Class 12-commerce NCERT Solutions Accountancy Chapter 3: Reconstitution of a Partnership Firm - Retirement/Death of a Partner

The NCERT solutions for CBSE Class 12 Commerce Accountancy Chapter Reconstitution of a Partnership Firm - Retirement/Death of a Partner at TopperLearning help students learn the chapter better. These detailed page-wise and exercise-wise solutions enable students to write better answers too. Studying from these credible solutions helps students score better in the exam. Along with the NCERT solutions, students can also refer to our sample papers, past years’ papers, revision notes, video lessons etc.

Reconstitution of a Partnership Firm - Retirement/Death of a Partner Exercise 207

Solution SA 1

A partner can retire from the firm:

- With the consent of all partners: A partner must take the consent of all the other partners of the firm before his/her retirement. The partner can retire from the firm only if all the partners have approved the decision of his/her retirement.

- According to the terms of the express agreement: If there is an express agreement among the partners, the partner may retire according to the terms of the agreement.

- At his own will: If the partner wants to retire at his/her own will, then a partner may retire by giving a written notice to all the other partners informing them about his/her intention to retire.

Solution SA 2

Various matters which need to be adjusted at the time of retirement of partner/s:

- Computation of new profit-sharing ratio of the remaining partners of the firm

- Computation of new gaining ratio of all the remaining partners of the firm

- Computation of goodwill and its treatment

- Adjustment for the revaluation of assets and liabilities

- Distribution of accumulated profits and losses and reserves between all the partners including retiring partner

- Adjustment of joint life policy

- Settlement of the dues of retiring partners

- Adjustment of capital account of the continuing partner in their new profit-sharing ratio

Solution SA 3

|

Basis of Difference |

Sacrificing Ratio |

Gaining Ratio |

|

1. Meaning |

Ratio in which old partners agree to surrender their share of profit in favour of new partner/s |

Ratio in which the continuing partner acquires the share of profit from outgoing partner/s |

|

2. Calculation |

Sacrificing Ratio = Old Ratio - New Ratio |

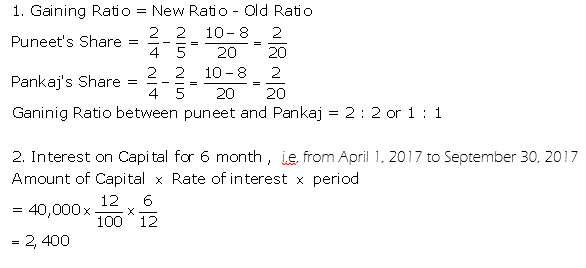

Gaining Ratio = New Ratio - Old Ratio |

|

3. Time |

Calculated at the time of admission of new partner/s |

Calculated at the time of retirement/death of the partner/s |

|

4. Objective |

To find out the share of profit and loss given up by the existing partners in favour of new partner/s |

To find out the share of profit and loss acquired by the remaining partners (of the new firm in case of retirement) from the retiring or deceased partner |

|

5. Effect |

Reduces the profit share of the existing partners |

Increases the profit share of the remaining partners |

Reconstitution of a Partnership Firm - Retirement/Death of a Partner Exercise 208

Solution SA 4

At the time of retirement or death of a partner, it becomes essential to revalue the assets and liabilities of the firm for finding out their true and fair values. Revaluation is needed as the value of assets and liabilities may increase or decrease with the passage of time. Further, it may be possible that certain assets and liabilities are left unrecorded in the books of accounts. The retiring or the deceased partner may be benefited or may bear loss due to change in the values of assets and liabilities. Therefore, the revaluation of the assets and liabilities is necessary to ascertain the true profit or loss which is to be distributed among all the partners in their old profit-sharing ratio.

Solution SA 5

The retiring/deceased partner is entitled to a share of goodwill of the firm because goodwill is an intangible asset which is earned by the efforts of all the partners in the firm. In the future, the fruits of past performance and reputation will be shared only by the remaining partners after the retirement or death of a partner. Therefore, the remaining partners should compensate the retiring/deceased partner by entitling him/her a share of the firm's goodwill.

Solution LA 1

The total amount due towards a retiring partner can be paid in any of the following manner:

(i) In lump sum: If the amount due to the retiring partner is to be paid in lump sum on the day of his/her retirement. This method is usually adopted when the amount payable is small and the following entry is passed to record such a payment.

|

Date |

Particulars |

|

L.F. |

Dr. Rs. |

Cr. Rs. |

|

|

Retiring Partner's Capital A/c |

Dr. |

|

|

|

|

|

---------To Cash/Bank A/c Capital A/c |

|

|

|

|

|

|

(Being retiring partner paid in cash) |

|

|

|

|

(ii) In instalments: Sometimes, the amount payable to the retiring partner is quite a large amount which a firm is unable to pay in one payment. In such cases, the amount not paid at the time of retirement (or amount which has been decided to be paid in instalments) is transferred to his/her loan account. In this case, the retiring partner receives equal instalments along with the interest on the amount outstanding. The following necessary journal entry is to be passed:

|

Date |

Particulars |

|

L.F. |

Dr. Rs. |

Cr. Rs. |

|

|

Retiring Partner's Capital A/c |

Dr. |

|

|

|

|

|

---------To Retiring Partner's Loan A/c |

|

|

|

|

|

|

(Being retiring partner's capital account transferred to the retiring partner's loan account @ % p.a.) |

|

|

|

|

(iii) Partly in Cash and Partly in Instalments: If the amount due to the retiring partner is to be paid partly in cash and partly in equal instalments, then a certain amount is paid in cash to the retiring partner on the date of the retirement and the rest amount due to him/her is transferred to his/her loan account. The following necessary journal entry is to be passed:

|

Journal |

|||||

|

Date |

Particulars |

|

L.F. |

Dr. Rs. |

Cr. Rs. |

|

|

Retiring Partner's Capital A/c |

Dr. |

|

|

|

|

|

---------To Cash/Bank A/c Capital A/c |

|

|

|

|

|

|

(Amount transferred to the partner's loan account) |

|

|

|

|

|

|

---------To Cash A/c (Amount paid in cash immediately on the date of the retirement) |

|

|

|

|

|

|

(Being retiring partner partly paid in cash and balance transferred to the partner's loan account) |

|

|

|

|

Solution LA 2

The amount payable to the deceased partner can be ascertained by preparing his/her capital account. The legal executer of the deceased partner would be entitled to the balance in deceased partner's capital account. The balancing figure of the deceased partner's capital account is derived after posting the below mentioned items:

1. Crediting deceased partner's capital account with

- Credit balance of capital account and/or current account

- Deceased partner's share of profit up to the date of his/her death

- Deceased partner's share of goodwill

- Deceased partner's share in accumulated reserves and profit account

- Deceased partner's share in gain on revaluation of assets and liabilities

- Deceased partner's share of Joint Life Policy

- Interest on capital, if any, up to the date of the death

- Salary or commission, if any, up to the date of the death

2. Debiting deceased partner's capital account with

Debit balance of the deceased partner's capital account and/or current account.

- Drawings up to the date of death of the partner

- Interest on drawings, if any, up to the date of the death

- Deceased partner's share in loss on revaluation of assets and liabilities

- Deceased partner's share of loss up to the date of the death

- Deceased partner's share in the accumulated losses of the firm

The legal executor is entitled to the balancing figure which is the excess of the credit side over the debit side of the deceased partner's capital account.

|

Date |

Particulars |

J.F |

Rs. |

Date |

Particulars |

J.F |

Rs. |

|

|

To Revaluation A/c (Loss) |

|

|

|

By Balance b/d |

|

|

|

|

To Profit and Loss Suspense A/c (Share of loss up to the date of the death) |

|

|

|

By Profit and Loss Suspense A/c (Share in profits up to the date of the death) |

|

|

|

|

To Accumulated Losses A/c |

|

|

|

By Goodwill A/c |

|

|

|

|

To Goodwill A/c (Written off) |

|

|

|

By Reserve and Profit A/c |

|

|

|

|

To Drawings A/c |

|

|

|

By Revaluation A/c (gain) |

|

|

|

|

To Interest on Drawings A/c |

|

|

|

By Joint Life Policy A/c |

|

|

|

|

To Partner's Executor's A/c (Balancing Figure) |

|

|

|

By Interest on Capital A/c |

|

|

|

|

|

|

|

|

By Salary A/c |

|

|

|

|

|

|

|

|

By Commission A/c |

|

|

|

|

|

|

xxx |

|

|

|

Xxx |

Solution LA 3

Generally, in accounting terms, the retiring or deceased partner's capital account is credited with his share of goodwill and continuing partner's capital accounts are debited from the gaining ratio. This treatment is based on Para 16 of Accounting Standard 10, which states that it is mandatory to record goodwill in the books only when consideration in money or money's worth has been paid for it.

In case of retirement and death of a partner, goodwill account cannot be raised. There are namely two probable situations on which the treatment of goodwill rests.

- If goodwill already appears in the books of the firm

- If no goodwill appears in the books of the firm

The treatment of goodwill in the above two scenarios is discussed below.

Scenario 1: Goodwill already appears in the books of the firm

Step 1: Write off the existing goodwill

The goodwill already appearing in the old balance sheet of the firm (if mentioned in the question), is first written off and is to be distributed among all partners of the firm including the retiring or deceased partner in their old profit-sharing ratio. The following journal entry is passed to write off the old/existing goodwill:

|

Date |

Particulars |

|

L.F. |

Dr. Rs. |

Cr. Rs. |

|

|

Partner's Capital A/c |

Dr. |

|

|

|

|

|

---------To Goodwill A/c |

|

|

|

|

|

|

(Being goodwill written off among all partners in their old ratio) |

|

|

|

|

Step 2: Adjusting goodwill through partner's capital account

After writing off the old goodwill, the goodwill needs to be adjusted through the partner's capital account with the share of the goodwill of the retiring or the deceased partner. The following journal entry is passed:

|

Date |

Particulars |

|

L.F. |

Dr. Rs. |

Cr. Rs. |

|

|

Remaining Partner's Capital A/c |

Dr. |

|

|

|

|

|

---------To Retiring/Deceased Partner's Capital A/c |

|

|

|

|

|

|

(Being gaining partner's capital A/c debited from gaining share and retiring/deceased partner's capital account credited for share of goodwill) |

|

|

|

|

Scenario 2: No goodwill appears in the books of the firm

In case no goodwill appears in the books of the firm, the goodwill is adjusted through the partner's capital account with the share of the goodwill of the retiring or deceased partner.

The following is the journal entry which is passed to give the required affect:

|

Date |

Particulars |

|

L.F. |

Dr. Rs. |

Cr. Rs. |

|

|

Remaining Partner's Capital A/c |

Dr. |

|

|

|

|

|

---------To Retiring/Deceased Partner's Capital A/c |

|

|

|

|

|

|

(Being gaining partner's capital A/c debited from gaining share and retiring/deceased partner's capital account credited for share of goodwill) |

|

|

|

|

Solution LA 4

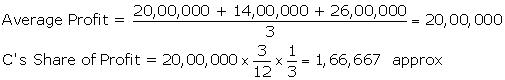

A deceased partner's share of profits can be calculated on any of the following basis depending on the agreement between partners.

1. On the basis of time:

Profit up to the date of the death of the partner is calculated on the basis of last year's profit or average profit of last few years. In this approach, it is assumed that the profit will be uniform throughout the current year. The deceased partner will be entitled to the share of the profit proportionately up to the date of his/her death.

Share of Deceased Partner in Profit =

![]()

Example:

L, M and N are equal partners. The profit of the firm for the years 2013, 2014 and 2015 are Rs 20,00,000, Rs 14,00,000 and Rs 26,00,000, respectively. N dies on 31 March 2016. The share of N in the firm's profit will be calculated on the basis of the average profit of the last three years. The firm closes its books every year on 31 December.

In this case, N's share in the profits will be calculated for four months, i.e. from 1 January 2016 to 31 March 2016.

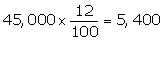

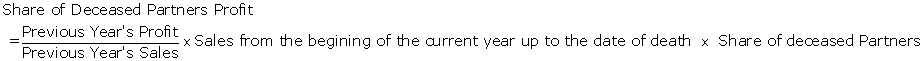

2. On the basis of sale: Profit is calculated on the basis of last year's sale. In this situation, it is assumed that the net profit margin of the current year's sale is similar to that of the last year.

Example: P, Q and R are equal partners. Sales for the previous year and the profits were Rs 12,50,000 and Rs 1,25,000. R died on 30 June 2015. Sale of the current year till the date of R's death amounted to Rs 6,00,000. The firm closes its books on 31 December every year.

![]()

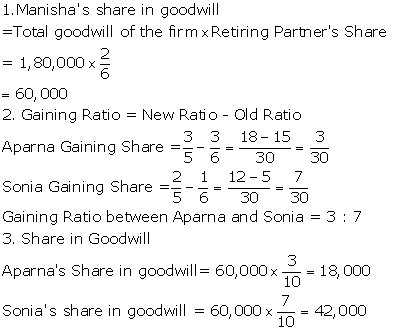

Solution NUM 1

|

Books of Aparna and Sonia Journal |

|||||

|

Date |

Particulars |

|

L.F. |

Dr. Rs. |

Cr. Rs. |

|

|

Aparna's Capital A/c |

Dr. |

|

18,000 |

|

|

|

Sonia's Capital A/c |

Dr. |

|

42,000 |

|

|

|

---------To Manisha's Capital A/c |

|

|

|

60,000 |

|

|

(Being manisha's share of goodwill adjusted to aparna's and Sonia's capital account in their gaining ratio) |

|

|

|

|

|

|

|

|

|

|

|

Working Note:

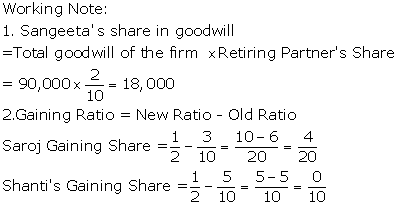

Solution Num 2

|

Books of Saroj and Shanti Journal |

|||||

|

Date |

Particulars |

|

L.F. |

Dr. Rs. |

Cr. Rs. |

|

|

Sangeeta's Capital A/c |

Dr. |

|

12,000 |

|

|

|

Saroj's Capital A/c |

Dr. |

|

18,000 |

|

|

|

Shanti's Capital A/c |

Dr. |

|

30,000 |

|

|

|

---------To Goodwill A/c |

|

|

|

60,000 |

|

|

(Being goodwill written off) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Saroj's Capital A/c |

Dr. |

|

18,000 |

|

|

|

---------To Sangeeta's Capital A/c |

|

|

|

18,000 |

|

|

(Being sangeeta's share of goodwill adjusted to saroj's capital account in her gaining ratio) |

|

|

|

|

|

|

|

|

|

|

|

Working Note:

Solution Num 3

|

Books of Himanshu and Gagan Journal |

|||||

|

Date |

Particulars |

|

L.F. |

Dr. Rs. |

Cr. Rs. |

|

|

Building A/c |

Dr. |

|

20,000 |

|

|

|

Investment A/c |

Dr. |

|

5,000 |

|

|

|

---------To Revaluation A/c |

|

|

|

25,000 |

|

|

(Being value of building and investment increased at the time of Naman's retirement) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Revaluation A/c |

Dr. |

|

7,000 |

|

|

|

---------To Plant and Machinery A/c |

|

|

|

4,000 |

|

|

---------To Provision for Bad and Doubt Debts A/c |

|

|

|

1,000 |

|

|

---------To Stock A/c |

|

|

|

2,000 |

|

|

(Being assets revalued and provision for bad and doubtful debts made at time of naman's retirement) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Revaluation A/c |

Dr. |

|

18,000 |

|

|

|

---------To Himanshu's Capital A/c |

|

|

|

9,000 |

|

|

---------To Gangan's Capital A/c |

|

|

|

6,000 |

|

|

---------To Naman's Capital A/c |

|

|

|

3,000 |

|

|

(Being Profit on revaluation transferred to all partners capital account in their old profit sharing ratio) |

|

|

|

|

|

|

|

|

|

|

|

|

Revaluation Account |

|||||

|

Dr. |

|

Cr. |

|||

|

Particulars |

|

Rs. |

Particulars |

Rs. |

|

|

To Plant and Machinery A/c |

|

4,000 |

By Building A/c |

20,000 |

|

|

To Stock A/c |

|

2,000 |

By Investment A/c |

5,000 |

|

|

To Provision for Bad and Doubtful Debts A/c |

|

1,000 |

|

|

|

|

To Profit transferred: |

|

|

|

|

|

|

|

Himanshu Capital A/c |

9,000 |

|

|

|

|

|

Gangan Capital A/c |

6,000 |

|

|

|

|

|

Naman Capital A/c |

3,000 |

18,000 |

|

|

|

|

|

25,000 |

|

25,000 |

|

Solution Num 4

|

Books of Naresh and Bishwajeet Journal |

|||||

|

Date |

Particulars |

|

L.F. |

Dr. Rs. |

Cr. Rs. |

|

|

General Reserve A/c |

Dr. |

|

36,000 |

|

|

|

---------To Naresh's Capital A/c |

|

|

|

12,000 |

|

|

---------To Raj Kumar's Capital A/c |

|

|

|

12,000 |

|

|

---------To Bishwajeet's Capital A/c |

|

|

|

12,000 |

|

|

(Being general reserve distributed among old partner in old ratio) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Naresh's Capital A/c |

Dr. |

|

5,000 |

|

|

|

Raj Kumar's Capital A/c |

|

|

5,000 |

|

|

|

Bishwajeet's Capital A/c |

|

|

5,000 |

|

|

|

---------To Profit and Loss A/c |

|

|

|

15,000 |

|

|

(Being debit balance of profit and loss account written off) |

|

|

|

|

|

|

|

|

|

|

|

Reconstitution of a Partnership Firm - Retirement/Death of a Partner Exercise 209

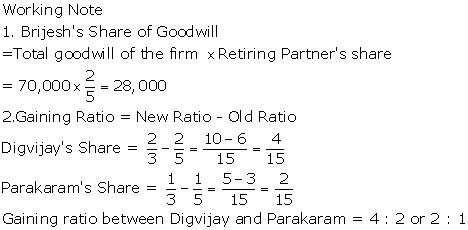

Solution Num 5

|

Books of Digvijay and Parakaram |

|||||||

|

Revaluation Account |

|||||||

|

Dr. |

|

|

Cr. |

||||

|

Particulars |

|

Rs. |

Particulars |

|

Rs. |

||

|

To Bad Debts A/c |

|

2,000 |

|

|

|

||

|

To Patents A/c |

|

9,000 |

By loss transferred to: |

|

|

||

|

|

|

|

|

Digvijay Capital A/c |

4,400 |

|

|

|

|

|

|

|

Brijesh Capital A/c |

4,400 |

|

|

|

|

|

|

|

Parakaram Capital A/c |

2,200 |

11,000 |

|

|

|

|

|

|

|

|

||

|

|

|

11,000 |

|

|

11,000 |

||

|

Partners' Capital Account |

||||||||

|

Dr. |

|

|

|

|

|

|

Cr. |

|

|

Particulars |

Digvijay |

Brijesh |

Parakaram |

Particulars |

Digvijay |

Brijesh |

Parakaram |

|

|

To Brijesh's Capital A/c |

18,667 |

|

9,333 |

By Balance b/d |

82,000 |

60,000 |

75,500 |

|

|

To Revaluation A/c(Loss) |

4,400 |

4,400 |

2,200 |

By Reserve A/c |

7,400 |

7,400 |

3,700 |

|

|

To Brijesh's Loan A/c |

|

91,000 |

|

By Digvijay's Capital A/c |

|

18,667 |

|

|

|

To Balance c/d |

66,333 |

|

67,667 |

By Parakaram's Capital A/c |

|

9,333 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

89,400 |

95,400 |

79,200 |

|

89,400 |

95,400 |

79,200 |

|

|

Balance Sheet as on March 31, 2017 |

|||||

|

Dr. |

|

|

|

Cr. |

|

|

Liabilities |

Rs. |

Assets |

|

Rs. |

|

|

Creditors |

49,000 |

Cash |

|

8,000 |

|

|

Brijesh's Loan |

91,000 |

Debtors |

19,000 |

|

|

|

Digvijay's Capital |

66,333 |

|

Less: Bad Debts |

2,000 |

17,000 |

|

Parakaram's Capital |

67,667 |

Stock |

|

42,000 |

|

|

|

|

Building |

|

2,07,000 |

|

|

|

2,74,000 |

|

|

2,74,000 |

|

Since, sufficient balance is not available to pay the amount due to Brijesh, the balance of his Capital Account transferred to his loan account.

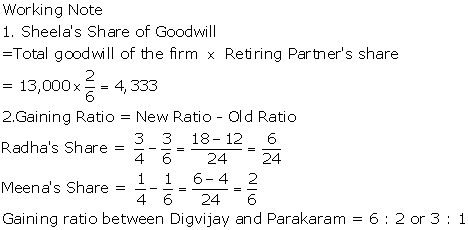

Solution Num 6

|

Books of Radha and Meena |

|||||

|

Revaluation Account |

|||||

|

Dr. |

|

Cr. |

|||

|

Particulars |

|

Rs. |

Particulars |

Rs. |

|

|

To Machinery A/c |

|

800 |

By Expenses Owing A/c |

750 |

|

|

To Losse Tools A/c |

|

400 |

By Factory Premises A/c |

1,800 |

|

|

To Profit transferred to: |

|

|

|

|

|

|

|

Meena Capital A/c |

675 |

|

|

|

|

|

Radha Capital A/c |

450 |

|

|

|

|

|

Sheela Capital A/c |

225 |

1,350 |

|

|

|

|

|

2,550 |

|

2,550 |

|

|

Partners' Capital Account |

|||||||

|

Dr. |

|

|

|

|

|

|

Cr. |

|

Particulars |

Radha |

Sheela |

Meena |

Particulars |

Radha |

Sheela |

Meena |

|

To Sheela's Capital A/c |

3,250 |

|

1,083 |

By Balance b/d |

15,000 |

15,000 |

15,000 |

|

To Sheela's Loan A/c |

|

24,283 |

|

By General Reserve A/c |

6,750 |

4,500 |

2,250 |

|

To Balance c/d |

19,175 |

|

16,392 |

By Revaluation A/c (Profit) |

675 |

450 |

225 |

|

|

|

|

|

By Radha's Capital A/c |

|

3,250 |

|

|

|

|

|

|

By Meena's Capital A/c |

|

1,083 |

|

|

|

22,425 |

24,283 |

17,475 |

|

22,425 |

24,283 |

17,475 |

|

Balance Sheet as on April 1,2017 |

|||||||

|

Liabilities |

|

Rs. |

Assets |

|

Rs. |

||

|

Trade Creditors |

|

3,000 |

Cash in Hand |

|

1,500 |

||

|

Bills Payable |

|

4,500 |

Cash at Bank |

|

7,500 |

||

|

Expenses Owing |

|

3,750 |

Debtors |

|

15,000 |

||

|

Sheela's Loan |

|

24,283 |

Stock |

|

12,000 |

||

|

Capital: |

|

|

Factory premises |

|

24,300 |

||

|

|

Radha |

19,175 |

|

Machinery |

8,000 |

|

|

|

|

Meena |

16,392 |

35,567 |

|

Less : 10% |

800 |

7,200 |

|

|

|

|

|

Losse Tools |

4,000 |

|

|

|

|

|

|

|

|

Less : 10% |

400 |

3,600 |

|

|

|

71,100 |

|

|

71,100 |

||

Reconstitution of a Partnership Firm - Retirement/Death of a Partner Exercise 210

Solution Num 7

|

Revaluation Account |

|||||

|

Dr. |

|

Cr. |

|||

|

Particulars |

|

Rs. |

Particulars |

Rs. |

|

|

Stock |

|

900 |

Premises |

16,000 |

|

|

Provision for Legal Damages |

|

1,200 |

Provision for Doubtful Debts |

100 |

|

|

Profit transferred to Capital Account: |

|

|

Furniture |

4,000 |

|

|

|

Pankaj |

9,000 |

|

|

|

|

|

Naresh |

6,000 |

|

|

|

|

|

Saurabh |

3,000 |

18,000 |

|

|

|

|

|

20,100 |

|

20,100 |

|

|

Partners' Capital Account |

|||||||

|

Dr. |

|

|

|

|

|

|

Cr. |

|

Particulars |

Pankaj |

Naresh |

Saurabh |

Particulars |

Pankaj |

Naresh |

Saurabh |

|

To Naresh's Capital A/c |

14,000 |

|

|

By Balance b/d |

46,000 |

30,000 |

20,000 |

|

To Naresh's Loan A/c |

|

26,000 |

|

By General Reserve A/c |

6,000 |

4,000 |

2,000 |

|

To Bank A/c |

|

28,000 |

|

By Revaluation A/c (Profit) |

9,000 |

6,000 |

3,000 |

|

To Balance c/d |

47,000 |

|

25,000 |

By Pankaj's Capital A/c |

|

14,000 |

|

|

|

|

|

|

|

|

|

|

|

|

61,000 |

54,000 |

25,000 |

|

61,000 |

54,000 |

25,000 |

|

Bank Account |

||||

|

Dr. |

|

Cr. |

||

|

Particulars |

|

Rs. |

Particulars |

Rs. |

|

To Balance b/d |

|

7,600 |

By Naresh's Capital A/c |

28,000 |

|

To Bank Loan A/c ( Balancing Figure) |

|

20,400 |

|

|

|

|

|

|

|

|

|

|

|

28,000 |

|

28,000 |

|

Balance Sheet as on September 30,2017 |

|||||||

|

Liabilities |

|

Rs. |

Assets |

|

Rs. |

||

|

Sundry Creditors |

|

15,000 |

Debtors |

6,000 |

|

||

|

Bills Payable |

|

12,000 |

|

Less: Provision for Doubtful Debts |

300 |

5,700 |

|

|

Bank Loan/ Overdraft |

|

20,400 |

Stock |

|

8,100 |

||

|

Outstanding Salaries |

|

2,200 |

Furniture |

|

45,000 |

||

|

Provision for Legal Damages |

|

7,200 |

Premises |

|

96,000 |

||

|

Naresh's Loan |

|

26,000 |

|

|

|

||

|

Capital: |

|

|

|

|

|

||

|

|

Pankaj |

47,000 |

|

|

|

|

|

|

|

Saurabh |

25,000 |

72,000 |

|

|

|

|

|

|

|

1,54,800 |

|

|

1,54,800 |

||

Reconstitution of a Partnership Firm - Retirement/Death of a Partner Exercise 211

Solution Num 8

|

Pammy's Capital Account |

||||

|

Dr. |

|

Cr. |

||

|

Particulars |

|

Rs. |

Particulars |

Rs. |

|

To Drawings A/c |

|

10,000 |

By Balance b/d |

40,000 |

|

To Pammy Executor's A/c |

|

75,400 |

By Profit and Loss A/c (Suspense) |

3,000 |

|

|

|

|

By Puneet's Capital A/c |

15,000 |

|

|

|

|

By Pankaj's Capital A/c |

15,000 |

|

|

|

|

By Interest on Capital A/c |

2,400 |

|

|

|

|

By Reserve |

10,000 |

|

|

|

85,400 |

|

85,400 |

|

Pammy's Executor Account |

|||||

|

Date |

Particulars |

Rs. |

Date |

Particulars |

Rs. |

|

2017-18 |

|

|

2017-18 |

|

|

|

Sept 30 |

To Bank A/c |

15,400 |

Sept 30 |

By Pammy's Capital A/c |

75,400 |

|

Mar 31 |

To Balance c/d |

63,600 |

Mar 31 |

By Interest A/c |

3,600 |

|

|

|

|

|

|

|

|

|

|

79,000 |

|

|

79,000 |

|

2018-19 |

|

|

2018-19 |

|

|

|

Sep 30 |

To Bank A/c (15,000+3,600+3,600) |

22,200 |

Apr 01 |

By Balance b/d |

63,600 |

|

Mar 31 |

To Balance c/d |

47,700 |

Sep 30 |

By Interest A/c |

3,600 |

|

|

|

|

Mar 31 |

By Interest A/c |

2,700 |

|

|

|

|

|

|

|

|

|

|

69,900 |

|

|

69,900 |

|

2019-20 |

|

|

2019-20 |

|

|

|

Sep 30 |

To Bank A/c |

20,400 |

Apr 01 |

By Balance b/d |

47,700 |

|

Mar 31 |

To Balance c/d |

31,800 |

Sep 30 |

By Interest A/c |

2,700 |

|

|

|

|

Mar 31 |

By Interest A/c |

1,800 |

|

|

|

|

|

|

|

|

|

|

52,200 |

|

|

52,200 |

|

2020-21 |

|

|

2020-21 |

|

|

|

Sep 30 |

To Bank A/c (15,000+1,800+1,800) |

18,600 |

Apr 01 |

By Balance b/d |

31,800 |

|

Mar 31 |

To Balance c/d |

15,900 |

Sep 30 |

By Interest A/c |

1,800 |

|

|

|

|

Mar 31 |

By Interest A/c |

900 |

|

|

|

|

|

|

|

|

|

|

34,500 |

|

|

34,500 |

|

2021-22 |

|

|

2021-22 |

|

|

|

Sep 30 |

To Bank A/c (15,000+900+900) |

16,800 |

Apr 01 |

By Balance b/d |

15,900 |

|

|

|

|

Sep 30 |

By Interest A/c |

900 |

|

|

|

|

|

|

|

|

|

|

16,800 |

|

|

16,800 |

|

|

|

|

|

|

|

3.Interest Amount

The firm closes its books every year on march 31 While installments to Pammy's Executor are paid on sept.30 every year.

Amount outstanding on 30 September = 75,400 - 15,400 = 60,000

|

Periods |

Outstanding |

Yearly Interest |

For 6 Month |

|

2017 - 18 |

60,000 |

|

|

|

2018 - 19 |

45,000 |

|

|

|

2019 - 20 |

30,000 |

|

|

|

2020 - 21 |

15,000 |

|

|

Solution Num 9

|

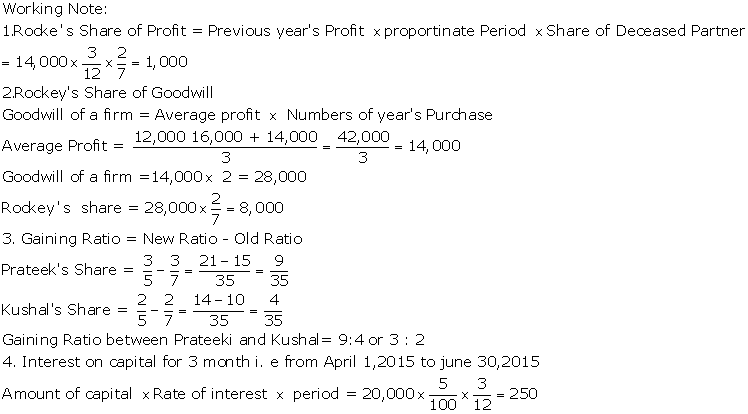

Books of Prateek and Kushal Journal |

|||||

|

Date |

Particulars |

|

L.F. |

Dr. Rs. |

Cr. Rs. |

|

2017 |

|

|

|

|

|

|

June 30 |

General Reserve A/c |

Dr. |

|

250 |

|

|

|

Profit and Loss ( Suspense) A/c |

Dr. |

|

1,000 |

|

|

|

General Reserve A/c |

Dr. |

|

4,571 |

|

|

|

---------To Rockey's Capital A/c |

|

|

|

5,821 |

|

|

(Being share of profit, interest on capital and share of general reserve credited to rockey's account) |

|

|

|

|

|

|

|

|

|

|

|

|

June 30 |

Pateek's Capital A/c |

Dr. |

|

4,800 |

|

|

|

Kunal Capital A/c |

Dr. |

|

3,200 |

|

|

|

---------To Rockey's A/c |

|

|

|

8,000 |

|

|

(Being rockey's share of goodwill adjusted to prateek's and Kunal's capital in their gaining ratio, 3:2) |

|

|

|

|

|

|

|

|

|

|

|

|

June 30 |

Rockey' Capital A/c |

Dr. |

|

33,821 |

|

|

|

---------To Rockey's Executor's A/c |

|

|

|

33,821 |

|

|

(Being balance of rockey capital account transferred to his executor 's account) |

|

|

|

|

|

|

|

|

|

|

|

|

Rockey's Capital Account |

|||||

|

Date |

Particulars |

Rs. |

Date |

Particulars |

Rs. |

|

2017 |

|

|

2017 |

|

|

|

Apr 01 |

To Rockey's Executor A/c |

33,821 |

Apr 01 |

By Balance b/d |

20,000 |

|

|

|

|

|

By Interest on capital A/c |

250 |

|

|

|

|

|

By Profit and Loss (Suspense) A/c |

1,000 |

|

|

|

|

|

By General Reserve A/c |

4,571 |

|

|

|

|

|

By Prateek's Capital A/c |

4,800 |

|

|

|

|

|

By Kushal's Capital A/c |

3,200 |

|

|

|

|

|

|

|

|

|

|

33,821 |

|

|

33,821 |

Reconstitution of a Partnership Firm - Retirement/Death of a Partner Exercise 212

Solution Num 10

|

Revaluation Account |

|||||

|

Dr. |

|

Cr. |

|||

|

Particulars |

|

Rs. |

Particulars |

Rs. |

|

|

To Machinery A/c |

|

3,000 |

By Freehold Property A/c |

8,000 |

|

|

To Furniture A/c |

|

840 |

By Stock A/c |

3,300 |

|

|

To Reserve for Bad Debts A/c |

|

500 |

|

|

|

|

To Capitals: |

|

|

|

|

|

|

|

Narang |

3,480 |

|

|

|

|

|

Suri |

1,160 |

|

|

|

|

|

Bajaj |

2,320 |

6,960 |

|

|

|

|

|

11,300 |

|

11,300 |

|

|

Partners' Capital Account |

|||||||

|

Dr. |

|

|

|

|

|

|

Cr. |

|

Particulars |

Narang |

Suri |

Bajaj |

Particulars |

Narang |

Suri |

Bajaj |

|

To Bajaj's Capital A/c |

5,250 |

1,750 |

|

By Balance b/d |

30,000 |

30,000 |

28,000 |

|

To Bajaj's Loan A/c |

|

|

41,320 |

By Reserve A/c |

6,000 |

2,000 |

4,000 |

|

To Balance c/d |

34,230 |

31,410 |

|

By Revaluation A/c (Profit) |

3,480 |

1,160 |

2,320 |

|

|

|

|

|

By Narang's Capital A/c |

|

|

5,250 |

|

|

|

|

|

By Suri's Capital A/c |

|

|

1,750 |

|

|

|

|

|

|

|

|

|

|

|

39,480 |

33,160 |

41,320 |

|

39,480 |

33,160 |

41,320 |

|

|

|

|

|

|

|

|

|

|

To Suri's Current A/c |

|

15,000 |

|

By Balance b/d |

34,230 |

31,410 |

|

|

To Balance c/d |

49,230 |

16,410 |

|

By Narang's Current A/c |

15,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

49,230 |

31,410 |

|

|

49,230 |

31,410 |

|

|

Balance Sheet as on April 01,2017 |

|||||||

|

Liabilities |

|

Rs. |

Assets |

|

Rs. |

||

|

Biils Payable |

|

12,000 |

Free hold Premises |

|

48,000 |

||

|

Sundry Creditors |

|

18,000 |

Machinery |

|

27,000 |

||

|

Bajan's Loan |

|

41,320 |

Furniture |

|

11,160 |

||

|

Suri current Capital Account: |

|

15,000 |

Stock |

|

25,300 |

||

|

|

Narang |

49,230 |

|

Sundry Debtors |

20,000 |

|

|

|

|

Suri |

16,410 |

65,640 |

|

Less: Reserve for Bad Debts |

1,500 |

18,500 |

|

|

|

|

Cash |

|

7,000 |

||

|

|

|

|

Narang's Current A/c |

|

15,000 |

||

|

|

|

|

|

|

|

||

|

|

|

1,51,960 |

|

|

1,51,960 |

||

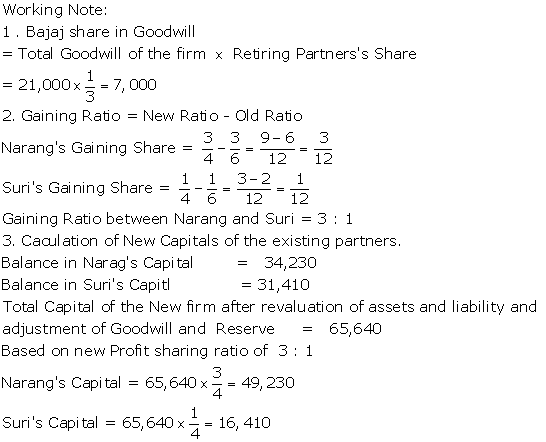

NOTE:

- In the given Question Suri's Capital is Rs 30,000 instead of Rs 20,000.

- Due to insufficient balance in Bajaj's Capital Account, the amount due to Bajaj is transferred to his Loan Account.

Reconstitution of a Partnership Firm - Retirement/Death of a Partner Exercise 213

Solution Num 11

|

Journal |

|||||

|

Date |

Particulars |

|

L.F. |

Dr. Rs. |

Cr. Rs. |

|

2015 |

|

|

|

|

|

|

Mar 30 |

Revalutaion A/c |

Dr. |

|

1,840 |

|

|

|

---------To Stock A/c |

|

|

|

1,550 |

|

|

---------To Reserve for Doubtful Debts A/c |

|

|

|

25 |

|

|

---------To Reserve for Legal Charges A/c |

|

|

|

265 |

|

|

(Being Assets and Liabilities are Revalued) |

|

|

|

|

|

|

|

|

|

|

|

|

June 30 |

Factory Building A/c |

Dr. |

|

1,440 |

|

|

|

---------To Revalutaion A/c |

|

|

|

1,440 |

|

|

(Being factory building appreciate) |

|

|

|

|

|

|

|

|

|

|

|

|

mar 31 |

Rajesh's Capital A/c |

Dr. |

|

160 |

|

|

|

Pramod's Capital A/c |

Dr. |

|

120 |

|

|

|

Nishant's Capital A/c |

Dr. |

|

120 |

|

|

|

---------To Revalutaion A/c |

|

|

|

400 |

|

|

(Being loss on revaluation adjusted to partners 'capital account) |

|

|

|

|

|

|

|

|

|

|

|

|

Mar 31 |

Rajesh's Capital A/c |

Dr. |

|

2,000 |

|

|

|

Nishant's Capital A/c |

Dr. |

|

1,000 |

|

|

|

---------To Pramod's Capital A/c |

|

|

|

3,000 |

|

|

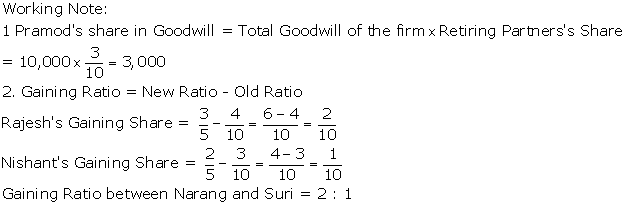

(Being pramod's share of goodwill adjusted to rajesh and nishant capital account in their gaining ratio) |

|

|

|

|

|

|

|

|

|

|

|

|

Mar.31 |

Reserve Fund A/c |

Dr. |

|

2,750 |

|

|

|

---------To Rajesh's Capital A/c |

|

|

|

1,100 |

|

|

---------To Pramod's Capital A/c |

|

|

|

825 |

|

|

---------To Nishant's Capital A/c |

|

|

|

825 |

|

|

(Being reserve fund distributed all the partners) |

|

|

|

|

|

|

|

|

|

|

|

|

Mar.31 |

Pramod's Capital A/c |

Dr. |

|

18,705 |

|

|

|

---------To Pramod's Loan A/c |

|

|

|

18,705 |

|

|

(Being pramod's capital transferred to his loana account) |

|

|

|

|

|

|

|

|

|

|

|

|

Mar.31 |

Rajesh's Capital A/c |

|

|

940 |

|

|

|

Nishant's Capital A/c |

|

|

2,705 |

|

|

|

---------To Rajesh's Current A/c |

|

|

|

940 |

|

|

---------To Nishant's Current A/c |

|

|

|

2,705 |

|

|

(Being excess in capital account is transferred to current account) |

|

|

|

|

|

|

|

|

|

|

|

|

Partners' Capital Account |

|||||||

|

Dr. |

|

|

|

|

|

|

Cr. |

|

Particulars |

Rajesh |

Pramod |

Nishant |

Particulars |

Rajesh |

Pramod |

Nishant |

|

To Revaluation A/c (Loss) |

160 |

120 |

120 |

By Balance b/d |

20,000 |

15,000 |

15,000 |

|

To Pramod's Capital A/c |

2,000 |

|

1,000 |

By Reserve Fund A/c |

1,100 |

825 |

825 |

|

To Pramod 's Loan A/c |

|

18,705 |

|

By Rajesh's Capital A/c |

|

2,000 |

|

|

To Rajesh's Current A/c |

940 |

|

|

By Nishant's Capital A/c |

|

1,000 |

|

|

To Nishant's Current A/c |

|

|

2,705 |

|

|

|

|

|

To Balance c/d |

18,000 |

|

12,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

21,100 |

18,825 |

15,825 |

|

21,100 |

18,825 |

15,825 |

|

Balance Sheet as on March 31,2015 |

|||||||

|

Liabilities |

|

Rs. |

Assets |

|

Rs. |

||

|

Bills Payable |

|

6,250 |

Plant and Machinery |

|

11,500 |

||

|

Sundry Creditors |

|

10,000 |

Debtors |

10,500 |

|

||

|

Reserve for Legal Charges |

|

265 |

|

Less: Reserve |

525 |

9,975 |

|

|

Pramod's Loan |

|

18,705 |

Bills Receivable |

|

7,000 |

||

|

Current Account: |

|

|

|

|

|

||

|

|

Rajesh |

940 |

|

Stock |

15,500 |

|

|

|

|

Nishant |

2,705 |

3,645 |

|

Less : 10% Depreciation |

1,550 |

13,950 |

|

Capital Account: |

|

|

Factory Building |

12,000 |

|

||

|

|

Rajesh |

18,000 |

|

|

Add: 12% Appreciation |

1,440 |

13,440 |

|

|

Nishant |

12,000 |

30,000 |

Bank Balance |

|

13,000 |

|

|

|

|

68,865 |

|

|

68,865 |

||

NOTE:

In the above solution, in order to adjust the capital of remaining partners in the new firm according to their new profit sharing ratio, the surplus or the deficit of Capital Account is transferred to their Current Account. But, in order to match the answer with that of given in the book, the surplus or the deficit amount of the Partners' Capital Account, will either be withdrawn or brought in by the old partners. This treatment will be shown in the Partners' Capital itself and no need to transfer the surplus or deficit capital balance to their Current Accounts. The following Journal entry is passed to record the withdrawal of surplus capital by the partners. If existing partners withdraw their excess capital Journal entry

|

Journal |

|||||

|

Date |

Particulars |

|

L.F. |

Dr. Rs. |

Cr. Rs. |

|

2015 |

|

|

|

|

|

|

Mar 30 |

Rajesh's Capital A/c |

Dr. |

|

940 |

|

|

|

Nishant's Capital A/c |

Dr. |

|

2,705 |

|

|

|

---------To Bank A/c |

|

|

|

3,645 |

|

|

(Being surplus capital withdrawn) |

|

|

|

|

|

Balance Sheet as on March 31,2015 |

|||||||

|

Liabilities |

|

Rs. |

Assets |

|

Rs. |

||

|

Biils Payable |

|

6,250 |

Plant and Machinery |

|

11,500 |

||

|

Sundry Creditors |

|

10,000 |

Debtors |

10,500 |

|

||

|

Reserve for Legal Charges |

|

265 |

|

Less: Reserve |

525 |

9,975 |

|

|

Pramod's Loan |

|

18,705 |

Bills Receivable |

|

7,000 |

||

|

Current Account: |

|

|

|

|

|

||

|

|

Rajesh |

18,000 |

|

Stock |

15,500 |

|

|

|

|

Nishant |

12,000 |

30,000 |

|

Less : 10% Depreciation |

1,550 |

13,950 |

|

|

|

|

Factory Building |

12,000 |

|

||

|

|

|

|

|

Add: 12% Appreciation |

1,440 |

13,440 |

|

|

|

|

|

Bank Balance |

|

9,355 |

||

|

|

|

65,220 |

|

|

65,220 |

||

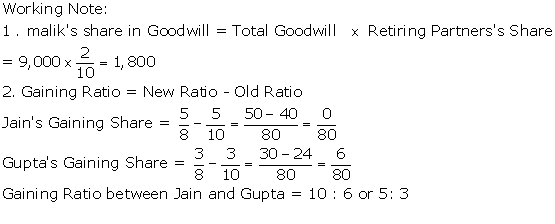

Solution Num 12

|

In the Books of Jain and Gupta |

||||||

|

Revaluation Account |

||||||

|

Dr. |

|

|

Cr. |

|||

|

Particulars |

|

Rs. |

Particulars |

|

Rs. |

|

|

To Office Furniture A/c |

|

4,000 |

By Stock A/c |

|

1,900 |

|

|

To Land and Building A/c |

|

6,000 |

By Plant and Machinery A/c |

|

3,300 |

|

|

To Provision for Doubtful Debts |

|

1,700 |

By Loss transferred to: |

|

|

|

|

|

|

|

|

Jain's Capital A/c |

3,250 |

|

|

|

|

|

|

Gupta's Capital A/c |

1,950 |

|

|

|

|

|

|

Malik's Capital A/c |

1,300 |

6,500 |

|

|

|

11,700 |

|

|

11,700 |

|

|

Partners' Capital Account |

|||||||

|

Dr. |

|

|

|

|

|

|

Cr. |

|

Particulars |

Jain |

Gupta |

Malik |

Particulars |

Jain |

Gupta |

Malik |

|

To Revaluation A/c (Profit) |

3,250 |

1,950 |

1,300 |

By Balance b/d |

40,000 |

60,000 |

20,000 |

|

To Malik's Capital A/c |

1,125 |

675 |

|

By Accumulated Profit A/c |

8,375 |

5,025 |

3,350 |

|

To Cash A/c |

|

|

16,500 |

By Jain Capital A/c |

|

|

1,125 |

|

To Malik's Loan A/c |

|

|

7,350 |

By Gupta's Capital A/c |

|

|

675 |

|

To Balance c/d |

53,900 |

69,000 |

|

By Cash A/c |

9,900 |

6,600 |

|

|

|

58,275 |

71,625 |

25,150 |

|

58,275 |

71,625 |

25,150 |

|

Balance Sheet as on April 01,2016 |

|||||||

|

|

|||||||

|

Dr. |

|

|

|

|

Cr. |

||

|

Liabilities |

|

Rs. |

Assets |

|

Rs. |

||

|

Sundry Creditors |

|

19,800 |

Stock (18,100+1,900) |

|

20,000 |

||

|

Telephone Bills Outstanding |

|

300 |

Bonds |

|

14,370 |

||

|

Account Payable |

|

8,950 |

Cash |

|

5,500 |

||

|

Malik's loan |

|

7,350 |

Bills Receivable |

|

23,450 |

||

|

Partner's Capital |

|

|

Sundry Debtors |

26,700 |

|

||

|

|

Jain |

53,900 |

|

|

Less: Provision for Bad Debts |

1,700 |

25,000 |

|

|

Gupta |

69,000 |

1,22,900 |

Land and Building (26,000-6,000) |

|

20,000 |

|

|

|

|

|

Office Furniture (18,250-4,000) |

|

14,250 |

||

|

|

|

|

Plant and Machinery (20,230+3,300) |

|

23,530 |

||

|

|

|

|

Computers |

|

13,200 |

||

|

|

|

1,59,300 |

|

|

1,59,300 |

||

Reconstitution of a Partnership Firm - Retirement/Death of a Partner Exercise 214

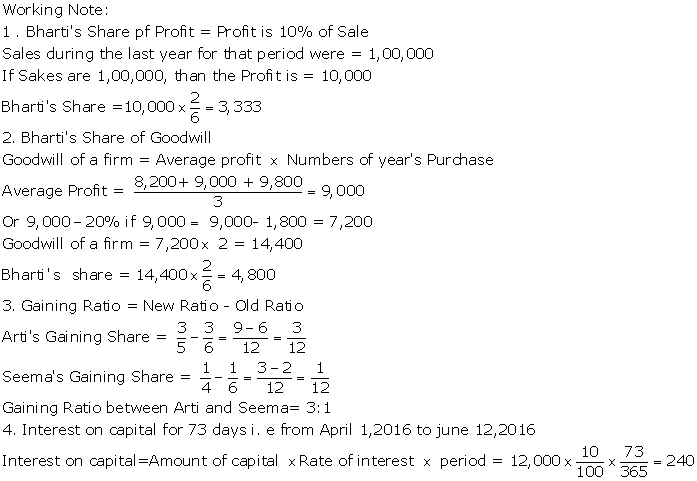

Solution Num 13

|

Journal |

|||||

|

Date |

Particulars |

|

L.F. |

Dr. Rs. |

Cr. Rs. |

|

2016 |

|

|

|

|

|

|

June 12 |

Interest on Capital A/c |

Dr. |

|

240 |

|

|

|

General Reserve A/c |

Dr. |

|

4,000 |

|

|

|

Profit and Loss A/c |

Dr. |

|

3,333 |

|

|

|

---------To Bharti's Capital A/c |

|

|

|

7,573 |

|

|

(Being Profit, interest and general reserve are in creditors to Bharti's capital account)) |

|

|

|

|

|

|

|

|

|

|

|

|

June 12 |

Arti's capital A/c |

Dr. |

|

3,600 |

|

|

|

Seema's Capital A/c |

Dr. |

|

1,200 |

|

|

|

---------To Bharti's Capital A/c |

|

|

|

4,800 |

|

|

(Being Bharti's Share of Goodwill adjusted to Arti's and Seem's capital account in their gaining ratio,3:1) |

|

|

|

|

|

|

|

|

|

|

|

|

June 12 |

Bharti's Capital A/c |

Dr. |

|

24,373 |

|

|

|

---------To Bharti's Executor's A/c |

|

|

|

24,373 |

|

|

(Being bharti's capital account is transferred to her executor's account) |

|

|

|

|

|

|

|

|

|

|

|

|

June 12 |

Bank A/c |

Dr. |

|

16,200 |

|

|

|

---------To Investment A/c |

|

|

|

13,250 |

|

|

---------To Profit on Sale of investment A/c |

|

|

|

2,950 |

|

|

(Being investment sold) |

|

|

|

|

|

|

|

|

|

|

|

|

June 12 |

Bharti's Executor's A/c |

Dr. |

|

24,373 |

|

|

|

---------To Bank A/c |

|

|

|

24,373 |

|

|

(Being bharti's executor paid) |

|

|

|

|

|

|

|

|

|

|

|

|

Bharti's Capital Account |

|||||||

|

Date |

Particulars |

J.F |

Rs. |

Date |

Particulars |

J.F |

Rs. |

|

2016 |

|

|

|

2016 |

|

|

|

|

June 12 |

To Bharti's Executor A/c |

|

24,373 |

Mar 31 |

By Balance b/d |

|

12,000 |

|

|

|

|

|

June 12 |

By Interest on capital |

|

240 |

|

|

|

|

|

|

By Profit and Loss (Suspense) A/c |

|

3,333 |

|

|

|

|

|

|

By General Reserve |

|

4,000 |

|

|

|

|

|

|

By Arti's Capital A/c |

|

3,600 |

|

|

|

|

|

|

By Seema's Capital A/c |

|

1,200 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

24,373 |

|

|

|

24,373 |

|

Bharti's Capital Account |

|||||||

|

Date |

Particulars |

J.F |

Rs. |

Date |

Particulars |

J.F |

Rs. |

|

2016 |

|

|

|

2016 |

|

|

|

|

June 12 |

To Bank A/c |

|

24,373 |

June 12 |

By Bharti's Capital A/c |

|

24,373 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

24,373 |

|

|

|

24,373 |

Reconstitution of a Partnership Firm - Retirement/Death of a Partner Exercise 215

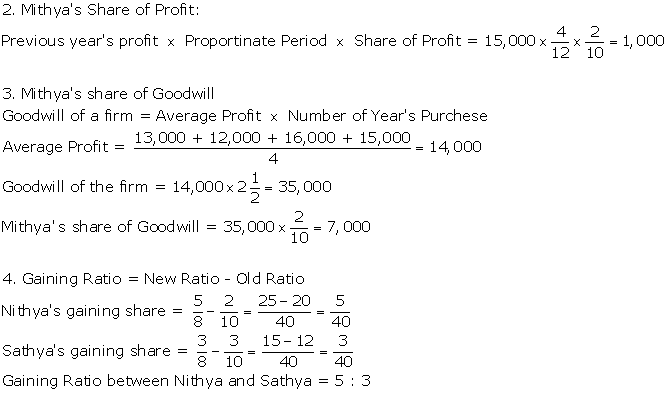

Solution Num 14

|

Journal |

|||||

|

Date |

Particulars |

|

L.F. |

Dr. Rs. |

Cr. Rs. |

|

2015 |

|

|

|

|

|

|

May 01 |

Nithya's Capital A/c |

Dr. |

|

2,500 |

|

|

|

Sathya's Capital A/c |

Dr. |

|

1,500 |

|

|

|

Mithya's Capital A/c |

Dr. |

|

1,000 |

|

|

|

---------To Goodwill A/c |

|

|

|

5,000 |

|

|

(Being goodwill written off among all the partners) |

|

|

|

|

|

|

|

|

|

|

|

|

May 01 |

Patents A/c |

Dr. |

|

2,000 |

|

|

|

Premise A/c |

Dr. |

|

5,000 |

|

|

|

---------To Revaluation A/c |

|

|

|

7,000 |

|

|

(Being increase in the value of patents and premises) |

|

|

|

|

|

|

|

|

|

|

|

|

May 01 |

Revaluation A/c |

Dr. |

|

5,000 |

|

|

|

---------To Machinery A/c |

|

|

|

5,000 |

|

|

(Being decrese in the value of machinery) |

|

|

|

|

|

|

|

|

|

|

|

|

May 01 |

Revaluation A/c |

Dr. |

|

2,000 |

|

|

|

---------To Nithya's Capital A/c |

|

|

|

1,000 |

|

|

---------To Sathya's Capital A/c |

|

|

|

600 |

|

|

---------To Mithya's Capital A/c |

|

|

|

400 |

|

|

(Being profit on revaluation of assets and liabilities transferred to partners' capital account) |

|

|

|

|

|

|

|

|

|

|

|

|

May 01 |

Reserve Fund A/c |

Dr. |

|

6,000 |

|

|

|

---------To Nithya's Capital A/c |

|

|

|

3,000 |

|

|

---------To Sathya's Capital A/c |

|

|

|

1,800 |

|

|

---------To Mithya's Capital A/c |

|

|

|

1,200 |

|

|

(Being reserve fund transferred to partners capital account) |

|

|

|

|

|

|

|

|

|

|

|

|

May 01 |

Nithya's Capital A/c |

Dr. |

|

4,375 |

|

|

|

Sathya's Capital A/c |

Dr. |

|

2,625 |

|

|

|

---------To Mithya's Capital A/c |

|

|

|

7,000 |

|

|

(Being mithya's share of goodwill adjusted to nithya's and sathya's capital account in their gaining ratio 5:3) |

|

|

|

|

|

|

|

|

|

|

|

|

May 01 |

Profit and Loss A/c (Suspense) |

Dr. |

|

1,000 |

|

|

|

---------To Mithya's Capital A/c |

|

|

|

1,000 |

|

|

(Being profit till date of death credited to mithya's capital account) |

|

|

|

|

|

|

|

|

|

|

|

|

May 01 |

Mithya's Capital A/c |

Dr. |

|

28,600 |

|

|

|

---------To Mithya's Executors A/c |

|

|

|

28,600 |

|

|

(Being mithya's capital account transferred to her executor account) |

|

|

|

|

|

|

|

|

|

|

|

|

May 01 |

Mithya's Executors A/c |

Dr. |

|

4,200 |

|

|

|

---------To Cash A/c |

|

|

|

4,200 |

|

|

(Being cash paid to mithya's executor) |

|

|

|

|

|

|

|

|

|

|

|

|

Mithya's Executor's Account |

|||||||

|

Date |

Particulars |

J.F |

Rs. |

Date |

Particulars |

J.F |

Rs. |

|

2015 |

|

|

|

2015 |

|

|

|

|

May 01 |

To Bank A/c |

|

4,200 |

May 01 |

By Mithya's Capital A/c |

|

28,600 |

|

Oct 31 |

To Bank A/c (6,100+ 1,220) |

|

7,320 |

Oct 31 |

By Interest A/c |

|

1,220 |

|

Dec 31 |

To Balance c/d |

|

18,605 |

Dec 31 |

By Interest {915 × 2/6} |

|

305 |

|

|

|

|

|

|

|

|

|

|

|

|

|

30,125 |

|

|

|

30,125 |

|

2016 |

|

|

|

2016 |

|

|

|

|

Apr 30 |

To Bank A/c ( 6,100 + 915 ) |

|

7,015 |

Jan 01 |

By Balance b/d |

|

18,605 |

|

Oct 31 |

To Bank A/c (6,100 + 610 ) |

|

6,710 |

Apr 30 |

By Interest A/c {915 × 4/6} |

|

610 |

|

Dec 31 |

To Balance c/d |

|

6,202 |

Oct 31 |

By Interest A/c |

|

610 |

|

|

|

|

|

Dec 31 |

By Interest A/c {305 × 2/6} |

|

102 |

|

|

|

|

|

|

|

|

|

|

|

|

|

19,927 |

|

|

|

19,927 |

|

2017 |

|

|

|

2017 |

|

|

|

|

Apr 30 |

To Bank A/c (6,100 + 305) |

|

6,405 |

Jan 01 |

By Balance b/d |

|

6,202 |

|

|

|

|

|

Apr 30 |

By Interest {305 × 4/6} |

|

102 |

|

|

|

|

|

|

|

|

|

|

|

|

|

6,405 |

|

|

|

6,405 |

|

Balance Sheet as on May 01, 2015 |

||||||

|

Liabilities |

|

Rs. |

Assets |

|

Rs. |

|

|

Creditors |

|

14,000 |

Investment |

|

10,000 |

|

|

Mithya's Executor's Loan A/c |

|

24,400 |

Premises |

|

25,000 |

|

|

Partners' Capitla A/c |

|

|

Machinery |

|

25,000 |

|

|

|

Nithya |

27,125 |

|

Stock |

|

13,000 |

|

|

Sathya |

28,275 |

55,400 |

Debtors |

|

8,000 |

|

|

|

|

Patents |

|

8,000 |

|

|

|

|

|

Bank ( 8,000 - 4,200) |

|

3,800 |

|

|

|

|

|

Profit and Loss (Suspense) |

|

1,000 |

|

|

|

|

93,800 |

|

|

93,800 |

|

Working Note:

1.

|

Partners' Capital Account |

|||||||

|

Dr. |

|

|

|

|

|

|

Cr. |

|

Particulars |

Nithya |

Sathya |

Mithya |

Particulars |

Nithya |

Sathya |

Mithya |

|

To Goodwill |

2,500 |

1,500 |

1,000 |

By Balance b/d |

30,000 |

30,000 |

20,000 |

|

To Mithya's Capital A/c |

4,375 |

2,625 |

|

By Revaluation A/c |

1,000 |

600 |

400 |

|

To mithya's executor's A/c |

|

|

28,600 |

By Reserve fund |

3,000 |

1,800 |

1,200 |

|

To Balance c/d |

27,125 |

28,275 |

|

By Profit and Loss A/c (Suspense) |

|

|

1,000 |

|

|

|

|

|

By Nithya's Capital A/c |

|

|

4,375 |

|

|

|

|

|

By Sathya's Capital A/c |

|

|

2,625 |

|

|

34,000 |

32,400 |

29,600 |

|

34,000 |

32,400 |

29,600 |

5.

|

Calculation of Interest |

||

|

Period |

Amount Outstanding |

Interest |

|

May 01, 15 to Oct 31, 15 |

24,400 |

|

|

Nov 01, 15 to Apr 30, 16 |

18,300 |

|

|

May 01,16 to Oct 31, 15 |

12,200 |

|

|

Nov 01, 16 to Apr 30,17 |

6,100 |

|