Class 11-commerce T S GREWAL Solutions Accountancy Chapter 20: Accounts from Incomplete Records - Single Entry System

Accounts from Incomplete Records - Single Entry System Exercise 20.37

Solution PQ 1

|

Statement of Profit or Loss |

|

|

Particulars |

Rs. |

|

Closing Capital |

90,000 |

|

Add : Drawings |

5,000 |

|

|

95,000 |

|

Less : Additional Capital during the year |

(10,000) |

|

Adjusted Closing Capital |

85,000 |

|

Less : Opening Capital |

(60,000) |

|

Net Profit for the year |

25,000 |

Accounts from Incomplete Records - Single Entry System Exercise 20.38

Solution PQ 2

|

Statement of Profit or Loss |

|

|

Particulars |

Rs. |

|

Closing Capital |

1,25,000 |

|

Add : Drawings |

30,000 |

|

|

1,55,000 |

|

Less : Additional Capital during the year |

(37,500) |

|

Adjusted Closing Capital |

1,17,500 |

|

Less : Opening Capital |

(1,00,000) |

|

Net Profit for the year |

17,500 |

Accounts from Incomplete Records - Single Entry System Exercise 20.39

Solution PQ 3

Capital at the end of the year

= Capital in the beginning + Additional Capital + Profit - Drawings

= 70,000 + 20,000 + 20,000 - 7,000

= Rs.1,03,000

Solution PQ 4

Additional Capital

= Closing Capital + Drawings - (Opening Capital + Profit)

= 2,00,000 + 50,000 - (1,30,000 + 1,00,000)

= 2,50,000 - 2,30,000

= Rs.20,000

Solution PQ 5

|

Statement of Profit or Loss |

|

|

Particulars |

Rs. |

|

Capital as on March 31, 2019 |

16,900 |

|

Add : Drawings |

4,800 |

|

|

21,700 |

|

Less : Additional Capital Introduced |

(2,000) |

|

Adjusted Capital as on March 31, 2019 |

19,700 |

|

Less : Capital as on April 01, 2018 |

(15,200) |

|

Profit made during the year 2018-19 |

4,500 |

Solution PQ 6

|

Statement of Profit or Loss |

|

|

Particulars |

Rs. |

|

Capital as on March 31, 2019 |

3,50,000 |

|

Add : Drawings |

2,80,000 |

|

|

6,30,000 |

|

Less : Capital as on April 01, 2018 |

(4,00,000) |

|

Profit made during the year 2018-19 |

2,30,000 |

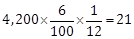

Calculation For Cost of Goods Sold:

Sales = COGS + Profit

Cost of Goods Sold= 100

Gross Profit = 50

Sales= 150

Gross Profit = 50/150 or 1/3

![]()

COGS= Sales - Gross Profit = 60,000 - 20,000 = 40,000

Drawings = Cash + Cost of Goods Sold

Drawings = 2,40,000 + 40,000 = 2,80,000

Solution PQ 7

|

Statement of Affairs as on March 31, 2019 |

|||

|

Liabilities |

Rs. |

Assets |

Rs. |

|

Sundry Creditors |

12,000 |

Cash |

3,200 |

|

Brother's Loan |

10,000 |

Stock |

34,800 |

|

Capital (Balancing Fig.) |

1,32,000 |

Debtors |

31,000 |

|

|

|

Plant |

85,000 |

|

|

|

|

|

|

|

1,54,000 |

|

1,54,000 |

|

Statement of Profit or Loss For the year end March 31, 2019 |

|

|

Particulars |

Rs. |

|

Capital as on March 31, 2019 |

1,32,000 |

|

Add : Drawings (Rs.2,000 × 12) |

24,000 |

|

|

1,56,000 |

|

Less : Capital as on April 01, 2018 |

(1,00,000) |

|

Profit made during the year 2018-2019 |

56,000 |

Solution PQ 8

|

In the books of Ram Prashad Statement of Affairs as on March 31, 2019 |

||||

|

Liabilities |

Rs. |

Assets |

|

Rs. |

|

Trade Creditors |

4,000 |

Book Debts |

|

10,000 |

|

Bank Overdraft |

1,000 |

Cash in Hand |

|

510 |

|

Capital (Balancing Fig.) |

12,590 |

Stock |

|

6,000 |

|

|

|

Furniture and Fittings |

1,200 |

|

|

|

|

Less : 10% Depreciation |

(120) |

1,080 |

|

|

17,590 |

|

|

17,590 |

|

Statement of Affairs as on April 01, 2018 |

|||

|

Liabilities |

Rs. |

Assets |

Rs. |

|

Capital (Balancing Fig.) |

10,000 |

Bank |

6,000 |

|

|

|

Stock |

4,000 |

|

|

|

|

|

|

|

10,000 |

|

10,000 |

|

Statement of Profit or Loss for the year end March 31, 2019 |

|

|

Particulars |

Rs. |

|

Capital as on March 31, 2019 |

12,590 |

|

Add : Drawings |

2,400 |

|

|

14,990 |

|

Less : Capital as on April 01, 2018 |

(10,000) |

|

Profit made during the year 2018-2019 |

4,990 |

Accounts from Incomplete Records - Single Entry System Exercise 20.40

Solution PQ 9

|

Books of Shruti Statement of Affairs 47,900 |

|

47,900 |

|||

|

Statement of Affairs 71,600 |

|

|

71,600 |

||||

|

Statement of Profit or Loss for the year end March 31, 2016 |

|

|

Particulars |

Rs. |

|

16,200 |

|

Solution PQ 10

|

Books of Hari Statement of Affairs 52,500 |

|

52,500 |

|||

|

Statement of Affairs 77,900 |

|

|

77,900 |

||||

|

Statement of Profit or Loss 23,900 |

Solution PQ 11

|

Statement of Affairs 17,800 |

|

|

17,800 |

|||||

|

Statement of Profit or Loss 4,025 |

Solution PQ 12

|

Statement of Affairs 17,50,000 |

|

17,50,000 |

|||

|

Statement of Affairs 20,25,000 |

|

20,25,000 |

|||

|

Statement of Profit or Loss 4,75,000 |

Accounts from Incomplete Records - Single Entry System Exercise 20.41

Solution PQ 13

|

Statement of Affairs as on April 01, 2018 |

|||

|

Liabilities |

Rs. |

Assets |

Rs. |

|

1,48,000 |

|

1,48,000 |

|

|

Statement of Affairs as on March 31, 2019 |

|||||

|

Liabilities |

|

Rs. |

Assets |

|

Rs. |

|

1,68,300 |

|

|

1,68,300 |

||

|

Statement of Profit or Loss for the year end March 31, 2019 |

|

|

Particulars |

Rs. |

|

35,400 |

|

Solution PQ 14

|

Statement of Profit or Loss for the year end December 31, 2014 |

|

|

Particulars |

Rs. |

|

×1,90,260 |

|

Solution PQ 15

|

Statement of Affairs For the year ending March 31, 2006 |

|||

|

Liabilities |

Rs. |

Assets |

Rs. |

|

8,50,000 |

|

8,50,000 |

|

|

Statement of Profit or Loss For the year end March 31, 2006 |

|

|

Particulars |

Rs. |

|

23,000 |

|

Solution PQ 16

|

Statement of Affairs as on April 01, 2018 |

|||

|

Liabilities |

Rs. |

Assets |

Rs. |

|

Statement of Affairs 20,400 |

|

|

20,400 |

|

Statement of Profit or Loss for the year end March 31, 2019 |

|

|

Particulars |

Rs. |

|

4,900 |

|

Accounts from Incomplete Records - Single Entry System Exercise 20.42

Solution PQ 17

|

Statement of Affairs (Previous Year) |

|||

|

Liabilities |

Rs. |

Assets |

Rs. |

|

29,440 |

|

29,440 |

|

|

Statement of Affairs (Current Year) |

|||||

|

Liabilities |

|

Rs. |

Assets |

|

Rs. |

|

28,070 |

|

|

28,070 |

||

|

Statement of Profit or Loss (Current Year) |

|

|

Particulars |

Rs. |

|

3,960 |

|

Solution PQ 18

|

Statement of Affairs as on March 31, 2019 |

|||||

|

Liabilities |

|

Rs. |

Assets |

|

Rs. |

|

1,70,700 |

|

|

1,70,700 |

||

|

Statement of Profit or Loss for the year end March 31, 2019 |

|

|

Particulars |

Rs. |

|

84,700 |

|

Solution PQ 19

|

Statement of Affairs as on July 01, 2018 |

|||||

|

Liabilities |

|

Rs. |

Assets |

|

Rs. |

|

2,80,000 |

|

|

2,80,000 |

||

|

Statement of Affairs as on December 31, 2018 |

|||||

|

Liabilities |

|

Rs. |

Assets |

|

Rs. |

|

2,76,500 |

|

|

2,76,500 |

||

|

Statement of Profit or Loss For the year end December 31, 2018 |

|

|

Particulars |

Rs. |

|

Gross Loss (Profit before Adjustment ) |

4,300 |

|

Net Loss (Profit After Adjustment ) |

17,379 |

|

Statement of Affairs as on December 31, 2018 (After Adjustments) |

|||||

|

Liabilities |

|

Rs. |

Assets |

|

Rs. |

|

2,63,400 |

|

|

2,63,400 |

||

Working Notes:

1.

Calculation of Deprecation for Plant and Machinery

2.

Calculation of Provision for Doubtful Debts

3.

Calculation of Interest on Drawings (Amount):

|

Date |

Amount |

Months |

Product |

|

Total |

|

|

4,200 |

Interest on Drawings (Amount):

Accounts from Incomplete Records - Single Entry System Exercise 20.43

Solution PQ 20

|

Statement of Affairs Trading A/c as on March 31, 2018 |

|||||

|

Particulars |

|

Rs. |

Particulars |

|

Rs. |

|

1,90,000 |

|

|

1,90,000 |

||

![]()

Solution PQ 21

|

Statement of Affairs Trading A/c |

|||||

|

Particulars |

|

Rs. |

Particulars |

|

Rs. |

|

2,55,000 |

|

|

2,55,000 |

||

Calculation For Gross Profit:

2,40,000 ×20%= 48,000

Solution PQ 22

|

Statement of Affairs Trading A/c |

|||||

|

Particulars |

|

Rs. |

Particulars |

|

Rs. |

|

1,04,000 |

|

|

1,04,000 |

||

Calculation For Gross Loss:

80,000 ×20%= 16,000

Solution PQ 23

|

Statement of Affairs Trading A/c |

|||||

|

Particulars |

|

Rs. |

Particulars |

|

Rs. |

|

1,15,000 |

|

|

1,15,000 |

||

Calculation For Gross Profit:

1,00,000 ×25%= 25,000

Accounts from Incomplete Records - Single Entry System Exercise 20.44

Solution PQ 24

|

Statement of Affairs Trading A/c |

|||||

|

Particulars |

|

Rs. |

Particulars |

|

Rs. |

|

1,53,000 |

|

|

1,53,000 |

||

Calculation For Gross Profit:

1,20,000 ×20%= 24,000

Note:- Carriage Outward pass the entry on Profit and Loss A/c

Solution PQ 25

= 66,000

Solution PQ 26

×2,00,000 + 50,000 = 2,50,000

Solution PQ 27

|

Debtors Account |

|||

|

Dr. |

|

|

Cr. |

|

Particulars |

Amount Rs |

Particulars |

Amount Rs |

|

Balance b/d |

30,000 |

Cash A/c |

35,000 |

|

Sales A/c |

75,000 |

Sales Return A/c |

5,000 |

|

|

|

Bill Receivable A/c |

25,000 |

|

|

|

Bad-Debts A/c |

2,000 |

|

|

|

Balance c/d |

38,000 |

|

|

|

|

|

|

|

1,05,000 |

|

1,05,000 |

|

|

|

|

|

Solution PQ 28

|

Creditors Account |

|||

|

Dr. |

|

|

Cr. |

|

Particulars |

Amount Rs |

Particulars |

Amount Rs |

|

Cash A/c |

20,000 |

Balance b/d |

15,000 |

|

Purchases Return A/c |

1,000 |

Purchases A/c |

30,000 |

|

Bills Payable A/c |

10,000 |

|

|

|

Balance c/d |

14,000 |

|

|

|

|

|

|

|

|

|

45,000 |

|

45,000 |

|

|

|

|

|

Solution PQ 29

|

Creditors Account |

|||

|

Dr. |

|

|

Cr. |

|

Particulars |

Amount Rs |

Particulars |

Amount Rs |

|

Cash A/c |

15,000 |

Balance b/d |

15,000 |

|

Purchases Return A/c |

1,000 |

Purchases A/c |

13,000 |

|

Balance c/d |

12,000 |

|

|

|

|

|

|

|

|

|

28,000 |

|

28,000 |

|

|

|

|

|

Solution PQ 30

|

Creditors Account |

|||

|

Dr. |

|

|

Cr. |

|

Particulars |

Amount Rs |

Particulars |

Amount Rs |

|

Cash A/c |

30,200 |

Balance b/d |

6,000 |

|

Purchases Return A/c |

1,200 |

Purchases A/c |

40,300 |

|

Bills Payable A/c |

10,900 |

|

|

|

Balance c/d |

4,000 |

|

|

|

|

|

|

|

|

|

46,300 |

|

46,300 |

|

|

|

|

|

Total Purchases = Cash Purchases + Credit Purchases

Total Purchases = 25,800 + 40,300 = Rs 66,100

Solution PQ 31

Gross Profit = Net Sales - Cost of Goods Sold

1,29,000 = Net Sales - 97,000

Net Sales = Rs 2,26,000

Credit Sales = Total Net Sales - Cash Sales

Credit Sales = 2,26,000 - 85,000 = Rs 1,41,000

Accounts from Incomplete Records - Single Entry System Exercise 20.45

Solution PQ 32

|

Debtors Account |

|||

|

Dr. |

|

|

Cr. |

|

Particulars |

Amount Rs |

Particulars |

Amount Rs |

|

Balance b/d |

20,400 |

Cash A/c |

60,800 |

|

Sales A/c |

75,800 |

Sales Return A/c |

5,400 |

|

|

|

Bad-Debts A/c |

2,400 |

|

|

|

Balance c/d |

27,600 |

|

|

|

|

|

|

|

96,200 |

|

96,200 |

|

|

|

|

|

Total Sales = Cash Sales + Credit Sales

Total Sales = 56,800 + 75,800 = Rs 1,32,600

Solution PQ 33

|

Debtors Account |

|||

|

Dr. |

|

|

Cr. |

|

Particulars |

Amount Rs |

Particulars |

Amount Rs |

|

Balance b/d |

30,800 |

Cash A/c |

70,000 |

|

Bill Receivable A/c |

1,800 |

Sales Return A/c |

8,700 |

|

Sales A/c |

97,300 |

Bad-Debts A/c |

4,800 |

|

|

|

Bill Receivable A/c |

20,900 |

|

|

|

Balance c/d |

25,500 |

|

|

|

|

|

|

|

1,09,000 |

|

1,09,000 |

|

|

|

|

|

Total Sales = Cash Sales + Credit Sales

Total Sales = 15,900 + 97,300 = Rs 1,13,200

Solution PQ 34

|

Debtors Account |

|||

|

Dr. |

|

|

Cr. |

|

Particulars |

Amount Rs |

Particulars |

Amount Rs |

|

Balance b/d |

43,100 |

Cash A/c |

1,30,000 |

|

Bill Receivable A/c |

1,900 |

Discount Allowed A/c |

1,100 |

|

Sales A/c |

1,40,000 |

Bill Receivable A/c |

16,500 |

|

|

|

Balance c/d |

37,400 |

|

|

|

|

|

|

|

|

|

|

|

|

1,85,000 |

|

1,85,000 |

|

|

|

|

|

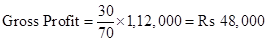

Cost of Goods Sold = Opening Stock + Purchases - Closing Stock

Cost of Goods Sold = 26,000 + 1,10,000 - 24,000 = 1,12,000

Sales = Cost of Goods Sold + Gross Profit

Sales = 1,12,000 + 48,000 = Rs 1,60,000

Credit Sales = 1,60,000 - 20,000 = Rs 1,40,000

|

Creditors Account |

|||

|

Dr. |

|

|

Cr. |

|

Particulars |

Amount Rs |

Particulars |

Amount Rs |

|

Cash A/c |

95,000 |

Balance b/d |

20,600 |

|

Discount Received A/c |

800 |

Purchases A/c |

1,10,000 |

|

Bills Payable A/c |

14,000 |

|

|

|

Balance c/d |

20,800 |

|

|

|

|

|

|

|

|

|

1,30,600 |

|

1,30,600 |

|

|

|

|

|

Solution PQ 35

|

Cash Accounts |

|||||

|

Dr. |

Cr. |

||||

|

Particulars |

|

Rs. |

Particulars |

|

Rs. |

|

To Balance b/d |

|

5,000 |

By Purchase A/c |

|

1,56,000 |

|

To Debtors A/c |

|

2,30,000 |

By Trade Expenses A/c |

|

7,200 |

|

|

|

|

By Salary and Wages A/c |

|

21,400 |

|

|

|

|

By Rent a/c - business premise |

|

5,920 |

|

|

|

|

By Drawings A/c |

|

29,360 |

|

|

|

|

By Balance C/d |

|

15,120 |

|

|

|

|

|

|

|

|

|

|

2,35,000 |

|

|

2,35,000 |

|

Trading and Profit and Loss Account for the year ended 31st March,2019 |

|||||

|

Dr. |

Cr. |

||||

|

Particulars |

|

Rs. |

Particulars |

|

Rs. |

|

To Opening Stock A/c |

|

35,000 |

By Sales A/c |

|

|

|

To Purchase A/c |

|

|

Cash |

2,30,000 |

|

|

Cash |

1,56,000 |

|

Credit |

15,000 |

2,45,000 |

|

Credit |

13,500 |

1,69,500 |

By Closing Stock A/c |

|

37,500 |

|

To Gross Profit c/d |

|

78,000 |

|

|

|

|

|

|

2,82,500 |

|

|

2,82,500 |

|

To Trade Expenses A/c |

|

7,200 |

By Gross Profit b/d |

|

78,000 |

|

To Salary and Wages A/c |

|

21,400 |

|

|

|

|

To Rent A/c - Business Premise |

|

5,920 |

|

|

|

|

To Depreciation A/c - Furniture |

|

250 |

|

|

|

|

To Interest on Loan A/c |

|

1,000 |

|

|

|

|

To Doubtful Debts A/c |

|

1,000 |

|

|

|

|

To Net Profit transferred to Capital A/c |

|

41,230 |

|

|

|

|

|

|

|

|

|

|

|

|

|

78,000 |

|

|

78,000 |

|

Balance Sheet as at 31st March,2019 |

|||||

|

Liabilities |

|

Rs. |

Assets |

|

Rs. |

|

Capital(WN 1) |

40,000 |

|

Goodwill |

|

15,000 |

|

Add: Net profit |

41,230 |

|

Furniture |

5,000 |

|

|

|

81,230 |

|

Less: Depreciation |

250 |

4,750 |

|

Less: Drawings |

29,360 |

51,870 |

Stock |

|

37,500 |

|

Loan from Wife |

20,000 |

|

Debtors |

15,000 |

|

|

Add: Interest @ 5% |

1,000 |

21,000 |

Less: doubtful Debt |

1,000 |

14,000 |

|

Creditors |

|

13,500 |

Cash |

|

15,120 |

|

|

|

|

|

|

|

|

|

|

86,370 |

|

|

86,370 |

Working Note:

|

Opening Statement of Affairs as at 1st April,2018 |

|||

|

Liabilities |

Rs. |

Assets |

Rs. |

|

Capital |

40,000 |

Goodwill |

15,000 |

|

|

|

Furniture |

5,000 |

|

Loan from wife |

20,000 |

Stock |

35,000 |

|

|

|

Cash (Balancing figure) |

5,000 |

|

|

|

|

|

|

|

60,000 |

|

60,000 |

Accounts from Incomplete Records - Single Entry System Exercise 20.46

Solution PQ 36

|

Trading Account for the year ended March 31, 2019 |

||||

|

Dr. |

|

|

Cr. |

|

|

Particulars |

Amount Rs |

Particulars |

Amount Rs |

|

|

Purchases |

4,00,000 |

|

Sales |

5,00,000 |

|

Less: Drawings |

12,000 |

3,88,000 |

Closing Stock |

1,60,000 |

|

Gross Profit |

2,72,000 |

|

|

|

|

|

6,60,000 |

|

6,60,000 |

|

|

|

|

|

|

|

|

Profit and Loss Account for the year ended March 31, 2019 |

|||

|

Dr. |

|

|

Cr. |

|

Particulars |

Amount Rs |

Particulars |

Amount Rs |

|

Bad Debts |

4,000 |

Gross Profit |

2,72,000 |

|

Salary |

48,000 |

|

|

|

Trade Expenses |

16,000 |

|

|

|

Net Profit |

2,04,000 |

|

|

|

|

2,72,000 |

|

2,72,000 |

|

|

|

|

|

|

Balance Sheet as on March 31, 2019 |

|||||

|

Dr. |

|

|

Cr. |

||

|

Liabilities |

Amount Rs |

Assets |

Amount Rs |

||

|

Capital |

4,00,000 |

|

Furniture |

80,000 |

|

|

Less: Drawings |

52,000 |

|

Debtors |

1,40,000 |

|

|

Add: Net Profit |

2,04,000 |

5,52,000 |

Less: Bad Debts |

4,000 |

1,36,000 |

|

Creditors |

80,000 |

Cash in Hand |

2,56,000 |

||

|

|

|

Closing Stock |

1,60,000 |

||

|

|

6,32,000 |

|

6,32,000 |

||

|

|

|

|

|

||

|

Cash Account |

|||

|

Dr. |

|

|

Cr. |

|

Particulars |

Amount Rs |

Particulars |

Amount Rs |

|

Capital A/c |

4,00,000 |

Furniture A/c |

80,000 |

|

Debtors A/c |

1,60,000 |

Creditors A/c |

2,00,000 |

|

Sales A/c |

2,00,000 |

Drawings A/c |

40,000 |

|

|

|

Salaries A/c |

48,000 |

|

|

|

Trade Expenses A/c |

16,000 |

|

|

|

Purchases A/c |

1,20,000 |

|

|

|

Balance c/d |

2,56,000 |

|

|

7,60,000 |

|

7,60,000 |

|

|

|

|

|

|

Debtors Account |

|||

|

Dr. |

|

|

Cr. |

|

Particulars |

Amount Rs |

Particulars |

Amount Rs |

|

Sales A/c |

3,00,000 |

Cash A/c |

1,60,000 |

|

|

|

Balance c/d |

1,40,000 |

|

|

|

|

|

|

|

3,00,000 |

|

3,00,000 |

|

|

|

|

|

|

Creditors Account |

|||

|

Dr. |

|

|

Cr. |

|

Particulars |

Amount Rs |

Particulars |

Amount Rs |

|

Cash A/c |

2,00,000 |

Purchases A/c |

2,80,000 |

|

Balance c/d |

80,000 |

|

|

|

|

|

|

|

|

|

2,80,000 |

|

2,80,000 |

|

|

|

|

|

Solution PQ 37

|

Trading Account for the year ended March 31, 2019 |

|||

|

Dr. |

|

|

Cr. |

|

Particulars |

Amount Rs |

Particulars |

Amount Rs |

|

Opening Stock |

31,250 |

Sales (1,00,000 + 20,625) |

1,20,625 |

|

Purchases |

37,500 |

Closing Stock |

15,625 |

|

Wages |

33,625 |

|

|

|

Light and Power |

2,375 |

|

|

|

Gross Profit |

31,500 |

|

|

|

|

1,36,250 |

|

1,36,250 |

|

|

|

|

|

|

Profit and Loss Account for the year ended March 31, 2019 |

|||

|

Dr. |

|

|

Cr. |

|

Particulars |

Amount Rs |

Particulars |

Amount Rs |

|

Salary |

5,625 |

Gross Profit |

31,500 |

|

Interest |

375 |

|

|

|

Rent |

6,625 |

|

|

|

Sundry Expenses |

10,625 |

|

|

|

Depreciation on Plant |

4,050 |

|

|

|

Net Profit |

4,200 |

|

|

|

|

31,500 |

|

31,500 |

|

|

|

|

|

|

Balance Sheet as on March 31, 2019 |

||||

|

Dr. |

|

|

Cr. |

|

|

Liabilities |

Amount Rs |

Assets |

Amount Rs |

|

|

Capital |

78,000 |

|

Plant |

36,575 |

|

Less: Drawings |

7,500 |

|

Debtors |

30,625 |

|

Add: Additional Capital |

12,500 |

|

Bank |

16,375 |

|

Add: Net Profit |

4,200 |

87,200 |

Closing Stock |

15,625 |

|

Creditors |

12,000 |

|

|

|

|

|

|

|

|

|

|

|

99,200 |

|

99,200 |

|

|

|

|

|

|

|

|

Balance Sheet as on April 01, 2018 |

|||

|

Dr. |

|

|

Cr. |

|

Liabilities |

Amount Rs |

Assets |

Amount Rs |

|

Creditors |

12,625 |

Plant |

37,500 |

|

Capital (bal. fig.) |

78,000 |

Debtors |

18,750 |

|

|

|

Bank |

3,125 |

|

|

|

Closing Stock |

31,250 |

|

|

90,625 |

|

90,625 |

|

|

|

|

|

|

Bank Account |

|||

|

Dr. |

|

|

Cr. |

|

Particulars |

Amount Rs |

Particulars |

Amount Rs |

|

Balance b/d |

3,125 |

Plant A/c |

3,125 |

|

Capital A/c |

12,500 |

Creditors A/c |

38,125 |

|

Debtors A/c |

88,125 |

Drawings A/c |

7,500 |

|

Sales A/c |

20,625 |

Salaries A/c |

5,625 |

|

|

|

Wages A/c |

33,625 |

|

|

|

Interest A/c |

375 |

|

|

|

Rent A/c |

6,625 |

|

|

|

Light and Power A/c |

2,375 |

|

|

|

Sundry Expenses A/c |

10,625 |

|

|

|

Balance c/d |

16,375 |

|

|

1,24,375 |

|

1,24,375 |

|

|

|

|

|

|

Debtors Account |

|||

|

Dr. |

|

|

Cr. |

|

Particulars |

Amount Rs |

Particulars |

Amount Rs |

|

Balance b/d |

18,750 |

Cash A/c |

88,125 |

|

Sales A/c (bal. fig.) |

1,00,000 |

Balance c/d |

30,625 |

|

|

|

|

|

|

|

1,18,750 |

|

1,18,750 |

|

|

|

|

|

|

Creditors Account |

|||

|

Dr. |

|

|

Cr. |

|

Particulars |

Amount Rs |

Particulars |

Amount Rs |

|

Cash A/c |

38,125 |

Balance b/d |

12,625 |

|

Balance c/d |

12,000 |

Purchases A/c (bal. fig.) |

37,500 |

|

|

|

|

|

|

|

50,125 |

|

50,125 |

|

|

|

|

|

Accounts from Incomplete Records - Single Entry System Exercise 20.47

Solution PQ 38

|

Trading and Profit and Loss Account for the year ended 31st March, 2019 |

|||||

|

Particulars |

|

Rs. |

Particulars |

|

Rs. |

|

To Opening Stock a/c |

|

28,000 |

By Sales a/c |

|

|

|

To Purchase a/c |

|

49,800 |

Cash |

15,000 |

|

|

|

|

|

Credit |

51,000 |

66,000 |

|

To Gross Profit c/d |

|

13,200 |

By Closing Stock a/c |

|

25,000 |

|

|

|

91,000 |

|

|

91,000 |

|

To Expenses a/c |

|

6,900 |

By Gross Profit b/d |

|

13,200 |

|

To Depreciation a/c - Furniture |

|

1,000 |

|

|

|

|

To Doubtful Debts a/c |

|

900 |

|

|

|

|

To Net Profit transferred to Capital a/c |

|

4,400 |

|

|

|

|

|

|

|

|

|

|

|

|

|

13,200 |

|

|

13,200 |

|

Balance Sheet as at 31st March, 2019 |

|||||

|

Liabilities |

|

Rs. |

Assets |

|

Rs. |

|

Capital(WN 1) |

46,900 |

|

Furniture |

12,000 |

|

|

Add: Net profit |

4,400 |

|

Less: Depreciation |

1,000 |

11,000 |

|

|

51,300 |

|

Stock |

|

25,000 |

|

Less: Drawings |

8,000 |

43,300 |

Debtors |

33,100 |

|

|

|

|

|

Less: doubtful Debt |

900 |

34,000 |

|

Bills Payable |

|

11,500 |

Cash |

|

5,600 |

|

Creditor- Goods |

|

19,000 |

|

|

|

|

Creditors - Expenses |

|

1,800 |

|

|

|

|

|

|

|

|

|

|

|

|

|

75,600 |

|

|

75,600 |

Working Note:

1.

|

Opening Statement of Affairs as at 1st April, 2018 |

|||||

|

Liabilities |

|

Rs. |

Assets |

|

Rs. |

|

Capital |

|

46,900 |

Furniture and fixture |

|

10,000 |

|

Bill payable |

|

8,700 |

Sundry Debtors |

|

35,000 |

|

Creditors- Goods |

|

21,000 |

Stock |

|

28,000 |

|

Creditors- Expenses |

|

1,500 |

Cash |

|

5,100 |

|

|

|

|

|

|

|

|

|

|

78,100 |

|

|

78,100 |

2.

|

Total Sales: |

|

Credit Sales: |

|

|

Opening Stock |

28,000 |

Total Sales |

66,000 |

|

Add: Purchases |

49,800 |

Less: Cash Sales |

15,000 |

|

Less: Closing Stock |

(25,000) |

Credit Sales |

51,000 |

|

Cost of Goods Sold |

52,800 |

|

|

|

Add: 25% on Cost of Goods Sold |

13,200 |

|

|

|

Total Sales |

66,000 |

|

|

3.

|

Cash Account |

|||||

|

Dr. |

|

|

|

|

Cr. |

|

Particulars |

|

Rs. |

Particulars |

|

Rs. |

|

To Balance b/d |

|

5,100 |

By Creditors a/c |

|

31,000 |

|

To Cash sales a/c |

|

15,000 |

By Expenses a/c |

|

6,600 |

|

To Debtors a/c |

|

51,100 |

By Bills payable a/c |

|

18,000 |

|

|

|

|

By Drawings a/c |

|

8,000 |

|

|

|

|

By Furniture a/c - New Purchase |

|

2,000 |

|

|

|

|

By Balance c/d |

|

5,600 |

|

|

|

|

|

|

|

|

|

|

71,200 |

|

|

71,200 |

4.

|

Sundry Creditors -Goods A/c |

|||||

|

Dr. |

|

Cr. |

|||

|

Particulars |

|

Rs. |

Particulars |

|

Rs. |

|

To Cash a/c |

|

31,000 |

By Balance b/d |

|

21,000 |

|

To Bills Payable a/c |

|

20,800 |

By Purchases a/c ( Credit purchases) |

|

49,800 |

|

To Balance c/d |

|

19,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

70,800 |

|

|

70,800 |

5.

|

Bill Payable A/C |

|||||

|

Dr. |

|

Cr. |

|||

|

Particulars |

|

Rs. |

Particulars |

|

Rs. |

|

To Cash a/c |

|

18,000 |

By Balance b/d |

|

8,700 |

|

|

|

|

By Sundry creditors a/c |

|

20,800 |

|

To Balance c/d |

|

11,500 |

|

|

|

|

|

|

|

|

|

|

|

|

|

29,500 |

|

|

29,500 |

6.

|

Debtors A/C |

|||||

|

Dr. |

|

Cr. |

|||

|

Particulars |

|

Rs. |

Particulars |

|

Rs. |

|

To Balance b/d |

|

35,000 |

By Cash a/c |

|

51,100 |

|

To Credit Sales a/c |

|

51,000 |

By Doubtful Debt a/c |

|

900 |

|

|

|

|

By Balance c/d |

|

34,000 |

|

|

|

|

|

|

|

|

|

|

86,000 |

|

|

86,000 |

7.

|

Expenses A/c |

|||||

|

Dr. |

|

Cr. |

|||

|

Particulars |

|

Rs. |

Particulars |

|

Rs. |

|

To Cash a/c |

|

6,600 |

By Balance b/d |

|

1,500 |

|

|

|

|

By Profit and loss a/c |

|

6,900 |

|

To Balance c/d |

|

1,800 |

|

|

|

|

|

|

|

|

|

|

|

|

|

8,400 |

|

|

8,400 |