Class 12-commerce T S GREWAL Solutions Accountancy Chapter 2: Accounting For Partnership FIRMS - Fundamentals

Accounting For Partnership FIRMS - Fundamentals Exercise 2.80

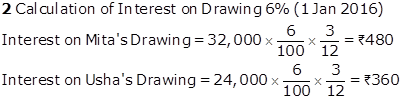

Solution Ex. 1

In the absence of Partnership Deed, the provisions of Indian Partnership Act, 1932 are applicable. Accordingly,

a. No Salary is to be allowed to a partner

b. No Interest on Partner's Capital is to be allowed

c. Interest on Partner's Loan to be allowed at 6% p.a.

d. Distribution of Profit to be done in equal ratio

e. No Interest on Partner's Drawings to be charged

Solution Ex. 2

a. P is bound to pay Rs.20,000 along with profit of Rs.5,000 to the firm. This is beacuse this because this amount belongs to the firm and according to the principal and agent relationship, P is principal as well as agent to the firm, to Q and to R. And as per the rule, any profit earned by an agent (P) by using the firm's property is attributable to the firm.

b. Q is liable to pay Rs.5,000 to the firm. This is beacuse, as per the Partnership Act, every partner of a partnership firm is liable to the firm for any loss caused by his/her wilful negligence which is clearly evident from the fact that he used the property of the firm and also mis-represented himself as a principal rather than an agent to the other partners and to the firm.

c. As per the Partnership Act, 1932, a partner has a right to buy and sell goods without consulting the other partners unless a Public Notice has been given by the partnership firm to restrict the partners to buy and sell. Accordingly, P and Q may buy goods from A Ltd.

d. No, C will not be admitted as one of the partners, P, has not agreed to admit C. And as per the Partnership Act, 1932 a new partner cannot be admitted into a firm unless all the existing partners agree on the same decision.

Accounting For Partnership FIRMS - Fundamentals Exercise 2.81

Solution Ex. 3

|

|

Disputes |

Possible Judgements |

|

a. |

A wants that interest on capital should be allowed to the partners, but B and C do not agree. |

According to the Partnership Act, no interest on capital will be allowed as there is no partnership agreement among A, B and C mentioning payment of interest on capital. |

|

b. |

B wants that the partners should be allowed to draw salary, but A and C do not agree. |

No salary will be allowed to any partner until and unless there is an agreement to the contrary. |

|

c. |

C wants that the loan given by him to the firm should bear interest @ 10% p.a., but A and B do not agree. |

Interest on C's loan will be allowed at 6% p.a. in the absence of a partnership agreement mentioning the said amount of interest. |

|

d. |

A and B having contributed larger amounts of capital, desire that the profits should be divided in the ratio of their capital contribution, but C does not agree. |

Profit will be shared equally if there is no agreement between the partners mentioning such distribution. |

Solution Ex. 4

In case there is no partnership deed entered between partners or if deed is silent on few of the aspects, then the provisions of Indian Partnership Act, 1932 are applicable. According to the Act, if there is no agreement regarding the ratio in which profits are to be shared, then profits (or losses) are to be shared equally among all the partners. Accordingly, Jaspal's view over distribution of profits in the capital ratio is not acceptable, and Rosy should convince Jaspal stating the provisions contained in the Partnership Act, 1932.

Solution Ex. 5

Harshad Claims:

i. It cannot Claim interest on capital to Indian Partnership Act 1932, he is entitled only for 6% interest on loan.

ii. In absence to any agreement profit are distributed equally, according to Indian Partnership Act 1932.

Dhiman Claims:

i. It will be accepted, according to Indian Partnership Act 1932.

ii. He is not entitled for any remuneration because there is no agreement on matter of remuneration.

iii. It is no interest on capital is allowed whereas 6% interest for loan should be given.

Distribution Profits:

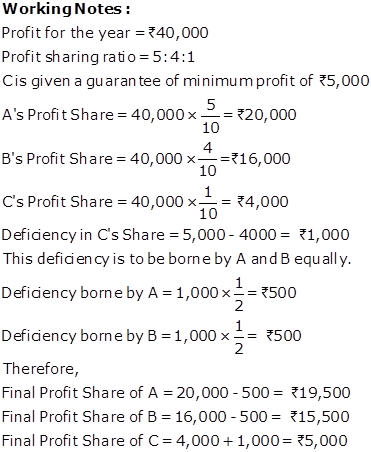

|

Profit and Loss Adjustment Account |

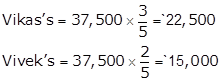

|||||

|

Dr |

|

Cr |

|||

|

Particulars |

Rs. |

Particulars |

Rs. |

||

|

To Interest on Partner's Loan A/c |

|

By Profit and Loss A/c |

1,80,000 |

||

|

Harshad [1,00,000 ×(6/100)× (6/12)] |

3,000 |

|

|

||

|

To Profit and Loss Appropriation A/c |

1,77,000 |

|

|

||

|

|

1,80,000 |

|

1,80,000 |

||

|

Profit and Loss Appropriation Account |

||||||

|

Dr |

|

Cr |

||||

|

Particulars |

Rs. |

Particulars |

Rs. |

|||

|

To Profit transferred to : |

|

By Profit and Loss Adjustment A/c |

1,77,000 |

|||

|

|

Harshad's Capital A/c |

88,500 |

|

|

||

|

|

Dhiman's Capital A/c |

88,500 |

|

|

||

|

|

1,77,000 |

|

1,77,000 |

|||

Solution Ex. 6

|

Profit and Loss Appropriation Account for the year ended March 31, 2019 |

|||||

|

Dr |

|

Cr |

|||

|

Particulars |

|

Rs. |

Particulars |

Rs. |

|

|

To Interest on A's Loan A/c |

|

240 |

By Profit b/d (before Interest) |

15,000 |

|

|

To Profit transferred to : |

|

|

|

|

|

|

|

A's Capital A/c |

7,380 |

|

|

|

|

|

B's Capital A/c |

7,380 |

14,760 |

|

|

|

|

|

15,000 |

|

15,000 |

|

Working notes :

1

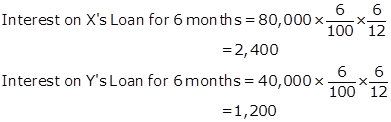

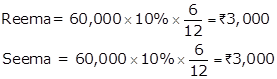

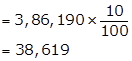

Calculation of interest on Loan

Interest on loan to be provided at 6% p.a.

Amount of Loan = Rs.8,000

Period (from October 01 to March 31) = 6 Months

![]()

2

Calculation of Profit Share of each partner

Equal distribution of profits

Profit after Interest on A's loan = Rs.15,000 - Rs.240 = Rs.14,760

![]()

Solution Ex. 7

Total amount advanced by the partners = Rs.30,000

Profit sharing ratio = 3 :2

Accounting For Partnership FIRMS - Fundamentals Exercise 2.82

Solution Ex. 8

Calculation of Interest on Loan for 6 months

|

Case 1 - When Profits before Interest amounted to Rs.21,000 |

|||||||

|

Profit and Loss Appropriation Account for the year ended March 31, 2019 |

|||||||

|

Dr |

|

Cr |

|

||||

|

Particulars |

|

Rs. |

Particulars |

Rs. |

|||

|

To Interest on X's Loan A/c |

|

2,400 |

By Profit b/d (before interest) |

21,000 |

|||

|

To Interest on Y's Loan A/c |

|

1,200 |

|

|

|||

|

To Profit transferred to |

|

|

|

|

|||

|

|

X's Capital A/c (17,400 × 2/5) |

6,960 |

|

|

|

||

|

|

Y's Capital A/c (17,400 × 3/5) |

10,440 |

17,400 |

|

|

||

|

|

|

21,000 |

|

21,000 |

|||

|

Case 2 - When Profits before Interest amounted to Rs.3,000 |

|||||

|

Profit and Loss Appropriation Account for the year ended March 31, 2019 |

|||||

|

Dr |

|

Cr |

|||

|

Particulars |

Rs. |

Particulars |

|

Rs. |

|

|

To Interest on X's Loan A/c |

2,400 |

By Profit b/d (before interest) |

|

3,000 |

|

|

To Interest on Y's Loan A/c |

1,200 |

By Loss transferred to- |

|

|

|

|

|

|

|

X's Capital A/c (600 ×2/5) |

240 |

|

|

|

|

|

Y's Capital A/s (600 × 3/5) |

360 |

600 |

|

|

|

|

|

|

|

|

|

3,600 |

|

|

3,600 |

|

|

Case 3 - When Profits before Interest amounted to Rs.5,000 |

|||||

|

Profit and Loss Appropriation Account for the year ended March 31, 2019 |

|||||

|

Dr |

|

Cr |

|||

|

Particulars |

|

Rs. |

Particulars |

Rs. |

|

|

To Interest on X's Loan A/c |

|

2,400 |

By Profit b/d (before interest) |

5,000 |

|

|

To Interest on Y's Loan A/c |

|

1,200 |

|

|

|

|

To Profit transferred to |

|

|

|

|

|

|

|

X's Capital A/c (1400 × 2/5) |

560 |

|

|

|

|

|

Y' Capital A/c (1400 × 3/5) |

840 |

1,400 |

|

|

|

|

|

5,000 |

|

5,000 |

|

|

Case 4 - When Losses before Interest were Rs.1,400 |

|||||

|

Profit and Loss Appropriation Account for the year ended March 31, 2019 |

|||||

|

Dr |

|

Cr |

|||

|

Particulars |

|

Rs. |

Particulars |

Rs. |

|

|

To Loss b/d (before interest) |

|

2,400 |

By Loss transferred to: |

|

|

|

To Interest on X's Loan A/c |

|

1,200 |

X's Capital A/c (1400 × 2/5) |

2,000 |

|

|

To Interest on Y's Loan A/c |

|

1,400 |

Y' Capital A/c (1400 × 3/5) |

3,000 |

5,000 |

|

|

|

5,000 |

|

|

5,000 |

Solution Ex. 9

|

Profit and Loss Appropriation Account for the year ended March 31, 2019 |

|||||

|

Dr |

|

Cr |

|||

|

Particulars |

Rs. |

Particulars |

|

Rs. |

|

|

To Loss b/d (before interest) |

9,000 |

By Loan transferred to : |

|

|

|

|

To Interest on Bat's Loan A/c |

7,200 |

|

Bat's Capital A/c |

31,920 |

|

|

To Interest on Ball's loan A/c |

3,600 |

|

Ball's Capital A/c |

47,880 |

79,800 |

|

To Rent A/c (Bat's) |

60,000 |

|

|

|

|

|

|

79,800 |

|

|

79,800 |

|

Working notes :

1.

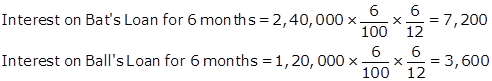

Interest on Partner's Loan

![]()

3.

Distribution of Loss to the Partners

Solution Ex. 10

|

Profit and Loss Appropriation Account |

||||

|

Dr. |

|

Cr. |

||

|

Particulars |

|

Rs. |

Particulars |

Rs. |

|

To Interest on Capital: |

|

|

By Profit and Loss (Net Profit) |

80,000 |

|

-----A's A/c (6% of 1,00,000) |

6,000 |

|

|

|

|

-----B's A/c(6% of 60,000) |

3,600 |

9,600 |

|

|

|

To Salary to B's A/c (3,000 × 12) |

|

36,000 |

|

|

|

To Profit transferred to : |

|

|

|

|

|

----A's Capital A/c |

17,200 |

|

|

|

|

----B's Capital A/c |

17,200 |

34,400 |

|

|

|

|

|

80,000 |

|

80,000 |

Working Notes :

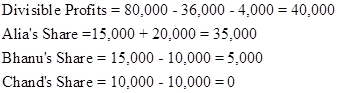

WN 1 Calculation of Profit Share of each Partner

Divisible Profit = 80,000 - 9,600 - 36,000 = 34,400

Solution Ex. 11

|

Profit and Loss Appropriation Account |

||||

|

Dr. |

|

Cr. |

||

|

Particulars |

|

Rs. |

Particulars |

Rs. |

|

To Interest on Capital A/c |

|

|

By Profit and Loss A/c |

4,00,000 |

|

----X (10% of 5,00,000) |

50,000 |

|

---- (Net Profit after Z's salary ) |

|

|

----Y (10% of 5,00,000) |

50,000 |

|

|

|

|

----Z (10% of 2,50,000) |

25,000 |

1,25000 |

|

|

|

To Profit transferred to : |

|

|

|

|

|

----X's Capital A/c |

1,10,000 |

|

|

|

|

----Y's Capital A/c |

1,10,000 |

|

|

|

|

----Z's Capital A/c |

55,000 |

2,75,000 |

|

|

|

|

|

4,00,000 |

|

4,00,000 |

Working Notes :

1.

Salary to Z will not be debited to Profit and Loss Appropriation Account as Profit of Rs.4,00,000 is already given after adjusting the Z's salary.

2.

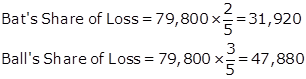

Calculation of Profit Share of each Partner

Divisible of Profit after Interest on Capital = Rs.4,00,000 - Rs.1,25,000 = Rs. 2,75,000

Profit sharing ratio = 2 : 2: 1

Solution Ex. 12

|

Profit and Loss Adjustment Account |

|||

|

Dr. |

|

Cr. |

|

|

Particulars |

Rs. |

Particulars |

Rs. |

|

To Manager's Commission A/c (3,00,000 × 5%) |

15,000 |

By Profit and Loss A/c (Net Profit after Y's salary) |

2,40,000 |

|

To Profit transferred to Profit and Loss Appropriation A/c: |

2,85,000 |

By Y's salary A/c |

60,000 |

|

|

3,00,000 |

|

3,00,000 |

|

Profit and Loss Appropriation Account |

||||

|

Dr. |

|

Cr. |

||

|

Particulars |

|

Rs. |

Particulars |

Rs. |

|

To Salary to Y's A/c |

|

60,000 |

By Profit and Loss Adjustment A/c (After manager's commission) |

2,85,000 |

|

To Interest on Capital A/c |

|

|

|

|

|

----X |

40,000 |

|

|

|

|

----Y |

30,000 |

70,000 |

|

|

|

To Profit transferred to : |

|

|

|

|

|

----X's Capital A/c |

93,000 |

|

|

|

|

----Y's Capital A/c |

62,000 |

1,55,000 |

|

|

|

|

|

2,85,000 |

|

2,85,000 |

Working Notes :

1.

Calculation of Manager's Commission

Profit to calculate Managers' Commission = 2,40,000 + 60,000 (Y's Salary) = Rs.3,00,000

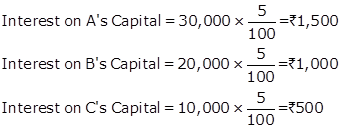

![]()

2.

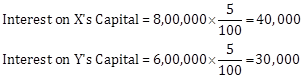

Calculation of Interest on Capital

3.

Calculation of Profit Share of each Partner

Profit available for distribution = 2,85,000 - 60,000 - 70,000 = Rs.1,55,000

Solution Ex. 13

|

Profit and Loss Appropriation Account |

|||||

|

Dr. |

|

Cr. |

|||

|

Particulars |

|

Rs. |

Particulars |

|

Rs. |

|

To Salary to Prem (2,500 × 12) |

|

30,000 |

By Profit and Loss A/c (Net Profit) |

|

90,575 |

|

To Commission to Manoj |

|

10,000 |

By Interest on Drawings A/c: |

|

|

|

To Interest on Capital A/c: |

|

|

----Prem |

1,250 |

|

|

----Prem (5% of 2 Lacs) |

10,000 |

|

----Manoj |

425 |

1,675 |

|

----Manoj (5% of 1.50 Lacs) |

7,500 |

17,500 |

|

|

|

|

To Profit transferred to: |

|

|

|

|

|

|

----Prem's Capital A/c |

20,850 |

|

|

|

|

|

----Manoj's Capital A/c |

13,900 |

34,750 |

|

|

|

|

|

|

92,250 |

|

|

92,250 |

Working Notes :

1.

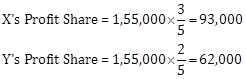

Calculation of Profit Share of each Partner

Profit available for distribution = 90,575 + 1,675 - 30,000 -10,000 - 17,500 = Rs.34,750

Profit Sharing Ratio = 3 : 2

Accounting For Partnership FIRMS - Fundamentals Exercise 2.83

Solution Ex. 14

|

Profit and Loss Appropriation Account for the year ended 31st March 2019 |

|||||

|

Dr. |

|

Cr. |

|||

|

Particulars |

|

Rs. |

Particulars |

|

Rs. |

|

To Profit and Loss A/c (Loss) |

1,00,000 |

By Interest on Drawings A/c: |

|

|

|

|

|

|

---- Reema |

3,000 |

|

|

|

|

|

---- Seema |

3,000 |

6,000 |

|

|

|

|

|

|

|

|

|

|

|

By Net Loss transferred to: |

|

|

|

|

|

|

---- Reema Capital A/c |

47,000 |

|

|

|

|

|

---- Seema Capital A/c |

47,000 |

94,000 |

|

|

|

1,00,000 |

|

|

1,00,000 |

|

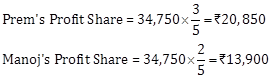

Working Notes :

1. Calculation of Interest on drawings of each Partner

In the no given of dates of drawings, interest thereon has been

calculated for the average period.

2. Loss share of each partner Ratio 1:1.

3. Interest on capital is charge against profit.

Solution Ex. 15

|

Profit and Loss Appropriation Account for the year ended 31st March 2019 |

|||||

|

Dr. |

|

Cr. |

|||

|

Particulars |

|

Rs. |

Particulars |

|

Rs. |

|

To Profit and Loss A/c (Loss) |

60,000 |

By Interest on Drawings A/c: |

|

|

|

|

(1,20,000 - 1,80,000) |

|

---- Bhanu Current A/c |

3,750 |

|

|

|

|

|

---- Partap Current A/c |

7,500 |

11,250 |

|

|

|

|

|

|

|

|

|

|

|

By Net Loss transferred to: |

|

|

|

|

|

|

---- Bhanu Current A/c |

24,375 |

|

|

|

|

|

---- Partap Current A/c |

24,375 |

48,750 |

|

|

|

60,000 |

|

|

60,000 |

|

Working Notes:

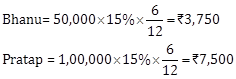

1. Calculation of Interest on Drawing of each partner

In the no given of dates of drawings, interest thereon has been

calculated for the average period.

2. Calculation of Interest on Capital of each partner

Interest on Capital is a charge against Profit. Thus, will be debited to Profit and Loss Account

![]()

Total interest = Rs.1,80,000

Solution Ex. 16

|

Journal Entries |

|||||

|

Date |

Particulars |

|

L.F. |

Debit Rs. |

Credit Rs. |

|

|

Profit and Loss Appropriation A/c |

Dr. |

|

40,000 |

|

|

|

----To Amar's Current A/c |

|

|

|

15,000 |

|

|

----To Bimal's Current A/c |

|

|

|

25,000 |

|

|

(Being interest on capital transferred to Profit and Loss Appropriation Account) |

|

|

|

|

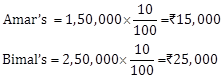

Working Notes :

Calculation of Interest on Capital :

Solution Ex. 17

|

Journal Entries |

|||||

|

Date |

Particulars |

|

L.F. |

Debit Rs. |

Credit Rs. |

|

|

Profit and Loss Appropriation A/c |

Dr. |

|

1,00,000 |

|

|

|

----To Kamal's Current A/c |

|

|

|

55,000 |

|

|

----To Kapil's Current A/c |

|

|

|

45,000 |

|

|

(Being interest on capital transferred to Profit and Loss Appropriation Account) |

|

|

|

|

|

Profit and Loss Appropriation Account year ended 31st March 2019 |

||||

|

Dr. |

|

Cr. |

||

|

Particulars |

|

Rs. |

Particulars |

Rs. |

|

To Interest on Capital |

|

|

By Profit and Loss A/c |

6,00,000 |

|

----Kamal A/c |

55,000 |

|

|

|

|

----Kapil A/c |

45,000 |

1,00,000 |

|

|

|

To Profit transferred to: |

|

|

|

|

|

----Kamal's Capital A/c |

2,50,000 |

|

|

|

|

----Kapil's Capital A/c |

2,50,000 |

5,00,000 |

|

|

|

|

|

6,00,000 |

|

6,00,000 |

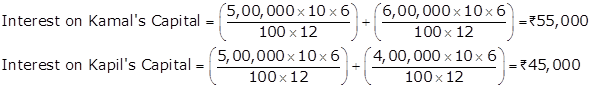

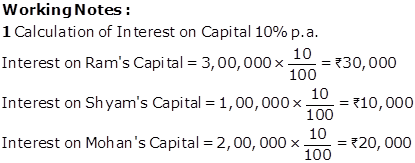

Working Notes :

Calculation of Interest on Capital:

Solution Ex. 18

|

Journal Entries |

|||||

|

Date |

Particulars |

|

L.F. |

Debit Rs. |

Credit Rs. |

|

|

Profit and Loss Appropriation A/c |

Dr. |

|

20,000 |

|

|

|

----To Simran's Current A/c |

|

|

|

10,000 |

|

|

----To Reema's Current A/c |

|

|

|

10,000 |

|

|

(Being interest on capital transferred to Profit and Loss Appropriation Account) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Profit and Loss Appropriation A/c |

Dr. |

|

2,80,000 |

|

|

|

----To Simran's Current A/c |

|

|

|

1,68,000 |

|

|

----To Reema's Current A/c |

|

|

|

1,12,000 |

|

|

(Being profit transferred to Partners Current Account) |

|

|

|

|

|

Profit and Loss Appropriation Account year ended 31st March 2019 |

||||

|

Dr. |

|

Cr. |

||

|

Particulars |

|

Rs. |

Particulars |

Rs. |

|

To Interest on Capitals: |

|

|

By Profit and Loss A/c |

3,00,000 |

|

----Simran's A/c |

10,000 |

|

|

|

|

----Reema's A/c |

10,000 |

20,000 |

|

|

|

To Profit transferred to : |

|

|

|

|

|

----Simran's Current A/c |

1,68,000 |

|

|

|

|

----Reema's Current A/c |

1,12,000 |

2,80,000 |

|

|

|

|

|

3,00,000 |

|

3,00,000 |

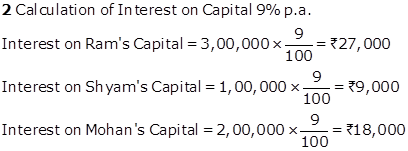

Working Notes :

1

Calculation of Interest on Capital

Solution Ex. 19

|

Journal Entries |

|||||

|

Date |

Particulars |

|

L.F. |

Debit Rs. |

Credit Rs. |

|

|

Profit and Loss Appropriation A/c |

Dr. |

|

90,000 |

|

|

|

----To Anita's Current A/c |

|

|

|

50,000 |

|

|

----To Ankita's Current A/c |

|

|

|

40,000 |

|

|

(Being interest on capital transferred to Profit and Loss Appropriation Account) |

|

|

|

|

Working Notes :

Calculation of Interest on Capital

Accounting For Partnership FIRMS - Fundamentals Exercise 2.84

Solution Ex. 20

|

Journal Entries |

|||||

|

Date |

Particulars |

|

L.F. |

Debit Rs. |

Credit Rs. |

|

|

Profit and Loss Appropriation A/c |

Dr. |

|

1,35,000 |

|

|

|

----To Ashish's Capital A/c |

|

|

|

65,000 |

|

|

----To Aakash's Capital A/c |

|

|

|

70,000 |

|

|

(Being interest on capital transferred to Profit and Loss Appropriation Account) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Profit and Loss Appropriation A/c |

Dr. |

|

3,65,000 |

|

|

|

----To Ashish's Capital A/c |

|

|

|

2,19,000 |

|

|

----To Aakash's Capital A/c |

|

|

|

1,46,000 |

|

|

(Being profit transferred to Partners Capital Account) |

|

|

|

|

|

Profit and Loss Appropriation Account year ended 31st march 2019 |

||||

|

Dr. |

|

Cr. |

||

|

Particulars |

|

Rs. |

Particulars |

Rs. |

|

To Interest on Capitals: |

|

|

By Profit and Loss A/c |

5,00,000 |

|

----Ashish's A/c |

65,000 |

|

|

|

|

----Aakash's A/c |

70,000 |

1,35,000 |

|

|

|

To Profit transferred to : |

|

|

|

|

|

----Ashish's Capital A/c |

2,19,000 |

|

|

|

|

----Aakash's Capital A/c |

1,46,000 |

3,65,000 |

|

|

|

|

|

5,00,000 |

|

5,00,000 |

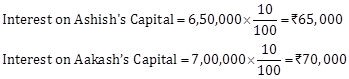

Working Notes :

1.

Calculation of Opening Capital:

|

Particulars |

Ashish |

Aakash |

|

Capital at the end |

5,00,000 |

6,00,000 |

|

Add: Drawings |

1,50,000 |

1,00,000 |

|

Opening Capital |

6,50,000 |

7,00,000 |

2.

Calculation of Interest on Capital

Solution Ex. 21

|

Journal Entries |

|||||

|

Date |

Particulars |

|

L.F. |

Debit Rs. |

Credit Rs. |

|

|

Profit and Loss Appropriation A/c |

Dr. |

|

82,500 |

|

|

|

----To Naresh's Capital A/c |

|

|

|

42,500 |

|

|

----To Sukesh's Capital A/c |

|

|

|

40,000 |

|

|

(Being interest on capital transferred to Profit and Loss Appropriation Account) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Profit and Loss Appropriation A/c |

Dr. |

|

1,17,500 |

|

|

|

----To Naresh's Capital A/c |

|

|

|

58,750 |

|

|

----To Sukesh's Capital A/c |

|

|

|

58,750 |

|

|

(Being profit transferred to Partners Capital Account) |

|

|

|

|

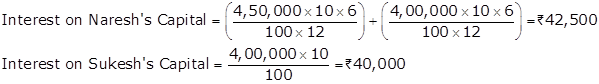

Working Notes :

1.

Calculation of Opening Capital:

|

Particulars |

Naresh |

Sukesh |

|

Capital at the end |

3,00,000 |

3,00,000 |

|

Add: Out of Capital Drawings |

50,000 |

----- |

|

Add: Against Profit Drawings |

1,00,000 |

1,00,000 |

|

Opening Capital |

4,50,000 |

4,00,000 |

2.

Calculation of Interest on Capital:

Solution Ex. 22

|

Profit and Loss Appropriation Account year ended 31st march 2014 |

||||

|

Dr. |

|

Cr. |

||

|

Particulars |

|

Rs. |

Particulars |

Rs. |

|

To Interest on Capitals: |

|

|

By Profit and Loss A/c |

7,800 |

|

----Jay A/c |

4,800 |

|

|

|

|

----Vijay A/c |

3,000 |

7,800 |

|

|

|

|

|

7,800 |

|

7,800 |

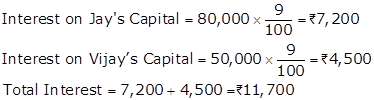

Working Notes :

1.

Calculation of Interest on Capital

2.

Calculation of Proportionate Interest on Capital

Solution Ex. 23

|

Profit and Loss Appropriation Account |

||||

|

Dr. |

|

Cr. |

||

|

Particulars |

|

Rs. |

Particulars |

Rs. |

|

To Salary A/c |

|

|

By Profit and Loss A/c |

4,80,000 |

|

----Amar |

1,20,000 |

|

|

|

|

----Bhanu |

1,20,000 |

2,40,000 |

|

|

|

To Profit transferred to : |

|

|

|

|

|

----Amar's Capital A/c |

80,000 |

|

|

|

|

----Bhanu's Capital A/c |

80,000 |

|

|

|

|

----Charu's Capital A/c |

80,000 |

2,40,000 |

|

|

|

|

|

4,80,000 |

|

4,80,000 |

Solution Ex.24

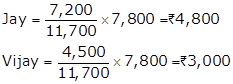

Net Profit for the year= Rs.1,10,000

Commission to A = 10% of on Net Profit

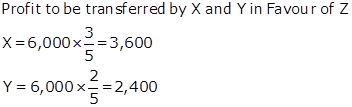

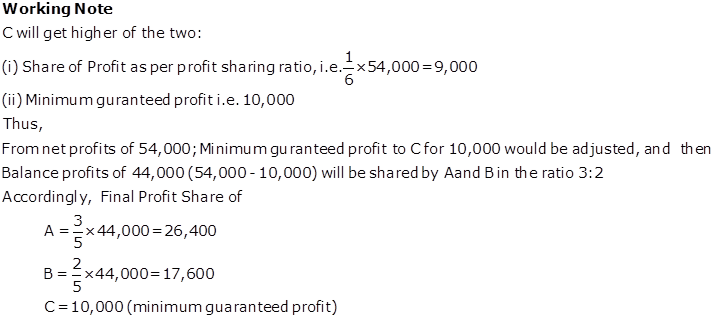

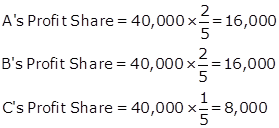

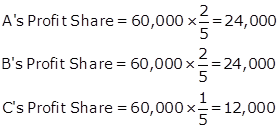

Solution Ex. 25

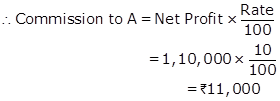

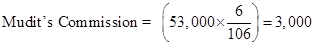

Net Profit before charging Commission = 2,20,000

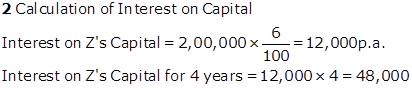

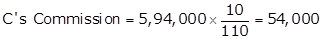

Commission to Z = 10% of on Net Profit after charging such commission

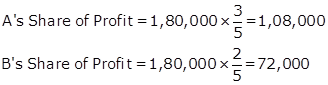

![]()

Solution Ex. 26

|

Profit and Loss Appropriation Account for the year ended March 31, 2019 |

||||||

|

Dr |

|

Cr. |

||||

|

Particulars |

|

Amount Rs. |

Particulars |

Amount Rs. |

||

|

To Partner's Commission |

|

|

By Profit and Loss A/c |

1,80,000 |

||

|

|

A's A/c |

6,000 |

|

(Net Profit) |

|

|

|

|

B's A/c |

9,000 |

|

|

|

|

|

|

C's A/c |

6,000 |

|

|

|

|

|

|

D's A/c |

9,000 |

30,000 |

|

|

|

|

To Profit transferred to : |

|

|

|

|

||

|

|

A's Capital A/c |

60,000 |

|

|

|

|

|

|

B's Capital A/c |

45,000 |

|

|

|

|

|

|

C's Capital A/c |

30,000 |

|

|

|

|

|

|

D's Capital A/c |

15,000 |

1,50,000 |

|

|

|

|

|

|

1,80,000 |

|

1,80,000 |

||

|

|

|

|

|

|

||

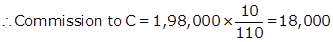

Working Notes :

1.

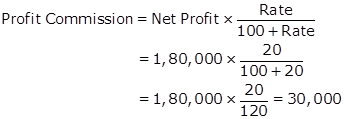

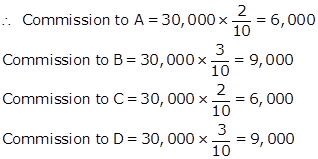

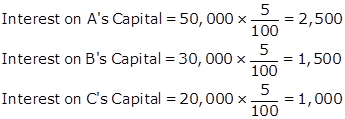

Calculation of Partner's Commission

Partners Commission = 20 % On Net Profit after charging such commission

This Commission is to be shared by the partners in the ratio of 2 : 3 : 2 : 3

2.

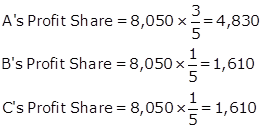

Calculation of Profit Share of each Partner

Profit available for Distribution = 1,80,000 - 30,000 = Rs.1,50,000

Profit sharing ratio = 4 : 3 : 2 : 1

Accounting For Partnership FIRMS - Fundamentals Exercise 2.85

Solution Ex. 27

|

Profit and Loss Appropriation Account for the year ended March 31, 2019 |

|||||

|

Dr. |

|

Cr. |

|||

|

Particulars |

|

Rs. |

Particulars |

Rs. |

|

|

To Partner's Salary A/c |

|

|

By Profit and Loss A/c |

4,20,000 |

|

|

|

X (10,000 × 12) |

1,20,000 |

|

---- (Net Profit) |

|

|

|

Y |

25,000 |

1,45,000 |

|

|

|

To Partner's Commission |

|

|

|

|

|

|

|

X's A/c |

27,500 |

|

|

|

|

|

Y's A/c |

22,500 |

50,000 |

|

|

|

To Profit transferred to : |

|

|

|

|

|

|

|

X's Capital A/c |

1,12,500 |

|

|

|

|

|

Y's Capital A/c |

1,12,500 |

2,25,000 |

|

|

|

|

|

4,20,000 |

|

4,20,000 |

|

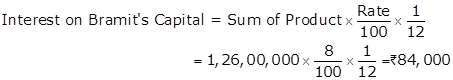

Working Notes :

1.

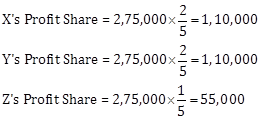

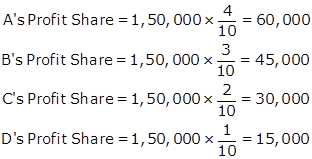

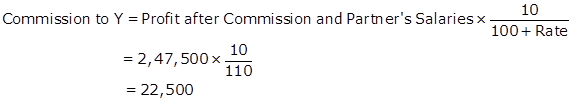

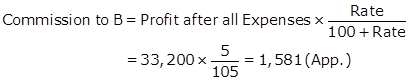

Calculation of Commission

Commission to X = 10% of Net Profit after partner's salaries but before charging such commission Profit after Partner's Salaries = Rs.4,20,000 - Rs.1,45,000 = Rs.2,75,000

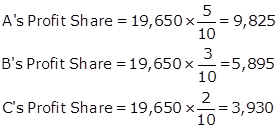

![]()

Commission to Y = 10% of Net Profit after charging Commission and Partner's Salaries

Profit after commission and partner's salaries = Rs.4,20,000 - Rs.1,45,000 - Rs.27,500 = Rs.2,47,500

2.

Calculation of Profit Share of each Partner

Profit available for distribution = Rs.4,20,000 - Rs.1,45,000 - Rs.50,000 = Rs.2,25,000

Profit sharing ratio = 1 : 1

![]()

Solution Ex. 28

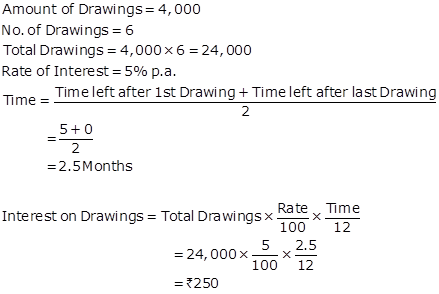

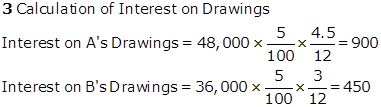

Date of drawings made by the partners is not given. Therefore, interest on drawings is calculated on average basis for a period of six months.

Solution Ex. 29

Drawings are made evenly at the middle of every month, therefore, interest on drawings is calculated for a period of six months.

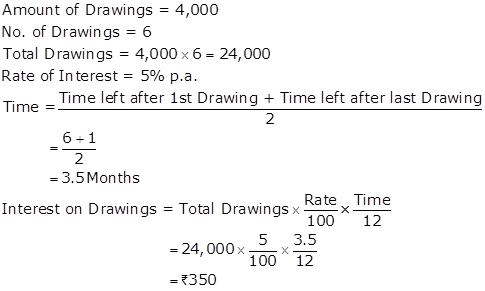

Solution Ex. 30

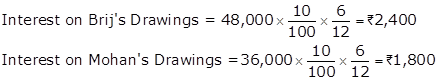

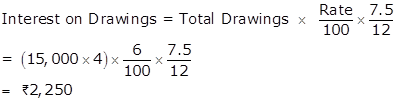

Solution Ex. 31

Solution Ex. 32

Solution Ex. 33

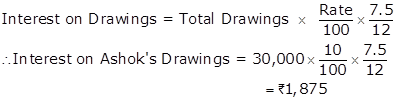

Total Drawings = 7,500 × 4 = Rs.30,000

Interest Rate = 10% p.a.

Case (a)

If equal amount is withdrawn in the beginning of each quarter:

Interest on drawings would be calculated for an average period of 7.5 months

Case (b)

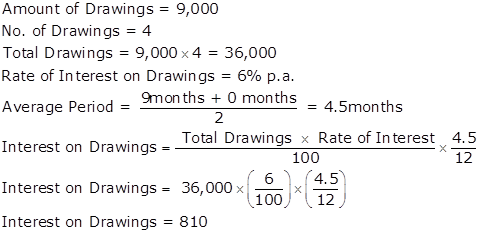

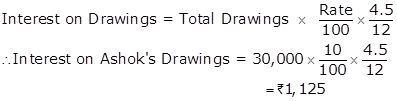

If equal amount is withdrawn at the end of each quarter:

Interest on drawings would be calculated for an average period of 4.5 months

Case (c)

If equal amount is withdrawn in the middle of each quarter:

Interest on drawings would be calculated for an average period of 6 months

Solution Ex. 34

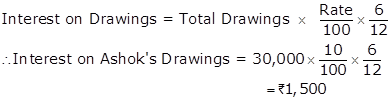

Interest on Kanika's Drawings = Rs.1,500

Interest on Gautam's Drawings = Rs.2,250

Working Notes :

1.

Calculation of Interest on Kanika's Drawings

|

By Product Method |

|||

|

Date |

Rs. (I) |

Months (II) |

Product (I × II) |

|

Apr. 01 |

10,000 |

12 |

1,20,000 |

|

June 01 |

9,000 |

10 |

90,000 |

|

Nov. 01 |

14,000 |

5 |

70,000 |

|

Dec. 01 |

5,000 |

4 |

20,000 |

|

Sum of Product |

3,00,000 |

||

2.

Calculation of Interest on Gautam's Drawings

Gautam withdrew Rs. 15,000 in the beginning of every quarter.

Accounting For Partnership FIRMS - Fundamentals Exercise 2.86

Solution Ex. 35

Calculation of Interest on A's Capital

|

Date |

Capital |

× |

Period |

= |

Product |

|

April 01, 2018 to June 30, 2018 |

50,000 |

× |

3 |

= |

1,50,000 |

|

July 01, 2018 to March 31, 2019 |

60,000 |

× |

9 |

= |

5,40,000 |

|

Sum of Product |

|

6,90,000 |

|||

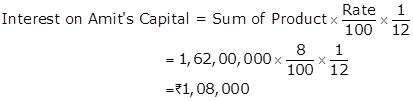

![]()

Calculation of Interest on B's Capital

|

Date |

Capital |

× |

Period |

= |

Product |

|

April 01, 2018 to June 30, 2018 |

40,000 |

× |

3 |

= |

1,20,000 |

|

July 01, 2018 to March 31, 2019 |

41,000 |

× |

9 |

= |

3,69,000 |

|

Sum of Product |

|

4,89,000 |

|||

![]()

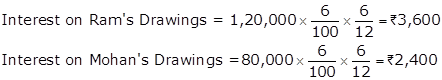

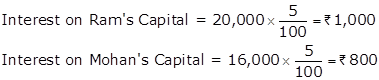

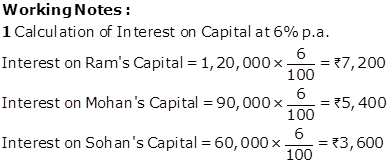

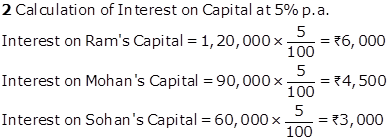

Solution Ex. 36

Interest on capital is calculated on the opening balance of partner's capital.

Calculation of Capital balance at the beginning

|

Particulars |

Ram |

Mohan |

|

Capital at the end |

24,000 |

18,000 |

|

Less : Profit already credited |

(8,000) |

(8,000) |

|

(1 : 1) |

|

|

|

Add : Drawings already debited |

4,000 |

6,000 |

|

Capital at the beginning |

20,000 |

16,000 |

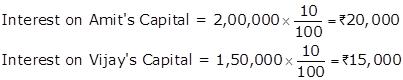

Solution Ex. 37

Calculation of Interest on Capital

![]()

Note: In this question, as the balances of both Partner's Capital Account and of Partner's Current Account are mentioned, so it has been assumed that the capital of the partners is fixed.

As we know, when the capital of the partners is fixed, drawings and interest on capital does not affect the capital balances of the partners. Rather, it would affect their current account balances. Therefore, in this case, capital at the beginning (i.e. opening capital) and capital at the end (i.e. closing capital) of the year would remain same.

Thus, the interest on capital is calculated on fixed capital balances (given in the Balance Sheet of the question).

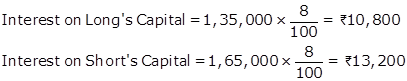

Solution Ex. 38

|

Calculation of Capital at the beginning (as on April 01, 2018) |

|||

|

Particulars |

Long Rs. |

Short Rs. |

|

|

Capital at the end |

1,20,000 |

1,40,000 |

|

|

|

Less : Adjusted Profit (1,50,000 - 1,00,000) in 1 : 1 ratio |

(25,000)

|

(25,000)

|

|

|

Add : Adjusted Drawings |

40,000 |

50,000 |

|

Capital in the beginning |

1,35,000 |

1,65,000 |

|

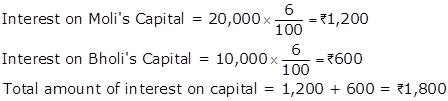

Solution Ex. 39

Calculation of Interest on Capital

Case (a)

Where there is no clean agreement except for interest on capitals

Profit for the year ended = Rs.1,500

Total amount of interest = Rs.1,800

Here, Interest on capital > the profits available for distribution. Therefore, profit of Rs. 1,500 is distributed between X and Y in the ratio of their interest on capital.

|

Particulars |

X |

: |

Y |

|

Interest on Capital or |

1,200 |

: |

600 |

|

Ratio of interest on Capital |

2 |

: |

1 |

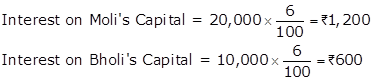

Case (b)

In case, there is an agreement that the interest on capital as a charge., then the whole amount of interest on capital is to be allowed to the partners.

Total Profit of the firm = Rs.1,500

Total amount of Interest on Capital = Rs.1,800 (i.e. Rs.1,200 + Rs.600). Therefore, loss to the firm amounts to Rs. 300. This loss is to be shared by Moli and Bholi in their profit sharing ratio that is 2:3.

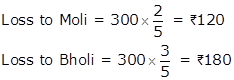

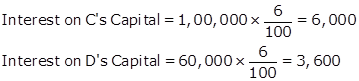

Solution Ex. 40

Calculation of Interest on Amit's Capital

|

Date |

Capital |

× |

Period |

= |

Product |

|

April 01, 2018 to Sept 30, 2018 |

15,00,000 |

× |

6 |

= |

90,00,000 |

|

Oct. 01, 2018 to March 31, 2019 |

12,00,000 |

× |

6 |

= |

72,00,000 |

|

Sum of Product |

|

1,62,00,000 |

|||

Calculation of Interest on Bramit's Capital

|

Date |

Capital |

× |

Period |

= |

Product |

|

April 01, 2018 to Sept 30, 2018 |

9,00,000 |

× |

6 |

= |

54,00,000 |

|

Oct. 01, 2018 to March 31, 2019 |

12,00,000 |

× |

6 |

= |

72,00,000 |

|

Sum of Product |

|

1,26,00,000 |

|||

Accounting For Partnership FIRMS - Fundamentals Exercise 2.87

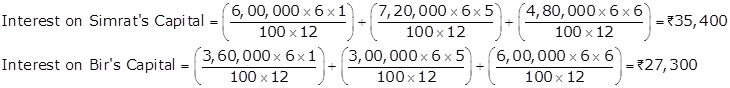

Solution Ex. 41

Case A: Interest on Capital, (If Capitals are Fixed):

Case B: Interest on Capital, (If Capitals are Fluctuating):

Working Notes:

WN 1: Calculation of Opening Capital (When Capitals were Fixed)

|

Particulars |

Simrat |

Bir |

|

Capital at the end |

4,80,000 |

6,00,000 |

|

Add: Drawings (out of capital) |

2,40,000 |

60,000 |

|

Less: Fresh Capital introduced |

(1,20,000) |

(3,00,000) |

|

Opening Capital |

6,00,000 |

3,60,000 |

WN 2: Calculation of Opening Capital (When Capitals are Fluctuating)

|

Particulars |

Simrat |

Bir |

|

Capital at the end |

4,80,000 |

6,00,000 |

|

Add: Drawings (out of capital) |

2,40,000 |

60,000 |

|

Add: Drawings (out of profits) |

1,20,000 |

60,000 |

|

Less: Fresh Capital introduced |

(1,20,000) |

(3,00,000) |

|

Less: Profit already credited |

(1,44,000) |

(96,000) |

|

Opening Capital |

5,76,000 |

3,24,000 |

Solution Ex. 42

|

Profit and Loss Appropriation Account for the year ended March 31, 2019 |

|||||

|

Dr |

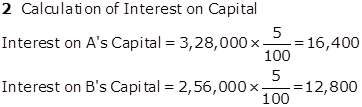

|

Cr |

|||

|

Particulars |

Rs. |

Particulars |

Rs. |

||

|

|

|

|

|

|

|

|

To Interest on Capital A/c |

|

|

By Profit and Loss A/c |

80,000 |

|

|

|

C |

6,000 |

|

----(Net Profit) |

|

|

|

D |

3,600 |

9,600 |

|

|

|

To Salary to D A/c (3,000 × 12) |

|

36,000 |

|

|

|

|

To Profit transferred to : |

|

|

|

|

|

|

|

C's Capital A/c |

17,200 |

|

|

|

|

|

D's Capital A/c |

17,200 |

34,400 |

|

|

|

|

|

80,000 |

|

80,000 |

|

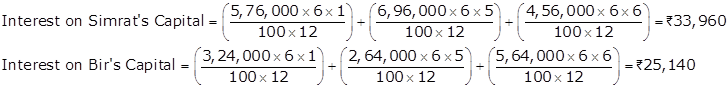

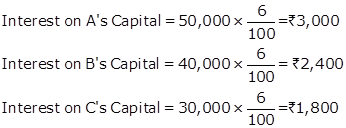

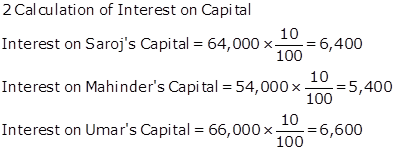

Working note

1.

Calculation of Interest on Capital

2.

Calculation of Profit Share of each Partner

Profit available for distribution =Rs.80,000 - Rs.9,600 -Rs.36,000 = Rs.34,400

![]()

Total amount received by C = Interest on Capital + Profit Share =Rs.6,000 + Rs.17,200 =Rs.23,200

Total amount received by D= Interest on Capital + Salary + Profit Share

= Rs.3,600 + Rs.36,000 + Rs.17,200

= Rs.56,800

Solution Ex. 43

|

Profit and Loss Appropriation Account |

|||||

|

Dr. |

|

Cr. |

|||

|

Particulars |

|

Rs. |

Particulars |

|

Rs. |

|

To Interest on Capital A/c |

|

|

By Profit and Loss A/c (Net Profit) |

|

2,16,000 |

|

----Amit |

20,000 |

|

By Interest on Drawings A/c |

|

|

|

----Vijay |

15,000 |

35,000 |

----Amit |

2,200 |

|

|

Salary A/c to : |

|

|

----Vijay |

2,500 |

4,700 |

|

----Amit (2,000 × 12) |

24,000 |

|

|

|

|

|

----Vijay (3,000 × 12) |

36,000 |

60,000 |

|

|

|

|

To Profit transferred to : |

|

|

|

|

|

|

----Amit's Capital A/c |

75,420 |

|

|

|

|

|

----Vijay's Capital A/c |

50,280 |

1,25,700 |

|

|

|

|

|

|

2,20,700 |

|

|

2,20,700 |

Working Notes :

1.

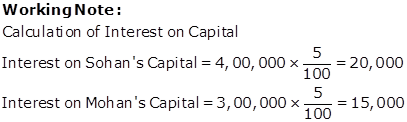

Calculation of Interest on Capital

2.

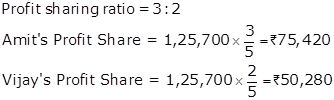

Calculation of Profit Share of each Partner

Divisible Profit = 2,16,000 + 4,700 - 35,000 - 60,000 = Rs.1,25,700

Solution Ex. 44

|

Partner's Capital Account |

|||||

|

Dr |

|

Cr |

|||

|

Particulars |

Sohan Rs. |

Mohan Rs. |

Particulars |

Sohan Rs. |

Mohan Rs. |

|

To Drawings A/c |

50,000 |

30,000 |

By Balance c/d |

4,00,000 |

3,00,000 |

|

To Interest on Drawings A/c |

1,250 |

750 |

By Interest on Capital A/c |

20,000 |

15,000 |

|

To Balance c/d |

4,69,750 |

3,37,250 |

By P and L Appropriation A/c |

60,000 |

50,000 |

|

|

|

|

By Partner's Salary A/c |

36,000 |

- |

|

|

|

|

By Commission A/c |

5,000 |

3,000 |

|

|

5,21,000 |

3,68,000 |

|

5,21,000 |

3,68,000 |

Solution Ex. 45

|

Profit and Loss Account |

|||

|

Dr |

|

Cr |

|

|

Particulars |

Rs. |

Particulars |

Rs. |

|

To Interest on Kajal's loan @ 6% p.a. |

1,800 |

By Profit b/d |

70,260 |

|

To Profit transferred to P/L Appropriation A/c |

68,460 |

|

|

|

|

70,260 |

|

70,260 |

|

Profit and Loss Appropriation Account |

|||||||

|

Dr |

|

Cr |

|||||

|

Particulars |

|

Rs. |

Particulars |

|

Rs. |

||

|

To Interest on Capital A/c |

|

|

By Profit and Loss A/c |

|

68,460 |

||

|

|

Sajal |

2,500 |

|

By Interest on Drawings A/c |

|

|

|

|

|

Kajal |

2,000 |

4,500 |

|

Sajal |

300 |

|

|

To Reserve A/c |

|

6,450 |

|

Kajal |

240 |

540 |

|

|

To Profit transferred to : |

|

|

|

|

|

||

|

|

Sajal's Capital; A/c |

38,700 |

|

|

|

|

|

|

|

Kajal's Capital A/c |

19,350 |

58,050 |

|

|

|

|

|

|

|

69,000 |

|

|

69,000 |

||

|

Partner's Capital Account |

|||||

|

Dr |

|

Cr |

|||

|

Particulars |

Sajal Rs. |

Kajal Rs. |

Particulars |

Sajal Rs. |

Kajal Rs. |

|

To Drawings A/c |

10,000 |

8,000 |

By Balance b/d |

50,000 |

40,000 |

|

To Interest on Drawings A/c |

300 |

240 |

By Interest on Capital A/c |

2,500 |

2,000 |

|

|

|

|

By P and L Appropriation A/c |

38,700 |

19,350 |

|

To Balance c/d |

80,900 |

53,110 |

|

|

|

|

|

91,200 |

61,350 |

|

91,200 |

61,350 |

Working Note :

1.

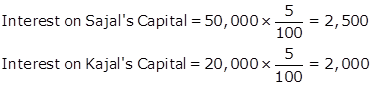

Calculation of Interest on Capital

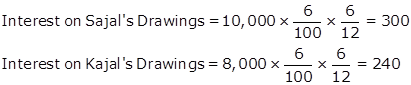

2.

Calculation of Interest on Drawings

3.

Calculation of Amount to be transferred to Reserve

Amount for Reserve = 10% of Divisible Profit

Divisible Profit = Profit + Interest on Drawings - Interest on Capital

=Rs. 68,460 + Rs.540 - Rs.4,500

= Rs.64,500

4.

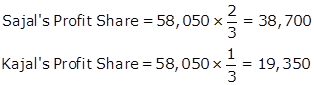

Calculation of Profit Share of each Partner

Profit available for Distribution

= 68,460 + 540 - 4,500 - 6,450

= Rs.58,050

Profit sharing ratio = 2:1

Accounting For Partnership FIRMS - Fundamentals Exercise 2.88

Solution Ex. 46

|

Profit and Loss Appropriation Account For the year ended March 31, 2019 |

||||||

|

Dr |

|

Cr |

||||

|

Particulars |

Rs. |

Particulars |

Rs. |

|||

|

To Interest on Capital A/c |

|

|

By Profit and Loss A/c |

|

50,000 |

|

|

|

A |

3,000 |

|

--- (Net Profit) |

|

|

|

|

B |

1,800 |

4,800 |

|

|

|

|

To B's Salary A/c(500 × 12) |

|

6,000 |

|

|

|

|

|

To Partner's Commission A/c |

|

|

|

|

|

|

|

|

A |

6,000 |

|

|

|

|

|

|

B |

1,581 |

7,581 |

|

|

|

|

To Profit transferred to : |

|

|

|

|

|

|

|

|

A's Capital A/c |

23,714 |

|

|

|

|

|

|

B's Capital A/c |

7,905 |

31,619 |

|

|

|

|

|

|

50,000 |

|

|

50,000 |

|

|

|

|

|

|

|

|

|

|

Partner's Current Account |

|||||

|

Dr |

Cr |

||||

|

Particulars |

A Rs. |

B Rs. |

Particulars |

A Rs. |

B Rs. |

|

To Drawings A/c |

8,000 |

6,000 |

By Balance b/d |

50,000 |

30,000 |

|

To Balance c/d |

74,714 |

41,286 |

By Interest on Capital A/c |

3,000 |

1,800 |

|

|

|

|

By Commission A/c |

6,000 |

1,581 |

|

|

|

|

By Salary A/c |

|

6,000 |

|

|

|

|

By P/L Appropriation A/c |

23,714 |

7,905 |

|

|

82,714 |

47,286 |

|

82,714 |

47,286 |

|

|

|

|

|

|

|

Working Notes :

1.

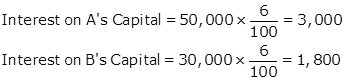

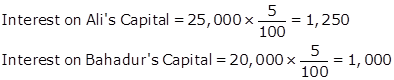

Calculation of Interest on Capital

2.

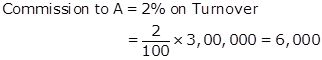

Calculation of Commission

Commission to B = 5% on Profits after all expenses (including Commission)

Profits after all expense

= Rs.50,000 - Rs.4,800 - Rs.6,000 - Rs.6,000

= Rs.33,200

3.

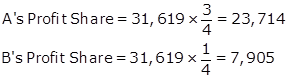

Calculation of Share of Profit of each Partner

Profit available for Distribution

= Rs.50,000 - Rs.4,800 - Rs.6,000 - Rs.7,581

= Rs.31,619

Profit sharing ratio = 3 :1

Solution Ex. 47

|

Profit and Loss Appropriation Account |

|||||

|

Dr. |

|

Cr. |

|||

|

Particulars |

|

Rs. |

Particulars |

|

Rs. |

|

To Interest on Capital |

|

|

By Profit and Loss A/c (Net Profit) |

|

1,72,000 |

|

-----A |

5,000 |

|

|

|

|

|

-----B |

5,000 |

|

|

|

|

|

-----C |

10,000 |

20,000 |

|

|

|

|

To Salary to C A/c |

|

12,000 |

|

|

|

|

To Profit transferred to : |

|

|

|

|

|

|

-----A's Capital A/c |

50,000 |

|

|

|

|

|

-----B's Capital A/c |

44,000 |

|

|

|

|

|

-----C's Capital A/c |

46,000 |

1,40,000 |

|

|

|

|

|

|

1,72,000 |

|

|

1,72,000 |

|

Journal Entries |

|||||

|

Date |

Particulars |

|

L.F. |

Debit Rs. |

Credit Rs. |

|

|

Interest on Capital A/c |

Dr. |

|

20,000 |

|

|

|

-----To A's Current A/c |

|

|

|

5,000 |

|

|

-----To B's Current A/c |

|

|

|

5,000 |

|

|

-----To C's Current A/c |

|

|

|

10,000 |

|

|

(Being Interest on partner's capital allowed to partners) |

|

|

|

|

|

|

Salary A/c |

Dr. |

|

12,000 |

|

|

|

-----To C's Current A/c |

|

|

|

12,000 |

|

|

(Being Salary Allowed to C) |

|

|

|

|

|

|

Profit and Loss Appropriation A/c |

Dr. |

|

1,40,000 |

|

|

|

-----To A's Current A/c |

|

|

|

50,000 |

|

|

-----To B,s Current A/c |

|

|

|

44,000 |

|

|

----- To C's Current A/c |

|

|

|

46,000 |

|

|

(Being profit available for distribution transferred to partners' current account) |

|

|

|

|

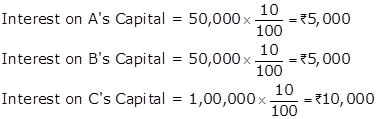

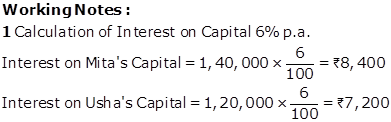

Working Notes :

1.

Calculation of Interest on Capital

2.

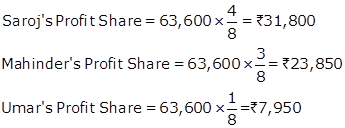

Calculation of share of Profit of each Partner

Profits available for Distribution = 1,72,000 - 20,000 - 12,000 = Rs. 1,40,000

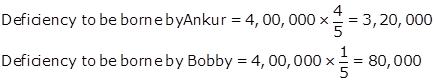

i. Distribution of first Rs. 20,000 in the Capital ratio i.e. 1:1:2

ii. Distribution of Next Rs. 30,000 in the ratio of 5: 3: 2

iii. Remaining profit available for distribution = 1,40,000 - 20,000 - 30,000 = Rs.90,000

This profit of Rs.90,000 is to be shared equally by the partners.

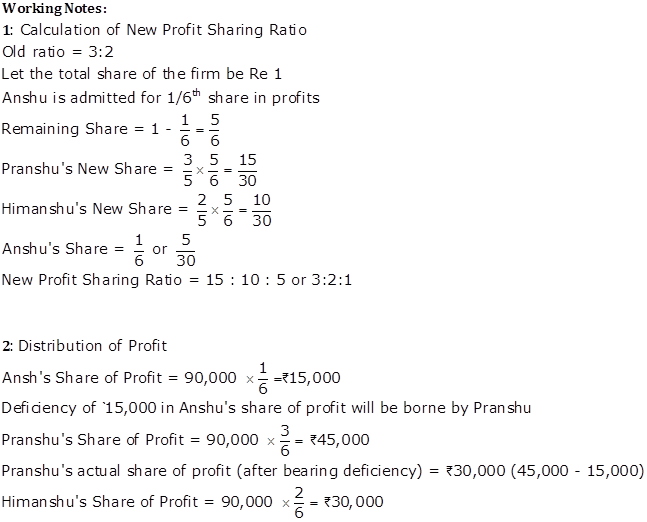

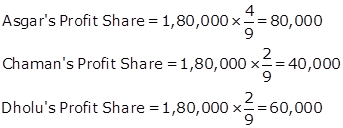

![]()

Therefore,

Total Profit Share of A = 5,000 + 15,000 + 30,000 = Rs.50,000

Total Profit Share of B = 5,000 + 9,000 + 30,000 = Rs.44,000

Total Profit Share of C = 10,000 + 6,000 + 30,000 = Rs.46,000

Solution Ex. 48

|

Profit and Loss Account |

|||

|

Dr |

|

|

Cr |

|

Particulars |

Rs. |

Particulars |

Rs. |

|

To Manager's Commission A/c ----(5% of 15,000) |

750 |

By Profit b/d (before B's Salary) ----(12,500 + 2,500) |

15,000 |

|

To Profit transferred to Profit and Loss Appropriation A/c |

14,250 |

|

|

|

|

15,000 |

|

15,000 |

|

Profit and Loss Appropriation Account |

|||||

|

Dr |

|

|

|

Cr |

|

|

Particulars |

|

Rs. |

Particulars |

Rs. |

|

|

To Interest on Capital A/c |

|

|

By Profit and Loss A/c |

14,250 |

|

|

|

A |

3,000 |

|

|

|

|

|

B |

1,800 |

4,800 |

|

|

|

To B's Salary A/c |

|

2,500 |

|

|

|

|

To Profit transferred to |

|

|

|

|

|

|

|

A's Capital A/c |

4,170 |

|

|

|

|

|

B's Capital A/c |

2,780 |

6,950 |

|

|

|

|

|

14,250 |

|

14,250 |

|

|

Partner's Capital Account |

|||||

|

Dr |

|

Cr |

|||

|

Particulars |

A Rs. |

B Rs. |

Particulars |

A Rs. |

B Rs. |

|

To Balance c/d |

57,170 |

37,080 |

By Balance b/d |

50,000 |

30,000 |

|

|

|

|

By Interest on Capital A/c |

3,000 |

1,800 |

|

|

|

|

By Salary A/c |

|

2,500 |

|

|

|

|

By PandL Appropriation A/c |

4,170 |

2,780 |

|

|

57,170 |

37,080 |

|

57,170 |

37,080 |

Working Note :

1.

Calculation of Manager's Commission

Manager's Commission = 5% on Net Profit (before Salary)

Profit

before Salary = Profit after Salary + Salary = Rs.12,500 + Rs.2,500 = Rs.15,000![]()

2.

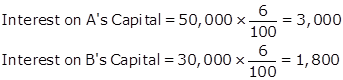

Calculation of Interest on Capital

3.

Calculation of share of profit of each Partner

Profit available for distribution = Rs.12,500 - Rs.750 - Rs.3,000 - Rs.1,800 = Rs.6,950

Profit sharing ratio = 3 : 2

Solution Ex. 49

|

Profit and Loss Appropriation Account for the year ended March 31, 2019 |

|||||

|

Dr |

|

Cr |

|||

|

Particulars |

Rs. |

Particulars |

Rs. |

||

|

To Interest on capital A/c |

|

|

By Profit b/d |

|

21,000 |

|

-----P |

2,000 |

|

----(after Salary) |

|

|

|

-----Q |

1,500 |

|

|

|

|

|

-----R |

1,500 |

5,000 |

|

|

|

|

To Profit transferred to |

|

|

|

|

|

|

-----P's Capital A/c |

7,000 |

|

|

|

|

|

-----Q's Capital A/c |

5,000 |

|

|

|

|

|

-----R's Capital A/c |

4,000 |

16,000 |

|

|

|

|

|

|

21,000 |

|

|

21,000 |

|

|

|

|

|

|

|

|

Partner's Capital Account |

|||||||

|

Dr |

Cr |

||||||

|

Particulars |

P

|

Q

|

R

|

Particulars |

P

|

Q

|

R

|

|

To Drawings A/c |

10,000 |

10,000 |

10,000 |

By Balance b/d |

40,000 |

30,000 |

30,000 |

|

To Balance c/d |

39,000 |

32,500 |

29,500 |

By Salaries A/c |

- |

6,000 |

4,000 |

|

|

|

|

|

By Interest Capital A/c |

2,000 |

1,500 |

1,500 |

|

|

|

|

|

By P/L Appropriation A/c |

7,000 |

5,000 |

4,000 |

|

|

49,000 |

42,500 |

39,500 |

|

49,000 |

42,500 |

39,500 |

|

|

|

|

|

|

|

|

|

Working Notes :

1.

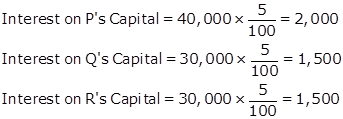

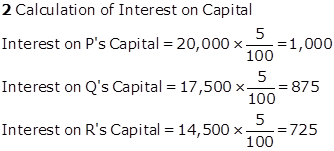

Calculation of Interest on Capital

2.

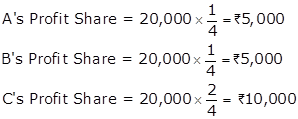

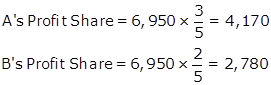

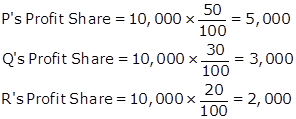

Calculation of share of profit of each Partner

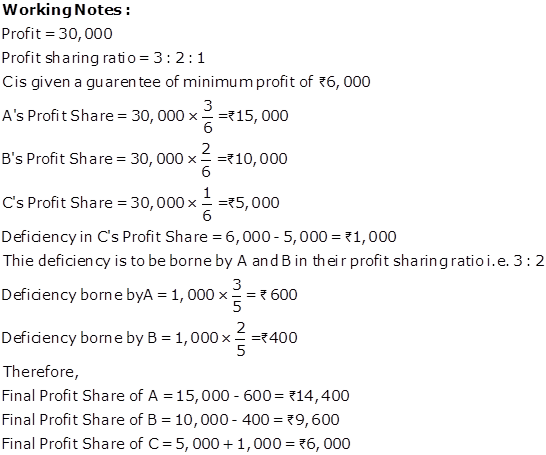

Profit available for distribution = Rs.21,000 - Rs.5,000 =Rs. 16,000

i. Distribution of first Rs.10,000 (50% 30% and 20%)

ii. Distribution of Reaming Profits in equal ratio i.e. Rs.6,000 (Rs.16,000 - Rs.10,000)

![]()

Accordingly,

Total Profit Share of P = Rs.5,000 + Rs.2,000 = Rs.7,000

Total Profit Share of Q = Rs.3,000 + Rs.2,000 = Rs.5,000

Total Profit Share of R = Rs.2,000 + Rs.2,000 = Rs.4,000

Accounting For Partnership FIRMS - Fundamentals Exercise 2.89

Solution Ex. 50

|

Profit and Loss Appropriation Account |

||||||

|

Dr |

|

Cr |

||||

|

Particulars |

Rs. |

Particulars |

Rs. |

|||

|

To Interest on capital A/c |

|

|

By Profit and Loss A/c |

|

45,000 |

|

|

|

A |

2,500 |

|

|

|

|

|

|

B |

1,500 |

|

|

|

|

|

|

C |

1,000 |

5,000 |

|

|

|

|

To Salary A/c to: |

|

|

|

|

|

|

|

|

B |

5,000 |

|

|

|

|

|

|

C |

5,000 |

10,000 |

|

|

|

|

To Profit transferred to: |

|

|

|

|

|

|

|

|

A's Current A/c |

15,000 |

|

|

|

|

|

|

B's Current A/c |

9,000 |

|

|

|

|

|

|

C's Current A/c |

6,000 |

30,000 |

|

|

|

|

|

|

45,000 |

|

|

45,000 |

|

|

|

|

|

|

|

|

|

|

Partner's Capital Account |

|||||||

|

Dr |

Cr |

||||||

|

Particulars |

A Rs. |

B Rs. |

C Rs. |

Particulars |

A Rs. |

B Rs. |

C Rs. |

|

|

|

|

|

By Balance b/d |

50,000 |

30,000 |

20,000 |

|

To Balance c/d |

50,000 |

30,000 |

20,000 |

|

|

|

|

|

|

50,000 |

30,000 |

20,000 |

|

50,000 |

30,000 |

20,000 |

|

|

|

|

|

|

|

|

|

|

Partner's Current Account |

|||||||

|

Dr |

Cr |

||||||

|

Particulars |

A Rs. |

B Rs. |

C Rs. |

Particulars |

A Rs. |

B Rs. |

C Rs. |

|

To Drawings A/c |

10,000 |

7,500 |

6,000 |

By Balance b/d |

4,500 |

1,500 |

1,000 |

|

To Balance c/d |

12,000 |

9,500 |

7,000 |

By Interest on Capital A/c |

2,500 |

1,500 |

1,000 |

|

|

|

|

|

By Salaries A/c |

- |

5,000 |

5,000 |

|

|

|

|

|

By P/L Appropriation A/c |

15,000 |

9,000 |

6,000 |

|

|

22,000 |

17,000 |

13,000 |

|

22,000 |

17,000 |

13,000 |

|

|

|

|

|

|

|

|

|

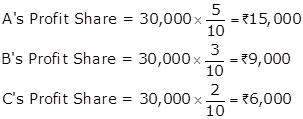

Working Notes

1.

Calculation of Interest on Capital

2.

Calculation of share of profit of each Partner

Profit available for Distribution = Rs.45,000 - Rs.15,000 = Rs.30,000

Solution Ex. 51

|

Partner's Capital Accounts |

|||||

|

Dr |

|

Cr |

|||

|

Particulars |

Ali |

Bahadur |

Particulars |

Ali |

Bahadur |

|

To Balance c/d |

25,000 |

20,000 |

By Balance b/d |

25,000 |

20,000 |

|

|

|

|

|

|

|

|

|

25,000 |

20,000 |

|

25,000 |

20,000 |

|

Partner's Current Accounts |

|||||

|

Dr |

|

Cr |

|||

|

Particulars |

Ali |

Bahadur |

Particulars |

Ali |

Bahadur |

|

To Drawings A/c |

3,500 |

2,500 |

By Interest on Capital A/c |

1,250 |

1,000 |

|

To Balance c/d |

19,642 |

10,883 |

By Bahadur's Salary A/c |

|

3,000 |

|

|

|

|

By P/L Appropriation A/c |

21,892 |

9,383 |

|

|

22,775 |

13,225 |

|

22,775 |

13,225 |

Working Notes

1.

|

Profit and Loss Appropriation Account for the year ended March 31, 2019 |

||||||

|

Dr |

|

Cr |

||||

|

Particulars |

Rs. |

Particulars |

Rs. |

|||

|

To Interest on Capital A/c |

|

|

By Profit and Loss A/c |

|

40,000 |

|

|

|

Ali |

1,250 |

|

|

|

|

|

|

Bahadur |

1,000 |

2,250 |

|

|

|

|

To Reserve A/c |

|

3,475 |

|

|

|

|

|

To Bahadur's Salary A/c |

|

3,000 |

|

|

|

|

|

To Profit transferred to |

|

|

|

|

|

|

|

|

Ali's Capital A/c |

21,892 |

|

|

|

|

|

|

Bahadur's Capital A/c |

9,383 |

31,275 |

|

|

|

|

|

|

40,000 |

|

|

40,000 |

|

|

|

|

|

|

|

|

|

2.

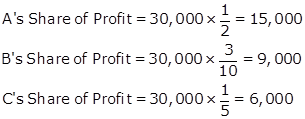

Calculation of Interest on Capital

3.

Calculation of Amount to be transferred to Reserve

4.

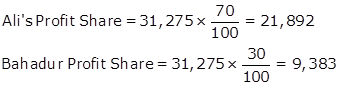

Calculation of share of profit of each partner

Profit available for distribution

=Rs. 40,000 - Rs.2,250 - Rs.3,475- Rs.3,000

= Rs.31,275

Solution Ex. 52

|

Profit and Loss Appropriation Account for the year ended March 31, 2019 |

||||||

|

Dr |

|

Cr |

||||

|

Particulars |

Rs. |

Particulars |

Rs. |

|||

|

To Interest on Capital A/c |

|

|

By Profit and Loss A/c |

|

33,360 |

|

|

|

Amal |

2,000 |

|

----(Net Profit) |

|

|

|

|

Bimal |

1,500 |

|

|

|

|

|

|

Kamal |

1,250 |

4,750 |

|

|

|

|

To Salary to Amal A/c -----(250 ×12) |

|

3,000 |

|

|

|

|

|

To Commission A/c (Bimal) |

|

985 |

|

|

|

|

|

To General Reserve A/c |

|

2,462 |

|

|

|

|

|

To Profit transferred to : |

|

|

|

|

|

|

|

|

Amal's Capital A/c |

7,388 |

|

|

|

|

|

|

Bimal's Capital A/c |

7,388 |

|

|

|

|

|

|

Kamal's Capital A/c |

7,387 |

22,163 |

|

|

|

|

|

|

33,360 |

|

|

33,360 |

|

|

|

|

|

|

|

|

|

|

Partner's Current Account |

|||||||

|

Dr |

Cr |

||||||

|

Particulars |

Amal |

Bimal |

Kamal |

Particulars |

Amal |

Bimal |

Kamal |

|

To Balance c/d |

52,388 |

39,873 |

33,637 |

By Balance b/d |

40,000 |

30,000 |

25,000 |

|

|

|

|

|

By Interest on Capital A/c |

2,000 |

1,500 |

1,250 |

|

|

|

|

|

By Salary A/c |

3,000 |

- |

- |

|

|

|

|

|

By Commission |

- |

985 |

- |

|

|

|

|

|

By P/L Appropriation A/c |

7,388 |

7,388 |

7,387 |

|

|

52,388 |

39,873 |

33,637 |

|

52,388 |

39,873 |

33,637 |

|

|

|

|

|

|

|

|

|

Working Note :

1.

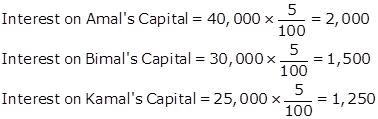

Calculation of Interest on Capital

2.

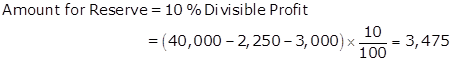

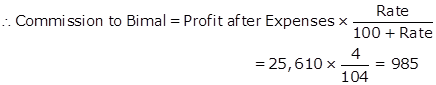

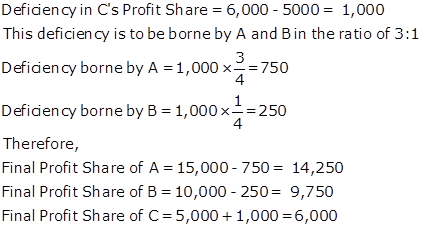

Calculation of Commission to Bimal

Commission to Bimal = 4% on Net Profits after Commission

Profit after expenses = Rs.33,360 - Rs.4,750 - Rs.3,000 = Rs.25,610

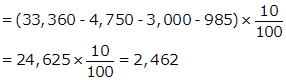

3.

Calculation of Amount to be transferred to General Reserve

Amount for General Reserve

= 10 % of Profit

4.

Calculation of share of profits to each partner

Profit available for Distribution

= Rs.33,360 - Rs.4,750 - Rs.3,000 - Rs.985 - Rs.2,462

= Rs.22,163

![]()

Solution Ex. 53

|

Profit and Loss Appropriation Account For the year ended March 31, 2019 |

|||||

|

Dr |

|

Cr |

|||

|

Particulars |

Rs. |

Particulars |

Rs. |

||

|

To Interest on Capital A/c |

|

|

By Profit and Loss A/c (Net Profit) |

5,00,000 |

|

|

|

Amit |

5,000 |

|

|

|

|

|

Binita |

10,000 |

|

|

|

|

|

Charu |

15,000 |

30,000 |

|

|

|

To Salary to Amit A/c (10,000 ×12) |

1,20,000 |

|

|

||

|

To Commission A/c (Binita) |

23,810 |

|

|

||

|

To General Reserve A/c |

50,000 |

|

|

||

|

To Profit transferred to : |

|

|

|

|

|

|

|

Amit's Capital A/c |

92,063 |

|

|

|

|

|

Binita's Capital A/c |

92,063 |

|

|

|

|

|

Charu's Capital A/c |

92,064 |

2,76,190 |

|

|

|

|

|

5,00,00 |

|

5,00,000 |

|

|

|

|

|

|

|

|

|

Partner's Capital Account |

|||||||

|

Dr |

Cr |

||||||

|

Particulars |

Amit |

Binita |

Charu |

Particulars |

Amit |

Binita |

Charu |

|

To Balance c/d |

3,17,063 |

3,25,873 |

4,07,064 |

By Balance b/d |

1,00,000 |

2,00,000 |

3,00,000 |

|

|

|

|

|

By Interest on Capital A/c |

5,000 |

10,000 |

15,000 |

|

|

|

|

|

By Salary A/c |

1,20,000 |

|

|

|

|

|

|

|

By Commission |

|

23,810 |

|

|

|

|

|

|

By P/L Appropriation A/c |

92,063 |

92,063 |

92,064 |

|

|

3,17,063 |

3,25,873 |

4,07,064 |

|

3,17,063 |

3,25,873 |

4,07,064 |

|

|

|

|

|

|

|

|

|

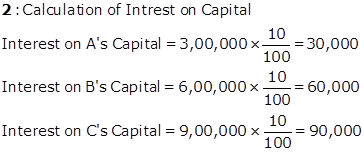

Working Note :

1.

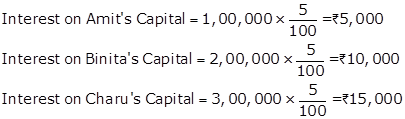

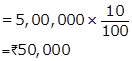

Calculation of Interest on Capital

2.

Calculation of Commission to Binita

3.

Calculation of Amount to be transferred to General Reserve

Amount for General Reserve 10 % of Profit

4.

Calculation of Share Profit of each Partner

Profit available for Distribution

= Rs.5,00,000 - Rs.30,000 - Rs.1,20,000 - Rs.23,810 - Rs.50,000

= Rs.2,76,190

![]()

Solution Ex. 54

|

Profit and Loss Appropriation Account For the year ended March 31, 2019 |

||||||

|

Dr. |

|

Cr. |

||||

|

Particulars |

Rs. |

Particulars |

Rs. |

|||

|

To Interest on Capital |

|

|

By Profit and Loss A/c |

|

5,00,000 |

|

|

|

Anita |

5,000 |

|

(Net Profit) |

|

|

|

|

Bimla |

10,000 |

|

|

|

|

|

|

Cherry |

15,000 |

30,000 |

|

|

|

|

To Salary to Anita A/c (5,000 ×12) |

|

60,000 |

|

|

|

|

|

To Commission A/c (Bimla) |

|

23,810 |

|

|

|

|

|

To General Reserve A/c |

|

38,619 |

|

|

|

|

|

To Profit transferred to : |

|

|

|

|

|

|

|

|

Anita's Capital A/c |

1,15,857 |

|

|

|

|

|

|

Bimla's Capital A/c |

1,15,857 |

|

|

|

|

|

|

Cherry's Capital A/c |

1,15,857 |

3,47,571 |

|

|

|

|

|

|

5,00,000 |

|

|

5,00,000 |

|

|

|

|

|

|

|

|

|

|

Partner's Capital Account |

|||||||

|

Dr |

Cr |

||||||

|

Particulars |

Anita |

Bimla |

Cherry |

Particulars |

Anita |

Bimla |

Cherry |

|

To Balance c/d |

2,80,857 |

3,49,667 |

4,30,857 |

By Balance b/d |

1,00,000 |

2,00,000 |

3,00,000 |

|

|

|

|

|

By Interest on Capital A/c |

5,000 |

10,000 |

15,000 |

|

|

|

|

|

By Salary A/c |

60,000 |

|

|

|

|

|

|

|

By Commission A/c |

|

23,810 |

|

|

|

|

|

|

By P/L Appropriation A/c |

1,15,857 |

1,15,857 |

1,15,857 |

|

|

2,80,857 |

3,49,667 |

4,30,857 |

|

2,80,857 |

3,49,667 |

4,30,857 |

|

|

|

|

|

|

|

|

|

Working Note :

1.

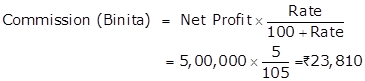

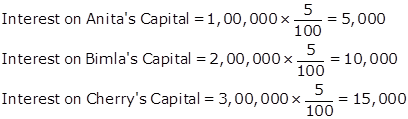

Calculation of Interest on Capital

2.

Calculation of Commission to Bimla

Commission to Bimla = 5% on Net Profits after Commission

3.

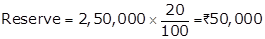

Calculation of Amount to be transferred to General Reserve

Amount for General Reserve 10 % of Divisible Profit

Divisible Profit = Rs.5,00,000 - Rs.30,000 - Rs.23,810 - Rs.60,000

= Rs.3,86,190

4.

Calculation of Share of Profit of each Partner

Profit available for Distribution

= Rs.5,00,000 - Rs.30,000 - Rs.60,000 - Rs.23,810 - Rs.38,619

= Rs.3,47,571

![]()

Accounting For Partnership FIRMS - Fundamentals Exercise 2.90

Solution Ex. 55

|

Profit and Loss Appropriation Account for the year ended March 31, 2019 |

|||

|

Dr. |

|

|

Cr. |

|

Particulars |

Rs. |

Particulars |

Rs. |

|

To Interest on Anshul's Capital A/c |

20,000 |

By Profit and Loss A/c |

32,000 |

|

To Anshul's Salary A/c |

12,000 |

|

|

|

|

32,000 |

|

32,000 |

|

|

|

|

|

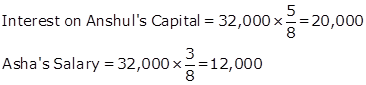

Working Note

Salary to Asha = Rs.24,000

Total appropriation to be made = Rs.40,000 + Rs.24,000 = Rs.64,000

Profit earned during the year = Rs.32,000

Here, profit available for distribution (i.e. Rs.32,000) is less than the sum of total of interest on Capital and Salary (i.e. Rs.64,000)

Therefore, profit will be distributed in the ratio of interest on Capital and Salary.

Ratio of Interest on Anshul's Capital to Asha' Salary is 40,000 : 24,000, i.e. 5 : 3.

Solution Ex. 56

|

Profit and Loss Appropriation Account For the year ended March 31, 2019 |

||||||

|

Dr. |

|

Cr. |

||||

|

Particulars |

Rs. |

Particulars |

Rs. |

|||

|

To Interest on Capital A/c |

|

|

By Profit and Loss A/c |

|

4,59,500 |

|

|

|

X |

24,000 |

|

(4,61,000 - 1,500) |

|

|

|

|

Y |

18,000 |

42,000 |

By Interest on drawings |

|

|

|

To X's Capital A/c (Commission) |

|

|

-----X's A/c |

5,000 |

|

|

|

(3,50,000×5%) |

|

17,500 |

-----Y's A/c |

6,250 |

11,250 |

|

|

To Salary A/c |

|

|

|

|

|

|

|

-----X |

60,000 |

|

|

|

|

|

|

-----Y |

90,000 |

1,50,000 |

|

|

|

|

|

To Reserve A/c |

|

50,000 |

|

|

|

|

|

To Profit transferred to : |

|

|

|

|

|

|

|

|

X's Capital A/c |

1,18,125 |

|

|

|

|

|

|

Y's Capital A/c |

93,125 |

2,11,250 |

|

|

|

|

|

|

4,70,750 |

|

|

4,70,750 |

|

|

|

|

|

|

|

|

|

|

Partner's Capital Account |

|||||||

|

Dr |

|

Cr |

|||||

|

Particulars |

X |

Y |

Particulars |

X |

Y |

||

|

To Drawings A/c |

1,00,000 |

1,25,000 |

By Balance b/d |

2,00,000 |

1,50,000 |

||

|

To Interest on drawings A/c |

5,000 |

6,250 |

By Interest on Capital A/c |

24,000 |

18,000 |

||

|

To Balance c/d |

3,14,625 |

2,19,875 |

By Salary A/c |

60,000 |

90,000 |

||

|

|

|

|

By Commission A/c |

17,500 |

|

||

|

|

|

|

By P/L Appropriation A/c |

1,18,125 |

93,125 |

||

|

|

4,19,625 |

3,51,125 |

|

4,19,625 |

3,51,125 |

||

|

|

|

|

|

|

|

||

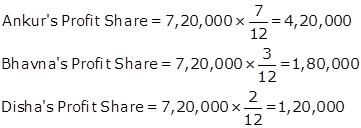

Working Note :

1.

Calculation of Reserve

Profit before charging Interest on Drawings but after making appropriations

= Rs.4,59,500 - Rs.42,000 - Rs.17,500 - Rs.60,000 - Rs.90,000

= Rs.2,50,000

2.