Class 12-commerce T S GREWAL Solutions Accountancy Chapter 8: Company Accounts - Accounting for Share Capital

Company Accounts - Accounting for Share Capital Exercise 8.113

Solution Ex. 1

|

Gopal Ltd |

||

|

Balance Sheet |

||

|

Particulars |

Note No. |

Rs. |

|

I. Equity and Liabilities |

|

|

|

----1. Shareholder's Funds |

|

|

|

------a. Share Capital |

1 |

44,90,000 |

|

----2. Non - Current Liabilities |

|

|

|

----3. Current Liabilities |

|

|

|

Total |

|

44,90,000 |

|

II. Assets |

|

|

|

----1. Non - Current Assets |

|

|

|

----2. Current Assets |

|

|

|

------a. Cash and Cash Equivalents |

2 |

44,90,000 |

|

Total |

|

44,90,000 |

|

NOTES TO ACCOUNTS |

|||

|

Note No. |

Particulars |

|

Rs. |

|

1. |

Share Capital |

|

|

|

|

Authorised Share Capital |

|

|

|

|

50,000 equity Shares of Rs.100 each |

|

50,00,000 |

|

|

Issued Share Capital |

|

|

|

|

50,000 equity shares of Rs.100 each |

|

50,00,000 |

|

|

Subscribed, Called -up and Paid up Share Capital |

|

|

|

|

45,000 equity Share of Rs.100 each |

45,00,000 |

|

|

|

Less: Calls in Arrears (500 Shares × Rs.20) |

(10,000) |

44,90,000 |

|

|

|

|

|

|

2. |

Cash and Cash Equivalents |

|

|

|

|

Cash at Bank |

|

44,90,000 |

|

|

|

|

|

Company Accounts - Accounting for Share Capital Exercise 8.114

Solution Ex. 2

|

Balance Sheet of Himmat Ltd. |

||

|

Particulars |

Note No |

Rs. |

|

I. Equity and Liabilities |

|

|

|

----1. Shareholders' Funds |

|

|

|

-------Share Capital |

1 |

20,00,000 |

|

Total |

|

20,00,000 |

|

|

|

|

|

II. Assets |

|

|

|

----2. Current Assets |

|

|

|

-------Cash and Cash Equivalents |

2 |

20,00,000 |

|

Total |

|

20,00,000 |

|

|

|

|

|

NOTES TO ACCOUNTS |

|||

|

Note No. |

Particulars |

|

Rs. |

|

1. |

Share Capital |

|

|

|

|

Authorised Share Capital |

|

|

|

|

5,00,000 equity Shares of Rs.10 each |

|

50,00,000 |

|

|

Issued Share Capital |

|

|

|

|

50,000 equity shares of Rs.10 each |

5,00,000 |

|

|

|

1,50,000 Equity Shares of Rs.10 Each |

15,00,000 |

20,00,000 |

|

|

Subscribed and Paid up Share Capital |

|

|

|

|

50,000 equity Share of Rs.10 each |

5,00,000 |

|

|

|

1,50,000 Equity Shares of Rs.10 each |

15,00,000 |

20,00,000 |

|

|

|

|

|

|

2. |

Cash and Cash Equivalents |

|

|

|

|

Bank |

|

20,00,000 |

|

|

|

|

|

Solution Ex. 3

|

Balance Sheet of Lennova Ltd |

||

|

Particulars |

Note No. |

Rs. |

|

I. Equity and Liabilities |

|

|

|

----1. Shareholder's Funds |

|

|

|

------a. Share Capital |

1 |

42,50,000 |

|

------b. Reserve and Surplus |

2 |

5,00,000 |

|

Total |

|

47,50,000 |

|

|

|

|

|

II. Assets |

|

|

|

----1. Current Assets |

|

|

|

-------Cash and Cash Equivalents |

3 |

47,50,000 |

|

Total |

|

47,50,000 |

|

|

|

|

|

NOTES TO ACCOUNTS |

|||

|

Note No |

Particulars |

|

Rs. |

|

1. |

Share Capital |

|

|

|

|

Authorised Share Capital |

|

|

|

|

1,00,000 equity Shares of Rs.100 each |

|

1,00,00,000 |

|

|

Issued Share Capital |

|

|

|

|

25,000 equity shares of Rs.100 each |

25,00,000 |

|

|

|

25,000 Equity Shares of Rs.100 each |

25,00,000 |

50,00,000 |

|

|

Subscribed and Paid up Share Capital |

|

|

|

|

Fully Called-up and Paid- up Capital |

|

|

|

|

25,000 Equity Shares of Rs.100 each |

25,00,000 |

|

|

|

Partially Called - up andPaid - up Capital |

|

|

|

|

25,000 Equity Shares Rs.100 each Rs.70 Called up |

17,50,000 |

42,50,000 |

|

|

|

|

|

|

2. |

Reserves and Surplus |

|

|

|

|

Securities Premium Reserve |

|

5,00,000 |

|

|

(25,000 shares @ Rs.20 per share) |

|

|

|

|

|

|

|

|

3. |

Cash and Cash Equivalents |

|

|

|

|

Bank |

|

47,50,000 |

|

|

|

|

|

Solution Ex. 4

|

Balance Sheet of Star Ltd |

||

|

Particulars |

Note No. |

Rs. |

|

I. Equity and Liabilities |

|

|

|

----1. Shareholder's Funds |

|

|

|

------a. Share Capital |

1 |

23,63,000 |

|

Total |

|

23,63,000 |

|

|

|

|

|

II. Assets |

|

|

|

----1. Current Assets |

|

|

|

-------Cash and Cash Equivalents |

2 |

23,63,000 |

|

Total |

|

23,63,000 |

|

|

|

|

|

NOTES TO ACCOUNTS |

|||

|

Note No |

Particulars |

|

Rs. |

|

1. |

Share Capital |

|

|

|

|

Authorised Share Capital |

|

|

|

|

50,000 equity Shares of Rs.100 each |

|

50,00,000 |

|

|

Issued Share Capital |

|

|

|

|

25,000 Equity Shares of Rs.100 each |

25,00,000 |

25,00,000 |

|

|

Subscribed and Paid up Share Capital |

|

|

|

|

Fully Called-up and Paid- up Capital |

|

|

|

|

23,750 Equity Shares of Rs.100 each |

23,75,000 |

|

|

|

Less: Calls-in-Arrears (20×600) |

12,000 |

23,63,000 |

|

|

|

|

|

|

|

|

|

|

|

2. |

Cash and Cash Equivalents |

|

|

|

|

Bank |

|

23,63,000 |

|

|

|

|

|

Solution Ex. 5

Authorised Capital: Rs.25,00,000 (2,50,000 Shares of Rs.10 each)

Issued and subscribed Capital: Rs.25,00,000 (2,50,000 Shares of Rs.10 each)

|

|

|||||

|

Journal |

|||||

|

Date |

Particulars |

|

L.F. |

Debit Rs. |

Credit Rs. |

|

|

|

|

|

|

|

|

|

Bank A/c |

Dr. |

|

25,00,000 |

|

|

|

--------To Equity Share Application A/c |

|

|

|

25,00,000 |

|

|

(Being share application money received for 2,50,000 equity share of Rs.10 each) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Equity share Application A/c |

Dr. |

|

25,00,000 |

|

|

|

--------To Equity Share Capital A/c |

|

|

|

25,00,000 |

|

|

(Being share application of 2,50,000 equity shares of Rs.10 each transferred to equity share capital A/c) |

|

|

|

|

|

|

|

|

|

|

|

Solution Ex. 6

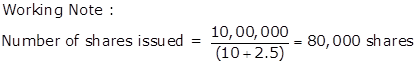

Authorised Capital: Rs.16,00,000 (1,60,000 Shares of Rs.10 each)

Issued and subscribed Capital: Rs.8,00,000 (80,000 Shares of Rs.10 each)

|

|

|||||

|

Books of XYZ Limited |

|||||

|

Journal |

|||||

|

Date |

Particulars |

|

L.F. |

Debit Rs. |

Credit Rs. |

|

|

|

|

|

|

|

|

|

Bank A/c |

Dr. |

|

8,00,000 |

|

|

|

--------To Equity Share Application A/c |

|

|

|

8,00,000 |

|

|

(Being share application money received for 80,000 equity share of Rs.10 each) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Equity share Application A/c |

Dr. |

|

8,00,000 |

|

|

|

--------To Equity Share Capital A/c |

|

|

|

8,00,000 |

|

|

(Being share application of 80,000 equity shares of Rs.10 each transferred to equity share capital A/c) |

|

|

|

|

|

|

|

|

|

|

|

Solution Ex. 7

|

Total |

Rs.100 |

|

|

Books of Hema Limited |

|||||

|

Journal |

|||||

|

Date |

Particulars |

|

L.F. |

Debit Rs. |

Credit Rs. |

|

|

|

|

|

|

|

|

|

Bank A/c |

Dr. |

|

2,00,000 |

|

|

|

-------- To Share Application A/c |

|

|

|

2,00,000 |

|

|

(Being share application money received for 10,000 shares at Rs.20 per share) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Share Application A/c |

Dr. |

|

2,00,000 |

|

|

|

-------- To Share Capital A/c |

|

|

|

2,00,000 |

|

|

(Being share application of 10,000 shares of Rs.20 each transferred to share Capital) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Share Allotment A/c |

Dr. |

|

3,00,000 |

|

|

|

-------- To Share Capital A/c |

|

|

|

3,00,000 |

|

|

(Being share allotment due on 10,000 shares at Rs.30 per share) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Bank A/c |

Dr. |

|

3,00,000 |

|

|

|

-------- To Share Allotment A/c |

|

|

|

3,00,000 |

|

|

(Being share allotment money received for 10,000 Shares at Rs.30 per share) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Share First Call A/c |

Dr. |

|

2,00,000 |

|

|

|

-------- To Share Capital A/c |

|

|

|

2,00,000 |

|

|

(Being share first call due on 10,000 shares at Rs.20 per share) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Bank A/c |

Dr. |

|

2,00,000 |

|

|

|

-------- To Share First call A/c |

|

|

|

2,00,000 |

|

|

(Being share first call received on 10,000 shares at Rs.20 per share) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Share Final Call A/c |

Dr. |

|

3,00,000 |

|

|

|

-------- To Share Capital A/c |

|

|

|

3,00,000 |

|

|

(Being share Final call due on 10,000 shares at Rs.30 per shares |

|

|

|

|

|

|

|

|

|

|

|

|

|

Bank A/c |

Dr. |

|

3,00,000 |

|

|

|

-------- To Share Final Call A/c |

|

|

|

3,00,000 |

|

|

(Being share final call received on 10,000 shares of Rs.30 per share) |

|

|

|

|

Solution Ex. 8

|

Journal |

|||||

|

Date |

Particulars |

L.F. |

Debit Amount (Rs.) |

Credit Amount (Rs.) |

|

|

|

|

|

|

|

|

|

|

Share Application A/c |

Dr. |

|

90,000 |

|

|

|

To Share Capital |

|

|

|

90,000 |

|

|

(Application money transferred to Capital A/c) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Share Allotment A/c |

Dr. |

|

1,20,000 |

|

|

|

To Share Capital A/c |

|

|

|

1,20,000 |

|

|

(Allotment money transferred to Capital A/c) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Share First and Final Call A/c |

Dr. |

|

90,000 |

|

|

|

To Share Capital A/c |

|

|

|

90,000 |

|

|

(Call money transferred to Capital A/c) |

|

|

|

|

|

Cash Book (Bank Column) |

|||||

|

Dr. |

|

Cr. |

|||

|

Particulars |

Amount Rs. |

Particulars |

Amount Rs. |

||

|

Share Application A/c |

90,000 |

Balance c/d |

3,00,000 |

||

|

Share Allotment A/c |

1,20,000 |

|

|

||

|

Share First and Final Call A/c |

90,000 |

|

|

||

|

|

3,00,000 |

|

3,00,000 |

||

|

|

|

|

|

||

Solution Ex. 9

|

Cash Book |

|||||

|

Dr. |

|

|

|

|

Cr. |

|

Date |

Particulars |

Bank Rs. |

Date |

Particulars |

Bank Rs. |

|

|

To Equity Share Application A/c |

10,000 |

|

By Balance c/d |

1,50,000 |

|

|

To Preference Share Application A/c |

12,500 |

|

|

|

|

|

To Equity Share Allotment A/c |

40,000 |

|

|

|

|

|

To Preference Share Allotment A/c |

12,500 |

|

|

|

|

|

To Equity Share First Call A/c |

25,000 |

|

|

|

|

|

To Preference share First and Final Call A/c |

25,000 |

|

|

|

|

|

To Equity Share Final Call A/c |

25,000 |

|

|

|

|

|

|

1,50,000 |

|

|

1,50,000 |

|

|

|

|

|

|

|

|

Journal |

|||||

|

Date |

Particulars |

|

L.F. |

Debit Rs. |

Credit Rs. |

|

|

|

|

|

|

|

|

|

Equity Share Application A/c |

Dr. |

|

10,000 |

|

|

|

------- To Equity Share Capital A/c |

|

|

|

10,000 |

|

|

(Being equity Share application of 1,000 shares of 10 each transferred to equity share capital account) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Preference Share Application A/c |

Dr. |

|

12,500 |

|

|

|

-------- To 9% Preference Share Capital A/c |

|

|

|

12,500 |

|

|

(Being preference share application of 500 shares Rs.25 each transferred to 9% preference share capital account) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Equity Share Allotment A/c |

Dr. |

|

40,000 |

|

|

|

-------- To Equity Share Capital A/c |

|

|

|

40,000 |

|

|

(Being equity share allotment due on 1,000 shares at Rs.40 each) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Preference Share Allotment A/c |

Dr. |

|

12,500 |

|

|

|

-------- To 9% Preference Share Capital A/c |

|

|

|

12,500 |

|

|

(Being preference share allotment due on 500 shares at Rs.25 each) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Equity Share First Call A/c |

Dr. |

|

25,000 |

|

|

|

-------- To Equity Share Capital A/c |

|

|

|

25,000 |

|

|

(Being equity share first call due on 1,000 shares at Rs.25 each) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Preference Share First and Final Call A/c |

Dr. |

|

25,000 |

|

|

|

--------- To 9% Preference Share Capital A/c |

|

|

|

25,000 |

|

|

(Being preference share first and final call due on 500 shares at Rs.50 each) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Equity Share Final Call A/c |

Dr. |

|

25,000 |

|

|

|

------- To Equity Share Capital A/c |

|

|

|

25,000 |

|

|

(Being equity share final call due on 1,000 shares at Rs.25 each) |

|

|

|

|

|

Balance Sheet |

||

|

Particulars |

Note No |

Rs. |

|

I. Equity and Liabilities |

|

|

|

----1. Shareholder's Funds |

|

|

|

------a. Share Capital |

1 |

1,50,000 |

|

----2. Non-Current Liabilities |

|

|

|

----3. Current Liabilities |

|

|

|

Total |

|

1,50,000 |

|

|

|

|

|

II. Assets |

|

|

|

----1. Non-Current Assets |

|

|

|

----2. Current Assets |

|

|

|

------a. Cash and Cash Equivalents |

2 |

1,50,000 |

|

Total |

|

1,50,000 |

|

NOTES TO ACCOUNTS |

|||

|

Note No |

Particulars |

|

Rs. |

|

1. |

Share Capital |

|

|

|

|

Authorised Share Capital |

|

|

|

|

7,500 equity Shares of Rs.100 each |

7,50,000 |

|

|

|

2,500 9% Preference Shares of Rs.100 each |

2,50,000 |

10,00,000 |

|

|

Issued Share Capital |

|

|

|

|

1,000 Equity shares of 100 each |

1,00,000 |

|

|

|

500 9 % Preference Shares of 100 each |

50,000 |

1,50,000 |

|

|

Subscribed Called-up and Paid up Share Capital |

|

|

|

|

1,000 Equity Shares of Rs.100 each |

1,00,000 |

|

|

|

500 9% Preference Shares of Rs.100 each |

50,000 |

1,50,000 |

|

|

|

|

|

|

2. |

Cash and Cash Equivalents |

|

|

|

|

Bank |

|

1,50,000 |

|

|

|

|

|

Company Accounts - Accounting for Share Capital Exercise 8.115

Solution Ex. 10

|

Issued 1,00,000 equity shares of Rs.10 each at a premium of Rs.5 Applied shares: 1,00,000 |

|||||

|

Books of Shiva Limited |

|||||

|

Journal |

|||||

|

Date |

Particulars |

|

L.F. |

Debit Rs. |

Credit Rs. |

|

|

|

|

|

|

|

|

|

Bank A/c |

Dr. |

|

15,00,000 |

|

|

|

-------- To Equity Share Application and Allotment A/c |

|

|

|

15,00,000 |

|

|

(Being share application and allotment money received for 1,00,000 Shares at Rs.15 each including 5 premium) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Equity Share Application and Allotment A/c |

Dr. |

|

15,00,000 |

|

|

|

-------- To Equity Share Capital A/c |

|

|

|

10,00,000 |

|

|

-------- To Securities Premium A/c |

|

|

|

5,00,000 |

|

|

(Being application and allotment money of 1,00,000 shares transferred to equity Share capital account at Rs.10 each and securities premium at Rs.5 each) |

|

|

|

|

|

|

|

|

|

|

|

Solution Ex. 11

Issued 10,000 shares of Rs.25 each at premium of Rs.5 Applied 10,000 shares Payable as :

|

Total (25 + 5) |

Rs.30 |

|

Cash Book |

|||||

|

Dr. |

|

|

|

|

Cr. |

|

Date |

Particulars |

Bank Rs. |

Date |

Particulars |

Bank Rs. |

|

|

|

|

|

By Balance c/d |

2,97,000 |

|

|

To Share Application A/c |

50,000 |

|

|

|

|

|

To Share Allotment A/c |

1,00,000 |

|

|

|

|

|

To Share First Call A/c |

50,000 |

|

|

|

|

|

To Share Second Call A/c |

49,000 |

|

|

|

|

|

To Share Final Call A/c |

48,000 |

|

|

|

|

|

|

2,97,000 |

|

|

2,97,000 |

|

|

|

|

|

|

|

|

Journal |

|||||

|

Date |

Particulars |

|

L.F. |

Debit Rs. |

Credit Rs. |

|

|

|

|

|

|

|

|

|

Share Application A/c |

Dr. |

|

50,000 |

|

|

|

-------- To Share Capital A/c |

|

|

|

50,000 |

|

|

(Being application money of 10,000 shares of Rs.5 each transferred to Share Capital) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Share Allotment A/c |

Dr. |

|

1,00,000 |

|

|

|

-------- To Share Capital A/c |

|

|

|

50,000 |

|

|

-------- To Securities Premium A/c |

|

|

|

50,000 |

|

|

(Being share allotment of 10,000 shares transferred to share capital at Rs.5 each and securities premium at Rs.5 each) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Share First Call A/c |

Dr. |

|

50,000 |

|

|

|

-------- To Share Capital A/c |

|

|

|

50,000 |

|

|

(Being first call due on 10,000 shares at Rs.5 each) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Share Second Call A/c |

Dr. |

|

50,000 |

|

|

|

-------- To Share Capital A/c |

|

|

|

50,000 |

|

|

(Being second call due on 10,000 shares at Rs.5 each) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Calls-in-Arrears A/c |

Dr. |

|

1,000 |

|

|

|

-------- To Share Second Call A/c |

|

|

|

1,000 |

|

|

(Being second call outstanding on 200 shares at Rs.5 each |

|

|

|

|

|

|

|

|

|

|

|

|

|

Share Final Call A/c |

Dr. |

|

50,000 |

|

|

|

-------- To Share Capital A/c |

|

|

|

50,000 |

|

|

(Being final Call due on 10,000 shares of Rs.5 per shares |

|

|

|

|

|

|

|

|

|

|

|

|

|

Calls-in-Arrears A/c |

Dr. |

|

2,000 |

|

|

|

-------- To Shares Final Call A/c |

|

|

|

2,000 |

|

|

(Being final call outstanding on 400 shares at Rs.5 each) |

|

|

|

|

|

Share Application Account |

|||||

|

Dr. |

|

|

|

|

Cr. |

|

Date |

Particulars |

Rs. |

Date |

Particulars |

Rs. |

|

|

To Share Capital A/c |

50,000 |

|

By Bank A/c |

50,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

50,000 |

|

|

50,000 |

|

|

|

|

|

|

|

|

Share Allotment Account |

|||||

|

Dr. |

|

|

|

|

Cr. |

|

Date |

Particulars |

Rs. |

Date |

Particulars |

Rs. |

|

|

|

|

|

By Bank A/c |

1,00,000 |

|

|

To Share Capital A/c |

50,000 |

|

|

|

|

|

To Securities Premium A/c |

50,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

1,00,000 |

|

|

1,00,000 |

|

|

|

|

|

|

|

|

Share First Call Account |

|||||

|

Dr. |

|

|

|

|

Cr. |

|

Date |

Particulars |

Rs. |

Date |

Particulars |

Rs. |

|

|

To Share Capital A/c |

50,000 |

|

By Bank A/c |

50,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

50,000 |

|

|

50,000 |

|

|

|

|

|

|

|

|

Share Second Call Account |

|||||

|

Dr. |

|

|

|

|

Cr. |

|

Date |

Particulars |

Rs. |

Date |

Particulars |

Rs. |

|

|

To Share Capital A/c |

50,000 |

|

By Bank A/c |

49,000 |

|

|

|

|

|

By Calls - in - Arrears A/c |

1,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

50,000 |

|

|

50,000 |

|

|

|

|

|

|

|

|

Share Final Call Account |

|||||

|

Dr. |

|

|

|

|

Cr. |

|

Date |

Particulars |

Rs. |

Date |

Particulars |

Rs. |

|

|

To Share Capital A/C |

50,000 |

|

By Bank A/c |

48,000 |

|

|

|

|

|

By Calls - in - Arrears A/c |

2,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

50,000 |

|

|

50,000 |

|

|

|

|

|

|

|

|

Calls in Arrears Account |

|||||

|

Dr. |

|

|

|

|

Cr. |

|

Date |

Particulars |

Rs. |

Date |

Particulars |

Rs. |

|

|

To Share Second Call A/C |

1,000 |

|

By Balance c/d |

3,000 |

|

|

To Share Final Call A/c |

2,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3,000 |

|

|

3,000 |

|

Share Capital Account |

|||||

|

Dr. |

|

|

|

|

Cr. |

|

Date |

Particulars |

Rs. |

Date |

Particulars |

Rs. |

|

|

To Balance c/d |

2,50,000 |

|

By Share Application A/c |

50,000 |

|

|

|

|

|

By Share Allotment A/c |

50,000 |

|

|

|

|

|

By Share First Call A/c |

50,000 |

|

|

|

|

|

By Share Second Call A/c |

50,000 |

|

|

|

|

|

By Share Final Call A/c |

50,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2,50,000 |

|

|

2,50,000 |

|

|

|

|

|

|

|

|

Securities Premium Account |

|||||

|

Dr. |

|

|

|

|

Cr. |

|

Date |

Particulars |

Rs. |

Date |

Particulars |

Rs. |

|

|

To Balance c/d |

50,000 |

|

By Share Allotment A/c |

50,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

50,000 |

|

|

50,000 |

|

|

|

|

|

|

|

|

Balance Sheet |

||||

|

Particulars |

Note No |

Rs. |

||

|

I. Equity and Liabilities |

|

|

||

|

|

1. Shareholder's Funds |

|

|

|

|

|

a. Share Capital |

1 |

2,47,000 |

|

|

|

b. Reserve and Surplus |

2 |

50,000 |

|

|

|

2. Non - Current Liabilities |

|

|

|

|

|

3. Current Liabilities |

|

|

|

|

Total |

|

2,97,000 |

||

|

|

|

|

||

|

II. Assets |

|

|

||

|

|

1.Non - Current Assets |

|

|

|

|

|

2. Current Assets |

|

|

|

|

|

a. Cash and Cash Equivalents |

3 |

2,97,000 |

|

|

Total |

|

2,97,000 |

||

|

NOTES TO ACCOUNTS |

||||

|

Note No |

Particulars |

|

Rs. |

|

|

1. |

Share Capital |

|

|

|

|

|

Authorised Share Capital |

|

|

|

|

|

Shares of Rs.25 each |

|

|

|

|

|

Issued Share Capital |

|

|

|

|

|

10,000 shares of Rs.25 each |

|

2,50,000 |

|

|

|

Subscribed Called-up and Paid up Share Capital |

|

|

|

|

|

10,000 shares of Rs.25 each |

2,50,000 |

|

|

|

|

|

Less : Calls-in-Arrears |

(3,000) |

2,47,000 |

|

2. |

Reserve and Surplus |

|

|

|

|

|

|

Securities Premium |

|

50,000 |

|

|

|

|

|

|

|

3. |

Cash and Cash Equivalents |

|

|

|

|

|

Cash at Bank |

|

2,97,000 |

|

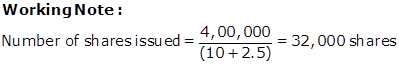

Solution Ex. 12

Authorised Capital 20,000 shares of Rs.10 each Issued Capital 2,000 shares Applied 1,800 shares Payable as :

|

Total (10 + 2) |

Rs.12 |

|

Journal |

|||||

|

Date |

Particulars |

|

L.F. |

Debit Rs. |

Credit Rs. |

|

|

|

|

|

|

|

|

|

Bank A/c |

Dr. |

|

5,400 |

|

|

|

-------- To Share Application A/c |

|

|

|

5,400 |

|

|

(Being application money received for 1,800 shares at Rs.3 per shares) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Share Application A/c |

Dr. |

|

5,400 |

|

|

|

-------- To Share Capital A/c |

|

|

|

3,600 |

|

|

-------- To Securities Premium A/c |

|

|

|

1,800 |

|

|

(Being application money of 1,800 share transferred to Share Capital at Rs.2 per share and securities premium Rs.1 per Share) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Share Allotment A/c |

Dr. |

|

7,200 |

|

|

|

-------- To share Capital A/c |

|

|

|

5,400 |

|

|

-------- To Securities Premium A/c |

|

|

|

1,800 |

|

|

(Being share allotment due on 1,800 shares at Rs.4 per share including 1 securities premium |

|

|

|

|

|

|

|

|

|

|

|

|

|

Bank A/c |

Dr. |

|

7,200 |

|

|

|

-------- To Share Allotment A/c |

|

|

|

7,200 |

|

|

(Being share allotment money received) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Share First Call A/c |

Dr. |

|

3,600 |

|

|

|

-------- To share Capital A/c |

|

|

|

3,600 |

|

|

(Being share first call due on 1,800 shares at Rs.2 per shares) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Bank A/c |

Dr. |

|

3,600 |

|

|

|

-------- To Share First Call A/c |

|

|

|

3,600 |

|

|

(Being share first call money received) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Share final Call A/c |

Dr. |

|

5,400 |

|

|

|

-------- To Share Capital A/c |

|

|

|

5,400 |

|

|

(Being share final call due on 1,800 shares at Rs.3 per share) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Bank A/c |

Dr. |

|

5,400 |

|

|

|

-------- To Share Final Call A/c |

|

|

|

5,400 |

|

|

(Being share final call money received) |

|

|

|

|

|

|

|

|

|

|

|

|

Balance Sheet |

||||

|

of Bharat Ltd. |

||||

|

Particulars |

Note No |

Rs. |

||

|

I. Equity and Liabilities |

|

|

||

|

|

1. Shareholders' Funds |

|

|

|

|

|

a. Share Capital |

1 |

18,000 |

|

|

|

b. Reserve and Surplus |

2 |

3,600 |

|

|

|

2. Non-Current Liabilities |

|

|

|

|

|

3. Current Liabilities |

|

|

|

|

Total |

|

21,600 |

||

|

|

|

|

||

|

II. Assets |

|

|

||

|

|

1.Non-Current Assets |

|

|

|

|

|

2. Current Assets |

|

|

|

|

|

a. Cash and Cash Equivalents |

3 |

21,600 |

|

|

Total |

|

21,600 |

||

|

NOTES TO ACCOUNTS |

||||

|

Note No |

Particulars |

|

Rs. |

|

|

1. |

Share Capital |

|

|

|

|

|

Authorised Share Capital |

|

|

|

|

|

20,000 Shares of Rs.10 each |

|

2,00,000 |

|

|

|

Issued Share Capital |

|

|

|

|

|

2,000 shares of Rs.10 each |

|

20,000 |

|

|

|

Subscribed Called-up and Paid up Share Capital |

|

|

|

|

|

1,800 shares of Rs.10 each |

|

18,000 |

|

|

|

|

|

|

|

|

2. |

Reserve and Surplus |

|

|

|

|

|

|

Securities Premium |

|

3,600 |

|

|

|

|

|

|

|

3. |

Cash and Cash Equivalents |

|

|

|

|

|

Cash at Bank |

|

21,600 |

|

Solution Ex. 13

|

Balance Sheet |

||||

|

Suhani Ltd. |

||||

|

Particulars |

Note No |

Amount Rs. |

||

|

I. Equity and Liabilities |

|

|

||

|

|

1. Shareholders' Funds |

|

|

|

|

|

a. Share Capital |

1 |

21,00,000 |

|

|

|

b. Reserve and Surplus |

2 |

1,40,000 |

|

|

|

2. Non - Current Liabilities |

|

|

|

|

|

3. Current Liabilities |

|

|

|

|

Total |

|

22,40,000 |

||

|

|

|

|

||

|

II. Assets |

|

|

||

|

|

1.Non - Current Assets |

|

|

|

|

|

2. Current Assets |

|

|

|

|

|

a. Cash and Cash Equivalents |

3 |

22,40,000 |

|

|

Total |

|

22,40,000 |

||

|

NOTES TO ACCOUNTS |

||||

|

Note No |

Particulars |

|

Rs. |

|

|

1. |

Share Capital |

|

|

|

|

|

Authorised Share Capital |

|

|

|

|

|

30,000 shares of Rs.150 each |

|

45,00,000 |

|

|

|

Issued Share Capital |

|

|

|

|

|

15,000 shares of Rs.150 each |

|

22,50,000 |

|

|

|

Subscribed Called-up and Paid up Share Capital |

|

|

|

|

|

14,000 shares of Rs.150 each |

|

21,00,000 |

|

|

|

|

|

|

|

|

2. |

Reserve and Surplus |

|

|

|

|

|

|

Securities Premium |

|

1,40,000 |

|

|

|

|

|

|

|

3. |

Cash and Cash Equivalents |

|

|

|

|

|

Cash at Bank |

|

22,40,000 |

|

Solution Ex. 14

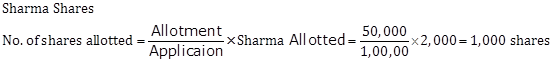

In this scenario, applications have been invited for 75,000 equity shares. The amount that has actually been received against application money is Rs 27,00,000 where per share amount is Rs 30.

Therefore,

Number of Application received = 27,00,000 ÷ 30 = 90,000.

Thus, the issue has been over-subscribed to the extent of 15,000 shares. Such subscription is called as Over-Subscription. The company can now go for any of the following alternatives.

i. Reject Excessive 15,000 applications

ii. Partial Allotment or Pro-rata allotment where shares are allotted to all in the ratio of 75:90 or 5 shares for every 6 applied.

iii. Combination of (i) and (ii): where some applications are rejected and remaining are issued on pro-rata basis.

Solution Ex. 15

Issued Capital (Rs.10 each) = 10,000 Shares

Applied = 12,000 shares

Over-subscribed = 2,000 shares

|

Journal |

|||||

|

Date |

Particulars |

|

L.F. |

Debit Rs. |

Credit Rs. |

|

|

|

|

|

|

|

|

|

Bank A/c |

Dr. |

|

1,20,000 |

|

|

|

-------- To Share Application A/c |

|

|

|

1,20,000 |

|

|

(Being share Application received for 12,000 shares at Rs.10 each |

|

|

|

|

|

|

|

|

|

|

|

|

|

Share Application A/c |

Dr. |

|

1,20,000 |

|

|

|

-------- To Share Capital A/c |

|

|

|

1,00,000 |

|

|

-------- To Bank A/c |

|

|

|

20,000 |

|

|

(Being application of 10,000 Shares Rs.10 each transferred to share Capital and of Rs.2,000 Shares returned) |

|

|

|

|

Solution Ex. 16

|

Journal |

|||||

|

Date |

Particulars |

|

L.F. |

Debit Rs. |

Credit Rs. |

|

|

|

|

|

|

|

|

|

Bank A/c (60,000 × 3) |

Dr. |

|

1,80,000 |

|

|

|

------ To Share Application A/c (60,000 × 3) |

|

|

|

1,80,000 |

|

|

(Being received application money on Rs.60,000 shares) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Share Application A/c (60,000 × 3) |

Dr. |

|

1,80,000 |

|

|

|

-------- To Share Capital A/c (50,000 × Rs.3) |

|

|

|

1,50,000 |

|

|

-------- To Bank A/c (10,000 × Rs.3) |

|

|

|

30,000 |

|

|

(Being transfer of application money to Share Capital) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Share Allotment A/c (50,000 × Rs.4) |

Dr. |

|

2,00,000 |

|

|

|

-------- To Share Capital A/c (50,000 × Rs.4) |

|

|

|

2,00,000 |

|

|

(Being allotment due on 50,000 shares) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Bank A/c (50,000 × Rs.4) |

Dr. |

|

2,00,000 |

|

|

|

-------- To Share Allotment A/c (50,000 × Rs.4) |

|

|

|

2,00,000 |

|

|

(Being allotment received) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Share First and Final Call A/c (50,000 × Rs.3) |

Dr. |

|

1,50,000 |

|

|

|

-------- To Share Capital A/c (50,000 × Rs.3) |

|

|

|

1,50,000 |

|

|

(Being call money due on 50,000 shares) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Bank A/c (49,500×3) |

Dr. |

|

1,48,500 |

|

|

|

-------- To Share First and Final A/c (49,500×3) |

|

|

|

1,48,500 |

|

|

(Being received call money on 49,500 shares) |

|

|

|

|

Solution Ex. 17

Issued Capital (Rs.10 each) = 20,000 Shares

Applied = 30,000 shares

Over-subscribed = 10,000 shares

|

Total |

Rs.8 |

|

Cash Book |

||||||

|

Dr. |

|

Cr. |

||||

|

Date |

Particulars |

Rs. |

Date |

Particulars |

Rs. |

|

|

|

|

|

|

|

|

|

|

|

1,75,000 |

|

|

1,75,000 |

||

|

Journal |

|||||

|

Date |

Particulars |

|

L.F. |

Dr. Rs. |

Cr. Rs. |

|

|

|

|

|

|

|

|

|

Share Application A/c |

Dr. |

|

75,000 |

|

|

|

--------To Share Capital A/c |

|

|

|

60,000 |

|

|

--------To Share Allotment A/c |

|

|

|

15,000 |

|

|

(Being share application of 20,000 shares at Rs. 3 each transferred to Share Capital Account and excess money Rs. 15,000 transferred to allotment) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Share Allotment A/c |

Dr. |

|

1,00,000 |

|

|

|

--------To Share Capital A/c |

|

|

|

1,00,000 |

|

|

(Being share allotment due on 20,000 shares at Rs. 5 each) |

|

|

|

|

|

|

|

|

|

|

|

|

Balance Sheet of Arti Ltd. |

||

|

|

||

|

Particulars |

Note No. |

Rs. |

|

I. Equity and Liabilities |

|

|

|

----1. Shareholder's Funds |

|

|

|

------a. Share Capital |

1 |

1,60,000 |

|

----2. Non-Current Liabilities |

|

|

|

----3. Current Liabilities |

|

|

|

Total |

|

1,60,000 |

|

II. Assets |

|

|

|

----1. Non-Current Assets |

|

|

|

----2. Current Assets |

|

|

|

------a. Cash and Cash Equivalents |

2 |

1,60,000 |

|

Total |

|

1,60,000 |

|

Note No |

Particulars |

Rs. |

|

1. |

Share Capital |

|

|

|

Authorised Share Capital |

|

|

|

shares of Rs.10 each |

NIL |

|

|

Issued Share Capital |

|

|

|

20,000 equity shares of Rs.10 each |

2,00,000 |

|

|

Subscribed, Called-up and Paid-up Share Capital |

|

|

|

20,000 equity Share of Rs.10 each, on which Rs.8 called-up and paid-up |

1,60,000 |

|

|

|

|

|

2. |

Cash and Cash Equivalents |

|

|

|

Cash at Bank |

1,60,000 |

|

|

|

|

Solution Ex. 18

|

Books of Eastern Company Limited Journal |

|||||

|

Date |

Particulars |

|

L.F. |

Debit Rs. |

Credit Rs. |

|

|

Share Application A/c |

Dr. |

|

1,80,000 |

|

|

|

---------To Share Capital A/c |

|

|

|

1,50,000 |

|

|

---------To Share Allotment A/c |

|

|

|

30,000 |

|

|

(Being Share Application money for 50,000 shares transferred to Share Capital Account and the excess money transferred to Share Allotment Account) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Share Allotment A/c |

Dr. |

|

2,50,000 |

|

|

|

---------To Share Capital A/c |

|

|

|

1,00,000 |

|

|

---------To Share Premium A/c |

|

|

|

1,50,000 |

|

|

(Being allotment money due on 50,000 shares @ Rs.5 per share including Rs.3 Security premium) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Share First Call A/c |

Dr. |

|

1,50,000 |

|

|

|

---------To Share Capital A/c |

|

|

|

1,50,000 |

|

|

(Being first call due on 50,000 shares @ Rs.3 per share) |

|

|

|

|

|

Cash Book (Bank Column) |

|||||||

|

Date |

Particulars |

J.F. |

Rs. |

Date |

Particulars |

J.F. |

Rs. |

|

|

To Share Application A/c |

|

1,80,000 |

|

|

|

|

|

|

To Share Allotment A/c |

|

2,20,000 |

|

|

|

|

|

|

To Share First Call A/c |

|

1,49,700 |

|

By Balance c/d |

|

5,49,700 |

|

|

|

|

|

|

|

|

|

|

|

|

|

5,49,700 |

|

|

|

5,49,700 |

|

Eastern Company Limited |

||

|

Balance Sheet |

||

|

Particulars |

Note No. |

Rs. |

|

I. Equity and Liabilities |

|

|

|

1. Shareholders' Fund |

|

|

|

a. Share capital |

1 |

3,99,700 |

|

b. Reserve and Surplus |

2 |

1,50,000 |

|

2. Non - Current Liabilities |

|

|

|

3. Current Liabilities |

|

|

|

Total |

|

5,49,700 |

|

II. Assets |

|

|

|

1. Non-Current Assets |

|

|

|

2. Current Assets |

|

|

|

a. Cash and Cash Equivalents |

3 |

5,49,700 |

|

Total |

|

5,49,700 |

NOTES TO ACCOUNT

|

Note No. |

Particulars |

|

Rs. |

|

1 |

Share Capital |

|

|

|

|

Authorized Share Capital |

|

|

|

|

-----1,00,000-Share of Rs.10 each |

|

10,00,000 |

|

|

Issued share Capital |

|

|

|

|

-------50,000 share of Rs.10 each |

|

5,00,000 |

|

|

Subscribed, Called-up and paid-up Share Capital |

|

|

|

|

-------50,000 Share of Rs.10 each, Rs. 8 Called-up |

4,00,000 |

|

|

|

-------Less : Calls-in-Arrears |

300 |

3,99,700 |

|

|

|

|

|

|

2 |

Reserve and Surplus |

|

|

|

|

-------Securities Premium |

|

1,50,000 |

|

|

|

|

|

|

3 |

Cash and Cash Equivalents |

|

|

|

|

-------Cash at Bank |

|

5,49,700 |

Company Accounts - Accounting for Share Capital Exercise 8.116

Solution Ex. 19

Shares Payable as :

|

Total Called up 120 |

|

Books of Varun Ltd. Journal |

|||||

|

Date |

Particulars |

|

L.F. |

Dr. Rs. |

Cr. Rs. |

|

|

|

|

|

|

|

|

|

Bank A/c |

Dr. |

|

2,30,000 |

|

|

|

--------To Share Application A/c |

|

|

|

2,30,000 |

|

|

(Being share application money received for 23,000 shares at Rs.10 each) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Share Application A/c |

Dr. |

|

2,30,000 |

|

|

|

--------To Share Capital A/c |

|

|

|

1,00,000 |

|

|

--------To Share Allotment A/c |

|

|

|

50,000 |

|

|

--------To Bank A/c |

|

|

|

80,000 |

|

|

(Being share application of 10,000 shares transferred to Share Capital Rs.50,000 adjusted on allotment and remaining amount returned ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Share Allotment A/c |

Dr. |

|

5,00,000 |

|

|

|

--------To Share Capital A/c |

|

|

|

4,00,000 |

|

|

--------To Securities Premium A/c |

|

|

|

1,00,000 |

|

|

(Being share allotment due on 10,000 shares at Rs.50 each including Rs.10 premium) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Bank A/c |

Dr. |

|

4,50,000 |

|

|

|

-------- To Share Allotment A/c |

|

|

|

4,50,000 |

|

|

(Being share allotment money received) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Share First and Final Call A/c |

Dr. |

|

6,00,000 |

|

|

|

--------To Share Capital A/c |

|

|

|

5,00,000 |

|

|

--------To Securities Premium A/c |

|

|

|

1,00,000 |

|

|

(Being first and final call due on 10,000 shares at Rs.60 each including Rs.10 premium) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Bank A/c |

Dr. |

|

6,00,000 |

|

|

|

--------To Share First and Final Call A/c |

|

|

|

6,00,000 |

|

|

(Being share first and final call money received) |

|

|

|

|

|

|

|

|

|

|

|

|

Balance Sheet of |

||

|

Varun Ltd. |

||

|

Particulars |

Note No. |

Rs. |

|

I. Equity and Liabilities |

|

|

|

----1. Shareholder's Funds |

|

|

|

------a. Share Capital |

1 |

10,00,000 |

|

------b. Reserve and Surplus |

2 |

2,00,000 |

|

----2. Non-Current Liabilities |

|

|

|

Total |

|

12,00,000 |

|

II. Assets |

|

|

|

----1. Non-Current Assets |

|

|

|

----2. Current Assets |

|

|

|

------a. Cash and Cash Equivalents |

3 |

12,00,000 |

|

Total |

|

12,00,000 |

|

Note No |

Particulars |

Rs. |

|

1. |

Share Capital |

|

|

|

Authorised Share Capital |

|

|

|

shares of Rs.100 each |

NIL |

|

|

Issued Share Capital |

|

|

|

10,000 shares of Rs.100 each |

10,00,000 |

|

|

Subscribed, Called-up and Paid up Share Capital |

|

|

|

10,000 share of Rs.100 each |

10,00,000 |

|

|

|

|

|

2. |

Reserve and Surplus |

|

|

|

Securities Premium |

2,00,000 |

|

|

|

|

|

3. |

Cash and Cash Equivalents |

|

|

|

Cash at Bank |

12,00,000 |

|

|

|

|

|

Working Notes: |

|||||||

|

Applied Shares |

Issued Shares |

Money received on Application @ Rs.10 each |

Money transferred to Share Capital @ Rs. 10 each |

Excess |

Allotment due @ Rs. 50 each |

Excess money adjusted on Allotment |

Excess money after Allotment |

|

12,000 |

1,000 |

1,20,000 |

10,000 |

1,10,000 |

50,000 |

50,000 |

60,000 (return) |

|

2,000 |

|

20,000 |

|

20,000 (return) |

|

|

|

|

9,000 |

9,000 |

90,000 |

90,000 |

|

4,50,000 |

|

|

|

23,000 |

10,000 |

2,30,000 |

1,00,000 |

|

5,00,000 |

50,000 |

60,000 |

|

Less : Excess application money adjusted on allotment |

(50,000) |

|

4,50,000 |

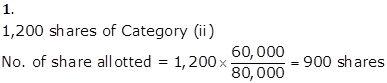

Solution Ex. 20

|

Issued Shares |

60,000 |

|

|

|

Less: Applied Shares |

(92,000) |

|

Over-subscribed Shares |

(32,000) |

|

|

Payable as : |

|

|

Total (10+2) |

Rs.12 |

|

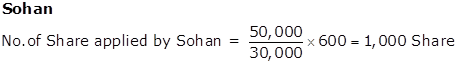

Applied

|

Allotted |

Application Money Received @ Rs.3 |

Money adjusted on Application @ Rs. 3 |

Excess |

Allotment due @ Rs.5 |

Excess money adjusted on Allotment @ Rs.5 |

|

40,000 |

30,000 |

1,20,000 |

90,000 |

30,000 |

1,50,000 |

30,000 |

|

50,000 |

30,000 |

1,50,000 |

90,000 |

60,000 |

1,50,000 |

60,000 |

|

2,000 |

|

6,000 |

|

6,000 (Bank) |

|

|

|

92,000 |

60,000 |

2,76,000 |

1,80,000 |

|

3,00,000 |

90,000 |

|

|

|

|

|

|

|

|

|

|

|

Rs. |

|

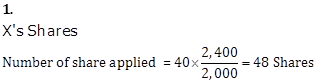

Money Received on Application (800 × Rs.3) |

= |

2,400 |

|

Less : Application money adjusted to Share Capital |

= |

(1,800) |

|

Excess Money on Application |

= |

600 |

|

|

|

|

|

Allotment due on 600 Shares (600 × Rs.5) |

= |

3,000 |

|

Less : Adjustment of excess money on application |

= |

(600) |

|

Calls - in - Arrears by Mohan |

|

2,400 |

|

|

|

Rs. |

|

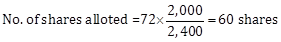

Money received on Application (1,000 × Rs.3) |

= |

3,000 |

|

Less: Application money adjusted to Share Capital (600 × Rs.3) |

= |

(1,800) |

|

Excess money on application |

= |

1,200 |

|

|

|

|

|

Allotment due on 600 Shares (600 × Rs.5) |

= |

3,000 |

|

Less : Excess Application money adjusted on Allotment |

|

(1,200) |

|

Calls-in-Arrears by Sohan |

|

1,800 |

|

|

|

|

|

Allotment due on 60,000 shares (60,000 × Rs.5) |

= |

3,00,000 |

|

Less : Excess Application money adjusted on Allotment |

= |

(90,000) |

|

|

|

2,10,000 |

|

Less : Calls - in - Arrears by Mohan |

= |

(2,400) |

|

Less : Calls - in Arrears by Sohan |

= |

(1,800) |

|

Money Received on Allotment |

= |

2,05,800 |

Solution Ex. 21

|

Journal |

|||||

|

Date |

Particulars |

|

L.F. |

Debit Rs. |

Credit Rs. |

|

|

|

|

|

|

|

|

|

Bank A/c (1,00,000 × Rs.3) |

Dr. |

|

3,00,000 |

|

|

|

-------- To Share Application A/c (1,00,000 × Rs.3) |

|

|

|

3,00,000 |

|

|

(Being share application money on 1,00,000 shares) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Share Application A/c (1,00,000 × Rs.3) |

Dr. |

|

3,00,000 |

|

|

|

-------- To Share Capital A/c (50,000 × Rs.3) |

|

|

|

1,50,000 |

|

|

-------- To Share Allotment A/c (50,000 × Rs.3) |

|

|

|

1,50,000 |

|

|

(Being transfer of application money to Share Capital) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Share Allotment A/c (50,000 × Rs.4) |

Dr. |

|

2,00,000 |

|

|

|

-------- To Share Capital A/c (50,000 × Rs.4) |

|

|

|

2,00,000 |

|

|

(Being share allotment due on 50,000 shares Rs.4 each) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Bank A/c |

Dr. |

|

49,000 |

|

|

|

-------- To Share Allotment A/c (49,000 × Rs.1) |

|

|

|

49,000 |

|

|

(Being remaining allotment money received on 49,000 shares) |

|

|

|

|

|

|

|

|

|

|

|

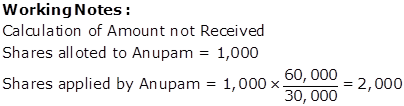

Excess money received on application (1,000 × Rs.3) = Rs.3,000

Money due on allotment from Anupam (1,000 × Rs.4) = Rs.4,000

Therefore, Rs.1,000 is still due from Anupam and has not been received.

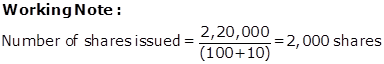

Solution Ex. 22

Authorised Capital 1,00,000 shares of Rs.10 each

Issued Capital 42,000 shares of Rs.10 each

40,000 shares applied and are payable as :

|

Total |

Rs.10 |

|

Kalyan Cotton Mills Ltd |

|||||

|

Cash Book |

|||||

|

Dr. |

|

|

|

|

Cr. |

|

Date |

Particulars |

Bank Rs. |

Date |

Particulars |

Bank Rs. |

|

2011 |

|

|

2011 |

|

|

|

1st Feb |

To Share Application A/c |

40,000 |

30th June |

By Balance c/d |

3,98,100 |

|

28th Feb |

To Share Allotment A/c |

80,000 |

|

|

|

|

1st May |

To Share First Call A/c |

1,19,700 |

|

|

|

|

30th June |

To Share Final Call A/c |

1,58,400 |

|

|

|

|

|

|

3,98,100 |

|

|

3,98,100 |

|

|

|

|

|

|

|

|

Journal |

|||||

|

Date |

Particulars |

|

L.F. |

Debit Rs. |

Credit Rs. |

|

2011 |

|

|

|

|

|

|

1st Feb |

Share Application A/c |

Dr. |

|

40,000 |

|

|

|

-------- To Share Capital A/c |

|

|

|

40,000 |

|

|

(Share application of 40,000 shares at Rs.1 each transferred to share capital account) |

|

|

|

|

|

|

|

|

|

|

|

|

1st Feb |

Share Allotment A/c |

Dr. |

|

80,000 |

|

|

|

-------- To Share Capital A/c |

|

|

|

80,000 |

|

|

(Being share allotment due on 40,000 shares at Rs.2 each) |

|

|

|

|

|

|

|

|

|

|

|

|

1st Mar |

Share First Call A/c |

Dr. |

|

1,20,000 |

|

|

|

-------- To Share Capital A/c |

|

|

|

1,20,000 |

|

|

(Being share first call due on 40,000 shares Rs.3 each) |

|

|

|

|

|

|

|

|

|

|

|

|

30th May |

Calls-in-Arrears A/c |

Dr. |

|

300 |

|

|

|

-------- To Share First Call A/c |

|

|

|

300 |

|

|

(Being share first call outstanding on 100 Shares Rs.3 each) |

|

|

|

|

|

|

|

|

|

|

|

|

1st June |

Share Final Call A/c |

Dr. |

|

1,60,000 |

|

|

|

-------- To Share Capital A/c |

|

|

|

1,60,000 |

|

|

(Being share first call due on 40,000 shares of Rs.4 each) |

|

|

|

|

|

|

|

|

|

|

|

|

30th June |

Calls - in Arrears A/c |

Dr. |

|

1,600 |

|

|

|

-------- To share Final Call A/c |

|

|

|

1,600 |

|

|

(Being share final Call outstanding on 400 shares at Rs.4 each) |

|

|

|

|

|

Kalyan Cotton Mills Ltd |

||

|

Balance Sheet |

||

|

Particulars |

Note No |

Rs. |

|

I. Equity and Liabilities |

|

|

|

----1. Shareholders' Funds |

|

|

|

--------Share Capital |

1 |

3,98,100 |

|

----2. Non-Current Liabilities |

|

|

|

----3. Current Liabilities |

|

|

|

Total |

|

3,98,100 |

|

|

|

|

|

II. Assets |

|

|

|

----1. Non-Current Assets |

|

|

|

----2. Current Assets |

|

|

|

------- Cash and Cash Equivalents |

2 |

3,98,100 |

|

Total |

|

3,98,100 |

|

NOTES TO ACCOUNTS |

|||

|

Note No |

Particulars |

|

Rs. |

|

1. |

Share Capital |

|

|

|

|

Authorised Share Capital |

|

|

|

|

1,00,000 Shares of Rs.10 each |

|

10,00,000 |

|

|

Issued Share Capital |

|

|

|

|

42,000 shares of 10 each |

|

4,20,000 |

|

|

Subscribed Called-up and Paid up Share Capital |

|

|

|

|

40,000 shares of 10 each |

4,00,000 |

|

|

|

Less : Calls-in-Arrears |

(1,900) |

3,98,100 |

|

|

|

|

|

|

2. |

Cash and Cash Equivalents |

|

|

|

|

Cash at Bank |

|

3,98,100 |

|

|

|

|

|

Company Accounts - Accounting for Share Capital Exercise 8.117

Solution Ex. 23

|

Books of Ghosh Ltd |

|||||

|

Journal |

|||||

|

Date |

Particulars |

|

L.F. |

Debit Rs. |

Credit Rs. |

|

2016 |

|

|

|

|

|

|

1st Jan |

Share Second and Final Call A/c |

Dr. |

|

1,00,000 |

|

|

|

-------- To Equity Share Capital A/c |

|

|

|

1,00,000 |

|

|

(Being share second and final call due on 50,000 shares at Rs.2 per share) |

|

|

|

|

|

|

|

|

|

|

|

|

15th Jan |

Bank A/c |

Dr. |

|

99,800 |

|

|

|

Calls-in-Arrears A/c |

Dr. |

|

200 |

|

|

|

-------- To Share Second and Final Call A/c |

|

|

|

1,00,000 |

|

|

(Being share second and final call received only from 49,900 shares Rs.2 each) |

|

|

|

|

|

|

|

|

|

|

|

Solution Ex. 24

|

Payable as : |

|

|

Total (7+2) |

Rs.9 |

|

Books of Star Ltd. |

|||||

|

Journal |

|||||

|

Date |

Particulars |

|

L.F. |

Debit Rs. |

Credit Rs. |

|

|

|

|

|

|

|

|

|

Bank A/c |

Dr. |

|

40,000 |

|

|

|

-------- To Share Application A/c |

|

|

|

40,000 |

|

|

(Being share application money received for 20,000 shares at Rs.2 per shares) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Share Application A/c |

Dr. |

|

40,000 |

|

|

|

-------- To Share Capital A/c |

|

|

|

40,000 |

|

|

(Being share application of 20,000 shares at Rs.2 per share transferred to share capital account) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Share Allotment A/c |

Dr. |

|

1,00,000 |

|

|

|

-------- To Share Capital A/c |

|

|

|

60,000 |

|

|

-------- To Securities Premium A/c |

|

|

|

40,000 |

|

|

(Being allotment due on 20,000 shares at Rs.5 per share including 2 securities premium |

|

|

|

|

|

|

|

|

|

|

|

|

|

Bank A/c |

Dr. |

|

1,00,000 |

|

|

|

-------- To Share Allotment A/c |

|

|

|

1,00,000 |

|

|

(Being share allotment received on 20,000 shares at Rs.5 per share) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Share First Call A/c |

Dr. |

|

40,000 |

|

|

|

-------- To share Capital A/c |

|

|

|

40,000 |

|

|

(Being first and final call due on 20,000 shares at Rs.2 per share) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Bank A/c |

Dr. |

|

38,900 |

|

|

|

Calls-in-Arrears A/c |

Dr. |

|

2,000 |

|

|

|

-------- To Share First Call A/c |

|

|

|

40,000 |

|

|

-------- To Calls-in-Advance A/c |

|

|

|

900 |

|

|

(Being share first call received on 39,000 shares at Rs.2 each 300 shares paid calls-in-arrears Rs.3 per share and 1,000 shares failed to pay first call money) |

|

|

|

|

|

|

|

|

|

|

|

|

Star Ltd. |

||||

|

Balance Sheet |

||||

|

Particulars |

Note No |

Rs. |

||

|

I. Equity and Liabilities |

|

|

||

|

|

1. Shareholder's Funds |

|

|

|

|

|

a. Share Capital |

1 |

1,38,000 |

|

|

|

b. Reserve and Surplus |

2 |

40,000 |

|

|

|

2. Non-Current Liabilities |

|

|

|

|

|

3. Current Liabilities |

|

|

|

|

|

Other Current Liabilities |

3 |

900 |

|

|

Total |

|

1,78,900 |

||

|

|

|

|

||

|

II. Assets |

|

|

||

|

|

1.Non-Current Assets |

|

|

|

|

|

2. Current Assets |

|

|

|

|

|

Cash and Cash Equivalents |

4 |

1,78,900 |

|

|

Total |

|

1,78,900 |

||

|

|

|

|

||

|

NOTES TO ACCOUNTS |

|||

|

Note No |

Particulars |

|

Rs. |

|

1. |

Share Capital |

|

|

|

|

Authorised Share Capital |

|

|

|

|

50,000 shares of Rs.10 each |

|

5,00,000 |

|

|

Issued Share Capital |

|

|

|

|

20,000 shares of Rs.10 each |

|

2,00,000 |

|

|

Subscribed Called-up and Paid up Share Capital |

|

|

|

|

20,000 shares of Rs.10 each 7 Called up and Paid Up |

1,40,000 |

|

|

|

Less : Calls-in-Arrears |

(2,000) |

1,38,000 |

|

|

|

|

|

|

2. |

Reserve and Surplus |

|

|

|

|

Securities Premium |

|

40,000 |

|

|

|

|

|

|

3. |

Other Current Liabilities |

|

|

|

|

Calls-in-Advance |

|

900 |

|

|

|

|

|

|

4. |

Cash and Cash Equivalents |

|

|

|

|

Cash at Bank |

|

1,78,900 |

Solution Ex. 25

Issued Capital 5,000 Shares of 10 each 5 called up

On Application = (8,000) Rs.2 each

On Allotment = (8,000 - 250 = 7,750) Rs.1 each

On First Call = (8,000 - 250 - 500 = 7,250) Rs.1 each

On Second Call = (8,000 - 250 - 500 - 1,250 = 6,000) Rs.1 each

Total Called-up = Rs.5 Per Share

|

Books of Green Ltd. |

|||||

|

Journal |

|||||

|

Date |

Particulars |

|

L.F. |

Debit Rs. |

Credit Rs. |

|

|

|

|

|

|

|

|

|

Bank A/c |

Dr. |

|

16,000 |

|

|

|

-------- To Share Application A/c |

|

|

|

16,000 |

|

|

(Being share application money received for 8,000 shares at Rs.2 per shares) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Share Application A/c |

Dr. |

|

16,000 |

|

|

|

-------- To Share Capital A/c |

|

|

|

16,000 |

|

|