Class 12-commerce T S GREWAL Solutions Accountancy Chapter 5: Admission of a Partner

Admission of a Partner Exercise 5.85

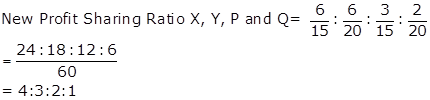

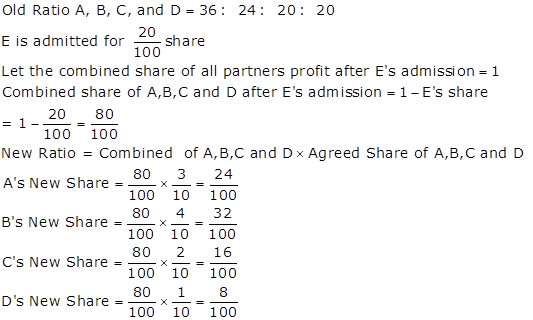

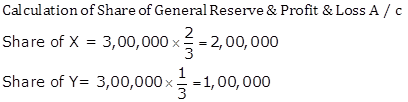

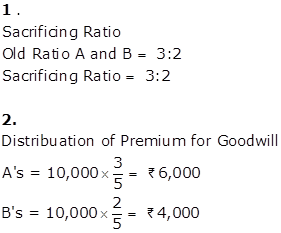

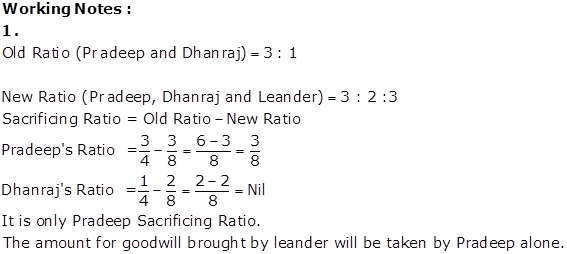

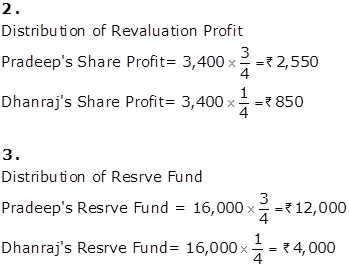

Solution Ex. 1

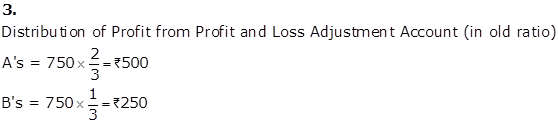

![]()

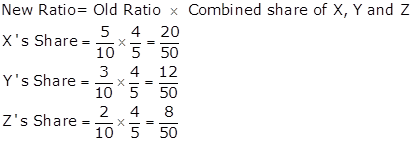

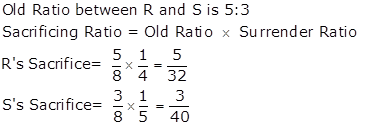

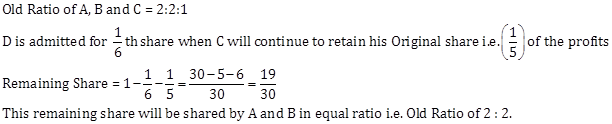

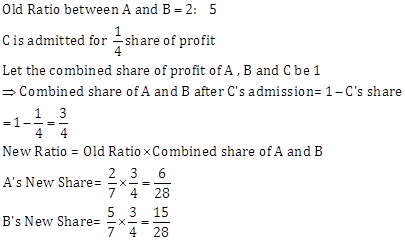

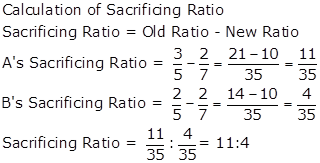

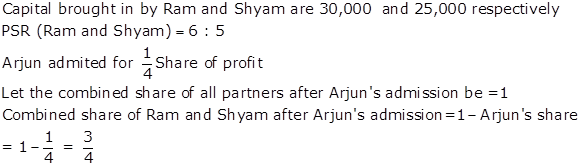

A is to be provided 1/5th share of Profits

Assuming combined share of profit for all partners after A's admission be = 1

Accordingly, combined share of X, Y and Z after A's admission = 1 - A's share

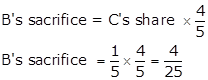

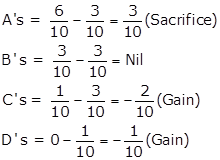

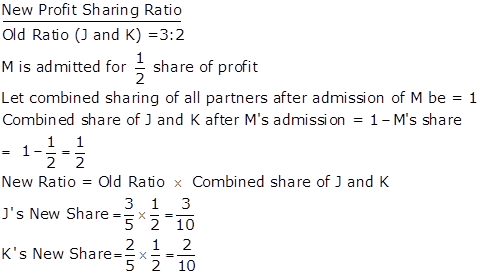

![]()

![]()

![]()

![]()

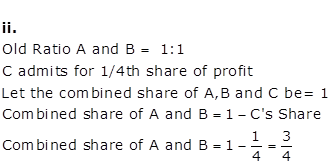

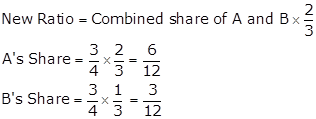

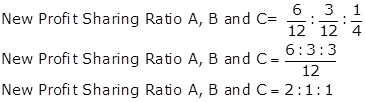

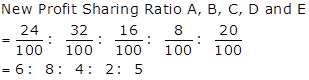

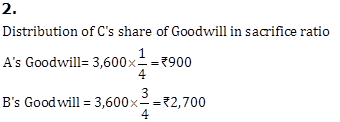

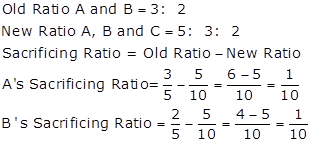

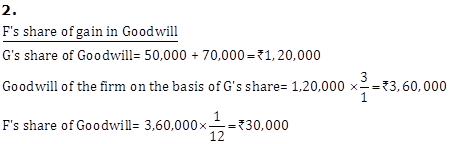

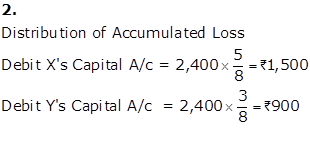

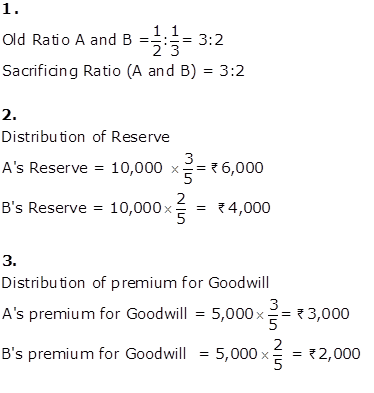

Solution Ex. 2

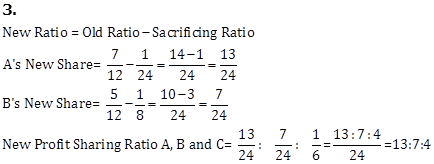

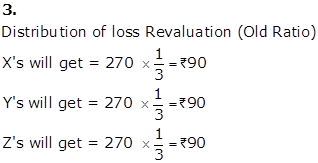

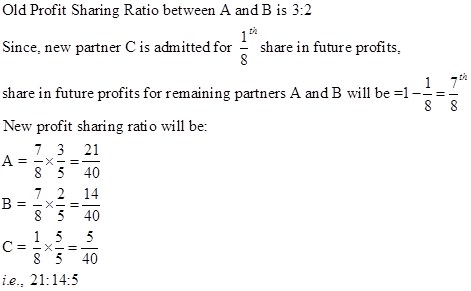

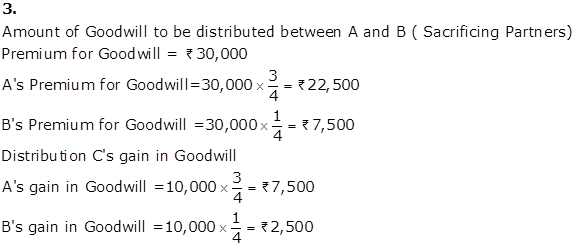

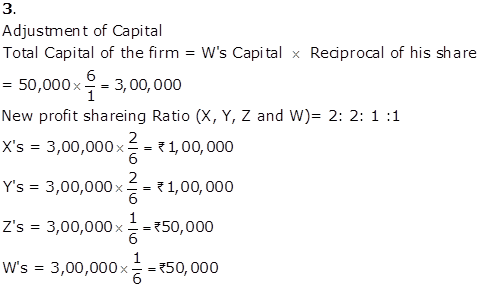

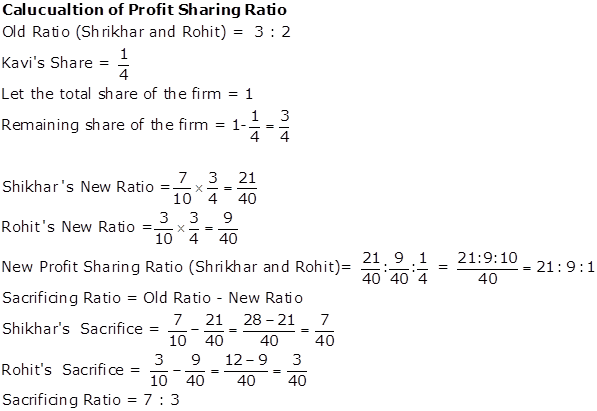

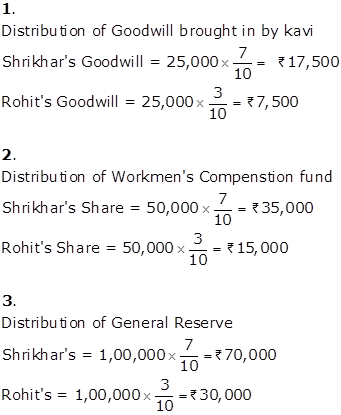

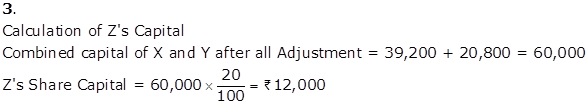

Solution Ex. 3

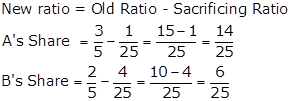

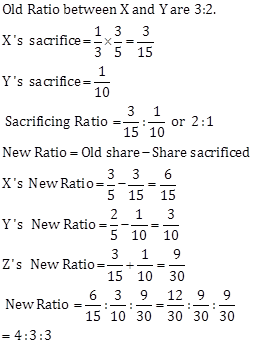

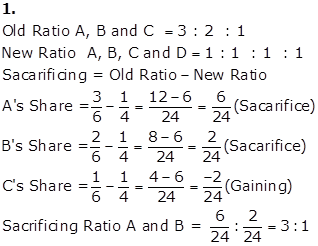

Solution Ex. 4

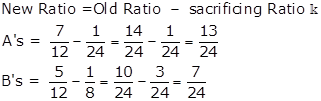

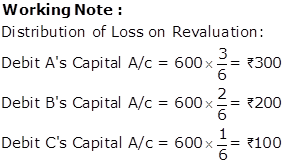

Profit sharing Ratio of A, B and C = 3:2:1

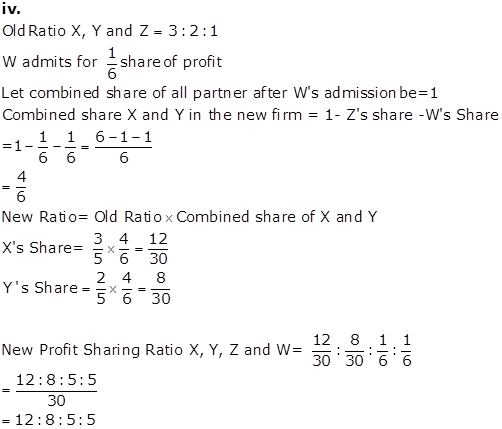

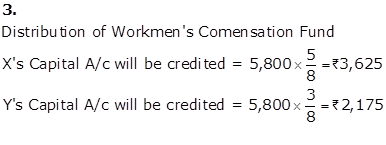

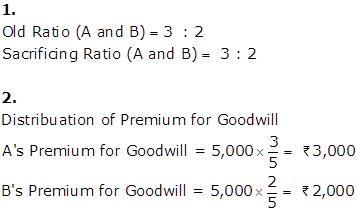

Solution Ex. 5

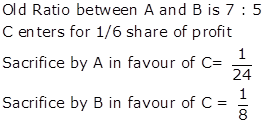

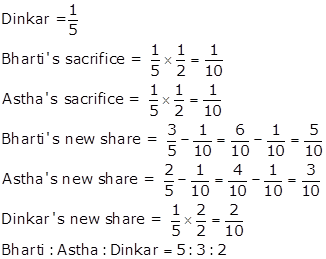

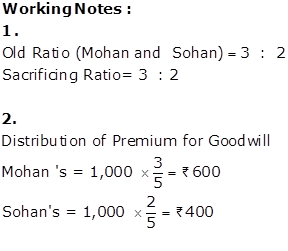

Old Ratio between Bharti and Astha = 3:2

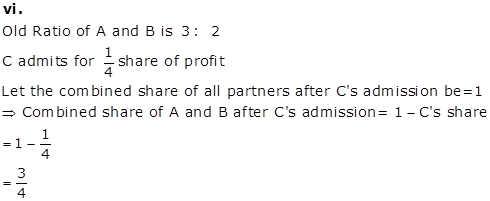

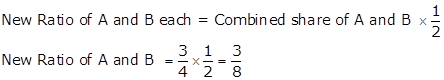

Solution Ex. 6

Admission of a Partner Exercise 5.86

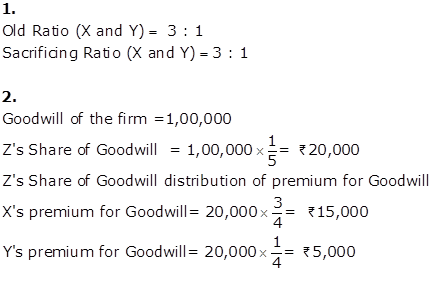

Solution Ex. 7

Solution Ex. 8

Solution Ex. 9

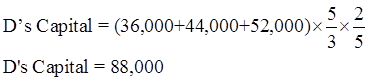

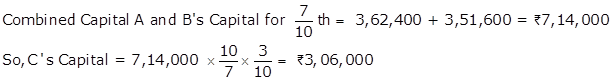

![]()

Admission of a Partner Exercise 5.87

Solution Ex. 10

![]()

Solution Ex. 11

Solution Ex. 12

![]()

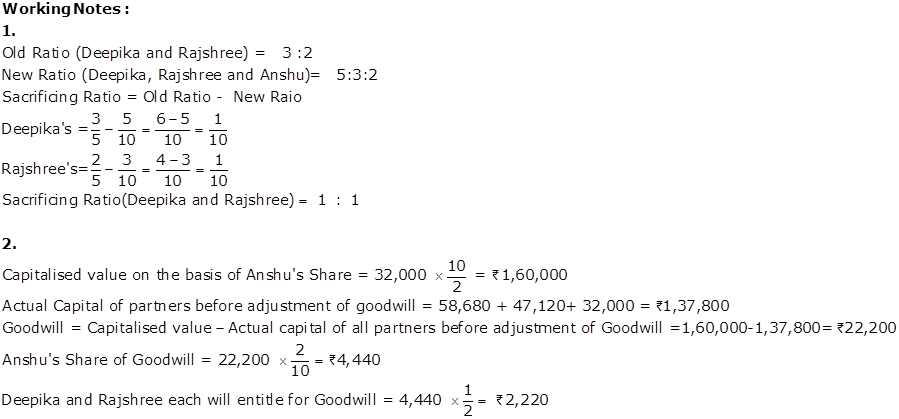

Solution Ex. 13

Solution Ex. 14

Solution Ex. 15

Solution Ex. 16

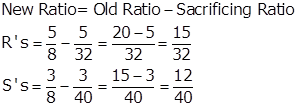

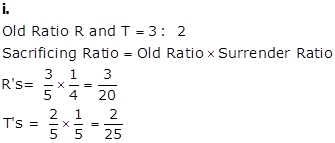

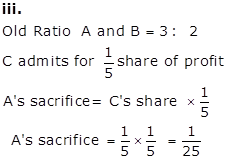

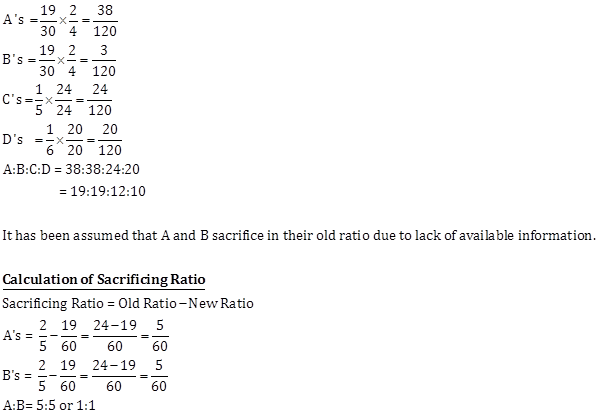

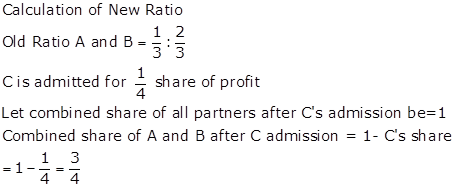

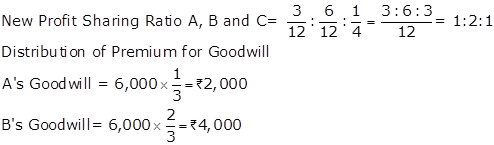

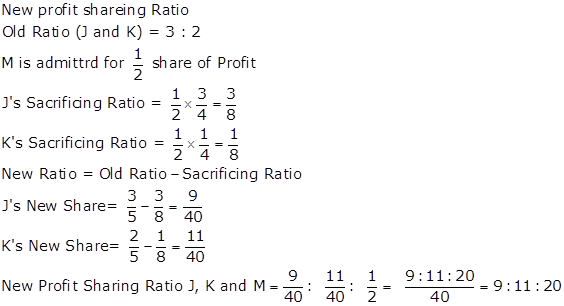

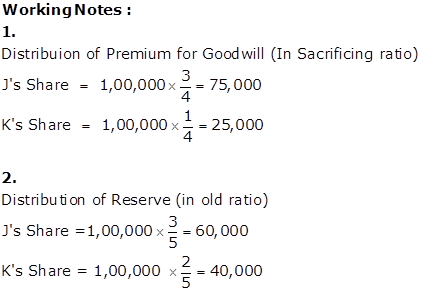

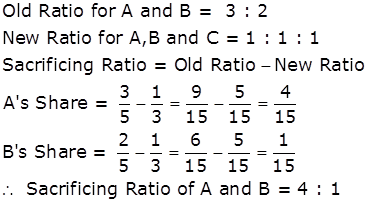

Calculation of New Profit Sharing Ratio

Solution Ex. 17

Solution Ex. 18

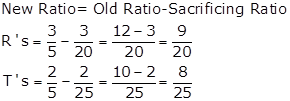

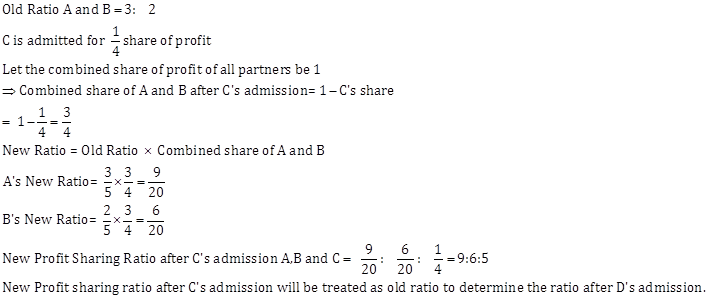

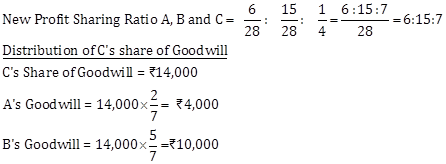

Old Ratio between P and Q = 3:2

Solution Ex. 19

|

Journal |

|||||

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

A's Capital

A/c |

Dr. |

10,000 |

|||

|

B's Capital

A/c |

Dr. |

5,000 |

|||

|

---------To Goodwill A/c |

15,000 |

||||

|

(Being goodwill written-off between A and B in old ratio of 2:1) |

|||||

Note:-

The amount brought in by C as Goodwill will not be recorded in the books of the firm as he paid to A and B privately in the old ratio.

Solution Ex. 20

Solution Ex. 21

|

Journal |

|||||

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

Cash A/c |

Dr. |

21,000 |

|||

|

-----To Premium for Goodwill A/c |

21,000 |

||||

|

(Being premium for goodwill brought in by C ) |

|||||

|

|

Premium for Goodwill A/c |

Dr. |

|

21,000 |

|

|

|

-----To A's Capital A/c |

|

|

|

9,000 |

|

|

-----To B's Capital A/c |

|

|

|

12,000 |

|

|

(Being premium for Goodwill brought in by C distributed between A and B in sacrificing ratio i.e. 3 : 4) |

|

|

|

|

Solution Ex. 22

(a)

|

Journal |

|||||

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

Cash A/c |

Dr. |

2,000 |

|||

|

-----To Premium for Goodwill A/c |

2,000 |

||||

|

(Being premium for goodwill brought in by D) |

|||||

|

|

Premium for Goodwill A/c |

Dr. |

|

2,000 |

|

|

|

-----To B's Capital A/c |

|

|

|

1,200 |

|

|

-----To C's Capital A/c |

|

|

|

800 |

|

|

(Being premium for goodwill distributed between B and C in sacrificing ratio i.e. 3:2) |

|

|

|

|

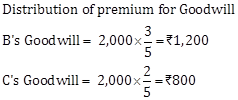

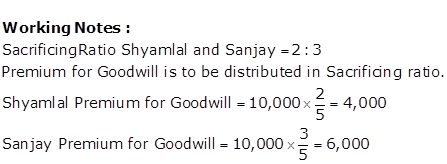

Working Note:

(b)

|

Journal |

|||||

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

Cash A/c |

Dr. |

2,100 |

|||

|

-----To Premium for Goodwill A/c |

2,100 |

||||

|

(Being premium for goodwill brought by D in cash) |

|||||

|

|

Premium for Goodwill A/c |

Dr. |

|

2,100 |

|

|

|

-----To B's Capital A/c |

|

|

|

1,400 |

|

|

-----To C's Capital A/c |

|

|

|

700 |

|

|

(Being premium for goodwill distributed between B and C in sacrificing ratio i.e. 2:1) |

|

|

|

|

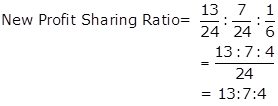

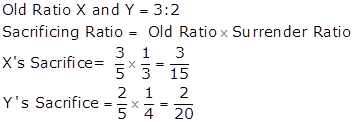

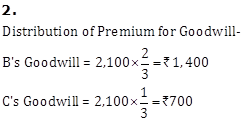

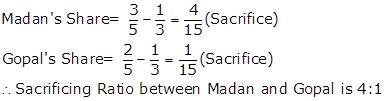

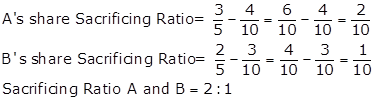

Working Note:

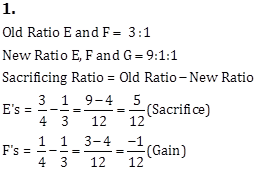

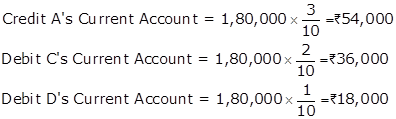

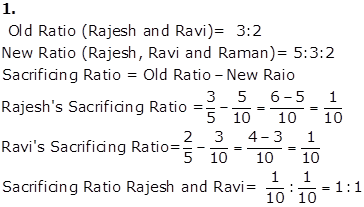

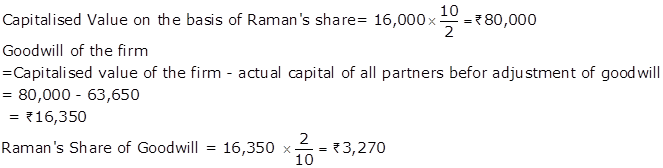

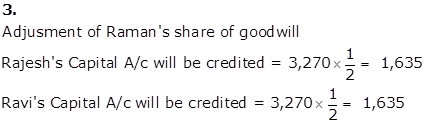

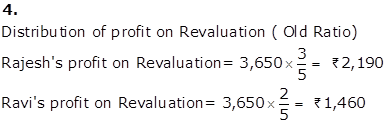

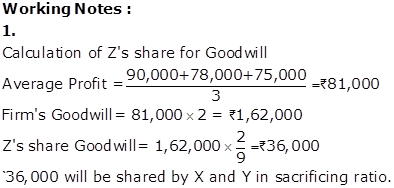

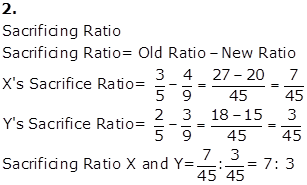

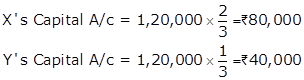

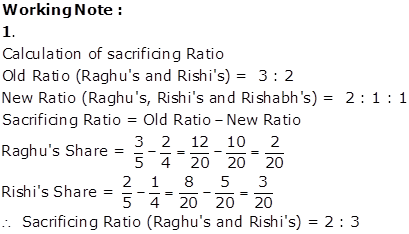

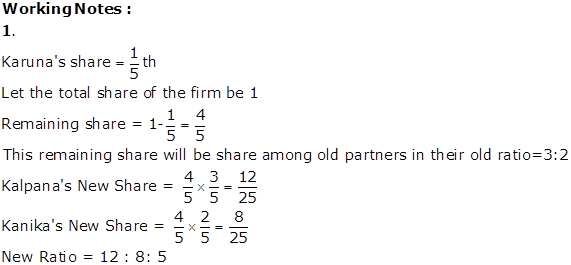

1.

![]()

Solution Ex. 23

|

Journal |

|||||

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

Cash A/c |

Dr. |

15,000 |

|||

|

-----To Premium for Goodwill A/c |

15,000 |

||||

|

(Being D brought his share of Goodwill in cash) |

|||||

|

|

Premium for Goodwill A/c |

Dr. |

|

15,000 |

|

|

|

-----To B's Capital A/c |

|

|

|

15,000 |

|

|

(Being premium for goodwill transferred to B's Capital) |

|

|

|

|

|

|

C's Capital A/c |

Dr. |

|

3,750 |

|

|

|

-----To B's Capital A/c |

|

|

|

3,750 |

|

|

(Being goodwill charged from C's Capital Account due to his gain in profit sharing) |

|

|

|

|

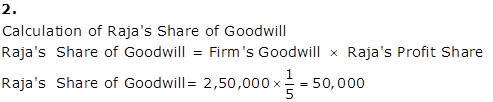

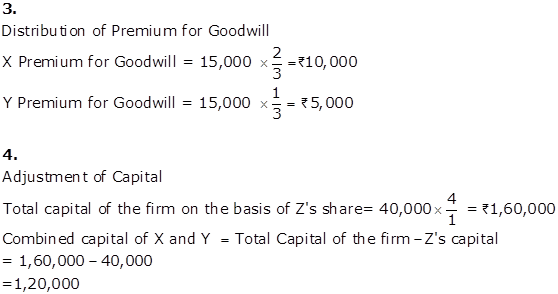

Working Notes:

1.

Solution Ex. 24

|

Journal |

|||||

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

Cash A/c |

Dr. |

25,000 |

|||

|

----To Premium for Goodwill A/c |

25,000 |

||||

|

( Being R brought his share of Goodwill in cash) |

|||||

|

|

Premium for Goodwill A/c |

Dr. |

|

25,000 |

|

|

|

-----To M's Capital A/c |

|

|

|

12,500 |

|

|

-----To J's Capital A/c |

|

|

|

12,500 |

|

|

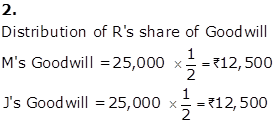

(Being C's share of Goodwill distributed in M and J in their sacrificing Ratio) |

|

|

|

|

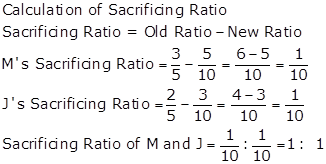

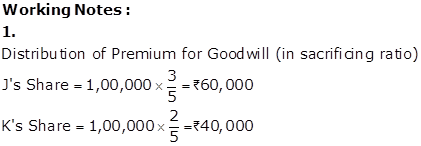

Working Notes:

1.

Solution Ex. 25

|

Journal |

|||||

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

Cash A/c |

Dr. |

52,000 |

|||

|

-----To C's Capital A/c |

40,000 |

||||

|

-----To Premium for Goodwill A/c |

12,000 |

||||

|

(Being capital and share of goodwill brought in by C in cash) |

|||||

|

|

Premium for Goodwill A/c |

Dr. |

|

12,000 |

|

|

|

-----To A's Capital A/c |

|

|

|

6,000 |

|

|

-----To, B's Capital A/c |

|

|

|

6,000 |

|

|

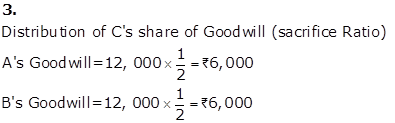

(Being C's share of goodwill distributed between A and B) |

|

|

|

|

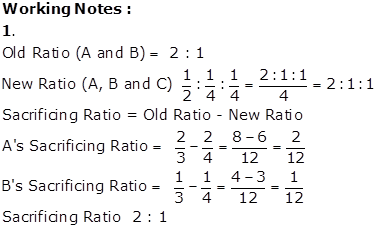

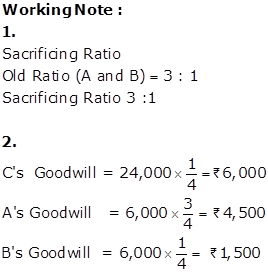

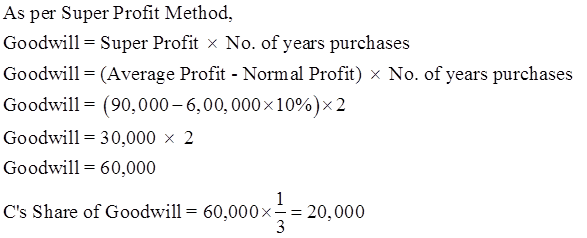

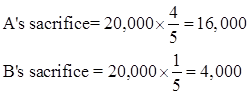

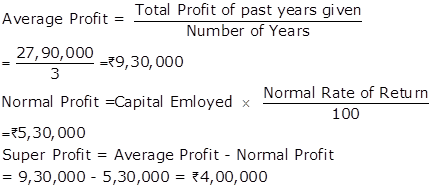

Working Notes:

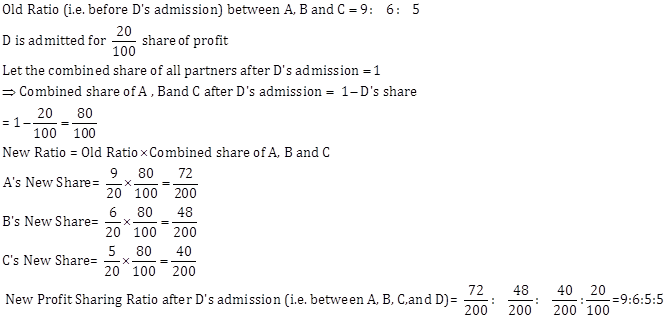

1.

![]()

Admission of a Partner Exercise 5.88

Solution Ex. 26

|

Journal |

|||||

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

Cash A/c |

Dr. |

13,600 |

|||

|

---------To C's Capital A/c |

10,000 |

||||

|

---------To Premium for Goodwill A/c |

3,600 |

||||

|

(Being capital and share of goodwill brought in by C) |

|||||

|

|

Premium for Goodwill A/c |

Dr. |

|

3,600 |

|

|

|

---------To A's Capital A/c |

|

|

|

900 |

|

|

---------To B's Capital A/c |

|

|

|

2,700 |

|

|

(Being C's share of goodwill transferred to A and B in their sacrificing ratio i.e. 3:1 ) |

|

|

|

|

|

|

Profit and Loss Appropriation A/c |

Dr. |

|

24,000 |

|

|

|

---------To A's Capital A/c |

|

|

|

13,000 |

|

|

---------To, B's Capital A/c |

|

|

|

7,000 |

|

|

---------To, C's Capital A/c |

|

|

|

4,000 |

|

|

(Being Profit after C's admission distributed ) |

|

|

|

|

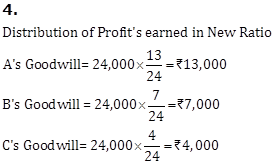

Working Notes:

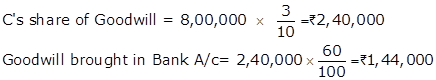

1.

![]()

Solution Ex. 27

|

Journal |

|||||

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

Cash A/c |

Dr. |

30,000 |

|||

|

---------To Premium for Goodwill A/c |

30,000 |

||||

|

(Being X brought his share of goodwill ) |

|||||

|

|

Premium for Goodwill A/c |

Dr. |

|

30,000 |

|

|

|

Y's Capital A/c |

Dr. |

|

7,500 |

|

|

|

---------To X's Capital A/c |

|

|

|

37,500 |

|

|

(Being Z share of gain and goodwill transferred to X's Capital Account) |

|

|

|

|

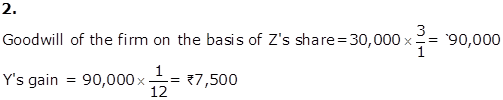

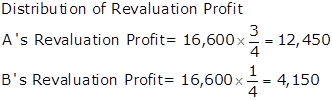

Working Notes:

1.

X's will get Z's share of goodwill + Y's share of gain

i.e. 30,000 + 7,500 =Rs.37,500

Solution Ex. 28

|

Journal |

|||||

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

Cash or Bank A/c |

Dr. |

8,37,500 |

|||

|

--------- To Payal's Capital A/c To Premium for Goodwill A/c |

5,00,000 3,37,500 |

||||

|

(Being Capital and share of Goodwill brought by Payal) |

|||||

|

|

Premium for Goodwill A/c |

Dr. |

|

3,37,500 |

|

|

|

To Ansul's Capital A/c |

|

|

|

2,02,500 |

|

|

--------- To Parul's Capital A/c |

|

|

|

1,35,000 |

|

|

(Being Payal's share of goodwill transferred to Ansul and Parul's Capital Accounts in their sacrificing ratio) |

|

|

|

|

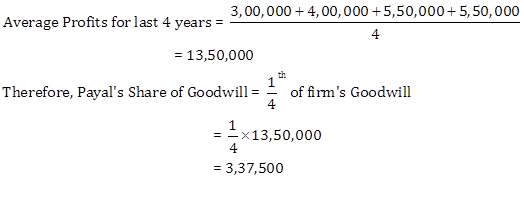

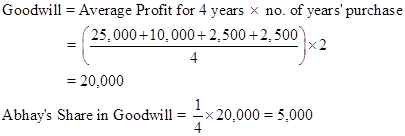

Working Notes: Calculation of Payal's Share of Goodwill

Calculation of Adjusted Profits

|

Years |

2015-16 |

2016-17 |

2017-18 |

2018-19 |

|

Profit /(Loss) |

4,00,000 |

5,00,000 |

6,00,000 |

7,00,000 |

|

Adjustments: Undervaluation of Stock Overvaluation of Stock Management Cost |

- - (1,00,000) |

- - (1,00,000) |

50,000 - (1,00,000) |

- (50,000) (1,00,000) |

|

Normal Profit |

3,00,000 |

4,00,000 |

5,50,000 |

5,50,000 |

Solution Ex. 29

|

Journal |

|||||

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

A's Capital A/c |

Dr. |

1,800 |

|||

|

B's Capital A/c |

Dr. |

1,200 |

|||

|

------To Goodwill A/c |

3,000 |

||||

|

(Being Goodwill written-off) |

|||||

|

|

Cash A/c |

Dr. |

|

40,000 |

|

|

|

-----To C's Capital A/c |

|

|

|

30,000 |

|

|

-----To Premium for Goodwill A/c |

|

|

|

10,000 |

|

|

(Being C brought capital and his share of goodwill in cash) |

|

|

|

|

|

|

Premium for Goodwill |

Dr. |

|

10,000 |

|

|

|

------To A's Capital A/c |

|

|

|

5,000 |

|

|

------To B's Capital A/c |

|

|

|

5,000 |

|

|

(Being Premium of Goodwill distributed) |

|

|

|

|

Solution Ex. 30

|

Journal |

|||||

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

Anu's Capital A/c |

Dr. |

3,30,000 |

|||

|

Bhagwan's Capital A/c |

Dr. |

1,10,000 |

|||

|

-----To Goodwill A/c |

4,40,000 |

||||

|

( Being old goodwill written off in old ratio) |

|||||

|

Cash A/c |

Dr. |

1,50,000 |

|||

|

-----To Raja's Capital A/c |

1,00,000 |

||||

|

-----To Premium for Goodwill A/c |

50,000 |

||||

|

(Being capital and goodwill brought in by raju) |

|||||

|

|

Premium for Goodwill A/c |

Dr. |

|

50,000 |

|

|

|

Bhagwan's Capital A/c |

Dr. |

|

37,500 |

|

|

|

-----To, Anu's Capital A/c |

|

|

|

87,500 |

|

|

(Being premium for goodwill adjusted ) |

|

|

|

|

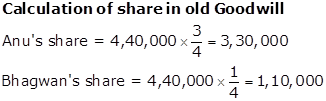

Working Notes:

1.

Solution Ex. 31

|

Journal |

|||||

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

Stock A/c |

Dr. |

60,000 |

|||

|

Debtors A/c |

Dr. |

80,000 |

|||

|

Land A/c |

Dr. |

1,00,000 |

|||

|

Plant and Machinery A/c |

Dr. |

40,000 |

|||

|

---------To Z's Capital A/c |

1,30,000 |

||||

|

---------To Premium for Goodwill A/c |

1,50,000 |

||||

|

(Being Z brought assets for his share of goodwill and Capital) |

|||||

|

|

Premium for Goodwill A/c |

Dr. |

|

1,50,000 |

|

|

|

---------To X's Capital A/c |

|

|

|

90,000 |

|

|

---------To Y's Capital A/c |

|

|

|

60,000 |

|

|

(Being Z's share of goodwill distributed between X and Y in sacrificing ratio ) |

|

|

|

|

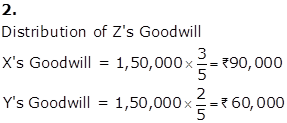

Working Notes:

1.

![]()

Admission of a Partner Exercise 5.89

Solution Ex. 32

|

Journal |

|||||

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

Cash A/c |

Dr. |

14,000 |

|||

|

---------To C's Capital A/c |

8,000 |

||||

|

---------To Premium for Goodwill A/c |

6,000 |

||||

|

(Being C brought capital and his share of goodwill) |

|||||

|

|

Premium for Goodwill A/c |

Dr. |

|

6,000 |

|

|

|

---------To A's Capital A/c |

|

|

|

2,000 |

|

|

---------To B's Capital A/c |

|

|

|

4,000 |

|

|

(Being C's share of goodwill distributed between A and B in sacrificing ratio i.e. 1:2 ) |

|

|

|

|

|

|

A's Capital A/c |

Dr. |

|

2,000 |

|

|

|

B's Capital A/c |

Dr. |

|

4,000 |

|

|

|

---------To Cash A/c |

|

|

|

6,000 |

|

|

(Being amount of goodwill withdrawn by A and B) |

|

|

|

|

|

Partner's Capital Accounts |

|||||||||

|

Dr |

|

Cr |

|||||||

|

Particulars |

A |

B |

C |

Particulars |

A |

B |

C |

||

|

To Cash A/c |

2,000 |

4,000 |

|

By Balance b/d |

8,000 |

10,000 |

|

||

|

To Balance c/d |

8,000 |

10,000 |

8,000 |

By Cash A/c |

|

8,000 |

|||

|

|

By Premium for Goodwill A/c |

2,000 |

4,000 |

|

|||||

|

10,000 |

14,000 |

8,000 |

10,000 |

14,000 |

8,000 |

||||

|

|

|

|

|

|

|||||

Solution Ex. 33

|

Journal |

|||||

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

Cash A/c |

Dr. |

3,50,000 |

|||

|

---------To C's Capital A/c |

2,00,000 |

||||

|

---------To Premium for Goodwill A/c |

1,50,000 |

||||

|

(Being C brought capital and Premium for goodwill) |

|||||

|

|

Premium for Goodwill A/c |

Dr. |

|

1,50,000 |

|

|

|

---------To A's Capital A/c |

|

|

|

1,10,000 |

|

|

---------To B's Capital A/c |

|

|

|

40,000 |

|

|

(Being premium for Goodwill distributed) |

|

|

|

|

|

|

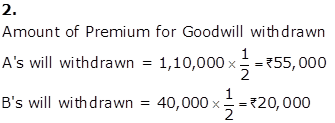

A's Capital A/c |

Dr. |

|

55,000 |

|

|

|

B's Capital A/c |

Dr. |

|

20,000 |

|

|

|

---------To Cash A/c |

|

|

|

75,000 |

|

|

(Being half of the goodwill withdrawn by A and B) |

|

|

|

|

Working Notes:

1.

Solution Ex. 34

|

Journal |

|||||

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

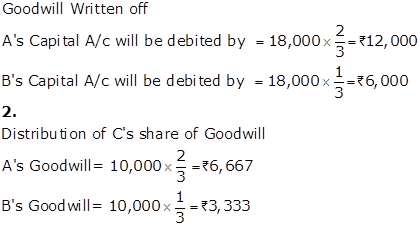

A's Capital A/c |

Dr. |

12,000 |

|||

|

B's Capital A/c |

Dr. |

6,000 |

|||

|

---------To Goodwill A/c |

18,000 |

||||

|

( Being goodwill written-off) |

|||||

|

|

Cash A/c |

Dr. |

|

38,000 |

|

|

|

---------To C's Capital A/c |

|

|

|

30,000 |

|

|

---------To Premium for Goodwill A/c |

|

|

|

8,000 |

|

|

(Being C brought capital and goodwill) |

|

|

|

|

|

|

Premium for Goodwill A/c |

Dr. |

|

8,000 |

|

|

|

C's Capital A/c |

Dr. |

|

2,000 |

|

|

|

---------To A's Capital A/c |

|

|

|

6,667 |

|

|

---------To B's Capital A/c |

|

|

|

3,333 |

|

|

(Being C's share of goodwill distributed between A and B in sacrificing Ratio) |

|

|

|

|

Working Notes:

1.

Solution Ex. 35

|

Journal |

|||||

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

|

|

|

|||

|

Bank A/c |

Dr. |

15,000 |

|||

|

----------To Premium for Goodwill A/c |

15,000 |

||||

|

(Being goodwill brought in cash) |

|||||

|

|

|

||||

|

Premium for Goodwill A/c |

Dr. |

15,000 |

|||

|

----------To A's Capital A/c |

10,000 |

||||

|

----------To B's Capital A/c |

5,000 |

||||

|

(Being goodwill distributed between A and B in sacrificing ratio) |

|||||

|

C's Capital A/c |

Dr. |

10,000 |

|||

|

|

----------To A's capital A/c |

|

|

|

6,667 |

|

|

----------To B's Capital A/c |

|

|

|

3,333 |

|

|

(Being goodwill adjusted) |

|

|

|

|

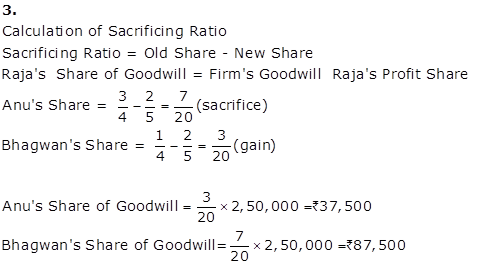

Working Note:

1.

Calculation of Sacrificing Ratio

2.

Calculation of share in goodwill of new partner

Solution Ex. 36

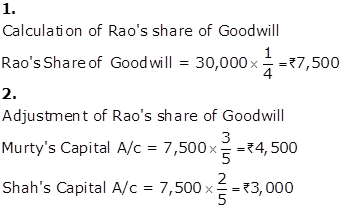

A) Where there is no Goodwill Account

|

Journal |

|||||

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

Rao's Capital A/c |

Dr. |

7,500 |

|||

|

---------To Murty's Capital A/c |

4,500 |

||||

|

---------To Shah's Capital A/c |

3,000 |

||||

|

(Being Rao's share of goodwill charged from his capital account and distributed between Murty and Shah in sacrificing ratio i.e. 3:2) |

|||||

B) When Goodwill appears at 10,000

|

Journal |

|||||

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

Murty's Capital A/c |

Dr. |

6,000 |

|||

|

Shah's Capital A/c |

Dr. |

4,000 |

|||

|

---------To Goodwill A/c |

10,000 |

||||

|

(Being goodwill written-off at the time of Rao's admission in old ratio) |

|||||

|

|

Rao's Capital A/c |

Dr. |

|

7,500 |

|

|

|

---------To Murty's Capital A/c |

|

|

|

4,500 |

|

|

---------To Shah's Capital A/c |

|

|

|

3,000 |

|

|

(Being Rao's share of goodwill charged from his capital Account and distributed between Murty and Shah in sacrificing ratio i.e. 3:2) |

|

|

|

|

Working Notes:

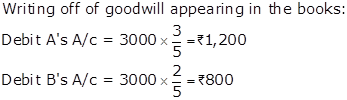

Solution Ex. 37

|

Journal |

|||||

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

A's Capital A/c |

Dr. |

1,200 |

|||

|

B's Capital A/c |

Dr. |

800 |

|||

|

---------To Goodwill A/c |

2,000 |

||||

|

(Being goodwill written-off at the time of C's admission) |

|||||

|

|

Cash A/c |

Dr. |

|

10,000 |

|

|

|

---------To C's Capital A/c |

|

|

|

10,000 |

|

|

(Being Capital brought by C) |

|

|

|

|

|

|

C's Capital A/c |

Dr. |

|

3,000 |

|

|

|

---------To A's Capital A/c |

|

|

|

1,800 |

|

|

---------To B's Capital A/c |

|

|

|

1,200 |

|

|

(Being C's share of capital charged from his capital distributed between A and B in their sacrificing ratio) |

|

|

|

|

Working Notes:

Solution Ex. 38

|

Journal |

|||||

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

|

|

|

|||

|

Bank A/c |

Dr. |

3,30,000 |

|||

|

----------To D's Capital A/c |

1,20,000 |

||||

|

----------To E's Capital A/c |

1,20,000 |

||||

|

----------To Premium for Goodwill A/c |

90,000 |

||||

|

(Being capital and goodwill brought in cash) |

|||||

|

|

|||||

|

C's Capital A/c |

Dr. |

36,000 |

|||

|

E's Capital A/c |

Dr. |

45,000 |

|||

|

Premium for goodwill A/c |

Dr. |

90,000 |

|||

|

----------To A's Capital A/c |

|

1,35,000 |

|||

|

----------To B's Capital A/c |

36,000 |

||||

|

(Being goodwill adjusted) |

|||||

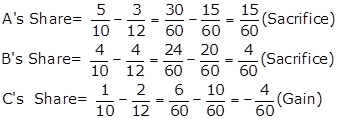

Working Notes:

1.

Calculation of Sacrificing Ratio

Old ratio (A: B: C) = 5: 4: 1

New ratio (A: B: C: D: E) = 3: 4: 2: 2: 1

Sacrificing (or Gaining) Ratio = Old Ratio - New Ratio

2.

Adjustment of Goodwill

Admission of a Partner Exercise 5.90

Solution Ex. 39

|

Journal |

|||||

|

Date |

Particulars |

L.F. |

Debit (Rs.) |

Credit (Rs.) |

|

|

|

|

|

|

|

|

|

(a) |

Mohan's Capital A/c |

Dr. |

|

1,21,500 |

|

|

|

Sohan's Capital A/c |

Dr. |

|

81,000 |

|

|

|

-----To Goodwill A/c |

|

|

|

2,02,500 |

|

|

(Being old goodwill written-off in old ratio) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Ram's Capital A/c |

Dr. |

|

50,625 |

|

|

|

-----To Mohan's Capital A/c |

|

|

|

30,375 |

|

|

-----To Sohan's Capital A/c |

|

|

|

20,250 |

|

|

(Being premium not brought debited to Ram and credited to sacrificing partners) |

|

|

|

|

|

|

|

|

|

|

|

|

(b) |

Mohan's Capital A/c |

Dr. |

|

1,500 |

|

|

|

Sohan's Capital A/c |

Dr. |

|

1,000 |

|

|

|

-----To Goodwill A/c |

|

|

|

2,500 |

|

|

(Being old goodwill written-off in old ratio) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Ram's Capital A/c |

Dr. |

|

50,625 |

|

|

|

-----To Mohan's Capital A/c |

|

|

|

30,375 |

|

|

-----To Sohan's Capital A/c |

|

|

|

20,250 |

|

|

(Being premium not brought debited to Ram and credited to sacrificing partners) |

|

|

|

|

|

|

|

|

|

|

|

|

(c) |

Mohan's Capital A/c |

Dr. |

|

1,23,000 |

|

|

|

Sohan's Capital A/c |

Dr. |

|

82,000 |

|

|

|

-----To Goodwill A/c |

|

|

|

2,02,500 |

|

|

(Being old goodwill written-off in old ratio) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Ram's Capital A/c |

Dr. |

|

50,625 |

|

|

|

-----To Mohan's Capital A/c |

|

|

|

30,375 |

|

|

-----To Sohan's Capital A/c |

|

|

|

20,250 |

|

|

(Being premium not brought debited to Ram and credited to sacrificing partners) |

|

|

|

|

|

|

|

|

|

|

|

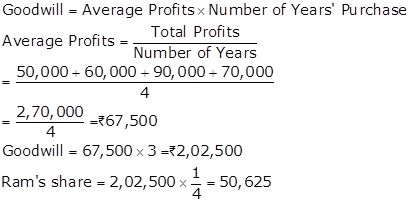

Working Notes:

WN1: Calculation of Goodwill

Note: Since no information is given about the share of sacrifice, it is assumed that the old partners are sacrificing in their old profit sharing ratio.

Solution Ex. 40

|

Journal |

|||||

|

Sr. no. |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

|

|

|

|||

|

a) |

Sooraj's Capital A/c |

Dr. |

1,50,000 |

||

|

----------To Mohan's Capital A/c |

1,20,000 |

||||

|

----------To Gopal's Capital A/c |

30,000 |

||||

|

(Being goodwill not raised and written off in their sacrificing ratio) |

|||||

|

b) |

Goodwill A/c |

Dr. |

4,50,000 |

||

|

To Madan's Capital A/c |

|

2,70,000 |

|||

|

To Gopal's Capital A/c |

|

1,80,000 |

|||

|

(Being goodwill raised in the books of the firm)

Madan's Capital A/c Gopal's Capital A/c Sooraj's Capital A/c To Goodwill A/c (Being entry passed to write off the amount of goodwill raised in the new profit sharing ratio of partners) |

Dr. Dr. Dr.

|

1,50,000 1,50,000 1,50,000

|

4,50,000 |

||

Working Notes:

1.

Calculation of Sacrificing Ratio

Old ratio = 5: 4: 1

New ratio = 1:1:1

Sacrificing (or Gaining) Ratio = Old Ratio - New Ratio

Solution Ex. 41

|

Journal |

|||||

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

Bank A/c |

Dr. |

3,20,000 |

|||

|

---------To Charu's Capital A/c |

3,20,000 |

||||

|

(Being capital brought in by Charu) |

|||||

|

|

Charu's Current A/c |

Dr. |

|

1,00,000 |

|

|

|

---------To Anil's Capital A/c |

|

|

|

50,000 |

|

|

---------To Sunil's Capital A/c |

|

|

|

50,000 |

|

|

(Being Charu's share of goodwill adjusted through current accounts) |

|

|

|

|

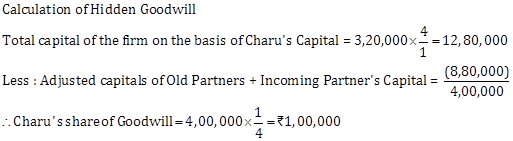

Working Notes:

Admission of a Partner Exercise 5.91

Solution Ex. 42

Solution Ex. 43

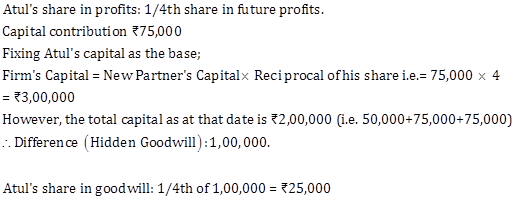

|

Journal |

|||||

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

Bank/ Cash A/c |

Dr. |

75,000 |

|||

|

---------To Atul's Capital A/c |

75,000 |

||||

|

(Being capital brought in) |

|||||

|

|

Atul's Capital A/c |

Dr. |

|

25,000 |

|

|

|

---------To Bhuwan's Capital A/c |

|

|

|

15,000 |

|

|

---------To Shivam's Capital A/c |

|

|

|

10,000 |

|

|

(Being goodwill distributed in sacrificing ratio of 3:2) |

|

|

|

|

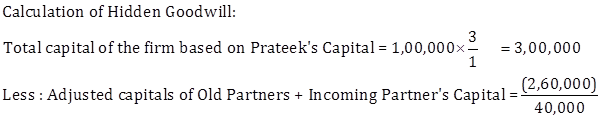

Solution Ex. 44

Solution Ex. 45

Solution Ex. 46

|

Journal |

|||||

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

Ajay's Capital A/c |

Dr. |

2,00,000 |

|||

|

---------To Asin's Capital A/c |

1,00,000 |

||||

|

---------To Shreya's Capital A/c |

1,00,000 |

||||

|

(Being Ajay's share of goodwill distributed among the old partners in their sacrificing ratio 1:1) |

|||||

Working Notes:

Solution Ex. 47

|

Journal Entries |

|||||||

|

S.No. |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|||

|

Case (a) |

|||||||

|

Cash A/c |

Dr. |

24,000 |

|||||

|

To Ghosh's Capital A/c |

20,000 |

||||||

|

To Premium for Goodwill A/c |

4,000 |

||||||

|

(Capital and Goodwill his share brought by Ghosh) |

|||||||

|

Premium for Godwill A/c |

Dr. |

4,000 |

|||||

|

To Verma's Capital A/c |

2,500 |

||||||

|

To Sharma's Capital A/c |

1,500 |

||||||

|

(Goodwill brought by Ghosh credited to Old Partners in Sacrificing ratio) |

|||||||

|

Case (b) |

Cash A/c |

Dr. |

24,000 |

||||

|

To Ghosh Capital A/c |

20,000 |

||||||

|

To Premium for Goodwill A/c |

4,000 |

||||||

|

(Capital and Goodwill brought by Ghosh for (1/5) share of profit) |

|||||||

|

Premium for Goodwill A/c |

Dr. |

4,000 |

|||||

|

To Verma's Capital A/c |

2,500 |

||||||

|

To Sharma's Capital A/c |

1,500 |

||||||

|

(Goodwill brought by Ghosh credited in Old Partner in Sacrificing Ratio) |

|||||||

|

Verma's Capital A/c |

Dr. |

2,500 |

|||||

|

Sharma's Capital A/c |

Dr. |

1,500 |

|||||

|

To Cash A/c |

4,000 |

||||||

|

(Amount of Premium for Goodwill withdrawn by Old Partners) |

|||||||

|

Case (c) |

Cash A/c |

Dr. |

24,000 |

||||

|

To Ghosh's Capital A/c |

20,000 |

||||||

|

To Premium for Goodwill A/c |

4,000 |

||||||

|

(Capital and Goodwill brought by Ghosh for (1/5) share of profit) |

|||||||

|

Premium for Goodwill A/c |

Dr. |

4,000 |

|||||

|

To Verma's Capital A/c |

2,500 |

||||||

|

To Sharma's Capital A/c |

1,500 |

||||||

|

(Premium for Goodwill credited to Old Partner's Capital Account in sacrificing ratio) |

|||||||

|

Verma's Capital A/c |

Dr. |

1,250 |

|||||

|

Sharma's Capital A/c |

750 |

||||||

|

To Cash A/c |

2,000 |

||||||

|

(Half of the amount of premium for goodwill withdrawn by Old partners) |

|||||||

|

Case (d) |

No entry: Goodwill was not brought into firm |

||||||

Solution Ex. 48

|

Journal |

|||||

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

Bank A/c |

Dr. |

3,00,000 |

|||

|

---------To Hina's Capital A/c |

3,00,000 |

||||

|

(Being capital brought in by Hina) |

|||||

|

|

Hina's Current A/c |

Dr. |

|

84,000 |

|

|

|

---------To Disha's Current A/c |

|

|

|

50,400 |

|

|

---------To Divya's Current A/c |

|

|

|

33,600 |

|

|

(Being Hina's Share of goodwill adjusted through current accounts) |

|

|

|

|

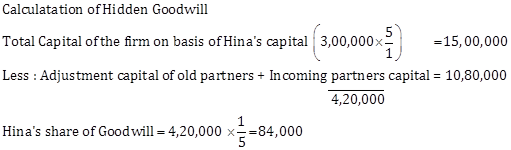

Working Notes:

Solution Ex. 49

|

Journal |

|||||

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

Cash A/c |

Dr. |

50,000 |

|||

|

Machinery A/c |

Dr. |

70,000 |

|||

|

---------To Premium for Goodwill A/c |

1,20,000 |

||||

|

(Being cash Rs.50,000 and Machinery Rs. 70,000 brought in by G for his share of Goodwill) |

|||||

|

|

Premium for Goodwill A/c |

Dr. |

|

1,20,000 |

|

|

|

---------To E's Capital A/c |

|

|

|

1,20,000 |

|

|

(Being G share of goodwill transferred to E's Capital Account) |

|

|

|

|

|

|

F's Capital A/c |

Dr. |

|

30,000 |

|

|

|

---------To E's Capital A/c |

|

|

|

30,000 |

|

|

(Being F's share of gain in goodwill charged from his capital and transferred to E's capital) |

|

|

|

|

Working Notes:

Admission of a Partner Exercise 5.92

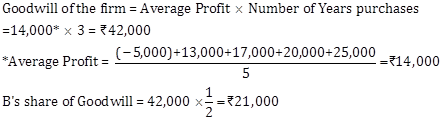

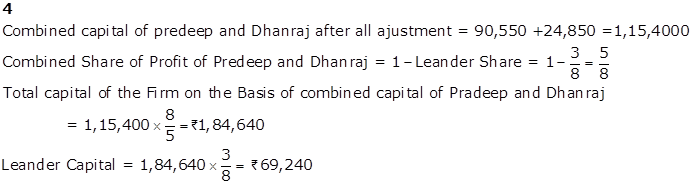

Solution Ex. 50

|

Capital as on April 01, 2013 |

2,50,000 |

|

Less: Loss in 2014 |

(5,000) |

|

Add: Profit in 2015 |

13,000 |

|

Add: Profit in 2016 |

17,000 |

|

Add: Profit in 2017 |

20,000 |

|

Add: Profit in 2018 |

25,000 |

|

|

3,20,000 |

|

Less: Drawings |

(40,000) |

|

A's Capital as on March 31,2018 |

2,80,000 |

|

|

|

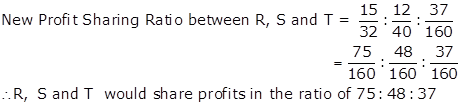

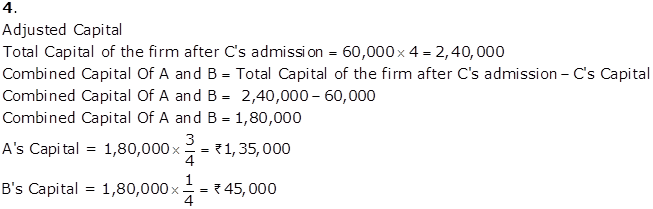

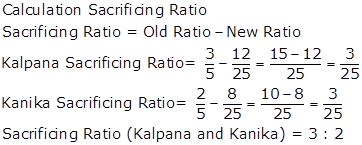

![]()

|

Journal |

|||||

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

Cash A/c |

Dr. |

3,01,000 |

|||

|

---------To B's Capital A/c |

Dr. |

2,80,000 |

|||

|

---------To Premium for Goodwill A/c |

21,000 |

||||

|

(Being capital and goodwill brought in) |

|||||

|

|

Premium for Goodwill A/c |

Dr. |

|

21,000 |

|

|

|

---------To A's Capital A/c |

|

|

|

21,000 |

|

|

(Being B's share of goodwill transferred to A's capital Accounts) |

|

|

|

|

Solution Ex. 51

|

Journal |

|||||

|

Sr. No. |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

|

|

|

|||

|

(i) |

Revaluation A/c |

Dr. |

16,000 |

||

|

----------To Machinery A/c |

16,000 |

||||

|

(Being value of machinery decreased) |

|||||

|

(ii) |

Building A/c |

Dr. |

40,000 |

||

|

----------To Revaluation A/c |

40,000 |

||||

|

(Being value of building increased) |

|||||

|

(iii) |

Revaluation A/c |

Dr. |

4,000 |

||

|

----------To Provision for doubtful Debts A/c |

4,000 |

||||

|

(Being provision created on debtors) |

|||||

|

(iv) |

Revaluation A/c |

Dr. |

12,000 |

||

|

----------To provision for warranty claims A/c |

12,000 |

||||

|

(Being liability recorded) |

|||||

Solution Ex. 52

|

Journal |

|||||

|

Sr. No. |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

|

|

|

|||

|

(i) |

Investment A/c |

Dr. |

20,000 |

||

|

----------To Revaluation A/c |

20,000 |

||||

|

(Being investments recorded) |

|||||

|

(ii) |

Revaluation A/c |

Dr. |

5,000 |

||

|

----------To Creditors A/c |

5,000 |

||||

|

(Being liability recorded) |

|||||

|

(iii) |

Creditors A/c |

Dr. |

1,600 |

||

|

----------To Revaluation A/c |

1,600 |

||||

|

(Being liability decreased) |

|||||

Solution Ex. 54

|

Journal |

|||||

|

Sr. No. |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

|

|

|

|||

|

(i) |

Revaluation A/c |

Dr. |

76,000 |

||

|

----------To Stock A/c |

40,000 |

||||

|

----------To Furniture A/c |

36,000 |

||||

|

(Being value of assets decreased) |

|||||

|

(ii) |

X's Capital A/c |

Dr. |

45,600 |

||

|

Y's Capital A/c |

Dr. |

30,400 |

|||

|

----------To Revaluation A/c |

76,000 |

||||

|

(Being loss on revaluation transferred to partners capital A/c) |

|||||

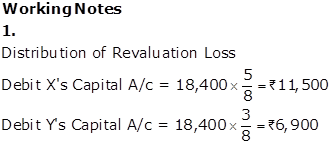

Solution Ex. 55

|

Journal |

|||||

|

Sr. No. |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

|

|

|

|||

|

(i) |

X's Capital A/c |

Dr. |

24,000 |

||

|

Y's Capital A/c |

Dr. |

16,000 |

|||

|

----------To Investment A/c |

40,000 |

||||

|

(Being half of the investment taken over by X and Y) |

|||||

|

(ii) |

Investment A/c |

Dr. |

10,000 |

||

|

----------To Revaluation A/c |

10,000 |

||||

|

(Being value of investment increased) |

|||||

|

(iii) |

Revaluation A/c |

Dr. |

10,000 |

||

|

----------To X's Capital A/c |

6,000 |

||||

|

----------To Y's Capital A/c |

4,000 |

||||

|

(Being profit on revaluation transferred to partners capital A/c) |

|||||

Solution Ex. 53

|

Journal |

|||||

|

Sr. No. |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

|

|

|

|||

|

(a) |

Provision for doubtful debts A/c |

Dr. |

5,000 |

||

|

----------To Revaluation A/c |

5,000 |

||||

|

(Being provision on debtors reduced) |

|||||

|

(b) |

Revaluation A/c |

Dr. |

5,000 |

||

|

----------To X's Capital A/c |

3,000 |

||||

|

----------To Y's Capital A/c |

2,000 |

||||

|

(Being profit on revaluation transferred to partners' capital A/c) |

|||||

Admission of a Partner Exercise 5.93

Solution Ex. 56

|

Journal |

|||||

|

Sr. No. |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

|

|

|

|||

|

(i) |

Bad Debts A/c |

Dr. |

6,000 |

||

|

----------To Debtors A/c |

6,000 |

||||

|

(Being bad debts incurred) |

|||||

|

(ii) |

Provision for doubtful debts A/c |

Dr. |

6,000 |

||

|

----------To Bad Debts A/c |

6,000 |

||||

|

(Being bad debts adjusted) |

|||||

|

(iii) |

Revaluation A/c |

Dr. |

1,500 |

||

|

----------To Provision for doubtful debts A/c |

1,500 |

||||

|

(Being provision created) |

|||||

|

(iv) |

X's Capital A/c |

Dr. |

900 |

||

|

Y's Capital A/c |

Dr. |

600 |

|||

|

----------To Revaluation A/c |

1,500 |

||||

|

(Being loss on revaluation transferred to partners' capital A/c) |

|||||

Working Notes:

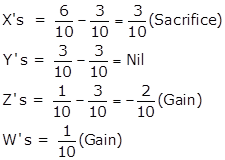

1.

Calculation of provision for Doubtful Debts

Solution Ex. 57

|

Journal |

|||||

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

|

|

|

|||

|

Z's Capital A/c |

Dr. |

7,000 |

|||

|

W's Capital A/c |

Dr. |

3,500 |

|||

|

----------To X's Capital A/c |

10,500 |

||||

|

(Being adjustment entry made) |

|||||

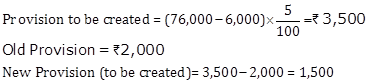

Working Notes:

1.

|

Revaluation Account |

||||

|

Dr. |

|

|

|

Cr. |

|

Particular |

|

Rs. |

Particular |

Rs. |

|

To Plant and Machinery A/c |

|

10,000 |

By Land and Building A/c |

50,000 |

|

To Outstanding Expenses A/c |

|

15,000 |

By Trade Creditors A/c |

10,000 |

|

To Profit t/f to: |

|

|

|

|

|

-----X's Capital A/c |

21,000 |

|

|

|

|

-----Y's Capital A/c |

10,500 |

|

|

|

|

-----Z's Capital A/c |

3,500 |

35,000 |

|

|

|

|

|

60,000 |

|

60,000 |

2.

Calculation of Sacrificing or gain

Old Ratio X: Y: Z = 6: 3: 1

New Ratio X: Y: Z: W = 3: 3: 3 :1

Sacrificing (or Gaining) Ratio = Old Ratio - New Ratio

3.

Adjustment of Revaluation Profit

Solution Ex. 58

|

Journal |

|||||

|

Sr. No. |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

|

|

|

|||

|

(i) |

Creditors A/c |

Dr. |

5,000 |

||

|

Building A/c |

Dr. |

40,000 |

|||

|

Investment A/c |

Dr. |

15,000 |

|||

|

----------To Revaluation A/c |

60,000 |

||||

|

(Being increase in assets and decrease in liabilities transferred to revaluation account) |

|||||

|

(ii) |

Revaluation A/c |

Dr. |

10,000 |

||

|

----------To Provision for doubtful debts A/c |

5,000 |

||||

|

----------To Reserve for outstanding Repair Bill A/c |

2,000 |

||||

|

----------To Creditors A/c |

3,000 |

||||

|

(Being increase in liabilities, decrease in assets and reserves and provision created transferred to revaluation account) |

|||||

|

(iii) |

Revaluation A/c |

Dr. |

50,000 |

||

|

----------To old partners capital A/c |

50,000 |

||||

|

(Being profit on revaluation transferred to partners' capital) |

|||||

Solution Ex. 59

|

Journal |

|||||

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

General Reserve A/c |

Dr. |

1,50,000 |

|||

|

---------To X's Capital A/c |

90,000 |

||||

|

---------To Y's Capital A/c |

60,000 |

||||

|

(Being balance in General Reserves adjusted in old ratio) |

|||||

|

|

X's Capital A/c |

Dr. |

|

12,000 |

|

|

|

Y's Capital A/c |

Dr. |

|

8,000 |

|

|

|

---------To Profit and Loss A/c |

|

|

|

20,000 |

|

|

(Being debit balance in PandL A/c adjusted in old ratio) |

|

|

|

|

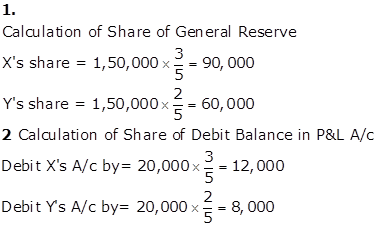

Working Notes:

Solution Ex. 60

|

Journal |

|||||

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

General Reserve A/c |

Dr. |

2,50,000 |

|||

|

Profit and Loss A/c |

Dr. |

50,000 |

|||

|

---------To X's Capital A/c |

2,00,000 |

||||

|

---------To Y's Capital A/c |

1,00,000 |

||||

|

|

(Being General Reserve A/c and balance in PandL adjusted in old ratio) |

|

|

|

|

Working Note:

Admission of a Partner Exercise 5.94

Solution Ex. 61

|

Journal |

|||||

|

Sr. No. |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

|

|

|

|||

|

(a) |

General Reserve A/c |

Dr. |

36,000 |

||

|

Contingency Reserve A/c |

Dr. |

6,000 |

|||

|

Profit and Loss A/c |

Dr. |

18,000 |

|||

|

----------To X's Capital A/c |

30,000 |

||||

|

----------To Y's Capital A/c |

18,000 |

||||

|

----------To Z's Capital A/c |

12,000 |

||||

|

(Being reserves distributed) |

|||||

|

X's Capital A/c |

Dr. |

12,000 |

|||

|

Y's Capital A/c |

Dr. |

7,200 |

|||

|

Z's Capital A/c |

Dr. |

4,800 |

|||

|

----------To Advertisement Suspense A/c |

24,000 |

||||

|

(Being advertisement suspense distributed) |

|||||

|

(b) |

General Reserve A/c |

Dr. |

84,000 |

||

|

----------To A's capital A/c |

48,000 |

||||

|

----------To B's Capital A/c |

36,000 |

||||

|

(Being general reserve distributed) |

|||||

|

A's capital A/c |

Dr. |

4,800 |

|||

|

B's Capital A/c |

Dr. |

3,600 |

|||

|

----------To Profit and Loss A/c |

8,400 |

||||

|

(Being profit and loss a/c distributed) |

|||||

|

(c) |

Workman Compensation Reserve A/c |

Dr. |

72,000 |

||

|

----------To X's Capital A/c |

36,000 |

||||

|

----------To Y's Capital A/c |

36,000 |

||||

|

(Being workman compensation reserve distributed) |

|||||

|

(d) |

Workman Compensation Reserve A/c |

Dr. |

72,000 |

||

|

----------To Workman Compensation Claim A/c |

48,000 |

||||

|

----------To X's Capital A/c |

12,000 |

||||

|

----------To Y's Capital A/c |

12,000 |

||||

|

(Being surplus workmen compensation reserve distributed) |

|||||

|

(e) |

Investment Fluctuation Reserve A/c |

Dr. |

24,000 |

||

|

----------To Investment A/c |

10,000 |

||||

|

----------To X's Capital A/c |

7,000 |

||||

|

----------To Y's Capital A/c |

7,000 |

||||

|

(Being surplus investment fluctuation reserve distributed) |

|||||

|

(f) |

General Reserve A/c |

Dr. |

4,800 |

||

|

----------To Investment Fluctuation Reserve A/c |

960 |

||||

|

----------To X's Capital A/c |

1,920 |

||||

|

----------To Y's Capital A/c |

1,920 |

||||

|

(Being surplus general reserve distribution) |

|||||

|

(g) |

C's Current A/c |

Dr. |

36,000 |

||

|

D's Current A/c |

Dr. |

18,000 |

|||

|

----------To A's Current A/c |

54,000 |

||||

|

(Being adjustment entry made) |

|||||

Working Notes:

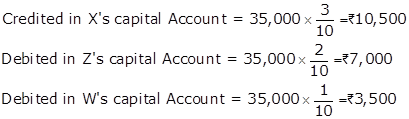

1.

Calculation of Sacrifice or Gain

Old Ratio (A, B and C) = 6: 3: 1

New Ratio (A, B, C and D) = 3: 3: 3: 1

Sacrificing (or Gaining Ratio) = Old Ratio - New Ratio

2.

Calculation and Adjustment of Net Effect

|

General Reserve |

1,50,000 |

|

Contingency Reserve |

60,000 |

|

Profit and Loss A/c (Cr.) |

90,000 |

|

|

3,00,000 |

|

Less: Advertisement Suspense A/c (Dr.) |

(1,20,000) |

|

Net Effect |

1,80,000 |

Adjustment

Admission of a Partner Exercise 5.95

Solution Ex. 62

|

Balance Sheet (before admission of W) |

|||||

|

Liabilities |

Rs. |

Assets |

Rs. |

||

|

|

Motors |

1,200 |

|||

|

Capital : |

Furniture |

400 |

|||

|

|

X |

1,500 |

Stock |

2,650 |

|

|

|

Y |

1,750 |

Debtors |

3,780 |

|

|

|

Z |

2,000 |

5,250 |

Cash (Balancing Fig.) |

220 |

|

Other Liabilities |

3,000 |

||||

|

|

8,250 |

|

8,250 |

||

|

Journal |

|||||

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

Cash A/c |

Dr. |

3,300 |

|||

|

---------To W's Capital A/c |

1,800 |

||||

|

---------To Premium for Goodwill A/c |

1,500 |

||||

|

(Being goodwill and capital brought in by W in cash) |

|||||

|

|

Premium for Goodwill A/c |

Dr. |

|

1,500 |

|

|

|

---------To X's Capital A/c |

|

|

|

500 |

|

|

---------To Y's Capital A/c |

|

|

|

500 |

|

|

---------To Z's Capital A/c |

|

|

|

500 |

|

|

(Being premium for goodwill distributed between X,Y and Z in sacrificing ratio) |

|

|

|

|

|

|

Revaluation A/c |

Dr. |

|

270 |

|

|

|

---------To Motors A/c |

|

|

|

250 |

|

|

---------To Furniture A/c |

|

|

|

20 |

|

|

(Being decrease in value of Motors and Furniture transferred to Revaluation Account) |

|

|

|

|

|

|

X's Capital A/c |

Dr. |

|

90 |

|

|

|

Y's Capital A/c |

Dr. |

|

90 |

|

|

|

Z's Capital A/c |

Dr. |

|

90 |

|

|

|

---------To Revaluation A/c |

|

|

|

270 |

|

|

(Being loss on revaluation transferred to Capital Account) |

|

|

|

|

|

Balance Sheet (after admission of W) |

|||||

|

Liabilities |

Rs. |

Assets |

Rs. |

||

|

|

Motors (1,200 - 250) |

950 |

|||

|

Capital : |

Furniture (400 -20) |

380 |

|||

|

|

X ( 1,500 - 90+500) |

1,910 |

Stock |

2,650 |

|

|

|

Y (1,750 - 90+500) |

2,160 |

Debtors |

3,780 |

|

|

|

Z (2,000 - 90+500) |

2,410 |

Cash (220+3,300) |

3,520 |

|

|

|

W |

1,800 |

|||

|

Other Liabilities |

3,000 |

||||

|

|

11,280 |

|

11,280 |

||

Solution Ex. 63

|

Journal |

|||||

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

Cash A/c |

Dr. |

5,880 |

|||

|

To Premium on Goodwill A/c (Being share of Goodwill brought in by the incoming partner) |

5,880 |

||||

|

|

Premium on Goodwill A/c To A's Capital A/c To B's Capital A/c (Being Premium on Goodwill credited to A and B in their sacrificing ratio 3:2) |

Dr.

|

|

5,880

|

3,528 2,352

|

|

|

Cash A/c To C's Capital A/c (Being cash brought in by C as his capital in the firm) |

Dr.

|

|

15,000

|

15,000

|

|

Balance Sheet (after admission of C) |

|||||

|

Liabilities |

Rs. |

Assets |

Rs. |

||

|

Creditors |

11,800 |

Cash (1,500+5,880+15,000) |

22,380 |

||

|

Capital : |

Stock |

28,000 |

|||

|

|

A ( 51,450 +3,528) |

54,978 |

Debtors |

19,500 |

|

|

|

B (36,750 + 2,352) |

39,102 |

Furniture |

2,500 |

|

|

|

C |

15,000 |

Machinery |

48,500 |

|

|

|

1,20,880 |

|

1,20,880 |

||

Calculation of New Profit Sharing Ratio:

Working Note:

1. Calculation of C's share in Goodwill:

Solution Ex. 64

|

Journal |

|||||

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

Profit and Loss Adjustment A/c |

Dr. |

1,750 |

|||

|

---------To Stock A/c |

500 |

||||

|

---------To Plant and Machinery A/c |

875 |

||||

|

---------To Reserve for doubtful debts A/c |

375 |

||||

|

(Being decrease in stock and Plant and Reserve for Doubtful Debt so created transferred to Profit and Loss Adjustment Account) |

|||||

|

|

Building A/c |

Dr. |

|

2,500 |

|

|

|

----------To Profit and Loss Adjustment A/c |

|

|

|

2,500 |

|

|

(Being increase in value of Building transferred to Profit and Loss Adjustment Account) |

|

|

|

|

|

|

Profit and Loss Adjustment A/c |

Dr. |

|

750 |

|

|

|

---------To A's Capital A/c |

|

|

|

500 |

|

|

---------To B's Capital A/c |

|

|

|

250 |

|

|

(Being profit on revaluation of asset and liabilities distributed between A and B in their old ratio) |

|

|

|

|

|

|

Cash A/c |

Dr. |

|

10,500 |

|

|

|

---------To C's Capital A/c |

|

|

|

7,500 |

|

|

---------To premium for Goodwill A/c |

|

|

|

3,000 |

|

|

(Being C brought capital and his share of goodwill) |

|

|

|

|

|

|

Premium for Goodwill A/c |

Dr. |

|

3,000 |

|

|

|

---------To A's Capital A/c |

|

|

|

2,000 |

|

|

---------To B's Capital A/c |

|

|

|

1,000 |

|

|

(Being premium for goodwill distributed between A and B in their sacrificing ratio i.e. 2:1) |

|

|

|

|

|

Profit and Loss Adjustment Account |

||||||

|

Dr. |

|

Cr. |

||||

|

Particulars |

Rs. |

Particulars |

Rs. |

|||

|

To Stock A/c |

500 |

By Building A/c |

2,500 |

|||

|

To Plant and Machinery A/c |

875 |

|||||

|

To Reserve for Doubtful Debts A/c |

375 |

|||||

|

To Profit transferred to |

||||||

|

|

A's Capital A/c |

500 |

||||

|

|

B's Capital A/c |

250 |

||||

|

|

2,500 |

2,500 |

||||

|

|

Partners Capital Accounts |

|

|||||

|

Dr. |

|

|

|

Cr. |

|||

|

Particulars |

A |

B |

C |

Particulars |

A |

B |

C |

|

To Balance c/d |

17,500 |

11,250 |

7,500 |

By Balance b/d |

15,000 |

10,000 |

|

|

|

By Cash A/c |

7,500 |

|||||

|

|

By Premium for Goodwill A/c |

2,000 |

1,000 |

|

|||

|

|

By Profit and Loss |

|

|||||

|

|

Adjustment A/c (Profit) |

500 |

250 |

|

|||

|

17,500 |

11,250 |

7,500 |

|

17,500 |

11,250 |

7,500 |

|

|

Balance Sheet as on March 31, 2019 after C's admission |

|||||||

|

Liabilities |

Rs. |

Assets |

Rs. |

||||

|

|

Building (25,000+2,500) |

27,500 |

|||||

|

Capital: |

Plant and Machinery ( 17,500 - 875) |

16,625 |

|||||

|

|

A |

17,500 |

Stock (10,000 - 500) |

9,500 |

|||

|

|

B |

11,250 |

Sundry Debtors |

4,850 |

|||

|

|

C |

7,500 |

36,250 |

Less: Provision for Doubtful Debt |

(375) |

4,475 |

|

|

Sundry Creditors |

32,950 |

Cash in Hand ( 600 + 10,500) |

11,100 |

||||

|

|

69,200 |

|

69,200 |

||||

Admission of a Partner Exercise 5.96

Solution Ex. 65

|

Journal |

||||||

|

Date |

Particulars |

L.F. |

Dr. Rs. |

Cr. Rs. |

||

|

2019 |

||||||

|

Mar 31 |

Bank A/c |

Dr. |

1,60,000 |

|||

|

To C's Capital A/c |

1,00,000 |

|||||

|

To Premium for Goodwill A/c |

60,000 |

|||||

|

(Capital and premium for goodwill brought by C for 1/4 share) |

||||||

|

|

|

|

|

|

|

|

|

Premium for Goodwill A/c |

Dr. |

60,000 |

||||

|

To A's Capital A/c |

40,000 |

|||||

|

To B's Capital A/c |

20,000 |

|||||

|

(Premium for Goodwill brought transferred to old partners' capital account in their sacrificing ratio) |

||||||

|

|

|

|

|

|

|

|

|

Plant A/c |

Dr. |

20,000 |

||||

|

Building A/c |

Dr. |

15,000 |

||||

|

To Revaluation A/c |

35,000 |

|||||

|

(Increase in value of assets) |

||||||

|

|

|

|

|

|

|

|

|

Revaluation A/c |

Dr. |

8,000 |

||||

|

To Stock |

4,000 |

|||||

|

To Provision for Doubtful Debts A/c |

3,000 |

|||||

|

To Creditors A/c (Unrecorded) |

1,000 |

|||||

|

(Assets and liabilities revalued) |

||||||

|

|

|

|

|

|

|

|

|

Revaluation A/c |

Dr. |

27,000 |

||||

|

To A's Capital A/c |

18,000 |

|||||

|

To B's Capital A/c |

9,000 |

|||||

|

(Profit on revaluation transferred to old partners) |

||||||

|

|

|

|

|

|

|

|

|

Revaluation Account |

||||||

|

Dr. |

Cr. |

|||||

|

Particulars |

Rs. |

Particulars |

Rs. |

|||

|

Stock |

4,000 |

Plant |

20,000 |

|||

|

Provision for Doubtful Debts |

3,000 |

Building |

15,000 |

|||

|

Creditors (Unrecorded) |

1,000 |

|||||

|

Revaluation Profit |

||||||

|

A's Capital |

18,000 |

|||||

|

B's Capital |

9,000 |

27,000 |

||||

|

35,000 |

35,000 |

|||||

|

Partners' Capital Account |

||||||||

|

Dr. |

Cr. |

|||||||

|

Particulars |

A |

B |

C |

Particulars |

A |

B |

C |

|

|

Balance c/d |

2,38,000 |

1,79,000 |

1,00,000 |

Balance b/d |

1,80,000 |

1,50,000 |

||

|

Bank |

1,00,000 |

|||||||

|

Premium for Goodwill |

40,000 |

20,000 |

||||||

|

Revaluation |

18,000 |

9,000 |

||||||

|

2,38,000 |

1,79,000 |

1,00,000 |

2,38,000 |

1,79,000 |

1,00,000 |

|||

|

Balance Sheet as on March 31, 2019 |

||||||

|

Liabilities |

Rs. |

Assets |

Rs. |

|||

|

Bills Payable |

10,000 |

Cash in Hand |

10,000 |

|||

|

Creditors |

59,000 |

Cash at Bank |

2,00,000 |

|||

|

Outstanding Expenses |

2,000 |

Sundry Debtors |

60,000 |

|||

|

Capital: |

Less: Provision for Doubtful Debt |

3,000 |

57,000 |

|||

|

A |

2,38,000 |

Stock |

36,000 |

|||

|

B |

1,79,000 |

Plant |

1,20,000 |

|||

|

C |

1,00,000 |

5,17,000 |

Building |

1,65,000 |

||

|

|

5,88,000 |

|

|

5,88,000 |

||

|

|

|

|

|

|

||

Note: Since no information is given about the share of sacrifice, it is assumed that the old partners are sacrificing in their old profit sharing ratio.

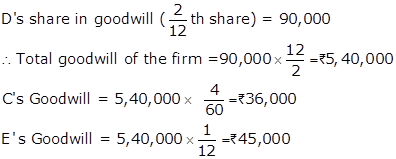

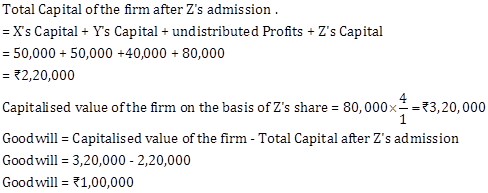

Solution Ex. 66

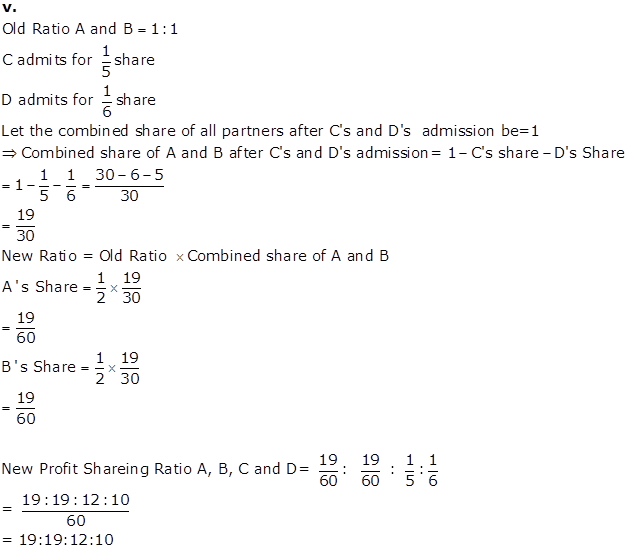

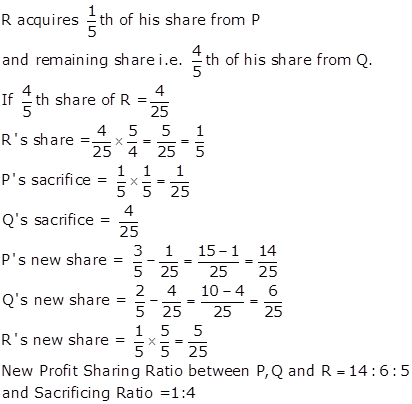

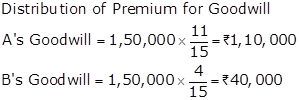

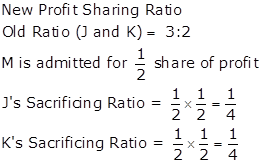

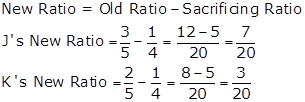

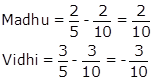

a. If M acquires his share of profit from the firm in the original ratio.

|

Journal |

|||||

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

Cash A/c |

Dr. |

4,00,000 |

|||

|

---------To M's Capital A/c |

3,00,000 |

||||

|

---------To Premium for Goodwill A/c |

1,00,000 |

||||

|

(Being capital and goodwill brought in by M in cash ) |

|||||

|

|

Premium for Goodwill A/c |

Dr. |

|

1,00,000 |

|

|

|

---------To J's Capital A/c |

|

|

|

60,000 |

|

|

---------To K's Capital A/c |

|

|

|

40,000 |

|

|

(Being premium for goodwill distributed between J and K in their Sacrificing Ratio) |

|

|

|

|

|

|

Reserve A/c |

Dr. |

|

1,00,000 |

|

|

|

---------To J's Capital A/c |

|

|

|

60,000 |

|

|

---------To K's Capital A/c |

|

|

|

40,000 |

|

|

(Being reserve distributed between J and K in their old ratio) |

|

|

|

|

|

Partners Capital Accounts |

|||||||||

|

Dr. |

|

Cr. |

|||||||

|

Particulars |

J |

K |

M |

Particulars |

J |

K |

M |

||

|

To Balance c/d |

2,70,000 |

1,80,000 |

3,00,000 |

By Balance b/d |

1,50,000 |

1,00,000 |

|

||

|

|

By Cash A/c |

3,00,000 |

|||||||

|

|

By Premium for Goodwill A/c |

60,000 |

40,000 |

|

|||||

|

|

By Reserve A/c |

60,000 |

40,000 |

|

|||||

|

2,70,000 |

1,80,000 |

3,00,000 |

|

2,70,000 |

1,80,000 |

3,00,000 |

|||

|

Balance Sheet as on April 01, 2019 after M's admission |

|||

|

Liabilities |

Rs. |

Assets |

Rs. |

|

J's Capital |

2,70,000 |

Cash (2,00,000+4,00,000) |

6,00,000 |

|

K's Capital |

1,80,000 |

Other Assets |

1,50,000 |

|

M's Capital |

3,00,000 |

||

|

|

7,50,000 |

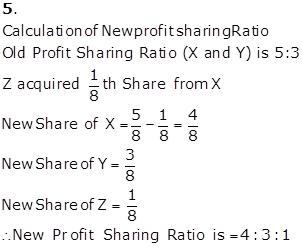

7,50,000 |

|

|

|

|||

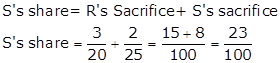

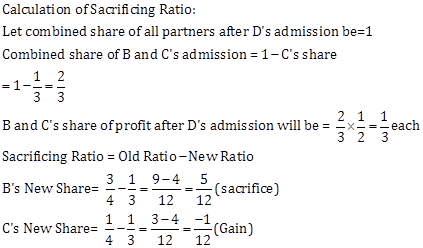

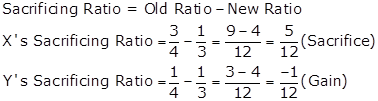

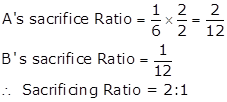

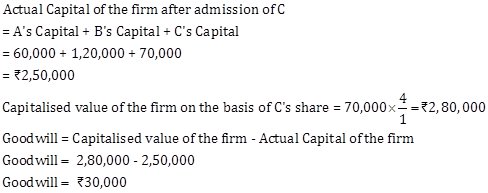

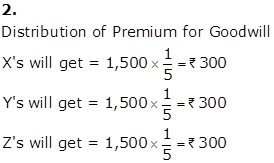

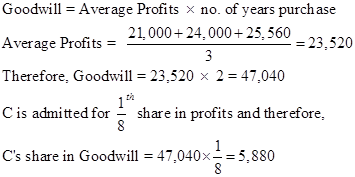

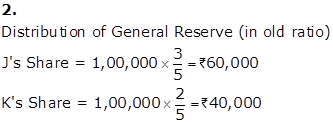

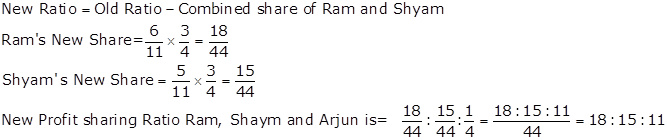

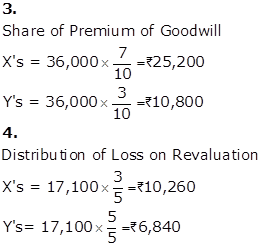

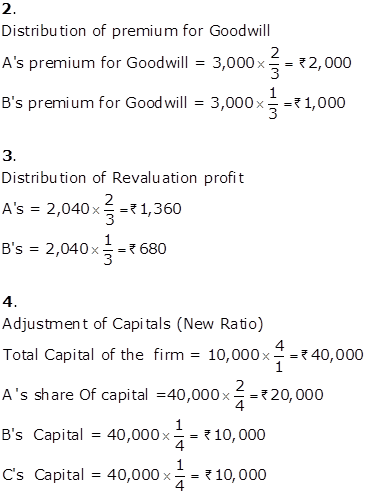

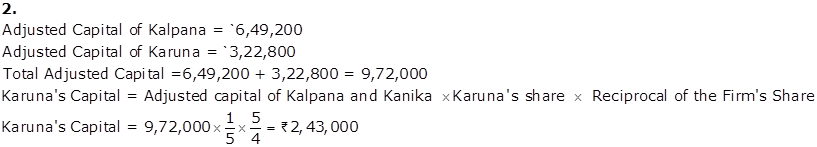

![]()

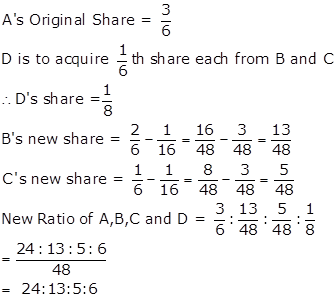

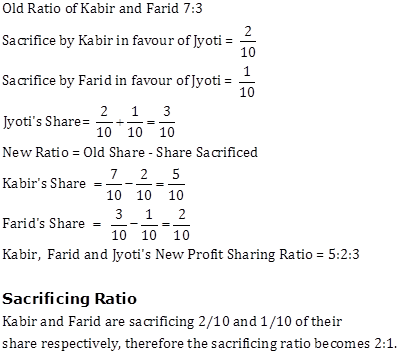

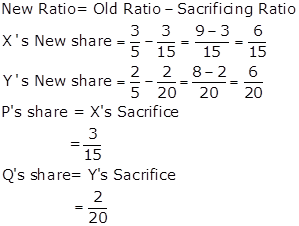

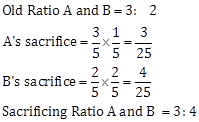

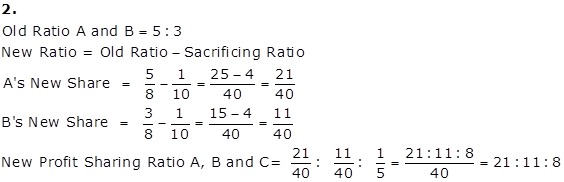

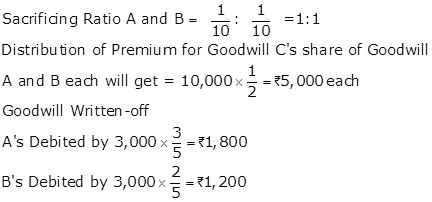

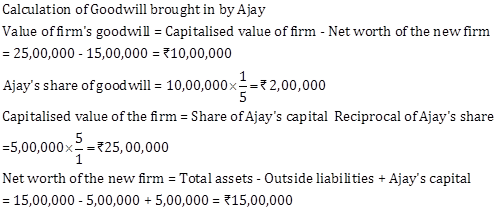

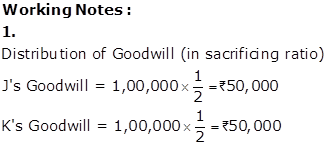

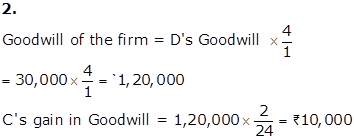

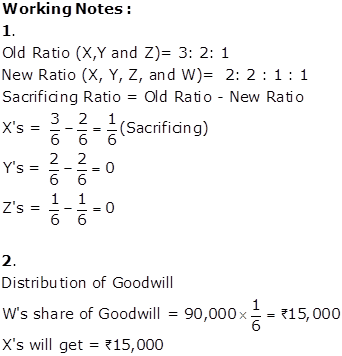

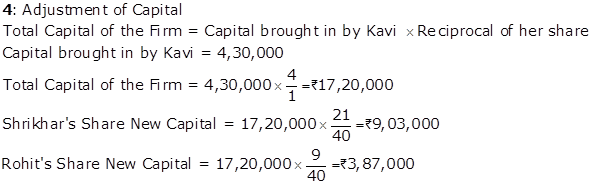

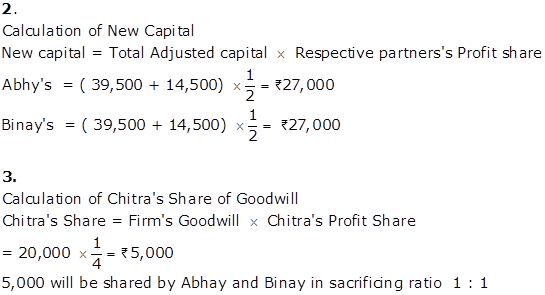

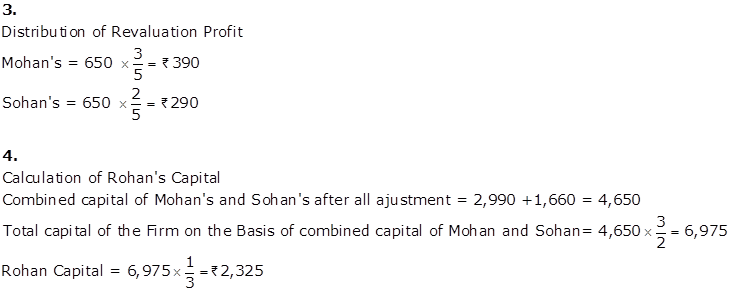

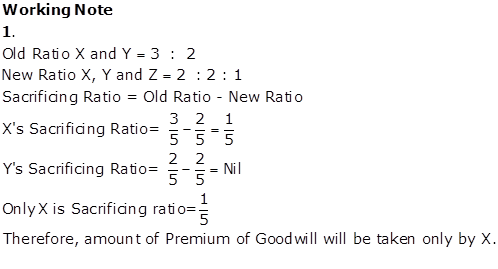

b. If M acquires his share of profit from the firm in equal proportions from the original partners.

|

Journal |

|||||

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

Reserve A/c |

Dr. |

1,00,000 |

|||

|

---------To J's Capital A/c |

60,000 |

||||

|

---------To K's Capital A/c |

40,000 |

||||

|

(Being reserve distributed between J and K in old ratio) |

|||||

|

|

Cash A/c |

Dr. |

|

4,00,000 |

|

|

|

---------To M's Capital A/c |

|

|

|

3,00,000 |

|

|

---------To Premium for Goodwill A/c |

|

|

|

1,00,000 |

|

|

(Being M brought capital and his share of goodwill) |

|

|

|

|

|

|

Premium for Goodwill A/c |

Dr. |

|

1,00,000 |

|

|

|

---------To J's capital A/c |

|

|

|

50,000 |

|

|

---------To K's capital A/c |

|

|

|

50,000 |

|

|

(Being premium for goodwill distributed between J and K in their sacrificing ratio i.e.1:1) |

|

|

|

|

|

Partner's Capital Accounts |

|||||||||

|

Dr. |

|

Cr. |

|||||||

|

Particulars |

J |

K |

M |

Particulars |

J |

K |

M |

||

|

To Balance c/d |

2,60,000 |

1,90,000 |

3,00,000 |

By Balance b/d |

1,50,000 |

1,00,000 |

|

||

|

|

By Cash A/c |

3,00,000 |

|||||||

|

|

By Premium for Goodwill A/c |

50,000 |

50,000 |

|

|||||

|

|

By Reserve A/c |

60,000 |

40,000 |

|

|||||

|

|

|

|

|

||||||

|

2,60,000 |

1,90,000 |

3,00,000 |

|

2,60,000 |

1,90,000 |

3,00,000 |

|||

|

Balance Sheet as on April 01, 2019 after M's admission |

|||

|

Liabilities |

Rs. |

Assets |

Rs. |

|

J's Capital |

2,60,000 |

Cash(2,00,000+4,00,000) |

6,00,000 |

|

K's Capital |

1,90,000 |

Other Assets |

1,50,000 |

|

M's Capital |

3,00,000 |

||

|

|

7,50,000 |

7,50,000 |

|

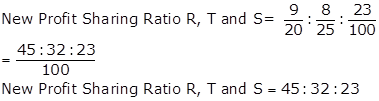

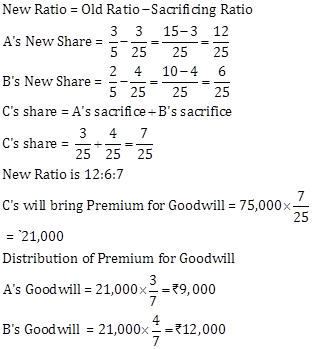

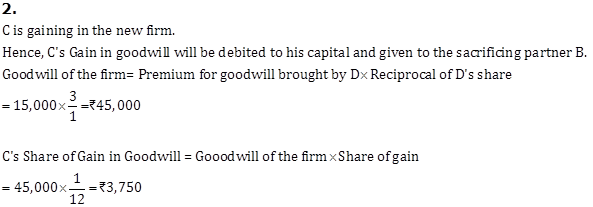

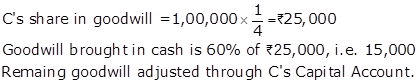

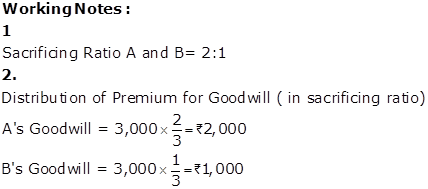

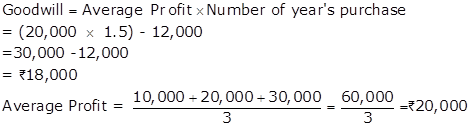

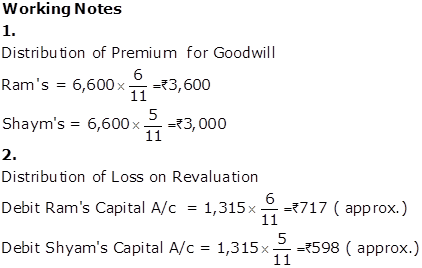

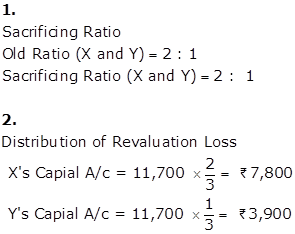

![]()

![]()

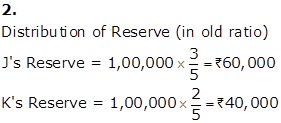

C. If M acquires his share of profit in the ratio of 3:1 from the original partners.

|

Journal |

|||||

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

Reserve A/c |

Dr. |

1,00,000 |

|||

|

---------To J's Capital A/c |

60,000 |

||||

|

(Being reserve distributed between J and K at the time of M's admission) |

|||||

|

|

Cash A/c |

Dr. |

|

4,00,000 |

|

|

|

---------To M's Capital A/c |

|

|

|

3,00,000 |

|

|

---------To Premium for Goodwill A/c |

|

|

|

1,00,000 |

|

|

(Being capital and share of goodwill brought in by M) |

|

|

|

|

|

|

Premium for Goodwill A/c |

Dr. |

|

1,00,000 |

|

|

|

---------To J's capital A/c |

|

|

|

75,000 |

|

|

---------To K's capital A/c |

|

|

|

25,000 |

|

|

(Being premium for goodwill distributed between J and K in their sacrificing ratio i.e. 3:1) |

|

|

|

|

|

Partner's Capital Accounts |

|||||||||

|

Dr. |

|

Cr. |

|||||||

|

Particulars |

J |

K |

M |

Particulars |

J |

K |

M |

||

|

To Balance c/d |

2,85,000 |

1,65,000 |

3,00,000 |

By Balance b/d |

1,50,000 |

1,00,000 |

|

||

|

|

By Cash A/c |

3,00,000 |

|||||||

|

|

By Premium for Goodwill A/c |

75,000 |

25,000 |

|

|||||

|

|

By Reserve A/c |

60,000 |

40,000 |

|

|||||

|

|

|

|

|

||||||

|

2,85,000 |

1,65,000 |

3,00,000 |

|

2,85,000 |

1,65,000 |

3,00,000 |

|||

|

Balance Sheet as on April 01, 2019 after M's admission |

|||

|

Liabilities |

Rs. |

Assets |

Rs. |

|

J's Capital |

2,85,000 |

Cash (2,00,000 + 4,00,000) |

6,00,000 |

|

K's Capital |

1,65,000 |

Other Assets |

1,50,000 |

|

M's Capital |

3,00,000 |

||

|

|

7,50,000 |

7,50,000 |

|

Solution Ex. 67

|

Revaluation Account |

||||||

|

Dr. |

Cr. |

|||||

|

Particulars |

Rs. |

Particulars |

Rs. |

|||

|

Provision for Doubtful Debts |

5,000 |

Land and Building |

26,000 |

|||

|

Claim against Workmen Compensation |

6,000 |

|||||

|

Revaluation Profit |

||||||

|

Madhu's Capital |

6,000 |

|||||

|

Vidhi's Capital |

9,000 |

15,000 |

||||

|

35,000 |

35,000 |

|||||

|

Partners' Capital Account |

||||||||

|

Dr. |

Cr. |

|||||||

|

Particulars |

Madhu |

Vidhi |

Gayatri |

Particulars |

Madhu |

Vidhi |

Gayatri |

|

|

Balance c/d |

5,98,000 |

4,17,000 |

4,00,000 |

Balance b/d |

5,20,000 |

3,00,000 |

||

|

Bank |

4,00,000 |

|||||||

|

|

|

|

|

General Reserve |

12,000 |

18,000 |

|

|

|

Premium for Goodwill |

60,000 |

90,000 |

||||||

|

Revaluation |

6,000 |

9,000 |

||||||

|

5,98,000 |

4,17,000 |

4,00,000 |

|

5,98,000 |

4,17,000 |

4,00,000 |

||

|

Balance Sheet as on March 31, 2016 |

||||||

|

Liabilities |

Rs. |

Assets |

Rs. |

|||

|

Bills Payable |

1,50,000 |

Bank (50,000 + 4,00,000 + 1,50,000) |

6,00,000 |

|||

|

Claim for Workmen Compensation |

6,000 |

Sundry Debtors |

3,00,000 |

|||

|

Capital: |

Less: Provision for Doubtful Debt |

15,000 |

2,85,000 |

|||

|

Madhu |

5,98,000 |

Stock |

80,000 |

|||

|

Vidhi |

4,17,000 |

Machinery |

2,80,000 |

|||

|

Gayatri |

4,00,000 |

14,15,000 |

Land and Building |

3,26,000 |

||

|

|

15,71,000 |

|

|

15,71,000 |

||

|

|

|

|

|

|

||

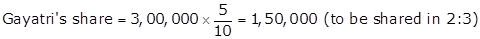

Working Notes:

WN1: Calculation of Gayatri's Share of Goodwill

WN1: Calculation of Sacrificing Ratio

Sacrificing Ratio = Old Ratio - New Ratio

Admission of a Partner Exercise 5.97

Solution Ex. 68

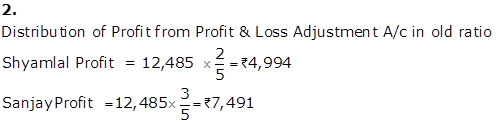

|

Profit and Loss Adjustment Account |

||||||

|

Dr. |

|

Cr. |

|

|||

|

Particulars |

Rs. |

Particulars |

Rs. |

|||

|

To Stock A/c |

1,800 |

By Building A/c |

15,000 |

|||

|

To Furniture A/c |

440 |

By Accrued Income A/c |

2,400 |

|||

|

To Provision for Doubtful Debts A/c |

275 |

By Debts Recovered A/c |

2,400 |

|||

|

To Outstanding Rent A/c |

4,800 |

|||||

|

To Profit transferred to: |

|

|||||

|

----Shyamlal Capital A/c |

4,994 |

|

||||

|

----Sanjay Capital A/c |

7,491 |

12,485 |

||||

|

|

19,800 |

19,800 |

||||

|

Partners Capital Accounts |

|||||||||

|

Dr. |

|

Cr. |

|||||||

|

Particulars |

Shyamlal |

Sanjay |

Shankar |

Particulars |

Shyamlal |

Sanjay |

Shankar |

||

|

To Balance c/d |

47,044 |

53,541 |

30,000 |

By Balance b/d |

34,050 |

34,050 |

|

||

|

|

By Cash A/c |

30,000 |

|||||||

|

|

By Premium for Goodwill A/c |

8,000 |

12,000 |

|

|||||

|

|

By Revaluation A/c |

4,994 |

7,491 |

|

|||||

|

|

|

|

|||||||

|

47,044 |

53,541 |

30,000 |

|

47,044 |

53,541 |

30,000 |

|||

|

Balance sheet as on April 01, 2019 after Shanker's admission |

||||||

|

Liabilities |

Rs. |

Assets |

|

Rs. |

||

|

Sundry Creditors |

12,435 |

Cash in Hand(710+50,000 + 2,400) |

53,110 |

|||

|

Outstanding Rent |

4,800 |

Cash at Bank |