Class 11-commerce T S GREWAL Solutions Accountancy Chapter 14: Depreciation

Depreciation Exercise 14.48

Solution PQ 1

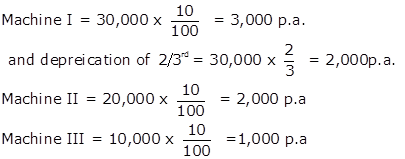

Calculation of Deprecation Amount and Rate

Deprecation (amount) = ![]()

Deprecation

(Rate) = ![]()

Solution PQ 2

|

In the Book of X Ltd. Machinery Account |

|||||||

|

Dr. |

|

|

|

|

|

|

Cr. |

|

Date |

Particulars |

J.F |

Rs. |

Date |

Particulars |

J.F. |

Rs. |

|

2016 |

|

|

|

2017 |

|

|

|

|

Apr 01 |

To Bank A/c |

|

4,00,000 |

Mar 31 |

By Depreciation A/c |

|

40,000 |

|

Apr 01 |

To Bank A/c |

|

50,000 |

|

By Balance c/d |

|

4,10,000 |

|

|

(Erection Expense) |

|

|

|

|

|

|

|

|

|

|

4,50,000 |

|

|

|

4,50,000 |

|

2017 |

|

|

|

2018 |

|

|

|

|

Apr 01 |

To Balance b/d |

|

4,10,000 |

Mar 31 |

By Depreciation A/c |

|

40,000 |

|

|

|

|

|

|

By Balance c/d |

|

3,70,000 |

|

|

|

|

4,10,000 |

|

|

|

4,10,000 |

|

2018 |

|

|

|

2019 |

|

|

|

|

Apr 01 |

To Balance b/d |

|

3,70,000 |

Mar 31 |

By Depreciation A/c |

|

40,000 |

|

|

|

|

|

Mar 31 |

By Balance c/d |

|

3,30,000 |

|

|

|

|

3,70,000 |

|

|

|

3,70,000 |

Calculation of Deprecation Amount

![]()

Solution PQ 3

|

Furniture Account |

|||||||||

|

Dr. |

|

|

|

|

|

|

|

|

Cr. |

|

Date |

Particulars |

|

J.F. |

Rs. |

Date |

Particulars |

|

J.F. |

Rs. |

|

2015 |

|

|

|

|

2016 |

|

|

|

|

|

Apr 01 |

To Bank A/c |

|

|

55,000 |

Mar 31 |

By Depreciation A/c Furniture 1 |

|

|

5000 |

|

|

|

|

|

|

Mar 31 |

By Balance c/d Furniture 1 |

|

|

50,000 |

|

|

|

|

|

55,000 |

|

|

|

|

55,000 |

|

2016 |

|

|

|

|

2017 |

|

|

|

|

|

Apr 01 |

To Balance b/d |

|

|

50,000 |

Mar 31 |

By Depreciation A/c |

|

|

|

|

|

Furniture 1 |

|

|

|

|

Furniture 1 |

5,000 |

|

|

|

Apr 01 |

To Bank A/c |

|

|

9,500 |

|

Furniture 2 |

900 |

|

5,900 |

|

|

Furniture 2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mar 31 |

By Balance c/d |

|

|

|

|

|

|

|

|

|

|

Furniture 1 |

45,000 |

|

|

|

|

|

|

|

|

|

Furniture 2 |

8,600 |

|

53,600 |

|

|

|

|

|

59,500 |

|

|

|

|

59,500 |

|

2017 |

|

|

|

|

2018 |

|

|

|

|

|

Apr 01 |

To Balance b/d |

|

|

|

Mar 31 |

By Depreciation A/c |

|

|

|

|

|

Furniture 1 |

45,000 |

|

|

|

Furniture 1 |

5,000 |

|

|

|

|

Furniture 2 |

8,600 |

|

53,600 |

|

Furniture 2 |

900 |

|

5,900 |

|

|

|

|

|

|

Mar 31 |

By Balance c/d |

|

|

|

|

|

|

|

|

|

|

Furniture 1 |

40,000 |

|

|

|

|

|

|

|

|

|

Furniture 2 |

7,700 |

|

47,700 |

|

|

|

|

|

53,600 |

|

|

|

|

53,600 |

|

2018 |

|

|

|

|

2019 |

|

|

|

|

|

Apr 01 |

To Balance b/d |

|

|

|

Mar 31 |

By Depreciation A/c |

|

|

|

|

|

Furniture 1 |

40,000 |

|

|

|

Furniture 1 |

5,000 |

|

|

|

|

Furniture 2 |

7,700 |

|

47,700 |

|

Furniture 2 |

900 |

|

|

|

|

|

|

|

|

|

Furniture 3 |

400 |

|

6,300 |

|

Oct 01 |

To Bank A/c |

|

|

8,400 |

|

|

|

|

|

|

|

|

|

|

|

Mar 31 |

By Balance c/d |

|

|

|

|

|

|

|

|

|

|

Furniture 1 |

35,000 |

|

|

|

|

|

|

|

|

|

Furniture 2 |

6,800 |

|

|

|

|

|

|

|

|

|

Furniture 3 |

8,000 |

|

49,800 |

|

|

|

|

|

56,100 |

|

|

|

|

56,100 |

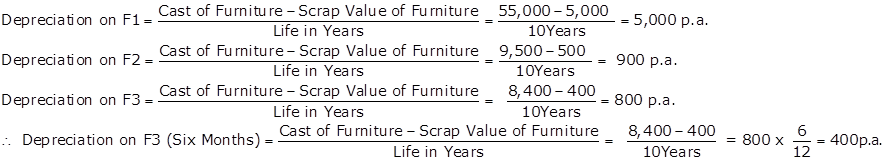

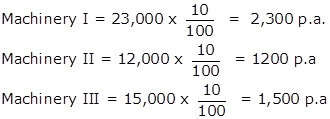

Working Note:

Calculation of Deprecation Amount

Solution PQ 4

|

Machinery Account |

||||||||

|

Dr. |

|

|

|

|

|

|

|

Cr. |

|

Date |

Particulars |

J.F. |

Rs. |

Date |

Particulars |

|

J.F. |

Rs. |

|

2018 |

|

|

|

2019 |

|

|

|

|

|

Apr 1 |

To Bank A/c |

|

50,000 |

Mar 31 |

By Depreciation A/c |

|

|

|

|

|

Machinery 1 |

|

|

|

Machinery 1 |

5,000 |

|

|

|

Sept 30 |

To Bank A/c |

|

20,000 |

|

Machinery 2 |

1,000 |

|

6,000 |

|

|

Machinery 2 |

|

|

|

|

|

|

|

|

|

|

|

|

Mar 31 |

By Balance c/d |

|

|

|

|

|

|

|

|

|

Machinery 1 |

45,000 |

|

|

|

|

|

|

|

|

Machinery 2 |

19,000 |

|

64,000 |

|

|

|

|

70,000 |

|

|

|

|

70,000 |

Note :

Repair and renewal made on December 31, 2018 will not be recorded in Machinery Account because, this repair was after putting the Machinery in to use.

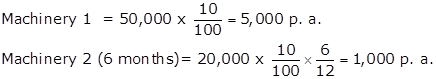

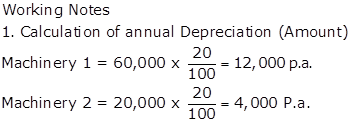

Working Note:

Calculation of Depreciation (Amount)

Solution PQ 5

|

Asset Account |

|||||||

|

Dr. |

|

|

|

|

|

|

Cr. |

|

Date |

Particulars |

J.F. |

Rs. |

Date |

Particulars |

J.F. |

Rs. |

|

2012 |

|

|

|

2013 |

|

|

|

|

Apr 01 |

To Bank A/c |

|

10,500 |

Mar 31 |

By Depreciation A/c |

|

1,000 |

|

|

|

|

|

Mar 31 |

By Balance c/d |

|

9,500 |

|

|

|

|

10,500 |

|

|

|

10,500 |

|

2013 |

|

|

|

2014 |

|

|

|

|

Apr 01 |

To Balance b/d |

|

9,500 |

Mar 31 |

By Depreciation A/c |

|

1,000 |

|

|

|

|

|

Mar 31 |

By Balance c/d |

|

8,500 |

|

|

|

|

9,500 |

|

|

|

9,500 |

|

2014 |

|

|

|

2015 |

|

|

|

|

Apr 01 |

To Balance b/d |

|

8,500 |

Mar 31 |

By Depreciation A/c |

|

1000 |

|

|

|

|

|

Mar 31 |

By Balance c/d |

|

7,500 |

|

|

|

|

8,500 |

|

|

|

8,500 |

|

2015 |

|

|

|

2016 |

|

|

|

|

Apr 01 |

To Balance b/d |

|

7,500 |

Mar 31 |

By Depreciation A/c |

|

1000 |

|

|

|

|

|

Mar 31 |

By Balance c/d |

|

6,500 |

|

|

|

|

7,500 |

|

|

|

7,500 |

|

2016 |

|

|

|

2017 |

|

|

|

|

Apr 01 |

To Balance b/d |

|

6,500 |

Mar 31 |

By Depreciation A/c |

|

1000 |

|

|

|

|

|

Mar 31 |

By Balance c/d |

|

5,500 |

|

|

|

|

6,500 |

|

|

|

6,500 |

|

2017 |

|

|

|

2018 |

|

|

|

|

Apr 01 |

To Balance b/d |

|

5,500 |

Mar 31 |

By Depreciation A/c |

|

1000 |

|

|

|

|

|

Mar 31 |

By Balance c/d |

|

4,500 |

|

|

|

|

5,500 |

|

|

|

5,500 |

|

2018 |

|

|

|

2019 |

|

|

|

|

Apr 01 |

To Balance b/d |

|

4,500 |

Mar 31 |

By Depreciation A/c |

|

1000 |

|

|

|

|

|

Mar 31 |

By Bank A/c |

|

600 |

|

|

|

|

|

Mar 31 |

By Profit and Loss A/c (Loss) |

|

2,900 |

|

|

|

|

4,500 |

|

|

|

4,500 |

(i) Depreciation Expense for the year ended March 31, 2013 = Rs.1000

(ii) The Net Book Value of the asset on March 31, 2017 = Rs.5,500

(iii) Loss on Sale of the asset on March 31, 2019 = Rs.2,900

Depreciation Exercise 14.49

Solution PQ 6

|

Machinery Account |

|||||||||

|

Dr. |

|

|

|

|

|

|

|

|

Cr. |

|

Date |

Particulars |

|

J.F |

Rs. |

Date |

Particulars |

|

J.F. |

Rs. |

|

2015 |

|

|

|

|

2016 |

|

|

|

|

|

Apr 01 |

To Bank A/c (2,40,000 +10,000) |

|

|

2,50,000 |

Mar 31 |

By Depreciation A/c |

|

|

|

|

|

Machinery 1 |

|

|

|

|

Machinery 1 |

12,500 |

|

|

|

Oct 01 |

To Bank A/c |

|

|

1,00,000 |

|

Machinery 2 (for 6 Months) |

2,500 |

|

15,000 |

|

|

Machinery 2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mar 31 |

By Balance c/d |

|

|

|

|

|

|

|

|

|

|

Machinery 1 |

2,37,500 |

|

|

|

|

|

|

|

|

|

Machinery 2 |

97,500 |

|

3,35,000 |

|

|

|

|

|

3,50,000 |

|

|

|

|

3,50,000 |

|

2016 |

|

|

|

|

2017 |

|

|

|

|

|

Apr 01 |

To Balance b/d |

|

|

|

Mar 31 |

By Depreciation A/c |

|

|

|

|

|

Machinery 1 |

2,37,500 |

|

|

|

Machinery 1 |

12,500 |

|

|

|

|

Machinery 2 |

97,500 |

|

3,35,000 |

|

Machinery 2 |

5,000 |

|

17,500 |

|

|

|

|

|

|

Mar 31 |

By Balance c/d |

|

|

|

|

|

|

|

|

|

|

Machinery 1 |

2,25,000 |

|

|

|

|

|

|

|

|

|

Machinery 2 |

92,500 |

|

3,17,500 |

|

|

|

|

|

3,35,000 |

|

|

|

|

3,35,000 |

|

2017 |

|

|

|

|

2017 |

|

|

|

|

|

Apr 01 |

To Balance b/d |

|

|

|

Oct 01 |

By Depreciation A/c (for 6 months) |

|

|

6,250 |

|

|

Machinery 1 |

2,25,000 |

|

|

Oct 01 |

To Bank A/c |

|

|

1,43,000 |

|

|

Machinery 2 |

92,500 |

|

3,17,500 |

|

(Machinery 1 sold) |

|

|

|

|

|

|

|

|

|

Oct 01 |

By Profit and loss A/c (loss on sale) |

|

|

75,750 |

|

|

|

|

|

|

2018 |

|

|

|

|

|

Oct 01 |

To Bank A/c |

|

|

2,00,000 |

Mar 31 |

By Depreciation A/c |

|

|

|

|

|

|

|

|

|

|

Machinery 2 |

5,000 |

|

|

|

|

|

|

|

|

|

Machinery 3 (for 6 months) |

5,000 |

|

10,000 |

|

|

|

|

|

|

Mar 31 |

By Balance c/d |

|

|

|

|

|

|

|

|

|

|

Machinery 2 |

87,500 |

|

|

|

|

|

|

|

|

|

Machinery 3 |

1,95,000 |

|

2,82,500 |

|

|

|

|

|

5,17,500 |

|

|

|

|

5,17,500 |

|

2018 |

|

|

|

|

2019 |

|

|

|

|

|

Apr 01 |

To Balance b/d |

|

|

|

Mar 31 |

By Depreciation A/c |

|

|

|

|

|

Machinery 1 |

87,500 |

|

|

|

Machinery 2 |

5,000 |

|

|

|

|

Machinery 2 |

1,95,000 |

|

2,82,500 |

|

Machinery 3 |

10,000 |

|

15,000 |

|

|

|

|

|

|

Mar 31 |

By Balance c/d |

|

|

|

|

|

|

|

|

|

|

Machinery 2 |

82,500 |

|

|

|

|

|

|

|

|

Machinery 3 |

1,85,000 |

|

2,67,500 |

|

|

|

|

|

|

2,82,500 |

|

|

|

|

2,82,500 |

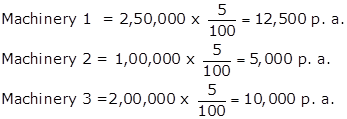

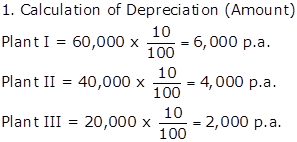

Working Note:

1.

Calculation of Depreciation (Amount)

2.

Calculation Profit and Loss (Machinery 1)

|

Particulars |

Rs. |

|

Book Value on April 01, 2014 |

2,25,000 |

|

Less: Deprecation for 6 month |

(6,250) |

|

Book Value on Oct. 1, 2017 |

2,18,750 |

|

Less: Sale proceeds |

(1,43,000) |

|

Loss on Sale Machine |

75,750 |

Solution PQ 7

|

Van Account |

|||||||||

|

Dr. |

|

|

|

|

|

|

|

|

Cr. |

|

Date |

Particulars |

|

J.F. |

Rs. |

Date |

Particulars |

|

J.F. |

Rs. |

|

2016 |

|

|

|

|

2017 |

|

|

|

|

|

Apr 01 |

To Bank A/c |

|

|

|

Mar 31 |

By Depreciation A/c Van I |

|

|

6,500 |

|

|

Van I |

|

|

65,000 |

Mar 31 |

By Balance c/d Van I |

|

|

58,500 |

|

|

|

|

|

65,000 |

|

|

|

|

65,000 |

|

2017 |

|

|

|

|

2018 |

|

|

|

|

|

Apr 01 |

To Balance b/d Van I |

|

|

58,500 |

Mar 31 |

By Depreciation A/c |

|

|

|

|

Oct 01 |

To Bank A/c |

|

|

|

|

Van I |

6,500 |

|

|

|

|

Van II |

|

|

70,000 |

|

Van II (6 month) |

3,500 |

|

10,000 |

|

|

|

|

|

|

Mar 31 |

By Balance c/d |

|

|

|

|

|

|

|

|

|

|

Van I |

52,000 |

|

|

|

|

|

|

|

|

|

Van II |

66,500 |

|

1,18,500 |

|

|

|

|

|

1,28,500 |

|

|

|

|

1,28,500 |

|

2018 |

|

|

|

|

2018 |

|

|

|

|

|

Apr 01 |

To Balance b/d |

|

|

|

Apr 01 |

By Bank A/c Van I |

|

|

45,000 |

|

|

Van I |

52,000 |

|

|

Apr 01 |

By Profit and Loss A/c |

|

|

7,000 |

|

|

Van II |

66,500 |

|

1,18,500 |

2019 |

|

|

|

|

|

|

|

|

|

|

Mar 31 |

By Depreciation A/c |

|

|

|

|

Apr 01 |

To Bank A/c |

|

|

|

|

Van II |

7,000 |

|

|

|

|

Van III |

|

|

1,70,000 |

|

Van III |

17,000 |

|

24,000 |

|

|

|

|

|

|

Mar 31 |

By Balance c/d |

|

|

|

|

|

|

|

|

|

|

Van II |

59,500 |

|

|

|

|

|

|

|

|

|

Van III |

1,53,000 |

|

2,12,500 |

|

|

|

|

|

2,88,500 |

|

|

|

|

2,88,500 |

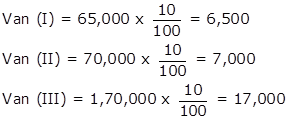

Working Notes

1.

Calculation of Annual Depreciation (Amount)

2.

Calculation of profit or loss on Sale of Maruti Van (I)

|

Particulars |

Rs. |

|

Book Value on April 01, 2018 |

52,000 |

|

Less: Sale of Maruti Van |

(45,000) |

|

Loss on Sale of Maruti Van |

7,000 |

Solution PQ 8

|

Machinery Account |

|||||||||

|

Dr. |

|

|

|

|

|

|

|

|

Cr. |

|

Date |

Particulars |

|

J.F. |

Rs. |

Date |

Particulars |

|

J.F. |

Rs. |

|

2015 |

|

|

|

|

2016 |

|

|

|

|

|

Apr 01 |

To Bank A/c (60,000×5) |

|

|

|

Mar 31 |

By Depreciation A/c (6,000×5) |

|

|

30,000 |

|

|

|

|

|

3,00,000 |

Mar 31 |

By Balance c/d Van I |

|

|

2,70,000 |

|

|

|

|

|

3,00,000 |

|

|

|

|

3,00,000 |

|

2016 |

|

|

|

|

2017 |

|

|

|

|

|

Apr 01 |

To Balance b/d (54,000×5) |

|

|

2,70,000 |

Mar 31 |

By Depreciation A/c |

|

|

|

|

|

|

|

|

|

|

(6,000×5) |

|

30,000 |

|

|

|

|

|

|

|

Mar. 31 |

By Balance c/d |

|

2,40,000 |

|

|

|

|

|

|

2,70,000 |

|

|

|

|

2,70,000 |

|

2017 |

|

|

|

|

2017 |

|

|

|

|

|

Apr 01 |

To Balance b/d |

|

|

|

Apr 01 |

By Bank A/c |

|

|

40,000 |

|

|

(48,000×5) |

|

2,40,000 |

Apr 01 |

By Profit and Loss A/c |

|

|

8,000 |

|

|

|

|

|

|

2018 |

|

|

|

|

|

|

|

|

|

|

|

Mar 31 |

By Depreciation A/c |

|

|

|

|

|

|

|

|

|

|

Remaining 4 Machines (6,000×4) |

|

24,000 |

|

|

|

|

|

|

|

Mar 31 |

By Balance c/d |

|

1,68,000 |

|

|

|

|

|

|

2,40,000 |

|

|

|

|

2,40,000 |

|

2018 |

|

|

|

|

2018 |

|

|

|

|

|

Apr 01 |

To Balance b/d |

|

|

1,68,000 |

Jul 01 |

By Bank A/c |

|

|

28,000 |

|

|

(42,000×4) |

|

|

|

Jul 01 |

By Profit and Loss A/c |

|

|

12,500 |

|

|

|

|

|

|

Jul 01 |

By Depreciation (Machine Sold) |

|

1,500 |

|

|

Oct 01 |

To Bank A/c |

|

|

1,00,000 |

2019 |

|

|

|

|

|

|

|

|

|

|

Mar 31 |

By Depreciation A/c |

|

|

|

|

|

|

|

|

|

|

Remaining 3 Machines (6,000×3) |

|

|

18,000 |

|

|

|

|

|

|

|

By Depreciation New Machine- 6 Months |

|

|

5,000 |

|

|

|

|

|

|

Mar 31 |

By Balance c/d |

|

|

|

|

|

|

|

|

|

|

Machine (Old-3)-36,000×3 |

|

|

1,08,000 |

|

|

|

|

|

|

|

Machine (New-1) 95,000 |

|

|

95,000 |

|

|

|

|

|

2,68,000 |

|

|

|

|

2,68,000 |

Working Notes

(i) Balance of Machinery Account on March 31, 2019: 1,08,000 + 95,000 = 2,03,000

Solution PQ 9

|

Machinery Account |

|||||||||

|

Dr. |

|

|

|

|

|

|

|

|

Cr. |

|

Date |

Particulars |

|

J.F. |

Rs. |

Date |

Particulars |

|

J.F. |

Rs. |

|

2015 |

|

|

|

|

2016 |

|

|

|

|

|

Jul 01 |

To Bank A/c |

|

|

|

Mar 31 |

By Depreciation A/c |

|

|

|

|

|

Machinery I |

|

|

30,000 |

|

Machinery I (9 months) |

2,250 |

|

|

|

2016 |

|

|

|

|

|

Machinery II |

500 |

|

2,750 |

|

Jan 1 |

To Bank A/c |

|

|

|

Mar 31 |

By Balance c/d |

|

|

|

|

|

Machinery II |

|

|

20,000 |

|

Machinery I |

27,750 |

|

|

|

|

|

|

|

|

|

Machinery II |

19,500 |

|

47,250 |

|

|

|

|

|

50,000 |

|

|

|

|

50,000 |

|

2016 |

|

|

|

|

2017 |

|

|

|

|

|

Apr 01 |

To Balance b/d |

|

|

|

Mar 31 |

By Depreciation A/c |

|

|

|

|

|

Machinery I |

27,750 |

|

|

|

Machinery I |

3,000 |

|

|

|

|

Machinery II |

19,500 |

|

47,250 |

|

Machinery II |

2,000 |

|

|

|

|

|

|

|

|

|

Machinery III |

500 |

|

5,500 |

|

Oct 01 |

To Bank A/c |

|

|

|

Mar 31 |

By Balance c/d |

|

|

|

|

|

Machinery III |

|

|

10,000 |

|

Machinery I |

24,750 |

|

|

|

|

|

|

|

|

|

Machinery II |

17,500 |

|

|

|

|

|

|

|

|

|

Machinery III |

9,500 |

|

51,750 |

|

|

|

|

|

57,250 |

|

|

|

|

57,250 |

|

2017 |

|

|

|

|

2017 |

|

|

|

|

|

Apr 01 |

To Balance b/d |

|

|

|

Apr 01 |

By Bank A/c Machinery I (1/3rd portion) |

|

|

3,000 |

|

|

Machinery I |

24,750 |

|

|

Apr 01 |

By Profit and Loss A/c |

|

|

5,250 |

|

|

Machinery II |

17,500 |

|

|

2018 |

|

|

|

|

|

|

Machinery III |

9,500 |

|

51,750 |

Mar 31 |

By Depreciation A/c |

|

|

|

|

|

|

|

|

|

|

Machinery I (on 2/3rd portion) |

2,000 |

|

|

|

|

|

|

|

|

|

Machinery II |

2,000 |

|

|

|

|

|

|

|

|

|

Machinery III |

1,000 |

|

5,000 |

|

|

|

|

|

|

Mar 31 |

By Balance c/d |

|

|

|

|

|

|

|

|

|

|

Machinery I (on 2/3rd portion) |

14,500 |

|

|

|

|

|

|

|

|

|

Machinery II |

15,500 |

|

|

|

|

|

|

|

|

|

Machinery III |

8,500 |

|

38,500 |

|

|

|

|

|

51,750 |

|

|

|

|

51,750 |

Working Notes:

1.

Calculation of Depreciation (Amount)

2.

Calculation of profit or loss a sale of 1/3rd Portion of Machine I

|

Particulars |

Rs. |

|

Book Value of 1/3rd portion of Machine I on April 01,2017 (24,750 × 1/3) |

8,250 |

|

Less : Sale Value |

(3,000) |

|

Loss on sale |

5,250 |

Depreciation Exercise 14.50

Solution PQ 10

|

In the books of A. Co. Ltd Machinery |

|||||||||

|

Dr. |

|

|

|

|

|

|

|

|

Cr. |

|

Date |

Particulars |

|

J.F. |

Rs. |

Date |

Particulars |

|

J.F. |

Rs. |

|

2015 |

|

|

|

|

2016 |

|

|

|

|

|

July 01 |

To Bank A/c |

|

|

|

Mar 31 |

By Depreciation A/c |

|

|

|

|

|

Machinery I (20,000+3,000) |

|

|

23,000 |

|

Machinery I (9 months) |

1,725 |

|

|

|

2016 |

|

|

|

|

|

Machinery II (3 months) |

300 |

|

2,025 |

|

Jan 01 |

To Bank A/c |

|

|

|

Mar 31 |

By Balance A/c |

|

|

|

|

|

Machinery II |

|

|

12,000 |

|

Machinery I |

21,275 |

|

|

|

|

|

|

|

|

|

Machinery II |

11,700 |

|

32,975 |

|

|

|

|

|

35,000 |

|

|

|

|

35,000 |

|

2016 |

|

|

|

|

2017 |

|

|

|

|

|

Apr 01 |

To Balance b/d |

|

|

|

Mar 31 |

By Depreciation A/c |

|

|

|

|

|

Machinery I |

21,275 |

|

|

|

Machinery I |

2,300 |

|

|

|

|

Machinery II |

11,700 |

|

32,975 |

|

Machinery II |

1,200 |

|

3,500 |

|

|

|

|

|

|

Mar 31 |

By Balance A/c |

|

|

|

|

|

|

|

|

|

|

Machinery I |

18,975 |

|

|

|

|

|

|

|

|

|

Machinery II |

10,500 |

|

29,475 |

|

|

|

|

|

32,975 |

|

|

|

|

32,975 |

|

2017 |

|

|

|

|

2017 |

|

|

|

|

|

Apr 01 |

To Balance c/d |

|

|

|

June 30 |

By Bank A/c |

|

|

|

|

|

Machinery I |

18,975 |

|

|

|

Machinery II |

|

|

8,000 |

|

|

Machinery II |

10,500 |

|

29,475 |

June 30 |

By Depreciation A/c |

|

|

|

|

|

|

|

|

|

|

Machinery II (3 months) |

|

|

300 |

|

July 01 |

To Bank A/c |

|

|

|

June 30 |

By Profit and Loss A/c |

|

|

2,200 |

|

|

Machinery III |

|

|

5,000 |

2018 |

|

|

|

|

|

July 01 |

To Creditors for Machinery A/c |

|

|

10,000 |

|

|

|

|

|

|

|

(Machinery III) |

|

|

|

Mar 31 |

By Depreciation A/c |

|

|

|

|

|

|

|

|

|

|

Machinery I |

2,300 |

|

|

|

|

|

|

|

|

|

Machinery III (on 15,000 for 8 months) |

1,125 |

|

3,425 |

|

|

|

|

|

|

|

By Balance c/d |

|

|

|

|

|

|

|

|

|

|

Machinery I |

16,675 |

|

|

|

|

|

|

|

|

|

Machinery III |

13,875 |

|

30,550 |

|

|

|

|

|

44,475 |

|

|

|

|

44,475 |

Working Notes

1.

Calculation of Depreciation (Amount)

2.

Calculation of profit on loss sale of Machinery II

|

Particulars |

Rs. |

|

Book Value of Machinery II on April 01, 2017 |

10,500 |

|

Less: Depreciation for 3 months |

(300) |

|

Book Value on June 30 |

10,200 |

|

Less : sale |

(8,000) |

|

Loss of Sale |

2,200 |

Solution PQ 11

Calculation of Deprecation Amount and Rate

Deprecation (amount) = ![]()

Deprecation (Rate) = ![]()

*Machinery Cost = Rs.52,000 + Rs.2,000 + Rs.3,000 + Rs.2,000 + Rs.1,000 = Rs.60,000

|

Books of Shivam Enterprise Machinery Account |

|||||||||

|

Dr. |

|

|

|

|

|

|

|

Cr. |

|

|

Date |

Particulars |

|

J.F. |

Rs. |

Date |

Particulars |

|

J.F. |

Rs. |

|

2016 |

|

|

|

|

2017 |

|

|

|

|

|

Apr 01 |

To Bank A/c |

|

|

60,000 |

Mar 31 |

By Depreciation A/c |

|

|

5,400 |

|

|

|

|

|

|

Mar 31 |

By Balance c/d |

|

|

54,600 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

60,000 |

|

|

|

|

60,000 |

|

2017 |

|

|

|

|

2018 |

|

|

|

|

|

Apr 01 |

To Balance b/d |

|

|

54,600 |

Mar 31 |

By Depreciation A/c |

|

|

5,400 |

|

|

|

|

|

|

Mar 31 |

By Balance c/d |

|

|

49,200 |

|

|

|

|

|

54,600 |

|

|

|

|

54,600 |

|

2018 |

|

|

|

|

2018 |

|

|

|

|

|

Apr 01 |

To Balance b/d |

|

|

49,200 |

Oct 1 |

By Depreciation A/c (6 months) |

|

2,700 |

|

|

|

|

|

|

|

Oct 1 |

By Bank A/c |

|

|

30,000 |

|

|

|

|

|

|

Oct 1 |

By Profit and Loss A/c |

|

|

16,500 |

|

|

|

|

|

49,200 |

|

|

|

|

49,200 |

Note: Amount spent on repairs is a recurring nature expenses. So it will not be added machinery account.

Working Note:

Calculation of profit on loss on sale of Machinery

|

Particulars |

Rs. |

|

Book Value on April 01, 2018 |

49,200 |

|

Less : Depreciation for 6 months |

(2,700) |

|

Book Value on Oct 01, 2018 |

46,500 |

|

Less: Sale Value |

(30,000) |

|

Loss on Sale |

16,500 |

Depreciation Exercise 14.51

Solution PQ 12

|

In the book of Modern Ltd. Machinery Account |

|||||||||

|

Dr. |

|

|

|

|

|

|

|

|

Cr. |

|

Date |

Particulars |

|

J.F. |

Rs. |

Date |

Particulars |

|

J.F. |

Rs. |

|

2016 |

|

|

|

|

2017 |

|

|

|

|

|

Aug 01 |

To Bank A/c |

|

|

60,000 |

Mar 31 |

By Depreciation A/c |

|

|

8,000 |

|

|

Machinery 1 |

|

|

|

|

Machinery 1 (8 months) |

|

|

|

|

|

|

|

|

|

Mar 31 |

Balance c/d |

|

|

52,000 |

|

|

|

|

|

60,000 |

|

|

|

|

60,000 |

|

2017 |

|

|

|

|

2018 |

|

|

|

|

|

Apr 01 |

To Balance b/d |

|

|

52,000 |

Mar 31 |

By Depreciation A/c |

|

|

|

|

Oct 1 |

To Bank A/c |

|

|

20,000 |

|

Machinery 1 |

12,000 |

|

|

|

|

Machinery 2 |

|

|

|

|

Machinery 2 (6 Months) |

2,000 |

|

14,000 |

|

|

|

|

|

|

Mar 31 |

By Balance c/d |

|

|

|

|

|

|

|

|

|

|

Machinery 1 |

40,000 |

|

|

|

|

|

|

|

|

|

Machinery 2 |

18,000 |

|

58,000 |

|

|

|

|

|

72,000 |

|

|

|

|

72,000 |

|

2018 |

|

|

|

|

2018 |

|

|

|

|

|

Apr 01 |

To Balance b/d |

|

|

|

June 30 |

By Depreciation A/c Machinery 1 (3 months) |

|

|

3000 |

|

|

Machinery 1 |

40,000 |

|

|

June 30 |

By Bank A/c Machinery 1 |

|

|

38,500 |

|

|

Machinery 2 |

18,000 |

|

58,000 |

2019 |

|

|

|

|

|

|

|

|

|

|

Mar 31 |

By Depreciation A/c |

|

|

4,000 |

|

June 30 |

To Profit and Loss A/c (profit) |

|

|

1,500 |

|

Machinery 2 |

|

|

|

|

|

|

|

|

|

Mar 31 |

By Balance c/d |

|

|

14,000 |

|

|

|

|

|

59,500 |

|

|

|

|

59,500 |

|

Input CGST A/c |

|||||||

|

Dr. |

Cr. |

||||||

|

Date |

Particulars |

J.F. |

Rs. |

Date |

Particulars |

J.F. |

Rs. |

|

2017 |

|

|

|

2018 |

|

|

|

|

Oct 01 |

To Purchases A/c |

|

1,200 |

Mar 31 |

By Balance c/d |

|

1,200 |

|

|

|

|

|

|

|

|

|

|

|

|

|

1,200 |

|

|

|

1,200 |

|

Input SGST A/c |

|||||||

|

Dr. |

Cr. |

||||||

|

Date |

Particulars |

J.F. |

Rs. |

Date |

Particulars |

J.F. |

Rs. |

|

2017 |

|

|

|

2018 |

|

|

|

|

Oct 01 |

To Purchases A/c |

|

1,200 |

Mar 31 |

By Balance c/d |

|

1,200 |

|

|

|

|

|

|

|

|

|

|

|

|

|

1,200 |

|

|

|

1,200 |

|

Output IGST A/c |

|||||||

|

Dr. |

Cr. |

||||||

|

Date |

Particulars |

J.F. |

Rs. |

Date |

Particulars |

J.F. |

Rs. |

|

2019 |

|

|

|

2018 |

|

|

|

|

Mar 31 |

By Balance c/d |

|

4,620 |

Jun 30 |

To sales A/c |

|

4,620 |

|

|

|

|

4,620 |

|

|

|

4,620 |

|

Particulars |

Rs. |

|

Value on Apr 01 |

40,000 |

|

Depreciation for 3 Months |

(3,000) |

|

Value on June 30 |

37,000 |

|

Less : Sale of Machinery |

(38,500) |

|

Profit on sale of Machinery 1 |

1,500 |

Solution PQ 13

|

In the book of Sohan Lal and Sons Plant Account |

|||||||||

|

Dr. |

|

|

|

|

|

|

|

|

Cr. |

|

Date |

Particulars |

|

J.F. |

Rs. |

Date |

Particulars |

|

J.F. |

Rs. |

|

2016 |

|

|

|

|

2017 |

|

|

|

|

|

July 01 |

To Bank A/c |

|

|

60,000 |

Mar 31 |

By Depreciation A/c |

|

|

|

|

|

Plant I |

|

|

|

|

Plant I (9 months) |

|

|

4,500 |

|

2017 |

|

|

|

|

|

Plant II (3 months) |

|

|

1,000 |

|

Jan 01 |

To Bank A/c |

|

|

40,000 |

Mar 31 |

By Balance c/d |

|

|

|

|

|

Plant II |

|

|

|

|

Plant I |

55,500 |

|

|

|

|

|

|

|

|

|

Plant II |

39,000 |

|

94,500 |

|

|

|

|

|

1,00,000 |

|

|

|

|

1,00,000 |

|

2017 |

|

|

|

|

2018 |

|

|

|

|

|

Apr 01 |

To Balance b/d |

|

|

|

Mar 31 |

By Depreciation A/c |

|

|

|

|

|

Plant I |

55,500 |

|

|

|

Plant I |

6,000 |

|

|

|

|

Plant II |

39,000 |

|

94,500 |

|

Plant II |

4,000 |

|

|

|

Oct 01 |

To Bank A/c |

|

|

|

|

Plant III (6 months) |

1,000 |

|

11,000 |

|

|

Plant III |

|

|

20,000 |

Mar 31 |

By Balance c/d |

|

|

|

|

|

|

|

|

|

|

Plant I |

49,500 |

|

|

|

|

|

|

|

|

|

Plant II |

35,000 |

|

|

|

|

|

|

|

|

|

Plant III |

19,000 |

|

1,03,500 |

|

|

|

|

|

1,14,500 |

|

|

|

|

1,14,500 |

|

2018 |

|

|

|

|

2018 |

|

|

|

|

|

Apr 01 |

To Balance b/d |

|

|

|

Apr 01 |

By Bank A/c |

|

|

6,000 |

|

|

Plant I |

49,500 |

|

|

Apr 01 |

By Profit and Loss A/c |

|

|

10,500 |

|

|

Plant II |

35,000 |

|

|

2019 |

|

|

|

|

|

|

Plant III |

19,000 |

|

1,03,500 |

Mar 31 |

By Depreciation A/c |

|

|

|

|

|

|

|

|

|

|

Plant I |

4,000 |

|

|

|

|

|

|

|

|

|

Plant II |

4,000 |

|

|

|

|

|

|

|

|

|

Plant III |

2,000 |

|

10,000 |

|

|

|

|

|

|

Mar 31 |

By Balance c/d |

|

|

|

|

|

|

|

|

|

|

Plant I |

29,000 |

|

|

|

|

|

|

|

|

|

Plant II |

31,000 |

|

|

|

|

|

|

|

|

|

Plant III |

17,000 |

|

77,000 |

|

|

|

|

|

1,03,500 |

|

|

|

|

1,03,500 |

|

Input CGST A/c |

|||||||

|

Dr. |

Cr. |

||||||

|

Date |

Particulars |

J.F. |

Rs. |

Date |

Particulars |

J.F. |

Rs. |

|

2017 |

|

|

|

2018 |

|

|

|

|

Oct 01 |

To Purchases A/c |

|

1,200 |

Mar 31 |

By Balance c/d |

|

1,200 |

|

|

|

|

|

|

|

|

|

|

|

|

|

1,200 |

|

|

|

1,200 |

|

Input SGST A/c |

|||||||

|

Dr. |

Cr. |

||||||

|

Date |

Particulars |

J.F. |

Rs. |

Date |

Particulars |

J.F. |

Rs. |

|

2017 |

|

|

|

2018 |

|

|

|

|

Oct 01 |

To Purchases A/c |

|

1,200 |

Mar 31 |

By Balance c/d |

|

1,200 |

|

|

|

|

|

|

|

|

|

|

|

|

|

1,200 |

|

|

|

1,200 |

|

Output CGST A/c |

|||||||

|

Dr. |

Cr. |

||||||

|

Date |

Particulars |

J.F. |

Rs. |

Date |

Particulars |

J.F. |

Rs. |

|

2019 |

|

|

|

2018 |

|

|

|

|

Mar 31 |

By Balance c/d |

|

360 |

Apr 01 |

To Sales A/c |

|

360 |

|

|

|

|

360 |

|

|

|

360 |

|

Output SGST A/c |

|||||||

|

Dr. |

Cr. |

||||||

|

Date |

Particulars |

J.F. |

Rs. |

Date |

Particulars |

J.F. |

Rs. |

|

2019 |

|

|

|

2018 |

|

|

|

|

Mar 31 |

By Balance c/d |

|

360 |

Apr 01 |

To Sales A/c |

|

360 |

|

|

|

|

360 |

|

|

|

360 |

Working Notes

2. Calculation of profit or loss on Sale of Plant I

|

Particulars |

Rs. |

|

1/3rd of Book Value of Plant I as on April 01 (49,500 × 1/3) |

16,500 |

|

Less : Sale of Plant |

(6,000) |

|

Loss on Sale of Plant |

10,500 |

Solution PQ 14

|

In the books of Rama Bros. Machinery Account |

|||||||

|

Dr. |

|

|

|

|

|

|

Cr. |

|

Date |

Particulars |

J.F. |

Rs. |

Date |

Particulars |

J.F. |

Rs. |

|

2016 |

|

|

|

2016 |

|

|

|

|

Apr 01 |

To Balance b/d* |

|

80,000 |

Apr 01 |

By Provision for Depreciation A/c |

|

6,400 |

|

|

|

|

|

Apr 01 |

By Bank A/c |

|

8,700 |

|

|

|

|

|

Apr 01 |

By Profit and Loss A/c |

|

900 |

|

|

|

|

|

2017 |

|

|

|

|

|

|

|

|

Mar 31 |

By Balance c/d |

|

64,000 |

|

|

|

|

80,000 |

|

|

|

80,000 |

*Machinery Cost = 64,000 + 16,000 = 80,000

|

Provision for Depreciation Account |

|||||||

|

Dr. |

|

|

|

|

|

|

Cr. |

|

Date |

Particulars |

J.F. |

Rs. |

Date |

Particulars |

J.F. |

Rs. |

|

2016 |

|

|

|

2016 |

|

|

|

|

Apr 01 |

To Machinery A/c (Accumulate dep. for Machinery sold ) |

|

6,400 |

Apr 01 |

By Balance b/d |

|

36,000 |

|

2017 |

|

|

|

2017 |

|

|

|

|

Mar 31 |

To Balance c/d |

|

36,000 |

Mar 31 |

By Depreciation A/c |

|

6,400 |

|

|

|

|

42,400 |

|

|

|

42,400 |

Working Notes

1.

Calculation of Book Value of Machine Sold on April 01, 2016

|

Particulars |

Rs. |

|

Machine purchased in 2012 |

16,000 |

|

Less : Accumulate Deprecation for 4 years till Mar 31, 2015 (1,600 × 4) |

(6,400) |

|

Book Value on April 01, 2016 |

9,600 |

2.

Calculation of profit or Loss on sale Machinery

|

Particulars |

Rs. |

|

Book Value on April 01, 2015 |

9,600 |

|

Less : Sale Value |

(8,700) |

|

Loss on Sale o Machine |

900 |

Solution PQ 15

|

In the book of Priyank Brothers Machinery Accounts |

|||||||

|

Dr. |

|

|

|

|

|

|

Cr. |

|

Date |

Particulars |

J.F. |

Rs. |

Date |

Particulars |

J.F. |

Rs. |

|

2017 |

|

|

|

2017 |

|

|

|

|

Apr 01 |

To Balance b/d |

|

20,00,000 |

Apr 01 |

By Provision for Depreciation A/c |

|

2,25,000 |

|

|

|

|

|

Apr 01 |

By Bank A/c |

|

5,00,000 |

|

|

|

|

|

Apr 01 |

By Profit and Loss A/c (Loss) |

|

25,000 |

|

|

|

|

|

2018 |

|

|

|

|

|

|

|

|

Mar 31 |

By Balance c/d |

|

12,50,000 |

|

|

|

|

20,00,000 |

|

|

|

20,00,000 |

|

Provision for Depreciation A/c Account |

|||||||

|

Dr. |

|

|

|

|

|

|

Cr. |

|

Date |

Particulars |

J.F. |

Rs. |

Date |

Particulars |

J.F. |

Rs. |

|

2017 |

|

|

|

2017 |

|

|

|

|

Apr 01 |

To Machinery A/c |

|

2,25,000 |

Apr 01 |

By Balance b/d |

|

8,00,000 |

|

2018 |

|

|

|

2018 |

|

|

|

|

Mar 31 |

To Balance c/d |

|

7,00,000 |

Mar 31 |

By Depreciation A/c |

|

1,25,000 |

|

|

|

|

9,25,,000 |

|

|

|

9,25,000 |

Working Note:

Calculation of profit on loss on sale of Machinery

|

Particulars |

Rs. |

|

Original Cost of machinery |

7,50,000 |

|

Less: Accumulate Deprecation machinery sold for 3 years till Mar (7,50,000 × 3×10%) |

(2,25,000) |

|

Book Value of Machinery sold |

5,25,000 |

|

Less: Sale Value |

(5,00,000) |

|

Loss on Sale |

25,000 |

Solution PQ 16

|

Machinery Account |

|||||||

|

Dr. |

|

|

|

|

|

|

Cr. |

|

Date |

Particulars |

J.F. |

Rs. |

Date |

Particulars |

J.F. |

Rs. |

|

2018 |

|

|

|

2018 |

|

|

|

|

Apr 01 |

To Balance b/d* |

|

5,00,000 |

Oct 01 |

By Provision for Depreciation A/c |

|

32,500 |

|

Oct 01 |

To Bank A/c |

|

2,00,000 |

Oct 01 |

By Bank A/c |

|

42,000 |

|

|

|

|

|

Oct 01 |

By Profit and Loss A/c |

|

25,500 |

|

|

|

|

|

2019 |

|

|

|

|

|

|

|

|

Mar 31 |

By Balance c/d |

|

6,00,000 |

|

|

|

|

7,00,000 |

|

|

|

7,00,000 |

*Machinery Cost = 4,00,000 + 1,00,000 = 5,00,000

|

Provision for Depreciation A/c Account |

|||||||

|

Dr. |

|

|

|

|

|

|

Cr. |

|

Date |

Particulars |

J.F. |

Rs. |

Date |

Particulars |

J.F. |

Rs. |

|

2018 |

|

|

|

2018 |

|

|

|

|

Oct 01 |

To Machinery A/c |

|

32,500 |

Apr 01 |

By Balance b/d |

|

2,25,000 |

|

2019 |

|

|

|

2019 |

|

|

|

|

Mar 31 |

To Balance c/d |

|

2,47,500 |

Mar 31 |

By Depreciation A/c |

|

55,000 |

|

|

|

|

2,80,000 |

|

|

|

2,80,000 |

|

Input IGST A/c |

|||||||

|

Dr. |

Cr. |

||||||

|

Date |

Particulars |

J.F. |

Rs. |

Date |

Particulars |

J.F. |

Rs. |

|

2019 |

|

|

|

2019 |

|

|

|

|

Oct 01 |

To Purchases A/c |

|

24,000 |

Mar 31 |

By Balance c/d |

|

24,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

24,000 |

|

|

|

24,000 |

|

Output CGST A/c |

|||||||

|

Dr. |

Cr. |

||||||

|

Date |

Particulars |

J.F. |

Rs. |

Date |

Particulars |

J.F. |

Rs. |

|

2019 |

|

|

|

2018 |

|

|

|

|

Mar 31 |

By Balance c/d |

|

1,440 |

Oct 01 |

To Sales A/c |

|

1,440 |

|

|

|

|

1,440 |

|

|

|

1,440 |

|

Output SGST A/c |

|||||||

|

Dr. |

Cr. |

||||||

|

Date |

Particulars |

J.F. |

Rs. |

Date |

Particulars |

J.F. |

Rs. |

|

2019 |

|

|

|

2018 |

|

|

|

|

Mar 31 |

By Balance c/d |

|

1,440 |

Oct 01 |

To Sales A/c |

|

1,440 |

|

|

|

|

1,440 |

|

|

|

1,440 |

Working Notes:

1.

Calculation of loss on sale of Machinery

|

Particulars |

Rs. |

|

Original cost of Machine sold |

1,00,000 |

|

Less : Accumulate Deprecation on Machine sold, from July 2015 to Oct 01, 2018 (1,00,000 × 10% × 3.25 years) |

(32,500) |

|

Book Value of Machine Sold |

67,500 |

|

Less : Sale Value |

(42,000) |

|

Loss on Sale of Machine |

25,500 |

2.

Calculation By Depreciation charged during the year

|

Particulars |

Rs. |

|

On 4,00,000 @ 10% (4,00,000 × 10%) |

40,000 |

|

On 2,00,000 @ 10% for 6 months (2,00,000 × 10% × 6/12) |

10,000 |

|

On 1,00,000 @ 10% for 6 months (1,00,000 ×10% × 6/12) |

5,000 |

|

Total |

55,000 |

Depreciation Exercise 14.52

Solution PQ 17

|

Boiler Account |

|||||||

|

Dr. |

|

|

|

|

|

|

Cr. |

|

Date |

Particulars |

J.F. |

Rs. |

Date |

Particulars |

J.F. |

Rs. |

|

I Year |

|

|

|

I year |

|

|

|

|

Jan 01 |

To Bank A/c * |

|

20,000 |

Dec 31 |

By Depreciation A/c |

|

2,000 |

|

|

|

|

|

Dec 31 |

By Balance c/d |

|

18,000 |

|

|

|

|

20,000 |

|

|

|

20,000 |

|

II year |

|

|

|

II Year |

|

|

|

|

Jan 01 |

To Balance b/d |

|

18,000 |

Dec 31 |

By Depreciation A/c |

|

1,800 |

|

|

|

|

|

Dec 31 |

By Balance c/d |

|

16,200 |

|

|

|

|

18,000 |

|

|

|

18,000 |

|

II year |

|

|

|

III Year |

|

|

|

|

Jan 01 |

To Balance b/d |

|

16,200 |

Dec 31 |

By Depreciation A/c |

|

1,620 |

|

|

|

|

|

Dec 31 |

By Balance c/d |

|

14,580 |

|

|

|

|

16,200 |

|

|

|

16,200 |

*Goods Cost = 10,000 + 2,000 + 7,000 + 1,000 = Rs.20,000

Solution PQ 18

|

Furniture Account (Original Cost Method) |

|||||||

|

Dr. |

|

|

|

|

|

|

Cr. |

|

Date |

Particulars |

J.F. |

Rs. |

Date |

Particulars |

J.F. |

Rs. |

|

I Year |

|

|

|

I year |

|

|

|

|

Jan 01 |

To Bank A/c |

|

4,000 |

Dec 31 |

By Depreciation A/c |

|

200 |

|

|

|

|

|

Dec 31 |

By Balance c/d |

|

3,800 |

|

|

|

|

4,000 |

|

|

|

4,000 |

|

II year |

|

|

|

II Year |

|

|

|

|

Jan 01 |

To Balance b/d |

|

3,800 |

Dec 31 |

By Depreciation A/c |

|

200 |

|

|

|

|

|

Dec 31 |

By Balance c/d |

|

3,600 |

|

|

|

|

3,800 |

|

|

|

3,800 |

|

III year |

|

|

|

III Year |

|

|

|

|

Jan 01 |

To Balance b/d |

|

3,600 |

Dec 31 |

By Depreciation A/c |

|

200 |

|

|

|

|

|

Dec 31 |

By Balance c/d |

|

3,400 |

|

|

|

|

3,600 |

|

|

|

3,600 |

|

IV Year |

|

|

|

IV Year |

|

|

|

|

Jan 01 |

To Balance b/d |

|

3,400 |

Dec 31 |

By Depreciation A/c |

|

200 |

|

|

|

|

|

Dec 31 |

By Balance c/d |

|

3,200 |

|

|

|

|

3,400 |

|

|

|

3,400 |

![]()

|

Furniture Account (Diminishing Balance Method) |

|||||||

|

Dr. |

|

|

|

|

|

|

Cr. |

|

Date |

Particulars |

J.F. |

Rs. |

Date |

Particulars |

J.F. |

Rs. |

|

I Year |

|

|

|

I year |

|

|

|

|

Jan 01 |

To Bank A/c |

|

4,000 |

Dec 31 |

By Depreciation A/c |

|

200 |

|

|

|

|

|

Dec 31 |

By Balance c/d |

|

3,800 |

|

|

|

|

4,000 |

|

|

|

4,000 |

|

II year |

|

|

|

II Year |

|

|

|

|

Jan 01 |

To Balance b/d |

|

3,800 |

Dec 31 |

By Depreciation A/c |

|

190 |

|

|

|

|

|

Dec 31 |

By Balance c/d |

|

3,610 |

|

|

|

|

3,800 |

|

|

|

3,800 |

|

II year |

|

|

|

III Year |

|

|

|

|

Jan 01 |

To Balance b/d |

|

3,610 |

Dec 31 |

By Depreciation A/c |

|

181 |

|

|

|

|

|

Dec 31 |

By Balance c/d |

|

3,429 |

|

|

|

|

3,610 |

|

|

|

3,610 |

|

IV year |

|

|

|

IV Year |

|

|

|

|

Jan 01 |

To Balance b/d |

|

3,429 |

Dec. 31 |

By Depreciation A/c |

|

171 |

|

|

|

|

|

Dec. 31 |

By Balance c/d |

|

3,258 |

|

|

|

|

3,429 |

|

|

|

3,429 |

![]()

Solution PQ 19

|

In the book of Babu Machinery Account |

||||||||

|

Dr. |

|

|

|

|

|

|

|

Cr. |

|

Date |

Particulars |

J.F. |

Rs. |

Date |

Particulars |

|

J.F. |

Rs. |

|

2017 |

|

|

|

2018 |

|

|

|

|

|

Apr 01 |

To Bank A/c Machinery I |

|

6,000 |

Mar 31 |

By Depreciation A/c |

|

|

|

|

Oct 01 |

To Bank A/c Machinery II |

|

5,000 |

|

Machinery I |

600 |

|

|

|

|

|

|

|

|

Machinery II (6 months) |

250 |

|

850 |

|

|

|

|

|

|

By Balance c/d |

|

|

|

|

|

|

|

|

|

Machinery I |

|

|

5,400 |

|

|

|

|

|

|

Machinery II |

|

|

4,750 |

|

|

|

|

11,000 |

|

|

|

|

11,000 |

|

2018 |

|

|

|

2018 |

|

|

|

|

|

|

|

|

|

Oct 01 |

By Depreciation A/c |

|

|

|

|

Apr 01 |

To Balance b/d |

|

|

|

Machinery I (6 months) |

|

|

270 |

|

|

Machinery I |

|

5,400 |

Oct 01 |

By Bank A/c |

|

|

4,000 |

|

|

Machinery II |

|

4,750 |

Oct 01 |

By Profit and Loss A/c |

|

|

1,130 |

|

|

|

|

|

2019 |

|

|

|

|

|

|

|

|

|

Mar 31 |

By Depreciation A/c |

|

|

|

|

|

|

|

|

|

Machinery II |

|

|

475 |

|

|

|

|

|

Mar 31 |

By Balance c/d Machinery II |

|

|

4,275 |

|

|

|

|

10,150 |

|

|

|

|

10,150 |

Working Note

1.

Calculation of profit and loss on sale of machine:

|

Particulars |

Rs. |

|

|

Book Value of Machinery April 01, 2018 |

5,400 |

|

|

|

Less: Depreciation A/c (6 Months) |

(270) |

|

Book Value of Machinery on Oct 01, 2017 |

5,130 |

|

|

|

Less: Sale |

(4,000) |

|

Loss on Sale of Machinery |

1,130 |

|

Solution PQ 20

|

In the books of X Machinery Account |

|||||||

|

Dr. |

|

|

|

|

|

|

Cr. |

|

Date |

Particulars |

J.F. |

Rs. |

Date |

Particulars |

J.F. |

Rs. |

|

I Year |

|

|

|

I Year |

|

|

|

|

Jan 01 |

To Bank A/c * |

|

35,000 |

Dec 31 |

By Depreciation A/c |

|

3,500 |

|

|

|

|

|

Dec 31 |

By Balance c/d |

|

31,500 |

|

|

|

|

35,000 |

|

|

|

35,000 |

|

II Year |

|

|

|

II Year |

|

|

|

|

Jan 01 |

To Balance b/d |

|

31,500 |

Dec 31 |

By Depreciation A/c |

|

3,150 |

|

|

|

|

|

Dec 31 |

By Balance c/d |

|

28,350 |

|

|

|

|

31,500 |

|

|

|

31,500 |

|

III Year |

|

|

|

III Year |

|

|

|

|

Jan 01 |

To Balance b/d |

|

28,350 |

Dec 31 |

By Depreciation A/c |

|

2,835 |

|

|

|

|

|

Dec 31 |

By Balance c/d |

|

25,515 |

|

|

|

|

28,350 |

|

|

|

28,350 |

|

IV Year |

|

|

|

IV Year |

|

|

|

|

Jan 01 |

To Balance b/d |

|

25,515 |

Jan 01 |

By Bank A/c (30,500 - 500 brokerage) |

|

30,000 |

|

Dec 31 |

To Profit and Loss A/c (Profit) |

|

4,485 |

|

|

|

|

|

|

|

|

30,000 |

|

|

|

30,000 |

*Cost of machinery = 25,000 + 5,000 + 1,000 + 3,500, + 500 = Rs.35,000

Solution PQ 21

|

Machinery Account |

|||||||||

|

Dr. |

|

|

|

|

|

|

|

|

Cr. |

|

Date |

Particulars |

|

J.F. |

Rs. |

Date |

Particulars |

|

J.F. |

Rs. |

|

2016 |

|

|

|

|

2017 |

|

|

|

|

|

Oct 01 |

To Bank A/c |

|

|

50,000 |

Mar 31 |

By Depreciation A/c (6 Months) |

|

|

3,750 |

|

|

Machinery I |

|

|

|

Mar 31 |

By Balance c/d |

|

|

46,250 |

|

|

|

|

|

50,000 |

|

|

|

|

50,000 |

|

2017 |

|

|

|

|

2018 |

|

|

|

|

|

1 April |

To Balance b/d |

|

|

46,250 |

Mar 31 |

By Depreciation A/c |

|

|

|

|

|

Machinery I |

|

|

|

|

Machinery I |

6,938 |

|

|

|

|

|

|

|

|

|

Machinery II |

500 |

|

7,438 |

|

Dec 01 |

To Bank A/c |

|

|

10,000 |

Mar 31 |

By Balance c/d |

|

|

|

|

|

Machinery II |

|

|

|

|

Machinery I |

39,312 |

|

|

|

|

|

|

|

|

|

Machinery II |

9,500 |

|

48,812 |

|

|

|

|

|

56,250 |

|

|

|

|

56,250 |

|

2018 |

|

|

|

|

2019 |

|

|

|

|

|

Apr 01 |

To Balance b/d |

|

|

|

Mar 31 |

By Depreciation A/c |

|

|

|

|

|

Machinery I |

39,312 |

|

|

|

Machinery I |

5,897 |

|

|

|

|

Machinery II |

9,500 |

|

48,812 |

|

Machinery II |

1,425 |

|

7,322 |

|

|

|

|

|

|

Mar 31 |

By Bank A/c Machinery I |

|

|

28,415 |

|

|

|

|

|

|

Mar 31 |

By Profit and Loss A/c |

|

|

5,000 |

|

|

|

|

|

|

Mar 31 |

By Balance c/d Machinery II |

|

|

8,075 |

|

|

|

|

|

48,812 |

|

|

|

|

48,812 |

Working Note

1.

Calculation of profit or loss on sale of machinery:

|

Particulars |

Rs. |

|

|

Book Value of Machinery I on April 01, 2018 |

39,312 |

|

|

|

Less: Depreciation (39,312 × 15%) |

(5,897) |

|

Book Value of Machine Machinery I on March 31, 2019 |

33,415 |

|

|

|

Less: Sale Value |

(28,415) |

|

Loss on Sale of Machine Machinery I |

5,000 |

|

Solution PQ 22

I. Calculation of Depreciation from April 01, 2016 to March 31, 2019

Depreciation Rate : 10% p.a. on Diminishing Balance Method

|

Year |

Machinery |

Date of Purchase |

Value |

No. of Months |

Amt. of Dep. |

Total Dep. |

|

2016-17 |

Machinery 1 |

April 01,2016 |

20,000 |

12 |

2,000 |

2,000 |

|

2017-18 |

Machinery 1 |

April 01, 2016 |

18,000 (20,000 - 2,000) |

12 |

1,800 |

|

|

|

Machinery 2 |

Oct. 01,2017 |

10,000 |

6 |

500 |

2,300 |

|

2018-19 |

Machinery 1 |

April 01, 2016 |

16,200 (18,000 -1,800) |

12 |

1,620 |

|

|

|

Machinery 2 |

Oct. 01, 2017 |

9,500 (10,000 - 500) |

12 |

950 |

|

|

|

Machinery 3 |

Apr. 01 2018 |

5,000 |

12 |

500 |

3,070 |

II. Balance in Machinery Account as on March 31, 2019 will be Rs.27,630

Working Notes: Preparation of Machinery Account

|

|

Machinery Account |

|||||||||

|

Dr. |

|

|

|

|

|

|

|

|

Cr. |

|

|

Date |

Particulars |

|

J.F. |

Rs. |

Date |

Particulars |

|

J.F. |

Rs. |

|

|

2016 |

|

|

|

|

2017 |

|

|

|

|

|

|

Apr 01 |

To Bank A/c |

|

|

20,000 |

Mar 31 |

By Depreciation A/c |

|

|

2,000 |

|

|

|

Machinery 1 |

|

|

|

|

Machinery 1 |

|

|

|

|

|

|

|

|

|

|

Mar 31 |

By Balance c/d |

|

|

18,000 |

|

|

|

|

|

|

|

|

Machinery 1 |

|

|

|

|

|

|

|

|

|

20,000 |

|

|

|

|

20,000 |

|

|

2017 |

|

|

|

|

2018 |

|

|

|

|

|

|

Apr 01 |

To Bank A/c b/d |

|

|

18,000 |

Mar 31 |

By Depreciation A/c |

|

|

|

|

|

|

Machinery 1 |

|

|

|

|

Machinery 1 |

1,800 |

|

|

|

|

Oct 01 |

To Bank A/c Machinery 2 |

|

|

10,000 |

|

Machinery 2 |

500 |

|

2300 |

|

|

|

|

|

|

|

|

By Balance c/d |

|

|

|

|

|

|

|

|

|

|

|

Machinery 1 |

16,200 |

|

|

|

|

|

|

|

|

|

|

Machinery 2 |

9,500 |

|

25,700 |

|

|

|

|

|

|

28,000 |

|

|

|

|

28,000 |

|

|

2018 |

|

|

|

|

2019 |

|

|

|

|

|

|

Apr 01 |

To Balance b/d |

|

|

|

Mar 31 |

By Depreciation A/c |

|

|

|

|

|

|

Machinery 1 |

16,200 |

|

|

|

Machinery 1 |

1,620 |

|

|

|

|

|

Machinery 2 |

9,500 |

|

25,700 |

|

Machinery 2 |

950 |

|

|

|

|

Apr 01 |

To Bank A/c Machinery 3 |

|

|

5,000 |

|

Machinery 3 |

500 |

|

3,070 |

|

|

|

|

|

|

|

Mar 31 |

By Balance c/d |

|

|

|

|

|

|

|

|

|

|

|

Machinery 1 |

14,580 |

|

|

|

|

|

|

|

|

|

|

Machinery 2 |

8,550 |

|

|

|

|

|

|

|

|

|

|

Machinery 3 |

4,500 |

|

27,630 |

|

|

|

|

|

|

30,700 |

|

|

|

|

30,700 |

|

Depreciation Exercise 14.53

Solution PQ 23

|

Machinery Account |

|||||||||

|

Dr. |

|

|

|

|

|

|

|

|

Cr. |

|

Date |

Particulars |

|

J.F. |

Rs. |

Date |

Particulars |

|

J.F. |

Rs. |

|

2016 |

|

|

|

|

2017 |

|

|

|

|

|

Oct 01 |

To Bank A/c |

|

|

|

Mar 31 |

By Depreciation A/c |

|

|

|

|

|

Machinery I (3/4) |

30,000 |

|

|

|

Machinery I (3/4) (for 6months) |

1,500 |

|

|

|

|

Machinery I(1/4) |

10,000 |

|

40,000 |

|

Machinery I (1/4) (for 6 months) |

500 |

|

2,000 |

|

|

|

|

|

|

Mar 31 |

By Balance c/d |

|

|

|

|

|

|

|

|

|

|

Machinery I (3/4) |

28,500 |

|

|

|

|

|

|

|

|

|

Machinery I (1/4) |

9,500 |

|

38,000 |

|

|

|

|

|

40,000 |

|

|

|

|

40,000 |

|

2017 |

|

|

|

|

2018 |

|

|

|

|

|