Class 12-commerce T S GREWAL Solutions Accountancy Chapter 1: Financial Statements of a Company

Financial Statements of a Company Exercise 1.64

Solution Ex. 1

The major heads in the Equity and Liabilities part of Balance sheet are:

i. Shareholder's Funds

ii. Share Application Money Pending Allotment

iii. Non-Current Liabilities and

iv. Current Liabilities

|

Balance Sheet as at____________ |

||

|

Particulars |

Note No. |

Rs. |

|

I. Equity and Liabilities |

|

|

|

1. Shareholders'' Funds |

|

|

|

a. Share Capital |

|

|

|

b. Reserves and Surplus |

|

|

|

c. Money Received against share Warrants |

|

|

|

2. Share Application Money Pending Allotment |

|

|

|

3. Non- Current Liabilities |

|

|

|

a. Long-Term Borrowings |

|

|

|

b. Deferred Tax Liabilities (Net) |

|

|

|

c. Other Long-Term Liabilities |

|

|

|

d. Long Term Provisions |

|

|

|

4. Current Liabilities |

|

|

|

a. Short -Term Borrowings |

|

|

|

b. Trade Payables |

|

|

|

c. Other Current Liabilities |

|

|

|

d. Short -Term Provisions |

|

|

|

Total |

|

|

Solution Ex. 2

|

Items |

Major Head |

|

Share Capital |

Shareholders' Funds |

|

Money received against share warrants |

Shareholder's Funds |

Financial Statements of a Company Exercise 1.65

Solution Ex. 3

Items shown under reserves and surplus are:

i. Capital Reserve,

ii. Capital Redemption Reserve,

iii. Securities Premium Reserve,

iv. Debenture Redemption Reserve,

v. Revaluation Reserve etc.

Solution Ex. 4

|

Items |

Sub-Head |

|

Long-Term Borrowings |

Non-Current Liabilities |

|

Deferred Tax Liabilities (Net) |

Non-Current Liabilities |

|

Long-Term Provisions |

Non-Current Liabilities |

Solution Ex. 5

Items shown under Long-term Borrowings are:

a. Debentures.

b. Bonds.

c. Terms Loans (both from Banks and from others).

d. Public Deposits,

e. Other Loans and Advances.

Solution Ex. 6

|

Extract of Balance Sheet as on____________ |

||

|

Particulars |

Note No. |

Rs. |

|

I. Equity and Liabilities |

|

|

|

1. Shareholders' Funds |

|

|

|

a. Share Capital |

|

|

|

b. Reserves and Surplus |

1 |

1,75,000 |

|

|

|

|

|

Total |

|

|

|

NOTE TO ACCOUNTS |

|

||

|

NOTE No. |

Particulars |

|

Rs. |

|

1 |

Reserves and Surplus |

|

|

|

|

a. Surplus, i. e. Balance in statement of Profit and Loss |

1,00,000 |

|

|

|

Add: Profit for the year |

75,000 |

|

|

|

Less: Appropriations |

|

|

|

|

--------Transfer to Debenture Redemption Reserve |

(15,000) |

|

|

|

--------Proposed Dividend |

(25,000) |

1,35,000 |

|

|

a. Debenture Redemption Reserve |

|

|

|

|

Transferred from surplus i.e. Balance in Statement of Profit and Loss |

|

15,000 |

|

|

Total (a+b) [to be Shown in Balance Sheet against Reserves and Surplus] |

|

1,50,000 |

|

|

Contingent Liability |

|

|

|

|

Proposed Dividend |

|

25,000 |

Solution Ex. 7

As per Companies Act, 2013, "Current Assets are those assets which are:

(i) Expected to be realized in or intended for sale or consumption in the company's normal operating cycle, or

(ii) Expected to be realized within 12 months from the reporting date"

|

Case |

Operating Cycle (Months) |

Expected Realisation Period (Months) |

Classified as |

|

(i) |

10 |

11 |

Current Assets |

|

(ii) |

10 |

12 |

Current Assets |

|

(iii) |

10 |

13 |

Non-Current Assets |

|

(iv) |

14 |

13 |

Current Assets |

|

(v) |

15 |

16 |

Non-Current Assets |

Solution Ex. 8

As per Companies Act, 2013, "Current Liabilities are those liabilities which are:

(i) Expected to be settled in company's normal operating cycle, or

(ii) Due to be settled within 12 months after the reporting date"

|

Case |

Operating Cycle (Months) |

Expected Realisation Period (Months) |

Classified as |

|

(i) |

10 |

11 |

Current Liabilities |

|

(ii) |

10 |

12 |

Current Liabilities |

|

(iii) |

10 |

13 |

Non-Current Liabilities |

|

(iv) |

14 |

13 |

Current Liabilities |

|

(v) |

15 |

16 |

Non-Current Liabilities |

Financial Statements of a Company Exercise 1.66

Solution Ex. 9

|

Items |

Head |

Disclosure |

|

Calls-in-Arrears |

Shareholder's Funds |

It is shown as a deduction from Subscribed Capital shown as 'Subscribed but not fully paid' under Shareholder's Funds |

|

Share Application Money Pending Allotment |

Share Application Money Pending Allotment |

It is shown as a separate line item |

|

Unpaid Dividend |

Current Liabilities |

It is shown as 'Other Current Liability' under Current Liabilities |

|

Dividend not paid on Cumulative Preference Shares |

Contingent Liabilities and Commitments |

It is shown as Contingent Liabilities and Commitments in Notes to Accounts |

Solution Ex. 10

|

Items |

Main Head |

Sub-head |

|

Bonds |

Non-Current Liabilities |

Long Term Borrowings |

|

Debentures |

Non-Current Liabilities |

Long Term Borrowings |

|

Public Deposits |

Non-Current Liabilities |

Long Term Borrowings |

|

Capital redemption Reserve |

Shareholder's Funds |

Reserves and Surplus |

|

Share Forfeiture Reserve |

Shareholder's Funds |

Subscribed Capital under share capital |

|

Sundry Creditors |

Current Liabilities |

Trade Payable |

|

Interest Accrued but not due on Debentures |

Current Liabilities |

Other Current Liabilities |

Solution Ex. 11

|

Major Head |

Items |

|

Reserves and Surplus |

Capital Reserve, Revaluation Reserve |

|

Long-term Borrowings |

Debentures, Term Loans form Bank and Others |

|

Short - term Borrowings |

Cash credit from bank, Loans repayable on demand |

|

Other Current Liabilities |

Income received in advance, Unpaid Dividends |

Solution Ex. 12

|

Particulars |

Head |

Sub- Head |

|

(i) Capital Work-in-Progress |

Non-Current Assets |

Fixed Assets |

|

(ii) Provision for Warranties |

Non-Current Liabilities |

Long-term Provision |

|

(iii) Income received in Advance |

Current Liabilities |

Other Current Liabilities |

|

(iv) Capital Advances |

Non-Current Assets |

Long-term Loans and Advance |

Solution Ex. 13

|

Items |

Main Head |

Sub-head |

|

Intangible Assets |

Non-Current Assets |

Fixed Assets |

|

Intangible Assets under development |

Non-Current Assets |

Fixed Assets |

|

Investments (more than 12 months) |

Non-Current Assets |

Non-Current Investments |

|

Deferred Tax Assets (Net) |

Non-Current Assets |

Deferred Tax Assets (Net) |

|

Stores and Spares |

Current Assets |

Inventories |

|

Loose Tools |

Current Assets |

Inventories |

Financial Statements of a Company Exercise 1.67

Solution Ex. 14

|

Items |

Main Head |

Sub-head |

|

Loose Tools |

Current Assets |

Inventories |

|

Bills Receivable |

Current Assets |

Trade Receivables |

|

Sundry Debtors |

Current Assets |

Trade Receivables |

|

Advance Recoverable in Cash |

Current Assets |

Short-term Loans and Advance |

Solution Ex. 15

|

Items |

Main Head |

Sub-head |

|

Sundry Debtors |

Current Assets |

Trade Receivables |

|

Patents and Trade Marks |

Non-Current Assets |

Fixed Assets (Intangible Assets) |

|

Share in Quoted Companies |

Non-Current Assets |

Non-Current Investments |

|

Advances Recoverable in Cash |

Current Assets |

Short- Term Loans and Advances |

|

Prepaid Insurance |

Current Assets |

Other Current Assets |

|

Work- in- Progress |

Non-Current Assets |

Fixed Assets (Capital Work-in-progress) |

Solution Ex. 16

|

Items |

Main Head |

Sub-head |

|

Unamortised Loss on Issue of Debentures (To be written off after 12 months from date of Balance Sheet) |

Non-Current Assets |

Other Non-Current Assets |

|

10% Debentures |

Non-Current Liabilities |

Long-term Borrowings |

|

Stock - in-Trade |

Current Assets |

Inventories |

|

Cash at Bank |

Current Assets |

Cash and Cash equivalents |

|

Bills Receivable |

Current Assets |

Trade Receivables |

|

Goodwill |

Non-Current Assets |

Fixed Assets (Intangible Assets) |

|

Loose Tools |

Current Assets |

Inventories |

|

Truck |

Non-Current Assets |

Fixed Assets (Tangible Assets) |

|

Provision for Tax |

Current Liabilities |

Short Term Provisions |

|

Sundry Creditors |

Current Liabilities |

Trade Payables |

Solution Ex. 17

|

S. No. |

Items |

Main Head |

Sub-head |

|

1 |

Bank Balance |

Current Assets |

Cash and Cash equivalents |

|

2 |

Investments (Long-Term) |

Non-Current Assets |

Non-Current Investments |

|

3 |

Outstanding Salary |

Current Liabilities |

Other Current Liabilities |

|

4 |

Authorised Capital |

Shareholder's Fund |

Share Capital |

|

5 |

Bills Payable |

Current Liabilities |

Trade Payables |

|

6 |

Unclaimed Dividends |

Current Liabilities |

Other Current Liabilities |

|

7 |

Share Option Outstanding Account |

Shareholder's Fund |

Reserves and Surplus |

|

8 |

General Reserve |

Shareholder's Fund |

Reserves and Surplus |

|

9 |

Subsidy Reserve |

Shareholder's Fund |

Reserves and Surplus |

Solution Ex. 18

|

S. No. |

Items |

Main Head |

Sub-head |

|

1 |

Calls-in-Arrears |

Shareholder's Fund |

Share Capital (i.e. as a deduction from subscribed share capital) |

|

2 |

Commission Received in Advance |

Current Liabilities |

Other Current Liabilities |

|

3 |

Debentures |

Non-Current Liabilities |

Long- Term Borrowings |

|

4 |

Stores and Spare Parts |

Current Assets |

Inventories |

|

5 |

Land and Building |

Non-Current Assets |

Fixed Assets (Tangible Assets |

|

6 |

Forfeited Shares Account |

Shareholder's Fund |

Share Capital (i.e. as a addition to subscribed share capital) |

Financial Statements of a Company Exercise 1.68

Solution Ex. 19

|

S. No. |

Items |

Main Head |

Sub-head |

|

i. 1 |

Public Deposits |

Non-Current Liabilities |

Long-Term Borrowings |

|

ii. 2 |

Office Furniture |

Non-Current Assets |

Fixed Assets (Tangible Assets) |

|

iii. 3 |

Prepaid Rent |

Current Assets |

Other Current Assets |

|

iv. 4 |

Outstanding Salaries |

Current Liabilities |

Other Current Liabilities |

|

v. 5 |

Computer Software |

Non-Current Assets |

Fixed Assets (Intangible Assets) |

|

vi. 6 |

Interest Accrued on Investment |

Current Assets |

Other Current Assets |

Solution Ex. 20

|

S. No. |

Items |

Major Head |

|

i. |

Loose Tools |

Current Assets |

|

ii. |

Unpaid Dividend |

Current Liabilities |

|

iii. |

Copyrights and Patents |

Non-Current Assets |

|

iv. |

Land and Building |

Non-Current Assets |

Solution Ex. 21

|

S. No. |

Items |

Major Head |

|

(i) |

Provision for Tax |

Current Liabilities |

|

(ii) |

Loan payable on Demand |

Current Liabilities |

|

(iii) |

Computer and Related Equipment |

Non-Current Assets |

|

(iv) |

Goods acquired for Trading |

Current Assets |

Solution Ex. 22

|

S. No. |

Items |

Major Head |

Sub-Head |

|

(i) |

Provision for Employee Benefits |

Non-Current Liabilities |

Long-term Provisions |

|

(ii) |

Calls-in-Advance |

Current Liabilities |

Other Current Liabilities |

Solution Ex. 23

|

S. No. |

Items |

Main Head |

Sub-head |

|

i. |

Surplus i.e. Balance in Statement of Profit and Loss (Dr.) |

Shareholder's Funds |

Reserves and Surplus (as negative figure) |

|

ii. |

Interest accrued and due on debentures |

Current Liabilities |

Other Current Liabilities |

|

iii. |

Computer Software under development |

Non-Current Assets |

Fixed Assets (Intangible Assets under development) |

|

iv. |

Interest accrued on Investments |

Current Assets |

Other Current Assets |

Solution Ex. 24

|

Extract of Balance Sheet as on March 31, 2019 |

|||

|

Particulars |

|

Note No. |

Rs. |

|

2. Non-Current Liabilities |

|

|

|

|

Long-term Borrowings |

|

|

|

|

11% Loan from SBI |

20,00,000 |

|

|

|

7,500, 10% Debentures of Rs 100 each |

7,50,000 |

|

27,50,000 |

|

3. Current Liabilities |

|

|

|

|

Other Current Liabilities |

|

|

|

|

Current Maturity of Long-term Debts (2,500 Debentures of Rs. 100 each maturing within 12 months) |

2,50,000 |

|

|

|

Interest accrued and Due on Debentures |

1,00,000 |

|

|

|

Interest accrued and Due on Loan |

2,20,000 |

|

5,70,000 |

|

Total |

|

|

33,20,000 |

Financial Statements of a Company Exercise 1.69

Solution Ex. 25

|

Balance Sheet of Recovery Ltd. as on____________ |

||

|

Particulars |

Note No. |

Rs. |

|

I. Equity and Liabilities |

|

|

|

1. Shareholders' Funds |

|

|

|

2. Non- Current Liabilities |

|

|

|

Long-Term Borrowings |

1 |

1,90,000 |

|

3. Current Liabilities Short -Term Provisions |

2 |

6,000 |

|

Total |

|

|

|

II. Assets |

|

|

|

1. Non- Current Assets |

|

|

|

Intangible (Fixed Assets) |

3 |

20,000 |

|

2. Current Assets |

|

|

|

Inventories |

4 |

40,000 |

|

Total |

|

|

|

|

|

|

NOTES TO ACCOUNTS

|

Note No. |

Particulars |

Rs. |

|

1 |

Long - Term Borrowings |

|

|

------10% Debentures |

1,90,000 |

|

|

2 |

Short-term Provisions |

|

|

------Provision for Tax |

6,000 |

|

|

3 |

Intangible (Fixed Assets) |

|

|

|

------Goodwill |

20,000 |

|

4 |

Inventories |

|

|

|

------Stock- in-Trade |

40,000 |

Solution Ex. 26

|

Balance Sheet as at March 31, 2019 |

||

|

Particulars |

Note No. |

Rs. |

|

I. Equity and Liabilities |

|

|

|

1. Shareholders' Funds |

|

|

|

a. Share Capital |

1 |

5,000 |

|

b. Reserves and Surplus |

2 |

4,200 |

|

2. Non-Current Liabilities |

|

|

|

Long Term Borrowings |

3 |

3,000 |

|

3. Non-Current Liabilities |

|

|

|

Other Current Liabilities |

|

2,500 |

|

Total |

|

14,700 |

|

II. Assets |

|

|

|

1. Non- Current Assets |

|

|

|

Fixed Assets (Tangible Assets ) |

4 |

8,300 |

|

2. Current Assets |

|

|

|

Other Current Assets |

|

6,400 |

|

Total |

|

14,700 |

NOTES TO ACCOUNTS:

|

Note No. |

Particulars |

|

Rs. |

|

1 |

Share Capital |

|

|

|

------Share Capital |

|

5,000 |

|

|

2 |

Reserves and Surplus |

|

|

|

------General Reserve |

|

3,000 |

|

|

------Balance in Statement of Profit and Loss (Credit) |

|

1,200 |

|

|

|

|

|

4,200 |

|

3 |

Long-Term Borrowings) |

|

|

|

|

------8% Debentures |

|

3,000 |

|

4 |

Fixed Assets |

|

|

|

|

------Tangible Assets (Cost) |

9,000 |

|

|

|

------Depreciation (Cost) |

(700) |

8,300 |

|

|

|

|

|

Solution Ex. 27

|

Balance Sheet as on March 31, 2019 |

||

|

Particulars |

Note No. |

Rs. (in '000) |

|

I. Equity and Liabilities |

|

|

|

1. Shareholders' Funds |

|

|

|

a. Share Capital |

|

8,00 |

|

b. Reserves and Surplus |

|

180 |

|

2. Non-Current Liabilities |

|

|

|

Long Term Borrowings |

|

1,000 |

|

3. Non-Current Liabilities |

|

|

|

Trade Payable |

|

60 |

|

Total |

|

2,040 |

|

II. Assets |

|

|

|

1. Non- Current Assets |

|

|

|

Fixed Assets (Tangible Assets ) |

|

1,600 |

|

2. Current Assets |

|

|

|

Inventories |

|

40 |

|

Trade Receivables |

|

160 |

|

Cash and Cash Equivalents |

|

240 |

|

Total |

|

2,040 |

Solution Ex. 28

|

Balance Sheet as on March 31, 2019 |

||

|

Particulars |

Note No. |

Rs. |

|

I. Equity and Liabilities |

|

|

|

1. Shareholders' Funds |

|

|

|

a. Share Capital |

1 |

30,00,000 |

|

b. Reserves and Surplus |

2 |

4,00,000 |

|

2. Non-Current Liabilities |

|

|

|

a. Long Term Borrowings |

3 |

6,00,000 |

|

3. Current Liabilities |

|

|

|

a. Other Current Liabilities |

4 |

8.00,000 |

|

b. Short Term Provisions |

5 |

2,00,000 |

|

Total |

|

50,00,000 |

|

II. Assets |

|

|

|

1. Non- Current Assets |

|

|

|

a. Fixed Assets |

|

|

|

i. Tangible Assets |

6 |

30,00,000 |

|

b. Non- Current Investments |

7 |

4,00,000 |

|

2. Current Assets |

|

|

|

a. Inventories |

8 |

6,00,000 |

|

b. Trade Receivables |

9 |

8,00,000 |

|

c. Cash and Cash Equivalents |

10 |

1,50,000 |

|

d. Short -Term Loans and Advances |

11 |

50,000 |

|

Total |

|

50,00,000 |

NOTES TO ACCOUNTS

|

Note No. |

Particulars |

|

Rs. |

|

1 |

Share Capital |

|

|

|

------Equity Share Capital |

|

20,00,000 |

|

|

-----112% Preference Share Capital |

|

10,00,000 |

|

|

|

30,00,000 |

||

|

2 |

Reserves and Surplus |

|

|

|

------Workmen Compensation Reserve |

|

1,00,000 |

|

|

------Balance in Statement of Profit and Loss (Credit) |

|

3,00,000 |

|

|

|

4,00,000 |

||

|

3 |

Long-term Borrowings |

|

|

|

|

------112% Debentures |

|

6,00,000 |

|

|

|

|

|

|

4 |

Other Current Liabilities |

|

|

|

|

------ Current Liabilities |

|

8,00,000 |

|

|

|

|

|

|

5 |

Short-term Provisions |

|

|

|

|

------Provision for Taxation |

|

2,00,000 |

|

|

|

|

|

|

6 |

Tangible Assets |

|

|

|

|

------Fixed Assets (Cost) |

46,60,000 |

|

|

|

------Depreciation |

(16,60,000) |

30,00,000 |

|

|

|

|

|

|

7 |

Non - Current Investments |

|

|

|

|

------Investments |

|

4,00,000 |

|

|

|

|

|

|

8 |

Inventories |

|

|

|

|

------Stock |

|

6,00,000 |

|

|

|

|

|

|

9 |

Trade Receivables |

|

|

|

|

------Sundry Debtors |

|

8,00,000 |

|

|

|

|

|

|

10 |

Cash and Cash Equivalents |

|

|

|

|

------Cash |

|

1,50,000 |

|

|

|

|

|

|

11 |

Short-term Loans and Advances |

|

|

|

|

------Loans and Advances |

|

50,000 |

|

|

|

|

|

Financial Statements of a Company Exercise 1.70

Solution Ex. 29

|

Items |

Head |

|

Sales |

Revenue from Operations |

|

Revenue from services rendered |

Revenue from Operations |

|

Sales of scrap |

Revenue from Operations |

|

Interest earned or Loans |

Other Income |

|

Profit on Sale of Investment |

Other Income |

Solution Ex. 30

|

Items |

Head |

|

Profit on Sale of Building |

Other Income |

|

Revenue from Project Consultancy Rendered |

Other Income |

|

Sales of scrap |

Other Income |

|

Interest earned or Loans |

Revenue from Operations |

|

Profit on Sale of Investment |

Revenue from Operations |

Solution Ex. 31

|

Items |

Head |

|

Profit on Sale of Fixed Assets |

Other Income |

|

Fee Received for Arranging Loans |

Other Income |

|

Interest on Loans Given |

Other Income |

|

Profit on Sale of Investments |

Other Income |

|

Sale of a Miscellaneous item |

Other Income |

Solution Ex. 32

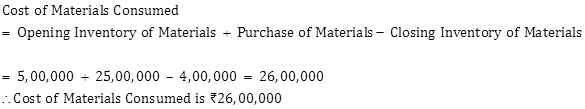

Solution Ex. 33

Note:

Opening Inventory and Closing Inventory of Finished Goods are not to be considered as these are shown under changes in Inventory of Finished Goods.

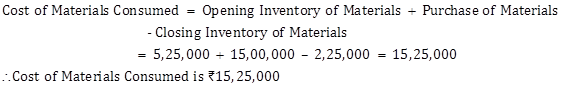

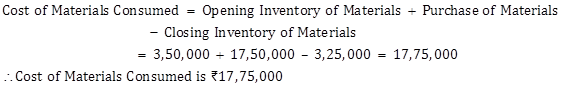

Solution Ex. 34

Note:

Opening Inventory and Closing Inventory of Finished Goods will not be considered as these are shown under changes in Inventory of Finished Goods. Also, opening, Closing and Purchases of Stock-in-Trade is not considered as they are not considered as a part of cost of materials consumed.

Solution Ex. 35

NOTES OF ACCOUNTS

|

Note No. |

Particulars |

|

Rs. |

|

(a) |

Finished Goods |

|

|

|

------Opening Inventory |

2,00,000 |

||

|

|

------Less: Closing Inventory |

(1,75,000) |

25,000 |

|

|

|

|

25,000 |

Rs.25,000 will be shown in the Statement of Profit and Loss against Changes in Inventories of Finished Goods.

Solution Ex. 36

|

Note No. |

Particulars |

|

Rs. |

|

(a) |

Finished Goods |

|

|

|

------Opening Inventory |

2,50,000 |

||

|

|

------Less: Closing Inventory |

(2,00,000) |

50,000 |

|

|

|

|

50,000 |

Rs.50,000 will be shown in the Statement of Profit and Loss against Changes in Inventories of Finished Goods.

Solution Ex. 37

NOTES OF ACCOUNTS

|

Note No. |

Particulars |

|

Rs. |

|

(a) |

Work-in-Progress |

|

|

|

------Opening Inventory |

1,00,000 |

||

|

|

------Less: Closing Inventory |

(1,15,000) |

(15,000) |

|

|

|

|

(15,000) |

(Rs.15,000) will be shown in the Statement of Profit and Loss against Changes in Inventories of Work-in-Progress

Solution Ex. 38

NOTES OF ACCOUNTS

|

Note No. |

Particulars |

|

Rs. |

|

(a) |

Work-in-Progress |

|

|

|

------Opening Inventory |

1,50,000 |

||

|

|

------Less: Closing Inventory |

(1,45,000) |

5,000 |

|

|

|

|

5000 |

Rs.5,000 will be shown in the Statement of Profit and Loss against Changes in Inventories of Work-in-Progress

Solution Ex. 39

NOTES OF ACCOUNTS

|

Note No. |

Particulars |

|

Rs. |

|

(a) |

Stock-in-Trade |

|

|

|

------Opening Inventory |

5,00,000 |

||

|

|

------Less: Closing Inventory |

(4,50,000) |

50,000 |

|

|

|

|

50,000 |

Rs.50,000 will be shown in the Statement of Profit and Loss against Changes in Inventories of Stock-in-Trade

Solution Ex. 40

NOTES OF ACCOUNTS

|

Note No. |

Particulars |

|

Rs. |

|

(a) |

Stock-in-Trade |

|

|

|

------Opening Inventory |

5,00,000 |

||

|

|

------Less: Closing Inventory |

(4,00,000) |

1,00,000 |

|

|

|

|

1,00,000 |

Rs.1,00,000 will be shown in the Statement of Profit and Loss against Changes in Inventories of Stock-in-Trade

Financial Statements of a Company Exercise 1.71

Solution Ex. 41

NOTES OF ACCOUNTS

|

Note No. |

Particulars |

|

Rs. |

|

Change in Inventories of Finished Goods, WIP and Stock-in-Trade |

|

||

|

(a) |

Finished Goods |

|

|

|

------Opening Inventory |

5,00,000 |

||

|

|

------Less: Closing Inventory |

(5,50,000) |

(50,000) |

|

|

|

|

(50,000) |

|

(b) |

Work-in-Progress |

|

|

|

|

------Opening Inventory |

4,45,000 |

|

|

|

------Less: Closing Inventory |

(4,25,000) |

25,000 |

|

|

|

|

25,000 |

|

(c) |

Stock-in-Trade |

|

|

|

|

------Opening Inventory |

6,50,000 |

|

|

|

------Less: Closing Inventory |

(6,00,000) |

50,000 |

|

|

|

|

50,000 |

|

|

Net Charge (a+b+c) |

|

25,000 |

Rs.25,000 will be shown in the Statement of Profit and Loss against Changes in Inventories of Finished Goods, Work-in-Progress and Stock-in-Trade

Solution Ex. 42

NOTES OF ACCOUNTS

|

Note No. |

Particulars |

|

Rs. |

|

Employee Benefit Expenses |

|

||

|

------Wages |

5,40,000 |

||

|

|

------Salaries |

7,20,000 |

|

|

|

------Bonus |

1,05,000 |

|

|

|

------Staff Welfare Expenses |

60,000 |

14,25,000 |

|

|

Amount to be shown in the statement of Profit and Loss |

|

14,25,000 |

|

|

|

|

|

**Amount spent on promotion of business is not included in Employees Benefit Expenses.

Solution Ex. 43

NOTES OF ACCOUNTS

|

Note No. |

Particulars |

|

Rs. |

|

Employee Benefit Expenses |

|

||

|

------Wages |

2,70,000 |

||

|

|

------Salaries |

3,60,000 |

|

|

|

------Staff Welfare Expenses |

60,000 |

6,90,000 |

|

|

Amount to be shown in the statement of Profit and Loss |

|

6,90,000 |

|

|

|

|

|

**Amount spent on promotion of business and printing and stationary expenses are not included in Employees Benefit Expenses

Solution Ex. 44

Items that will be shown in the Notes to Accounts on Finance Costs are:

i. Interest paid on Borrowings from Prince Finance Ltd.;

ii. Interest paid on Term Loan to Bank;

iii. Interest paid on Public Deposits;

iv. Loss on Issue of Debentures written off.

The Bank charges are not shown under Finance Costs but under 'Other Expenses', as they are expenses for the services availed from the bank.

Solution Ex. 45

NOTES OF ACCOUNTS

|

Note No. |

Particulars |

|

Rs. |

|

Finance Costs |

|

||

|

------Interest paid to bank |

75,000 |

||

|

|

------Interest on Debentures |

58,000 |

|

|

|

------Loss on Issue of Debentures written off |

27,500 |

|

|

|

------Commitment charges |

15,000 |

1,75,500 |

|

|

|

|

1,75,500 |

Solution Ex. 46

NOTES OF ACCOUNTS

|

Note No. |

Particulars |

|

Rs. |

|

Depreciation and Amortisation Expenses |

|

||

|

Depreciation |

|

||

|

------Building |

15,500 |

||

|

|

------Plant and Machinery |

25,000 |

|

|

|

------Computers |

60,000 |

1,00,500 |

|

|

Amortisation |

|

|

|

|

------Goodwill written of |

7,500 |

|

|

|

------Patents written off |

12,500 |

20,000 |

|

|

Amount to be shown in the Statement of Profit and Loss |

|

1,20,500 |

|

|

|

|

|

Solution Ex. 47

Items that will be shown in the Notes to Accounts on 'other expenses' are

ii. Postage Expenses;

iii. Telephone and Internet Expenses;

iv. Rent for warehouse;

v. Carriage Inwards;

viii. Computer Hiring charges;

ix. Audit fee

Financial Statements of a Company Exercise 1.72

Solution Ex. 48

|

Items |

Major Head |

|

Sale of Goods |

Revenue from Operations |

|

Revenue from Services rendered |

Revenue from Operations |

|

Interest earned |

Other Income |

|

Profit on Sale of Investments |

Other Income |

|

Purchase of Stock-in-Trade |

Purchase of Stock-in-Trade |

|

Salaries and Wages |

Employees Benefit Expenses |

|

Interest paid to Bank |

Finance Costs |

|

Carriage Outward |

Other Expenses |

Solution Ex. 49

|

Items |

Major Head |

|

Interest on Loans Given |

Revenue from Operations |

|

Profit on Sale of Securities |

Revenue from Operations |

|

Loss on Sale of Fixed Assets |

Other Expenses |

|

Interest paid on Deposits |

Finance Costs |

|

Depreciation on Computers |

Depreciation and Amortisation Expenses |

|

Goodwill Written off |

Depreciation and Amortisation Expenses |

|

Commission paid for Deposit Mobilisation |

Finance Costs |

|

Repairs Expenses |

Other Expenses |

Solution Ex. 50

|

Items |

Line Items of Financial Statements |

|

Sales |

Revenue from Operations |

|

Loss on Sale of Vehicle |

Other Expenses |

|

Debentures |

Loan Term Borrowings |

|

Unamortised Loss on Issue of Debentures (to be written off within 12 months of the date of Balance Sheet) |

Other Non-Current Assets |

|

Encashable Leave Payable at the time of Retirement |

Long Term Provisions |

|

Tax Reserve |

Reserves and Surplus |

|

Carriage on Purchase of Stock-in -Trade |

Other Expenses |

|

Telephone and Internet expenses |

Other Expenses |

|

|

|

Solution Ex. 51

|

Items |

Major Head |

Sub - Head |

|

Capital Reserve |

Shareholder's Fund |

Reserve and Surplus |

|

Calls - in - Advance |

Current Liabilities |

Other Current Liabilities |

|

Loose Tools |

Current Assets |

Inventories |

|

Bank Overdraft |

Current Liabilities |

Short - term Borrowings |