Class 12-commerce T S GREWAL Solutions Accountancy Chapter 4: Accounting Ratios

Accounting Ratios Exercise 4.91

Solution Ex. 1

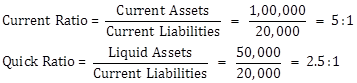

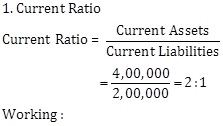

Current Assets = Trade Receivables + Pre-paid Expenses + Cash and Cash Equivalents + Marketable Securities + Inventories

= Rs.1,80,000 + Rs.40,000 + Rs.50,000 + Rs.50,000 + Rs.80,000

=Rs.4,00,000

Current Liabilities = Bills Payable + Sundry Creditors + Expenses Payable

= Rs.20,000 + Rs.1,00,000 + Rs.80,000 = Rs.2,00,000

![]()

Solution Ex. 2

Total Assets = Fixed Tangible Assets + Non-Current Investments + Current Assets

Rs.5,00,000 = Rs.2,50,000 + Rs.1,50,000 + Current Assets

Current Assets = Rs.5,00,000 - Rs.4,00,000 = Rs.1,00,000

Total Assets = Shareholder's Funds + Non - Current Liabilities + Current Liabilities

Rs.5,00,000 = Rs.3,20,000 + Rs.1,30,000 + Current Liabilities

Current Liabilities = Rs.5,00,000 - Rs.4,50,000 = Rs.50,000

![]()

Solution Ex. 3

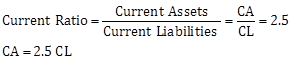

Current Ratio = 2.5

Working Capital = Rs.1,50,000

Current Liabilities = Trade Payables + Other Current Liabilities

= Rs.90,000+ Rs.2,10,000 = Rs.3,00,000

Working Capital = Current Assets - Current Liabilities

Rs. 1,50,000 = Current Assets - Current Liabilities

and Current Assets = 2.5 x 1,00,000 = 2,50,000

Solution Ex. 4

Working Capital = Rs.9,00,000

Current Liabilities = Trade Payables + Other Current Liabilities

= Rs.90,000+ Rs.2,10,000 = Rs.3,00,000

Working Capital = Current Assets - Current Liabilities

Rs. 9,00,000 = Current Assets - Rs.3,00,000

Current Assets =Rs.9,00,000 + Rs.3,00,000 = Rs. 12,00,000

![]()

Solution Ex. 5

Total Debts = Rs.3,90,000

Long-term Debts = Rs.3,00,000

Current Liabilities = Total Debts - Long-term Debts

= Rs.3,90,000 - Rs.3,00,000 = Rs.90,000

Working Capital = Current Assets - Current Liabilities

Rs.1,80,000 = Current Assets - Rs.90,000

Current Assets = Rs.2,70,000

![]()

Solution Ex. 6

Current Assets = Rs.7,50,000

Working Capital = Rs.2,50,000

Working Capital = Current Assets - Current Liabilities

Rs.2,50,000 = Rs.7,50,000 - Current Liabilities

Current Liabilities = Rs.7,50,000 - Rs.2,50,000 = Rs.5,00,000

![]()

Solution Ex. 7

Trade Payables =Rs.50,000

Working Capital =Rs.9,00,000

Current Liabilities = Rs.3,00,000

Working Capital = Current Assets - Current Liabilities

Current Assets = 9,00,000 + 3,00 ,000 = 12,00,000

![]()

Accounting Ratios Exercise 4.92

Solution Ex. 8

Purchase of Goods on Credit for Rs.30,000 will have two effects:

(i) Increase Stock by Rs.30,000;

Current Assets will thereby increase to Rs.4,80,000 (Rs.4,50,000 + Rs.30,000)

(ii) Increase Creditors by Rs.30,000;

Current Liabilities will now be Rs.2,30,000 (Rs.2,00,000 + Rs.30,000)

![]()

Solution Ex. 9

![]()

Current Liabilities = Rs.1,75,000

Payment of Rs.30,000 to a Creditor will have two effects:

Decrease in Cash by Rs.30,000 and therefore Current Assets will decrease to Rs.3,20,000.

Decrease in Creditors by Rs.30,000 and this will decrease Current Liabilities to Rs.1,45,000.

![]()

Solution Ex. 10

Solution Ex. 11

Current Assets = Rs.8,75,000

Current Liabilities = Rs.3,50,000

Current Ratio = 2.5:1

The business is interested to maintain its Current Ratio at 2:1 by purchasing goods on credit.

Let the amount of goods purchased on credit be 'x'

Current Liabilities = Rs.3,50,000 + x

Current Assets = Rs.8,75,000 + x

![]()

Rs.8,75,000 + x = Rs.7,00,000 +2x

Rs.8,75,000 - Rs.7,00,000 = 2x - x

Rs.1,75,000 = x

Therefore, goods worth Rs.1,75,000 must be purchased on credit to maintain the current ratio at 2:1

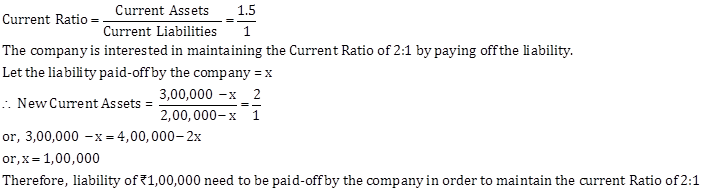

Solution Ex. 12

Firm paid off liabilities of Rs.1,00,000 which results in decrease in current liabilities and current assets by the same amount.

After making the payment:

Current Assets = Rs.4,00,000 (Rs.5,00,000 - Rs.1,00,000)

And, Let Current Liabilities be (x - Rs.1,00,000)

![]()

Rs.4,00,000 = 2x - Rs.2,00,000

Rs.6,00,000 = 2x

Therefore, x = Rs.3,00,000

Current Liabilities after payment = x - Rs.1,00,000 = Rs.2,00,000

Working Capital after Payment = Current Assets - Current Liabilities = Rs.4,00,000 - Rs.2,00,000

= Rs.2,00,000

Current Assets before payment = Rs.5,00,000

Current Liabilities before Payment = Rs.3,00,000

Therefore, Working Capital Before Payment - Current Assets - Current Liabilities

= Rs.5,00,000 - Rs.3,00,000 = Rs.2,00,000

Solution Ex. 13

Current Ratio = 2:1

Let Current Assets be = Rs.20,000

Current Liabilities = Rs.10,000

a) Cash paid to Trade Payables- Improve

Reason: Payment results into decrease in Current Assets and Current Liabilities with same amount but with a positive impact on Current Ratio.

Example: Amount paid to Creditors Rs.5,000

Current Asset = Rs.20,000 - Rs.5,000 (Cash) = Rs.15,000

Current Liabilities = Rs.10,000 - Rs.5,000 (Creditors) = Rs.5,000

![]()

b) Bills Payable discharged- Improve

Reason: Payment results into decrease in Current Assets and Current Liabilities with same amount but with a positive impact on Current Ratio.

Example: Amount of bill discharged Rs.5,000

Current Asset = Rs.20,000 - Rs.5,000 (Cash) = Rs.15,000

Current Liabilities = Rs.10,000 - Rs.5,000 (B/P) = Rs.5,000

![]()

c) Bills receivable endorsed to a creditor- Improve

Reason: The endorsement of B/R leads to decrease in amount of B/R (current assets) and an equal decrease in liabilities in for form of creditors.

Example: Amount of bill endorsed Rs.5,000

Current Asset = Rs.20,000 - Rs.5,000 (B/R) = Rs.15,000

Current Liabilities = Rs.10,000 - Rs.5,000 (Creditors) = Rs.5,000

![]()

d) Payment of final dividend already declared- Improve

Reason- Current Asset (Cash/Bank) decreases with an equal decrease in current liabilities.

e) Purchase of Stock-in-Trade on credit- Decline

Reason: Lead to increase in Current Assets with an equal increase in Current Liabilities.

![]()

f) B/R endorsed to a Creditor dishonoured- Decline

Reason: It will result into increase in Current Assets and Current Liabilities by same amount.

![]()

g) Purchase of stock in trade for cash - No effect

Reason: Current Asset increase and decreases by same amount

h) Sale of Fixed Asset (BV-Rs.50,000) for Rs.45,000- Improve

Reason: Current Asset increases by Rs.45,000 without any affect on current liabilities.

i) Sale of Fixed Asset (BV-Rs.50,000) for Rs.60,000- Improve

Reason: Current Asset increases by Rs.60,000 without any affect on current liabilities.

Solution Ex. 14

For Current Ratio to be 1 : 1, Lets assume, Current Assets are Rs 10,000 and Current Liabilities to be Rs 10,000. Accordingly,

(a) Cash Paid to Trade Payable- No Change

![]()

(b) Purchase of Stock in Trade on credit- No Change

![]()

(c) Purchase of Stock in Trade for cash- No Change

![]()

(d) Payment of dividend-No Change

![]()

(e) Bills Payable discharged- No Change

![]()

(f) B/R endorsed to a creditor- No Change

![]()

(g) B/R endorsed to a creditor dishonoured- No Change

![]()

For Current Ratio to be 0.8 : 1, Lets assume, Current Assets are Rs 80,000 and Current Liabilities to be Rs 1,00,000. Accordingly,

(a) Cash Paid to Trade Payable- Reduce

![]()

(b) Purchase of Stock in Trade on credit- Improve

![]()

(c) Purchase of Stock in Trade for cash- No Change

![]()

(d) Payment of dividend-Reduce

![]()

(e) Bills Payable discharged- Reduce

![]()

(f) B/R endorsed to a creditor- Reduce

![]()

(g) B/R endorsed to a creditor dishonoured- Improve

![]()

Accounting Ratios Exercise 4.93

Solution Ex. 15

Quick Assets or Liquid Assets = Current Assets - Inventories - Pre-paid Expenses

= Rs.20,00,000 - Rs.50,000 - Rs.10,000 = Rs.1,40,000

![]()

Solution Ex. 16

Quick Assets = Rs.1,50,000

Inventory = Rs.40,000

Prepaid Expenses = Rs.10,000

Current Assets = Quick Assets + Inventory + Prepaid Expenses

= Rs.1,50,000 + Rs.40,000 + Rs.10,000

= Rs.2,00,000

Working Capital = Current Assets - Current Liabilities

Rs.1,20,000 = Rs.2,00,000 - Current Liabilities

Current Liabilities = Rs.80,000

![]()

Solution EX. 17

Current Liabilities = Current Assets - Working Capital

= Rs.3,00,000 - Rs.2,52,000 = Rs.48,000

Quick Assets = Current Assets - Inventories

= Rs.3,00,000 - Rs.60,000 = Rs.2,40,000

![]()

Solution Ex. 18

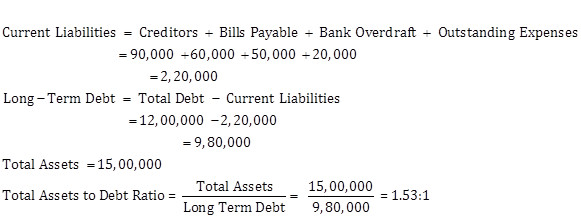

Current Liabilities = Total Debts - Long-term Debts

= Rs.7,80,000 - Rs.6,00,000

= Rs.1,80,000

Current Assets = Current Liabilities + Working Capital

= Rs.1,80,000 + Rs.3,60,000

= Rs.5,40,000

Quick Assets = Current Assets - Stock

= Rs.5,40,000 - Rs.1,80,000

= Rs.3,60,000

![]()

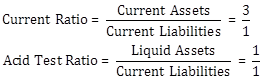

Solution Ex. 19

Current Liabilities = 6,00,000

Current Assets = 3 x Current Liabilities

= 3 x Rs.6,00,000 = Rs.18,00,000

Liquid Assets = 1 x Rs.6,00,000 = Rs.6,00,000

Inventory = Current Assets - Liquid Assets

= Rs.18,00,000 - Rs.6,00,000 = Rs.12,00,000

Solution Ex. 20

Solution Ex. 21

Solution Ex. 22

Solution Ex. 23

Solution Ex. 24

Solution Ex. 25

Solution Ex. 26

Quick Ratio = 2:1

Let Quick Assets be = Rs.20,000

Current Liabilities = Rs.10,000

i. Purchase of goods for Cash- Reduce

Reason: This transaction will result decrease in cash and increases in stock. Liquid Asset will decrease due payment for goods purchased.

Example: Purchase of goods Rs.5,000 for cash

Quick Assets = Rs.20,000 - Rs.5,000 (Cash) = Rs.15,000

![]()

ii. Purchase of goods on Credit- Reduce

Reason: Purchase of goods on credit will result increase in Current Liabilities and no change in Quick Assets.

Example: Purchase of goods on Credit Rs.5,000

Current Liabilities = Rs.10,000 + Rs.5,000 (Creditors) = Rs.15,000

![]()

iii. Sale of goods for Rs.10,000- Improve

Reason: Sale of goods will result in increase in Quick Assets by the amount Rs.10,000 in the form of either in cash or debtor. This transaction will result no change in current liabilities.

![]()

iv. Sale of goods costing Rs.10,000 of or Rs.11,000- Improve

Reason: This transaction will increase the Quick Assets by Rs.11,000 in the form of either in cash or debtors but no effect on the Current Liabilities.

Quick Assets after sale of goods = Rs.20,000 + Rs.11,000 = Rs.31,000

![]()

v. Cash received from Trade Receivables- No change

Reason: This transaction results increase in one quick asset in the form of cash and decrease in other quick asset in the form of debtors with an equal amount. Therefore it results in no change in the total of Quick Assets.

Example: Cash received from debtors Rs.5,000

Quick Assets = Rs.20,000 + Rs.5,000 (Cash) - Rs.5,000 (Debtors) = Rs.20,000

![]()

Solution Ex. 27

|

Transaction |

Impact |

|

Purchase of loose tools Rs.2,000 |

As cash is going out, quick assets are decreasing by 2,000. So, quick ratio will decrease. |

|

Insurance premium paid in advance Rs.500 |

As cash is going out, quick assets are decreasing by 500. So, quick ratio will decrease. |

|

Sale of goods on credit Rs.3,000 |

As debtors increase, quick assets also increase by 3,000. So, quick ratio will increase. |

|

Honoured a bills payable Rs.5,000 on maturity |

As cash is going out, quick assets are decreasing by 5,000 and since bill is honoured current liabilities are decreasing. Thus, quick ratio will decrease. |

Accounting Ratios Exercise 4.94

Solution Ex. 28

Solution Ex. 29

Solution Ex. 30

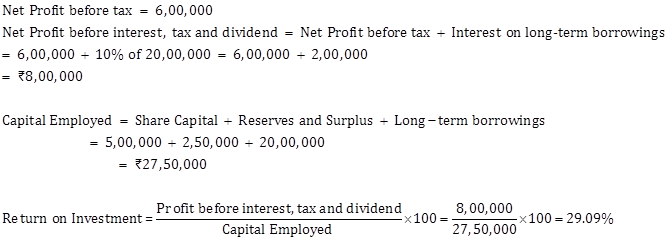

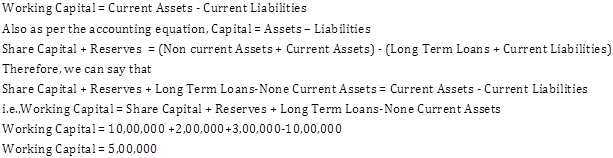

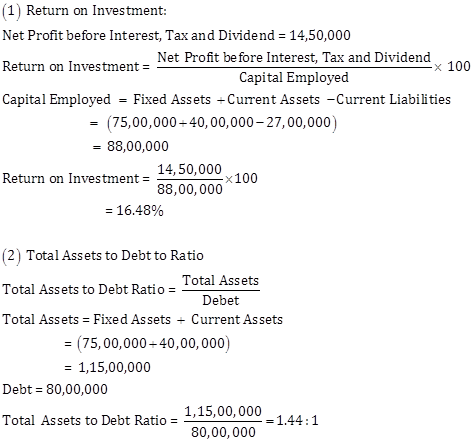

Capital Employed = Rs.10,00,000

Fixed Assets = Rs.7,00,000

Current Assets = Capital Employed + Current Liabilities - Fixed Assets = Rs.10,00,000 + Rs.1,00,000 - Rs.7,00,000

= Rs.4,00,000

![]()

Solution Ex. 31

Current Assets

= Inventory + Trade Receivables + Cash and Cash Equivalents

= Rs.50,000 + Rs.30,000 + Rs.20,000

= Rs.1,00,000

Current Liabilities

= Short-term Borrowings + Trade Payables + Provision for Tax

= Rs.3,000 + Rs.13,000 + Rs.4,000

= Rs.20,000

Quick Assets

= Trade Receivables + Cash and Cash Equivalents

= Rs.30,000 + Rs.20,000

= Rs.50,000

Comments:

1. Ideal Current Ratio for a business is considered to be 2:1. But in this case the ratio is quite high i.e. 5:1. This may be due to the following reasons:

(i) Blockage of Funds in Stock

(ii) High Amount outstanding from Debtors

(iii) Huge Cash and Bank Balances

2. Ideal Quick Ratio of a business is supposed to be 1:1. This implies that Liquid Assets should be equal to the Current Liabilities. But in the given case Quick Ratio is 2.5: 1 which indicates that the Liquid Assets are quite high in comparison to the Current Liabilities.

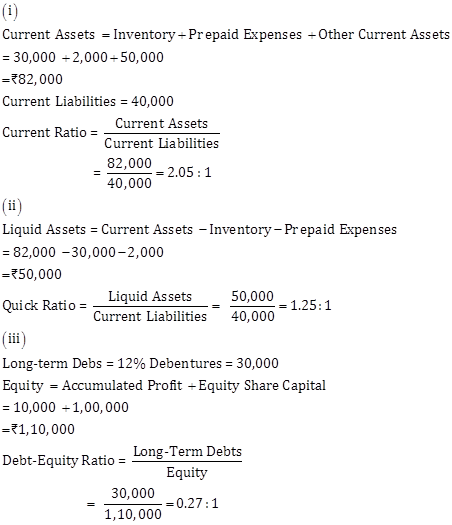

Solution Ex. 32

Current Assets = Total Assets - Fixed Assets - Non-Current Investments - Long term Loans and Advances

Therefore, Current Assets = 8,00,000 - 3,00,000 - 50,000 - 50,000 =4,00,000

And Current Liabilities = Total Debt - Non-Current Liabilities

= 6,00,000 - 2,00,000 - 2,00,000= 2,00,000

Solution Ex. 33

Equity

= Equity Share Capital + General Reserve + Accumulated Profits

= Rs.5,00,000 + Rs.90,000 + Rs.50,000 = Rs.6,40,000

Debt = 10% Debentures = Rs.1,30,000

![]()

Solution Ex. 34

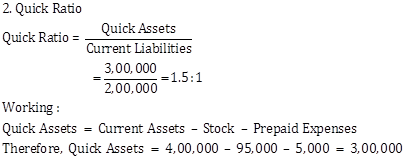

Total Debts = Rs.1,80,000

Current Liabilities = Rs.20,000

Long-term Debts = Total Debts - Current Liabilities

= Rs.1,80,000 - Rs.20,000 = Rs.1,60,000

Equity = Total Assets - Total Liabilities

= Rs.2,60,000 - Rs.1,80,000 = Rs.80,000

![]()

Accounting Ratios Exercise 4.95

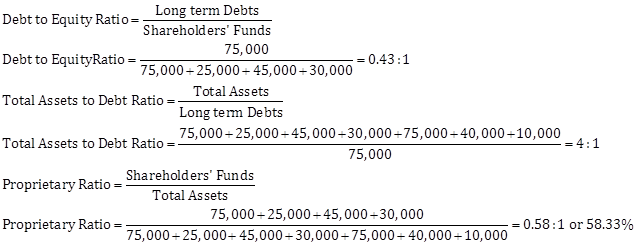

Solution Ex. 35

Long-Term Debt = Debentures = Rs.75,000

Shareholder's Funds = Equity Share Capital + Preference Share Capital + General Reserve + Surplus

= Rs.1,00,000 + Rs.50,000 + Rs.45,000 + Rs.20,000

= Rs.2,15,000

![]()

Solution Ex. 36

Debt-Equity Ratio = 2:1

Let Long-term loan = Rs.20,00,000

Shareholders' Funds = Rs.10,00,000

i. Sale of Land (Book Value Rs.4,00,000) for Rs.5,00,000- Decrease

Reason: This transaction will result increase in Shareholders' Funds by Rs.1,00,000 as profit on sale of Land.

Shareholders' Funds after adjusting profit on sale of land = Rs.10,00,000

![]()

ii. Issue of Equity share for the purchase of plant and Machinery worth Rs.10,00,000 - Decrease Reason: This transaction will increase the amount of Shareholders Fund by Rs.10, 00,000 in the form of equity shares and have no effect on Long-term Loans.

![]()

iii. Issue of preference Shares for redemption of 13% Debentures worth Rs.10,00,000- Decrease Reason: This transaction will lead to decrease in Long-term Loan by Rs.10,00,000 in the form of redemption of debentures and increase in Shareholders' Funds with the same amount in the form of Preference Shares.

networ

Solution Ex. 37

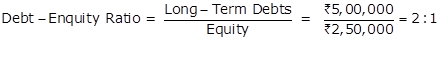

Total Assets = Rs.12,50,000

Total Debts = Rs.10,00,000

Equity = Total Assets - Total Liabilities

= Rs.12,50,000 - Rs.10,00,000

= Rs.2,50,000

Long-term Debts = Total Debts - Current Liabilities

= Rs.10,00,000 - Rs.5,00,000

= Rs.5,00,000

Solution Ex. 38

Shareholders' Funds = Rs.2,00,000

Capital Employed = Rs.8,00,000

Long-Term Debts = Capital Employed - Shareholders' Funds

= Rs.8,00,000 - Rs.2,00,000

= Rs.6,00,000

![]()

Solution Ex. 39

i. Debt-Equity Ratio: An indicator of Long-term financial health.

![]()

Debt = Loan from IDBI @ 9% = Rs.30,00,000

Equity = 10% Preference Share Capital + Equity Share Capital + Reserves and Surplus

= Rs.5,00,000 + Rs.15,00,000 + Rs.4,00,000 = Rs.24,00,000

![]()

ii. Current Ratio: An indicator of short-term financial portion.

![]()

Current Assets = Rs.12,00,000

Current Liabilities = Rs.8,00,000

![]()

Note: Securities Premium Reserve is not to be considered while computing Equity because it is already included in the amount of Reserves and Surplus.

Solution Ex. 40

![]()

Debt = Long-Term Borrowings + Long-Term Provisions

= 4,20,000 + 1,40,000 = 5,60,000

Equity = Total Assets - Total Debts

= {(8,40,000 - 1,40,000) + 14,000 + 56,000 + 3,50,000} - {4,20,000 + 1,40,000 + 2,80,000}

= 2,80,000

![]()

Solution Ex. 41

Debt Equity Ratio = 0.5:1

Let, Long-term Loans be Rs.10,00,000

and Shareholders' Funds Rs.20,00,000

![]()

i. Issue of Equity shares- Decrease

Reason: Results in increase in Shareholders' Funds with no change in Long-term Loan.

Example: Issue of equity share Rs.10,00,000

Shareholders' Funds after issue of equity shares = Rs.20,00,000 + Rs.10,00,000 = Rs.30,00,000

![]()

ii. Cash received from Debtors- No Change

Reason: Cash received increases one current asset in the form of cash and decreases other assets (debtors). But, it will not have any effect on Long-term Loan and Shareholders' Funds.

iii. Redemption of Debentures- Decrease

Reason: Results in decrease in Long-term Loans in the form of reduction in debtors with no change in Shareholders' Funds.

Example: Redemption of Debentures Rs.4,00,000

Long-term Loan = Rs.10,00,000 - Rs.4,00,000 = Rs.6,00,000

![]()

iv. Purchased of goods on Credit- No Change

Reason: It will not affect the transaction because purchase of goods results in no change in Long-term Loan and Shareholders' Funds.

Solution Ex. 42

Debt Equity Ratio = 2 : 1

Let, Debt be Rs.10,00,000

and Equity be Rs.5,00,000

![]()

i. Issue of New Shares for Cash (Say 2,50,000)- Decrease

Reason:

![]()

ii. Conversion of debentures into Equity Shares (Say 2,50,000)- Decrease

Reason:

![]()

iii. Sale of Fixed Asset at Profit (Say 2,50,000)- Decrease

Reason:

![]()

iv. Purchase of Fixed Asset on Long-term Deferred Payment Basis- Increases

Reason:

![]()

v. Payment to Creditors- No Change

Reason:

![]()

Accounting Ratios Exercise 4.96

Solution Ex. 43

Long-Term Debt (Debentures) = 2,50,000

Equity = Equity Share Capital + 10% Preference Share Capital + Reserves and Surplus

= 5,00,000 + 5,00,000 + 2,40,000 = 12,40,000

![]()

Solution Ex. 44

Long - Term Debts = Rs.4,00,000

Total Assets = Rs.7,70,000

![]()

Solution Ex. 45

Total Debts = Rs.3,60,000

Shareholders' Funds = Rs.1,60,000

Current Liabilities = Rs.40,000

Total Assets = Total Debts + Shareholders' Funds

= Rs.3,60,000 + Rs.1,60,000

= Rs.5,20,000

Long-term Debts = Total Debt - Current Liabilities

= Rs.3,60,000 - Rs.40,000

= Rs.3,20,000

![]()

Solution Ex. 46

Total Assets = Land and Buildings + Trade Receivables + Cash and Cash Equivalents + Investments (Trade)

And, Long Term Debts = Capital Employed - Shareholders' funds

![]()

Total Assets = Land and Buildings + Trade Receivables + Cash and Cash Equivalents + Investments (Trade)

= Rs.60,00,000 + Rs.4,00,000 + Rs.5,00,000 + Rs.1,00,000

= Rs.70,00,000

Long Term Debts = Capital Employed - Shareholders' funds*

= Rs.50,00,000 - Rs.40,00,000

= Rs.10,00,000

*Shareholder's Fund = Share Capital + Reserve and Surplus

= Rs.35,00,000 + Rs.3,00,000 + Rs.2,00,000

= Rs.40,00,000

![]()

Solution Ex. 47

![]()

Total Assets = Total Liabilities = Total Debt + Shareholders' Funds

= Rs.60,00,000 + Rs.10,00,000

= Rs.70,00,000

Working Capital = Current Assets - Current Liabilities

Rs.5,00,000 = Rs.25,00,000 - Current Liabilities

Current Liabilities = Rs.20,00,000

Long Term Debts = Total Debt - Current Liabilities

= Rs.60,00,000 - Rs.20,00,000

= Rs.40,00,000

![]()

Accounting Ratios Exercise 4.97

Solution Ex. 48

![]()

Capital Employed = Total Assets - Current Liabilities

Rs.15,00,000 = Total Assets - Rs.5,00,000

Total Assets =Rs.20,00,000

Long Term Debt = Total Debt - Current Liabilities

= Rs.15,00,000 - Rs.5,00.000

= Rs.10,00,000

![]()

Solution Ex. 49

Solution Ex. 50

Debt = Total Debt - Current Liabilities

Total Debt = 12,00,000

Working Capital = Current Asset - Current Liabilities

Current Liabilities = Working Capital - Current Assets = 5,00,000 - 1,00,000 = 4,00,000

Debt = 12,00,000 - 4,00,000 = 8,00,000

Total Assets = Shareholders' Funds + Total Debt

= 2,00,000 + 12,00,00= 14,00,000

![]()

![]()

Solution Ex. 51

![]()

Debt = Total Debt - Current Liabilities

= 12,00,000 - 4,00,000 = 8,00,000

Total Assets = Capital Employed + Current Liabilities = 12,00,000 + 4,00,000 = 16,00,000

![]()

Solution Ex. 52

![]()

Debts = Long-term Borrowings + Long-term Provisions = 3,00,000 + 1,00,000 = 4,00,000

Total Assets = Current Assets + Non-Current Assets

= Current Assets + (Fixed Assets - Depreciation) + Non-Current Investments + Long-term Loans and Advances

= 2,50,000 + (6,00,000 - 1,00,000) + 10,000 + 40,000 = 8,00,000

![]()

Solution Ex. 53

Solution Ex. 54

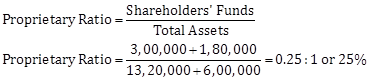

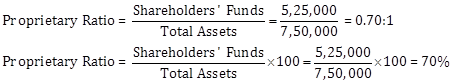

Total Assets = Fixed Assets + Current Assets + Short-term Investments

= Rs.3,75,000 + Rs.1,50,000 + Rs.2,25,000

= Rs.7,50,000

Shareholders' Funds

= Equity Share Capital + Preference Share Capital + Reserves and Surplus

= Rs.3,00,000 + Rs.1,50,000 + Rs.75,000

= Rs.5,25,000

![]()

Solution Ex. 55

Total Assets = Fixed Assets + Trade Investments + Current Assets

= Rs.7,00,000 + Rs.2,45,000 + Rs.3,00,000

= Rs.12,45,000

Shareholders' Funds

= Equity Share Capital + 10% Preference Share Capital + Reserves and Surplus

= Rs.4,50,000 + Rs.3,20,000 + Rs.65,000 = Rs.8,35,000

![]()

![]()

Accounting Ratios Exercise 4.98

Solution Ex. 56

Total Assets = Non-Current Assets + Current Assets (Short-term Investments + Inventories + Trade Receivables + Cash and Cash Equivalents)

= Rs.5,00,000 + (Rs.1,50,000 + Rs.1,00,000 + Rs.1,50,000 + Rs.1,00,000)

= Rs.10,00,000

Shareholders' Funds = Share Capital + Reserves and Surplus

= Rs.6,00,000 + Rs.1,50,000

= Rs.7,50,000

![]()

![]()

Solution Ex. 57

|

Transaction |

Impact |

|

Obtained a loan of Rs.5,00,000 from State Bank of India payable after five years. |

As cash is coming in, total assets increase by 5,00,000. However, since shareholders' funds remain intact therefore proprietary ratio will decrease. |

|

Purchased machinery of Rs.2,00,000 by cheque. |

As cash is going out and machinery is coming in, total assets are increasing and decreasing by 2,00,000 simultaneously. Thus, both numerator and denominator remain intact and so proprietary ratio will not change. |

|

Redeemed 7% Redeemable Preference Shares Rs.3,00,000. |

Shareholders' funds and total assets both decrease by 3,00,000 simultaneously and so proprietary ratio decreases. |

|

Issued equity shares to the vendor of building purchased for Rs.7,00,000. |

Shareholders' funds and total assets both increase by 7,00,000 simultaneously and so proprietary ratio improves. |

|

Redeemed 10% redeemable debentures of Rs.6,00,000 |

As cash is going out, total assets decrease by 6,00,000. However, since shareholders' funds remain intact therefore proprietary ratio will improve. |

Solution Ex. 58

Solution Ex. 59

Solution Ex. 60

![]()

![]()

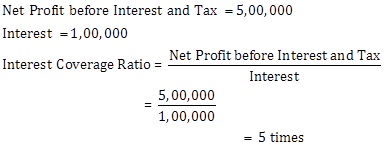

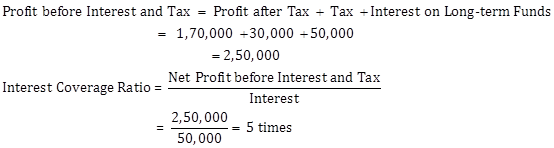

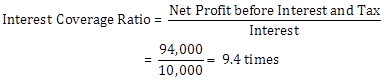

Total Interest Amount

= Interest on Debentures + Interest on Long-term loans from Bank

= Rs.5,000 + Rs.5,000 = Rs.10,000

Profit before Interest and Tax = Profit after Tax + Tax + Interest

= Rs.75,000 + Rs.9,000 + Rs.10,000

= Rs.94,000

Accounting Ratios Exercise 4.99

Solution Ex. 61

Solution Ex. 62

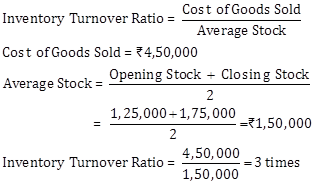

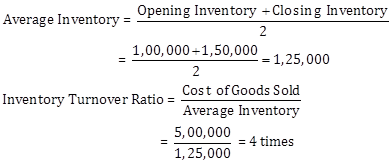

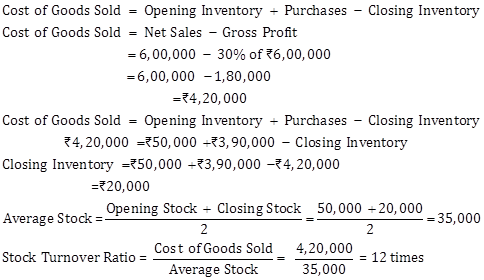

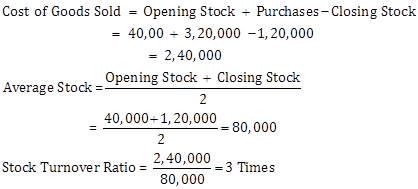

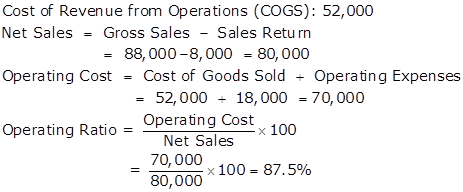

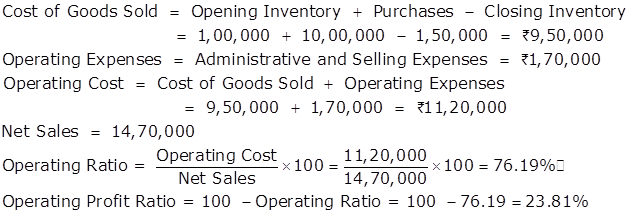

Cost of Goods Sold = Opening Inventory + Purchases - Closing Inventory

Rs.5,00,000 = Rs.1,00,000 + Rs.5,50,000 - Closing Inventory

Closing Inventory = Rs.1,50,000

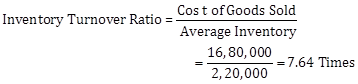

Solution Ex. 63

Solution Ex. 64

Solution Ex. 65

Cost of Revenue from Operations = Revenue from Operations + Gross Loss

= 16,00,000 + 80,000 = 16,80,000

Solution Ex. 66

Solution Ex. 67

Solution Ex. 68

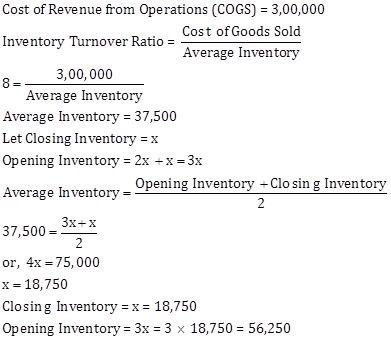

Calculation of Average Inventory:

Solution Ex. 69

a) Sale of goods for Rs.40,000 (Cost Rs.32,000)- Increase

Reason: Leads to decrease in value of closing stock which results into increase in proportion of Cost of Goods Sold and decrease in Average Stock.

b) Increase in value of Closing Inventory by 40,000 - Decrease

Reason: Results in decrease in Cost of Goods Sold and increase in Average Stock.

c) Goods purchased for Rs.80,000- Decrease

Reason: Increases the amount of Closing Stock and reduces the proportion of Cost of Goods Sold along with an increase in average stock.

d) Purchase Return Rs.20,000- Increase

Reason: Decrease Cost of Goods Sold and Average Stock with same amount.

e) Goods costing Rs.10,000 withdrawn for personal use- Increase

Reason: Decreases the amount of Closing Stock and Increases Cost of Goods Sold.

f) Goods costing Rs.20,000 distributed as free sample- Increase

Reason: Distribution of goods as free sample reduces Closing Stock which will result in increase in Cost of Goods Sold and decrease in Average Stock.

Accounting Ratios Exercise 4.100

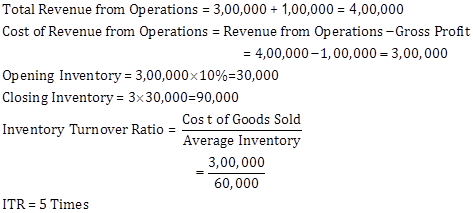

Solution Ex. 70

Solution Ex. 71

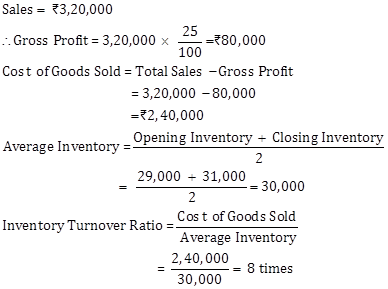

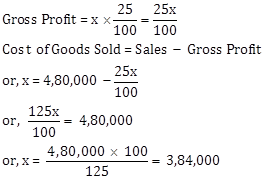

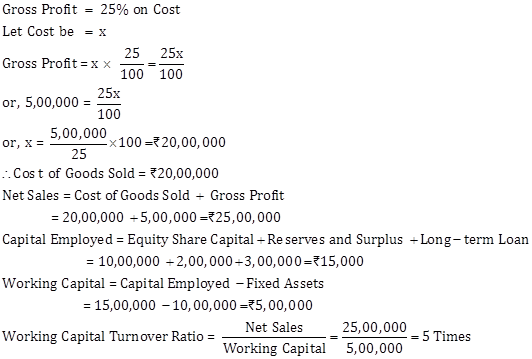

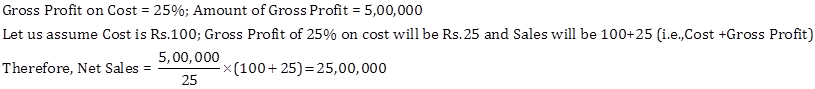

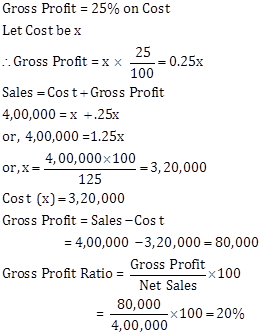

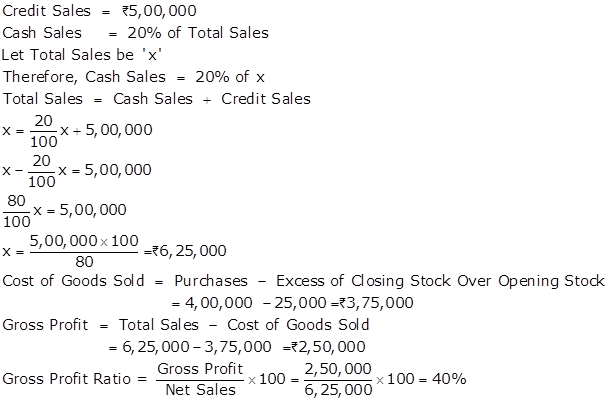

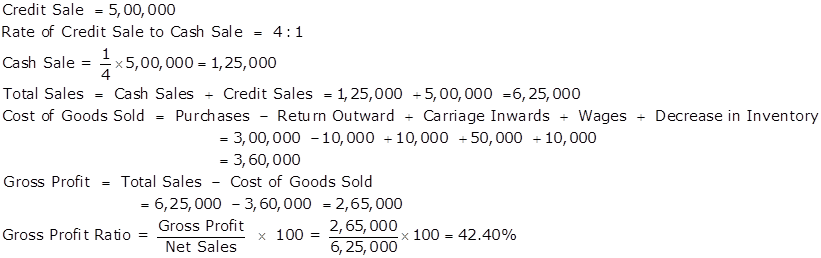

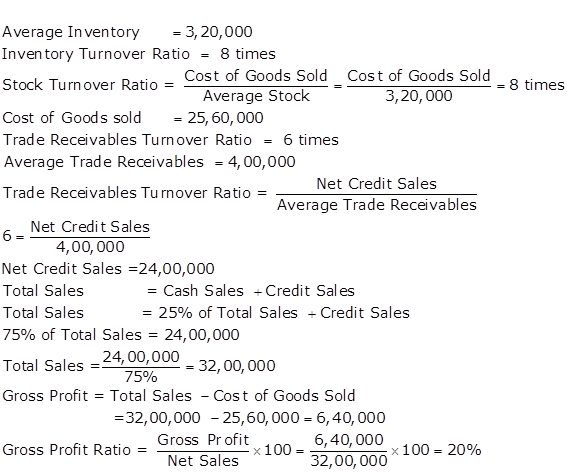

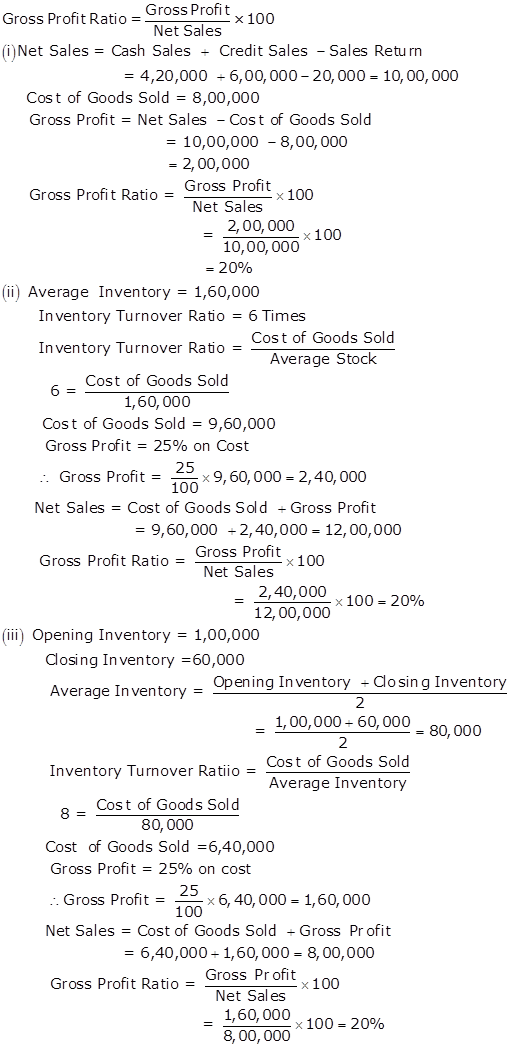

Given: Gross Profit is 25% of Cost.

Let, Cost of Goods Sold be x

Cost of Goods Sold (x) = Rs.3,84,000

Cost of Goods Sold = Opening Inventory (Stock) + Purchases - Closing Inventory (Stock)

Rs.3,84,000 = Opening Inventory + Rs.3,60,000 - Rs.68,000

Opening Inventory = Rs.3,84,000 - Rs.2,92,000 = Rs.92,000

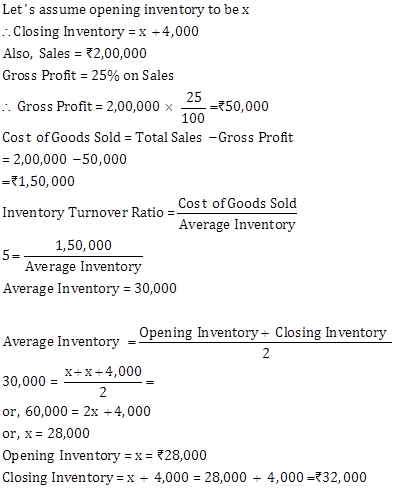

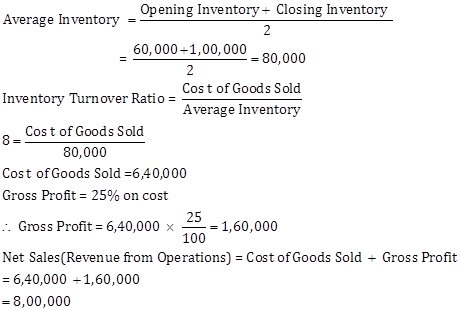

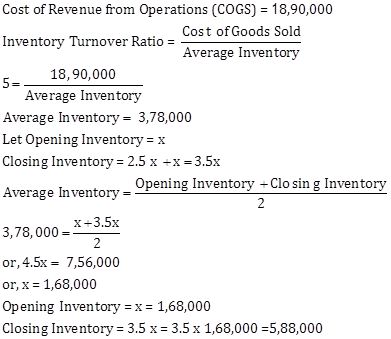

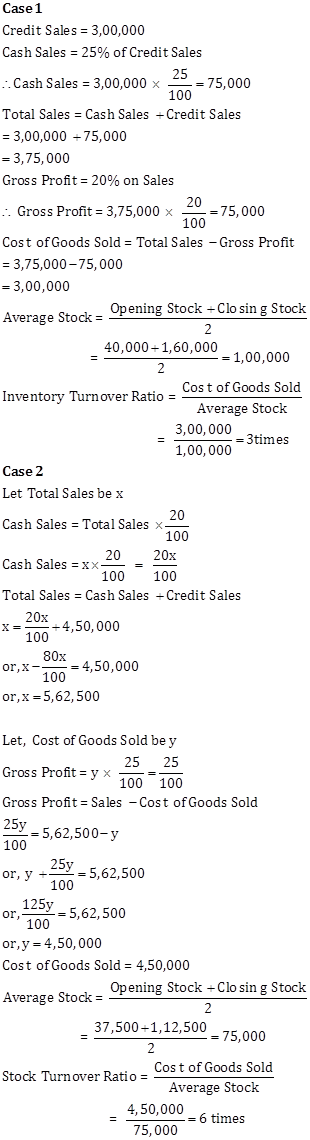

Solution Ex. 72

Solution Ex. 73

Solution Ex. 74

Solution Ex. 75

Solution Ex. 76

Solution Ex. 77

Accounting Ratios Exercise 4.101

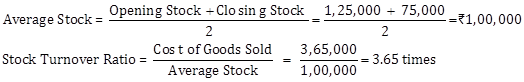

Solution Ex. 78

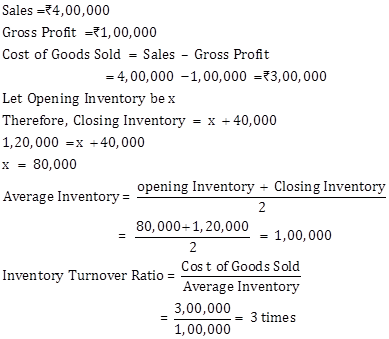

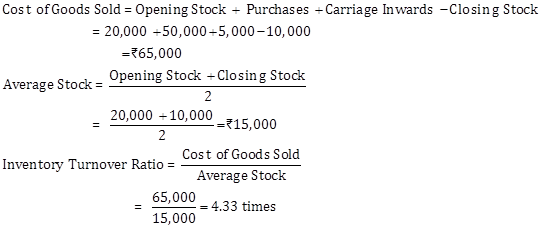

Cost of Goods Sold = Opening Stock + Purchases + Direct Expenses - Closing Stock

= Rs.1,25,000 + Rs.3,00,000 + Rs.15,000 + Rs.75,000 = Rs.3,65,000

Solution Ex. 79

Solution Ex. 80

Solution Ex. 81

Accounting Ratios Exercise 4.102

Solution Ex. 82

Solution Ex. 83

Solution Ex. 84

Solution Ex. 85

Solution Ex. 86

Solution Ex. 87

Solution Ex. 88

Solution Ex. 89

Accounting Ratios Exercise 4.103

Solution Ex. 90

Solution Ex. 91

Solution Ex. 92

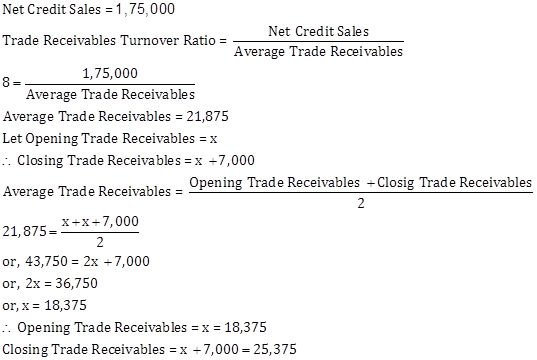

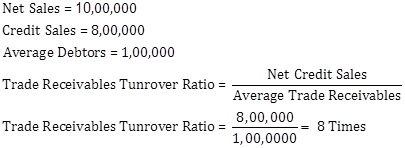

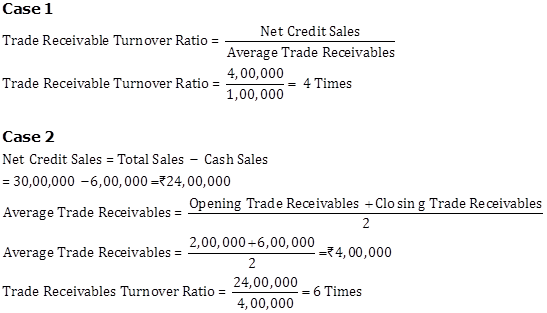

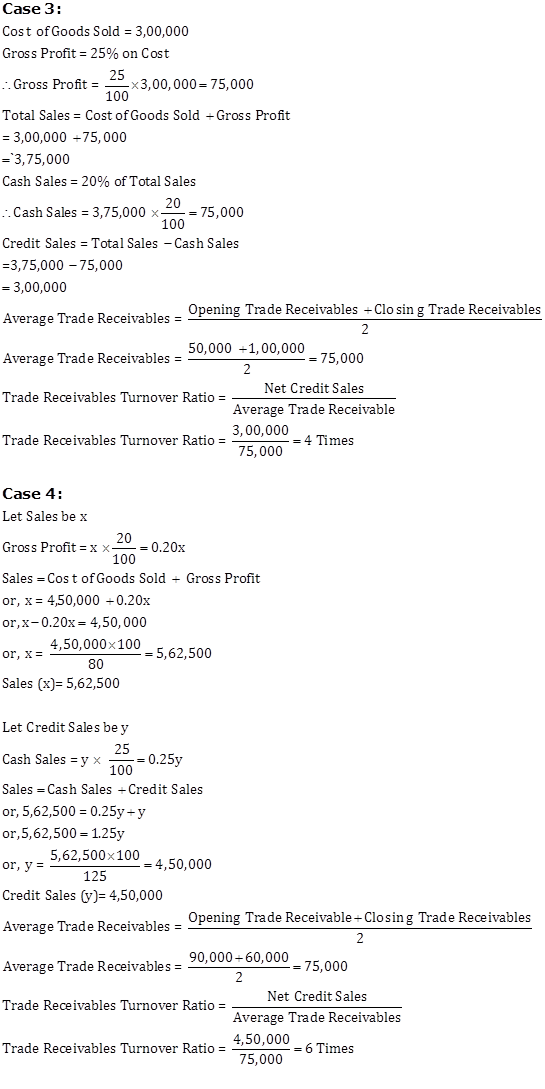

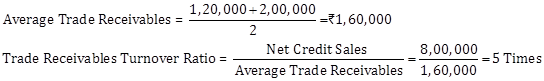

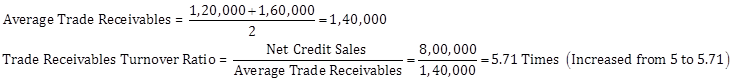

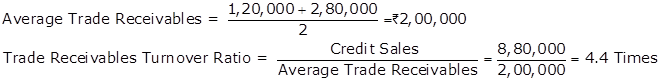

Net Credit Sales = 8,00,000

(i). Collection from Trade Receivables Rs.40,000- Increase

Reason: Collection results in decrease in the amount of closing trade receivables which reduces the amount of average trade receivables.

Closing Trade Receivables = Rs.2,00,000 - Rs.40,000 = Rs.1,60,000

(ii). Credit Revenue from Operations, i.e. Sales Rs.80,000- Decrease

Reason: Results in increase in both credit sales as well as closing receivables.

Credit Sales = 8,00,000 + 80,000 = Rs.8,80,000

Closing Trade Receivables = 2,00,000 + 80,000 = Rs.2,80,000

(iii). Sales Return Rs.20,000- Increase

Reason: Results in decrease in both sales and average trade receivables.

Credit Sales = 8,00,000 - 20,000= Rs.7,80,000

Closing Trade Receivables = 2,00,000 - 20,000 = Rs.1,80,000

(iv). Credit Purchase Rs.1,60,000 - No Change

Reason: It is only the credit sales that affects the DTR, credit purchases does not affect the Debtors Turnover Ratio.

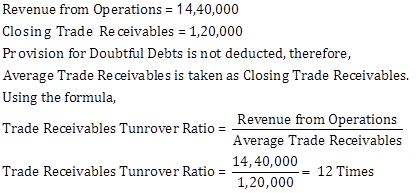

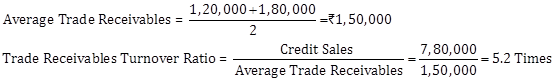

Solution Ex. 93

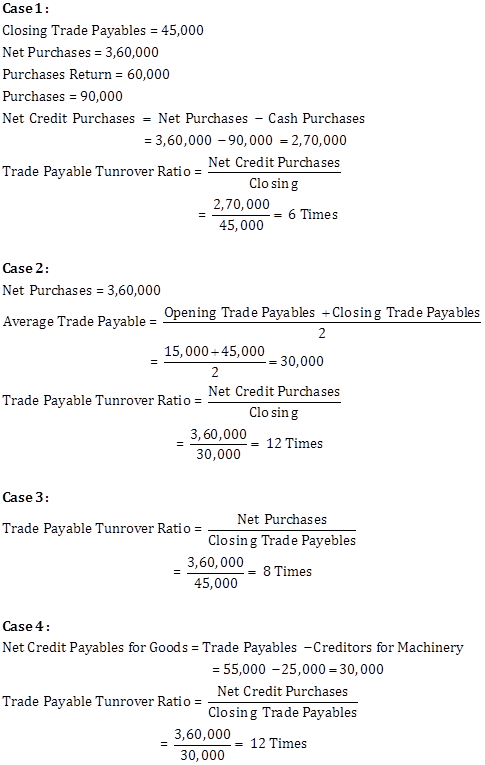

Total Purchases = 21,00,000

Purchases Return = 1,00,000

Cash Purchases = 4,00,000

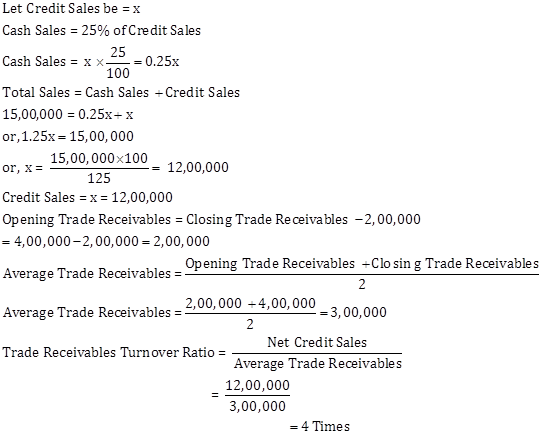

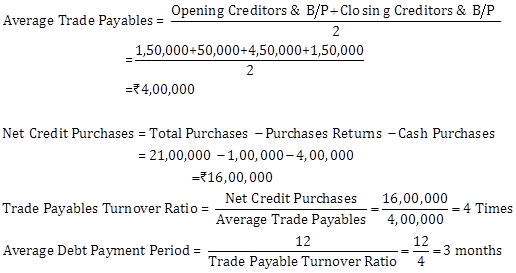

Solution Ex. 94

Given: Purchases = 9,50,000; Cash Purchases = 1,00,000 and Purchases Return = 45,000

Solution Ex. 95

Accounting Ratios Exercise 4.104

Solution Ex. 96

Solution Ex. 97

Solution Ex. 98

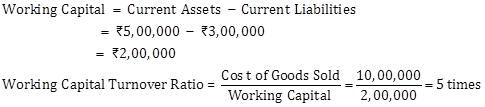

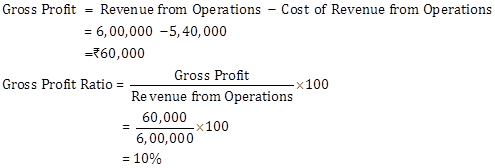

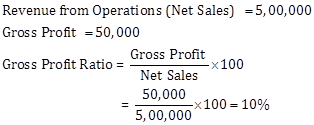

Cost of Goods Sold = 20,00,000

Net Sales = Cost of Goods Sold + Gross Profit

Solution Ex. 99

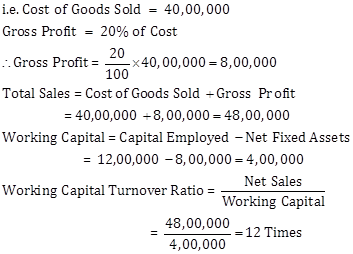

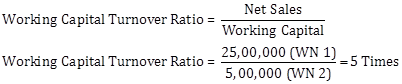

Gross Profit = 5,00,000

Solution Ex. 100

Cost of Revenue from Operations = 40,00,000

Solution Ex. 101

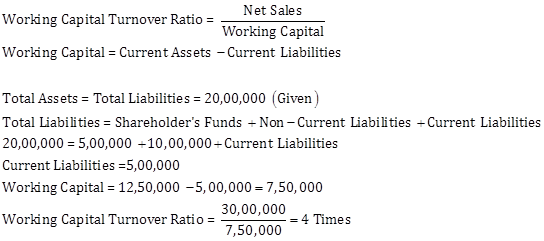

Revenue from Operations (Net Sales) = 30,00,000

Current Assets = 12,50,000

Solution Ex. 102

![]()

![]()

Solution Ex. 103

Solution Ex. 104

Solution Ex. 105

Accounting Ratios Exercise 4.105

Solution Ex. 106

Solution Ex. 107

Solution Ex. 108

Solution Ex. 109

Solution Ex. 110

(i) Purchase of Stock-in-Trade 50,000- No Change

Reason: Purchases and Closing Inventory will increase by 50,000. Accordingly, Cost of Goods Sold will not change and Gross Profit remains unaffected.

(ii) Purchases Return 15,000- No Change

Reason: Purchases and Closing Inventory will decrease by 15,000. Accordingly, Cost of Goods Sold will not change and Gross Profit remains unaffected.

(iii) Cash Sale of Stock-in-Trade 40,000- No Change

Reason: Actual Revenue from Operations will increase by 10,000 and gross profit by 10,000 (25% of 40,000). Thus, Gross Profit Ratio will remain same.

(iv) Stock-in-Trade costing 20,000 withdrawn for personal use- No Change

Reason: Purchases and Closing stock both will decrease by 20,000 leaving cost of revenue from operations unaffected. So, Gross Profit Ratio will not change.

(v) Stock-in-Trade costing 15,000 distributed as free sample- No Change

Reason: Purchases and Closing stock both will decrease by 15,000 leaving cost of revenue from operations unaffected. So, Gross Profit Ratio will not change.

Solution Ex. 111

Solution Q 112

*Note:

Sales Return has already been adjusted in the sales figure.

Solution Ex. 113

Solution Ex. 114

Accounting Ratios Exercise 4.106

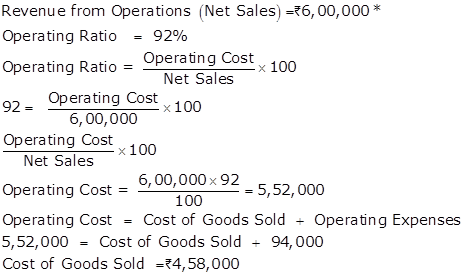

Solution Ex. 115

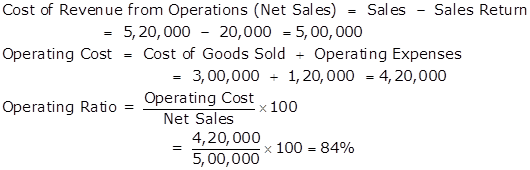

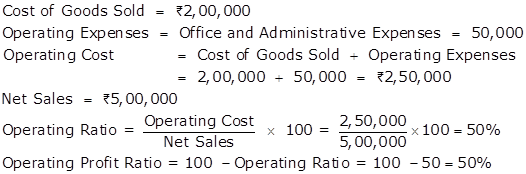

Operating Cost = Rs.9,00,000

Operating Cost = Cost of Revenue from Operations + Operating Expenses Rs.9,00,000 = Cost of Revenue from Operations + Rs.1,00,000

Cost of Revenue from Operations = Rs.8,00,000

Solution Ex. 116

Solution Ex. 117

Solution Ex. 118

Solution Ex. 119

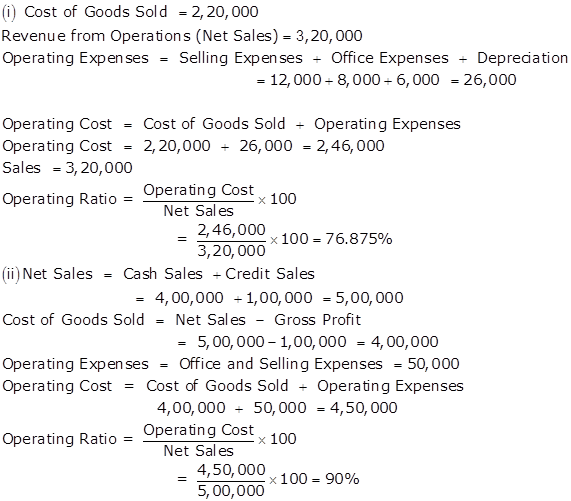

Operating Ratio = 82.59%

Operating Ratio + Operating Profit Ratio = 100%

Operating Profit Ratio = 100% - 82.59% = 17.41%

Solution Ex. 120

Solution Ex. 121

Solution Ex. 122

Solution Ex. 123

Solution Ex. 124

Solution Ex. 125

Solution Ex. 126

Accounting Ratios Exercise 4.107

Solution Ex. 128

Solution Ex. 127

Solution Ex. 129

Solution Ex. 130

Solution Ex. 131

Solution Ex. 132

Accounting Ratios Exercise 4.108

Solution Ex. 133

Solution Ex. 134

|

Transaction |

Impact |

|

Purchase of machinery worth Rs.10,00,000 by issue of equity shares. |

Issue of shares will lead to an increase in the capital employed by Rs.10,00,000. But profit remains intact and so there will be a decline in the return on investment ratio. |

|

Charging depreciation of Rs.25,000 on machinery. |

Simultaneous decrease in profits and capital employed by Rs.25,000 will lead to a decline in return on investment ratio. |

|

Redemption of debentures by cheque Rs.2,00,000. |

Redemption of debentures will lead to a decrease in the capital employed by Rs.2,00,000. But profit remains intact and so there will be an increase in the return on investment ratio. |

|

Conversion of 9% Debentures of Rs.1,00,000 into equity shares. |

Decrease in debentures and increase in share capital causing a simultaneous increase and decrease in capital employed will leave the return on investment ratio unchanged. |

Solution Ex. 135

Solution Ex. 136

Accounting Ratios Exercise 4.109

Solution Ex. 137

Solution Ex. 138

Solution Ex. 139

Solution Ex. 140

Solution Ex. 141

Accounting Ratios Exercise 4.110

Solution Ex. 142

Solution Ex. 143

Solution Ex. 144

Solution Ex. 145

Solution Ex. 146

Solution Ex. 147