Class 12-commerce NCERT Solutions Economics Chapter 6: Open Economy Macroeconomics

Open Economy Macroeconomics Exercise 101

Solution 1

Differences between balance of trade and current account balance:

|

Balance of trade |

Current account balance |

|

Difference between export and import of visible goods |

Difference between export and import of unilateral transfers and services |

|

Comprises two components-export and import of goods |

Comprises two components-export and import of goods, unilateral transfers and services |

|

Includes the export and import of only visible goods |

Includes the export and import of goods or services or both |

|

Narrow in nature |

Comparatively a wider concept as it considers visible and invisible items |

Solution 2

Official reserve transactions are transactions carried out by a monetary authority of a nation. These transactions cause a change in the official reserves of a country.

Official reserve transactions are used in the exchange market. During the time of deficit, reserves are strained by selling foreign currency in the exchange market. Foreign currency is bought by using official reserve transactions during the time of surplus.

Official reserve transactions help in the process of adjusting surpluses and deficits arising in the balance of payments.

Solution 3

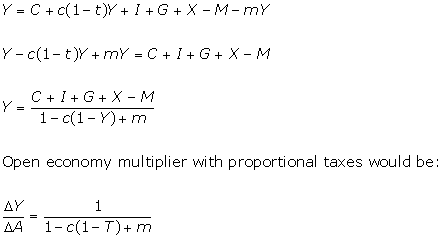

Nominal exchange rate is the price of one currency in the form of other currency. Real exchange rate is the ratio between the relative prices of foreign goods and the price of domestically produced goods and services.

If I want to buy domestic goods or foreign goods, then I would prefer the real exchange rate as compared to the nominal exchange rate. The real exchange rate takes inflation into consideration, whereas the nominal exchange rate does not consider it.

Solution 4

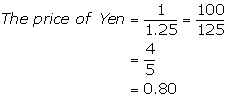

As given,

Price level in Japan = 3

Price level in India = 1.2

Price of 1 rupee = 1.25

Calculating the price of Yen,

Calculating the real exchange rate,

Thus, the real exchange rate between India and Japan is 2.

Solution 5

Gold is used as a common unit for determining the value of domestic currency in terms of other currency. This causes a valuation of a currency in terms of gold.

The value of a currency is determined by the worth in terms of gold in the open market. This value is allowed to change according to the changes in its worthiness in terms of gold.

Thus, the exchange rate becomes stable because of the valuation of currencies in terms of gold in many countries.

Solution 6

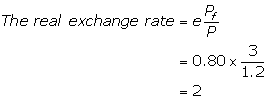

The demand and supply forces of market determine the exchange rate under a flexible exchange rate regime. The equilibrium level occurs when there is an intersection between market demand and market supply.

Exchange rate determination under a flexible exchange rate regime

The above figure indicates that the rate of exchange is determined at the level where demand and supply of currency equal each other. The figure also indicates that there is an inverse relationship between the rate of exchange and the demand for currency.

There is a positive relationship between the supply of a currency and the rate of exchange.

Solution 7

Differences between devaluation and depreciation:

|

Devaluation |

Depreciation |

|

Official process of lowering the currency exchange under the fixed exchange rate system |

Decline in the value of currency as compared to other currencies |

|

Normally done by the government |

Normally occurs due to changes in demand and supply forces of the market |

|

Occurs in the fixed exchange rate system |

Occurs in the flexible exchange rate system |

Solution 8

The Central Bank would need to intervene in a managed floating system to evade dirty floating in the exchange rate system.

Floating and fixed exchange rate systems are part of a managed floating system. So, the government needs to intervene for purposes of moderation.

The Central Bank interferes by selling and buying of foreign currency to create a balance in the floating system. Also, whenever there is a requirement of any improvement in the system, the government or the Central Bank would need to intervene in a managed floating system.

Solution 9

The concepts of demand for domestic goods and domestic demand for goods have the same meaning in a closed economy. However, these concepts have different meanings in an open economy.

Domestic demand for goods indicates the domestic market demand of a nation in a particular year, whereas demand for domestic goods indicates the domestic and foreign demand for domestically produced goods.

Solution 10

Marginal propensity to import shows the level of additional income spent on importing foreign goods and services.

As given,

M = 60 + 0.06Y

Here, marginal propensity to import is 0.06. This marginal propensity to import indicates the portion of income which is spent on imports of goods and services.

The aggregate demand is negatively affected by the marginal propensity to imports. An increase in the level of income causes a decrease in the aggregate demand as the additional income is spent on imports.

Solution 11

Open economy autonomous expenditure multiplier is smaller than the closed economy due to the dependency on demand for foreign goods. A rise in the demand causes a smaller increase in the output as compared to the closed economy.

Closed economy autonomous expenditure multiplier is comparatively greater as there is less dependency on demand for foreign goods.

A rise in the demand causes a greater increase in output as compared to an open economy.

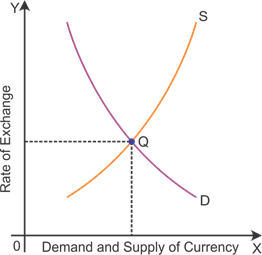

Solution 12

Equilibrium income level in the case of proportional taxes:

Open economy autonomous expenditure multiplier is smaller than the closed economy because of the dependency on demand for foreign goods.

Solution 13

As given,

M = 50 + 0.05Y

X = 90

G = 40

I = 60

T = 50

(a)

Calculation for equilibrium level:

Thus, the equilibrium level is 560.

(b)

Formula for calculating net exports at the equilibrium level:

![]()

Substituting the values in the above formula,

![]()

Thus, the net export balance at equilibrium income is 12.

(c)

An increase in government purchases from 40 to 50 is likely to raise the equilibrium level.

Thus, the equilibrium level is 600.

Net export balance

Putting the changed values in the formula,

![]()

Thus, the net export balance at equilibrium income is 10.

Solution 14

As given,

M = 50 + 0.05Y

X = 100

G = 40

I = 60

T = 50

C = 40 + 0.8 YD

Calculation for the equilibrium level:

Thus, the equilibrium level is 600.

Net export balance

Putting the changed values in the formula,

![]()

Thus, the net export balance at equilibrium income is 20.

Solution 15

The rupee-dollar exchange rate is given as Rs.30 =$1 in the year 2010.

This implies that the price of a good (say, pen) is $1 in USA and Rs.30 in India. It is given that prices have doubled in India over 20 years while they have remained fixed in the USA, so the cost of the pen will be Rs. 60 in 2030 and the cost of the pen remains the same i.e. $1 in the USA since the prices are not changing.

Exchange rate between dollar and rupee in the year 2030 will be Rs.60=$1. The rupee, therefore, will depreciate.

Solution 16

The exchange rate plays an important role in determining trade between two nations. If there is higher inflation in Country A than in Country B and there is a fixed exchange rate, then it would be beneficial for Country A to import goods and services from Country B. This situation will benefit if Country B exports its goods and services to Country A.

Inflationary situation in Country A reduces its export to other countries causing a deficit in its foreign trade. On the other hand, Country B imports less and exports more. This would lead to a surplus in foreign trade.

Solution 17

Current account deficit is the excess of the total value of imported goods and services over the total value of exported goods and services.

Current account deficit should be a cause for alarm as a country becomes a debtor. This situation can lead to deprecation of currency. However, current account deficit cannot always be a cause of concern as deficit may be caused by productive reasons.

An increase in investments helps a country to increase its growth and development in the future. So, a current account deficit should not always be a cause for alarm.

Solution 18

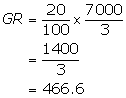

As given,

Taxes = 20% of income

G = 750

I = 500

C = 100 + 0.75Y D

M = 100 + 0.2Y

X = 150

Formula for calculating the equilibrium income level:

Thus, the equilibrium income level is ![]()

The budgetary deficit or surplus can be calculated by considering government receipts and expenditures.

As given,

Government expenditure = 750

Government receipts are given as follows:

Government receipts = 466.6.

This indicates that government receipts are less than government expenditures. Thus, there will be a budgetary deficit as government expenditures exceed government receipts.

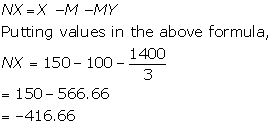

The trade deficit can be calculated by considering the total value of exports and imports. The following formula is used to find trade deficit:

Negative NX indicates a deficit in trade. This situation shows that exports are more than imports.

Solution 19

Some exchange rate arrangements which countries have opted to bring stability in their external accounts.

Flexible exchange rate system: Adjustments are allowed in the rate of exchange.

Approximately 10% variation in currencies of two nations is allowed. The flexible exchange rate system helps to change the value of currency for improving the growth rate of an economy.

Crawling peg system: One percent of variation in the value of currency is allowed. This system allows regular adjustments in the exchange rate.

Managed floating: The Central Bank interferes by selling and buying of foreign currency to create balance in the managed floating system. Also, whenever there is the requirement of any improvement in the system, the government or the central bank would need to intervene in a managed floating system.