Class 12-commerce T S GREWAL Solutions Accountancy Chapter 5: Cash Flow Statements

Cash Flow Statements Exercise 5.89

Solution Ex. 1

a. Cash Sale of Goods- Operating Activity

b. Cash Received against Revenue from Services rendered- Operating Activity

c. Cash Purchases of Goods- Operating Activity

d. Cash paid against Services Taken- Operating Activity

e. Patents Purchased- Investing Activity

f. Marketable Securities- Cash and Cash Equivalents

g. Bank overdraft- Financing Activity

h. Proceeds from Issue of Debentures- Financing Activity

i. Purchases of Share- Investing Activity

j. Repayment of Long-term Loan- Financing Activity

k. Commission Received- Operating Activity

l. Redemption of Debentures- Financing Activity

m. Interest of Debenture- Financing Activity

n. Interest on Investments- Investing Activity

o. Income Tax paid- Operating Activity

p. Income Tax Paid on Gain of Sale of Asset- Investing Activity

q. Cash Received from Debtors- Operating Activity

r. Cash Paid to Creditors. - Operating Activity

Cash Flow Statements Exercise 5.90

Solution Ex. 2

Classification of transactions as operating activities for a financial company:

a. Purchase of Shares on a Stock Exchange- Operating Activities

b. Dividend received on Shares- Operating Activities

c. Dividend paid on Shares- Refer Note

d. Loans given- Operating Activities

e. Loans taken- Operating Activities

f. Interest paid on borrowings- Operating Activities

A financial company is one that deals in shares, bonds, debentures, etc. on a regular basis. The transactions related to purchase and sale of these securities is regular phenomenon and forms part of their stock and is categorised under Operating Activity. However, dividend paid by them does not form part of Financing Activities.

Also, for a non-financial company issue of shares, debentures, etc. forms part of financing activities and not the operating activities.

Solution Ex. 3

a. Sale of Fixed Assets, Book Value Rs.1,00,000 at a profit of Rs.10,000- Inflow

b. Sale of goods against cash- Inflow

c. Purchase of machinery for cash- Outflow

d. Purchase of Land and Building fort Rs.10,00,000. Consideration paid by issue of debenture- No flow

e. Issued fully paid Bonus Shares - No flow

f. Cash withdrawn from bank- No flow

g. Payment of Interim Dividend- Outflow

h. Proposed Dividend- No flow

Solution Ex. 4

(a) Investing Activity: 50,000 (outflow)

(b) Investing Activity: 2,00,000 (outflow)

(c) Investing Activity: 60,000 (inflow)

Solution Ex. 5

|

Particulars |

Rs. |

|

| Profit as per Statement of Profit and Loss (10,00,000 - 5,00,000) | 5,00,000 | |

|

Add: Proposed Dividend |

4,00,000 |

|

| Profit Before Taxation and Extraordinary Item |

9,00,000 |

|

Cash Flow Statements Exercise 5.91

Solution Ex. 6

|

|

||

|

|

Particulars |

Rs. |

|

|

Profit as per Statement of Profit and Loss (7,20,000 - 4,00,000) |

3,20,000 |

|

|

----Add: Proposed Dividend |

1,60,000 |

|

|

----Add: Proposed Preference Dividend (Current Year, i.e. 10% of 6,00,000) |

60,000 |

|

|

----Add: Interim Dividend |

40,000 |

|

|

Profit Before Taxation and Extraordinary Item |

5,80,000 |

Solution Ex. 7

|

|

||

|

|

Particulars |

Rs. |

|

|

Profit as per Statement of Profit and Loss (2,00,000 - 1,45,000) |

55,000 |

|

|

----Add: Proposed Dividend |

50,000 |

|

|

----Add: Proposed Preference Dividend (Current Year) |

50,000 |

|

|

----Add: Interim Dividend Paid |

10,000 |

|

|

Profit Before Taxation and Extraordinary Item |

1,65,000 |

Cash Flow Statements Exercise 5.92

Solution Ex. 8

|

|

Particulars |

Rs. |

|

|

Profit as per Statement of Profit and Loss (3,36,000 - 1,00,000) |

2,36,000 |

|

|

Items to be Added: |

|

|

|

-----------Transfer to Reserve |

1,00,000 |

|

|

Proposed Dividend |

72,000 |

|

|

Interim Dividend |

90,000 |

|

|

Provision for Taxation |

1,50,000 |

|

|

Extraordinary Items (Earthquake Loss) |

2,00,000 |

|

|

----Less: Extraordinary Items |

|

|

|

----------- Earthquake Insurance Proceeds |

(1,00,000) |

|

|

---- Income Tax Refund |

(3,000) |

|

|

|

|

|

|

Net Profit Before Tax and Extraordinary Items |

7,45,000 |

Solution Ex. 9

|

|

Particulars |

Rs. |

|

A |

Cash Flow From Operating Activities |

|

|

|

Net Profit before Taxation and Extraordinary Items |

4,47,000 |

|

|

Items to be Added: |

|

|

|

----------Depreciation on Machinery |

84,000 |

|

|

Loss on Sale of Furniture |

18,000 |

|

|

Interest on Borrowings |

16,800 |

|

|

Goodwill Amortised |

18,600 |

|

|

Items to be Deducted: |

|

|

|

----------- Profit on Sale of Investment |

(12,000) |

|

|

---- Interest and Dividend Received |

(27,600) |

|

|

|

|

|

|

Operating Profit before Working Capital Changes |

5,44,800 |

Solution Ex. 10

|

Computation of Operating Profit before Working Capital Changes for the year ended March 31, 2019 |

||

|

|

Particulars |

Rs. |

|

|

Profit as per Statement of Profit and Loss (1,70,000 - 1,00,000) |

70,000 |

|

|

Transfer to General Reserve (5,00,000 - 4,00,000) |

1,00,000 |

|

|

Provision for Taxation (Current Year) |

1,00,000 |

|

|

Profit before Tax |

2,70,000 |

|

|

Items to be Added: |

|

|

|

-----------Depreciation for the year |

75,000 |

|

|

Operating Profit before Working Capital Changes |

3,45,000 |

Cash Flow Statements Exercise 5.93

Solution Ex. 11

|

Cash Flow Statement for the year ended March 31, 2019 |

|||

|

|

Particulars |

Rs. |

Rs. |

|

|

Profit as per Statement of Profit and Loss (Net Income) |

|

20,000 |

|

|

Items to be Added: |

|

|

|

|

-----------Depreciation |

10,000 |

|

|

|

-----------Goodwill written off |

8,000 |

18,000 |

|

|

Operating Profit before Working Capital Changes |

|

38,000 |

|

|

----Add: Decrease in Current Assets |

|

|

|

|

-----------Trade Receivables |

6,000 |

|

|

|

-----------Prepaid Insurance |

1,000 |

|

|

|

----Less: Increase in Current Assets |

|

|

|

|

-----------Inventories |

(20,000) |

|

|

|

----Less: Decrease in Current Liabilities |

|

|

|

|

-----------Outstanding Rent |

(9,000) |

|

|

|

-----------Trade Payables |

(6,000) |

(28,000) |

|

|

Cash Generated from operations |

|

10,000 |

|

|

----Less: Tax Paid |

|

Nil |

|

|

Net Cash Flows from Operating Activities |

|

10,000 |

Solution Ex. 12

|

Cash Flow From Operating Activities for the year ended March 31, 2019 |

|||

|

|

Particulars |

Rs. |

Rs. |

|

|

Net Profit after Provision for Tax and Proposed Dividend |

|

2,15,000 |

|

|

----Add: Provision Tax |

|

45,000 |

|

|

----Add: Proposed Dividend |

|

50,000 |

|

|

Profit Before Taxation |

|

3,10,000 |

|

|

Items to be Added: |

|

|

|

|

-----------Depreciation |

25,000 |

|

|

|

-----------Loss on Sale of Machinery |

10,000 |

|

|

|

-----------Patents Amortised |

30,000 |

65,000 |

|

|

|

|

3,75,000 |

|

|

Items to be Deducted: |

|

|

|

|

-----------Income Tax Refund |

(30,000 |

|

|

|

-----------Gain on Sale of Land |

(70,000) |

(1,00,000) |

|

|

Operating Profit before Working Capital Changes |

|

2,75,000 |

|

|

----Less: Net Tax Paid (45,000 - 30,000) |

|

(15,000) |

|

|

Net Cash Flows from Operating Activities |

|

2,60,000 |

Solution Ex. 13

|

Cash Flow From Operating Activities Fo the year ended …. |

|||

|

|

Particulars |

Rs. |

Rs. |

|

|

Profit as per Statement of Profit and Loss |

|

7,00,000 |

|

|

----Add: Transfer to Reserve |

|

60,000 |

|

|

Profit Before Extraordinary Items |

|

7,60,000 |

|

|

Items to be Added: |

|

|

|

|

-----------Depreciation on fixed Assets |

40,000 |

|

|

|

-----------Goodwill Amortised |

20,000 |

60,000 |

|

|

|

|

8,20,000 |

|

|

Items to be Deducted: |

|

|

|

|

-----------Gain on Sale of Land |

|

(90,000) |

|

|

Operating Profit before Working Capital Changes |

|

7,30,000 |

|

|

----Less: Decrease in Current Liabilities |

|

|

|

|

-----------Trade Payable |

(25,000) |

|

|

|

----Less: Increase in Current Assets |

|

|

|

|

-----------Trade Receivables |

(15,000) |

(40,000) |

|

|

|

|

6,90,000 |

|

|

----Add: Decrease in Current Assets |

|

|

|

|

-----------Prepaid Expenses |

|

8,000 |

|

|

Cash Generated from Operations |

|

6,98,000 |

|

|

----Less: Tax Paid |

|

Nil |

|

|

Net Cash Flows from Operating Activities |

|

6,98,000 |

Cash Flow Statements Exercise 5.94

Solution Ex. 14

|

Cash Flow From Operating Activities for the year ended March, 31, 2019 |

|||

|

|

Particulars |

Rs. |

Rs. |

|

|

Profit as per Statement of Profit and Loss |

|

6,40,000 |

|

|

----Add: Provision for Tax |

|

20,000 |

|

|

----Less: Extraordinary Item |

|

|

|

|

-----------Insurance Claim |

|

(50,000) |

|

|

Profit Before Tax and Extraordinary items |

|

6,10,000 |

|

|

Items to be Added: |

|

|

|

|

-----------Depreciation on Plant and Machinery |

|

55,000 |

|

|

|

|

6,65,000 |

|

|

Items to be Deducted: |

|

|

|

|

-----------Gain on Sale of Investments |

|

(20,000) |

|

|

Operating Profit before Working Capital Adjustments |

|

6,45,000 |

|

|

----Add: Increase in Current Liabilities |

|

|

|

|

-----------Trade Payable |

30,000 |

|

|

|

----Add: Decrease in Current Liabilities |

|

|

|

|

-----------Inventories |

10,000 |

40,000 |

|

|

----Less: Increase in Current Assets |

|

6,85,000 |

|

|

-----------Trade Receivables |

(40,000) |

|

|

|

-----------Prepaid Expenses |

(14,000) |

(54,000) |

|

|

Cash Generated from Operations before tax and Extraordinary items |

|

6,31,000 |

|

|

----Less: Tax Paid |

|

(15,000) |

|

|

Cash Flow from Operating Activities after Tax |

|

6,16,000 |

|

|

----Add: Extraordinary Items |

|

|

|

|

-----------Insurance Claim |

|

50,000 |

|

|

Net Cash Flows from Operating Activities |

|

6,66,000 |

Solution Ex. 15

|

Cash Flow From Operating Activities for the year ended ….. |

|||

|

|

Particulars |

|

Rs. |

|

|

Profit as per Statement of Profit and Loss |

|

8,00,000 |

|

|

----Add: Provision for Tax |

|

1,10,000 |

|

|

----Add: Proposed Dividend |

|

1,10,000 |

|

|

----Less: Compensation for Natural Disaster |

|

(75,000) |

|

|

Profit Before Tax and Extraordinary items |

|

9,45,000 |

|

|

Items to be Added: |

|

|

|

|

-----------Depreciation |

1,50,000 |

|

|

|

-----------Loss on Sale of Investment |

30,000 |

1,80,000 |

|

|

|

|

11,25,000 |

|

|

Items to be Deducted: |

|

|

|

|

-----------Profit on Sale of Land |

(90,000) |

|

|

|

-----------Dividend Received |

(20,000) |

(1,10,000) |

|

|

Operating Profit before Working Capital Adjustments |

|

10,15,000 |

|

|

----Add: Increase in Current Liabilities |

70,000 |

|

|

|

----Add: Decrease in Current Assets |

40,000 |

1,10,000 |

|

|

----- |

|

11,25,000 |

|

|

----Less: Increase in Current Liabilities |

(10,000) |

|

|

|

----Less: Increase in Current Assets |

(60,000) |

(70,000) |

|

|

Cash Generated from Operations |

|

10,55,000 |

|

|

----Less: Net Tax Paid (1,20,000 - 10,000) |

|

(1,10,000) |

|

|

Cash Flow from Operating Activities after Tax |

|

|

|

|

----Add: Compensation for Natural Disaster |

|

75,000 |

|

|

Net Cash Flows from Operating Activities |

|

10,20,000 |

Note: The answer given in the book is different.

Solution Ex. 16

|

Cash Flow From Operating Activities for the year ended March, 31, 2019 |

|||

|

|

Particulars |

|

Rs. |

|

|

Profit as per Statement of Profit and Loss |

|

18,00,000 |

|

|

----Add: Payment of Tax |

|

64,000 |

|

|

Profit Before Tax and Extraordinary items |

|

2,44,000 |

|

|

Items to be Added: |

|

|

|

|

-----------Loss on Sale of Assets |

36,000 |

|

|

|

-----------Depreciation and Amortisation Expenses |

1,85,000 |

2,21,000 |

|

|

|

|

4,65,000 |

|

|

Items to be Deducted: |

|

|

|

|

-----------Dividend Received |

(5,000) |

|

|

|

-----------Profit on Sale of Plant |

(40,000) |

(45,000) |

|

|

Operating Profit before Working Capital Adjustments |

|

4,20,000 |

|

|

----Less: Decrease in Current Liabilities |

|

|

|

|

-----------Office Expenses Outstanding |

|

(5,000) |

|

|

----Add: Increase in Current Liabilities |

|

|

|

|

-----------Trade Payable ---- |

28,000 |

|

|

|

-----------Selling Expenses Outstanding |

3,000 |

31,000 |

|

|

----Less: Increase in Current Assets |

|

|

|

|

-----------Trade Receivables ---- |

|

(37,000) |

|

|

-----------Inventories ---- |

|

(16,000) |

|

|

Cash Generated from Operations |

|

3,93,000 |

|

|

----Less: Tax Paid |

|

(64,000) |

|

|

Net Cash Flows from Operating Activities |

|

3,29,000 |

Cash Flow Statements Exercise 5.95

Solution Ex. 17

|

Cash Flow From Operating Activities

|

|||

|

|

Particulars |

|

Rs. |

|

|

Profit as per Statement of Profit and Loss |

5,000 |

|

|

|

----Add: Transfer to Reserve |

35,000 |

40,000 |

|

|

Profit Before Tax and Extraordinary items |

|

40,000 |

|

|

Items to be Added: |

|

|

|

|

-----------Depreciation written of (WN1) |

22,000 |

|

|

|

-----------Goodwill Written-off |

10,000 |

32,000 |

|

|

Items to be Deducted: |

|

|

|

|

-----------Profit on Sale of Asset |

|

8,000 |

|

|

Operating Profit before Working Capital Adjustments |

|

64,000 |

|

|

----Less: Increase in Current Assets |

|

|

|

|

-----------Bills Receivables |

|

(41,000) |

|

|

----Add: Increase in Current Assets |

|

|

|

|

-----------Debtors ---- |

|

35,000 |

|

|

----Less: Decrease in Current Liabilities |

|

|

|

|

-----------Outstanding Expenses ---- |

|

(18,000) |

|

|

Cash Generated from Operations |

|

40,000 |

|

|

----Less: Tax Paid |

|

Nil |

|

|

Net Cash Flows from Operating Activities |

|

40,000 |

Working Note:

|

Provision for Depreciation Account |

|||

|

Dr. |

|

|

Cr. |

|

Particulars |

Rs. |

Particulars |

Rs. |

|

To Assets A/c (40,000 - 28,000)* |

12,000 |

By Balance b/d |

20,000 |

|

To Balance c/d |

30,000 |

By Profit and Loss A/c |

22,000 |

|

|

42,000 |

|

42,000 |

|

Particulars |

Rs. |

|

Cost of Asset Sold |

40,000 |

|

----Less: Provision for Depreciation* |

(12,000) |

|

Book Value |

28,000 |

|

----Less: Sale of Assets |

(36,000) |

|

Profit on Sale |

8,000 |

Solution Ex. 18

|

|

Cash Flow Statement |

||||

|

|

Particulars |

Amount (Rs.) |

Amount (Rs.) |

||

|

|

Cash Flow from Operating Activities |

|

|

||

|

|

Profit as per Statement of Profit and Loss |

|

1,00,000 |

||

|

|

Items to be Added: |

|

|

||

|

|

Depreciation |

20,000 |

|

||

|

|

Goodwill amortised |

7,000 |

|

||

|

|

Transfer to General Reserve |

30,000 |

|

||

|

|

Items to be Deducted: |

|

|

||

|

|

Gain on sale of machinery |

(3,000) |

54,000 |

||

|

|

Operating Profit before Working Capital Adjustments |

|

1,54,000 |

||

|

|

Less: Increase in Current Assets |

|

|

||

|

|

|

Trade Receivables |

(3,000) |

|

|

|

|

|

Prepaid Expenses |

(200) |

|

|

|

|

Less: Decrease in Current Liabilities |

|

|

||

|

|

Outstanding Expenses |

(2,000) |

|

||

|

|

Add: Increase in Current Liabilities |

|

|

||

|

|

Trade Payables |

6,000 |

800 |

||

|

|

Cash Generated from Operations |

|

1,54,800 |

||

Cash Flow Statements Exercise 5.96

Solution Ex. 19

|

|

Cash Flow Statement |

||||

|

|

Particulars |

Amount (Rs.) |

Amount (Rs.) |

||

|

|

Cash Flow from Operating Activities |

|

|

||

|

|

Profit as per Statement of Profit and Loss |

|

10,000 |

||

|

|

Items to be Added: |

|

|

||

|

|

Depreciation |

2,000 |

|

||

|

|

Operating Profit before Working Capital Adjustments |

|

12,000 |

||

|

|

Less: Increase in Current Assets |

|

|

||

|

|

|

Trade Receivables |

(1,000) |

|

|

|

|

|

Other Current Assets |

(2,000) |

|

|

|

|

|

Inventories |

(3,000) |

|

|

|

|

|

Accrued Income |

(1,000) |

|

|

|

|

Less: Decrease in Current Liabilities |

|

|

||

|

|

Income Received in Advance |

(1,000) |

|

||

|

|

Add: Increase in Current Liabilities |

|

|

||

|

|

Trade Payables |

2,000 |

|

||

|

|

Expenses Payable |

500 |

|

||

|

|

Provision for Doubtful Debts |

200 |

|

||

|

|

Add: Decrease in Current Assets |

|

|

||

|

|

Prepaid Expenses |

1,000 |

(4,300) |

||

|

|

Cash Generated from Operations |

|

7,700 |

||

Solution Ex. 20

|

Cash Flow From Operating Activities for the year ended March, 31, 2019 |

|||

|

|

Particulars |

|

Rs. |

|

|

Profit as per Statement of Profit and Loss |

|

43,750 |

|

|

-----------Provision for Tax |

|

18,750 |

|

|

Profit Before Taxation |

|

62,500 |

|

|

Items to be Added: |

|

|

|

|

-----------Loss on Sale of Furniture |

1,500 |

|

|

|

-----------Depreciation |

15,000 |

16,500 |

|

|

Items to be Deducted: |

|

|

|

|

-----------Profit on Sale of machinery |

(2,500) |

|

|

|

-----------Rent |

(15,000) |

|

|

|

-----------Interest on Investment |

(2,000) |

(19,500) |

|

|

Operating Profit before Working Capital Adjustments --- |

|

59,500 |

|

|

----Less: Increase in Current Assets |

|

|

|

|

-----------Trade Receivables---- |

(5,000) |

|

|

|

-----------Prepaid Expenses |

(1,500) |

|

|

|

----Add: Increase in Current Liabilities |

|

|

|

|

-----------Outstanding Expenses ---- |

3,000 |

|

|

|

----Less: Decrease in Current Liabilities |

|

|

|

|

-----------Trade Payables---- |

(2,500) |

|

|

|

----Add: Decrease in Current Assets |

|

|

|

|

-----------Inventories---- |

15,000 |

9,000 |

|

|

Cash Generated from Operations |

|

68,500 |

|

|

----Less: Tax Paid |

|

(18,750) |

|

|

Net Cash Flows from Operating Activities |

|

49,750 |

Cash Flow Statements Exercise 5.97

Solution Ex. 21

|

Cash Flow From Operating Activities for the year ended March, 31, 2019 |

|||

|

|

Particulars |

|

Rs. |

|

|

Purchase of Plant and Machinery |

|

(1,55,000) |

|

|

Sale of Plant and Machinery |

|

45,000 |

|

|

Net Cash Used in Investing Activities |

|

(1,10,000) |

Working Notes:

|

Plant and Machinery Account |

|||

|

Dr. |

|

|

Cr. |

|

Particulars |

Rs. |

Particulars |

|

|

To Balance b/d |

9,60,000 |

By Depreciation |

35,000 |

|

To Profit and Loss A/c (Profit on Sale) |

15,000 |

By Bank A/c (Sale) |

45,000 |

|

To Bank A/c (Purchase) |

1,55,000 |

By Balance c/d |

10,50,000 |

|

|

11,30,000 |

|

11,30,000 |

Solution Ex. 22

|

Cash Flow From Investing Activities for the year ended …. |

||

|

Particulars |

Rs. |

Rs. |

|

Purchase of Machinery |

(1,40,000) |

|

|

----------Sale of Machinery |

50,000 |

|

|

----------Sale of Patents |

90,000 |

Nil |

|

Net Cash Used in Investing Activities |

|

Nil |

Working Notes:

1:

|

Machinery Account |

|||

|

Dr. |

|

|

Cr. |

|

Particulars |

Rs. |

Particulars |

Rs. |

|

To Balance b/d |

9,50,000 |

By Provision for Depreciation A/c |

60,000 |

|

To Profit and Loss A/c (Profit on Sale) |

20,000 |

By Bank A/c (Sale) |

50,000 |

|

To Bank A/c (Purchase) |

1,40,000 |

By Balance c/d |

10,00,000 |

|

|

11,10,000 |

|

11,10,000 |

2:

|

Patents Account |

|||

|

Dr. |

|

|

Cr. |

|

Particulars |

Rs. |

Particulars |

Rs. |

|

To Balance b/d |

3,00,000 |

By Patents Written off |

50,000 |

|

To Profit and Loss A/c (Profit on Sale) |

40,000 |

By Bank A/c (Sale) (Balancing Fig.) |

90,000 |

|

|

|

By Balance e c/d |

2,00,000 |

|

|

3,40,000 |

|

3,40,000 |

3:

|

Accumulated Depreciation Account |

|||

|

Dr. |

|

|

Cr. |

|

Particulars |

Rs. |

Particulars |

Rs. |

|

To Asset A/c |

60,000 |

By Balance b/d |

1,10,000 |

|

To Balance c/d |

1,50,000 |

By Profit and Loss (Depreciation Charged during the year) |

1,00,000 |

|

|

2,10,000 |

|

2,10,000 |

Solution Ex. 23

|

|

Cash Flow Statement |

|||

|

|

Particulars |

Amount (Rs.) |

Amount (Rs.) |

|

|

|

Cash Flow from Investing Activities |

|

|

|

|

|

Sale of Machinery |

13,000 |

|

|

|

|

Purchase of Machinery |

(35,000) |

(22,000) |

|

|

|

Cash Used in Investing Activity |

|

(22,000) |

|

Working Notes:

|

Machinery Account |

|||

|

Dr. |

Cr. |

||

|

Particulars |

Amount (Rs.) |

Particulars |

Amount (Rs.) |

|

Balance b/d |

50,000 |

Bank A/c (Sale) |

13,000 |

|

Profit and Loss A/c (Profit on Sale) |

3,000 |

Accumulated Depreciation |

15,000 |

|

Bank A/c (Purchase- Bal. Fig.) |

35,000 |

Balance c/d |

60,000 |

|

|

|

|

|

|

|

88,000 |

|

88,000 |

|

|

|

|

|

|

Accumulated Depreciation Account |

|||

|

Dr. |

Cr. |

||

|

Particulars |

Amount (Rs.) |

Particulars |

Amount (Rs.) |

|

Fixed Assets A/c |

15,000 |

Balance b/d |

25,000 |

|

Balance c/d |

15,000 |

Profit and Loss A/c (Dep. charged during the year- Bal. Fig.) |

5,000 |

|

|

30,000 |

|

30,000 |

|

|

|

|

|

Solution Ex. 24

|

Cash Flow From Investing Activities for the year ended March, 31, 2019 |

||

|

Particulars |

Rs. |

Rs. |

|

Purchase of Land and Building |

(6,50,000) |

|

|

Interest received on Investments |

75,000 |

|

|

Sale of Debentures |

2,75,000 |

|

|

Purchase of Debentures |

(7,50,000) |

(10,50,000) |

|

Net Cash Used in Investing Activities |

|

(10,50,000) |

Working Notes:

1:

|

Land and Building Account |

|||

|

Dr. |

|

|

Cr. |

|

Particulars |

Rs. |

Particulars |

Rs. |

|

To Balance b/d |

9,00,000 |

By Depreciation A/c |

50,000 |

|

To Bank A/c |

6,50,000 |

By Balance c/d |

15,00,000 |

|

|

15,50,000 |

|

15,50,000 |

2:

|

Investment in 10% Debentures Account |

|||

|

Dr. |

|

|

Cr. |

|

Particulars |

Rs. |

Particulars |

Rs. |

|

To Balance b/d |

5,00,000 |

By Bank A/c (Sale) |

2,75,000 |

|

To Profit and Loss A/c (Profit on Sale) |

25,000 |

By Balance c/d |

10,00,000 |

|

By Bank A/c (Purchase) |

7,50,000 |

|

|

|

|

12,75,000 |

|

12,75,000 |

Cash Flow Statements Exercise 5.98

Solution Ex. 25

|

Cash Flow From Investing Activities

|

|||

|

|

Particulars |

Rs. |

Rs. |

|

|

Purchase of Machine |

(2,50,000) |

|

|

|

Purchase of Goodwill |

(1,00,000) |

|

|

|

Purchase of Investments |

(1,50,000) |

|

|

|

Sale of Machine |

35,000 |

|

|

|

Sale of Investment |

50,000 |

|

|

|

Sale of Patents |

40,000 |

|

|

|

Interest and Dividend Received |

10,000 |

|

|

|

Rent Received |

20,000 |

|

|

|

Net Cash Flow from (used in) Investing Activities |

|

(3,45,000) |

Solution Ex. 26

|

Cash Flow From Investing Activities for the year Ended March 31, 2019 |

|||

|

|

Particulars |

Rs. |

Rs. |

|

|

Cash Flow from Investing Activities |

|

|

|

|

----------Sale of Machinery |

1,50,000 |

|

|

|

----------Purchase of Machinery |

(1,50,000) |

|

|

|

----------Purchase of Non-Current Investments |

(2,00,000) |

|

|

|

Net Cash Flow from (used in) Investing Activities |

|

(2,00,000) |

Working Notes:

|

Plant and Machinery Account |

|||

|

Dr. |

|

|

Cr. |

|

Particulars |

Rs. |

Particulars |

Rs. |

|

To Balance b/d |

5,00,000 |

By Bank A/c (Sale) |

1,50,000 |

|

To Bank A/c (Purchase - Bal. Fig) |

1,50,000 |

By Balance c/d |

5,00,000 |

|

|

6,50,000 |

|

6,50,000 |

Solution Ex. 27

|

Cash Flow From Investing Activities for the year ended March, 31, 2019 |

||

|

Particulars |

Rs. |

Rs. |

|

Purchase of Plant and Machinery |

(2,60,000) |

|

|

Purchase of Investments |

(60,000) |

|

|

Sale of Plant and Machinery |

40,000 |

|

|

Sale of Land |

1,60,000 |

|

|

Net Cash Flow from (used in) Investing Activities |

|

(1,20,000) |

Working Notes:

1:

|

Plant and Machinery Account |

|||

|

Dr. |

|

|

Cr. |

|

Particulars |

Rs. |

Particulars |

Rs. |

|

To Balance b/d |

8,50,000 |

By Depreciation A/c |

50,000 |

|

To Bank A/c (Purchase - b/f) |

2,60,000 |

By Bank A/c (Sale) |

40,000 |

|

|

|

By Profit and Loss A/c (Loss on Sale) |

20,000 |

|

|

|

By Balance c/d |

10,00,000 |

|

|

11,10,000 |

|

11,10,000 |

2

|

Land Account |

|||

|

Dr. |

|

|

Cr. |

|

Particulars |

Rs. |

Particulars |

Rs. |

|

To Balance b/d |

2,00,000 |

By Bank A/c (Sale-Bal. Fig) |

1,60,000 |

|

To Profit and Loss A/c (Profit on Sale) |

60,000 |

By Balance c/d |

1,00,000 |

|

|

11,10,000 |

|

11,10,000 |

Cash Flow Statements Exercise 5.99

Solution Ex. 28

|

Cash Flow From Investing Activities for the year ended March, 31, 2019 |

||

|

Particulars |

Rs. |

Rs. |

|

Purchase of Patents |

(25,000) |

|

|

Purchase of Furniture |

(2,25,000) |

|

|

Interest received on Investment |

14,000 |

|

|

Sale of Investment |

20,,000 |

|

|

Sale of Land |

10,000 |

|

|

Net Cash Flow from Used in Investing Activities |

|

(2,06,000) |

Note:

It has been assumed that investments have been sold at their Book Value at the end of the accounting period.

Working Note:

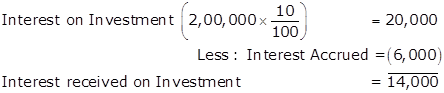

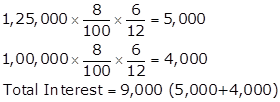

Computation of Interest on Investments

Solution Ex. 29

|

Cash Flow From Investing Activities for the year ended March, 31, 2019 |

||

|

Particulars |

Rs. |

Rs. |

|

Purchase of Plant and Machinery |

(2,70,000) |

|

|

Purchase of Investment |

(1,00,000) |

|

|

Purchases of Goodwill |

(50,000) |

|

|

Rent Received |

20,000 |

|

|

Dividend Received (1,50,000 x 12%) |

18,000 |

|

|

Sale of Plant and Machinery |

35,000 |

|

|

Sale of Investment |

80,000 |

|

|

Interest on Investments |

6,000 |

|

|

Sale of Patents |

20,000 |

|

|

Net Cash Used in Investing Activities |

|

(2,41,000) |

Working Note:

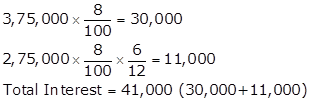

1 : Computation of Interest on Investments

![]()

2

|

Patents Account |

|||

|

Dr. |

|

|

Cr. |

|

Particulars |

Rs. |

Particulars |

Rs. |

|

To Balance b/d |

1,00,000 |

By Profit and Loss A/c (Written-off) |

20,000 |

|

To Profit and Loss A/c (Profit on Sale) |

10,000 |

By Bank A/c (Sale-Bal. Fig) |

20,000 |

|

|

|

Balance c/d |

70,000 |

|

|

1,10,000 |

|

1,10,,000 |

3

|

12% Long -Term Investments Account |

|||

|

Dr. |

|

|

Cr. |

|

Particulars |

Rs. |

Particulars |

Rs. |

|

To Balance b/d |

50,000 |

By Bank A/c (Sale-Bal. Fig) |

80,000 |

|

To Bank A/c (Purchase) |

1,00,000 |

By Balance c/d |

80,000 |

|

To Profit and Loss A/c (Profit on Sale) |

10,000 |

|

|

|

|

1,60,000 |

|

1,60,000 |

4

|

Plant and Machinery Account |

|||

|

Dr. |

|

|

Cr. |

|

Particulars |

Rs. |

Particulars |

Rs. |

|

To Balance b/d |

6,00,000 |

By Depreciation A/c |

70,000 |

|

To Bank A/c (Purchase-Bal. Fig) |

2,70,000 |

By Bank A/c (Sale) |

35,000 |

|

|

|

By Profit and Loss A/c (Loss on Sale) |

15,000 |

|

|

|

By Balance c/d |

7,50,000 |

|

|

8,70,000 |

|

8,70,000 |

Cash Flow Statements Exercise 5.100

Solution Ex. 30

|

Cash Flow From Investing Activities |

||

|

Particulars |

Rs. |

Rs. |

|

Purchase of Machinery |

(1,00,000) |

|

|

Sale of Investment |

26,000 |

|

|

Net Cash Flow from (used in) Investing Activities |

|

(74,000) |

Working Notes:

|

Machinery Account |

|||

|

Dr. |

|

|

Cr. |

|

Particulars |

Rs. |

Particulars |

Rs. |

|

To Balance b/d |

5,00,000 |

By Accumulated Depreciation A/c |

20,000 |

|

To Bank A/c (Purchase-Bal. Fig) |

1,00,000 |

By Bank A/c (Sale) |

26,000 |

|

|

|

By Profit and Loss A/c (Loss on Sale) |

4,000 |

|

|

|

By Balance c/d |

5,50,000 |

|

|

6,00,000 |

|

6,00,000 |

|

Accumulated Depreciation Account |

|||

|

Dr. |

|

|

Cr. |

|

Particulars |

Rs. |

Particulars |

Rs. |

|

To Machinery A/c |

20,000 |

By Balance b/d |

1,00,000 |

|

To Balance c/d |

1,70,000 |

By Profit and Loss A/c (Dep. Charged during the year - Bal. Fig) |

90,000 |

|

|

1,90,000 |

|

1,90,,000 |

Solution Ex. 31

|

Cash Flow From Investing Activities |

|||

|

|

Particulars |

Rs. |

Rs. |

|

|

Purchase of Machinery |

(6,20,000) |

|

|

|

Purchase of Investment |

(2,40,000) |

|

|

|

Purchases of Goodwill |

(1,00,000) |

|

|

|

Sale of Machinery |

2,00,000 |

|

|

|

Rent Received |

50,000 |

|

|

|

Dividend Received |

20,000 |

|

|

|

Sale of Investments |

80,000 |

|

|

|

Interest on Debentures |

8,000 |

|

|

|

Sale of Patents |

1,50,000 |

|

|

|

Net Cash Flow from (used in) Investing Activities |

|

(4,52,000) |

Note: Dividend and interest paid is considered as a part of Financing Activities.

Solution Ex. 32

|

|

Cash Flow Statement |

|||

|

|

Particulars |

Amount (Rs.) |

Amount (Rs.) |

|

|

|

Cash Flow from Financing Activities |

|

|

|

|

|

Loan Repaid |

(1,00,000) |

|

|

|

|

New Loan Raised |

1,50,000 |

50,000 |

|

|

|

Cash Flows from Financing Activity |

|

50,000 |

|

Working Notes:

|

Long Term Loan Account |

|||

|

Dr. |

Cr. |

||

|

Particulars |

Amount (Rs.) |

Particulars |

Amount (Rs.) |

|

Bank A/c (Loan Repaid) |

1,00,000 |

Balance b/d |

2,00,000 |

|

Balance c/d |

2,50,000 |

Bank A/c (Loan Raised) |

1,50,000 |

|

|

3,50,000 |

|

3,50,000 |

|

|

|

|

|

Solution Ex. 33

|

Cash Flow From Financing Activities for the year ended March, 31, 2019 |

||

|

Particulars |

Rs. |

Rs. |

|

Proceeds from Issue of Equity Shares |

1,10,000 |

|

|

Redemption of 12% Debentures |

(50,000) |

|

|

Interest Paid |

(18,000) |

|

|

Net Cash Flow from Financing Activities |

|

42,000 |

Cash Flow Statements Exercise 5.101

Solution Ex. 34

|

Cash Flow From Financing Activities for the year ended March, 31, 2019 |

||

|

Particulars |

Rs. |

Rs. |

|

Issue of Shares |

1,25,000 |

|

|

Transfer to Securities Premium Reserve |

1,25,000 |

|

|

Issue of Debentures |

1,00,000 |

|

|

Premium on redemption of Preference Shares (5% of 1,50,000) |

(7,500) |

|

|

Interim Dividend Paid (15% of 4,00,000) |

(60,000) |

|

|

Redemption of Preference Share Capital |

(1,50,000) |

|

|

Interest on Debentures (12% of 3,00,000) |

(36,000) |

|

|

Interest on Preference Share Capital |

(55,000) |

|

|

Net Cash Flow from Financing Activities |

|

41,500 |

Solution Ex. 35

|

Cash Flow Statement for the year ended March, 31, 2019 |

||

|

Particulars |

Rs. |

Rs. |

|

Cash Flow from Investing Activities |

|

|

|

----------- Purchase of Machinery |

(20,000) |

|

|

-----------Sale of Machine |

4,000 |

|

|

Net Cash Flow from (used in) Investing Activities |

|

(16,000) |

|

|

|

|

|

Cash Flow from Financing Activities |

|

|

|

----------- Proceeds from Issue of Equity Shares |

5,000 |

|

|

-----------Repayment of Bank Loan |

(10,000) |

|

|

Net Cash Flow from (used in) Financing Activities |

|

(5,000) |

Working Notes:

|

Machinery Account |

|||

|

Dr. |

|

|

Cr. |

|

Particulars |

Rs. |

Particulars |

Rs. |

|

To Balance b/d |

40,000 |

By Accumulated Depreciation A/c |

4,000 |

|

To Bank A/c (Purchase-Bal. Fig) |

20,000 |

By Bank A/c (Sale) |

4,000 |

|

|

|

By Profit and Loss A/c (Loss on Sale) |

2,000 |

|

|

|

By Balance c/d |

50,000 |

|

|

60,000 |

|

60,000 |

|

Accumulated Depreciation Account |

|||

|

Dr. |

|

|

Cr. |

|

Particulars |

Rs. |

Particulars |

Rs. |

|

To Machinery A/c (Bal. Fig.) |

4,000 |

By Balance b/d |

10,000 |

|

To Balance c/d |

12,000 |

By Profit and Loss A/c (Dep. Charged during the year) |

6,000 |

|

|

16,000 |

|

16,000 |

Solution Ex. 36

|

|

Cash Flow Statement |

||||

|

|

Particulars |

Amount (Rs.) |

Amount (Rs.) |

||

|

A |

Cash Flow from Operating Activities |

|

|

||

|

|

Profit as per Statement of Profit and Loss |

|

7,50,000 |

||

|

|

Items to be Added: |

|

|

||

|

|

Provision for Tax |

75,000 |

|

||

|

|

Depreciation |

2,00,000 |

|

||

|

|

Loss on Sale of Machine |

20,000 |

|

||

|

|

Operating Profit before Working Capital Adjustments |

10,45,000 |

|

||

|

|

Less: Increase in Current Assets |

|

|

||

|

|

|

Trade Receivables and Inventories |

(1,50,000) |

|

|

|

|

Add: Increase in Current Liabilities |

|

|

||

|

|

Trade Payables |

2,75,000 |

|

||

|

|

Cash Generated from Operations |

11,70,000 |

|

||

|

|

Less: Taxes Paid |

(75,000) |

|

||

|

|

Cash Flow from Operating Activities |

|

10,95,000 |

||

|

B |

Cash Flow from Investing Activities |

|

|

||

|

|

Sale of Fixed Assets Purchase of Fixed Asset |

80,000

(4,67,500) |

|

||

|

|

Cash Flows from Investing Activities |

|

3,87,500 |

||

Working Notes:

|

Fixed Asset Account |

|||

|

Dr. |

|

|

Cr. |

|

Particulars |

Rs. |

Particulars |

Rs. |

|

To Balance b/d |

21,25,000 |

By Accumulated Depreciation A/c |

1,62,500 |

|

To Bank A/c (Purchase-Bal. Fig) |

4,67,500 |

By Bank A/c (Sale) |

80,000 |

|

|

|

By Profit and Loss A/c (Loss on Sale) |

20,000 |

|

|

|

By Balance c/d |

23,30,000 |

|

|

25,92,500 |

|

25,92,500 |

|

Accumulated Depreciation Account |

|||

|

Dr. |

|

|

Cr. |

|

Particulars |

Rs. |

Particulars |

Rs. |

|

To Fixed Asset A/c (Bal. Fig.) |

1,62,500 |

By Balance b/d |

10,62,500 |

|

To Balance c/d |

11,00,000 |

By Profit and Loss A/c (Dep. Charged during the year) |

2,00,000 |

|

|

12,62,5000 |

|

12,62,5000 |

Cash Flow Statements Exercise 5.102

Solution Ex. 37

|

Cash Flow From Financing Activities for the year ended March, 31, 2019 |

||

|

Particulars |

Rs. |

Rs. |

|

Proceeds from Issue of 12% Debentures |

1,00,000 |

|

|

Interest Paid |

(19,000) |

|

|

Dividend Paid |

(50,000) |

|

|

Net Cash Flow from (used in) Financing Activities |

|

(31,000) |

Note:

Issue of bonus shares does not lead to any change in cash flow statement. Therefore, increase in share capital due to issue of bonus shares will not be classified as Financing Activities.

Solution Ex. 38

|

|

Cash Flow Statement |

||||

|

|

Particulars |

Amount (Rs.) |

Amount (Rs.) |

||

|

|

Cash Flow from Operating Activities |

|

|

||

|

|

Profit as per Statement of Profit and Loss |

|

7,25,000 |

||

|

|

Items to be Added: |

|

|

||

|

|

Provision for Tax |

1,12,500 |

|

||

|

|

Interest on Debentures |

41,000 |

|

||

|

|

Interest on Bank Loan |

9,000 |

|

||

|

|

Dividend on Equity Shares |

90,000 |

|

||

|

|

Dividend on Preference Shares |

37,500 |

|

||

|

|

Transfer to General Reserve |

75,000 |

3,65,000 |

||

|

|

Operating Profit before Working Capital Adjustments |

|

10,90,000 |

||

|

|

Less: Increase in Current Assets |

|

|

||

|

|

|

Trade Receivables and Inventories |

(1,50,000) |

|

|

|

|

Add: Increase in Current Liabilities |

|

|

||

|

|

Trade Payables |

2,50,000 |

1,00,000 |

||

|

|

Cash Generated from Operations |

|

11,90,000 |

||

|

|

Less: Taxes Paid |

|

62,500 |

||

|

|

Cash Flow from Operating Activities |

|

11,27,500 |

||

|

|

Cash Flow Statement |

|||

|

|

Particulars |

Amount (Rs.) |

Amount (Rs.) |

|

|

|

Cash Flow from Financing Activities |

|

|

|

|

|

Proceeds from Issue of Equity Shares |

2,50,000 |

|

|

|

|

Redemption of Preference Shares |

(2,50,000) |

|

|

|

|

Increase in Securities Premium Reserve |

25,000 |

|

|

|

|

Proceeds from Issue of Debentures |

2,75,000 |

|

|

|

|

Repayment of Bank Loan |

(25,000) |

|

|

|

|

Interest on Debentures |

(41,000) |

|

|

|

|

Interest on Bank Loan |

(9,000) |

|

|

|

|

Dividend on Equity Shares |

(90,000) |

|

|

|

|

Dividend on Preference Shares |

(37,500) |

|

|

|

|

Cash Flows from Financing Activity |

|

97,500 |

|

Working Notes:

|

Provision for Tax Account |

|||

|

Dr. |

Cr. |

||

|

Particulars |

Amount (Rs.) |

Particulars |

Amount (Rs.) |

|

Bank A/c (Bal. fig.) |

62,500 |

Balance b/d |

50,000 |

|

Balance c/d |

1,00,000 |

Profit and Loss A/c |

1,12,500 |

|

|

1,62,500 |

|

1,62,500 |

|

|

|

|

|

Calculation of Interest on Debentures

Calculation of Interest on Bank Loan

Note: Dividend on equity shares (@8%) and on preference shares (@5%) is calculated on their opening balances respectively.

Cash Flow Statements Exercise 5.103

Solution Ex. 39

|

Cash Flow Statement |

|||

|

|

Particulars |

Rs. |

Rs. |

|

A |

Cash Flow from Operating Activities |

|

|

|

|

-----------Profit as per Statement of Profit and Loss (Net Profit) |

20,000 |

|

|

|

-----------Profit Before Taxation |

20,000 |

|

|

|

Items to be Added: |

- |

|

|

|

Operating Profit before Working Capital Adjustments --- |

20,000 |

|

|

|

----Add: Decrease in Current Assets |

|

|

|

|

------------Stock |

80,000 |

|

|

|

----Add: Increase in Current Liabilities |

|

|

|

|

-----------Bills Payable |

1,20,000 |

|

|

|

Cash Generated from Operations |

2,20,000 |

|

|

|

----Less: Tax Paid |

- |

|

|

|

Net Cash Flows from Operating Activities |

|

2,20,000 |

|

|

|

|

|

|

B |

Cash Flow from Investing Activities |

|

|

|

|

-----------Sale of Fixed Assets |

3,00,000 |

|

|

|

Net Cash Flows from Investing Activities |

|

3,00,000 |

|

|

|

|

|

|

C |

Cash Flow from Financing Activities |

|

|

|

|

-----------Repayment of Long-Term Loan |

(5,00,000) |

|

|

|

Net Cash Flows from (used in) Financing Activities |

|

(5,00,000) |

|

|

|

|

|

|

D |

Net Increase or Decrease in Cash and Cash Equivalents |

|

20,000 |

|

|

-----------Add : Cash and Cash Equivalent in the beginning of the period |

|

1,50,000 |

|

|

Cash and Cash Equivalents at the end of the period |

|

1,70,000 |

Solution Ex. 40

|

Cash Flow Statement for the year ended March, 31, 2019 |

|||

|

|

Particulars |

Rs. |

Rs. |

|

A |

Cash Flow from Operating Activities |

|

|

|

|

-----------Profit as per Statement of Profit and Loss (1,83,000 - 82,000) |

1,01,000 |

|

|

|

-----------Profit Before Tax |

1,01,000 |

|

|

|

Items to be Added: |

|

|

|

|

-----------Interest on Debentures |

7,500 |

|

|

|

Operating Profit before Working Capital Adjustments --- |

1,08,500 |

|

|

|

----Less: Increase in Current Assets |

|

|

|

|

-----------Inventories |

(56,000) |

|

|

|

----Add: Increase in Current Liabilities |

|

|

|

|

-----------Trade Payable |

40,000 |

|

|

|

----Less: Decrease in Current Liabilities |

|

|

|

|

-----------Other Current Liabilities |

(8,000) |

|

|

|

----Add: Decrease in Current Assets |

|

|

|

|

-----------Trade Receivables |

38,000 |

|

|

|

Cash Generated from Operations |

1,22,500 |

|

|

|

----Less: Tax Paid |

- |

|

|

|

Net Cash Flows from Operating Activities |

|

1,22,500 |

|

|

|

|

|

|

B |

Cash Flow from Investing Activities |

|

|

|

|

-----------Purchase of Fixed Assets |

(1,57,000) |

|

|

|

-----------Purchase of Investments |

(13,000) |

|

|

|

Net Cash Flows from (used in)Investing Activities |

|

(1,70,000) |

|

|

|

|

|

|

C |

Cash Flow from Financing Activities |

|

|

|

|

-----------Proceeds from Issue of Equity Share Capital |

50,000 |

|

|

|

-----------Proceeds from Issue of 15% Debentures |

30,000 |

|

|

|

-----------Interest on Debentures (50,000 x 15%) |

(7,500) |

|

|

|

Net Cash Flows from Financing Activities |

|

72,500 |

|

|

|

|

|

|

D |

Net Increase or Decrease in Cash and Cash Equivalents |

|

25,000 |

|

|

----Add : Cash and Cash Equivalent in the beginning of the period |

|

70,000 |

|

|

Cash and Cash Equivalents at the end of the period |

|

95,000 |

Assumption:

Debentures were issued at the end of the accounting period. Accordingly, Interest on debentures has been computed on the opening balance (@15% on 50,000).

Cash Flow Statements Exercise 5.104

Solution Ex. 41

|

|

Cash Flow Statement for the year ended March 31, 2019 |

||||

|

|

Particulars |

Amount (Rs.) |

Amount (Rs.) |

||

|

A |

Cash Flow from Operating Activities |

|

|

||

|

|

Profit as per Statement of Profit and Loss |

|

9,000 |

||

|

|

Items to be Added: |

|

|

||

|

|

Provision for Taxation |

32,000 |

|

||

|

|

General Reserve |

10,000 |

|

||

|

|

Goodwill |

10,000 |

|

||

|

|

Proposed Dividend |

45,000 |

97,000 |

||

|

|

Operating Profit before Working Capital Adjustments |

|

1,06,000 |

||

|

|

Less: Increase in Current Assets |

|

|

||

|

|

|

Trade Receivables |

(33,000) |

|

|

|

|

Less: Decrease in Current Liabilities |

|

|

||

|

|

Other Current Liabilities |

(2,000) |

|

||

|

|

Add: Decrease in Current Assets |

|

|

||

|

|

Inventories |

18,000 |

|

||

|

|

Add: Increase in Current Liabilities |

|

|

||

|

|

Trade Payables |

18,000 |

1,000 |

||

|

|

Cash Generated from Operations |

|

1,07,000 |

||

|

|

Less: Tax Paid |

|

(28,000) |

||

|

|

Net Cash Flows from Operating Activities |

|

79,000 |

||

|

|

|

|

|

|

|

|

B |

Cash Flow from Investing Activities |

|

|

||

|

|

|

Sale of Land and Building |

|

53,000 |

|

|

|

|

Purchase of Non-Current Investments |

|

(25,000) |

|

|

|

|

Purchase of Plant and Machinery |

|

(1,01,000) |

|

|

|

Net Cash Used in Investing Activities |

|

(73,000) |

||

|

|

|

|

|

||

|

C |

Cash Flow from Financing Activities |

|

|

||

|

|

Proceeds from Issue of Share Capital |

|

50,000 |

||

|

|

Dividend Paid |

|

(39,000) |

||

|

|

Net Cash Flow from Financing Activities |

|

11,000 |

||

|

D |

Net Increase or Decrease in Cash and Cash Equivalents |

|

11,000 |

||

|

|

|

Add: Cash and Cash Equivalent in the beginning of the period |

|

17,000 |

|

|

|

Cash and Cash Equivalents at the end of the period |

|

28,000 |

||

|

|

|

|

|

||

Cash Flow Statements Exercise 5.105

Solution Ex. 42

|

Cash Flow Statement for the year ended March, 31, 2013 |

|||

|

|

Particulars |

Rs. |

Rs. |

|

A |

Cash Flow from Operating Activities |

|

|

|

|

Net Profit |

|

1,00,000 |

|

|

-----------Operating Profit before Working Capital Adjustments --- |

|

1,00,000 |

|

|

----Add: Decrease in Current Assets |

|

|

|

|

-----------Inventories |

6,000 |

|

|

|

-----------Trade Receivables |

54,000 |

|

|

|

----Less: Decrease in Current Liabilities |

|

|

|

|

-----------Trade Payable |

(8,000) |

52,000 |

|

|

Cash Generated from Operations |

|

1,52,000 |

|

|

----Less: Tax Paid |

- |

|

|

|

Net Cash Flows from Operating Activities |

|

1,52,000 |

|

|

|

|

|

|

B |

Cash Flow from Investing Activities |

|

|

|

|

-----------Purchases of Tangible Assets |

(2,90,000) |

|

|

|

-----------Purchases on Non Current Investment |

(72,000) |

|

|

|

Net Cash Flows from (used in) Investing Activities |

|

(3,62,000) |

|

|

|

|

|

|

C |

Cash From Financing Activities |

|

|

|

|

-----------Issue of Share Capital |

2,00,000 |

|

|

|

-----------Long Term Borrowings |

(50,000) |

|

|

|

Net Cash Flows from Financing Activities |

|

1,50,000 |

|

|

|

|

|

|

D |

Net Increase or Decrease in Cash and Cash Equivalents |

|

(60,000) |

|

|

--Add: Cash and Cash Equivalent in the beginning of the period (70,000 + 1,34,000) |

|

2,04,000 |

|

|

Cash and Cash Equivalents at the end of the period |

|

1,44,000 |

Cash Flow Statements Exercise 5.106

Solution Ex. 43

|

Cash Flow Statement for the year ended March, 31, 2014 |

|||

|

|

Particulars |

Rs. |

Rs. |

|

A |

Cash Flow from Operating Activities |

|

|

|

|

Profit as per Statement of Profit and Loss |

2,00,000 |

|

|

|

----------- Profit Before Tax |

|

2,00,000 |

|

|

Items to be Added: |

|

|

|

|

-----------Amortisation of Goodwill |

1,44,000 |

|

|

|

-----------Depreciation |

1,32,00 |

|

|

|

-----------Loss on Sale of Fixed Assets |

4,000 |

2,80,000 |

|

|

Operating Profit before Working Capital Adjustments --- |

|

4,80,000 |

|

|

----Less: Increase in Current Assets |

|

|

|

|

-----------Inventories |

16,000 |

|

|

|

-----------Trade Receivables |

54,000 |

|

|

|

----Less: Decrease in Current Liabilities |

|

|

|

|

-----------Trade Payable |

(50,000) |

|

|

|

-----------Short-Term Provisions |

(54,000) |

1,74,000 |

|

|

Net Cash Flows from Operating Activities |

|

3,06,000 |

|

|

|

|

|

|

B |

Cash Flow from Investing Activities |

|

|

|

|

-----------Sale of Machinery |

12,000 |

|

|

|

-----------Purchases of Machinery |

(5,88,000) |

|

|

|

Net Cash Flows from (used in) Investing Activities |

|

(5,76,000) |

|

|

|

|

|

|

C |

Cash Flow from Financing Activities |

|

|

|

|

-----------Proceeds from Issue of Share Capital |

2,00,000 |

|

|

|

-----------Proceeds from Long Term Borrowings |

1,40,000 |

|

|

|

Net Cash Flows from Financing Activities |

|

3,40,000 |

|

|

|

|

|

|

D |

Net Increase or Decrease in Cash and Cash Equivalents |

|

70,000 |

|

|

-----------Add : Cash and Cash Equivalent in the beginning of the period |

|

10,50,000 |

|

|

Cash and Cash Equivalents at the end of the period |

|

11,20,000 |

Working Notes:

|

Machinery Account |

|||

|

Dr. |

|

|

Cr. |

|

Particulars |

Rs. |

Particulars |

Rs. |

|

To Balance b/d |

20,00,000 |

By Bank A/c (Sale) |

12,000 |

|

To Bank A/c (Purchases-Bal. Fig) |

5,88,000 |

By Depreciation A/c (on part of machinery) |

32,000 |

|

|

|

By Profit and Loss A/c (Loss on sale) |

4,000 |

|

|

|

By Balance c/d |

25,40,000 |

|

|

25,88,000 |

|

25,88,000 |

|

Accumulated Depreciation Account |

|||

|

Dr. |

|

|

Cr. |

|

Particulars |

Rs. |

Particulars |

Rs. |

|

To Machinery A/c |

32,000 |

By Balance b/d |

3,00,000 |

|

To Balance c/d |

4,00,000 |

By Profit and Loss A/c (Dep. Charged during the year) |

1,32,000 |

|

|

4,32,000 |

|

4,32,000 |

Cash Flow Statements Exercise 5.107

Solution Ex. 44

|

Cash Flow Statement for the year ended March, 31, 2019 |

|||

|

|

Particulars |

Rs. |

Rs. |

|

A |

Cash Flow from Operating Activities |

|

|

|

|

-----------Profit as per Statement of Profit and Loss (1,20,000 - 25,000) |

(95,000) |

|

|

|

Items to be Added: Provision for Tax (WN) |

51,000 |

|

|

|

-----------Depreciation (WN) |

25,000 |

|

|

|

Profit Before Taxation |

(19,000) |

|

|

|

Items to be Added: |

|

|

|

|

-----------Interest Paid |

7,500 |

|

|

|

Operating Profit before Working Capital Adjustments --- |

(11,500) |

|

|

|

----Less: Increase in Current Assets |

|

|

|

|

-----------Trade Payables |

(14,000) |

|

|

|

-----------Inventories |

(7,000) |

|

|

|

----Add: Decrease in Current Liabilities |

|

|

|

|

-----------Trade Receivables Other Current Assets |

14,000 4,000 |

|

|

|

Cash Generated from Operations |

|

|

|

|

----Less: Tax Paid |

(53,000) |

|

|

|

Net Cash Flows from Operating Activities |

|

(67,500) |

|

|

|

|

|

|

B |

Cash Flow from Investing Activities |

|

|

|

|

-----------Purchase of Fixed Assets (WN) |

(1,69,000) |

|

|

|

Net Cash Flows from (used in) Investing Activities |

|

(1,69,000) |

|

|

|

|

|

|

C |

Cash Flow from Financing Activities |

|

|

|

|

-----------Proceeds from Additional Loan |

20,000 |

|

|

|

-----------Interest Paid Proceeds from Share Capital |

(7,500) 2,00,000 |

|

|

|

Net Cash Flows from Financing Activities |

|

2,12,500 |

|

|

|

|

|

|

D |

Net Increase or Decrease in Cash and Cash Equivalents |

|

(24,000) |

|

|

-----------Add : Cash and Cash Equivalent in the beginning of the period |

|

49,000 |

|

|

Cash and Cash Equivalents at the end of the period |

|

25,000 |

Working Notes:

|

Fixed Assets Account |

|||

|

Dr. |

|

|

Cr. |

|

Particulars |

Rs. |

Particulars |

Rs. |

|

To Balance b/d |

2,15,000 |

|

|

|

To Bank A/c (Purchase-Bal. Fig) |

1,69,000 |

|

|

|

|

|

By Balance c/d |

3,84,000 |

|

|

3,84,000 |

|

3,84,000 |

|

Accumulated Depreciation Account |

|||

|

Dr. |

|

|

Cr. |

|

Particulars |

Rs. |

Particulars |

Rs. |

|

|

|

By Balance b/d |

23,000 |

|

To Balance c/d |

48,000 |

By Profit and Loss A/c (Dep. Charged during the year) |

25,000 |

|

|

48,000 |

|

48,000 |

|

Provision for Tax Account |

|||

|

Dr. |

Cr. |

||

|

Particulars |

Amount (Rs.) |

Particulars |

Amount (Rs.) |

|

Bank A/c (Bal. fig.) |

53,000 |

Balance b/d |

70,000 |

|

Balance c/d |

68,000 |

Profit and Loss A/c |

51,000 |

|

|

1,21,000 |

|

1,21,000 |

|

|

|

|

|

Cash Flow Statements Exercise 5.108

Solution Ex. 45

|

Cash Flow Statement for the year ended March, 31, 2019 |

|||

|

|

Particulars |

Rs. |

Rs. |

|

A |

Cash Flow from Operating Activities |

|

|

|

|

-----------Profit as per Statement of Profit and Loss (1,50,000 - 2,00,000) |

(50,000) |

|

|

|

-----------Transfer to General Reserve |

3,40,000 |

|

|

|

-----------Dividend Paid |

50,000 |

|

|

|

-----------Profit Before Taxation |

3,40,000 |

|

|

|

Items to be Added: |

|

|

|

|

-----------Interest Paid |

54,000 |

|

|

|

-----------Loss on Sale of Machinery |

14,000 |

|

|

|

Operating Profit before Working Capital Adjustments --- |

4,08,000 |

|

|

|

----Less: Increase in Current Assets |

|

|

|

|

-----------Inventories |

(1,00,000) |

|

|

|

-----------Trade Receivables |

(1,00,000) |

|

|

|

----Add: Decrease in Current Liabilities |

|

|

|

|

-----------Trade Payable |

3,50,000 |

|

|

|

Cash Generated from Operations |

5,58,000 |

|

|

|

----Less: Tax Paid |

- |

|

|

|

Net Cash Flows from Operating Activities |

|

5,58,000 |

|

|

|

|

|

|

B |

Cash Flow from Investing Activities |

|

|

|

|

-----------Sale of Machinery |

6,000 |

|

|

|

-----------Purchase of Fixed Assets |

(5,20,000) |

|

|

|

Net Cash Flows from (used in) Investing Activities |

|

(5,14,000) |

|

|

|

|

|

|

C |

Cash Flow from Financing Activities |

|

|

|

|

-----------Proceeds from Issue of Equity Share Capital |

5,00,000 |

|

|

|

-----------Proceeds from 7% Preference Share Capital |

60,000 |

|

|

|

-----------Dividend Paid |

(50,000) |

|

|

|

-----------Redemption of 9% Debentures |

(2,00,000) |

|

|

|

-----------Interest Paid (60,000 x 9%) |

(54,000) |

|

|

|

Net Cash Flows from Financing Activities |

|

2,56,000 |

|

|

|

|

|

|

D |

Net Increase or Decrease in Cash and Cash Equivalents |

|

3,00,000 |

|

|

-----------Add : Cash and Cash Equivalent in the beginning of the period |

|

2,00,000 |

|

|

Cash and Cash Equivalents at the end of the period |

|

5,00,000 |

Working Notes:

|

Fixed Assets Account |

|||

|

Dr. |

|

|

Cr. |

|

Particulars |

Rs. |

Particulars |

|

|

To Balance b/d |

15,00,000 |

By Bank A/c (Sale) |

6,000 |

|

To Bank A/c (Purchase-Bal. Fig) |

5,20,000 |

By Profit and Loss A/c (Loss on Sale) |

14,000 |

|

|

|

By Balance c/d |

20,00,000 |

|

|

20,20,000 |

|

20,20,000 |

Cash Flow Statements Exercise 5.109

Solution Ex. 46

|

Cash Flow Statement for the year ended March, 31, 2015 |

|||

|

|

Particulars |

Rs. |

Rs. |

|

A |

Cash Flow from Operating Activities |

|

|

|

|

Net Profit before Tax and Extraordinary Items |

|

2,50,000 |

|

|

Items to be Added: |

|

|

|

|

-----------Depreciation |

99,000 |

|

|

|

Intangible Assets w/off |

10,000 |

|

|

|

Interest on Debentures (@12% on 5,00,000) |

60,000 |

|

|

|

-----------Provision for Tax |

50,000 |

2,19,000 |

|

|

Operating Profit before Working Capital Adjustments --- |

|

4,69,000 |

|

|

----Less: Increase in Current Assets |

|

|

|

|

-----------Inventories |

(62,000) |

(62,000) |

|

|

Cash Generated from Operations |

|

4,07,000 |

|

|

----Less: Tax Paid (Net) |

70,000 |

(70,000) |

|

|

Net Cash Flows from Operating Activities |

|

3,37,000 |

|

|

|

|

|

|

B |

Cash Flow from Investing Activities |

|

|

|

|

----------- Purchase of Non-Current Investments |

(25,000) |

|

|

|

-----------Purchase of Fixed Assets |

(3,82,000) |

|

|

|

Net Cash Flows from (used in) Investing Activities |

|

(4,07,000) |

|

|

|

|

|

|

C |

Cash Flow from Financing Activities |

|

|

|

|

-----------Proceeds from Issue of Share Capital |

1,00,000 |

|

|

|

-----------Repayments of Debentures |

(50,000) |

|

|

|

-----------Interest Paid on Debentures |

(60,000) |

|

|

|

-----------Increase in Bank o/d |

1,00,000 |

|

|

|

Net Cash Flows from (used in) Financing Activities |

|

90,000 |

|

|

|

|

|

|

D |

Net Increase or Decrease in Cash and Cash Equivalents |

|

20,000 |

|

|

-----------Add : Cash and Cash Equivalent in the beginning of the period |

|

1,20,000 |

|

|

Cash and Cash Equivalents at the end of the period |

|

1,40,000 |

Working Notes:

|

Provision for Taxation |

|||

|

Dr. |

|

|

Cr. |

|

Particulars |

Rs. |

Particulars |

Rs. |

|

To Bank |

70,000 |

By Balance b/d |

90,000 |

|

To Balance c/d (b/f) |

70,000 |

By PandL |

50,000 |

|

|

1,40,000 |

|

1,40,000 |

Also, Cash and Cash Equivalents includes the current investments.

Cash Flow Statements Exercise 5.110

Solution Ex. 47

|

Cash Flow From Operating Activities for the year ended March, 31, 2019 |

|||

|

|

Particulars |

Rs. |

Rs. |

|

A |

Cash Flow from Operating Activities |

|

|

|

|

Profit as per Statement of Profit and Loss (4,8,000 - 3,75,000) |

1,05,000 |

|

|

|