Class 12-commerce T S GREWAL Solutions Accountancy Chapter 4: Change in Profit - Sharing Ratio Among the Existing Partners

Change in Profit - Sharing Ratio Among the Existing Partners Exercise 4.37

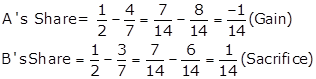

Solution Ex. 1

Old Ratio (A and B)=1:1

New Ratio (A and B)=4:3

Sacrificing Ratio (or Gaining)=Old Ratio - New Ratio

![]() A's

Gain=1/14 and B's Sacrifice= 1/14

A's

Gain=1/14 and B's Sacrifice= 1/14

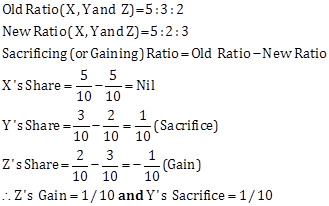

Solution Ex. 2

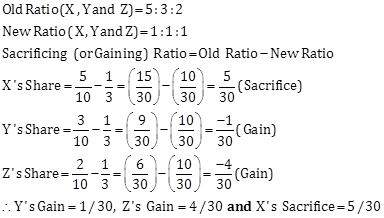

Solution Ex. 3

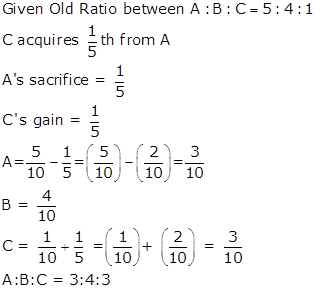

Solution Ex. 4

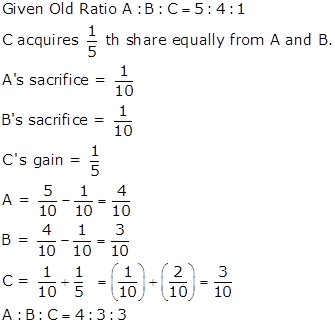

Calculation of New Profit Sharing Ratio

Case.1: C acquires 1/5th Share from A.

Case.2: C acquires 1/5th Share equally from A and B.

Case: 3 A, B and C will share future profits and losses equally.

Case: 4 C acquires 1/10th Share of A and 1/2 share of B.

Solution Ex. 5

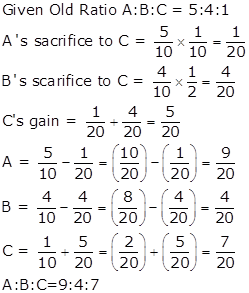

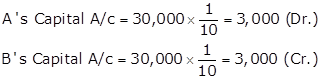

(a) Goodwill Account is not opened

|

Journal |

|||||

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

C's Capital A/c |

Dr. |

3,000 |

|||

|

----------To A's capital A/c |

3,000 |

||||

|

|

(Being adjustment of goodwill made on change in profit sharing ratio) |

|

|

|

|

(b) Goodwill Account is opened

|

Journal |

|||||

|

Sr. No. |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

(i) |

Goodwill A/c |

Dr. |

|

18,000 |

|

|

|

----------To A's capital A/c |

|

|

|

9,000 |

|

|

----------To B's capital A/c |

|

|

|

6,000 |

|

|

----------To C's capital A/c |

|

|

|

3,000 |

|

|

(Being the goodwill raised and distrusted old ratio) |

|

|

|

|

|

|

|

|

|

|

|

|

(ii) |

A's capital A/c |

Dr. |

|

6,000 |

|

|

|

B's capital A/c |

Dr. |

|

6,000 |

|

|

|

C's capital A/c |

Dr. |

|

6,000 |

|

|

|

----------To Goodwill A/c |

|

|

|

18,000 |

|

(Being the goodwill distrusted on new ratio) |

|||||

Working Note:

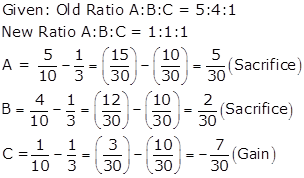

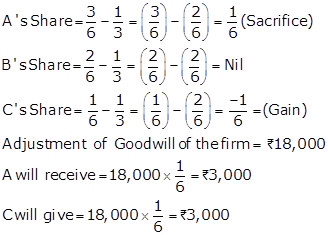

Old Ratio (A,B and C)= 3:2:1

New Ratio (A,B and C)=1:1:1

Sacrificing (or Gaining ) Ratio = Old Ratio - New Ratio

Change in Profit - Sharing Ratio Among the Existing Partners Exercise 4.38

Solution Ex. 6

|

Journal |

|||||

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

Y's Capital A/c |

Dr. |

3,000 |

|||

|

Z's Capital A/c |

Dr. |

12,000 |

|||

|

---------- To X's Capital A/c |

15,000 |

||||

|

|

(Being amount of goodwill adjusted on change in profit sharing ratio) |

|

|

|

|

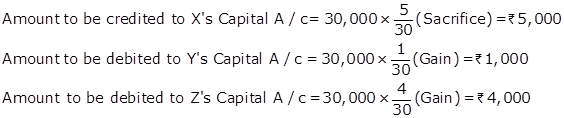

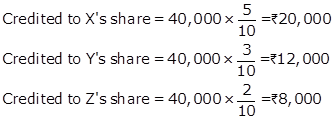

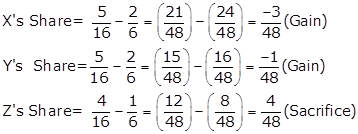

Working Notes:

1.

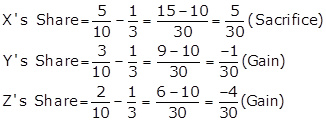

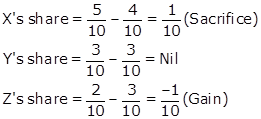

Calculation of Sacrificing (or Gaining) Ratio

Old Ratio ( X,Y and Z) = 5:3:2

New Ratio ( X,Y and Z) = 1:1:1

Sacrificing (or Gaining) Ratio = Old Ratio - New Ratio

2.

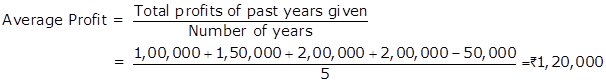

Calculation of Goodwill

3.

Adjustment of Goodwill

Solution Ex.7

|

Journal |

|||||

|

Date |

Particulars |

|

L.F. |

Debit Rs. |

Credit Rs. |

|

|

|

|

|

|

|

|

|

Abbas's Capital A/c |

Dr. |

|

60,000 |

|

|

|

-------- To Mandeep's Capital A/c |

|

|

|

60,000 |

|

|

(Being adjustment entry made for change in ratio) |

|

|

|

|

|

|

|

|

|

|

|

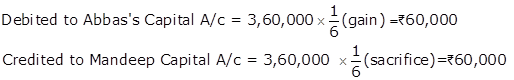

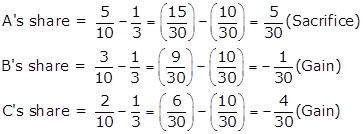

Working notes:

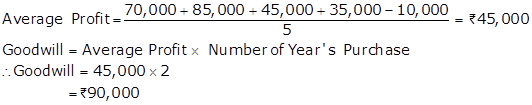

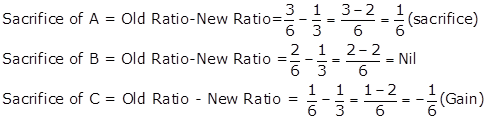

1.

Calculation of Sacrifice or Gain

Old Ratio between Mandeep, Vinod and Abbas = 3:2:1

New Ratio between Mandeep, Vinod and Abbas=1:1:1

Sacrificing ( or Gaining Ratio) = Old Ratio - New Ratio

2.

Valuation of Goodwill

Goodwill = Average Profit × No. of years Purchase

=1,20,000 × 3=Rs.3, 60,000

3.

Adjustment of Goodwill

Solution Ex. 8

|

Journal |

|||||

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

X's Capital A/c |

Dr. |

6,000 |

|||

|

Y's Capital A/c |

Dr. |

3,600 |

|||

|

Z's Capital A/c |

Dr. |

2,400 |

|||

|

|

---------- To Goodwill A/c |

|

|

|

12,000 |

|

|

(Being goodwill written off) |

|

|

|

|

|

|

Y's Capital A/c |

Dr. |

|

1,000 |

|

|

|

Z's Capital A/c |

Dr. |

|

4,000 |

|

|

|

----------To X's Capital A/c |

|

|

|

5,000 |

|

|

(Being amount of goodwill adjusted on change in profit sharing ratio) |

|

|

|

|

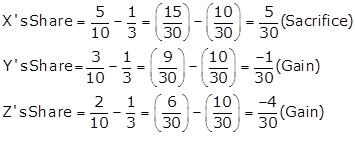

Working Notes:

1.

Calculation of Sacrificing (or Gaining) Ratio

Old Ratio (X, Y and Z)=5:3:2

New Raito (X,Y and Z)= 1:1:1

Sacrificing (or Gaining ) Ratio = Old Ratio- New Ratio

2.

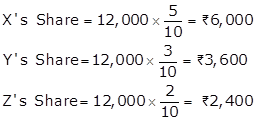

Old Goodwill Written off

3.

Adjustment of Goodwill

Solution Ex. 9

|

Journal |

|||||

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

A's Capital A/c |

Dr. |

6,000 |

|||

|

----------To B's Capital A/c |

6,000 |

||||

|

(Being adjustment of profit for 2017-18 on change in profit sharing ratio) |

|||||

|

|

B's Capital A/c |

Dr. |

|

9,000 |

|

|

|

----------To A's Capital A/c |

|

|

|

9,000 |

|

|

(Being adjustment of goodwill made on change in profit sharing ratio) |

|

|

|

|

|

Partner's Capital Accounts |

|||||

|

Dr |

|

Cr |

|||

|

Particulars |

A |

B |

Particulars |

A |

B |

|

To B's Capital A/c |

6,000 |

By Balance b/d |

1,50,000 |

90,000 |

|

|

----(Adjustment of profit) |

By A's Capital A/c |

6,000 |

|||

|

To A's Capital A/c |

|

9,000 |

----(Adjustment Profit) |

||

|

----(Adjustment of Goodwill) |

By B's Capital A/c |

9,000 |

|||

|

To Balance c/d |

1,53,000 |

87,000 |

----(Adjustment of Goodwill) |

||

|

1,59,000 |

96,000 |

|

1,59,000 |

96,000 |

|

|

|

|

|

|||

Working Notes:

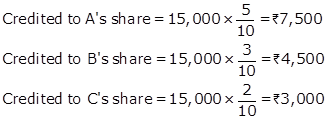

1.

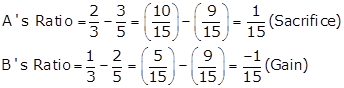

Calculation of Sacrificing (or Gaining) Ratio

Old Ratio (A and B)=2:1

New Ratio (A and B)=3:2

Sacrificing (or Gaining) Ratio=Old Ratio-New Ratio

2.

Adjustment of Profits for 2016-17

3.

Calculation of New Goodwill

Goodwill

= Profit of (2016-17)+ Profit of (2017-18)

= 60,000+75,000

=Rs.1,35,000

4.

Adjustment of Goodwill

Solution Ex. 10

|

Journal |

|||||

|

Date |

Particulars |

L.F. |

Debit Amount (Rs.) |

Credit Amount (Rs.) |

|

|

|

|

|

|

|

|

|

|

Raj's Capital A/c |

Dr. |

|

7,500 |

|

|

|

----To Jai's Capital A/c |

|

|

|

7,500 |

|

|

(Being adjustment for goodwill) |

|

|

|

|

|

|

|

|

|

|

|

Working Notes:

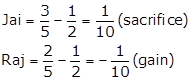

Calculation of Gaining/Sacrificing Ratio

Sacrificing Ratio = Old Ratio ─ New Ratio

Goodwill to be adjusted = 1,00,000 ─ 25,000 = 75,000

Solution Ex. 11

|

Journal |

|||||

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

Profit andLoss A/c |

Dr. |

1,50,000 |

|||

|

---------- To X's Capital A/c |

90,000 |

||||

|

---------- To Y's Capital A/c |

60,000 |

||||

|

|

(Being adjustment of balance in PandL A/c in old ratio) |

|

|

|

|

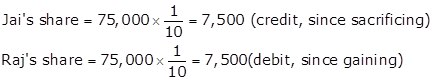

Working Notes:

1.

Calculation of Share of Profit and Loss A/c

Change in Profit - Sharing Ratio Among the Existing Partners Exercise 4.39

Solution Ex. 12

|

Journal |

|||||

|

Date |

Particulars |

|

L.F. |

Debit Rs. |

Credit Rs. |

|

|

|

|

|

|

|

|

|

A's Capital A/c |

Dr. |

|

80,000 |

|

|

|

B's Capital A/c |

Dr. |

|

20,000 |

|

|

|

-------- To Profit and Loss A/c |

|

|

|

1,00,000 |

|

|

(Being Profit and Loss distributed) |

|

|

|

|

|

|

|

|

|

|

|

Solution Ex. 13

|

Journal |

|||||

|

Date |

Particulars |

|

L.F. |

Debit Rs. |

Credit Rs. |

|

|

|

|

|

|

|

|

|

Z's Capital A/c |

Dr. |

|

5,400 |

|

|

|

-------- To X's Capital A/c |

|

|

|

5,400 |

|

|

(Being adjustment for General Reserve, Profit and Loss account and Advertisement Suspense account made on change in PSR) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

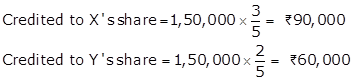

Working notes :

1.

Net amount to be adjusted = General Reserve + Profit and Loss A/c (Credit) - Adjustment Suspense A/c

Net amount to be adjustment = 6,000 + 24,000 - 12000 =Rs.18,000

2.

Calculation of Sacrificing (or Gaining) Ratio

Old Ratio (X, Y and Z) = 5: 3: 2

New Ratio (X, Y and Z) = 2: 3: 5

Sacrificing (or gaining) Ratio = old Ratio - New Ratio

Solution Ex. 14

Case : (i) and (ii)

|

Journal |

|||||

|

Date |

Particulars |

|

L.F. |

Debit Rs. |

Credit Rs. |

|

|

|

|

|

|

|

|

|

Workmen Compansation Reserve A/c |

Dr. |

|

1,20,000 |

|

|

|

-------- To A's Capital A/c |

|

|

|

60,000 |

|

|

-------- To B's Capital A/c |

|

|

|

36,000 |

|

|

------- To C's Capital A/c |

|

|

|

24,000 |

|

|

(Being Workmen Compensation Reserve distributed) |

|

|

|

|

|

|

|

|

|

|

|

Note: Workmen Compensation Reserve should be distributed in the old ratio i.e. 5:3:2 in both the cases (i) and (ii).

Solution Ex. 15

|

Journal |

|||||

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

|

Workmen Compensation Reserve A/c |

Dr. |

|

40,000 |

|

|

|

---------- To X's Capital A/c |

|

|

|

20,000 |

|

|

---------- To Y's Capital A/c |

|

|

|

12,000 |

|

|

---------- To Z's Capital A/c |

|

|

|

8,000 |

|

|

(Being adjustment of balance in workmen composition reserve account in old ratio) |

|

|

|

|

Working Notes:

Calculation of Share (Workmen Compensation Reserve)

Solution Ex. 16

|

Journal |

|||||

|

Sr. No. |

Particulars |

|

L.F. |

Debit Rs. |

Credit Rs. |

|

|

|

|

|

|

|

|

(i) |

Workmen Compensation Reserve A/c |

Dr. |

|

1,20,000 |

|

|

|

Revaluation A/c |

Dr. |

|

30,000 |

|

|

|

--------- To Provision for W.C. Claim A/c |

|

|

|

1,50,000 |

|

|

(Being provision created and shortfall charged to Revaluation account) |

|

|

|

|

|

|

|

|

|

|

|

|

(ii) |

X's Capital A/c |

Dr. |

|

15,000 |

|

|

|

Y's Capital A/c |

Dr. |

|

9,000 |

|

|

|

Z's Capital A/c |

Dr. |

|

6,000 |

|

|

|

-------- To Revaluation A/c |

|

|

|

30,000 |

|

|

(Being loss on revaluation transferred to Partner's Capital account) |

|

|

|

|

Solution Ex. 17

|

Journal |

|||||

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

Investment Fluctuation Reserve A/c |

Dr. |

5,000 |

|||

|

-------- To Investment A/c |

5,000 |

||||

|

|

(Being adjustment for decrease in the value of investments) |

|

|

|

|

|

|

Investment Fluctuation Reserve A/c |

Dr. |

|

15,000 |

|

|

|

-------- To A's Capital A/c |

|

|

|

7,500 |

|

|

-------- To B's Capital A/c |

|

|

|

4,500 |

|

|

-------- To C's Capital A/c |

|

|

|

3,000 |

|

|

(Being adjustment of balance in Investment Fluctuation Reserve A/c in old ratio) |

|

|

|

|

Working Notes:

Calculation of Share of Investment Fluctuation Reserve

Solution Ex. 18

|

Journal |

|||||

|

Sr. No. |

Particulars |

|

L.F. |

Debit Rs. |

Credit Rs. |

|

|

|

|

|

|

|

|

(i) |

Investment Fluctuation Reserve A/c |

Dr. |

|

60,000 |

|

|

|

-------- To Nitin's Capital A/c |

|

|

|

20,000 |

|

|

-------- To Tarun's Capital A/c |

|

|

|

20,000 |

|

|

-------- To Amar's Capital A/c |

|

|

|

20,000 |

|

|

(Being Investment Fluctuation Reserve distributed) |

|

|

|

|

|

|

|

|

|

|

|

|

(ii) |

Investment Fluctutation Reserve A/c |

Dr. |

|

60,000 |

|

|

|

-------- To Nitin's Capital A/c |

|

|

|

20,000 |

|

|

-------- To Tarun's Capital A/c |

|

|

|

20,000 |

|

|

-------- To Amar's Capital A/c |

|

|

|

20,000 |

|

|

(Being Investment Fluctuation Reserve distributed) |

|

|

|

|

|

|

|

|

|

|

|

|

(iii) |

Investment Fluctutation Reserve A/c |

Dr. |

|

60,000 |

|

|

|

-------- To Nitin's Capital A/c |

|

|

|

20,000 |

|

|

-------- To Tarun's Capital A/c |

|

|

|

20,000 |

|

|

-------- To Amar's Capital A/c |

|

|

|

20,000 |

|

|

(Being Investment Fluctuation Reserve distributed) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Investments A/c |

Dr. |

|

24,000 |

|

|

|

--------- To Revaluation A/c |

|

|

|

24,000 |

|

|

(Being investment revalued) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Revaluation A/c |

Dr. |

|

24,000 |

|

|

|

-------- To Nitin's Capital A/c |

|

|

|

8,000 |

|

|

-------- To Tarun's Capital A/c |

|

|

|

8,000 |

|

|

-------- To Amar's Capital A/c |

|

|

|

8,000 |

|

|

(Being revaluation profit transferred to partners' Capital A/c) |

|

|

|

|

|

|

|

|

|

|

|

|

(iv) |

Investment Fluctuation Reserve A/c |

Dr. |

|

60,000 |

|

|

|

------- To Investment A/c |

|

|

|

30,000 |

|

|

-------- To Nitin's Capital A/c |

|

|

|

10,000 |

|

|

-------- To Tarun's Capital A/c |

|

|

|

10,000 |

|

|

-------- To Amar's Capital A/c |

|

|

|

10,000 |

|

|

(Being investment Fluctuation Reserve distributed) |

|

|

|

|

|

|

|

|

|

|

|

|

(v) |

Investment Fluctuation Reserve A/c |

Dr. |

|

60,000 |

|

|

|

Revaluation A/c |

Dr. |

|

30,000 |

|

|

|

--------- To Investment A/c |

|

|

|

90,000 |

|

|

(Being decrease in investment set off against IFR and balance debited to Revaluation A/c) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Nitin's Capital A/c |

Dr. |

|

10,000 |

|

|

|

Tarun's Capital A/c |

Dr. |

|

10,000 |

|

|

|

Amar's Capital A/c |

Dr. |

|

10,000 |

|

|

|

--------- To Revaluation A/c |

|

|

|

30,000 |

|

|

(Being loss on revaluation transferred to Partner's Capital |

|

|

|

|

Change in Profit - Sharing Ratio Among the Existing Partners Exercise 4.40

Solution Ex. 19

Case:(i) If General Reserves are not to be shown in the new Balance Sheet

|

Journal |

|||||

|

Date |

Particulars |

|

L.F. |

Debit Rs. |

Credit Rs. |

|

|

|

|

|

|

|

|

|

General Reserve A/c |

Dr. |

|

60,000 |

|

|

|

-------- To X's Capital A/c (2/3rd) |

|

|

|

40,000 |

|

|

-------- To Y's Capital A/c (1/3rd) |

|

|

|

20,000 |

|

|

(Being adjustment of balance in General Reserve account in old ratio) |

|

|

|

|

|

|

|

|

|

|

|

Case: (ii) If General Reserves are to be shown in the new Balance sheet

|

Journal |

|||||

|

Date |

Particulars |

|

L.F. |

Debit Rs. |

Credit Rs. |

|

|

|

|

|

|

|

|

|

Y's Capital A/c |

Dr. |

|

4,000 |

|

|

|

-------- To X's Capital A/c |

|

|

|

4,000 |

|

|

(Being balance in General Reserve A/c adjusted in sacrificing gaining ratio) |

|

|

|

|

|

|

|

|

|

|

|

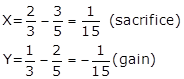

Working notes :

1.

Calculation of Gain/sacrifice

Sacrificing Ratio = Old Ratio - New Ratio

2.

Calculation of Compensation by Y to X

![]()

Solution Ex. 20

In the books of the firm

JOURNAL

|

Date |

Particulars |

L.F. |

Debit (Rs.) |

Credit (Rs.) |

|

2018 Mar, 31 |

Investment Fluctuation Fund A/c …Dr. To Investment A/c To Bhavya's Capital A/c To Sakshi's Capital A/c (Being the excess fund distributed amongst partners after making adjustments for fluctuations in market value of the Investment) |

|

20,000 |

10,000 6,000 4,000 |

|

|

Sakshi's Capital A/c …Dr. To Bhavya's Capital A/c (Being adjustment made for Goodwill between partners on account of change in profit sharing ratio between the partners) |

|

2,400 |

2,400 |

|

|

Sakshi's Capital A/c …Dr. To Bhavya's Capital A/c (Being adjustment made for General Reserve among the partners without writing it off) |

|

2,340 |

2,340 |

Working Notes: Calculation of Sacrificing and Gaining Ratios

Solution Ex. 21

|

Journal |

|||||

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

Z's Capital A/c |

Dr. |

760 |

|||

|

---------- To X's Capital A/c |

760 |

||||

|

|

(Being adjustment of revaluation profit made) |

|

|

|

|

Working Notes:

1.

Calculation of Net Profit or Loss on Revaluation

|

Particulars |

(Rs.) |

|

Increase in Investment |

3,000(Cr.) |

|

Increase in Land and Building |

10,000(Cr.) |

|

Decrease in Trade Creditors |

10,000(Cr.) |

|

Less: Decrease in Sundry Debtors |

(10,000)(Dr.) |

|

Less: Decrease in Plant and Machinery |

(5,000)(Dr.) |

|

Less: Increase in Outstanding Expenses |

(400)(Dr.) |

|

Profit on Revaluation |

7,600(Cr.) |

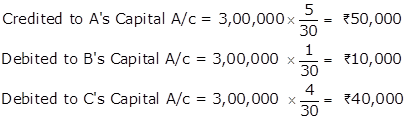

2 Calculation of Sacrificing (or Gaining) Ratio:

Old Ratio (X,Y and Z)= 5:3:2

New Ratio (X,Y and Z)=4:3:3

Sacrificing (or Gaining ) Ratio = Old Ratio - New Ratio

3 Adjustment of Revaluation Profit

![]()

![]()

Solution Ex. 22

|

Journal |

|||||

|

Date |

Particulars |

|

L.F. |

Debit Rs. |

Credit Rs. |

|

|

|

|

|

|

|

|

|

General Reserve A/c |

Dr. |

|

90,000 |

|

|

|

-------- To Ashish's Capital A/c |

|

|

|

30,000 |

|

|

-------- To Akash's Capital A/c |

|

|

|

30,000 |

|

|

-------- To Amit's Capital A/c |

|

|

|

30,000 |

|

|

(Being reserves distributed) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Ashish's Capital A/c |

Dr. |

|

2,000 |

|

|

|

Akash's Capital A/c |

Dr. |

|

2,000 |

|

|

|

Amit's Capital A/c |

Dr. |

|

2,000 |

|

|

|

-------- To Advertisement Suspense A/c |

|

|

|

6,000 |

|

|

(Being advertisement Suspense Distributed) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Revaluation A/c |

Dr. |

|

54,000 |

|

|

|

-------- To Stock A/c |

|

|

|

15,000 |

|

|

-------- To Machinery A/c |

|

|

|

25,000 |

|

|

-------- To Provision Doubtful Debts A/c |

|

|

|

4,000 |

|

|

-------- To Akash's Capital A/c |

|

|

|

10,000 |

|

|

(Being assets revalued) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Land and Building A/c |

Dr. |

|

62,000 |

|

|

|

-------- To Revaluation A/c |

|

|

|

62,000 |

|

|

(Being assets revalued) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Revaluation A/c |

Dr. |

|

8,000 |

|

|

|

-------- To Ashish's Capital A/c |

|

|

|

2,666 |

|

|

-------- To Akash's Capital A/c |

|

|

|

2,667 |

|

|

-------- To Amit's Capital A/c |

|

|

|

2,667 |

|

|

(Being profits distributed) |

|

|

|

|

|

|

|

|

|

|

|

Change in Profit - Sharing Ratio Among the Existing Partners Exercise 4.41

Solution Ex. 23

|

Journal |

|||||

|

Date |

Particulars |

|

L.F. |

Debit Rs. |

Credit Rs. |

|

|

|

|

|

|

|

|

|

General Reserve A/c |

Dr. |

|

60,000 |

|

|

|

-------- To A's Capital A/c |

|

|

|

30,000 |

|

|

-------- To B's Capital A/c |

|

|

|

18,000 |

|

|

-------- To C's Capital A/c |

|

|

|

12,000 |

|

|

(Being reserve distributed) |

|

|

|

|

|

|

|

|

|

|

|

|

|

A's Capital A/c |

Dr. |

|

2,500 |

|

|

|

B's Capital A/c |

Dr. |

|

1,500 |

|

|

|

C's Capital A/c |

Dr. |

|

1,000 |

|

|

|

-------- To Advertisement Suspense A/c |

|

|

|

5,000 |

|

|

(Being advertisement Suspense distributed) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Investment Fluctuation Reserve A/c |

Dr. |

|

30,000 |

|

|

|

-------- To Investment A/c |

|

|

|

10,000 |

|

|

-------- To A's Capital A/c |

|

|

|

10,000 |

|

|

-------- To B's Capital A/c |

|

|

|

6,000 |

|

|

-------- To C's Capital A/c |

|

|

|

4,000 |

|

|

(Being Investment Fluctuation Reserve distributed) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Machinery A/c |

Dr. |

|

12,000 |

|

|

|

Motorcycle A/c |

Dr. |

|

20,000 |

|

|

|

Creditors A/c |

Dr. |

|

10,000 |

|

|

|

-------- To Revaluation A/c |

|

|

|

42,000 |

|

|

(Being the assets revalued) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Revaluation A/c |

Dr. |

|

25,000 |

|

|

|

-------- To Land and Building A/c |

|

|

|

17,500 |

|

|

-------- To Provision for Doubtful Debts A/c |

|

|

|

2,500 |

|

|

-------- To Bank A/c (Remuneration) |

|

|

|

5,000 |

|

|

(Being the assets revalued) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Revaluation A/c |

Dr. |

|

17,000 |

|

|

|

-------- To A's Capital A/c |

|

|

|

8,500 |

|

|

-------- To B's Capital A/c |

|

|

|

5,100 |

|

|

-------- To C's Capital A/c |

|

|

|

3,400 |

|

|

(Being profit on revaluation transferred to Partner's Capital A/c) |

|

|

|

|

|

|

|

|

|

|

|

|

|

B's Capital A/c |

Dr. |

|

10,000 |

|

|

|

C's Capital A/c |

Dr. |

|

40,000 |

|

|

|

-------- To A's Capital A/c |

|

|

|

50,000 |

|

|

(Being goodwill adjusted) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revaluation Account |

|||||

|

Dr. |

|

|

Cr. |

||

|

Particulars |

|

Rs. |

Particulars |

Rs. |

|

|

To Land and Building A/c |

|

17,500 |

By Machinery A/c |

12,000 |

|

|

To Provision for Doubtful Debts A/c |

|

2,500 |

By Motorcycle A/c |

20,000 |

|

|

To Bank A/c (Remuneration) |

|

5,000 |

By Creditors A/c |

10,000 |

|

|

To Profit transferred to |

|

|

|

|

|

|

|

A A/c |

8,500 |

|

|

|

|

|

B A/c |

5,100 |

|

|

|

|

|

C A/c |

3,400 |

17,000 |

|

|

|

|

42,000 |

|

42,000 |

||

|

|

|

|

|

||

Working Notes :

1.

Calculation of sacrifice or gain

Old Ratio between A, B and C = 5:3:2

New Ratio between A, B and C = 1:1:1

Sacrificing (or Gaining Ratio) = Old Ratio - New Ratio

2.

Valuation of Goodwill

Goodwill = Average profit × No. of year's Purchase

= 1,50,000 × 2 = Rs.3,00,000

3.

Adjustment of Goodwill

Change in Profit - Sharing Ratio Among the Existing Partners Exercise 4.42

Solution Ex. 24

|

Journal |

|||||

|

Date |

Particulars |

|

L.F. |

Debit Rs. |

Credit Rs. |

|

|

|

|

|

|

|

|

|

A' s Capital A/c |

|

|

3,000 |

|

|

|

-------- To B's Capital A/c |

|

|

|

3,000 |

|

|

(Adjustment entry made for change in ratio) |

|

|

|

|

|

|

|

|

|

|

|

Working Notes :

1.

Calculation of Sacrifice or Gain

Old Ratio between A, B and C- 2:2:1

New Ratio between A, B and C- 5:3:2

Sacrificing (or Gaining Ratio) = Old Ratio - New Ratio

Adjustment Entry

2.

Calculation of Profit or Loss on Revaluation

|

Revaluation Account |

|||

|

Dr. |

|

|

Cr. |

|

Particulars |

Rs. |

Particulars |

Rs. |

|

To Computers A/c |

25,000 |

By Machinery A/c |

50,000 |

|

To Outstanding expenses A/c |

10,000 |

By Creditors A/c |

15,000 |

|

To Profit on Revaluation A/c |

30,000 |

|

|

|

|

|

|

|

|

|

65,000 |

|

65,000 |

|

|

|

|

|

Solution Ex. 25

|

Journal |

|||||

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

X's Capital A/c |

Dr. |

15,000 |

|||

|

Y's Capital A/c |

Dr. |

5,000 |

|||

|

|

---------- To Z's Capital A/c |

|

|

|

20,000 |

|

|

(Being adjustment made for Goodwill, General Reserve and Profit and Loss A/c on change in PSR) |

|

|

|

|

|

New Balance Sheet (i.e. after change in PSR) |

|||||

|

Liabilities |

Rs. |

Assets |

Rs. |

||

|

Capital |

Sundry Assets |

7,00,000 |

|||

|

|

X |

1,95,000 |

|||

|

|

Y |

1,45,000 |

|||

|

|

Z |

1,40,000 |

4,80,000 |

||

|

General Reserve |

65,000 |

||||

|

Profit and Loss A/c |

25,000 |

||||

|

Creditors |

1,30,000 |

||||

|

|

|||||

|

|

7,00,000 |

7,00,000 |

|||

|

|

|

|

|||

Working Notes:

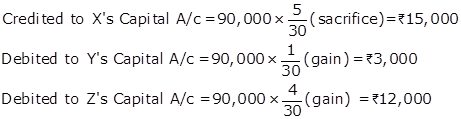

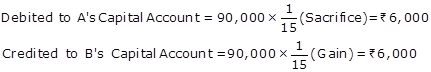

1.

Calculation of Sacrificing (or Gaining ) Ratio

Old Ratio between X, Y and Z- 7:5:4

New Ratio between X, Y and Z- 3:2:1

Sacrificing (or Gaining) Ratio= Old Ratio - New Ratio

2.

Adjustment of General Reserve, Profit and Loss Account and Goodwill

Total Amount for Adjustment= General Reserve+ Profit and Loss Account + Goodwill

= 65,000+25,000+1,50,000=Rs.2,40,000

![]()

![]()

![]()

3.

|

Partners Capital Accounts |

|||||||

|

Dr |

|

|

|

Cr |

|||

|

Particulars |

X |

Y |

Z |

Particulars |

X |

Y |

Z |

|

To Z's Capital A/c |

15,000 |

5,000 |

|

By Balance B/d |

2,10,000 |

1,50,000 |

1,20,000 |

|

To Balance c/d |

1,95,000 |

1,45,000 |

1,40,000 |

By X's Capital A/c |

|

15,000 |

|

|

|

By Y's Capital A/c |

|

5,000 |

||||

|

|

|

|

|||||

|

2,10,000 |

1,50,000 |

1,40,000 |

2,10,000 |

1,50,000 |

1,40,000 |

||

|

|

|

|

|

|

|||

Solution Ex. 26

|

Revaluation Account |

|||||

|

Dr. |

|

|

Cr. |

||

|

Particulars |

Rs. |

Particulars |

Rs. |

||

|

To Building A/c |

3,000 |

By Land A/c |

30,000 |

||

|

To Revaluation profit |

|

By Creditors A/c |

6,000 |

||

|

|

A's A/c |

16,500 |

|

|

|

|

|

B's A/c |

11,000 |

|

|

|

|

|

C's A/c |

5,500 |

33,000 |

|

|

|

|

|

|

|

||

|

|

36,000 |

|

36,000 |

||

|

|

|

|

|

||

|

Partner's Capital Account |

||||||||

|

Dr. |

Cr. |

|||||||

|

Particulars |

A |

B |

C |

Particulars |

A |

B |

C |

|

|

To A's Capital A/c |

|

|

25,000 |

By Balance b/d |

1,00,000 |

50,000 |

25,000 |

|

|

To Balance c/d |

1,56,500 |

71,000 |

10,500 |

By R/v Profit A/c |

16,500 |

11,000 |

5,500 |

|

|

|

|

|

|

By General Reserve A/c |

15,000 |

10,000 |

5,000 |

|

|

|

|

|

|

By C's Capital A/c |

25,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1,56,500 |

71,000 |

35,500 |

|

1,56,500 |

71,000 |

35,500 |

|

|

Balance Sheet as on 31st March 2015 |

|||||

|

Liabilities |

|

Rs. |

Assets |

|

Rs. |

|

Capital: |

|

|

Land |

50,000 |

|

|

----A |

1,56,500 |

|

Add: Increase |

30,000 |

80,000 |

|

----B |

71,000 |

|

Building |

50,000 |

|

|

----C |

10,500 |

2,38,000 |

Less: Depreciation |

(3,000) |

47,000 |

|

Creditors |

50,000 |

|

Plant |

|

1,00,000 |

|

Less: Written off |

(6,000) |

44,000 |

Bank |

|

5,000 |

|

Bills Payable |

|

20,000 |

Stock |

|

40,000 |

|

|

|

|

Debtors |

|

30,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3,02,000 |

|

|

3,02,000 |

Working Note

Old Ratio : 3:2:1

New Ratio: 1:1:1

|

C will compensate A: |

|||||

|

|

C's Capital A/c |

Dr. |

|

25,000 |

|

|

|

-------- To A's Capital A/c |

|

|

|

25,000 |

Change in Profit - Sharing Ratio Among the Existing Partners Exercise 4.43

Solution Ex. 27

|

Journal |

|||||

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

A's Capital A/c |

Dr. |

4,000 |

|||

|

-------- To B's Capital A/c |

|

4,000 |

|||

|

|

(Being adjustment of General Reserve on change in PSR) |

|

|

|

|

|

|

|

|

|

|

|

|

Partners Capital Accounts |

|||||

|

Dr |

|

|

Cr |

||

|

Particulars |

A |

B |

Particulars |

A |

B |

|

To B's Capital A/c |

4,000 |

|

By Balance b/d |

2,40,000 |

1,20,000 |

|

To Balance c/d |

2,54,000 |

1,37,500 |

By Revaluation A/c |

18,000 |

13,500 |

|

|

By A's Capital A/c |

|

4,000 |

||

|

|

|

|

|||

|

2,58,000 |

1,37,500 |

2,58,000 |

1,37,500 |

||

|

|

|

|

|

||

|

Balance Sheet |

||||||

|

Liabilities |

` |

Assets |

|

Rs. |

||

|

Sundry Creditors(28,000 - 3,700) |

24,300 |

Cash |

|

20,000 |

||

|

General Reserve |

42,000 |

Sundry Debtors |

1,20,000 |

|||

|

Capital |

Less: Provision for Doubtful Debts |

(7,200) |

1,12,800 |

|||

|

|

A |

2,54,000 |

Stock |

|

1,90,000 |

|

|

|

B |

1,37,500 |

3,91,500 |

Fixed Assets(1,50,000 - 15,000) |

|

1,35,000 |

|

|

|

|||||

|

|

4,57,800 |

|

4,57,800 |

|||

|

|

|

|

|

|||

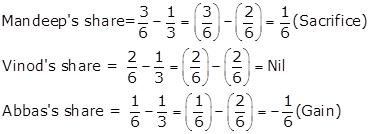

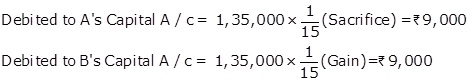

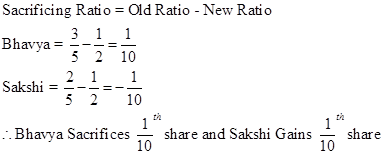

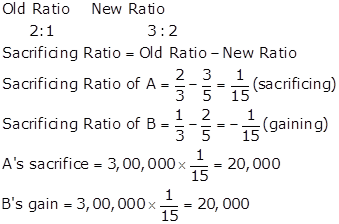

Working Notes:

1.

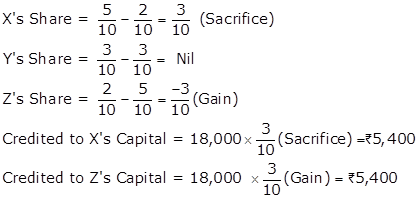

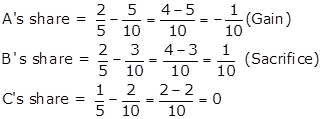

Calculation of Sacrificing (or Gaining) Ratio

Old Ratio between A and B= 4:3

New Ratio between A and B = 2:1

Sacrificing (or Gaining) Ratio = Old Ratio - New Ratio

![]()

![]()

2.

Adjustment of General Reserve

![]()

![]()

3.

|

Revaluation Account |

|||||

|

Dr |

|

|

Cr |

||

|

Particulars |

|

Rs. |

Particulars |

Rs. |

|

|

To Fixed Assets A/c |

|

15,000 |

By Stock A/c |

50,000 |

|

|

To Provision

for Doubtful Debts A/c (1,20,000 |

|

7,200 |

By Creditors A/c |

3,700 |

|

|

To Profit transfer to: |

|

|

|

||

|

A's Capital A/c |

18,000 |

|

|

||

|

B's Capital A/c |

13,500 |

31,500 |

|

||

|

|

53,700 |

53,700 |

|||

|

|

|

|

|

||

Solution Ex. 28

|

Journal |

|||||

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

X's Capital A/c |

Dr. |

2,500 |

|||

|

---------- To Z's Capital A/c |

2,500 |

||||

|

|

(Being revaluation profit and General reserve adjusted on change in profit sharing ratio) |

|

|

|

|

|

|

|

|

|

|

|

|

Balance Sheet |

||||

|

Dr |

|

|

Cr |

|

|

Liabilities |

|

Rs. |

Assets |

Rs. |

|

Sundry Creditors |

|

40,000 |

Cash at Bank |

40,000 |

|

Outstanding Expenses |

|

15,000 |

Sundry Debtors |

2,10,000 |

|

General Reserve |

|

75,000 |

Stock |

3,00,000 |

|

Capital A/c |

|

|

Furniture |

60,000 |

|

X |

3,97,500 |

|

Plant and Machinery |

4,20,000 |

|

Y |

3,00,000 |

|

|

|

|

Z |

2,02,500 |

9,00,000 |

|

|

|

|

10,30,000 |

10,30,000 |

||

|

|

|

|

|

|

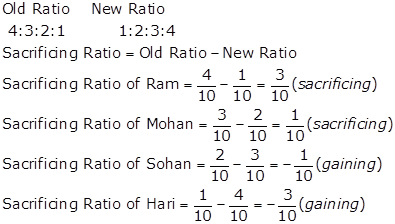

Working Notes:

1.

Calculation of Sacrificing (or Gaining) Ratio

Old Ratio between X, Y and Z = 5:4:3

Old Ratio between X, Y and Z = 4:3:2

Sacrificing (or Gaining) Ratio= Old Ratio - New Ratio

![]()

![]()

![]()

2.

Calculation of Profit or Loss on Revaluation

|

Particulars |

Amount (Rs.) |

|

Increase in Stock |

60,000 (Cr.) |

|

Less: Decrease Furniture |

12,000 (Dr.) |

|

Less: Decrease in Plant and Machinery |

20,000 (Dr.) |

|

Less: Increase in Outstanding Expenses |

13,000 (Dr.) |

|

Profit on Revaluation |

15,000(Cr.) |

3.

Adjustment of Profit on Revaluation and General Reserve

Amount for Adjustment = Profit on Revaluation + General Reserve = 15,000+75,000= Rs 90,000

![]()

![]()

4.

|

Partner's Capital Accounts |

|||||||

|

Dr |

|

|

|

Cr |

|||

|

Particulars |

X |

Y |

Z |

Particulars |

X |

Y |

Z |

|

To Z's Capital A/c |

2,500 |

|

By Balance B/d |

4,00,000 |

3,00,000 |

2,00,000 |

|

|

To Balance c/d |

3,97,500 |

3,00,000 |

2,02,500 |

By X's Capital A/c |

|

2,500 |

|

|

|

|

|

|||||

|

|

|

|

|||||

|

4,00,000 |

3,00,000 |

2,02,500 |

4,00,000 |

3,00,000 |

2,02,500 |

||

|

|

|

|

|

||||

Change in Profit - Sharing Ratio Among the Existing Partners Exercise 4.44

Solution Ex. 29

|

Revaluation Account |

|||||

|

Dr. |

|

|

Cr. |

||

|

Particulars |

|

Rs. |

Particulars |

Rs. |

|

|

To Profit transferred to: |

|

|

By Machinery A/c |

7,000 |

|

|

X's Capital A/c |

5,000 |

|

By Stock A/c |

1,000 |

|

|

Y's Capital A/c |

3,000 |

8,000 |

|

||

|

|

8,000 |

8,000 |

|||

|

Partner's Capital Account |

|||||

|

Dr |

|

Cr |

|||

|

Particulars |

X |

Y |

Particulars |

X |

Y |

|

To Advertisement Suspense A/c |

500 |

300 |

By Balance b/d |

52,000 |

54,000 |

|

To Goodwill A/c |

5,000 |

3,000 |

By General Reserve A/c |

3,000 |

1,800 |

|

To X's Capital A/c |

3,000 |

By WCF A/c |

2,500 |

1,500 |

|

|

To Balance c/d |

60,000 |

54,000 |

By Revaluation A/c (Profit) |

5,000 |

3,000 |

|

By Y's Capital A/c |

3,000 |

|

|||

|

65,500 |

60,300 |

65,500 |

60,300 |

||

|

|

|

||||

|

New Balance Sheet as on 1st April 2019 (after Change in Profit Sharing Ratio) |

|||

|

Liabilities |

Rs. |

Assets |

Rs. |

|

X's Capital |

60,000 |

Machinery |

45,000 |

|

Y's Capital |

54,000 |

Furniture |

15,000 |

|

Sundry Creditors |

5,000 |

Sundry Debtors |

33,000 |

|

Employee's Provident Fund |

1,000 |

Stock |

8,000 |

|

Workmen Compensation Reserve |

6,000 |

Bank |

25,000 |

|

|

|||

|

|

1,26,000 |

1,26,000 |

|

|

|

|

||

Working Notes:

1.

Calculation of Sacrificing (or Gaining) Ratio

Old Ratio (X and Y)= 5:3

New Ratio (X and Y) = 3:5

Sacrificing (or Gaining) Ratio= Old Ratio - New Ratio

![]()

![]()

2.

Calculation of Goodwill

Goodwill= Average Profit ![]() No. of Years Purchase

No. of Years Purchase

![]()

![]()

3.

Adjustment of Goodwill

![]()

![]()

|

Journal |

|||||

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

Workmen's Compensation Reserve A/c |

Dr. |

10,000 |

|||

|

---------- To Workmen's Compensation Claim A/c |

6,000 |

||||

|

|

---------- To X's Capital A/c |

|

|

|

2,500 |

|

|

---------- To Y's Capital A/c |

|

|

|

1,500 |

|

|

(Being workmen's compensation claim distributed among partners in their old ratio i.e.5:3) |

|

|

|

|

|

|

X's Capital A/c |

Dr. |

|

5,000 |

|

|

|

Y's Capital A/c |

Dr. |

|

3,000 |

|

|

|

---------- To Goodwill A/c |

|

|

|

8,000 |

|

|

(Being goodwill written off among partners in their old ratio) |

|

|

|

|

|

|

X's Capital A/c |

Dr. |

|

500 |

|

|

|

Y's Capital A/c |

Dr. |

|

300 |

|

|

|

---------- To Advertisement suspense A/c |

|

|

|

800 |

|

|

(Being advertisement suspense written off among partners in their old ratio) |

|

|

|

|

|

|

General Reserve A/c |

Dr. |

|

4,800 |

|

|

|

---------- To X's Capital A/c |

|

|

|

3,000 |

|

|

---------- To Y's Capital A/c |

|

|

|

1,800 |

|

|

(Being general reserve distributed among partners in their old ratio) |

|

|

|

|

|

|

Revaluation A/c |

Dr. |

|

8,000 |

|

|

|

---------- To X's Capital A/c |

|

|

|

5,000 |

|

|

---------- To Y's Capital A/c |

|

|

|

3,000 |

|

|

(Being revaluation profit distributed among partners in their old ratio) |

|

|

|

|

|

|

Y's Capital A/c |

Dr. |

|

3,000 |

|

|

|

---------- To X's Capital A/c |

|

|

|

3,000 |

|

|

(Being adjustment of goodwill made ) |

|

|

|

|

Solution Ex. 30

|

Revaluation Account |

||||

|

Dr. |

Cr. |

|||

|

Particulars |

(Rs.) |

Particulars |

(Rs.) |

|

|

Provision for Workmen Compensation Claim |

30,000 |

Revaluation Loss |

||

|

Ram's Capital A/c |

12,000 |

|||

|

Mohan's Capital A/c |

9,000 |

|||

|

Sohan's Capital A/c |

6,000 |

|||

|

Hari's Capital A/c |

3,000 |

30,000 |

||

|

30,000 |

30,000 |

|||

|

Partners' Capital Account |

|||||||||

|

Dr. |

Cr. |

||||||||

|

Particulars |

Ram |

Mohan |

Sohan |

Hari |

Particulars |

Ram |

Mohan |

Sohan |

Hari |

|

Revaluation A/c |

12,000 |

9,000 |

6,000 |

3,000 |

Balance b/d |

4,00,000 |

4,50,000 |

2,50,000 |

2,00,000 |

|

Ram's Capital A/c |

13,500 |

40,500 |

Sohan's Capital A/c |

13,500 |

4,500 |

||||

|

Mohan's Capital A/c |

4,500 |

13,500 |

Hari's Capital A/c |

40,500 |

13,500 |

||||

|

Current A/c |

3,15,000 |

2,05,000 |

Current A/c |

1,55,000 |

3,65,000 |

||||

|

Balance c/d |

1,27,000 |

2,54,000 |

3,81,000 |

5,08,000 |

|||||

|

4,54,000 |

4,68,000 |

4,05,000 |

5,65,000 |

4,54,000 |

4,68,000 |

4,05,000 |

5,65,000 |

||

|

Balance Sheet |

|||||

|

Liabilities |

Amount (Rs.) |

Assets |

Amount (Rs.) |

||

|

Capital A/c |

Fixed Assets |

9,00,000 |

|||

|

Ram |

1,27,000 |

Current Assets |

5,20,000 |

||

|

Mohan |

2,54,000 |

Current A/c |

|||

|

Sohan |

3,81,000 |

Ram |

3,15,000 |

||

|

Hari |

5,08,000 |

12,70,000 |

Mohan |

2,05,000 |

5,20,000 |

|

Current A/c |

|||||

|

Sohan |

1,55,000 |

||||

|

Hari |

3,65,000 |

5,20,000 |

|||

|

Claim against WCF |

1,50,000 |

||||

|

19,40,000 |

19,40,000 |

||||

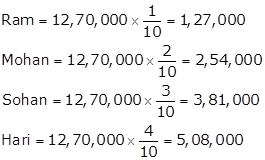

Working Notes

WN1: Calculation of Gaining/Sacrificing Ratio

(a) Sohan will compensate Ram and Mohan in the ratio 3 : 1

(b) Hari will compensate Ram and Mohan in the ratio of 3 : 1

Adjustment for Goodwill

|

Sohan's Capital A/c |

Dr. |

18,000 |

||

|

Hari's Capital A/c |

Dr. |

54,000 |

||

|

------To Ram's Capital A/c |

54,000 |

|||

|

------To Mohan's Capital A/c |

18,000 |

|||

|

(Sohan and Hari will compensate Ram and Mohan in their gaining ratio) |

WN2: Calculation of Adjusted Capital

Ram = 4,54,000 - 12,000 = Rs.4,42,000

Mohan = 4,68,000 - 9,000 = Rs.4,59,000

Sohan = 2,50,000 - 24,000 = Rs.2,26,000

Hari = 2,00,000 - 57,000 = Rs.1,43,000

Total Combined Capital = 12,70,000

WN3: Calculation of New Capital

Change in Profit - Sharing Ratio Among the Existing Partners Exercise 4.45

Solution Ex. 31

|

Revaluation Account |

||||

|

Dr. |

Cr. |

|||

|

Particulars |

(Rs.) |

Particulars |

(Rs.) |

|

|

Depreciation on Fixed Assets A/c |

60,000 |

Revaluation Loss |

||

|

Provision for Claim against WCF |

25,000 |

Suresh's Capital A/c |

17,000 |

|

|

Ramesh's Capital A/c |

17,000 |

|||

|

Mahesh's Capital A/c |

25,500 |

|||

|

Ganesh's Capital A/c |

25,500 |

85,000 |

||

|

85,000 |

85,000 |

|||

|

Partners' Capital Account |

|||||||||

|

Dr. |

Cr. |

||||||||

|

Particulars |

Suresh |

Ramesh |

Mahesh |

Ganesh |

Particulars |

Suresh |

Ramesh |

Mahesh |

Ganesh |

|

Revaluation A/c |

17,000 |

17,000 |

25,500 |

25,500 |

Balance b/d |

1,00,000 |

1,50,000 |

2,00,000 |

2,50,000 |

|

Mahesh's Capital A/c |

2,250 |

2,250 |

Suresh's Capital A/c |

2,250 |

2,250 |

||||

|

Ganesh's Capital A/c |

2,250 |

2,250 |

Ramesh's Capital A/c |

2,250 |

2,250 |

||||

|

Cash A/c |

25,250 |

75,250 |

Cash A/c |

75,250 |

25,250 |

||||

|

Balance c/d |

1,53,750 |

1,53,750 |

1,53,750 |

1,53,750 |

|||||

|

1,75,250 |

1,75,250 |

2,04,500 |

2,54,500 |

1,75,250 |

1,75,250 |

2,04,500 |

2,54,500 |

||

|

Balance Sheet |

||||

|

Liabilities |

(Rs.) |

Assets |

(Rs.) |

|

|

Capital A/c |

Fixed Assets (Less depreciation) |

5,40,000 |

||

|

Suresh |

1,53,750 |

Current Assets |

3,45,000 |

|

|

Ramesh |

1,53,750 |

|||

|

Mahesh |

1,53,750 |

|

|

|

|

Ganesh |

1,53,750 |

6,15,000 |

|

|

|

Claim against WCF |

1,00,000 |

|||

|

Sundry Creditors |

1,70,000 |

|||

|

8,85,000 |

8,85,000 |

|||

Working Notes

WN1: Calculation of Gaining/Sacrificing Ratio

Adjustment for Goodwill

|

Suresh's Capital A/c |

Dr. |

4,500 |

||

|

Ramesh's Capital A/c |

Dr. |

4,500 |

||

|

------To Mahesh's Capital A/c |

4,500 |

|||

|

------To Ganesh's Capital A/c |

4,500 |

|||

|

(Gaining partners compensate sacrificing partners) |

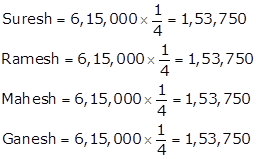

WN2: Calculation of Adjusted Capital

Suresh = 1,00,000 - 21,500 = Rs.78,500

Ramesh = 1,50,000 - 21,500 = Rs.1,28,500

Mahesh = 2,04,500 - 25,500 = Rs.1,79,000

Ganesh = 2,54,500 - 25,500 = Rs.2,29,000

Total Combined Capital = 6,15,000

WN3: Calculation of New Capital

Solution Ex. 32

|

Revaluation Account |

||||

|

Dr. |

Cr. |

|||

|

Particulars |

(Rs.) |

Particulars |

(Rs.) |

|

|

Revaluation Profit |

|

Land and Building |

2,10,000 |

|

|

A's Capital A/c |

1,40,000 |

|

|

|

|

B's Capital A/c |

70,000 |

2,10,000 |

|

|

|

2,10,000 |

2,10,000 |

|||

|

Partners' Capital Accounts |

|||||

|

Particulars |

A |

B |

Particulars |

A |

B |

|

Reserve |

1,80,000 |

1,20,000 |

Balance b/d |

3,00,000 |

2,00,000 |

|

Cash A/c (bal. fig.) |

20,000 |

|

Reserve |

1,00,000 |

50,000 |

|

A's Capital |

|

20,000 |

B's Capital A/c |

20,000 |

|

|

Balance c/d |

3,60,000 |

2,40,000 |

Revaluation A/c |

1,40,000 |

70,000 |

|

|

|

|

Cash A/c (bal. fig.) |

60,000 |

|

|

5,60,000 |

3,80,000 |

5,60,000 |

3,80,000 |

||

|

Balance Sheet |

||||

|

Liabilities |

Amount (Rs.) |

Assets |

Amount (Rs.) |

|

|

Capital A/c |

Land and Building |

5,00,000 |

||

|

A |

3,60,000 |

Furniture |

80,000 |

|

|

B |

2,40,000 |

6,00,000 |

Stock |

2,40,000 |

|

Reserve |

3,00,000 |

Debtors |

1,50,000 |

|

|

Creditors |

2,00,000 |

Bank |

60,000 |

|

|

|

|

Cash (30,000 + 60,000 - 20,000) |

70,000 |

|

|

11,00,000 |

11,00,000 |

|||

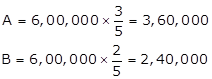

Working Notes

WN1: Calculation of New Capital

WN2: Calculation of Gaining/Sacrificing Ratio andAdjustment for Goodwill

Adjustment for Goodwill

|

B's Capital A/c |

Dr. |

20,000 |

||

|

------To A's Capital A/c |

20,000 |

|||

|

(B will compensate A to the extent of his gain) |