Class 12-commerce NCERT Solutions Economics Chapter 2: National Income Accounting

The NCERT solutions for the CBSE Class 12 Commerce Economics chapter National Income Accounting at TopperLearning are complete solutions to questions in the CBSE-recommended book. These solutions provide detailed answers for every question and help students learn better and score more in the exam. Along with the NCERT solutions, students can refer to our sample papers, past years’ papers, revision notes, video lessons etc. for revision and practice.

National Income Accounting Exercise 33

Solution 1

Four factors of production and their remunerations to each:

Land: Land is the most important factor of production. It is a free gift given by nature. It is the primary factor of production.

Rent is given as remuneration for the use of land.

Labour: Labour is considered a human factor of production. It is a person-engaged factor of production.

Wages are paid for the use of labour in the production process. Wages are determined on the basis of labour skills.

Capital: Capital is a monetary investment in businesses. Capital helps in the process of growing and developing business activities.

Interest is paid for the use of capital.

Entrepreneur: The entrepreneur is the most important factor of production. All the production activities are governed by the entrepreneur. The role of the entrepreneur is to bring all factors of production together to perform production activities.

Profit is received by the entrepreneur for performing entrepreneurial activities.

Solution 2

In an economy, income is either saved or used for the purpose of buying final goods and services. The following equation shows the use of income:

Y = C + S

Y = income

C = consumption

S = saving

The use of income for buying final goods and services causes final investment or consumption expenditure. If the income is used for the purpose of saving, then it causes a reduction in the selling of final goods and services. However, this is regarded as inventory investment. Therefore, the aggregate final expenditure of an economy should be equal to the aggregate factor payments.

Solution 3

Differences between stock and flow:

|

Stock |

Flow |

|

Stock is a variable that is measured at a particular time. |

Flow is a variable that is measured over a long period of time. |

|

Stock is static. |

Flow is dynamic. |

|

Time dimension is not applied to the stock concept. |

Time dimension is applied to the flow concept. |

|

Example: National wealth |

Example: National income |

Differences between net investment and capital:

|

Net investment |

Capital |

|

Net investment is calculated by deducting depreciation of a fixed asset from gross investment. |

Capital is the monetary income that is used by businesses in the production process. |

|

Net investment is regarded as a flow concept. |

Capital is regarded as a stock concept. |

In a tank of water, the flow of water can be considered a flow variable and the stock of water can be considered a stock variable because it can be measured at a particular point in time. Capital is like the stock of water in the tank at a particular point of time, whereas net investment is like the flow of water into the tank.

Solution 4

Planned inventory refers to an inventory that is expected by a firm well in advance, whereas unplanned inventory accumulation refers to an unexpected change in the level of inventories.

Unplanned inventory occurs due to unexpected changes in sales. For example, unplanned inventory occurs when actual sales are less than expected.

Planned inventory is a deliberate action of a producer. For example, if a producer wants 100 units as inventory accumulation, then he/she produces 100 units more to raise the inventory.

The following equation indicates the relation between change in inventories and value-added of a firm:

Value-added of a firm = Sales + ∆ in inventory - Value of intermediate goods

There is a positive relationship between change in inventories and value-added of a firm as an increase in inventories causes an increase in the value-added of a firm.

Solution 5

Three identities for calculating the GDP of a country by three methods:

1. Product method: The product method considers value addition by each production factor in the economy. This method is also called the value-added method. Gross value added in all the three-primary, secondary, and territory-is considered while calculating the gross domestic product.

GDP = Total of gross value added by all firms in the country

2. Income method: Factor payments made to the owners of factors of production are considered while calculating the GDP. Following identity is used to calculate the GDP by the income method.

GDP = Total payments made to the factors of production (land, labour, capital, and entrepreneur)

GDP = W + R + I + P

3. Expenditure method: Spending on final goods and services is taken into account while calculating the GDP. The following identity is used to calculate the GDP by the expenditure method.

GDP = Total consumption expenditure + Investment expenditure + Government consumption expenditure + Net exports

All these three methods give the same value of GDP because the income is either consumed or invested. Here, saving is considered equal to investment.

Solution 6

Budget deficit: Budget deficit refers to an excess of government expenditure over government income.

Trade deficit: Trade deficit refers to an excess of import expenditure over export income in a country.

As given,

Investment - Saving = Rs. 2000 crores

Government expenditure - Income = (-) Rs. 1500 crores

Therefore,

Trade deficit = [I - S] + [G - Y]

= 2000 + [-1500]

= Rs. 500 crores

Thus, the volume of trade deficit of the country was 500 crores.

Solution 7

GDP at the market price of a country in a particular year = 1100

National income = Rs. 850

Net factor income from abroad = Rs. 100

Value of indirect taxes - Subsidies = 150

Putting these values in the formula,

National income = GDP at market price + Net factor income from abroad - Depreciation - Net indirect taxes

850 = 1100 + 100 - Depreciation - 150

850 = 1100 - 50 - Depreciation

850 = 1050 - Depreciation

Depreciation = 1050 - 850 = Rs. 200

Hence, depreciation is Rs. 200.

Solution 8

Net national product at factor cost = 1900

Personal disposable income = 1200

Personal income tax = 600

Value of retained earnings = 200

Putting these values in the formula,

Personal disposable income = Net national product at factor cost - Value of retained earnings of firms and government + Value of transfer payments - Personal tax

1200 = 1900 - 200 + Value of transfer payments - 600

1200 = 1100 + Value of transfer payments

Value of transfer payment = 1200 - 1100 = Rs 100 crores

Therefore, the value of transfer payments made by the government and firms to the households is 100 crores.

Solution 9

The following formula can be used to calculate personal income and personal disposable income:

Personal income = Net domestic product at factor cost + Net factor income from abroad + Transfer income - Undistributed profit - Corporate tax - Net interest paid by households

Net interest paid by households = Interest paid - Interest received

Net interest paid by households = 1200 - 1500

= -300 crores

Substituting values in the formula,

PI = 8000 + 200 + 300 - 1000 - 500 - (-300)

PI = 8000 + 200 + 300 - 1000 - 500 + 300

Personal income = 7300 crores

Personal disposable income = Personal income - Personal payments

Substituting values in the above formula,

Personal disposable income = 7300 - 500

Personal disposable income = Rs. 6800 crores

Solution 10

As given,

Depreciation = 50

Indirect taxes = 30

Personal taxes = 20

Retained earnings = 220

a) GDP = Total collections of the barber from haircuts

= 500

Hence, GDP is 500.

b) NNP at market price

NNP at market price = GDP - Depreciation

= 500 - 50

= Rs. 450

Hence, NNP at market price is 450 rupees.

c) NNP at factor cost

NNP at factor cost = NNP - Sales tax

= 450 - 30

= Rs. 420

Hence, NNP at factor cost is 420 rupees.

d) Personal income

Personal income = NNP at factor cost - Retained earnings

= 420 - 220

= 200

Hence, personal income is 200 rupees.

e) Personal disposable income

Personal disposable income = PI - Income tax

= 200 - 20

= 180

Hence, personal disposable income is 180 rupees.

National Income Accounting Exercise 34

Solution 11

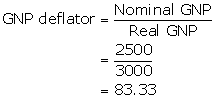

As given,

Value of the nominal GNP of an economy = 2500

Value of the real GNP = 3000

Thus, the value of GNP deflator is 83.33.

Solution 12

Limitations of using GDP as an index of the welfare of a country:

Non-monetary transactions are not considered: GDP measures the value of all goods and services produced in a country. It does not consider the transactions which are done through non-monetary exchanges. Mostly in rural areas, transactions are done through the barter system. These types of transactions remain outside the scope of GDP.

Externality: GDP considers an increase in the value of goods and services. However, it does not consider the negative effects of pollution, diminution of natural resources, etc.

Inequality in income: GDP considers an increase in the level of income. However, it does not consider the income distribution pattern in the country. A rise in the income of the rich also leads to a rise in the GDP.

Welfare of people: GDP neglects the important component of social welfare. The production of goods such as tobacco, narcotic drugs, guns, etc does not add value to social welfare.

Effect of inflation: Effect of the inflationary situation is not considered while measuring the GDP. Inflation increases the cost of buying final goods and services. The standard of living reduces due to the adverse effects of inflation.