Class 12-commerce T S GREWAL Solutions Accountancy Chapter 9: Company Accounts - Issue of Debentures

Company Accounts - Issue of Debentures Exercise 9.51

Solution Ex. 1

|

In the books of Vishwas Ltd. Journal Entries |

|||||

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

Bank A/c |

Dr. |

50,000 |

|||

|

------To 9% Debenture Application A/c |

|

50,000 |

|||

|

(Being application money received for 2,000 debentures at Rs.25 each) |

|

||||

|

|

|||||

|

9% Debenture Application A/c |

Dr. |

50,000 |

|||

|

------To9% Debenture A/c |

|

50,000 |

|||

|

(Being debenture application money transferred to 9% Debentures A/c) |

|

||||

|

|

|||||

|

9% Debenture Allotment A/c |

Dr. |

50,000 |

|||

|

------To 9% Debenture A/c |

|

50,000 |

|||

|

(Being debenture allotment money due on 2,000 Debentures at Rs.25 each) |

|

||||

|

|

|||||

|

Bank A/c |

Dr. |

50,000 |

|||

|

|

------To 9% Debenture Allotment A/c |

|

|

|

50,000 |

|

|

(Being debenture allotment money received) |

|

|

|

|

|

|

|

|

|

|

|

|

|

9% Debenture First and Final Call A/c |

Dr. |

|

1,00,000 |

|

|

|

------To9% Debenture A/c |

|

|

|

1,00,000 |

|

|

(Being debenture first and final call money due on 2,000 debentures at Rs.50 each) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Bank A/c |

Dr. |

|

1,00,000 |

|

|

|

------To 9% Debenture First and Final Call A/c |

|

|

|

1,00,000 |

|

|

(Being debenture first and final call received) |

|

|

|

|

Solution Ex. 2

|

In the books of A Ltd. Journal Entries |

|||||

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

Bank A/c |

Dr. |

48,000 |

|||

|

------To 9% Debenture Application A/c |

|

48,000 |

|||

|

(Being application money received for 2,400 debentures at Rs.20 each) |

|

||||

|

|

|||||

|

9% Debenture Application A/c |

Dr. |

48,000 |

|||

|

------To9% Debenture A/c |

|

40,000 |

|||

|

------To 9% Debenture Allotment A/c |

|

4,000 |

|||

|

------To Bank A/c |

|

4,000 |

|||

|

(Being debenture application money transferred to 9% debentures A/c for 2,000 debenture, adjusted to debenture allotment account for 200 debentures and money refunded for 200 debentures) |

|

||||

|

|

|||||

|

9% Debenture Allotment A/c |

Dr. |

40,000 |

|||

|

------To 9% Debenture A/c |

|

40,000 |

|||

|

(Being debenture allotment money due on 2,000 debentures at Rs.20 each) |

|

||||

|

|

|||||

|

Bank A/c |

Dr. |

36,000 |

|||

|

|

------To 9% Debenture Allotment A/c |

|

|

|

36,000 |

|

|

(Being debenture allotment money received) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Debenture First Call A/c |

Dr. |

|

60,000 |

|

|

|

------To 9% Debenture A/c |

|

|

|

60,000 |

|

|

(Being debenture first call money due on 2,000 9% debentures at Rs.30 each) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Bank A/c |

Dr. |

|

60,000 |

|

|

|

------To Debenture First Call A/c |

|

|

|

60,000 |

|

|

(Being debenture first call received) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Debenture Final Call A/c |

Dr. |

|

60,000 |

|

|

|

------To 9% Debenture A/c |

|

|

|

60,000 |

|

|

(Being debenture Final call money due on 2,000 9% debentures at Rs.30 each) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Bank A/c |

Dr. |

|

60,000 |

|

|

|

------To Debenture Final Call A/c |

|

|

|

60,000 |

|

|

(Being debenture first call received on 2,000 9% debenture at Rs.30 each) |

|

|

|

|

|

|

|

|

|

|

|

Solution Ex. 3

|

Journal |

|||||

|

Date |

Particulars |

|

L.F. |

Dr. Rs. |

Cr. Rs. |

|

|

Bank A/c (60,000 × 100) |

Dr. |

|

60,00,000 |

|

|

|

--------- To Debenture Application and Allotment A/c |

|

|

|

60,00,000 |

|

|

(Being received application money on 60,000 Debenture) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Debenture Application and Allotment A/c |

Dr. |

|

60,00,000 |

|

|

|

-------- To 10% Debenture A/c (40,000 × 100) |

|

|

|

40,00,000 |

|

|

-------- To Bank A/c |

|

|

|

20,00,000 |

|

|

(Being application money transferred to Debentures A/c) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Company Accounts - Issue of Debentures Exercise 9.52

Solution Ex. 4

|

Books of Narain Laxmi Ltd. Journal Entries |

|||||

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

Bank A/c |

Dr. |

13,50,000 |

|||

|

------To 9% Debenture Application and Allotment A/c |

|

13,50,000 |

|||

|

(Being application money received on 10,000 12% debentures of Rs.100 each at a premium of Rs.35) |

|

||||

|

|

|||||

|

Debenture Application and Allotment A/c |

Dr. |

13,50,000 |

|||

|

------To12% Debenture A/c |

|

7,50,000 |

|||

|

------To Securities Premium Reserve A/c |

|

2,62,500 |

|||

|

------To Bank A/c |

|

3,37,500 |

|||

|

(Being 7,500; 12% debenture of Rs.100 each issued at a premium of Rs.35 and excess money refunded) |

|

||||

Solution Ex. 5

|

Books of Raj Ltd. Journal Entries |

|||||

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

Bank A/c |

Dr. |

50,000 |

|||

|

------To 8% Debenture Application A/c |

|

50,000 |

|||

|

(Being application money received for 5,000 debentures at Rs.10 each) |

|

||||

|

|

|||||

|

8% Debenture Application A/c |

Dr. |

50,000 |

|||

|

------To 8% Debenture A/c |

|

50,000 |

|||

|

(Being debenture application money transferred to 8% debentures A/c) |

|

||||

|

|

|||||

|

8% Debenture Allotment A/c |

Dr. |

1,00,000 |

|||

|

------To 8% Debenture A/c |

|

75,000 |

|||

|

------To Securities Premium A/c |

|

25,000 |

|||

|

(Being debenture allotment money due on 5,000 8% debentures at Rs.20 including premium of Rs.5) |

|

||||

|

|

|||||

|

Bank A/c |

Dr. |

1,00,000 |

|||

|

|

------To 8% Debenture Allotment A/c |

|

|

|

1,00,000 |

|

|

(Being debenture allotment money received) |

|

|

|

|

|

|

|

|

|

|

|

|

|

8% Debenture First and Final Call A/c |

Dr. |

|

3,75,000 |

|

|

|

------To 8% Debenture A/c |

|

|

|

3,75,000 |

|

|

(Being debenture first and final call money due on 5,000 debentures at Rs.75 each) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Bank A/c |

Dr. |

|

3,75,000 |

|

|

|

------To 8% Debenture First and Final Call A/c |

|

|

|

3,75,000 |

|

|

(Being debenture first and final call received) |

|

|

|

|

Solution Ex.6

Face value ![]() Rs.100

Rs.100

Premium 10%= (100 × 10%) Rs.10

![]() Issue Price = Rs.110

Issue Price = Rs.110

Payable as:

|

On Application (25%) (10+15) |

Rs.25 including premium of Rs.10 |

|

On Allotment (85%) |

Rs.85 per |

|

Journal Entries |

|||||

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

Debenture Application A/c |

Dr. |

2,50,000 |

|||

|

------To Debenture A/c |

|

1,50,000 |

|||

|

------To Securities Premium A/c |

|

1,00,000 |

|||

|

(Being debenture application money received for 10,000 debentures at Rs.25 including premium of Rs.10 each transferred to debenture account) |

|

||||

|

|

|||||

|

Debenture Allotment A/c |

Dr. |

8,50,000 |

|||

|

------To Debenture A/c |

|

8,50,000 |

|||

|

(Being debenture allotment due on 10,000 Debentures at Rs.85 each) |

|

||||

|

Cash Book |

|||||

|

Dr. |

|

|

|

|

Cr. |

|

Date |

Particulars |

Rs. |

Date |

Particulars |

Rs. |

|

|

To Debenture Application A/c |

2,50,000 |

|

By Balance c/d |

11,00,000 |

|

|

To Debenture Allotment A/c |

8,50,000 |

|

|

|

|

|

|

11,00,000 |

|

|

11,00,000 |

Solution Ex. 7

|

Journal |

|||||

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

Bank A/c |

Dr. |

14,00,000 |

|||

|

------To Debenture Application A/c |

|

14,00,000 |

|||

|

(Being application money received for 7,000 debentures Rs.200 each) |

|

||||

|

|

|||||

|

Debenture Application A/c |

Dr. |

14,00,000 |

|||

|

------To10% Debenture A/c |

|

14,00,000 |

|||

|

(Being transferred of application money to Debentures A/c) |

|

||||

|

|

|||||

|

Debenture Allotment A/c |

Dr. |

24,50,000 |

|||

|

Loss on issue of Debentures A/c |

Dr. |

3,50,000 |

|||

|

------To10% Debenture A/c |

|

21,00,000 |

|||

|

------To Securities Premium Reserve A/c |

|

3,50,000 |

|||

|

------To premium on Redemption of Debentures A/c |

|

3,50,000 |

|||

|

(Being allotment due on 7,000 Debentures Rs.300 each at a premium of Rs.50 per debentures and redeemable at premium of 10%) |

|

||||

|

|

|||||

|

Bank A/c |

Dr. |

24,50,000 |

|||

|

|

------To Debenture Allotment A/c |

|

|

|

24,50,000 |

|

|

(Being allotment money received) |

|

|

|

|

Solution Ex. 8

|

Books of Vijay Laxmi Limited Journal Entries |

|||||

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

Bank A/c |

Dr. |

22,95,000 |

|||

|

------To Debenture Application and Allotment A/c |

|

22,95,000 |

|||

|

(Being application money received on 13,500 12% debenture) |

|

||||

|

|

|||||

|

Debenture Application and Allotment A/c |

Dr. |

22,95,000 |

|||

|

------To12% Debenture A/c |

|

10,00,000 |

|||

|

------To Securities Premium Reserve A/c |

|

7,00,000 |

|||

|

------To Bank A/c |

|

5,95,000 |

|||

|

(Being 10,000; 12% debenture issued at a premium of Rs.70 and excess money refunded) |

|

||||

Solution Ex. 9

|

Journal |

|||||

|

Date |

Particulars |

|

L.F. |

Dr. Rs. |

Cr. Rs. |

|

|

Bank A/c |

Dr. |

|

2,00,000 |

|

|

|

-------- To debenture Application A/c |

|

|

|

2,00,000 |

|

|

(Being application money received) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Debenture Application A/c |

Dr. |

|

2,00,000 |

|

|

|

------- To 9% Debenture A/c |

|

|

|

1,50,000 |

|

|

------- To Security Premium Reserve A/c |

|

|

|

50,000 |

|

|

(Being application money adjusted) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Debenture Allotment A/c |

Dr. |

|

2,25,000 |

|

|

|

-------- To 9% Debenture A/c |

|

|

|

1,50,000 |

|

|

-------- To Security Premium Reserve A/c |

|

|

|

75,000 |

|

|

(Being allotment money due) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Bank A/c |

Dr. |

|

2,25,000 |

|

|

|

-------- To Debenture Allotment A/c |

|

|

|

2,25,000 |

|

|

(Being allotment money received) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Debenture First and Final call A/c |

Dr. |

|

2,75,000 |

|

|

|

-------- To 9% Debenture A/c |

|

|

|

2,00,000 |

|

|

-------- To Security Premium Reserve A/c |

|

|

|

75,000 |

|

|

(Being first call money due) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Bank A/c |

Dr. |

|

2,75,000 |

|

|

|

--------- To Debenture Final and Final call A/c |

|

|

|

2,75,000 |

|

|

(First Call money Received) |

|

|

|

|

|

|

|

|

|

|

|

Solution Ex. 10

Face value ![]() Rs.100

Rs.100

Discount 5% =(Rs.100 × 5%)Rs.5

![]() Issue Price = Rs.95

Issue Price = Rs.95

Payable as:

|

On Application (25%) |

Rs.25 per |

|

On Allotment (85%) (25 - 5 )per |

Rs.20 |

|

On First and Final Call (50%) |

Rs.50 per |

|

Journal |

|||||

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

Bank A/c |

Dr. |

3,00,000 |

|||

|

------To 8% Debenture Application A/c |

|

3,00,000 |

|||

|

(Being application money received for 12,000 8% debentures at Rs.25 each) |

|

||||

|

|

|||||

|

8% Debenture Application A/c |

Dr. |

3,00,000 |

|||

|

------To 8% Debenture A/c |

|

3,00,000 |

|||

|

(Being debenture application money transferred to 8% debentures A/c) |

|

||||

|

|

|||||

|

8% Debenture Allotment A/c |

Dr. |

2,40,000 |

|||

|

Discounted on Issue of Debentures A/c |

Dr. |

60,000 |

|||

|

------To 8% Debenture A/c |

|

3,00,000 |

|||

|

(Being allotment money due on 12,000 8% debentures at Rs.20 each at discount of Rs.5) |

|

||||

|

|

|||||

|

Bank A/c |

Dr. |

2,40,000 |

|||

|

|

------To 8% Debenture Allotment A/c |

|

|

|

2,40,000 |

|

|

(Being allotment money received) |

|

|

|

|

|

|

|

|

|

|

|

|

|

8% Debenture First and Final Call A/c |

Dr. |

|

6,00,000 |

|

|

|

------To8% Debenture A/c |

|

|

|

6,00,000 |

|

|

(Being first and final call money due on 12,000 8% debentures at Rs.50 each) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Bank A/c |

Dr. |

|

6,00,000 |

|

|

|

------To 8% Debenture First and Final Call A/c |

|

|

|

6,00,000 |

|

|

(Being first and final call received) |

|

|

|

|

Solution Ex.11

|

Journal Entries |

|||||

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

Bank A/c |

Dr. |

25,00,000 |

|||

|

------To Debenture Application A/c |

|

25,00,000 |

|||

|

(Being application money received for 5,000 debentures Rs.500 each ) |

|

||||

|

|

|||||

|

Debenture Application A/c |

Dr. |

25,00,000 |

|||

|

------To10% Debenture A/c |

|

25,00,000 |

|||

|

(Being transferred application money to debentures A/c) |

|

||||

|

|

|||||

|

Debenture Allotment A/c |

Dr. |

20,00,000 |

|||

|

Discount on issue of Debentures A/c |

Dr. |

5,00,000 |

|||

|

Loss on issue of Debentures A/c |

Dr. |

2,50,000 |

|||

|

------To 10% Debenture A/c |

|

25,00,000 |

|||

|

------To Premium on Redemption of Debentures A/c |

|

2,50,000 |

|||

|

(Being allotment due on 5,000 debentures Rs.500 each at a discounted of Rs.100 per debentures and redeemable at premium of 5%) |

|

||||

|

|

|||||

|

Bank A/c |

Dr. |

20,00,000 |

|||

|

|

------To Debenture Allotment A/c |

|

|

|

20,00,000 |

|

|

(Being allotment money received) |

|

|

|

|

Solution Ex. 12

|

Journal |

|||||

|

Date |

Particulars |

|

L.F. |

Dr. Rs. |

Cr. Rs. |

|

|

|

|

|

|

|

|

|

Incorporation Cost A/c |

Dr. |

|

2,00,000 |

|

|

|

-------- To 6% Debentures A/c |

|

|

|

2,00,000 |

|

|

(Being 2000 debenture Rs.100 each issued to promoters) |

|

|

|

|

|

|

|

|

|

|

|

Company Accounts - Issue of Debentures Exercise 9.53

Solution Ex. 13

|

Journal Entries |

|||||

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

Building A/c |

Dr. |

9,00,000 |

|||

|

------To Vendor A/c |

|

9,00,000 |

|||

|

(Being building purchased) |

|

||||

|

|

|||||

|

Vendor A/c |

Dr. |

9,00,000 |

|||

|

Discount on Issue of Debentures A/c |

Dr. |

1,00,000 |

|||

|

------To 10% Debentures A/c |

|

10,00,000 |

|||

|

(Being issued 10,000, 10% debentures at 10% discount) |

|

||||

Working Note:

![]()

Solution Ex. 14

|

In the books of Wye Ltd. Journal Entries |

|||||

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

Sundry Assets A/c |

Dr. |

2,00,000 |

|||

|

------To vendor A/c |

|

2,00,000 |

|||

|

(Being business purchased) |

|

||||

|

|

|||||

|

Vendor A/c |

Dr. |

65,000 |

|||

|

------To Bank A/c |

|

65,000 |

|||

|

(Being amount paid to vendor in cash) |

|

||||

|

|

|||||

|

Vendor A/c |

Dr. |

1,35,000 |

|||

|

Discount on Issue of Debentures A/c |

Dr. |

15,000 |

|||

|

------To 9% Debenture A/c |

|

1,50,000 |

|||

|

(Being issued 1,500 debentures at 10% discount) |

|

||||

Working Note:

![]()

Solution Ex. 15

|

In the books of Newton Ltd. Journal Entries |

|||||

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

Machinery A/c |

Dr. |

5,76,000 |

|||

|

------To B's A/c |

|

5,76,000 |

|||

|

(Being machinery purchased from B) |

|

||||

|

|

|||||

|

B's A/c |

Dr. |

5,76,000 |

|||

|

Discount on Issue of Debentures A/c |

Dr. |

24,000 |

|||

|

------To 9% Debenture A/c |

|

6,00,000 |

|||

|

(Being issued 6,000 debentures at 4% discount) |

|

||||

Working Note:

![]()

Solution Ex. 16

(i)

|

In the books of Reliance Ltd. Journal Entries |

|||||

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

Machinery A/c |

Dr. |

1,35,000 |

|||

|

------To Vendor A/c |

|

1,35,000 |

|||

|

(Being machinery purchased) |

|

||||

|

|

|||||

|

Vendor A/c |

Dr. |

1,35,000 |

|||

|

------To 9% Debenture A/c |

|

1,35,000 |

|||

|

(Being issued 1,350 debentures at par) |

|

||||

Working Note:

![]()

(ii)

|

In the books of Reliance Ltd. Journal Entries |

|||||

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

Machinery A/c |

Dr. |

1,35,000 |

|||

|

------To Vendor A/c |

|

1,35,000 |

|||

|

(Being machinery purchased) |

|

||||

|

|

|||||

|

Vendor A/c |

Dr. |

1,35,000 |

|||

|

Discount on Issue of Debentures A/c |

Dr. |

15,000 |

|||

|

------To 9% Debenture A/c |

|

1,50,000 |

|||

|

(Being issued 1,500 debentures at 10% discount) |

|

||||

Working Note:

![]()

Solution Ex. 17

|

Books of Deepak Ltd. Journal Entries |

|||||

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

Furniture A/c |

Dr. |

2,20,000 |

|||

|

------To Furniture Mart A/c |

|

2,20,000 |

|||

|

(Being furniture purchased from furniture mart ) |

|

||||

|

|

|||||

|

Furniture Mart A/c |

Dr. |

1,10,000 |

|||

|

------To Bills Payable A/c |

|

1,10,000 |

|||

|

(Being bill accepted from furniture mart against 50% payment) |

|

||||

|

|

|||||

|

Furniture Mart A/c |

Dr. |

1,10,000 |

|||

|

------To 9% Debenture A/c |

|

1,00,000 |

|||

|

------To Securities Premium A/c |

|

10,000 |

|||

|

(Being issued 1,000 9% debentures of Rs.100 each at a premium of 10% furniture mart) |

|

||||

Working Note:

![]()

Solution Ex. 18

|

Journal |

|||||

|

Sr. No. |

Particulars |

|

L.F. |

Dr. Rs. |

Cr. Rs. |

|

|

Assets A/c |

Dr. |

|

6,60,000 |

|

|

|

Goodwill A/c (Balancing figure) |

Dr. |

|

20,000 |

|

|

|

-------- To Liablities A/c |

|

|

|

80,000 |

|

|

-------- To Star Ltd. |

|

|

|

6,00,000 |

|

|

(Being purchase of business of Star Ltd.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Star Ltd. |

Dr. |

|

60,000 |

|

|

|

-------- To Cash A/c |

|

|

|

60,000 |

|

|

(Being payment made in cash) |

|

|

|

|

|

|

|

|

|

|

|

|

(a) |

Star Ltd. |

Dr. |

|

5,40,000 |

|

|

|

---------- To 12 % Debenture A/c |

|

|

|

5,40,000 |

|

|

(Being purchase consideration discharged by issue of 12% Debentures) |

|

|

|

|

|

|

|

|

|

|

|

|

(b) |

Star Ltd. |

Dr. |

|

5,40,000 |

|

|

|

-------- To 12% Debentures A/c |

|

|

|

4,50,000 |

|

|

-------- To Securities Premium Reserve A/c |

|

|

|

90,000 |

|

|

(Being purchase consideration discharged by issue of 12 % Debentures) |

|

|

|

|

|

|

|

|

|

|

|

|

(c) |

Star Ltd. |

Dr. |

|

5,40,000 |

|

|

|

Discount on Issue of Debentures A/c |

Dr. |

|

60,000 |

|

|

|

-------- To 12% Debenture A/c |

|

|

|

6,00,000 |

|

|

(Being purchase consideration discharged by issue of 12% Debentures) |

|

|

|

|

|

|

|

|

|

|

|

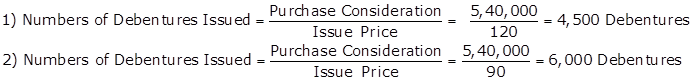

Working Notes:

Solution Ex. 19

|

Journal |

|||||

|

Sr. No. |

Particulars |

|

L.F. |

Dr. Rs. |

Cr. Rs. |

|

|

Assets A/c |

Dr. |

|

6,60,000 |

|

|

|

Goodwill A/c (Balancing Figure) |

Dr. |

|

20,000 |

80,000 |

|

|

-------- Ti Liablities A/c |

|

|

|

6,00,000 |

|

|

-------- To Moon Ltd. |

|

|

|

|

|

|

(Being purchase of business took over) |

|

|

|

|

|

|

|

|

|

|

|

|

(a) |

Moon Ltd. |

Dr. |

|

6,00,000 |

|

|

|

-------- To Cash A/c |

|

|

|

60,000 |

|

|

-------- To 12 % Debenture A/c |

|

|

|

5,40,000 |

|

|

(Being purchase consideration discharged) |

|

|

|

|

|

|

|

|

|

|

|

|

(b) |

Moon Ltd. |

Dr. |

|

6,00,000 |

|

|

|

-------- To Cash A/c |

|

|

|

60,000 |

|

|

-------- To 12% Debentures A/c |

|

|

|

4,50,000 |

|

|

-------- To Securities Premium Reserve A/c |

|

|

|

90,000 |

|

|

(Purchase consideration discharged) |

|

|

|

|

|

|

|

|

|

|

|

Company Accounts - Issue of Debentures Exercise 9.54

Solution Ex. 20

|

Books of Romi Ltd. Journal Entries |

|||||

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

Assets A/c |

Dr. |

20,00,000 |

|||

|

------To Creditors A/c |

|

2,00,000 |

|||

|

------To Kapil Enterprises A/c |

|

18,00,000 |

|||

|

(Being assets purchased and creditors took over from Kapil enterprises ) |

|

||||

|

|

|||||

|

Kapil Enterprises A/c |

Dr. |

18,00,000 |

|||

|

------To 8%Debenture A/c |

|

14,40,000 |

|||

|

------To Securities Premium A/c |

|

3,60,000 |

|||

|

(Being issued 14,400 8% debentures of Rs.100 each at a premium of 25% to Kapil enterprises) |

|

||||

Working Note:

![]()

Solution Ex. 21

|

Books of Romi Ltd. Journal Entries |

|||||

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

Assets A/c |

Dr. |

20,00,000 |

|||

|

------To Creditors A/c |

|

2,00,000 |

|||

|

------To Kapil Enterprises A/c |

|

18,00,000 |

|||

|

(Being assets purchased and Creditors took over from Kapil Enterprises ) |

|

||||

|

|

|||||

|

Kapil Enterprises A/c |

Dr. |

18,00,000 |

|||

|

Discount on Issue of Debentures A/c |

Dr. |

2,00,000 |

|||

|

------To 8%Debenture A/c |

|

20,00,000 |

|||

|

(Being issued 20,00 8% Debentures of Rs.100 each at discount of 10% to Kapil Enterprises) |

|

||||

Working Note:

![]()

Solution Ex. 22

|

Journal Entries |

|||||

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

Assets A/c |

Dr. |

4,00,000 |

|||

|

Goodwill A/c |

Dr. |

30,000 |

|||

|

------To Liabilities A/c |

|

50,000 |

|||

|

------To Mohan Bros. A/c |

|

3,80,000 |

|||

|

(Being business purchased of Mohan Bros.) |

|

||||

(a) When Debentures are issued at par

|

Journal Entries |

|||||

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

Mohan Bros A/c (WN 1) |

Dr. |

3,80,000 |

|||

|

------To Debenture A/c |

|

3,80,000 |

|||

|

(Being issued 3,800 debenture at par) |

|

||||

(b)When Debentures are issued discount at 10%

|

Journal Entries |

|||||

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

Mohan Bros. A/c (WN 2) |

Dr. |

3,80,000 |

|||

|

Discount on issue of Debenture A/c |

Dr. |

42,220 |

|||

|

------To Debenture A/c |

|

4,22,200 |

|||

|

------To Bank A/c |

|

20 |

|||

|

(Being issued 4,222 debentures of Rs.100 each at 10% discount to Mohan Bros. and fraction of debentures is paid in cash) |

|

||||

(c) When Debentures are issued premium at 10%

|

Journal Entries |

|||||

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

Mohan Bros. A/c (WN 3) |

Dr. |

3,80,000 |

|||

|

------To Debenture A/c |

|

3,45,400 |

|||

|

------To Securities Premium A/c |

|

34,540 |

|||

|

------To Bank A/c |

|

60 |

|||

|

(Being issued 3,454 debentures of Rs.100 each at 10% premium to mohan bros. and fraction of debentures is paid in cash) |

|

||||

Working Notes:

(1)

![]()

(2)

![]()

(3)

![]()

Solution Ex. 23

|

In the books of R Ltd. Journal Entries |

|||||

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

Assets A/c |

Dr. |

5,00,000 |

|||

|

------To Sundry Liabilities A/c |

|

2,00,000 |

|||

|

------To S Ltd. A/c |

|

2,80,000 |

|||

|

------To Capital Reserve A/c |

|

20,000 |

|||

|

(Being assets purchased and liabilities took over from S Ltd.) |

|

||||

|

|

|||||

|

S Ltd. A/c |

Dr. |

2,80,000 |

|||

|

------To 9% Debenture A/c |

|

2,80,00 |

|||

|

(Being issued 2,800 9% debenture of Rs.10 each) |

|

||||

Working Note:

![]()

Solution Ex. 24

|

Books of Green Ltd. Journal Entries |

|||||

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

Sundry Assets A/c |

Dr. |

40,00,000 |

|||

|

------To Sundry Liabilities A/c |

|

7,00,000 |

|||

|

------To Strong Ltd. A/c |

|

32,40,000 |

|||

|

|

------To Capital Reserve A/c |

|

|

|

60,000 |

|

(Being business acquired) |

|

||||

|

|

|||||

|

Strong Ltd. A/c |

Dr. |

32,40,000 |

|||

|

Discount on Issue of Debentures A/c |

Dr. |

3,60,000 |

|||

|

------To 10% Debenture A/c |

|

36,00,000 |

|||

|

(Being 36,000 10% Debentures issued) |

|

||||

Working Note:

![]()

Solution Ex. 25

|

Books of Wellbeing Ltd. Journal Entries |

|||||

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

Sundry Assets A/c |

Dr. |

9,80,000 |

|||

|

------To Sundry Liabilities A/c |

|

40,000 |

|||

|

------To HDR Ltd. A/c |

|

9,00,000 |

|||

|

|

------To Capital Reserve A/c |

|

|

|

40,000 |

|

(Being business acquired) |

|

||||

|

|

|||||

|

HDR Ltd. A/c |

Dr. |

9,00,000 |

|||

|

------To 9% Debenture A/c |

|

7,50,000 |

|||

|

------To Securities Premium Reserve A/c |

|

1,50,000 |

|||

|

(Being 7,500 10% Debentures issued) |

|

||||

Working Note:

![]()

Solution Ex. 26

|

In the books of Grown Ltd. Journal Entries |

|||||

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

Incorporation Expenses A/c |

Dr. |

5,00,000 |

|||

|

------To Promoter's A/c |

|

5,00,000 |

|||

|

(Being cost of company incorporation being paid to promoters) |

|

||||

|

|

|||||

|

Promoter's A/c |

Dr. |

5,00,000 |

|||

|

------To 10% Debentures A/c |

|

5,00,000 |

|||

|

(Being 500, 10% debenture allotted to promoters) |

|

||||

|

|

|

|

|

|

|

|

|

Underwriting Commission A/c |

Dr. |

|

1,00,000 |

|

|

|

------To Underwriters' A/c |

|

|

|

1,00,000 |

|

|

(Being the underwriting commission due) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Underwriters' A/c |

Dr. |

|

1,00,000 |

|

|

|

------To 10% Debentures A/c |

|

|

|

1,00,000 |

|

|

(Being 100, 10% Debentures issued to underwriters) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Statement of Profit and Loss A/c |

|

|

6,00,000 |

|

|

|

------To Incorporation Expenses A/c |

|

|

|

5,00,000 |

|

|

------To Underwriting Commission A/c |

|

|

|

1,00,000 |

|

|

(Being incorporation expenses and underwriting expenses written off) |

|

|

|

|

Company Accounts - Issue of Debentures Exercise 9.55

Solution Ex. 27

|

In the books of Sangam Wollens Ltd. Journal Entries |

|||||

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

Machinery A/c |

Dr. |

5,00,000 |

|||

|

------To Vendor's A/c |

|

5,00,000 |

|||

|

(Being the purchase of machinery) |

|

||||

|

|

|||||

|

Vendor's A/c |

Dr. |

5,00,000 |

|||

|

------To Equity Share Capital A/c |

|

4,00,000 |

|||

|

|

------To 9% Debentures A/c |

|

|

|

1,00,000 |

|

(Being issue of 40,000 equity shares and 1,000, 9% Debentures to vendor in consideration of his dues) |

|

||||

|

|

|

|

|

|

|

Solution Ex. 28

|

Balance Sheet of Best Barcode Ltd. |

|||||

|

Particulars |

Note No. |

Rs. |

|||

|

I. Equity and Liabilities |

|||||

|

1. Shareholder's Funds |

|||||

|

2. Non-Current Liabilities |

|||||

|

a. Long-Term Borrowings |

1 |

5,00,000 |

|||

|

Total |

5,00,000 |

||||

|

II. Assets |

|||||

|

1. Non-Current Assets |

|||||

|

2. Current Assets |

|||||

|

|

a. Cash and Cash Equivalents |

2 |

5,00,000 |

||

|

Total |

|

5,00,000 |

|||

|

|

|

|

|||

NOTES TO ACCOUNTS

|

Note No. |

Particulars |

Rs. |

|

1 |

Long-Term Borrowings |

|

|

Loan (Secured by issue of 9% Debentures of Rs.6,00,000 as Collateral Security) |

5,00,000 |

|

|

2 |

Cash and Cash Equivalents |

|

|

Cash at Bank |

5,00,000 |

|

|

|

|

|

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

Bank A/c |

Dr. |

5,00,000 |

|||

|

------To Loan A/c |

|

5,00,000 |

|||

|

(Being loan taken against issuing 9% Debentures as collateral Security ) |

|

||||

|

|

|

|

|

|

|

Alternative Method:

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

Bank A/c |

Dr. |

5,00,000 |

|||

|

------To Loan A/c |

|

5,00,000 |

|||

|

(Being loan taken against issuing 9% Debentures as collateral Security ) |

|

||||

|

|

|

|

|

|

|

|

|

Debenture Suspense A/c |

Dr. |

|

6,00,000 |

|

|

|

------To 9% Debentures A/c |

|

|

|

6,00,000 |

|

|

(Being issued 9% Debentures of Rs.6,00,0000 as collateral security) |

|

|

|

|

|

|

|

|

|

|

|

|

Balance Sheet of Best Barcode Ltd. |

|||||

|

Particulars |

Note No. |

Rs. |

|||

|

I. Equity and Liabilities |

|||||

|

1. Shareholder's Funds |

|||||

|

2. Non-Current Liabilities |

|||||

|

a. Long-Term Borrowings |

1 |

5,00,000 |

|||

|

Total |

5,00,000 |

||||

|

II. Assets |

|||||

|

1. Non-Current Assets |

|||||

|

2. Current Assets |

|||||

|

|

a. Cash and Cash Equivalents |

2 |

5,00,000 |

||

|

Total |

|

5,00,000 |

|||

|

|

|

|

|||

NOTES TO ACCOUNTS

|

Note No. |

Particulars |

Rs. |

|

|

1 |

Long - Term Borrowings |

|

|

|

Secured: |

|

||

|

Loan (Secured by issue of 9% Debentures of Rs.6,00,000 as Collateral Security) |

|

5,00,000 |

|

|

9% Debenture(Issued as Collateral Security to Bank against loan) |

6,00,000 |

||

|

Less: Debenture Suspense Account |

(6,00,000) |

NIL |

|

|

|

5,00,000 |

||

|

|

|||

|

2 |

Cash and Cash Equivalents |

|

|

|

Cash at Bank |

|

5,00,000 |

|

|

|

|

|

|

Solution Ex. 29

Debentures issued as Collateral Security shown separately

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

Bank A/c |

Dr. |

4,00,000 |

|||

|

------To Loan from Bandhan Bank Ltd. |

|

4,00,000 |

|||

|

(Being loan taken against issuing 8% Debentures as collateral Security ) |

|

||||

|

|

|

|

|

|

|

|

|

Debenture Suspense A/c |

Dr. |

|

4,00,000 |

|

|

|

------To 8% Debentures A/c |

|

|

|

4,00,000 |

|

|

(Being issued 8% Debentures as collateral security) |

|

|

|

|

Company's Balance Sheet

|

Balance Sheet |

||||

|

Particulars |

Note No. |

Rs. |

||

|

I. Equity and Liabilities |

||||

|

1. Shareholders' Funds |

||||

|

2. Non-Current Liabilities |

||||

|

Long-Term Borrowings |

1 |

4,00,000 |

||

|

Total |

4,00,000 |

|||

|

II. Assets |

||||

|

1. Non-Current Assets |

||||

|

2. Current Assets |

||||

|

|

Cash and Cash Equivalents |

2 |

4,00,000 |

|

|

Total |

|

4,00,000 |

||

NOTES TO ACCOUNTS

|

Note No. |

Particulars |

Rs. |

|

|

1 |

Long-Term Borrowings |

|

|

|

Secured: |

|

||

|

Loan form Bandhan Bank (Secured by issue of Debentures of Rs.4,00,000) |

|

4,00,000 |

|

|

8% Debenture(Issued as Collateral Security to Bank against loan) |

4,00,000 |

||

|

Less: Debenture Suspense Account |

(4,00,000) |

NIL |

|

|

|

4,00,000 |

||

|

|

|||

|

2 |

Cash and Cash Equivalents |

|

|

|

Cash at Bank |

|

4,00,000 |

|

|

|

|

|

|

Alternative Method

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

Bank A/c |

Dr. |

4,00,000 |

|||

|

------To Loan Form Bandhan Bank Ltd A/c |

|

4,00,000 |

|||

|

(Being loan taken from Bandhan Bank secured by issuing Debentures as collateral Security ) |

|

||||

|

Balance Sheet |

||||

|

Particulars |

Note No. |

Rs. |

||

|

I. Equity and Liabilities |

||||

|

1. Shareholders' Funds |

||||

|

2. Non-Current Liabilities |

||||

|

Long-Term Borrowings |

1 |

4,00,000 |

||

|

Total |

4,00,000 |

|||

|

II. Assets |

||||

|

1. Non-Current Assets |

||||

|

2. Current Assets |

||||

|

|

Cash and Cash Equivalents |

2 |

4,00,000 |

|

|

Total |

|

4,00,000 |

||

NOTES TO ACCOUNTS

|

Note No. |

Particulars |

Rs. |

|

1 |

Long-Term Borrowings |

|

|

Secured: |

||

|

Loan form Bandhan Bank (Secured by issue of 8% Debenture of Rs.4,00,000 as Collateral Security) |

4,00,000 |

|

|

2 |

Cash and Cash Equivalents |

|

|

Cash at Bank |

4,00,000 |

Solution Ex. 30

|

X Ltd. Balance Sheet |

||||

|

Particulars |

Note No. |

Rs. |

||

|

I. Equity and Liabilities |

||||

|

1. Shareholders' Funds |

||||

|

2. Non-Current Liabilities |

||||

|

Long-Term Borrowings |

1 |

3,00,000 |

||

|

Total |

3,00,000 |

|||

|

II. Assets |

||||

|

1. Non-Current Assets |

||||

|

2. Current Assets |

||||

|

|

Cash and Cash Equivalents |

2 |

3,00,000 |

|

|

Total |

|

3,00,000 |

||

Notes To Accounts

|

Note No. |

Particulars |

Rs. |

|

|

1 |

Long-Term Borrowings |

|

|

|

Secured: |

|

||

|

Loan Form IDBI (Secured by issue of Debentures of Rs.4,00,000) |

|

3,00,000 |

|

|

9% Debenture(Issued as Collateral Security to Bank against loan) |

4,00,000 |

||

|

Less: Debenture Suspense Account |

4,00,000 |

NIL |

|

|

|

3,00,000 |

||

|

|

|||

|

2 |

Cash and Cash Equivalents |

|

|

|

Cash at Bank |

|

3,00,000 |

|

Solution Ex. 31

(i) When Company decides not to record the issue of 10% Debentures as Collateral Security

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

Bank A/c |

Dr. |

5,00,000 |

|||

|

------To Bank Loan A/c |

|

5,00,000 |

|||

|

(Being loan taken from SBI @ 10% interest, against collateral security of 7,500 10% Debentures of 100 each) |

|

||||

|

Balance Sheet |

||||

|

Particulars |

Note No. |

Rs. |

||

|

I. Equity and Liabilities |

||||

|

1. Shareholders' Funds |

||||

|

2. Non-Current Liabilities |

||||

|

Long-Term Borrowings |

1 |

5,00,000 |

||

|

Total |

5,00,000 |

|||

|

II. Assets |

||||

|

1. Non-Current Assets |

||||

|

2. Current Assets |

||||

|

|

Cash and Cash Equivalents |

2 |

5,00,000 |

|

|

Total |

|

5,00,000 |

||

NOTES TO ACCOUNTS

|

Note No. |

Particulars |

Rs. |

|

1 |

Long-Term Borrowings |

|

|

Secured: |

||

|

Loan form SBI (Secured by issue of 10% Debenture of Rs.7,50,000 as Collateral Security) |

5,00,000 |

|

|

2 |

Cash and Cash Equivalents |

|

|

Cash at Bank |

5,00,000 |

(ii) When Company decides to record the issue of 10% Debentures as Collateral Security

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

Bank A/c |

Dr. |

5,00,000 |

|||

|

------To Bank Loan A/c |

|

5,00,000 |

|||

|

(Being loan taken from SBI @ 10% interest, against collateral security of 7,500 10% Debentures of 100 each) |

|

||||

|

|

|

|

|

|

|

|

|

Debenture Suspense A/c |

Dr. |

|

7,50,000 |

|

|

|

------To 10% Debentures A/c |

|

|

|

7,50,000 |

|

|

(Being issued 10% Debentures as collateral security) |

|

|

|

|

Company's Balance Sheet

|

Balance Sheet |

||||

|

Particulars |

Note No. |

Rs. |

||

|

I. Equity and Liabilities |

||||

|

1. Shareholders' Funds |

||||

|

2. Non-Current Liabilities |

||||

|

Long-Term Borrowings |

1 |

5,00,000 |

||

|

Total |

5,00,000 |

|||

|

II. Assets |

||||

|

1. Non-Current Assets |

||||

|

2. Current Assets |

||||

|

|

Cash and Cash Equivalents |

2 |

5,00,000 |

|

|

Total |

|

5,00,000 |

||

NOTES TO ACCOUNTS

|

Note No. |

Particulars |

Rs. |

|

|

1 |

Long-Term Borrowings |

|

|

|

Secured: |

|

||

|

Loan form SBI (Secured by issue of Debentures of Rs.7,50,000) |

|

5,00,000 |

|

|

10% Debenture(Issued as Collateral Security to Bank against loan) |

7,50,000 |

||

|

Less: Debenture Suspense Account |

(7,50,000) |

NIL |

|

|

|

5,00,000 |

||

|

|

|||

|

2 |

Cash and Cash Equivalents |

|

|

|

Cash at Bank |

|

5,00,000 |

|

|

|

|

|

|

Solution Ex. 32

|

Journal Entries |

|||||

|

Sr. No. |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

a. |

Bank A/c |

Dr. |

95 |

||

|

------To Debenture Application A/c |

|

95 |

|||

|

(Being debentures application money received ) |

|

||||

|

|

|||||

|

Debenture Application A/c |

Dr. |

95 |

|||

|

Discount On Issue of Debentures A/c |

Dr. |

5 |

|||

|

------To Debenture A/c |

|

100 |

|||

|

(Being debenture of Rs.100 each issued at Rs.95 with the term repayable at par) |

|

||||

|

|

|||||

|

b. |

Bank A/c |

Dr. |

95 |

||

|

------To Debenture Application A/c |

|

95 |

|||

|

(Being debenture application money received) |

|

||||

|

|

|||||

|

Debenture Application A/c |

Dr. |

95 |

|||

|

Discount On Issue of Debentures A/c |

Dr. |

5 |

|||

|

Loss on Issue of Debentures A/c |

Dr. |

5 |

|||

|

|

------To Debenture A/c |

|

|

|

100 |

|

|

------To premium on Redemption A/c |

|

|

|

5 |

|

|

(Being debenture of Rs.100 each issued of Rs.95 with the term repayable at Rs.105) |

|

|

|

|

|

|

|

|

|

|

|

|

c. |

Bank A/c |

Dr. |

|

100 |

|

|

|

------To Debenture Application A/c |

|

|

|

100 |

|

|

(Being debenture application received) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Debenture Application A/c |

Dr. |

|

100 |

|

|

|

Loss On Issue of Debentures A/c |

Dr. |

|

5 |

|

|

|

------To Debenture A/c |

|

|

|

100 |

|

|

------To premium on Redemption A/c |

|

|

|

5 |

|

|

(Being debenture of Rs.100 each issued at par with the term repayable at Rs.105) |

|

|

|

|

Solution Ex. 33

|

Journal Entries |

|||||

|

Sr. No. |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

a. |

Bank A/c |

Dr. |

42,000 |

||

|

------To 12%Debenture Application A/c |

|

42,000 |

|||

|

(Being debentures application money received ) |

|

||||

|

|

|||||

|

12%Debenture Application A/c |

Dr. |

42,000 |

|||

|

------To 12%Debenture A/c |

|

40,000 |

|||

|

------To Securities Premium A/c |

|

2,000 |

|||

|

(Being debenture application money transferred to 12% Debentures account and securities premium account) |

|

||||

|

b. |

Bank A/c |

Dr. |

36,000 |

||

|

------To 12% Debenture Application A/c |

|

36,000 |

|||

|

(Being debenture application money received) |

|

||||

|

|

|||||

|

12% Debenture Application A/c |

Dr. |

36,000 |

|||

|

Discount On Issue of Debentures A/c |

Dr. |

4,000 |

|||

|

------To 12% Debenture A/c |

|

40,000 |

|||

|

(Being debenture of Rs.40,000 issued at 10% discount) |

|

||||

|

c. |

Bank A/c |

Dr. |

40,000 |

||

|

------To 12% Debenture Application A/c |

|

40,000 |

|||

|

(Being debenture application money received) |

|

||||

|

|

|||||

|

12%Debenture Application A/c |

Dr. |

40,000 |

|||

|

Loss On Issue of Debentures A/c |

Dr. |

4,000 |

|||

|

------To 12% Debenture A/c |

|

40,000 |

|||

|

------To Premium on Redemption A/c |

|

4,000 |

|||

|

(Being debenture of Rs.40,000 issued at par with the term repayable at 10% premium) |

|

||||

|

d. |

Bank A/c |

Dr. |

38,000 |

||

|

------To 12%Debenture Application A/c |

|

38,000 |

|||

|

(Being debenture application money received) |

|

||||

|

|

|||||

|

12% Debenture Application A/c |

Dr. |

38,000 |

|||

|

Discount on Issue of Debentures A/c |

Dr. |

2,000 |

|||

|

Loss On Issue of Debentures A/c |

Dr. |

2,000 |

|||

|

------To 12%Debenture A/c |

|

40,000 |

|||

|

------To Premium on Redemption A/c |

|

2,000 |

|||

|

(Being debenture of Rs.40,000 issued at 5% discount with the term repayable at 5% premium) |

|

||||

|

|

|||||

|

e. |

Bank A/c |

Dr. |

44,000 |

||

|

------To 12%Debenture Application A/c |

|

44,000 |

|||

|

(Being debenture application money received) |

|

||||

|

|

|||||

|

12% Debenture Application A/c |

Dr. |

44,000 |

|||

|

Loss On Issue of Debentures A/c |

Dr. |

4,000 |

|||

|

------To 12%Debenture A/c |

|

40,000 |

|||

|

------To Securities Premium A/c |

|

4,000 |

|||

|

------To Premium on Redemption A/c |

|

4,000 |

|||

|

(Being debenture of Rs.40,000 issued and Payable with at 10% premium ) |

|

||||

|

|

|||||

Solution Ex. 34

|

In the books of Footfall Ltd. Journal Entries |

|||||

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

Bank A/c |

Dr. |

9,00,000 |

|||

|

------To Debenture Application A/c |

|

9,00,000 |

|||

|

(Being debentures application money received for 10,000 debentures at Rs.90 each) |

|

||||

|

|

|||||

|

Debenture Application A/c |

Dr. |

9,00,000 |

|||

|

Discount on Issue of Debentures A/c |

Dr. |

1,00,000 |

|||

|

Loss On Issue of Debentures A/c |

Dr. |

50,000 |

|||

|

------To Debenture A/c |

|

10,00,000 |

|||

|

------To Premium on Redemption A/c |

|

50,000 |

|||

|

(Being 10,000 debenture of Rs.100 each issued at 10% discount with the term repayable at 5% redemption) |

|

||||

|

|

|

|

|

|

|

|

|

Debentures A/c |

Dr. |

|

10,00,000 |

|

|

|

Premium on Redemption A/c |

Dr. |

|

50,000 |

|

|

|

------To Debenture holders' A/c |

|

|

|

10,50,000 |

|

|

(Being debenture due for redemption along with premium on redemption) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Debenture holders' A/c |

Dr. |

|

10,50,000 |

|

|

|

------To Bank A/c |

|

|

|

10,50,000 |

|

|

(Being amount due for redemption paid to debenture holders) |

|

|

|

|

Solution Ex. 35

|

Journal Entries |

|||||

|

Sr. No. |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

a. |

Bank A/c |

Dr. |

4,32,000 |

||

|

------To Debenture Application and Allotment A/c |

|

4,32,000 |

|||

|

(Being application money received on 4,000 9% debentures ) |

|

||||

|

|

|||||

|

Debenture Application and Allotment A/c |

Dr. |

4,32,000 |

|||

|

Loss on Issue of Debentures A/c |

Dr. |

40,000 |

|||

|

------To 9% Debenture A/c |

|

4,00,000 |

|||

|

------To Securities Premium Reserve A/c |

|

32,000 |

|||

|

------To Premium on Redemption of debentures A/c |

|

40,000 |

|||

|

(Being 4,000 9% debenture issued at a premium of Rs.8 and redeemable at premium of 10%) |

|

||||

|

|

|||||

|

b. |

Bank A/c |

Dr. |

6,00,000 |

||

|

------To Debenture Application and Allotment A/c |

|

6,00,000 |

|||

|

(Being application money received on 6,000 9% debentures) |

|

||||

|

|

|||||

|

Debenture Application and Allotment A/c |

Dr. |

6,00,000 |

|||

|

Loss On Issue of Debentures A/c |

Dr. |

60,00 |

|||

|

|

------To 9% Debenture A/c |

|

|

|

6,00,000 |

|

|

------To premium on Redemption of Debentures A/c |

|

|

|

60,000 |

|

|

(Being 6,000 9%debenture issued at par and redeemable at premium of 10%) |

|

|

|

|

|

|

|

|

|

|

|

|

c. |

Bank A/c |

Dr. |

|

10,50,000 |

|

|

|

------To Debenture Application and Allotment A/c |

|

|

|

10,50,000 |

|

|

(Being application money received on 10,000 9% debentures) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Debenture Application and Allotment A/c |

Dr. |

|

10,50,000 |

|

|

|

------To 9% Debenture A/c |

|

|

|

10,00,000 |

|

|

------To Securities Premium Reserve A/c |

|

|

|

50,000 |

|

|

(Being 1,000 9% debentures issued at a premium of Rs.5) |

|

|

|

|

Solution Ex. 36

|

Journal Entries |

|||||

|

Sr. No. |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

a. |

Bank A/c |

Dr. |

32,200 |

||

|

------To Debenture Application and Allotment A/c |

|

32,200 |

|||

|

(Being application money received 280 debentures Rs.115 each) |

|

||||

|

|

|||||

|

Debenture Application and Allotment A/c |

Dr. |

32,200 |

|||

|

------To 10% Debenture A/c |

|

28,000 |

|||

|

------To Securities Premium Reserve A/c |

|

4,200 |

|||

|

(Being 280 10% debenture issued at a premium of 15%) |

|

||||

|

|

|||||

|

b. |

Bank A/c |

Dr. |

33,000 |

||

|

------To Debenture Application and Allotment A/c |

|

33,000 |

|||

|

(Being application money received) |

|

||||

|

|

|||||

|

Debenture Application and Allotment A/c |

Dr. |

33,000 |

|||

|

Loss On Issue of Debentures A/c |

Dr. |

4,500 |

|||

|

|

------To 10% Debenture A/c |

|

|

|

30,000 |

|

|

------To Securities Premium Reserve A/c |

|

|

|

3,000 |

|

|

------To Premium on Redemption of Debentures A/c |

|

|

|

4,500 |

|

|

(Being 300 10% debenture issued at a premium of 10% and redeemable at a premium of 15%) |

|

|

|

|

|

|

|

|

|

|

|

|

c. |

Bank A/c |

Dr. |

|

80,000 |

|

|

|

------To Debenture Application and Allotment A/c |

|

|

|

80,000 |

|

|

(Being application money received) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Debenture Application and Allotment A/c |

Dr. |

|

80,000 |

|

|

|

Loss On Issue of Debentures A/c |

Dr. |

|

8,000 |

|

|

|

------To 10% Debenture A/c |

|

|

|

80,000 |

|

|

------To Premium on Redemption of Debentures A/c |

|

|

|

8,000 |

|

|

(Being 800 10% debentures issued at a par and redeemable at premium of 10%) |

|

|

|

|

Company Accounts - Issue of Debentures Exercise 9.56

Solution Ex. 37

|

Journal |

|||||

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

|

Bank A/c |

Dr. |

|

85,500 |

|

|

|

------To Debenture Application and Allotment A/c |

|

|

|

85,500 |

|

|

(900, 12% Debentures issued at a discount of 5%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Debenture Application and Allotment A/c |

Dr. |

|

85,500 |

|

|

|

Loss on Issue of Debentures A/c |

Dr. |

|

13,500 |

|

|

|

------To 12% Debentures A/c |

|

|

|

90,000 |

|

|

------To Premium on Redemption of Debentures A/c |

|

|

|

9,000 |

|

|

(900, 12% Debentures issued at a discount of 5%, redeemable at a premium of 10%) |

|

|

|

|

|

|

|

|

|

|

|

Solution Ex. 38

a.

|

Journal Entries |

|||||

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

Bank A/c |

Dr. |

42,000 |

|||

|

------To Debenture Application A/c |

|

42,000 |

|||

|

(Being 400 debentures issued at Rs.100 at a premium of 5%) |

|

||||

|

|

|||||

|

Debenture Application A/c |

Dr. |

42,000 |

|||

|

------To 12% Debenture A/c |

|

40,000 |

|||

|

------To Securities Premium A/c |

|

2,000 |

|||

|

(Being 400 debentures issued at a premium of 5% and redeemable at par) |

|

||||

b.

|

Journal Entries |

|||||

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

Bank A/c |

Dr. |

73,500 |

|||

|

------To Debenture Application A/c |

|

73,500 |

|||

|

(Being 700 debentures issued at Rs.100 at a premium of 5%) |

|

||||

|

|

|||||

|

Debenture Application A/c |

Dr. |

73,500 |

|||

|

Loss On Issue of Debentures A/c |

Dr. |

7,000 |

|||

|

|

------To 12% Debenture A/c |

|

|

|

70,000 |

|

|

------To Securities Premium Reserve A/c |

|

|

|

3,500 |

|

|

------To Premium on Redemption A/c |

|

|

|

7,000 |

|

|

(Being 70,000 debenture issued at a premium of 5% and redeemable at Rs.110) |

|

|

|

|

Solution Ex. 39

a.

|

Journal Entries |

|||||

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

Bank A/c |

Dr. |

36,000 |

|||

|

------To Debenture Application A/c |

|

36,000 |

|||

|

(Being 400 debentures issued at Rs.100 at a premium of 10%) |

|

||||

|

|

|||||

|

Debenture Application A/c |

Dr. |

36,000 |

|||

|

Discount on Issue of Debentures A/c |

Dr. |

4,000 |

|||

|

------To 15% Debenture A/c |

|

40,000 |

|||

|

(Being 400 debentures issued at discount and redeemable at par) |

|

||||

b.

|

Journal Entries |

|||||

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

Bank A/c |

Dr. |

88,000 |

|||

|

------To Debenture Application A/c |

|

88,000 |

|||

|

(Being 800 debentures issued at Rs.100 at a premium of 10%) |

|

||||

|

|

|||||

|

Debenture Application A/c |

Dr. |

88,000 |

|||

|

Loss On Issue of Debentures A/c |

Dr. |

8,000 |

|||

|

|

------To 15% Debenture A/c |

|

|

|

80,000 |

|

|

------To premium on Redemption A/c |

|

|

|

8,000 |

|

|

------To Securities Premium A/c |

|

|

|

8,000 |

|

|

(Being 800 debenture issued at a premium of 10% and redeemable at a premium of 10%) |

|

|

|

|

Solution Ex. 40

|

Books of XYZ Ltd. Journal Entries |

|||||

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

2015 |

|

||||

|

1st April |

Bank A/c |

Dr. |

4,50,000 |

||

|

------To Debenture Application A/c |

|

4,50,000 |

|||

|

(Being application money received) |

|

||||

|

|

|||||

|

1st April |

Debenture Application A/c |

Dr. |

4,50,000 |

||

|

Loss On Issue of Debentures A/c |

Dr. |

1,00,000 |

|||

|

------To 10% Debenture A/c |

|

5,00,000 |

|||

|

------To premium on Redemption A/c |

|

50,000 |

|||

|

(Being 5,000 debentures of Rs.100 each issued at 10% discount with the term repayable at premium of 10%) |

|

||||

|

2015 |

|

||||

|

30th Sep |

Interest on Debentures A/c |

Dr. |

25,000 |

||

|

------To Debenture holders A/c |

|

22,500 |

|||

|

------To Income Tax Payable A/c |

|

2,500 |

|||

|

(Being interest due on 10% debentures) |

|

||||

|

|

|||||

|

30th Sep |

Debenture holders A/c |

Dr. |

22,500 |

||

|

|

------To Bank A/c |

|

|

|

22,500 |

|

|

(Being interest on debentures paid to debenture holders) |

|

|

|

|

|

|

|

|

|

|

|

|

30th Sep |

Income Tax Payable A/c |

Dr. |

|

2,500 |

|

|

|

------To Bank A/c |

|

|

|

2,500 |

|

|

(Being payment of tax on interest on debentures) |

|

|

|

|

|

2016 |

|

|

|

|

|

|

31st Mar |

Interest on debentures A/c |

Dr. |

|

25,000 |

|

|

|

------To Debentures holders' A/c |

|

|

|

22,500 |

|

|

------To Income Tax Payable A/c |

|

|

|

2,500 |

|

|

(Being interest due on 10% debentures) |

|

|

|

|

|

|

|

|

|

|

|

|

31st Mar |

Debenture holders A/c |

Dr. |

|

22,500 |

|

|

|

------To Bank A/c |

|

|

|

22,500 |

|

|

(Being interest on debentures paid to debenture holders) |

|

|

|

|

|

|

|

|

|

|

|

|

31st Mar |

Income Tax Payable A/c |

Dr. |

|

2,500 |

|

|

|

------To Bank A/c |

|

|

|

2,500 |

|

|

(Being payment of tax on interest on debentures) |

|

|

|

|

|

|

|

|

|

|

|

|

31st Mar |

Profit and Loss A/c |

Dr. |

|

50,000 |

|

|

|

------To Interest on debentures A/c |

|

|

|

50,000 |

|

|

(Being interest on debentures transferred to profit and loss account) |

|

|

|

|

Working Note:

![]()

Solution Ex. 41

|

In the books of Bright Ltd. Journal |

|||||

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

2016 |

|

||||

|

31st Mar |

Debentures Interest A/c |

Dr. |

25,000 |

||

|

------To Debenture holders A/c |

|

22,500 |

|||

|

------To Income Tax Payable A/c |

|

2,500 |

|||

|

(Being debentures interest due) |

|

||||

|

|

|||||

|

Debenture holders A/c |

Dr. |

22,500 |

|||

|

Income Tax Payable A/c |

Dr. |

2,500 |

|||

|

------To Bank A/c |

|

25,000 |

|||

|

(Being interest on debentures paid) |

|

||||

|

|

|||||

|

31st Mar |

Statement of Profit and Loss A/c |

Dr. |

50,000 |

||

|

------To Debentures Interest A/c |

|

50,000 |

|||

|

(Being interest transferred to profit and loss) |

|

||||

Solution Ex. 42

|

Journal |

|||||

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

2015 |

|

|

|

|

|

|

Apr. 01 |

Bank A/c |

Dr. |

|

94,000 |

|

|

|

------To Debenture Application and Allotment A/c |

|

|

|

94,000 |

|

|

(1,000, 9% Debentures issued at a discount of 6%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Debenture Application and Allotment A/c |

Dr. |

|

94,000 |

|

|

|

Loss on Issue of Debentures A/c |

Dr. |

|

16,000 |

|

|

|