worth Rs.16,000 accepted Machinery worth Rs.18,000 in full settlement. No entry as both asset and liability are already transferred to the Realisation Account) |

|||||||

|

(c) |

Cash A/c |

Dr. |

30,000 |

||||

|

----To Realisation A/c |

30,000 |

||||||

|

(Creditors worth Rs.90,000 accepted Building worth Rs.1,20,000 and paid back Rs.30,000 as cash after settlement of claim to the firm) |

|||||||

Solution Ex. 6

|

Journal |

|||||

|

S. No. |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

(a) |

Bank A/c |

Dr. |

50,000 |

||

|

----------To Realisation A/c |

50,000 |

||||

|

(Being assets realized for cash) |

|||||

|

(b) |

Realisation A/c |

Dr. |

10,000 |

||

|

----------ToBank A/c |

10,000 |

||||

|

(Being payment of liabilities made) |

|||||

|

(c) |

Realisation A/c |

Dr. |

2,500 |

||

|

----------To X's Capital A/c |

2,500 |

||||

|

(Being 5% commission allowed to X's on sale of assets of Rs.50,000) |

|||||

|

(d) |

Realisation A/c |

Dr. |

10,000 |

||

|

|

----------To Amrit Capital A/c |

|

|

|

10,000 |

|

|

(Being Amrit was allowed remuneration on account of relalisation ) |

|

|

|

|

|

|

Amrit Capital A/c |

Dr. |

|

15,000 |

|

|

|

----------To Bank A/c |

|

|

|

15,000 |

|

|

(Being realisation expense paid on behalf Amrit ) |

|

|

|

|

|

|

Alternatively, only one single entry can also be passed instead of above two entries |

|

|

|

|

|

|

Realisation A/c |

Dr. |

|

10,000 |

|

|

|

Amrit Capital A/c |

Dr. |

|

5,000 |

|

|

|

----------To Bank A/c |

|

|

|

15,000 |

|

|

(Being realisation expenses paid) |

|

|

|

|

|

(e) |

Bad debts Recovered A/c |

Dr. |

|

3,600 |

|

|

|

To Realisation A/c |

|

|

|

3,600 |

|

|

(Being bad debts recovered) |

|

|

|

|

|

(f) |

Cash A/c |

Dr. |

|

|

|

|

|

----------To Realisation A/c |

|

|

15,000 |

|

|

|

(Being investments are realized at 150% ) |

|

|

|

15,000 |

Solution Ex. 7

|

Journal |

|||||

|

Sr. No. |

Particulars |

|

L.F. |

Debit Rs. |

Credit Rs. |

|

a. |

Partners Loan A/c |

Dr. |

|

10,000 |

|

|

|

------------------------------------------------------------To Bank A/c |

|

|

|

28,000 |

|

|

(Being creditors paid ) |

|

|

|

|

Solution Ex. 8

|

Journal |

|||||

|

S. No. |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

a. |

Realisation A/c |

Dr. |

12,000 |

||

|

----------To Bank A/c |

12,000 |

||||

|

(Being bank loan paid at the time of dissolution) |

|||||

|

b. |

Q's capital A/c |

Dr. |

16,000 |

||

|

----------To Realisation A/c |

16,000 |

||||

|

(Being stock taken over by Q) |

|||||

|

c. |

Realisation A/c |

Dr. |

4,000 |

||

|

----------To P's Capital A/c |

4,000 |

||||

|

(Being 5% commission allowed to X's on sale of assets of Rs.50,000) |

|||||

|

d. |

Bank A/c |

Dr. |

1,200 |

||

|

|

----------To Realisation A/c |

|

|

|

1,200 |

|

|

(Being unrecorded assets realised ) |

|

|

|

|

|

e. |

Realisation A/c |

Dr. |

|

2,000 |

|

|

|

----------To Q' Capital A/c |

|

|

|

2,000 |

|

|

(Being bad debts recovered) |

|

|

|

|

|

f. |

Realisation A/c |

Dr. |

|

36,000 |

|

|

|

----------To P's Capital A/c |

|

|

|

20,000 |

|

|

----------To Q's Capital A/c |

|

|

|

16,000 |

|

|

(Being realisation Profit distributed) |

|

|

|

|

Solution Ex. 9

|

Journal |

|||||

|

S. No. |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

(a) |

Profit and Loss A/c |

Dr. |

18,000 |

||

|

----------To X's capital A/c |

9,000 |

||||

|

----------To Y's capital A/c |

6,000 |

||||

|

----------To Z's capital A/c |

3,000 |

||||

|

(Being balance in P and L A/c divided among Partners in the ratio of 3:2:1) |

|||||

|

(b) |

X's capital A/c |

Dr. |

50,000 |

||

|

----------To Realisation A/c |

50,000 |

||||

|

(Being unrecorded asset taken over by X) |

|||||

|

(c) |

Realisation A/c |

Dr. |

4,000 |

||

|

----------To Bank A/c |

4,000 |

||||

|

(Being creditors were paid Rs.4,000 in full settlement of their claim of Rs.5,000) |

|||||

Solution Ex. 10

|

Journal |

|||||||

|

|

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|||

|

(a) |

Cash/Bank A/c |

Dr. |

3,000 |

||||

|

-----To Realisation A/c |

3,000 |

||||||

|

(Old and unrecorded furniture sold) |

|||||||

|

|

|

|

|

|

|||

|

(b) |

Cash/Bank A/c |

Dr. |

600 |

||||

|

-----To Realisation A/c |

600 |

||||||

|

(Bad debts previously written off now recovered) |

|||||||

|

(c) |

Paras's Capital A/c |

Dr. |

30,000 |

||||

|

-----To Realisation A/c |

30,000 |

||||||

|

(Unrecorded goodwill taken over by Paras) |

|||||||

|

(d) |

Priya's Capital A/c |

Dr. |

300 |

||||

|

-----To Realisation A/c |

300 |

||||||

|

(Unrecorded Typewriter taken over by Priya at 25% less price) |

|||||||

|

(e) |

Paras's Capital A/c |

Dr. |

300 |

||||

|

Priya's Capital A/c |

Dr. |

300 |

|||||

|

-----To Realisation A/c |

600 |

||||||

|

(100 unrecorded shares of Rs.10 each in the books taken @ Rs.6 each by Paras and Priya and divided between them in profit sharing ratio) |

|||||||

Dissolution of Partnership Firm Exercise 7.53

Solution Ex. 11

|

Journal |

|||||

|

Sr. No. |

Particulars |

|

L.F |

Debit Rs. |

Credit Rs. |

|

(a) |

-------------------------------------------------------------------------------To Bank A/c |

|

|

|

1,250 |

|

|

(Being creditors paid ) |

|

|

|

|

|

|

|

|

|

|

|

Solution Ex. 12

|

Journal |

|||||

|

Sr. No. |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

a. |

Realisation A/c |

Dr. |

6,000 |

||

|

----------To Kunal's capital A/c |

6,000 |

||||

|

(Being Kunal agrees to pay off his wife's loan) |

|||||

|

b. |

Realisation A/c |

Dr. |

27,000 |

||

|

----------To Cash A/c |

27,000 |

||||

|

(Being creditors worth Rs.30,000 paid off at a discount 10%) |

|||||

|

c. |

Rohit Loan A/c |

Dr. |

70,000 |

||

|

----------To Cash A/c |

70,000 |

||||

|

(Being loan paid by firm ) |

|||||

|

d. |

Kunal Capital A/c |

Dr. |

3,000 |

||

|

|

----------To Realisation A/c |

|

|

|

3,000 |

|

|

(Being asset taken over by Kunal) |

|

|

|

|

|

e. |

Rohit Capital A/c |

Dr. |

|

5,000 |

|

|

|

Kunal Capital A/c |

Dr. |

|

5,000 |

|

|

|

Sarthak Capital A/c |

Dr. |

|

5,000 |

|

|

|

----------To Profit and Loss A/c |

|

|

|

15,000 |

|

|

(Being loss distributed equally) |

|

|

|

|

|

f. |

Realisation A/c |

Dr. |

|

15,000 |

|

|

|

----------To Sarthak's Capital A/c |

|

|

|

15,000 |

|

|

(Being remuneration of Rs.15,000 paid for completion of dissolution process ) |

|

|

|

|

Solution Ex. 13

|

Journal |

|||||||

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|||

|

|

Realisation A/c |

Dr. |

1,00,000 |

||||

|

|

-----To Sundry Assets A/c |

1,00,000 |

|||||

|

|

(All assets other than cash and bank transferred to Realisation Account) |

||||||

|

|

|||||||

|

|

Atul's Capital A/c |

Dr. |

40,000 |

||||

|

|

-----To Realisation A/c |

40,000 |

|||||

|

|

(Atul took over 50% of assets worth Rs 1,00,000 at 20% discount) [1,00,000 @ 50% @ 80%] |

||||||

|

|

|||||||

|

|

Bank A/c |

Dr. |

26,000 |

||||

|

|

-----To Realisation A/c |

26,000 |

|||||

|

|

(Assets worth Rs 20,000, i.e. 40% of assets of Rs 50,000 are sold at a profit of 30%) [50,000 × (40/100) × (130/100)] |

||||||

|

|

|||||||

|

|

No entry for obsolete assets and for the assets given to the creditors in the full settlement as these are already transferred to the Realisation Account) |

||||||

|

|

|||||||

Dissolution of Partnership Firm Exercise 7.54

Solution Ex. 14

|

Journal |

|||||

|

Sr. No. |

Particular |

|

L.F |

Debit Rs. |

Credit Rs. |

|

a. |

Bank A/c |

Dr. |

|

1,40,000 |

|

|

|

------------------------------To Realisation A/c |

|

|

|

15,000 |

|

|

(Being loss on dissolution transferred to partners' capital account ) |

|

|

|

|

Note: **No pass for asset taken over by the creditor

Solution Ex. 15

|

Journal |

|||||

|

Date |

Particular |

|

L.F |

Debit Rs. |

Credit Rs. |

|

--------------------------------------------------------------------82,000 |

|||||

|

|

(Being creditors paid) |

|

|

|

|

Solution Ex. 16

|

Journal |

|||||

|

Date |

Particular |

|

L.F |

Debit Rs. |

Credit Rs. |

|

(a) |

Bank A/c |

Dr. |

|

1,250 |

|

|

|

------------------------------------------------To Bank A/c |

|

|

|

3,500 |

|

|

(Being liability discharged) |

|

|

|

|

Dissolution of Partnership Firm Exercise 7.55

Solution Ex. 17

|

Journal |

|||||

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

(a) |

Realisation A/c |

Dr. |

12,000 |

||

|

-----To Dharam's Capital A/c |

12,000 |

||||

|

(Remuneration paid) |

|||||

|

(b) |

Realisation A/c |

Dr. |

15,000 |

||

|

-----To Jay's's Capital A/c |

15,000 |

||||

|

(Remuneration paid) |

|||||

|

|

|

|

|

|

|

|

Jay's Capital A/c |

Dr. |

16,000 |

|||

|

-----To Vijay's Capital A/c |

16,000 |

||||

|

(Expenses borne by Jay, paid by Vijay) |

|||||

|

(c) |

Realisation A/c |

Dr. |

7,000 |

||

|

-----To Deepa's Capital A/c |

7,000 |

||||

|

(Remuneration paid) |

|||||

|

Deepa's Capital A/c |

Dr. |

6,000 |

|||

|

-----To Bank A/c |

6,000 |

||||

|

(Expenses paid by firm) |

|||||

|

(d) |

No Entry |

|

|

|

|

|

(e) |

Realisation A/c |

Dr. |

10,000 |

||

|

-----To Jeev's Capital A/c |

10,000 |

||||

|

(Remuneration paid) |

|||||

|

Jeev's Capital A/c |

Dr. |

12,000 |

|||

|

-----To Bank A/c |

12,000 |

||||

|

(Expenses paid by firm) |

|||||

|

(f) |

No Entry |

||||

Solution Ex. 18

|

Realisation Account |

|||||

|

Dr. |

|

|

|

|

Cr. |

|

Particulars |

|

Rs. |

Particulars |

|

Rs. |

|

To Sundry Assets A/c |

|

|

By Creditors A/c |

|

1,70,000 |

|

---Debtors |

2,40,000 |

|

By Ramesh's Current A/c (stock) |

|

55,000 |

|

---Stock |

1,30,000 |

|

|

|

|

|

---Furniture |

2,00,000 |

|

By Cash A/c (Assets) |

|

|

|

---Machinery |

9,30,000 |

15,00,000 |

---Stock |

50,000 |

|

|

|

|

|

---Machinery |

4,50,000 |

|

|

|

|

|

---Debtors |

2,28,000 |

7,28,000 |

|

To Cash A/c (Liabilities) |

|

|

By Umesh's Current A/c (Furniture) |

|

50,000 |

|

---Creditors |

1,70,000 |

|

|

|

|

|

---Outstanding Bill |

1,40,000 |

3,10,000 |

By Realistion Loss: |

|

|

|

|

|

|

---Ramesh's Current A/c |

5,64,900 |

|

|

|

|

|

---Umesh's Current A/c |

2,42,100 |

8,07,000 |

|

|

|

|

|

|

|

|

|

|

18,10,000 |

|

|

18,10,000 |

Solution Ex. 19

|

In the books of the firm Realisation Account |

||||||

|

Dr. |

|

|

|

|

|

Cr. |

|

Date |

Particulars |

|

Rs. |

Date |

Particulars |

Rs. |

|

|

To Building |

|

1,20,000 |

|

By Provision on Debtors |

4,000 |

|

|

To Investment |

|

30,600 |

|

By Creditors |

80,000 |

|

|

To Debtors |

|

34,000 |

|

By Mrs. Pradeep's Loan |

40,000 |

|

|

To Bills Receivable |

|

37,400 |

|

By Investment Fluctuation Fund |

8,000 |

|

|

To Goodwill |

|

4,000 |

|

By Bank (Debtors) |

12,000 |

|

|

To Pradeep's Capital |

|

40,000 |

|

By Bank (Building) |

1,52,000 |

|

|

To Bank (expenses) |

|

2,500 |

|

By Bank (Bills Receivable) |

36,000 |

|

|

To Bank (WN 1) |

|

59,000 |

|

By Cash |

27,000 |

|

|

To Pradeep's Capital |

|

1,000 |

|

|

|

|

|

To Partner's Capital: |

|

|

|

|

|

|

|

Pradeep |

18,300 |

|

|

|

|

|

|

Rajesh |

12,200 |

30,500 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3,59,000 |

|

|

3,59,000 |

Working Notes:

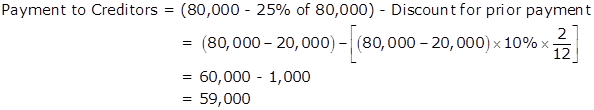

1. Calculation of amount to be paid to creditors

Dissolution of Partnership Firm Exercise 7.56

Solution Ex. 20

|

Realisation Account |

|||||

|

Dr. |

|

|

|

|

Cr. |

|

Particulars |

|

Rs. |

Particulars |

|

Rs. |

|

To Machinery A/c |

|

10,580 |

By Sundry Creditors A/c |

|

14,000 |

|

To Stock A/c |

|

4,740 |

By Bank A/c (Assets Realised) |

|

19,500 |

|

To Debtors A/c |

|

5,540 |

By Loss transferred to: |

|

|

|

To Bank A/c: |

|

|

X's Capital A/c |

1,200 |

|

|

Creditors |

14,000 |

|

Y's Capital A/c |

600 |

1,800 |

|

Expenses |

440 |

14,440 |

|

|

|

|

|

|

35,300 |

|

|

35,300 |

|

Partner's Capital Account |

|||||

|

Dr. |

|

|

|

|

Cr. |

|

Particulars |

X |

Y |

Particulars |

X |

Y |

|

To Realisation A/c (Loss) |

1,200 |

600 |

By Balance b/d |

4,000 |

3,000 |

|

To Bank A/c |

3,133 |

2,567 |

By Reserve for contingencies A/c |

333 |

167 |

|

|

|

|

|

|

|

|

|

4,333 |

3,167 |

|

4,333 |

3,167 |

|

Bank Account |

|||

|

Dr. |

|

|

Cr. |

|

Particulars |

Rs. |

Particulars |

Rs. |

|

To Balance b/d |

640 |

By Realisation A/c |

14,440 |

|

To Realisation A/c |

19,500 |

By X's Capital A/c |

3,133 |

|

|

|

By Y's Capital A/c |

2,567 |

|

|

20,140 |

|

20,140 |

Solution Ex. 21

|

Journal |

|||||

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

Realisation A/c |

Dr. |

9,22,000 |

|||

|

----------To Land and Building A/c |

4,00,000 |

||||

|

----------T0 Machinery A/c |

3,00,000 |

||||

|

----------To Debtors A/c |

2,22,000 |

||||

|

(Being assets transferred) |

|||||

|

Creditors A/c |

Dr. |

1,79,000 |

|||

|

Employees' Provident Fund A/c |

Dr. |

21,000 |

|||

|

----------To Realisation A/c |

2,00,000 |

||||

|

(Being liabilities transferred) |

|||||

|

Bank A/c |

Dr. |

4,30,000 |

|||

|

----------To Realisation A/c |

4,30,000 |

||||

|

(Being Land and Building realized) |

|||||

|

Bank A/c (2,25,000 + 1,000) |

Dr. |

2,26,000 |

|||

|

|

----------To Realisation A/c |

|

|

|

2,26,000 |

|

|

(Being debtors realized along with Bad- debts recovered) |

|

|

|

|

|

|

Bank A/c |

Dr. |

|

25,000 |

|

|

|

----------To Realisation A/c |

|

|

|

25,000 |

|

|

(Being unrecorded investment sold) |

|

|

|

|

|

|

Bank A/c |

Dr. |

|

2,80,000 |

|

|

|

----------To Realisation A/c |

|

|

|

2,80,000 |

|

|

(Being machinery took over by Vichal for Cash) |

|

|

|

|

|

|

Realisation A/c |

Dr. |

|

1,96,000 |

|

|

|

----------To Bank A/c (85,500 + 89,500 + 21,000) |

|

|

|

1,96,000 |

|

|

(Being 50% creditors of Rs.89,500 were paid at a discount of Rs.4,000 and remaining 50% were settled in full and EPF) |

|

|

|

|

|

|

Realisation A/c |

Dr. |

|

43,000 |

|

|

|

----------To Achal's Capital A/c |

|

|

|

16,125 |

|

|

----------To Vichal's Capital A/c |

|

|

|

26,875 |

|

|

(Being profits on realization transferred) |

|

|

|

|

|

|

Achal's Capital A/c |

Dr. |

|

3,16,125 |

|

|

|

Vichal's Capital A/c |

Dr. |

|

5,26,875 |

|

|

|

----------To Bank A/c |

|

|

|

8,43,000 |

|

|

(Being partners paid off) |

|

|

|

|

Dissolution of Partnership Firm Exercise 7.57

Solution Ex. 22

|

Realisation Account |

|||||

|

Dr. |

|

|

|

|

Cr. |

|

Particulars |

|

Rs. |

Particulars |

|

Rs. |

|

To Building A/c |

|

45,000 |

By Sundry Creditors A/c |

|

14,000 |

|

To Machinery A/c |

|

15,000 |

By Bank A/c: |

|

|

|

To Furniture A/c |

|

12,000 |

Stock |

22,000 |

|

|

To Debtors A/c |

|

8,000 |

Debtors |

7,500 |

|

|

To Stock A/c |

|

24,000 |

Machinery |

16,000 |

|

|

|

|

|

Building |

35,000 |

80,500 |

|

To Bank A/c: |

|

|

By Bale's Loan A/c |

|

500 |

|

---Creditors |

14,000 |

|

By Yale's Capital A/c |

|

9,000 |

|

---Expenses |

2,500 |

16,500 |

By Loss transferred to: |

|

|

|

|

|

|

---Bale's Capital A/c |

8,250 |

|

|

|

|

|

---Yale's Capital A/c |

8,250 |

16,500 |

|

|

|

1,20,500 |

|

|

1,20,500 |

|

Partner's Capital Account |

|||||

|

Dr. |

|

|

|

|

Cr. |

|

Particulars |

Bale |

Yale |

Particulars |

X |

Y |

|

To Realisation A/c (Loss) |

8,250 |

8,250 |

By Balance b/d |

50,000 |

40,000 |

|

To Realisation A/c |

|

9,000 |

By General Reserve A/c |

4,000 |

4,000 |

|

To Bank A/c |

45,750 |

26,750 |

|

|

|

|

|

54,000 |

44,000 |

|

54,000 |

44,000 |

|

Bale's Loan Account |

|||

|

Dr. |

|

|

Cr. |

|

Particulars |

Rs. |

Particulars |

Rs. |

|

To Bank A/c |

2,500 |

By Balance b/d |

3,000 |

|

To Realisation A/c |

500 |

|

|

|

|

|

|

|

|

|

3,000 |

|

3,000 |

|

Bank Account |

|||

|

Dr. |

|

|

Cr. |

|

Particulars |

Rs. |

Particulars |

Rs. |

|

To Balance b/d |

11,000 |

By Balance b/d |

2,500 |

|

To Realisation A/c |

80,500 |

By Realisation A/c |

16,500 |

|

|

|

By Bale Capital A/c |

45,750 |

|

|

|

By Yale's Capital A/c |

26,750 |

|

|

91,500 |

|

91,500 |

Solution Ex. 23

|

Realisation Account |

||||||||||

|

Dr. |

|

Cr. |

||||||||

|

Particulars |

Rs. |

Particulars |

Rs. |

|||||||

|

Land |

81,000 |

Bank Loan |

20,000 |

|||||||

|

Stock |

56,760 |

Creditors |

37000 |

|||||||

|

Debtors |

18,600 |

Provision for doubtful debts |

1,200 |

|||||||

|

Shilpa's Capital A/c |

20,000 |

Shilpa's Capital A/c (Stock) |

35,000 |

|||||||

|

Cash: |

Cash: |

|||||||||

|

Creditors |

31000 |

Stock |

14000 |

|||||||

|

Realisation Expenses |

1,200 |

32200 |

Debtors |

12300 |

||||||

|

Realisation Profit |

Land |

1,10,000 |

1,36,300 |

|||||||

|

Shilpa's Capital A/c |

10,470 |

|||||||||

|

Meena's Capital A/c |

6,980 |

|||||||||

|

Nanda's Capital A/c |

3,490 |

20,940 |

||||||||

|

2,29,500 |

2,29,500 |

|||||||||

|

Partners' Capital Account |

||||||||||

|

Dr. |

|

Cr. |

||||||||

|

Particulars |

Shilpa |

Meena |

Nanda |

Particulars |

Shilpa |

Meena |

Nanda |

|||

|

Balance b/d |

- |

- |

23,000 |

Balance b/d |

80,000 |

40,000 |

- |

|||

|

Realisation |

35,000 |

General Reserve |

6,000 |

4,000 |

2,000 |

|||||

|

(Stock) |

Realisation |

20,000 |

||||||||

|

Cash |

81,470 |

50,980 |

(Bank Loan) |

|||||||

|

Realisation (Profit) |

10,470 |

6,980 |

3,490 |

|||||||

|

Cash |

17,510 |

|||||||||

|

1,16,470 |

50,980 |

23,000 |

1,16,470 |

50,980 |

23,000 |

|||||

|

Cash Account |

||||||

|

Dr. |

|

Cr. |

||||

|

Particulars |

Rs. |

Particulars |

Rs. |

|||

|

Balance b/d |

10,840 |

Realisation (Expenses) |

32,200 |

|||

|

Realisation (Assets) |

1,36,300 |

Shilpa's Capital A/c |

81,470 |

|||

|

Nanda's Capital A/c |

17,510 |

Meena's Capital A/c |

50,980 |

|||

|

1,64,650 |

1,64,650 |

|||||

Dissolution of Partnership Firm Exercise 7.58

Solution Ex. 24

|

Realisation Account |

|||||

|

Dr. |

|

|

|

|

Cr. |

|

Particulars |

|

Rs. |

Particulars |

|

Rs. |

|

To Stock A/c |

|

6,000 |

By Creditors A/c |

|

38,000 |

|

To Debtors A/c |

|

19,000 |

By Mrs. A's Loan A/c |

|

10,000 |

|

To Furniture A/c |

|

4,000 |

By A's Capital A/c |

|

8,000 |

|

To Plant A/c |

|

28,000 |

By Bank A/c: |

|

|

|

To Investment A/c |

|

10,000 |

Stock |

5,000 |

|

|

To A's Capital A/c: (Mrs. A's Loan) |

|

10,000 |

Debtors |

18,500 |

|

|

To Bank A/c: |

|

|

Furniture |

4,500 |

|

|

Creditors |

37,000 |

|

Plant |

25,000 |

53,000 |

|

Expenses |

1,600 |

38,600 |

By Loss transferred to: |

|

|

|

|

|

|

A's Capital A/c |

3,960 |

|

|

|

|

|

B's Capital A/c |

2,640 |

6,600 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1,15,600 |

|

|

1,15,600 |

|

Partner's Capital Account |

|||||

|

Dr. |

|

|

|

|

Cr. |

|

Particulars |

A |

B |

Particulars |

A |

B |

|

To Realisation A/c (Loss) |

3,960 |

2,640 |

By Balance b/d |

10,000 |

8,000 |

|

To Realisation A/c |

8,000 |

|

By Reserve A/c |

3,000 |

2,000 |

|

To Profit and Loss A/c |

4,500 |

3,000 |

By Realisation A/c |

10,000 |

|

|

To Bank A/c |

6,540 |

4,360 |

|

|

|

|

|

23,000 |

10,000 |

|

23,000 |

10,000 |

|

B's Loan Account |

|||

|

Dr. |

|

|

Cr. |

|

Particulars |

Rs. |

Particulars |

Rs. |

|

To Bank A/c |

15,000 |

By Balance b/d |

15,000 |

|

|

15,000 |

|

15,000 |

|

Bank Account |

|||

|

Dr. |

|

|

Cr. |

|

Particulars |

Rs. |

Particulars |

Rs. |

|

To Balance b/d |

11,500 |

By Realisation A/c |

38,600 |

|

To Realisation A/c |

53,000 |

By A's Capital A/c |

6,540 |

|

|

|

By B's Capital A/c |

4,360 |

|

|

|

By B's Loan A/c |

15,000 |

|

|

|

|

|

|

|

64,500 |

|

64,500 |

Solution Ex. 25

|

Realisation Account |

|||||

|

Dr. |

|

|

|

|

Cr. |

|

Particulars |

|

Rs. |

Particulars |

|

Rs. |

|

To Building A/c |

|

40,000 |

By Provision for Doubtful Debts A/c |

|

2,000 |

|

To Plant and Machinery A/c |

|

40,000 |

By Bills Payable A/c |

|

40,000 |

|

To Stock A/c |

|

19,000 |

By Loan from Bank A/c |

|

30,000 |

|

To Sundry Debtors A/c |

|

42,000 |

By Bank A/c |

|

|

|

To Bank A/c |

|

|

Stock |

23,400 |

|

|

Bill Payable |

32,000 |

|

Debtors |

21,000 |

|

|

Outstanding Bill |

800 |

|

Building |

36,000 |

|

|

Expenses |

1,250 |

|

Plant and Machinery |

36,000 |

1,16,400 |

|

Loan from Bank |

30,000 |

64,050 |

By Loss transferred to |

|

|

|

|

|

|

P's Capital A/c |

9,250 |

|

|

|

|

|

Q's Capital A/c |

5,550 |

|

|

|

|

|

R's Capital A/c |

1,850 |

16,650 |

|

|

|

|

|

|

|

|

|

|

2,05,050 |

|

|

2,05,050 |

|

Partner's Capital Accounts |

|||||||

|

Dr. |

|

|

|

|

|

|

Cr. |

|

Particulars |

P |

Q |

R |

Particulars |

P |

Q |

R |

|

To Realisation A/c (Loss) |

9,250 |

5,550 |

1,850 |

By Balance b/d |

44,000 |

36,000 |

20,000 |

|

To Bank A/c |

39,750 |

33,450 |

19,150 |

By Reserve A/c |

5,000 |

3,000 |

1,000 |

|

|

|

|

|

|

|

|

|

|

|

49,000 |

39,000 |

21,000 |

|

49,000 |

39,000 |

21,000 |

|

Bank Account |

|||

|

Dr. |

|

|

Cr. |

|

Particulars |

Rs. |

Particulars |

Rs. |

|

To Balance b/d |

40,000 |

By Realisation A/c |

64,050 |

|

To Realisation A/c |

1,16,400 |

By P's Capital |

39,750 |

|

|

|

By Q's Capital |

33,450 |

|

|

|

By R's Capital |

19,150 |

|

|

|

|

|

|

|

1,56,400 |

|

1,56,400 |

Solution Ex. 26

|

Realisation Account |

||||

|

Dr. |

|

|

|

Cr. |

|

Particulars |

Rs. |

Particulars |

|

Rs. |

|

To Stock A/c |

19,800 |

By Provision for Doubtful Debts A/c |

|

1,000 |

|

To Debtors A/c |

15,000 |

By Creditors A/c |

|

17,000 |

|

To Investments A/c |

4,000 |

By Bills Payable A/c |

|

12,000 |

|

To Furniture A/c |

10,000 |

By Vindo's Capital A/c |

|

5,000 |

|

To Machinery A/c |

33,000 |

By Bank A/c: |

|

|

|

To Bank A/c (Expenses) |

2,000 |

Stock |

17,500 |

|

|

To Bank A/c (Creditors) |

17,000 |

Debtors |

14,500 |

|

|

To Bank A/c (Bills Payable) |

12,000 |

Building |

6,800 |

|

|

|

|

Machinery |

30,300 |

69,100 |

|

|

|

By Loss transferred to: |

|

|

|

|

|

Vinod |

4,350 |

|

|

|

|

Vijay |

2,900 |

|

|

|

|

Venkat |

1,450 |

8,700 |

|

|

1,12,800 |

|

|

1,12,800 |

|

Partner's Capital Accounts |

|||||||

|

Dr. |

|

|

|

|

|

|

Cr. |

|

Particulars |

Vinod |

Vijay |

Venkat |

Particulars |

Vinod |

Vijay |

Venkat |

|

To Realisation A/c |

5,000 |

|

|

By Balance b/d |

25,000 |

11,000 |

8,000 |

|

To Realisation A/c (Loss) |

4,350 |

2,900 |

1,450 |

By General Reserve A/c |

3,000 |

2,000 |

1,000 |

|

To Bank A/c |

18,650 |

10,100 |

7,550 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

28,000 |

13,000 |

9,000 |

|

28,000 |

13,000 |

9,000 |

|

Vinod's Loan Account |

|||

|

Dr. |

|

|

Cr. |

|

Particulars |

Rs. |

Particulars |

Rs. |

|

To Bank A/c |

5,300 |

By Balance b/d |

5,300 |

|

|

5,300 |

|

5,300 |

|

Bank Account |

|||

|

Dr. |

|

|

Cr. |

|

Particulars |

Rs. |

Particulars |

Rs. |

|

To Balance b/d |

3,500 |

By Realisation A/c (Expenses) |

2,000 |

|

To Realisation A/c |

69,100 |

By Realisation A/c |

17,000 |

|

(Assets realized) |

|

(Creditors) |

|

|

|

|

By Realisation A/c |

12,000 |

|

|

|

(Bills Payable) |

|

|

|

|

By Vinod's Loan A/c |

5,300 |

|

|

|

By Vinod's Capital A/c |

18,650 |

|

|

|

By Vijay's Capital A/c |

10,100 |

|

|

|

By Venkat's Capital A/c |

7,550 |

|

|

72,600 |

|

72,600 |

Dissolution of Partnership Firm Exercise 7.59

Solution Ex. 27

|

Realisation Account |

|||||

|

Dr. |

|

|

|

|

Cr. |

|

Particulars |

|

Rs. |

Particulars |

|

Rs. |

|

To Plant and Machinery A/c |

|

30,000 |

By Creditors A/c |

|

10,000 |

|

To Stock A/c |

|

5,500 |

By Bills Payable A/c |

|

3,700 |

|

To Investments A/c |

|

15,000 |

By Investments Fluctuation Reserve A/c |

|

4,500 |

|

To Debtors A/c |

|

7,100 |

By Provision for Doubtful Debts A/c |

|

450 |

|

|

|

|

By P's Capital A/c (Investments) |

|

12,500 |

|

To Cash A/c |

|

|

By Cash A/c: |

|

|

|

Creditors |

10,000 |

|

Stock and Debtors |

11,500 |

|

|

Bills Payable |

3,700 |

|

Plant and Machinery |

22,500 |

|

|

Expenses |

900 |

14,600 |

Unrecorded Assets |

1,500 |

35,500 |

|

To P's Capital A/c |

|

1,000 |

By Loss transferred to: |

|

|

|

|

|

|

P's Capital A/c |

3,275 |

|

|

|

|

|

Q's Capital A/c |

1,965 |

|

|

|

|

|

R's Capital A/c |

1,310 |

6,550 |

|

|

|

|

|

|

|

|

|

|

73,200 |

|

|

73,200 |

|

Partner's Capital Accounts |

|||||||

|

Dr. |

|

|

|

|

|

|

Cr. |

|

Particulars |

P |

Q |

R |

Particulars |

P |

Q |

R |

|

To Balance b/d |

|

|

8,000 |

By Balance b/d |

37,550 |

15,000 |

|

|

To Realisation A/c (Loss) |

3,275 |

1,965 |

1,310 |

By Realisation A/c |

1,000 |

|

|

|

To Realisation A/c |

12,500 |

|

|

By Cash A/c |

|

|

9,310 |

|

To Cash A/c |

22,775 |

13,035 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

38,550 |

15,000 |

9,310 |

|

38,550 |

15,000 |

9,310 |

|

Cash Account |

|||

|

Dr. |

|

|

Cr. |

|

Particulars |

Rs. |

Particulars |

Rs. |

|

To Balance b/d |

5,600 |

By Realisation A/c |

14,600 |

|

To Realisation A/c |

35,500 |

By P's Capital A/c |

22,775 |

|

To R's Capital A/c |

9,310 |

By Q's Capital A/c |

13,035 |

|

|

50,410 |

|

50,410 |

Solution Ex. 28

|

Realisation Account |

|||||||

|

Dr. |

|

Cr. |

|||||

|

Particulars |

Rs. |

Particulars |

Rs. |

|

|||

|

Building |

80,000 |

Creditors |

88,000 |

|

|||

|

Machinery |

70,000 |

Bank overdraft |

50,000 |

|

|||

|

Furniture |

14,000 |

Ashu's Capital A/c (see working note) |

1,43,000 |

|

|||

|

Stock |

20,000 |

Harish's Capital A/c (see working note) |

1,12,000 |

|

|||

|

Investments |

60,000 |

Cash (Debtors) |

46,000 |

|

|||

|

Debtors |

48,000 |

|

|||||

|

Ashu's Capital A/c (Creditors) |

88,000 |

|

|||||

|

Harish's Capital A/c (Bank Overdraft) |

50,000 |

|

|||||

|

Cash (Expenses) |

3,000 |

|

|||||

|

Realisation Profit |

|

||||||

|

Ashu's Capital A/c |

3,600 |

|

|||||

|

Harish's Capital A/c |

2,400 |

6,000 |

|

||||

|

4,39,000 |

4,39,000 |

|

|||||

|

|||||||

|

Partners' Capital Account |

||||||||

|

Dr. |

|

Cr. |

||||||

|

Particulars |

Ashu |

Harish |

Particulars |

Ashu |

Harish |

|||

|

Realisation (Assets taken) |

1,43,000 |

1,12,000 |

Balance b/d |

1,08,000 |

54,000 |

|||

|

Cash |

56,600 |

Realisation (Liabilities) |

88,000 |

50,000 |

||||

|

Realisation (Profit) |

3,600 |

2,400 |

||||||

|

Cash |

5,600 |

|||||||

|

1,99,600 |

1,12,000 |

1,99,600 |

1,12,000 |

|||||

|

Cash Account |

||||||

|

Dr. |

|

Cr. |

||||

|

Particulars |

Rs. |

Particulars |

Rs. |

|||

|

Balance b/d |

8,000 |

Realisation (Expenses) |

3,000 |

|||

|

Realisation (Debtors) |

46,000 |

Ashu's Capital A/c |

56,600 |

|||

|

Harish's Capital A/c |

5,600 |

|||||

|

59,600 |

59,600 |

|||||

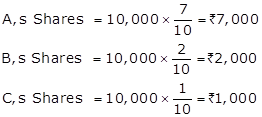

Working Notes:

|

Ashu |

Harish |

|

|

Building |

95,000 |

|

|

Machinery and Furniture |

80,000 |

|

|

Stock (3:2) |

12,000 |

8,000 |

|

Investment (3:2) |

36,000 |

24,000 |

|

1,43,000 |

1,12,000 |

Dissolution of Partnership Firm Exercise 7.60

Solution Ex. 29

|

Realisation Account |

|||||

|

Dr. |

|

|

|

|

Cr. |

|

Particulars |

|

Rs. |

Particulars |

|

Rs. |

|

To Stock A/c |

|

20,100 |

By Creditors A/c |

|

50,400 |

|

To Debtors A/c |

|

62,600 |

By A's Capital A/c (Investments) |

|

18,000 |

|

To Investments A/c |

|

16,000 |

By Cash A/c: |

|

|

|

To Furniture A/c |

|

6,500 |

Furniture and Building |

29,700 |

|

|

To Building A/c |

|

23,500 |

Stock and Debtors |

80,000 |

1,09,700 |

|

To Cash A/c |

|

|

|

|

|

|

Expenses |

1,300 |

|

By Loss transferred to: |

|

|

|

Creditors |

49,600 |

|

A's Capital A/c |

1,000 |

|

|

Bills |

1,500 |

52,400 |

B's Capital A/c |

1,000 |

|

|

|

|

|

C's Capital A/c |

1,000 |

3,000 |

|

|

|

1,81,100 |

|

|

1,81,100 |

|

Partner's Capital Accounts |

|||||||

|

Dr. |

|

|

|

|

|

|

Cr. |

|

Particulars |

P |

Q |

R |

Particulars |

P |

Q |

R |

|

To Realisation A/c(Investments) |

18,000 |

|

|

By Balance b/d |

30,000 |

25,000 |

15,000 |

|

To Realisation A/c (Loss) |

1,000 |

1,000 |

1,000 |

By Reserve A/c |

4,000 |

4,000 |

4,000 |

|

To Cash A/c |

15,000 |

28,000 |

18,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

34,000 |

29,000 |

19,000 |

|

34,000 |

29,000 |

19,000 |

|

Cash Account |

|||

|

Dr. |

|

|

Cr. |

|

Particulars |

Rs. |

Particulars |

Rs. |

|

To Balance b/d |

3,700 |

By Realisation A/c |

52,400 |

|

To Realisation A/c |

1,09,700 |

By A's Capital A/c |

15,000 |

|

|

|

By B's Capital A/c |

28,000 |

|

|

|

By C's Capital A/c |

18,000 |

|

|

1,13,400 |

|

1,13,400 |

*The answer provided in the book is different.

Solution Ex. 30

|

Realisation Account |

||||||||||||||||||||||

|

Dr. |

|

|

|

|

Cr. |

|||||||||||||||||

|

Particulars |

|

Rs. |

Particulars |

|

Rs. |

|||||||||||||||||

|

To Naresh's Capital A/c |

|

10,000 |

By Creditors A/c |

|

40,000 |

|||||||||||||||||

|

To Investments |

|

30,000 |

By Bills Payable |

|

40,000 |

|||||||||||||||||

|

To Debtors |

|

36,000 |

By Mrs. Yogesh's Loan |

|

42,000 |

|||||||||||||||||

|

To Bills Receivable |

|

33,400 |

By Naresh's Capital A/c |

|

26,000 |

|||||||||||||||||

|

To Yogesh's Capital A/c To Cash/Bank A/c

|

|

42,000 78,000

|

By Cash/Bank A/c By Cash/Bank A/c By Cash/Bank A/c By Cash/Bank A/c |

|

30,000 31,730 15,000 10,000 |

|||||||||||||||||

|

To Gain transferred to: |

|

|

By Investment Fluctuation Reserve |

|

8,000 |

|||||||||||||||||

|

Yogesh's Capital A/c |

6,665 |

|

|

|

|

|||||||||||||||||

|

Naresh's Capital A/c |

6,665 |

13,330 |

|

|

|

|||||||||||||||||

|

|

|

2,42,730 |

|

|

2,42,730 |

|||||||||||||||||

|

|

|

|||||||||||||||||||||

|

Dr. Partner's Capital Accounts Cr. |

|

|||||||||||||||||||||

|

Particulars |

Yogesh |

Naresh |

Particulars |

Yogesh |

Naresh |

|

||||||||||||||||

|

To Profit and Loss A/c |

55,300 |

55,300 |

By Balance b/d |

21,000 |

21,000 |

|

||||||||||||||||

|

To Realisation A/c To Cash/Bank A/c

|

- 14,365

|

26,000

|

By Realisation A/c By Realisation A/c By Realisation A/c |

42,000 - 6,665 |

- 10,000 6,665 |

|

||||||||||||||||

|

|

|

|

By Partner's Loan A/c |

- |

43,635 |

|

||||||||||||||||

|

|

69,665 |

81,300 |

|

69,665 |

81,300 |

|

||||||||||||||||

|

|

|

Partner's Loan Account |

|

|||||||||||||||||||

|

Dr. |

|

|

|

|

Cr. |

|

||||||||||||||||

|

Particulars |

Yogesh |

Naresh |

Particulars |

Yogesh |

Naresh |

|

||||||||||||||||

|

To Partners Capital A/c |

- |

43,635 |

By Balance c/d |

- |

44,000 |

|

||||||||||||||||

|

To Cash/Bank A/c |

- |

365 |

|

|

|

|

||||||||||||||||

|

|

- |

44,000 |

|

- |

44,000 |

|

||||||||||||||||

|

Cash/Bank Account |

|

||||||||||||||||||||||

|

Dr. |

|

|

Cr. |

|

|||||||||||||||||||

|

Particulars |

Rs. |

Particulars |

Rs. |

|

|||||||||||||||||||

|

To Balance b/d |

6,000 |

By Realisation A/c |

78,000 |

|

|||||||||||||||||||

|

To Realisation A/c |

30,000 |

By Yogesh's Capital A/c |

14,365 |

|

|||||||||||||||||||

|

To Realisation A/c |

31,730 |

By Partner's Loan A/c |

365 |

|

|||||||||||||||||||

|

To Realisation A/c To Realisation A/c |

15,000 10,000 |

|

|

|

|||||||||||||||||||

|

|

92,730 |

|

92,730 |

|

|||||||||||||||||||

Dissolution of Partnership Firm Exercise 7.61

Solution Ex. 31

|

Realisation Account |

|||||

|

Dr. |

|

|

|

|

Cr. |

|

Particulars |

|

Rs. |

Particulars |

|

Rs. |

|

To Land and Building A/c |

|

57,000 |

By Creditors A/c |

|

40,000 |

|

To Stock A/c |

|

50,000 |

By A's Capital A/c (car) |

|

20,000 |

|

To A's Salary A/c |

|

20,000 |

By Land and Building A/c |

40,000 |

|

|

To Sundry Debtors A/c |

|

50,000 |

By Stock A/c |

30,000 |

|

|

To Bank A/c |

|

|

By Sundry Debtors A/c |

42,000 |

1,12,000 |

|

Creditors (40,000 + 15,000) |

55,000 |

|

By Loss transferred to: |

|

|

|

Expenses |

1,200 |

56,200 |

A's Capital A/c |

30,600 |

|

|

|

|

|

B's Capital A/c |

20,400 |

|

|

|

|

|

C's Capital A/c |

10,200 |

61,200 |

|

|

|

|

|

|

|

|

|

|

2,33,200 |

|

|

2,33,200 |

|

Partners' Capital Accounts |

|||||||

|

Dr. |

|

|

|

|

|

|

Cr. |

|

Particulars |

A |

B |

C |

Particulars |

A |

B |

C |

|

To Realisation A/c (Loss) |

30,600 |

20,400 |

10,200 |

By Balance b/d |

60,000 |

40,000 |

10,000 |

|

To Advt. Suspense A/c |

3,000 |

2,000 |

1,000 |

By Workmen C. Reserve |

10,500 |

7,000 |

3,500 |

|

To Realisation A/c |

20,000 |

|

|

By Realisation A/c |

20,000 |

|

|

|

To Profit and Loss A/c |

7,500 |

5,000 |

2,500 |

By Bank A/c |

|

|

200 |

|

To Bank A/c |

29,400 |

19,600 |

|

|

|

|

|

|

|

90,500 |

47,000 |

13,700 |

|

90,500 |

47,000 |

13,700 |

|

A's Loan Account |

|||

|

Dr. |

|

|

Cr. |

|

Particulars |

Rs. |

Particulars |

Rs. |

|

To Bank A/c |

10,000 |

By Balance b/d |

10,000 |

|

|

10,000 |

|

10,000 |

|

Bank Account |

|||

|

Dr. |

|

|

Cr. |

|

Particulars |

Rs. |

Particulars |

Rs. |

|

To Balance b/d |

3,000 |

By Realisation A/c |

56,200 |

|

To Realisation A/c |

1,12,000 |

By A's Capital A/c |

29,400 |

|

To C's Capital A/c |

200 |

By B's Capital A/c |

19,600 |

|

|

|

By A's Loan A/c |

10,000 |

|

|

1,15,200 |

|

1,15,200 |

Solution Ex. 32

|

Realisation Account |

|||||

|

Dr. |

|

|

|

|

Cr. |

|

Particulars |

|

Rs. |

Particulars |

|

Rs. |

|

To Sundry Debtors A/c |

|

26,000 |

By Provision for Doubtful Debts A/c |

|

2,000 |

|

To Investments A/c |

|

40,000 |

By Bank Overdraft A/c |

|

30,000 |

|

To Stock A/c |

|

10,000 |

By Investment Fluctuation Reserve A/c |

|

20,000 |

|

To Furniture A/c |

|

10,000 |

By A's Capital A/c (Investment) |

|

35,000 |

|

To Building A/c |

|

60,000 |

By Bank A/c: |

|

|

|

To Bank A/c: |

|

|

---Sundry Debtors |

26,000 |

|

|

Compensation of Employees |

10,000 |

|

---Stock |

8,500 |

|

|

Bank Overdraft |

30,000 |

40,000 |

---Furniture |

8,000 |

|

|

To Profit transferred to: |

|

|

---Building |

1,00,000 |

1,42,500 |

|

---A's Capital A/c |

29,000 |

|

|

|

|

|

---B's Capital A/c |

14,500- |

43,500 |

|

|

|

|

|

|

|

|

|

|

|

|

|

2,29,500 |

|

|

2,29,500 |

|

Partner's Capital Accounts |

|||||

|

Dr. |

|

|

|

|

Cr. |

|

Particulars |

A |

B |

Particulars |

A |

B |

|

To Balance b/d |

|

30,000 |

By Balance b/d |

50,000 |

|

|

To Realisation A/c (Investment) |

35,000 |

|

By General Reserve A/c |

37,333 |

18,667 |

|

To Bank A/c |

81,333 |

3,167 |

By Realisation A/c (Profit) |

29,000 |

14,500 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1,16,333 |

33,167 |

|

1,16,333 |

33,167 |

|

A's Loan Account |

|||

|

Dr. |

|

|

Cr. |

|

Particulars |

Rs. |

Particulars |

Rs. |

|

To Bank A/c |

34,000 |

By Balance b/d |

34,000 |

|

|

34,000 |

|

34,000 |

|

Bank Account |

|||

|

Dr. |

|

|

Cr. |

|

Particulars |

Rs. |

Particulars |

Rs. |

|

To Balance b/d |

10,000 |

By Realisation A/c |

40,000 |

|

To Cash A/c |

6,000 |

By A's Capital A/c |

81,333 |

|

To Realisation A/c |

1,42,500 |

By B's Capital A/c |

3,167 |

|

|

|

By A's Loam A/c |

34,000 |

|

|

1,58,500 |

|

1,58,500 |

Dissolution of Partnership Firm Exercise 7.62

Solution Ex. 33

|

Realisation Account |

|||||||||

|

Dr. |

|

Cr. |

|||||||

|

Particulars |

Rs. |

Particulars |

Rs. |

||||||

|

Sundry Debtors |

58,000 |

Sundry Creditors |

20,000 |

||||||

|

Stock |

39,500 |

Bills Payable |

25,500 |

||||||

|

Machinery |

48,000 |

Ashok's Current A/c (Investment) |

40,000 |

||||||

|

Investment |

42,000 |

Babu's Current A/c (Machinery) |

45,000 |

||||||

|

Freehold property |

50,500 |

Chetan's Current A/c |

55,000 |

||||||

|

Bank: |

(Freehold property) |

||||||||

|

Sundry Creditors |

18,600 |

Bank: |

|||||||

|

Bills Payable |

25,500 |

Sundry Debtors |

56,500 |

||||||

|

Expenses |

3,000 |

47,100 |

Stock |

36,500 |

|||||

|

Realisation Profit |

Unrecorded Computer |

9,000 |

1,02,000 |

||||||

|

Ashok's Current A/c |

1,200 |

||||||||

|

Babu's Current A/c |

800 |

||||||||

|

Chetan's Current A/c |

400 |

2,400 |

|||||||

|

2,87,500 |

2,87,500 |

||||||||

|

Partners' Current Account |

||||||||||

|

Dr. |

|

Cr. |

||||||||

|

Particulars |

Ashok |

Babu |

Chetan |

Particulars |

Ashok |

Babu |

Chetan |

|||

|

Realisation |

40,000 |

45,000 |

55,000 |

Balance b/d |

10,000 |

5,000 |

3,000 |

|||

|

(Assets taken) |

Realisation (Profit) |

1,200 |

800 |

400 |

||||||

|

Ashok's Capital A/c |

28,800 |

|||||||||

|

Babu's Capital A/c |

39200 |

|||||||||

|

Chetan's Capital A/c |

51600 |

|||||||||

|

40,000 |

45,000 |

55,000 |

40,000 |

45,000 |

55,000 |

|||||

|

Partners' Capital Account |

||||||||||

|

Dr. |

|

Cr. |

||||||||

|

Particulars |

Ashok |

Babu |

Chetan |

Particulars |

Ashok |

Babu |

Chetan |

|||

|

Ashok's Current A/c |

28,800 |

Balance b/d |

70,000 |

55,000 |

27,000 |

|||||

|

Babu's Current A/c |

39200 |

Bank A/c |

24,600 |

|||||||

|

Chetan's Current A/c |

51600 |

|||||||||

|

Bank A/c |

41,200 |

15,800 |

||||||||

|

70,000 |

55,000 |

51,600 |

70,000 |

55,000 |

51,600 |

|||||

|

Babu's Loan A/c |

|||||

|

Dr. |

Cr. |

||||

|

Particulars |

Rs. |

Particulars |

Rs. |

||

|

Bank A/c |

30,000 |

Balance b/d |

30,000 |

||

|

30,000 |

30,000 |

||||

|

Bank Account |

||||||

|

Dr. |

|

Cr. |

||||

|

Particulars |

Rs. |

Particulars |

Rs. |

|||

|

Balance b/d |

7,500 |

Realisation A/c (Payment of Expenses and Liabilities) |

47,100 |

|||

|

Realisation A/c (Assets realised) |

102,000 |

|||||

|

Chetan's Capital A/c |

24,600 |

Babu's Loan |

30,000 |

|||

|

Ashok's Capital A/c |

41,200 |

|||||

|

Babu's Capital A/c |

15,800 |

|||||

|

1,34,100 |

1,34,100 |

|||||

Solution Ex. 34

|

Realisation Account |

|||||

|

Dr. |

Cr. |

||||

|

Particulars |

Rs. |

Particulars |

Rs. |

||

|

To Stock A/c |

|

80,000 |

By Creditor A/c |

41,500 |

|

|

To Debtors A/c |

|

50,000 |

By Bills payable A/c |

20,000 |

|

|

To Investment A/c |

|

55,000 |

By Bank Loan A/c |

40,000 |

|

|

To Premises A/c |

|

1,51,500 |

By Investment Fluctuation Reserve A/c |

40,000 |

|

|

To Bank A/c :- |

|

|

By Provision for Doubtful Debts A/c |

2,500 |

|

|

Bill |

5,000 |

|

By Bank A/c- |

|

|

|

Creditor and Bills payable |

57,500 |

|

By Assets |

3,25,000 |

|

|

Expenses |

15,000 |

|

By Investments |

56,500 |

|

|

Bank loan |

40,000 |

1,17,500 |

By Bill |

2,500 |

3,84,000 |

|

To Profit transferred to: |

|

|

|

|

|

|

X's Capital A/c |

29,600 |

|

|

|

|

|

Y's Capital A/c |

29,600 |

|

|

|

|

|

Z's Capital A/c |

14,800 |

74,000 |

|

|

|

|

|

|

5,28,000 |

|

5,28,000 |

|

|

|

|

|

|

|

|

|

Partners' Capital Accounts |

|||||||

|

Dr. |

Cr. |

||||||

|

Particulars |

X |

Y |

Z |

Particulars |

X |

Y |

Z |

|

To Bank A/c |

1,24,600 |

1,24,600 |

39,800 |

By Balance b/d |

75,000 |

75,000 |

15,000 |

|

(bal. fig.) |

|

|

|

By General Reserve A/c |

20,000 |

20,000 |

10,000 |

|

|

|

|

|

By Realisation A/c |

29,600 |

29,600 |

14,800 |

|

|

1,24,600 |

1,24,600 |

39,800 |

|

1,24,600 |

1,24,600 |

39,800 |

|

|

|

|

|

|

|

|

|

|

Bank Account |

||||

|

Dr. |

Cr. |

|||

|

Particulars |

Rs. |

Particulars |

Rs. |

|

|

To Balance b/d |

22,500 |

By Realisation A/c |

1,17,500 |

|

|

To Realisation A/c |

3,84,000 |

By X's Capital A/c |

1,24,600 |

|

|

|

|

By Y 's Capital A/c |

1,24,600 |

|

|

|

|

By Z 's Capital A/c |

39,800 |

|

|

|

4,06,500 |

|

4,06,500 |

|

|

|

|

|

|

|

Dissolution of Partnership Firm Exercise 7.63

Solution Ex. 35

|

Realisation Account |

|||||

|

Dr. |

|

|

|

|

Cr. |

|

Particulars |

|

Rs. |

Particulars |

|

Rs. |

|

To Stock A/c |

|

75,000 |

By Provision for Doubtful Debts |

|

6,000 |

|

To Book Debts A/c |

|

66,000 |

By Sundry Creditors A/c |

|

75,000 |

|

To Plant and Machinery A/c |

|

45,000 |

By Bills Payable A/c |

|

30,000 |

|

To Land and Building A/c |

|

48,000 |

By Rita's Loan A/c |

|

15,000 |

|

To Bank A/c: |

|

|

By Rita's A/c - Goodwill |

30,000 |

|

|

Sundry Creditors |

67,500 |

|

|

|

|

|

Bills Payable |

30,000 |

|

By Bank A/c: |

|

|

|

Expenses |

5,250 |

1,02,750 |

---Book Debts |

54,000 |

|

|

To Profit transferred to: |

|

|

---Stock |

73,125 |

|

|

---Rita's Capital A/c |

70,688 |

|

---Plant and Machinery |

75,000 |

|

|

---Sobha's Capital A/c |

70,687 |

1,41,375 |

---Land and Building |

1,20,000 |

3,22,125 |

|

|

|

|

|

|

|

|

|

|

4,78,125 |

|

|

4,78,125 |

|

Partner's Capital Accounts |

|||||

|

Dr. |

|

|

|

|

Cr. |

|

Particulars |

Rita |

Sobha |

Particulars |

Rita |

Sobha |

|

To Realisation A/c (Assets) |

30,000 |

|

By Balance b/d |

90,000 |

30,000 |

|

To Bank A/c |

1,42,688 |

1,12,687 |

By Reserve fund A/c |

12,000 |

12,000 |

|

|

|

|

By Realisation A/c (Profit) |

70,688 |

70,687 |

|

|

1,72,688 |

1,12,687 |

|

1,72,688 |

1,12,687 |

|

Bank Account |

|||

|

Dr. |

|

|

Cr. |

|

Particulars |

Rs. |

Particulars |

Rs. |

|

To Balance b/d |

30,000 |

By Realisation A/c |

1,02,750 |

|

To Cash Capital A/c |

6,000 |

By Rita's Captial A/c |

1,42,688 |

|

To Realisation A/c |

3,22,125 |

By Sobha's Capital A/c |

1,12,687 |

|

|

|

|

|

|

|

3,58,125 |

|

3,58,125 |

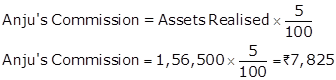

Working Notes:

1.

Value of stock taken by Rita

![]()

2.

Value of Stock sold

![]()

Solution Ex. 36

|

Realisation Account |

|||||

|

Dr. |

|

|

|

|

Cr. |

|

Particulars |

|

Rs. |

Particulars |

|

Rs. |

|

To Stock A/c |

|

7,500 |

By Provision for Doubtful Debts A/c |

|

3,000 |

|

To Investments A/c |

|

15,000 |

By Trade Creditors A/c |

|

45,000 |

|

To Book Debts A/c |

|

30,000 |

By Bills Payable A/c |

|

12,000 |

|

To Building A/c |

|

22,500 |

By Mrs. Arvind's Loan A/c |

|

7,500 |

|

To Plant A/c |

|

30,000 |

By Mrs. Balbir's Loan A/c |

|

15,000 |

|

To Goodwill A/c |

|

6,000 |

By Investments Fluctuation Reserve A/c |

|

1,500 |

|

To Arvind's Capital A/c (Mrs. Arvind's Loan) |

|

7,500 |

By Arvind Capital A/c (Stock) |

|

6,000 |

|

To Bank A/c: |

|

|

By Balbir's Capital A/c |

|

6,750 |

|

Trade Creditors |

44,925 |

|

(Investments 7500 x 90%) |

|

|

|

Bills Payable |

11,980 |

|

By Balbir's Capital A/c |

|

450 |

|

Expense |

1,500 |

|

(Unrecorded Typewriter) |

|

|

|

Mrs. Balbir's Loan |

15,000 |

73,405 |

By Bank A/c |

|

|

|

Profit transferred to: |

|

|

Book Debts |

28,500 |

|

|

Arvind's Capital A/c |

23,522.50 |

|

Plant |

37,500 |

|

|

Balbir's Capital A/c |

23,522.50 |

47,045 |

Building |

60,000 |

|

|

|

|

|

Goodwill |

9,000 |

|

|

|

|

|

Investments |

6,750 |

1,41,750 |

|

|

|

|

|

|

|

|

|

|

2,38,950 |

|

|

2,38,950 |

|

Partner's Capital Accounts |

|||||

|

Dr. |

|

|

|

|

Cr. |

|

Particulars |

Arvind |

Balbir |

Particulars |

Arvind |

Balbir |

|

To Profit and Loss A/c |

2,625 |

2,625 |

By Balance b/d |

15,000 |

15,000 |

|

To Realisation A/c (Assets) |

6,000 |

7,200 |

By Realisation A/c |

7,500 |

|

|

To Bank A/c |

44,897.50 |

36,197.50 |

By Reserve Fund A/c |

7,500 |

7,500 |

|

|

|

|

By Realisation A/c (Profit) |

23,522.50 |

23,522.50 |

|

|

|

|

|

|

|

|

|

53,522.50 |

46,022.50 |

|

53,522.50 |

46,022.50 |

|

Bank Account |

|||

|

Dr. |

|

|

Cr. |

|

Particulars |

Rs. |

Particulars |

Rs. |

|

To Balance b/d |

12,000 |

By Realisation A/c |

73,405 |

|

To Cash A/c |

750 |

By Arvind's Capital A/c |

44,897.5 |

|

To Realisation A/c |

1,41,750 |

By Balbir's Capital A/c |

36,197.5 |

|

|

|

|

|

|

|

1,54,500 |

|

1,54,500 |

Working Notes:

|

Creditors |

45,000 |

|

Less: 2% discount for 1 month |

(75) |

|

Payment made to Creditors |

44,925 |

|

|

|

|

Bills Payable |

12,000 |

|

Less: 2% discount for 1 month |

(20) |

|

Payment made to for Bills Payable |

11,980 |

Dissolution of Partnership Firm Exercise 7.64

Solution Ex. 37

|

Realisation Account |

|||||

|

Dr. |

|

|

|

|

Cr. |

|

Particulars |

|

Rs. |

Particulars |

|

Rs. |

|

To Debtors A/c |

|

75,000 |

By Creditors A/c |

|

50,000 |

|

To Stock A/c |

|

40,000 |

By Bank Loan A/c |

|

35,000 |

|

To Investments A/c |

|

20,000 |

By Provident Fund A/c |

|

15,000 |

|

To Plant A/c |

|

50,000 |

By Commission Received in Advance A/c |

|

8,000 |

|

To Cash A/c: |

|

|

By Investments Fluctuation Fund A/c |

|

10,000 |

|

Commission Received in Advance |

5,000 |

|

By Cash A/c |

|

|

|

Outstanding Salary |

8,500 |