Class 12-commerce T S GREWAL Solutions Accountancy Chapter 10: Company Accounts - Redemption of Debentures

Company Accounts - Redemption of Debentures Exercise 10.29

Solution Ex.1

Amount required to be transferred to DRR = 25% of the Face value of Debentures

= 25% of Rs 25, 00,000 = Rs 6,25,0000

Solution Ex.2

a. As the debentures are fully convertible, there is no need for creation of Debenture Redemption Reserve.

b. For the non- convertible part of debentures, DRR would be created as follows:

Non-Convertible Part: 25% of 20,00,000 = 5,00,000

Amount required to be transferred to DRR (25% of Face Value) = 5,00,000 × 25% = 1, 25,000

Solution Ex.3

As per Section 71 (4) of the Companies Act, 2013, an amount equal to at least 25% of the value of debentures is to be transferred to the Debenture Redemption Reserve Account.

Thus, the amount to be transferred to Debenture Redemption Reserve A/c would be 2,00,000 × 25% = Rs.50,000.

Solution Ex.4

As per Section 71 (4) of the Companies Act, 2013, an amount equal to at least 25% of the value of debentures is to be transferred to the Debenture Redemption Reserve Account.

Thus, the amount to be transferred to Debenture Redemption Reserve A/c would be 10,00,000 × 25% = Rs.2,50,000

Further, as per Rule 18 (7) every company required to create Debenture Redemption Reserve is to invest an amount at least equal to 15% of the value of debentures in specified securities.

Thus, amount transferred to Debenture Redemption Investment A/c would be 10,00,000 × 15% = Rs.1,50,000.

|

Journal In the Books of Nirbhai Chemicals Ltd. |

|||||

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

2018 |

10,80,000 |

||||

|

30th June |

Bank A/c |

Dr. |

10,00,000 |

||

|

-------To 6% Debenture A/c |

80,000 |

||||

|

-------To Securities Premium Reserve A/c |

|||||

|

(Being debenture issued) |

|||||

|

2019 |

|||||

|

31st Mar |

Statement of Profit and Loss A/c |

Dr. |

2,50,000 |

||

|

-------To Debenture Redemption Reserve A/c |

2,50,000 |

||||

|

(Being DRR created) |

|||||

|

30th April |

Debenture Redemption Investment A/c |

Dr. |

1,50,000 |

||

|

-------To Bank A/c |

1,50,000 |

||||

|

|

(Being investment made in specified securities) |

|

|

|

|

|

|

|

|

|

|

|

|

30th June |

Bank A/c |

Dr. |

|

1,50,000 |

|

|

|

-------To Debenture Redemption Investment A/c |

|

|

|

1,50,000 |

|

|

(Being investment enchased) |

|

|

|

|

|

|

|

|

|

|

|

|

30th June |

6% Debenture A/c |

Dr. |

|

10,00,000 |

|

|

|

-------To Debenture holders' A/c |

|

|

|

10,00,000 |

|

|

(Being amount due on 6% debenture) |

|

|

|

|

|

|

|

|

|

|

|

|

30th June |

Debenture holders' A/c |

Dr. |

|

10,00,000 |

|

|

|

-------To Bank A/c |

|

|

|

10,00,000 |

|

|

(Being payment made on redemption) |

|

|

|

|

|

|

|

|

|

|

|

|

30th June |

Debenture Redemption Reserve A/c |

Dr. |

|

2,50,000 |

|

|

|

-------To General Reserve A/c |

|

|

|

2,50,000 |

|

|

(Being transfer of debenture redemption reserve to general reserve) |

|

|

|

|

Note:

As the question was silent, so the entries for interest on debentures have been ignored. The students' may Journalize the entries related to interest on debentures as given below.

|

Journal |

|||||

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

2019 |

|||||

|

31st Mar |

Debenture Interest A/c |

Dr. |

45,000 |

||

|

-------To Debenture holders' A/c |

45,000 |

||||

|

(Being interest on 6% debenture due for 9 months) |

|||||

|

31st Mar |

Debenture holders' A/c |

Dr. |

45,000 |

||

|

-------To Bank A/c |

45,000 |

||||

|

(Being payment of interest to debenture holders) |

|||||

|

31st Mar |

Statement of Profit and Loss A/c |

Dr. |

45,000 |

||

|

|

-------To Debenture Interest A/c |

|

|

|

45,000 |

|

|

( Being transfer of debenture interest to statement of profit and loss) |

|

|

|

|

Solution Ex.5

Banking Companies have been exempted to invest in specified securities as per the Companies Act, 2013.

Solution Ex.6

|

Year ended on |

Date of Investment |

Redeemable Amount |

Minimum amount of DRI |

|

31st March 2018 |

On or before 30th April 2017 |

20,00,000 × 15% = 3,00,000 |

3,00,000 × 15% =45,000 |

|

31st March 2019 |

On or before 30th April 2018 |

20,00,000 × 25% = 5,00,000 |

5,00,000 × 15% = 75,000 |

|

31st March 2020 |

On or before 30th April 2019 |

20,00,000 × 15% = 3,00,000 |

3,00,000 × 15% = 45,000 |

|

31st March 2021 |

On or before 30th April 2020 |

20,00,000 × 25% = 5,00,000 |

5,00,000 × 15% = 75,000 |

|

31st March 2022 |

On or before 30th April 2021 |

20,00,000 × 20% = 4,00,000 |

4,00,000 × 15% = 60,000 |

Company Accounts - Redemption of Debentures Exercise 10.30

Solution Ex.7

|

In the books of IFCI Limited Journal |

|||||

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

2011 |

|||||

|

1st April |

Bank A/c |

Dr. |

5,00,00,000 |

||

|

-------To 9% Debenture Application A/c |

5,00,00,000 |

||||

|

(Being debenture Application money received) |

|||||

|

1st April |

9% Debenture Application A/c |

Dr. |

5,00,00,000 |

||

|

-------To 9% Debenture A/c |

5,00,00,000 |

||||

|

(Being debenture application money transferred to debenture account) |

|||||

|

2019 |

|||||

|

1st April |

9%Debenture A/c |

Dr. |

5,00,00,000 |

||

|

-------To Debenture holders' A/c |

5,00,00,000 |

||||

|

(Being debentures due for redemption) |

|||||

|

|

|

|

|

|

|

|

1st April |

Debenture holders' A/c |

Dr. |

|

5,00,00,000 |

|

|

|

-------To Bank A/c |

|

|

|

5,00,00,000 |

|

|

(Being amount due for redemption paid to debenture holders) |

|

|

|

|

Notes:

1. No DRR is to be created for All India Financial Institutions.

2. Entries for interest on debentures have been ignored in the above solution as the question was silent in this regards. However, the entries related to interest on debentures every year from April 01, 2011 to March 31, 2019 can be recorded as provided below.

|

Journal |

|||||

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

2011 |

|||||

|

31st Mar |

Debenture Interest A/c |

Dr. |

45,00,000 |

||

|

-------To Debenture holders A/c |

45,00,000 |

||||

|

(Being interest on 9% debentures due) |

|||||

|

31st Mar |

Debenture holders' A/c |

Dr. |

45,00,000 |

||

|

-------To Bank A/c |

45,00,000 |

||||

|

(Being payment of interest to debenture holders') |

|||||

|

31st Mar |

Statement of Profit and Loss A/c |

Dr. |

|

45,00,000 |

|

|

|

-------To Debenture Interest A/c |

|

|

|

45,00,000 |

|

|

(Being transfer of debenture interest to Statement of Profit and Loss) |

|

|

|

|

Solution Ex.8

|

Journal |

|||||

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

2002 |

|||||

|

31st Mar |

Statement of Profit and Loss A/c |

Dr. |

60,000 |

||

|

-------To Debenture Redemption Reserve A/c |

60,000 |

||||

|

(Being surplus amount is transferred to DRR) |

|||||

|

30th April |

Debenture Redemption Investment A/c |

Dr. |

1,.20,000 |

||

|

-------To Bank A/c |

1,20,000 |

||||

|

(Being investment is made in specified securities equal to 15% of the value of debenture redeemed) |

|||||

|

2003 |

|||||

|

31st Mar |

9% Debenture A/c |

Dr. |

8,00,000 |

||

|

-------To Debenture holders' A/c |

8,00,000 |

||||

|

(Being debenture due for redemption) |

|||||

|

|

|

|

|

|

|

|

31st Mar |

Bank A/c |

Dr. |

|

1,20,000 |

|

|

|

-------To Debenture Redemption Investment A/c |

|

|

|

1,20,000 |

|

|

(Being investment made in specified securities is now encased) |

|

|

|

|

|

|

|

|

|

|

|

|

31st Mar |

Debenture holders' A/c |

Dr. |

|

8,00,000 |

|

|

|

-------To Bank A/c |

|

|

|

8,00,000 |

|

|

(Being amount paid to debenture holders) |

|

|

|

|

|

|

|

|

|

|

|

|

31st Mar |

Debenture Redemption Reserve A/c |

Dr. |

|

2,00,000 |

|

|

|

-------To General Reserve A/c |

|

|

|

2,00,000 |

|

|

(Being DRR transferred to general reserve) |

|

|

|

|

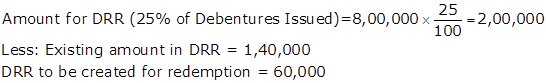

Working Notes:

Notes:

1. No interest has been calculated on Investments as rate of interest is not provided.

2. Entries for interest on debentures have been ignore, however, the entries have been provided for reference.

|

Journal |

|||||

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

2002 |

|||||

|

31st Mar |

Debenture Interest A/c |

Dr. |

72,000 |

||

|

-------To Debenture holder' A/c |

72,000 |

||||

|

(Being interest on 9% debenture due) |

|||||

|

31st Mar |

Debenture holder' A/c |

Dr. |

72,000 |

||

|

-------To Bank A/c |

72,000 |

||||

|

(Being payment of interest to debenture holders') |

|||||

|

31st Mar |

Statement of Profit and Loss A/c |

Dr. |

|

72,000 |

|

|

|

-------To Debenture Interest A/c |

|

|

|

72,000 |

|

|

(Being transfer of debenture interest to statement of profit and loss) |

|

|

|

|

Solution Ex.9

|

Books Of W Ltd. Journal |

|||||

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

2018 |

|||||

|

Mar.31 |

Statement of Profit and Loss A/c |

Dr. |

1,00,000 |

||

|

-------To Debenture Redemption Reserve A/c |

1,00,000 |

||||

|

(Being surplus transferred to debenture redemption reserve) |

|||||

|

Apr.30 |

Debenture Redemption Investment A/c |

Dr. |

45,000 |

||

|

-------To Bank A/c |

45,000 |

||||

|

(Being investment is made in specified securities equal to 15% of the value of debenture redeemed) |

|||||

|

2018 |

|||||

|

June 30 |

9% Debenture A/c |

Dr. |

3,00,000 |

||

|

-------To Debenture holders' A/c |

3,00,000 |

||||

|

(Being debenture due for redemption) |

|||||

|

|

|

|

|

|

|

|

June 30 |

Bank A/c |

Dr. |

|

45,000 |

|

|

|

-------To Debenture Redemption Investment A/c |

|

|

|

45,000 |

|

|

(Being investment made in specified is now encased) |

|

|

|

|

|

|

|

|

|

|

|

|

June 30 |

Debenture holders A/c |

Dr. |

|

3,00,000 |

|

|

|

-------To Bank A/c |

|

|

|

3,00,000 |

|

|

(Being amount due to debenture holders Paid) |

|

|

|

|

|

|

|

|

|

|

|

|

June 30 |

Debenture Redemption Reserves A/c |

|

|

75,000 |

|

|

|

-------To General Reserves A/c |

|

|

|

75,000 |

|

|

(50% Debenture Redemption Reserves transferred to General Reserves A/c) |

|

|

|

|

|

|

|

|

|

|

|

Working Note:

![]()

Note:

1. Here, the entry for transferring the amount of DRR to General Reserve has been passed with 50% of DRR amount, since the company has not fully redeemed all its debentures. Therefore, 50% of DRR amount i.e. 50% of 1,50,000, has been transferred to General Reserve.

2. As the question was silent, entries for interest on debentures have been ignored. However, these have been provided for reference.

|

Journal |

|||||

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

2018 |

|||||

|

31st Mar |

Debenture Interest A/c |

Dr. |

33,750 |

||

|

-------To Debenture holder A/c |

33,750 |

||||

|

(Being interest on 9% debenture due for 12 month) |

|||||

|

31st Mar |

Debenture holders' A/c |

Dr. |

33,750 |

||

|

-------To Bank A/c |

33,750 |

||||

|

(Being payment of interest to debenture holders') |

|||||

|

31st Mar |

Statement of Profit and Loss A/c |

Dr. |

|

33,750 |

|

|

|

-------To Debenture Interest A/c |

|

|

|

33,750 |

|

|

(Being transfer of debenture interest to statement of profit and loss) |

|

|

|

|

Solution Ex.10

|

Journal |

|||||

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

2018 |

|||||

|

31st Mar |

Statement of Profit and Loss A/c |

Dr. |

6,00,000 |

||

|

-------To Debenture Redemption Reserve A/c |

6,00,000 |

||||

|

(Being surplus amount is transferred to debenture redemption reserve) |

|||||

|

30th April |

Debenture Redemption Investment A/c |

Dr. |

90,000 |

||

|

-------To Bank A/c |

90,000 |

||||

|

(Being investment is made in specified equal to 15% of the value of debenture redeemed) |

|||||

|

2019 |

|||||

|

31st Mar |

10% Debenture A/c |

Dr. |

6,00,000 |

||

|

-------To Debenture holders A/c |

6,00,000 |

||||

|

(Being debenture due for redemption) |

|||||

|

|

|

|

|

|

|

|

31st Mar |

Bank A/c |

Dr. |

|

90,000 |

|

|

|

-------To Debenture Redemption Investment A/c |

|

|

|

90,000 |

|

|

(Being investment made in securities, now encased) |

|

|

|

|

|

|

|

|

|

|

|

|

31st Mar |

Debenture holders' A/c |

Dr. |

|

6,00,000 |

|

|

|

-------To Bank A/c |

|

|

|

6,00,000 |

|

|

(Being payment made to debenture holders) |

|

|

|

|

|

|

|

|

|

|

|

|

31st Mar |

Debenture Redemption Reserve A/c |

Dr. |

|

6,00,000 |

|

|

|

-------To General Reserve A/c |

|

|

|

6,00,000 |

|

|

(Being debenture redemption reserve transferred to general reserve) |

|

|

|

|

In case of redemption of debentures by profits, 100% of the nominal value of debentures is transferred to DRR A/c.

Note:

As the question was silent, entries for interest on debentures have been ignored. However, these have been provided for reference.

|

Journal |

|||||

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

2019 |

|||||

|

31st Mar |

Debenture Interest A/c |

Dr. |

60,000 |

||

|

-------To Debenture Holders A/c |

60,000 |

||||

|

(Being interest on 10% debenture due) |

|||||

|

31st Mar |

Debenture Holders A/c |

Dr. |

60,000 |

||

|

-------To Bank A/c |

60,000 |

||||

|

(Being payment of interest to debenture holders) |

|||||

|

31st Mar |

Statement of Profit and Loss A/c |

Dr. |

|

60,000 |

|

|

|

-------To Debenture Interest A/c |

|

|

|

60,000 |

|

|

(Being payment of interest to debenture holders') |

|

|

|

|

Solution Ex.11

|

Books of India Textiles Corporation Ltd Journal |

|||||

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

2019 |

|||||

|

31st Mar |

Statement of Profit and Loss A/c |

Dr. |

9,50,000 |

||

|

-------To Debenture Redemption to Debenture A/c |

9,50,000 |

||||

|

(Being profit transferred to debenture redemption reserve) |

|||||

|

30th April |

Debenture Redemption Investment A/c |

Dr. |

7,50,000 |

||

|

-------To Bank A/c |

7,50,000 |

||||

|

(Being investment is made in specified equal to 15% of the value of debenture redeemed) |

|||||

|

2019 |

|||||

|

31st July |

9% Debenture A/c |

Dr. |

50,00,000 |

||

|

-------To Debenture holders A/c |

50,00,000 |

||||

|

(Being debenture due for redemption) |

|||||

|

|

|

|

|

|

|

|

31st July |

Bank A/c |

Dr. |

|

7,50,000 |

|

|

|

-------To Debenture Redemption Investment A/c |

|

|

|

7,50,000 |

|

|

(Being investment made in securities, now encased) |

|

|

|

|

|

|

|

|

|

|

|

|

31st July |

Debenture holders A/c |

Dr. |

|

50,00,000 |

|

|

|

-------To Bank A/c |

|

|

|

50,00,000 |

|

|

(Being payment made to debenture holders) |

|

|

|

|

|

|

|

|

|

|

|

|

31st July |

Debenture Redemption Reserve A/c |

Dr. |

|

12,50,000 |

|

|

|

-------To General Reserve A/c |

|

|

|

12,50,000 |

|

|

(Being debenture redemption reserve transferred to general reserve) |

|

|

|

|

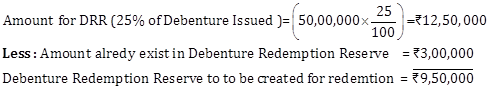

Working Notes:

1.

Calculation of amount transferred to Debenture Redemption Reserve Account

2.

Calculation of amount invested in Specified Securities

![]()

Note:

As the question was silent, entries for interest on debentures have been ignored. However, these have been provided for reference.

|

Journal |

|||||

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

2019 |

|||||

|

31st Mar |

Debenture Interest A/c |

Dr. |

4,50,000 |

||

|

-------To Debenture Holders A/c |

4,50,000 |

||||

|

(Being interest on 9% debenture due) |

|||||

|

31st Mar |

Debenture holders A/c |

Dr. |

4,50,000 |

||

|

-------To Bank A/c |

4,50,000 |

||||

|

(Being payment of interest debenture holders) |

|||||

|

31st Mar |

Statement of Profit and Loss A/c |

Dr. |

|

4,50,000 |

|

|

|

-------To Debenture Interest A/c |

|

|

|

4,50,000 |

|

|

(Being transfer of debenture interest to statement of profit and loss) |

|

|

|

|

Solution Ex.12

|

Books of Manish Ltd. Journal |

|||||

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

2017 |

|||||

|

1st April |

Bank A/c |

Dr. |

40,00,000 |

||

|

-------To Debenture Application A/c |

40,00,000 |

||||

|

(Being debenture application money received) |

|||||

|

Debenture Application A/c |

Dr. |

40,00,000 |

|||

|

Loss on Issue of Debenture A/c |

Dr. |

2,00,000 |

|||

|

-------To 8% Debenture A/c |

40,00,000 |

||||

|

-------To Premium on Redemption of Debenture A/c |

2,00,000 |

||||

|

(Being debenture issued with the term repayable at 5% Premium) |

|||||

|

2018 |

|||||

|

31st Mar |

Statement of Profit and Loss A/c (Note 1) |

Dr. |

10,00,000 |

||

|

-------To Debenture Redemption Reserve A/c |

10,00,000 |

||||

|

(Being Surplus amount is transferred to debenture redemption Reserve) |

|||||

|

|

|

|

|

|

|

|

2019 |

|

|

|

|

|

|

31st Mar |

Statement of Profit and Loss A/c (Note 1) |

Dr. |

|

10,00,000 |

|

|

|

-------To Debenture Redemption Reserve A/c |

|

|

|

10,00,000 |

|

|

(Being surplus amount is transferred to debenture redemption Reserve) |

|

|

|

|

|

|

|

|

|

|

|

|

30th April |

Debenture Redemption investment A/c (Note 2) |

Dr. |

|

6,00,000 |

|

|

|

-------To Bank A/c |

|

|

|

6,00,000 |

|

|

(Being investment is made in specified securities equal to 15% of the value of debenture redeemed) |

|

|

|

|

|

|

|

|

|

|

|

|

31st Mar |

8% Debenture A/c |

Dr. |

|

40,00,000 |

|

|

|

Premium on Redemption of Debenture A/c |

Dr. |

|

2,00,000 |

|

|

|

-------To Debenture holders A/c |

|

|

|

42,00,000 |

|

|

(Being debenture due to redemption along with premium) |

|

|

|

|

|

|

|

|

|

|

|

|

30th June |

Bank A/c |

Dr. |

|

6,00,000 |

|

|

|

-------To Debenture Redemption Investment A/c |

|

|

|

6,00,000 |

|

|

(Being investment made in securities, now encased) |

|

|

|

|

|

|

|

|

|

|

|

|

30th June |

Debenture holders A/c |

Dr. |

|

42,00,000 |

|

|

|

-------To Bank A/c |

|

|

|

42,00,000 |

|

|

(Being amount paid to debenture holders) |

|

|

|

|

|

|

|

|

|

|

|

|

30th June |

Debenture Redemption Reserve A/c |

Dr. |

|

20,00,000 |

|

|

|

-------To General Reserve A/c |

|

|

|

20,00,000 |

|

|

(Being debenture redemption reserve transferred to general reserve) |

|

|

|

|

Note:

1. As per Section 71(4) of the Companies Act, 2013, companies are required to create DRR at 25% of the total value of debentures. However, it is the discretion of the company to transfer more amounts to DRR than the prescribed amount of 25%. In this case, as explicitly specified about company's discretion for creation of DRR of a total amounting to Rs.20,00,000 which is 50% of the total value of redeemable debentures is allowed.

2. As explicitly stated in the question, entries for interest on debentures have been ignored.

Solution Ex.13

|

Journal In the Books of Godrej Ltd. |

|||||

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

2017 |

|||||

|

Apr.01 |

Debenture Redemption Investment A/c |

Dr. |

3,00,000 |

||

|

-------To Bank A/c |

3,00,000 |

||||

|

(Being investment is made in specified securities) |

|||||

|

2018 |

|||||

|

Mar.31 |

Bank A/c |

Dr. |

|

3,16,200 |

|

|

|

Tax Payable A/c |

Dr. |

|

1,800 |

|

|

|

-------To Interest on Debenture Redemption Investment A/c |

|

|

|

18,000 |

|

|

-------To Debenture Redemption Investment A/c |

|

|

|

3,00,000 |

|

|

(Being investment encased and interest received) |

|

|

|

|

|

|

|

|

|

|

|

|

Mar.31 |

Statement of Profit and Loss A/c |

Dr. |

|

1,50,000 |

|

|

|

-------To Debenture Redemption Reserve A/c |

|

|

|

1,50,000 |

|

|

(Being Debenture Redemption Reserve created) |

|

|

|

|

|

|

|

|

|

|

|

|

31st Aug |

7% Debenture A/c |

Dr. |

|

20,00,000 |

|

|

|

-------To Debenture holders A/c |

|

|

|

20,00,000 |

|

|

(Being amount due o 7% Debenture) |

|

|

|

|

|

|

|

|

|

|

|

|

31st Aug |

Debenture holders A/c |

Dr. |

|

20,00,000 |

|

|

|

-------To Bank A/c |

|

|

|

20,00,000 |

|

|

(Being payment made on redemption on Debenture) |

|

|

|

|

|

|

|

|

|

|

|

|

31st Aug |

Debenture Redemption Reserve A/c |

Dr. |

|

5,00,000 |

|

|

|

-------To General Reserve A/c |

|

|

|

5,00,000 |

|

|

(Being debenture redemption reserve transferred to general reserve) |

|

|

|

|

|

|

|

|

|

|

|

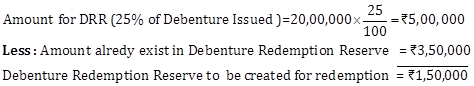

Working Notes:

WN 1: Calculation of amount transferred to DRR)

Solution Ex.14

|

In the books of Apollo Limited Journal |

|||||

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

2013 |

|||||

|

1st April |

Bank A/c |

Dr. |

21,00,000 |

||

|

-------To 8% Debenture application A/c |

21,00,000 |

||||

|

(Being debenture application money received) |

|||||

|

s |

|||||

|

8% Debenture application A/c |

Dr. |

21,00,000 |

|||

|

Loss on Issue of debenture A/c |

Dr. |

1,68,000 |

|||

|

-------To 8% Debenture A/c |

21,00,000 |

||||

|

-------To Premium on Redemption A/c |

1,68,000 |

||||

|

(Being 21,00,000 8% debenture of 10 each issued with the term repayable at 8% premium) |

|||||

|

2017 |

|||||

|

31st Mar |

Statement of Profit and Loss A/c |

Dr. |

1,75,000 |

||

|

-------To Debenture Redemption Reserve A/c |

1,75,000 |

||||

|

(Being profit transferred to debenture redemption reserve) |

|||||

|

|

|

|

|

|

|

|

2018 |

|

|

|

|

|

|

31st Mar |

Statement of Profit and Loss A/c |

Dr. |

|

1,75,000 |

|

|

|

-------To Debenture Redemption Reserve A/c |

|

|

|

1,75,000 |

|

|

(Being profit transferred to debenture redemption reserve) |

|

|

|

|

|

|

|

|

|

|

|

|

2019 |

|

|

|

|

|

|

31st Mar |

Statement of Profit and Loss A/c |

Dr. |

|

1,75,000 |

|

|

|

-------To Debenture Redemption Reserve A/c |

|

|

|

1,75,000 |

|

|

(Being profit transferred to debenture redemption reserve) |

|

|

|

|

|

|

|

|

|

|

|

|

30th April |

Debenture Redemption Investment A/c |

Dr. |

|

3,15,000 |

|

|

|

-------To Bank A/c |

|

|

|

3,15,000 |

|

|

(Being investment is made in government securities equal to 15% of the value of debentures redeemed) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

30th June |

8% Debenture A/c |

Dr. |

|

21,00,000 |

|

|

|

Premium on Redemption Reserve A/c |

|

|

1,68,000 |

|

|

|

-------To Debentures Holders' A/c |

|

|

|

22,68,000 |

|

|

(Being debenture due for redemption along with Premium) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Bank A/c |

Dr. |

|

3,15,000 |

|

|

|

-------To Debenture Redemption Reserve A/c |

Dr. |

|

|

3,15,000 |

|

|

(Being investment made in specified securities now encased) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Debenture holders A/c |

Dr. |

|

22,68,000 |

|

|

|

-------To Bank A/c |

|

|

|

22,68,000 |

|

|

(Being payment made to debenture holders) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Debenture Redemption Reserve A/c |

Dr. |

|

5,25,000 |

|

|

|

------To General reserve A/c |

|

|

|

5,25,000 |

|

|

(Being debenture redemption reserve transferred to general reserve) |

|

|

|

|

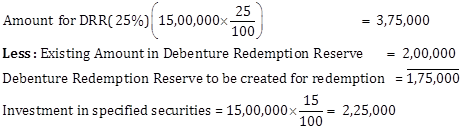

Working Notes:

1

Calculation of amount transferred to Debenture Redemption Reserve

As per Section 71(4) of the Companies Act, 2013, companies are required to create Debenture Redemption Reserve at 25% of the total value of debentures. Here, debentures worth Rs.21,00,000 are to be redeemed, so. the amount of Debenture Redemption Reserve will he:

Solution Ex.15

|

Journal |

|||||

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

2019 |

|||||

|

31st Mar |

Statement of Profit and Loss A/c |

Dr. |

1,75,000 |

||

|

------To Debenture Redemption Reserve A/c |

1,75,000 |

||||

|

(Being surplus amount is transferred to DRR) |

|||||

|

30th April |

Debenture Redemption Investment A/c |

Dr. |

2,25,000 |

||

|

------To Bank A/c |

2,25,000 |

||||

|

(Being investment is made in specified securities equal to 15% of the value of debenture redeemed) |

|||||

|

30th Sep |

10% Debenture A/c |

Dr. |

15,00,000 |

||

|

------To Debenture holders A/c |

15,00,000 |

||||

|

(Being 10% debenture due for redemption ) |

|||||

|

30th Sep |

Bank A/c |

Dr. |

2,25,000 |

||

|

|

------To Debenture Redemption Investment A/c |

|

|

|

2,25,000 |

|

|

(Being investment made in specified securities now enchased) |

|

|

|

|

|

|

|

|

|

|

|

|

30th Sep |

Debenture holders A/c |

Dr. |

|

15,00,000 |

|

|

|

-------To Bank A/c |

|

|

|

15,00,000 |

|

|

(Being amount paid to debenture holders) |

|

|

|

|

|

|

|

|

|

|

|

|

30th Sep |

A/c |

Dr. |

|

3,75,000 |

|

|

|

-------To General Reserve A/c |

|

|

|

3,75,000 |

|

|

(Being DRR amount is transferred to general reserve) |

|

|

|

|

Working Note:

Note:

Interest on Debentures has been ignored as the question was silent. However, the students' may pass the following entries given below for their reference.

|

Journal |

|||||

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

2018 and 2019 |

|||||

|

31st Mar |

Debenture Interest A/c |

Dr. |

75,000 |

||

|

-------To Debenture holders A/c |

75,000 |

||||

|

(Being interest on 7% debenture due) |

|||||

|

31st Mar |

Debenture holders A/c |

Dr. |

75,000 |

||

|

-------To Bank A/c |

75,000 |

||||

|

(Being payment of interest debenture holders) |

|||||

|

31st Mar |

Statement of Profit and Loss A/c |

Dr. |

|

75,000 |

|

|

|

-------To Debenture Interest A/c |

|

|

|

75,000 |

|

|

(Being transfer of debenture interest to statement of profit and loss) |

|

|

|

|

Company Accounts - Redemption of Debentures Exercise 10.31

Solution Ex.16

|

Journal |

|||||

|

Date |

Particulars |

|

L.F. |

Dr. Rs. |

Cr. Rs. |

|

2015 |

|

|

|

|

|

|

31st Mar |

Statement of Profit and Loss A/c |

Dr. |

|

9,50,000 |

|

|

|

-------- To Debentures Redemption Reserve A/c |

|

|

|

9,50,000 |

|

|

(Being amount transferred to DRR) |

|

|

|

|

|

|

|

|

|

|

|

|

1st April |

Debenture Redemption Investment A/c |

Dr |

|

5,70,000 |

|

|

|

-------- To Bank A/c |

|

|

|

5,70,000 |

|

|

(Being amount invested in specified security) |

|

|

|

|

|

|

|

|

|

|

|

|

30th June |

Bank A/c |

Dr. |

|

5,70,000 |

|

|

|

--------- To Debenture Redemption Investment A/c |

|

|

|

5,70,000 |

|

|

(Being debenture Redemption Investment realized) |

|

|

|

|

|

|

|

|

|

|

|

|

30th June |

9% Debenture A/c |

Dr. |

|

38,00,000 |

|

|

|

Premium on Redemption of Debenture A/c |

Dr. |

|

1,90,000 |

|

|

|

--------- To Debenture holder's A/c |

|

|

|

39,90,000 |

|

|

(Debenture due for redemption) |

|

|

|

|

|

|

|

|

|

|

|

|

30th June |

Debenture holder's A/c |

Dr. |

|

39,90,000 |

|

|

|

-------- To Bank A/c |

|

|

|

39,90,000 |

|

|

(Debentures redeemed) |

|

|

|

|

|

|

|

|

|

|

|

|

30th June |

Debentures Redemption Reserve A/c |

Dr. |

|

9,50,000 |

|

|

|

-------- To General Reserve A/c |

|

|

|

9,50,000 |

|

|

(Debentures Redemption Reserve transferred to General Reserve) |

|

|

|

|

|

|

|

|

|

|

|

Working Notes:

Amount transferred to DRR (25% of face value) =Rs.38, 00,000 × 25% = Rs.9,50,000

Amount transferred to DRI (15% of face value) = Rs.38,00,000 × 15%= Rs.5,70,000

Solution Ex.17

|

Journal |

|||||

|

Date |

Particulars |

|

L.F. |

Dr. Rs. |

Cr. Rs. |

|

2015 |

|

|

|

|

|

|

Mar.31 |

Statement of Profit and Loss A/c |

Dr. |

|

3,00,000 |

|

|

|

-------- To Debentures Redemption Reserve A/c |

|

|

|

3,00,000 |

|

|

(Being amount transferred to DRR) |

|

|

|

|

|

|

|

|

|

|

|

|

Apr.30 |

Debenture Redemption Investment A/c |

Dr. |

|

3,00,000 |

|

|

|

-------- To Bank A/c |

|

|

|

3,00,000 |

|

|

(Being amount invested in specified security) |

|

|

|

|

|

|

|

|

|

|

|

|

Aug 31 |

Bank A/c |

Dr. |

|

3,00,000 |

|

|

|

--------- To Debenture Redemption Investment A/c |

|

|

|

3,00,000 |

|

|

(Being debenture Redemption Investment realized) |

|

|

|

|

|

|

|

|

|

|

|

|

Aug 31 |

9% Debenture A/c |

Dr. |

|

20,00,000 |

|

|

|

--------- To Debenture holders A/c |

|

|

|

20,00,000 |

|

|

(Being debenture due for redemption) |

|

|

|

|

|

|

|

|

|

|

|

|

Aug 31 |

Debenture holders A/c |

Dr. |

|

20,00,000 |

|

|

|

-------- To Bank A/c |

|

|

|

20,00,000 |

|

|

(Being debentures redeemed) |

|

|

|

|

|

|

|

|

|

|

|

|

Aug 31 |

Debentures Redemption Reserve A/c |

Dr. |

|

5,00,000 |

|

|

|

-------- To General Reserve A/c |

|

|

|

5,00,000 |

|

|

(Being debentures Redemption Reserve transferred to General Reserve) |

|

|

|

|

|

|

|

|

|

|

|

Working Note:

Amount transferred to DRR (25% of face value) = Rs.20, 00,000 × 25% =Rs.5,00,0000

Old Balance in Debentures Redemption Reserve = Rs.2, 00,000

Net Amount transferred to DRR = Rs.5,00,000 - Rs.2, 00,000 = Rs.3,00,000

Amount transferred to DRI (15% of face value) = Rs.20, 00,000× 15% = Rs.3, 00,000

Solution Ex.18

|

In the books of Rich Sugar Limited Journal |

|||||

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

2013 |

|||||

|

1st April |

Bank A/c |

Dr. |

20,00,000 |

||

|

-------To 8% Debenture Application A/c |

20,00,000 |

||||

|

(Being debenture application money received) |

|||||

|

1st April |

8% Debenture Application A/c |

Dr. |

20,00,000 |

||

|

-------To 8% Debentures A/c |

20,00,000 |

||||

|

(Being debenture application transferred to 8% debenture account) |

|||||

|

2014 |

|||||

|

31st Mar |

Statement of Profit and Loss A/c |

Dr. |

1,25,000 |

||

|

-------To Debenture Redemption Reserve A/c |

1,25,000 |

||||

|

(Being profit transferred to debenture redemption reserve) |

|||||

|

|

|

|

|

|

|

|

2015 |

|

|

|

|

|

|

31st Mar |

Statement of Profit and Loss A/c |

Dr. |

|

2,50,000 |

|

|

|

-------To Debenture Redemption Reserve A/c |

|

|

|

2,50,000 |

|

|

(Being profit transferred to debenture redemption reserve) |

|

|

|

|

|

|

|

|

|

|

|

|

30th April |

Debenture Redemption Investment A/c |

Dr. |

|

3,00,000 |

|

|

|

-------To Bank A/c |

|

|

|

3,00,000 |

|

|

(Being investment is made in government securities equal to 15% of the value of debentures redeemed) |

|

|

|

|

|

|

|

|

|

|

|

|

2016 |

|

|

|

|

|

|

31st Mar |

8% Debenture A/c |

Dr. |

|

5,00,000 |

|

|

|

-------To debentures holders' A/c |

|

|

|

5,00,000 |

|

|

(Being debenture due for redemption ) |

|

|

|

|

|

|

|

|

|

|

|

|

31st Mar |

Debenture holders A/c |

Dr. |

|

5,00,000 |

|

|

|

-------To Bank A/c |

|

|

|

5,00,000 |

|

|

(Being amount of debenture paid to debenture holders) |

|

|

|

|

|

|

|

|

|

|

|

|

31st Mar |

Debenture Redemption Reserve A/c |

Dr. |

|

1,25,000 |

|

|

|

------To General Reserve A/c |

|

|

|

1,25,000 |

|

|

(Being debenture redemption reserve transferred to general reserve) |

|

|

|

|

|

|

|

|

|

|

|

|

2017 |

|

|

|

|

|

|

31st Mar |

8% Debenture A/c |

Dr. |

|

5,00,000 |

|

|

|

-------To Debenture holders' A/c |

|

|

|

5,00,000 |

|

|

(Being debenture due for redemption) |

|

|

|

|

|

|

|

|

|

|

|

|

31st Mar |

Debenture holders' A/c |

Dr. |

|

5,00,000 |

|

|

|

-------To Bank A/c |

|

|

|

5,00,000 |

|

|

(Being amount of debenture paid to debenture holders) |

|

|

|

|

|

|

|

|

|

|

|

|

31st Mar |

Debenture Redemption Reserve A/c |

Dr. |

|

1,25,000 |

|

|

|

------To General Reserve A/c |

|

|

|

1,25,000 |

|

|

(Being debenture redemption reserve transferred to general reserve) |

|

|

|

|

|

2018 |

|

|

|

|

|

|

31st Mar |

8% Debenture A/c |

Dr. |

|

5,00,000 |

|

|

|

-------To Debenture holders' A/c |

|

|

|

5,00,000 |

|

|

(Being debenture due for redemption) |

|

|

|

|

|

|

|

|

|

|

|

|

31st Mar |

Debenture holders' A/c |

Dr. |

|

5,00,000 |

|

|

|

-------To Bank A/c |

|

|

|

5,00,000 |

|

|

(Being amount of debenture paid to debenture holders) |

|

|

|

|

|

|

|

|

|

|

|

|

31st Mar |

Debenture Redemption Reserve A/c |

Dr. |

|

1,25,000 |

|

|

|

------To General Reserve A/c |

|

|

|

1,25,000 |

|

|

(Being debenture redemption reserve transferred to general reserve) |

|

|

|

|

|

2019 |

|

|

|

|

|

|

31st Mar |

8% Debenture A/c |

Dr. |

|

5,00,000 |

|

|

|

-------To Debenture holders' A/c |

|

|

|

5,00,000 |

|

|

(Being debenture due for redemption) |

|

|

|

|

|

|

|

|

|

|

|

|

31st Mar |

Debenture holders' A/c |

Dr. |

|

5,00,000 |

|

|

|

-------To Bank A/c |

|

|

|

5,00,000 |

|

|

(Being amount of debenture paid to debenture holders) |

|

|

|

|

|

|

|

|

|

|

|

|

31st Mar |

Bank A/c |

Dr. |

|

3,00,000 |

|

|

|

-------To Debenture redemption investment A/c |

|

|

|

3,00,000 |

|

|

(Being investment made in securities ,now enchased) |

|

|

|

|

|

|

|

|

|

|

|

|

31st Mar |

Debenture Redemption Reserve A/c |

Dr. |

|

5,00,000 |

|

|

|

-------To General Reserve A/c |

|

|

|

5,00,000 |

|

|

(Being debenture redemption reserve transferred to general reserve) |

|

|

|

|

'As per circular no. 04/2015 issued by Ministry of Corporate Affairs (dated 11.02.2013), every company required to create/maintain DRR shall on or before the 30th day of April of each year, deposit or invest, as the case may be, a sum which shall not be less than fifteen percent of the amount of its debentures maturing during the year ending on the 31st day of March next following year. Accordingly, entry for investment in Government securities has been passed a year before first redemption year.

Solution Ex. 21

|

In the books of Tata Motors Limited Journal |

|||||

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

2009 |

|||||

|

Jul.01 |

Bank A/c |

Dr. |

40,00,000 |

||

|

-------To Debenture Application A/c |

40,00,000 |

||||

|

(Being debenture application money received) |

|||||

|

Debenture Application A/c |

Dr. |

40,00,000 |

|||

|

Loss on Issue of Debenture A/c |

2,00,000 |

||||

|

-------To 7% Debenture A/c |

40,00,000 |

||||

|

-------To Premium on Redemption A/c |

2,00,000 |

||||

|

(Being 40,000 7% debenture of Rs.100 each issued) |

|||||

|

2012 |

|||||

|

Mar.31 |

Statement of Profit and Loss A/c |

Dr. |

2,00,000 |

||

|

-------To Debenture Redemption Reserve A/c |

2,00,000 |

||||

|

(Being surplus amount is transferred to debenture redemption Reserve) |

|||||

|

|

|

|

|

|

|

|

2013 |

|

|

|

|

|

|

Mar.31 |

Statement of Profit and Loss A/c |

Dr. |

|

4,00,000 |

|

|

|

-------To Debenture Redemption Reserve A/c |

|

|

|

4,00,000 |

|

|

(Being surplus amount is transferred to debenture redemption Reserve) |

|

|

|

|

|

|

|

|

|

|

|

|

2014 |

|

|

|

|

|

|

Mar.31 |

Statement of Profit and Loss A/c |

Dr. |

|

4,00,000 |

|

|

|

-------To Debenture Redemption Reserve A/c |

|

|

|

4,00,000 |

|

|

(Being surplus amount is transferred to debenture redemption reserve) |

|

|

|

|

|

|

|

|

|

|

|

|

Apr.30 |

Debenture Redemption Investment A/c |

Dr. |

|

2,40,000 |

|

|

|

------To Bank A/c |

|

|

|

2,40,000 |

|

|

(Being investment is made in specified securities equal to 15% of the value of debenture redeemed on march 31,2014) |

|

|

|

|

|

|

|

|

|

|

|

|

2015 |

|

|

|

|

|

|

Mar.31 |

7% Debenture A/c |

Dr. |

|

16,00,000 |

|

|

|

Premium on Redemption of Debenture A/c |

|

|

80,000 |

|

|

|

-------To Debenture holders' A/c |

|

|

|

16,80,000 |

|

|

(Being 16,000 7% debenture of Rs.100 each due for redemption along 5% premium on redemption ) |

|

|

|

|

|

|

|

|

|

|

|

|

Mar.31 |

Debenture holders' A/c |

Dr. |

|

16,80,000 |

|

|

|

-------To Bank A/c |

|

|

|

16,80,000 |

|

|

(Being amount paid to debenture holders) |

|

|

|

|

|

|

|

|

|

|

|

|

Mar.31 |

Debenture Redemption Reserve A/c |

Dr. |

|

4,00,000 |

|

|

|

-------To General Reserve A/c |

|

|

|

4,00,000 |

|

|

(Being debenture redemption reserve transferred to general reserve) |

|

|

|

|

|

|

|

|

|

|

|

|

Apr.30 |

Debenture Redemption Investment A/c |

Dr. |

|

2,40,000 |

|

|

|

-------To Bank A/c |

|

|

|

2,40,000 |

|

|

(Being investment is made in specified securities equal to 15% of the value of debenture redeemed on march 31,2015) |

|

|

|

|

|

|

|

|

|

|

|

|

2016 |

|

|

|

|

|

|

Mar.31 |

7% Debenture A/c |

Dr. |

|

16,00,000 |

|

|

|

Premium on Redemption of Debenture A/c |

Dr. |

|

80,000 |

|

|

|

-------To Debenture holders' A/c |

|

|

|

16,80,000 |

|

|

(Being 16,000 7% debenture of Rs.100 each due for redemption along 5% premium on redemption) |

|

|

|

|

|

|

|

|

|

|

|

|

Mar.31 |

Debenture holders' A/c |

Dr. |

|

16,80,000 |

|

|

|

-------To Bank A/c |

|

|

|

16,80,000 |

|

|

(Being amount of debenture paid to debenture holders) |

|

|

|

|

|

|

|

|

|

|

|

|

Mar.31 |

Debenture Redemption Reserve A/c |

Dr. |

|

4,00,000 |

|

|

|

-------To General Reserve A/c |

|

|

|

4,00,000 |

|

|

(Being debenture redemption reserve transferred to general reserve) |

|

|

|

|

|

|

|

|

|

|

|

|

Apr.30 |

Debenture Redemption Investment A/c |

Dr. |

|

1,20,000 |

|

|

|

-------To Bank A/c |

|

|

|

1,20,000 |

|

|

(Being investment is made in specified securities equal to 15% of the value of debenture redeemed on march 31,2016) |

|

|

|

|

|

|

|

|

|

|

|

|

2017 |

|

|

|

|

|

|

Mar.31 |

7% Debenture A/c |

Dr. |

|

8,00,000 |

|

|

|

Premium on Redemption of Debenture A/c |

Dr. |

|

40,000 |

|

|

|

-------To Debenture holders' A/c |

|

|

|

8,40,000 |

|

|

(Being 8,000 7% debenture of Rs.100 each due for redemption along 5% premium on redemption) |

|

|

|

|

|

|

|

|

|

|

|

|

Mar.31 |

Debenture holders' A/c |

Dr. |

|

8,40,000 |

|

|

|

-------To Bank A/c |

|

|

|

8,40,000 |

|

|

(Being amount of debenture paid to debenture holders) |

|

|

|

|

|

|

|

|

|

|

|

|

Mar.31 |

Bank A/c |

Dr. |

|

6,00,000 |

|

|

|

-------To Debenture Redemption Investment A/c |

|

|

|

6,00,000 |

|

|

(Being investment made in securities, now enchased) |

|

|

|

|

|

|

|

|

|

|

|

|

Mar.31 |

Debenture Redemption Reserve A/c |

Dr. |

|

2,00,000 |

|

|

|

-------To General Reserve A/c |

|

|

|

2,00,000 |

|

|

(Being debenture redemption reserve transferred to general reserve) |

|

|

|

|

|

|

|

|

|

|

|

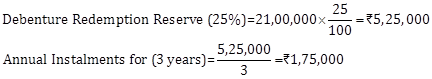

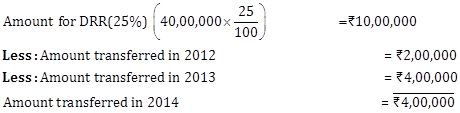

Working Note:

Calculation of amount of Debenture Redemption Reserve

Solution Ex. 19

|

In the books of HP Limited Journal |

|||||

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

2015 |

|||||

|

31st Mar |

Statement of Profit and Loss A/c |

Dr. |

7,50,000 |

||

|

-------To Debenture Redemption Reserve A/c |

7,50,000 |

||||

|

(Being surplus amount is transferred to debenture redemption reserve) |

|||||

|

30th April |

Debenture Redemption Investment A/c |

Dr. |

1,50,000 |

||

|

-------To Bank A/c |

1,50,000 |

||||

|

(Being investment made in specified securities @ 15% of the value of debentures redeemable in first installment, i.e. Rs.10,00,0000 |

|||||

|

|

|

|

|

|

|

|

|

8% Debenture A/c |

Dr. |

|

10,00,0000 |

|

|

30th June |

-------To Debenture holders A/c |

|

|

|

10,00,000 |

|

|

(Being 20,000 8% debenture of Rs.50 each due for redemption) |

|

|

|

|

|

|

|

|

|

|

|

|

30th June |

Bank A/c |

Dr. |

|

1,50,000 |

|

|

|

-------To Debenture Redemption Investment A/c |

|

|

|

1,50,000 |

|

|

(Being investment made in securities, now enchased) |

|

|

|

|

|

|

|

|

|

|

|

|

30th June |

Debenture holders' A/c |

Dr. |

|

10,00,000 |

|

|

|

-------To Bank A/c |

|

|

|

10,00,000 |

|

|

(Being payment made to debenture holders) |

|

|

|

|

|

|

|

|

|

|

|

|

30th June |

Debenture Redemption Reserve A/c |

Dr. |

|

2,50,000 |

|

|

|

-------To General Reserve A/c |

|

|

|

2,50,000 |

|

|

(Being debenture redemption reserve transferred to general reserve) |

|

|

|

|

|

|

|

|

|

|

|

|

2016 |

|

|

|

|

|

|

30th April |

Debenture Redemption Investment A/c |

Dr. |

|

1,50,000 |

|

|

|

-------To Bank A/c |

|

|

|

1,50,000 |

|

|

(Being investment is made in specified securities @ 15% of the value of debenture redeemable in second installment , i.e Rs.10,00,000) |

|

|

|

|

|

|

|

|

|

|

|

|

30th June |

8% Debenture A/c |

Dr. |

|

10,00,000 |

|

|

|

-------To Debenture holders A/c |

|

|

|

10,00,000 |

|

|

(Being 20,000 8% debenture of Rs.50 each due for redemption) |

|

|

|

|

|

|

|

|

|

|

|

|

30th June |

Bank A/c |

Dr. |

|

1,50,000 |

|

|

|

-------To Debenture Redemption Investment A/c |

|

|

|

1,50,000 |

|

|

(Being investment made in securities, now enchased) |

|

|

|

|

|

|

|

|

|

|

|

|

30th June |

Debenture holders A/c |

Dr. |

|

10,00,000 |

|

|

|

-------To Bank A/c |

|

|

|

10,00,000 |

|

|

(Being Payment made to debenture holders) |

|

|

|

|

|

|

|

|

|

|

|

|

30th June |

Debenture Redemption Reserve A/c |

Dr. |

|

2,50,000 |

|

|

|

-------To General Reserve A/c |

|

|

|

2,50,000 |

|

|

(Being debenture redemption reserve transferred to general reserve) |

|

|

|

|

|

|

|

|

|

|

|

|

2017 |

|

|

|

|

|

|

30th April |

Debenture Redemption Investment A/c |

Dr. |

|

1,50,000 |

|

|

|

-------To Bank A/c |

|

|

|

1,50,000 |

|

|

(Being investment is made in specified securities @ 15% of the value of debenture redeemable in second installment , i.e. Rs.10,00,000) |

|

|

|

|

|

|

|

|

|

|

|

|

30th June |

8% Debenture A/c |

Dr. |

|

10,00,000 |

|

|

|

-------To Debenture holders A/c |

|

|

|

10,00,000 |

|

|

(Being 20,000 8% debenture of Rs.50 each due for redemption) |

|

|

|

|

|

|

|

|

|

|

|

|

30th June |

Bank A/c |

Dr. |

|

1,50,000 |

|

|

|

-------To Debenture Redemption Investment A/c |

|

|

|

1,50,000 |

|

|

(Being investment made in securities, now enchased) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

30th June |

Debenture holders A/c |

Dr. |

|

10,00,000 |

|

|

|

-------To Bank A/c |

|

|

|

10,00,000 |

|

|

(Being payment made to debenture holders) |

|

|

|

|

|

|

|

|

|

|

|

|

30th June |

Debenture Redemption Reserve A/c |

Dr. |

|

2,50,000 |

|

|

|

-------To General Reserve A/c |

|

|

|

2,50,000 |

|

|

(Being debenture redemption reserve transferred to general reserve) |

|

|

|

|

|

|

|

|

|

|

|

|

2018 |

|

|

|

|

|

|

30th April |

Debenture Redemption Investment A/c |

Dr. |

|

1,50,000 |

|

|

|

-------To Bank A/c |

|

|

|

1,50,000 |

|

|

(Being investment made in specified securities @ 15% of the value of debenture redeemable in second installment , i.e. Rs.10,00,000) |

|

|

|

|

|

|

|

|

|

|

|

|

30th June |

8% Debenture A/c |

Dr. |

|

10,00,000 |

|

|

|

-------To Debenture holders A/c |

|

|

|

10,00,000 |

|

|

(Being 20,000 8% debenture of Rs.50 each due for redemption) |

|

|

|

|

|

|

|

|

|

|

|

|

30th June |

Bank A/c |

Dr. |

|

1,50,000 |

|

|

|

-------To Debenture Redemption Investment A/c |

|

|

|

1,50,000 |

|

|

(Being investment made in securities, now enchased) |

|

|

|

|

|

|

|

|

|

|

|

|

30th June |

Debenture holders A/c |

Dr. |

|

10,00,000 |

|

|

|

-------To Bank A/c |

|

|

|

10,00,000 |

|

|

(Being payment made to debenture holders) |

|

|

|

|

|

|

|

|

|

|

|

|

30th June |

Debenture Redemption Reserve A/c |

Dr. |

|

2,50,000 |

|

|

|

-------To General Reserve A/c |

|

|

|

2,50,000 |

|

|

(Being debenture redemption reserve transferred to general reserve) |

|

|

|

|

|

|

|

|

|

|

|

|

2019 |

|

|

|

|

|

|

30th April |

Debenture Redemption Investment A/c |

Dr. |

|

1,50,000 |

|

|

|

-------To Bank A/c |

|

|

|

1,50,000 |

|

|

(Being investment is made in specified securities @ 15% of the value of debenture redeemable in second installment , i.e. Rs.10,00,000) |

|

|

|

|

|

|

|

|

|

|

|

|

30th June |

8% Debenture A/c |

Dr. |

|

10,00,000 |

|

|

|

-------To Debenture holders A/c |

|

|

|

10,00,000 |

|

|

(Being 20,000 8% debenture of Rs.50 each due for redemption) |

|

|

|

|

|

|

|

|

|

|

|

|

30th June |

Bank A/c |

Dr. |

|

1,50,000 |

|

|

|

-------To Debenture Redemption Investment A/c |

|

|

|

1,50,000 |

|

|

(Being investment made in securities, now enchased) |

|

|

|

|

|

|

|

|

|

|

|

|

30th June |

Debenture holders A/c |

Dr. |

|

10,00,000 |

|

|

|

-------To Bank A/c |

|

|

|

10,00,000 |

|

|

(Being payment made to debenture holders) |

|

|

|

|

|

|

|

|

|

|

|

|

30th June |

Debenture Redemption Reserve A/c |

Dr. |

|

2,50,000 |

|

|

|

-------To General Reserve A/c |

|

|

|

2,50,000 |

|

|

(Being debenture redemption reserve transferred to general reserve) |

|

|

|

|

|

|

|

|

|

|

|

As per circular no. 04/2015 issued by Ministry of Corporate Affairs every company is required to create/maintain DRR shall on or before the 30th day of April of each year, deposit or invest, as the case may be, a sum which shall not be less than fifteen percent of the amount of its debentures maturing during the year ending on the 31st day of March next following year. Accordingly, entry for investment in Government securities has been passed a year before first redemption year.

Also, it has been assumed that investments will be enchased before debentures are redeemed.

Solution Ex. 20

|

Journal |

|||||

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

2014 |

|

|

|

|

|

|

Mar. 31 |

Statement of Profit and Loss |

Dr. |

|

2,00,000 |

|

|

|

-----To Debenture Redemption Reserve A/c |

|

|

|

2,00,000 |

|

|

(Transfer to DRR) |

|

|

|

|

|

|

|

|

|

|

|

|

Apr. 30 |

Debenture Redemption Investment A/c |

Dr. |

|

45,000 |

|

|

|

-----To Bank A/c |

|

|

|

45,000 |

|

|

(Invested in 15% securities) |

|

|

|

|

|

|

|

|

|

|

|

|

2015 |

|

|

|

|

|

|

Mar. 31 |

9% Debentures A/c |

Dr. |

|

3,00,000 |

|

|

|

Premium on Redemption of Debentures A/c |

Dr. |

|

10,000 |

|

|

|

-----To Debentureholders' |

|

|

|

3,10,000 |

|

|

(3,000, 9% Debentures due for payment at 10% premium) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Bank A/c |

Dr. |

|

45,000 |

|

|

|

-----To Debenture Redemption Investment A/c |

|

|

|

45,000 |

|

|

(Encashment of DRI) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Debentureholders' A/c |

Dr. |

|

3,10,000 |

|

|

|

-----To Bank A/c |

|

|

|

3,10,000 |

|

|

(Payment to debentureholders') |

|

|

|

|

|

|

|

|

|

|

|

|

Apr. 30 |

Debenture Redemption Investment A/c |

Dr. |

|

45,000 |

|

|

|

-----To Bank A/c |

|

|

|

45,000 |

|

|

(Invested in 15% securities) |

|

|

|

|

|

|

|

|

|

|

|

|

2016 |

|

|

|

|

|

|

Mar. 31 |

9% Debentures A/c |

Dr. |

|

3,00,000 |

|

|

|

Premium on Redemption of Debentures A/c |

Dr. |

|

10,000 |

|

|

|

-----To Debentureholders' |

|

|

|

3,10,000 |

|

|

(3,000, 9% Debentures due for payment at 10% premium) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Bank A/c |

Dr. |

|

45,000 |

|

|

|

-----To Debenture Redemption Investment A/c |

|

|

|

45,000 |

|

|

(Encashment of DRI) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Debentureholders' A/c |

Dr. |

|

3,10,000 |

|

|

|

-----To Bank A/c |

|

|

|

3,10,000 |

|

|

(Payment to debentureholders') |

|

|

|

|

|

|

|

|

|

|

|

|

Apr. 30 |

Debenture Redemption Investment A/c |

Dr. |

|

45,000 |

|

|

|

-----To Bank A/c |

|

|

|

45,000 |

|

|

(Invested in 15% securities) |

|

|

|

|

|

|

|

|

|

|

|

|

2017 |

|

|

|

|

|

|

Mar. 31 |

9% Debentures A/c |

Dr. |

|

3,00,000 |

|

|

|

Premium on Redemption of Debentures A/c |

Dr. |

|

10,000 |

|

|

|

-----To Debentureholders' |

|

|

|

3,10,000 |

|

|

(3,000, 9% Debentures due for payment at 10% premium) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Bank A/c |

Dr. |

|

45,000 |

|

|

|

-----To Debenture Redemption Investment A/c |

|

|

|

45,000 |

|

|

(Encashment of DRI) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Debentureholders' A/c |

Dr. |

|

3,10,000 |

|

|

|

-----To Bank A/c |

|

|

|

3,10,000 |

|

|

(Payment to debentureholders') |

|

|

|

|

|

|

|

|

|

|

|

|

|

Debenture Redemption Reserve A/c |

Dr. |

|

2,25,000 |

|

|

|

-----To General Reserve A/c |

|

|

|

2,25,000 |

|

|

|

|

|

|

|

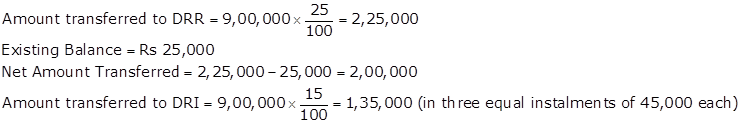

Working Notes:

Company Accounts - Redemption of Debentures Exercise 10.32

Solution Ex. 22

|

9 % Debenture A/c |

||||||

|

Dr. |

|

Cr. |

||||

|

Date |

Particular |

Rs. |

Date |

Particular |

Rs. |

|

|

2009 |

|

|

2008 |

|

|

|

|

31st Mar |

To Balance c/d |

1,00,00,000 |

1st April |

By Debenture Application A/c |

95,00,000 |

|

|

|

|

|

1st April |

By Dis. on Iss. of Debentures A/c |

5,00,000 |

|

|

|

|

1,00,00,000 |

|

|

1,00,00,000 |

|

|

|

|

|

|

|

|

|

|

2010 |

|

|

2009 |

|

|

|

|

31st Mar |

To Balance c/d |

1,00,00,000 |

1st April |

By Balance b/d |

1,00,00,000 |

|

|

|

|

|

|

|

|

|

|

|

|

1,00,00,000 |

|

|

1,00,00,000 |

|

|

|

|

|

|

|

|

|

|

2011 |

|

|

2010 |

|

|

|

|

31st Mar |

To Debenture holder's A/c |

10,00,000 |

1st April |

By Balance b/d |

1,00,00,000 |

|

|

31st Mar |

To Balance c/d |

90,00,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1,00,00,000 |

|

|

1,00,00,000 |

|

|

|

|

|

|

|

|

|

|

2012 |

|

|

2011 |

|

|

|

|

31st Mar |

To Debenture holder's A/c |

20,00,000 |

1st April |

By Balance b/d |

90,00,000 |

|

|

31st Mar |

To Balance c/d |

70,00,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

90,00,000 |

|

|

90,00,000 |

|

|

|

|

|

|

|

|

|

|

2013 |

|

|

2012 |

|

|

|

|

31st Mar |

To Debenture holder's A/c |

30,00,000 |

1st April |

By Balance b/d |

70,00,000 |

|

|