Class 12-commerce NCERT Solutions Accountancy Chapter 1: Accounting for Partnership : Basic Concepts

The NCERT solutions for CBSE Class 12 Commerce Accountancy Chapter Accounting for Partnership: Basic Concepts at TopperLearning provide textbook solutions. These solutions help students to learn better and have access to detailed answers. These answers help students score more as they are extensive and detailed. The solutions are arranged both page-wise and unit-wise. Along with the NCERT solutions, students can also refer to our sample papers, past years’ papers, revision notes, video lessons etc.

Accounting for Partnership : Basic Concepts Exercise 96

Solution SA 1

Partnership Deed is a legal written agreement between partners containing the terms and conditions of the partnership and is signed by all partners. It incorporates the following clauses:

- Names and addresses of all partners

- Name and address of the firm

- Type and nature of the business

- Principal place of the firm

- Date of commencement and duration of partnership

- Contribution of capital by each partner

- Profit-sharing ratio of partners

- Method of calculation of goodwill

- Salary and commission, if any, payable to partners

- Rights and duties of partners

- Rules in respect to admission, retirement and death of the partner and dissolution of the firm

- Dispute settlement between partners

Solution SA 2

Partnership comes into existence by an agreement which may be oral or written. It is not mandatory to create a partnership agreement in writing under the Partnership Act, 1932. However, a written partnership deed is better than an oral agreement as it helps to avoid disputes and conflicts between partners. It also helps in settling disputes as a written partnership deed can be referred to anytime. If the written partnership deed is duly signed by all partners and registered under the Partnership Act, then it can be used as evidence in the court.

Solution SA 3

- When Capitals are fixed:

Items credited to Partner's Capital Account:

- Opening balance of capital

- Additional capital introduced during the year

Items debited to Partner's Capital Account:

- Drawings made during the year

- Closing balance of capital

Items credited to Partner's Capital Account:

- Opening balance of capital

- Additional capital introduced during the year

- Salaries to partners

- Commission to partners

- Bonus to partners

- Interest on capital

- Share in profit

Items debited to Partner's Capital Account:

- Drawings made during the year

- Interest on drawings

- Share in loss

- Closing balance of capital

Solution SA 4

A Profit and Loss Adjustment Account is prepared:

- To record omitted items and rectify errors, if any: If any error or omission is noticed after the Profit and Loss Account and Balance Sheet are prepared, then these adjustment are to be adjusted by preparing a Profit and Loss Adjustment Account in the succeeding accounting period without altering the old Profit and Loss Account.

- To distribute profit or loss between partners: This account is also used for distribution of profit (or loss) between partners in addition to adjusting and rectifying errors. It acts as an alternative to the Profit and Loss Appropriation Account. The main reason for preparing a Profit and Loss Adjustment Account is to ascertain correct profit.

Solution SA 5

Two circumstances under which the fixed capitals of partners may change:

- When additional capital is introduced by partners during the year.

- When a part of capital is permanently withdrawn by the partner from the firm.

Solution SA 6

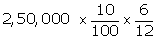

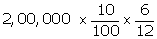

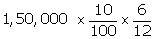

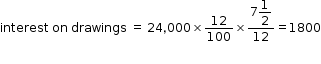

When a fixed amount is withdrawn on the first day of every quarter, the interest on drawing will be calculated for a period of seven and half ![]() months.

months.

Example: If a partner withdraws Rs.6,000 on the first day of each quarter and the interest is charged @ 12% on the drawings, then the interest on drawings will be calculated as

Total drawing made during the year by the partner is Rs.24,000 (i.e. 6,000 × 4)

Solution SA 7

In the absence of a partnership deed, the rules according to the Partnership Act, 1932, are as follows:

- Sharing of profits and losses: To be shared equally by all partners in the firm.

- Interest on partner's capital: No interest on capital should be given to the partner in the firm.

- Interest on partner's drawing: No interest on drawing is to be charged from the partner of the firm.

- Interest on partner's loan: Partners are entitled to 6% p.a. interest on the loan lent to the firm by them.

- Salary to a partner: No salary should be given to any partner.

Solution LA 1

According to the Partnership Act, 1932 (Sec 4), a partnership is an agreement between two or more persons who have agreed to share profits or losses of business which are to be borne by all or any one of them acting for all. Persons who come together to set up the business are called 'partners' individually and 'firm' collectively, and the name under which the business is carried on is termed 'firm name'.

Important Characteristics of a Partnership

Important characteristics of a partnership:

- Two or more persons: A partnership is an agreement between two or more persons coming together for a common purpose. There should be at least two persons to begin a partnership firm. In a partnership firm, there is no maximum limit according to the Partnership Act, 1932, on the number of partners, but according to Rule 10 of the Companies (Miscellaneous) Rules, 2014, the maximum number of partners cannot exceed 50. In case the number of partners exceeds the aforesaid limit, then the concerned partnership is considered illegal. In concern to this, it must be noted that in Sec 464 of the Companies Act, 2013, the maximum number of partners cannot exceed 100. However, the maximum number of partners is not limited in case an association or partnership is formed by professionals such as doctors, lawyers, chartered accountants and company secretaries. These professionals are governed by their special laws as formed by their respective professional institutions. Before the enforcement of the Companies Act, 2013, the earlier act of 1956, imposed restrictions on the maximum number of partners to 10 in case of banking business and 20 in case of any other kind of business. However, with effect from 1 April 2014, the Companies Act, 1956, has been replaced by the Companies Act, 2013.

- Partnership Deed: A partnership among partners should be supported by a partnership deed. A partnership deed is an agreement between partners governing them in carrying out the business. The deed may be oral or written.

- Business: The business carried out by the partnership firm should be legal. Activities such as smuggling and black marketing are illegal business activities, and hence, the partnership is also illegal.

- Sharing of profit: The profit or loss earned by a partnership firm must be shared according to the partnership deed. If there is no partnership deed between partners, then the profit will be shared equally by them. It is an important feature of partnership. If a group is formed for charitable purpose or not to earn profit, then this group will not be regarded as a partnership.

- Liability: Liability of a partnership firm is unlimited. Each partner is liable for a firm's liabilities jointly and severally with other partners to outsiders. Furthermore, each partner along with his/her co-partners is responsible for all the acts of the partnership firm.

- Mutual agency: A partnership may be carried on by all or any one of them acting for all. It means that all partners of a firm are entitled to participate equally in the activities of the business or any one of them acting on behalf of all. Every partner acts as an agent for others and binds others by his/her act and in turn is bound by others by their acts.

Solution LA 2

In the absence of a partnership deed, the main provisions according to the Indian Partnership Act, 1932, which are relevant to partnership accounts are

- Sharing of profits and losses: Profits and losses are to be shared equally by all partners of the firm.

- Interest on partner's capital: No interest on capital should be given to partners in the firm. However, it is to be given only out of the profits, if agreed.

- Interest on partner's drawings: No interest on drawings is to be charged from the partner of the firm for the amount of capital withdrawn by them by the way of drawings.

- Interest on partner's loan: Partners are entitled to 6% p.a. interest on the loan lent to the firm by them.

- Salary to a partner: No salary should be given to any partner.

Accounting for Partnership : Basic Concepts Exercise 97

Solution LA 3

A partnership deed is a legal written agreement between partners containing the terms and conditions of the partnership which is agreed by all partners.

It incorporates the following clauses:

- Names and addresses of all partners

- Name and address of the firm

- Type and nature of the business

- Principal place of the firm

- Date of commencement and duration of partnership

- Contribution of capital by each partner

- Profit-sharing ratio of partners

- Method of calculation of goodwill

- Salary, commission, if any, payable to partners

- Rights and duties of partners

- Rules in respect to admission, retirement and death of the partner and dissolution of the firm

- Dispute settlement between partners

A partnership can come into existence by an agreement which may be oral or written. The Partnership Act, 1932, has not made it mandatory to draft a partnership agreement in writing. The partnership deed in writing is better than an oral agreement as it ensures smooth functioning of business. It also helps avoid disputes and conflicts between partners. In addition, it helps in settling disputes as a written partnership deed can be called anytime. If the written partnership agreement is registered under the Partnership Act and is duly signed by all partners, then it can be used as evidence in court.

Solution LA 4

Withdrawal made by the partner either in the form of cash or in any other form from the firm for his/her personal use is termed drawings. Interest on drawings is an interest charged by the firm on the amount of drawings made by the partner. Interest on drawings can be calculated by different methods depending on the time and frequency of drawings made by the partner. The calculation of interest on drawings charged by the firm in different situations is explained with the illustration below:

Situation 1: When amount, date and rate of interest on drawings are given

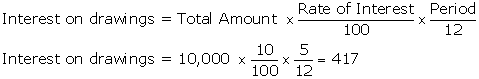

A partner withdrew Rs.10,000 on 1st August, and the interest on drawings is charged at 10% p.a. If the firm closes its books on 31st December every year, then the interest on drawings will be Rs.417.

Situation 2: When amount and rate of interest on drawings are given

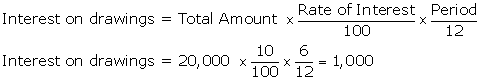

Case 1: Amount and rate of interest on drawings (p.a.) are given, but date of drawings is not mentioned

In such a case, the period of drawings will be taken as 6 months.

Example: When a partner withdraws Rs.20,000 and the rate of interest on drawings is 10% p.a., the interest of drawings will be Rs.1,000.

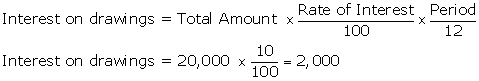

Case 2: Amount and rate of interest on drawings are given, but date and per annum rate of interest are not mentioned

In such a case, the interest will be charged annually.

Example: When a partner withdraws Rs.20,000 and the rate of interest on drawings is 10%, the interest on drawings will be Rs.2000.

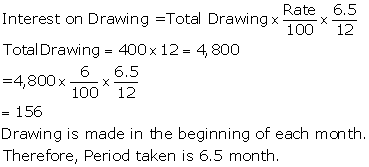

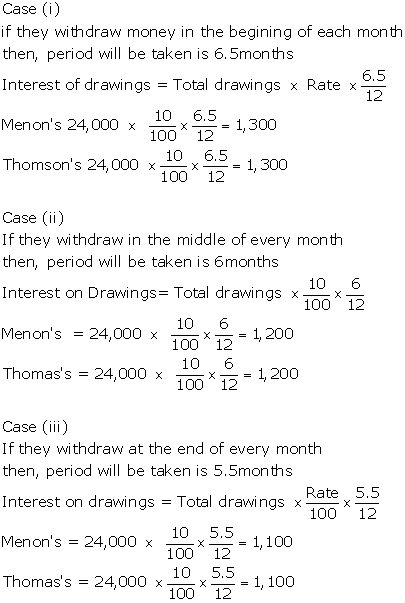

Situation 3: Fixed amount is withdrawn at regular intervals

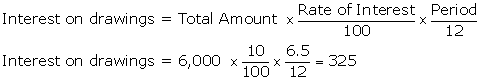

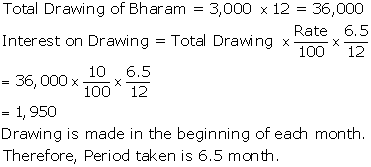

Case 1: Fixed amount withdrawn at the beginning of each month

In this case, interest will be calculated for 6.5 months.

Example: When a partner withdraws Rs.500 in the beginning of each month and the interest on drawings is 10% p.a., the interest on drawings will be Rs.325.

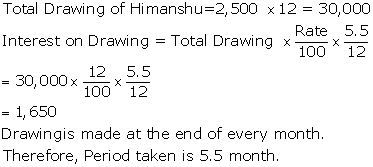

Case 2: Fixed amount is withdrawn at the end of each month

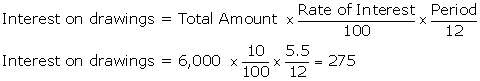

In this case, the interest will be calculated for 5.5 months.

Example: When a partner withdraws Rs.500 at the end of each month and the rate of interest is 10% p.a., the interest on drawings amount to Rs.275.

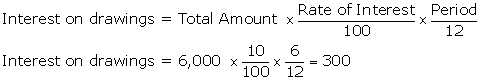

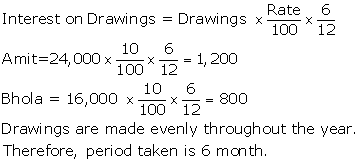

Case 3: Fixed amount is withdrawn in the middle of every month

In this case, assume drawings are made on the 15th of every month and the interest on drawings is calculated for 6 months.

Example: When a partner withdraws Rs.500 on the 15th of every month and the rate of interest is 10% p.a., the interest on drawings amount to Rs.300.

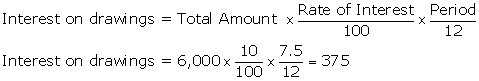

Case 4: Fixed amount is withdrawn at the beginning of every quarter

In this case, the interest will be calculated for 7.5 months.

Example: When a partner withdraws Rs.500 at the beginning of every quarter and the rate of interest is 10% p.a., the interest on drawings will be Rs.375.

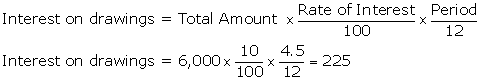

Case 5: Fixed amount is withdrawn at the end of every quarter

In this case, the interest on drawings will be calculated for 4.5 months.

Example: When a partner withdraws Rs.500 at the end of every quarter and the rate of interest is 10% p.a., the interest on drawings will be Rs.225.

Situation 4: Different amount is withdrawn at different intervals

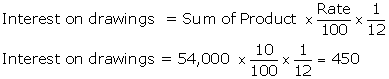

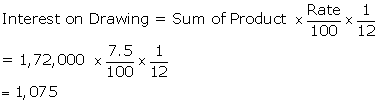

When a different amount is withdrawn at different intervals of time by a partner, the interest on drawings will be calculated by the product method. The period of drawings is calculated from the date of withdrawal to the last date of the accounting year.

Example: A partner withdraws Rs.3,000 on 1 March, Rs.2,000 on 1 June, Rs.5,000 on 31 October and Rs.8,000 on 31 December, and the rate of interest on drawings is 10% p.a. The firm closes its books on 31 December.

Calculation of Interest on Drawings by Product Method

|

Interest on Drawings |

|||

|

Date |

Amount Rs. |

Outstanding Period |

Product |

|

1 Mar. |

3,000 |

10 |

3,000 × 10 = 30,000 |

|

1 Jun. |

2,000 |

7 |

2,000 × 7 = 14,000 |

|

1 Oct. |

5,000 |

2 |

5,000 × 2 = 10,000 |

|

31 Dec. |

8,000 |

0 |

8,000 × 0 = 0 |

|

|

|

|

54,000 |

Solution LA 5

Profit-sharing ratio may be changed due to admission, retirement or death of a partner or due to a general agreement between partners. Adjustment such as goodwill, reserves and accumulated profits, profit or loss on the revaluation of assets and liabilities and adjustment of capitals are to be considered during the change in the profit-sharing ratio. The general reserves and accumulated profits (if any) and the profit on revaluation of assets and liabilities should be credited and the loss on revaluation of assets and liabilities should be debited from the Partner's Capital Account in their old profit-sharing ratio.

However, if the existing partners decide to change the profit-sharing ratio, then some partners gain (gaining partners) at the cost of other partners (sacrificing partners). Thus, the gaining partner should compensate the sacrificing partner. Therefore, the gaining Partners' Capital Accounts are debited to the extent of their gain and sacrificing Partners' Capital Accounts are credited to the extent of their sacrifice. The following journal entry is passed:

|

Gaining Partner's Capital A/c------------ |

Dr. |

|

-------- To Sacrificing Partner's Capital A/c |

|

|

(Being adjustment entry passed) |

|

Example:

A, B and C are partners in a firm sharing profit and loss in a 3:2:1 ratio. They decide to share the profit and loss equally in the future. On that date, the books of the firm show Rs.2,40,000 as general reserve and profit due to revaluation of the building as Rs.90,000. The following adjustment entry is passed through the capital accounts without affecting the books of accounts.

|

Particulars |

A |

B |

C |

|

Share of profit as per 3:2:1 Profit on revaluation of building |

1,20,000 45,000 |

80,000 30,000 |

40,000 15,000 |

|

Share of profit as per 1:1:1 |

1,65,000 1,10,000 |

1,10,000 1,10,000 |

55,000 1,10,000 |

|

Difference (Gain or loss) |

55,000 (Loss) |

- |

55,000 (Gain) |

Hence, in this example, C gains at the cost of A. So, partner A needs to be compensated by C with the amount of 55,000. The following adjustment entry is passed.

|

Adjustment entry |

||||

|

C's Capital A/c |

Dr. |

55,000 |

|

|

|

-------- To A's Capital A/c |

|

|

55,000 |

|

|

(Being adjustment entry passed) |

|

|

|

|

Solution NUM 1

|

Profit and Loss Appropriation Account |

|||||||

|

Dr. |

|

Cr. |

|||||

|

Particulars |

|

Amount |

Particulars |

|

Amount |

||

|

To Partner’s Salary |

|

|

By Profit and Loss A/c |

|

30,000 |

||

|

|

Tripathi (1,000 * 12) |

12,000 |

|

By Interest on Drawings |

|

|

|

|

|

Chauhan (1,000 * 12) |

12,000 |

24,000 |

|

Tripathi |

600 |

|

|

|

|

|

|

Chauhan |

400 |

1,000 |

|

|

|

|

|

|

|

|

||

|

To Interest on Capital |

|

|

|

|

|

||

|

|

Tripathi |

3,000 |

|

|

|

|

|

|

|

Chauhan |

2,000 |

5,000 |

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

||

|

To Profit Transferred to |

|

|

|

|

|

||

|

|

Tripathi’s Current |

1,200 |

|

|

|

|

|

|

|

Chauhan’s Current |

800 |

2,000 |

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

||

|

|

|

31,000 |

|

|

31,000 |

||

|

|

|

|

|

|

|

||

|

Partner’s Capital Account |

|||||

|

Dr. |

|

Cr |

|||

|

Particulars |

Tripathi |

Chauhan |

Particulars |

Tripathi |

Chauhan |

|

|

|

|

By Balance b/d |

60,000 |

40,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

To Balance c/d |

60,000 |

40,000 |

|

|

|

|

|

60,000 |

40,000 |

|

60,000 |

40,000 |

|

|

|

|

|

|

|

|

Partner’s Current Account |

|||||

|

Dr. |

|

Cr |

|||

|

Particulars |

Tripathi |

Chauhan |

Particulars |

Tripathi |

Chauhan |

|

To Drawings |

12,000 |

8,000 |

By Partner’s Salaries |

12,000 |

12,000 |

|

To Interest on Drawings |

600 |

400 |

By Interest on Capital |

3,000 |

2,000 |

|

To Balance c/d |

3,600 |

6,400 |

By Profit and Loss Appropriation A/c |

1,200 |

800 |

|

|

|

|

|

|

|

|

|

16,200 |

14,800 |

|

16,200 |

14,800 |

|

|

|

|

|

|

|

Note:

Treatment for Interest on Capitals, Salaries to partners and Interest on Drawings can be given using the following 2 methods:

a) Charge against profit

b) Distribution out of profits

If no information is given about the treatment of the above items then we usually follow Distribution Out Of Profits Method.

Solution NUM 2

|

Profit and Loss Appropriation Account |

|||||||

|

Dr. |

|

Cr |

|||||

|

Particulars |

|

Amount |

Particulars |

|

Amount |

||

|

To Partner’s Salary |

|

|

By Profit and Loss A/c |

|

45,000 |

||

|

|

Anubha |

8,400 |

|

By Interest on Drawings |

|

|

|

|

|

Kajal |

6,000 |

14,400 |

|

Anubha |

425 |

|

|

|

|

|

|

Kajal |

325 |

750 |

|

|

To Interest on Capital |

|

|

|

|

|

||

|

|

Anubha |

4,500 |

|

|

|

|

|

|

|

Kajal |

3,000 |

7,500 |

|

|

|

|

|

|

|

|

|

|

|

||

|

To Profit transferred to |

|

|

|

|

|

||

|

|

Anubha’s Capital |

15,900 |

|

|

|

|

|

|

|

Kajal’s Capital |

7,950 |

23,850 |

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

||

|

|

|

45,750 |

|

|

45,750 |

||

|

|

|

|

|

|

|

||

|

Partner’s Capital Account |

|||||

|

Dr. |

|

Cr |

|||

|

Particulars |

Anubha |

Kajal |

Particulars |

Anubha |

Kajal |

|

To Drawings |

8,500 |

6,500 |

By Balance c/d |

90,000 |

60,000 |

|

To Interest on Drawings |

425 |

325 |

By Partner’s Salaries |

8,400 |

6,000 |

|

|

|

|

By Interest on Capital |

4,500 |

3,000 |

|

|

|

|

By Profit and Loss Appropriation A/c |

15,900 |

7,950 |

|

|

|

|

|

|

|

|

To Balance c/d |

1,09,875 |

70,125 |

|

|

|

|

|

1,18,800 |

76,950 |

|

1,18,800 |

76,950 |

|

|

|

|

|

|

|

Note:

Treatment for Interest on Capitals, Salaries to partners and Interest on Drawings can be given using the following 2 methods:

a) Charge against profit

b) Distribution out of profits

If no information is given about the treatment of the above items then we usually follow Distribution Out Of Profits Method.

Solution NUM 3

DISTRIBUTION OF PROFITS

Harshad Claims:

Decisions

- Harshad's claim is not justified on the matter of interest on capital and loan as there is no agreement between the partners. According to the Partnership Act, 1932, no interest on capital will be allowed to partners whereas; interest on loan will be allowed only upto 6% p.a.

- In the absence of Partnership agreement, profit shall be shared equally according to Partnership Act, 1932. Therefore, his claim cannot be justified.

Dhiman Claims:

- Dhiman claim is justified according partnership act 1932 if there is no agreement on the matter of profit distribution, profit shall be distributed equally

- No salary will be allowed to any partner as there is no agreement on matter of remuneration.

- Dhiman's claim is not justified on the matter of interest on capital but justified on the matter of interest on loan. If there is no agreement on interest on partner's loan. Interest oon loan shall be provided at 6% p.a.

|

Profit and Loss Adjustment Account |

|||

|

Dr. |

|

Cr. |

|

|

Particulars |

Amount Rs. |

Particulars |

Amount Rs. |

|

To Interest on Partner's Loan |

|

By Profit and Loss A/c |

1,80,000 |

|

Harshad [1,00,000 × 6% × 6/12] |

3,000 |

|

|

|

|

|

|

|

|

To Profit and Loss Appropriation A/c |

1,77,000 |

|

|

|

|

|

|

|

|

|

1,80,000 |

|

1,80,000 |

|

|

|

|

|

|

Profit and Loss Account |

||||

|

Dr. |

|

Cr. |

||

|

Particulars |

Amount Rs. |

Particulars |

Amount Rs. |

|

|

To Profit transferred to |

|

By Profit and Loss Adjustment A/c |

1,77,000 |

|

|

|

Harshad's Capital |

88,500 |

|

|

|

|

Shama's Capital |

88,500 |

|

|

|

|

|

|

|

|

|

|

1,77,000 |

|

1,77,000 |

|

|

|

|

|

|

|

Accounting for Partnership : Basic Concepts Exercise 98

Solution NUM 4

|

Profit and Loss Adjustment Account |

||||

|

Dr. |

|

Cr. |

||

|

Particulars |

|

Amount Rs. |

Particulars |

Amount Rs. |

|

To Interest on Partner's Loan |

|

|

By Profit and Loss A/c |

43,000 |

|

Aakriti (20,000 × 6% × 6/12) |

|

600 |

|

|

|

|

|

|

|

|

|

To Profit transferred to |

|

|

|

|

|

Aakriti's Capital |

21,200 |

|

|

|

|

Bindu's Capital |

21,200 |

42,400 |

|

|

|

|

|

|

|

|

|

|

|

43,000 |

|

43,000 |

|

|

|

|

|

|

Note:

- In the absence of partnership agreement, interest on partner's loan shall be allowed at 6% p.a.

- In the absence of partnership agreement, interest on capital shall not be allowed.

- In the absence of partnership agreement, profit or loss will be shared equally.

Solution NUM 5

If interest on capital and Partner's salaries is provided even if there is a loss.

|

Profit and Loss Appropriation Account |

|||||

|

Dr. |

|

Cr. |

|||

|

Particular |

|

Amount Rs. |

Particular |

|

Amount Rs. |

|

To Partner's Salaries |

|

60,000 |

By Profit and Loss A/c |

|

23,200 |

|

|

|

|

By Loss transferred to |

|

|

|

To Interest on Capital |

|

|

Rakhi Capital |

34,720 |

|

|

Rakhi |

20,000 |

|

Shikha Capital |

52,080 |

86,800 |

|

Shikha |

30,000 |

50,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

1,10,000 |

|

|

1,10,000 |

|

|

|

|

|

|

|

|

Partner's Capital Account |

|||||

|

Dr. |

|

Cr |

|||

|

Particulars |

Rakhi |

Shikha |

Particulars |

Rakhi |

Shikha |

|

To Drawings |

7,000 |

10,000 |

By Balance b/d |

2,00,000 |

3,00,000 |

|

To Profit and Loss Appropriation |

34,720 |

52,080 |

By Partner's Salaries |

|

60,000 |

|

|

|

|

By Interest on Capital |

20,000 |

30,000 |

|

To Balance c/d |

1,78,280 |

3,27,920 |

|

|

|

|

|

|

|

|

|

|

|

|

2,20,000 |

3,90,000 |

|

2,20,000 |

3,90,000 |

|

|

|

|

|

|

|

Solution NUM 6

|

Profit and Loss Appropriation Account |

|||||||

|

Dr. |

|

Cr |

|||||

|

Particulars |

|

Amount Rs. |

Particulars |

|

Amount Rs. |

||

|

To Interest on Capital |

|

|

By Profit and Loss A/c |

|

15,000 |

||

|

|

Lokesh |

3,000 |

|

(12,500 + 2,500) |

|

|

|

|

|

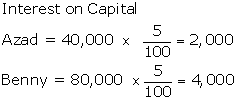

Azad |

1,800 |

4,800 |

|

|

|

|

|

|

|

|

|

|

|

||

|

To Partner's Salary |

|

|

|

|

|

||

|

|

Azad |

|

2,500 |

|

|

|

|

|

|

|

|

|

|

|

||

|

To Provision for Manager's Commission [15,000 × 5%] |

750 |

|

|

|

|||

|

|

|

|

|

|

|

||

|

To Profit transferred to |

|

|

|

|

|

||

|

|

Lokesh Capital |

4,170 |

|

|

|

|

|

|

|

Azad Capital |

2,780 |

6,950 |

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

15,000 |

|

|

15,000 |

||

|

|

|

|

|

|

|

||

|

Partner's Capital Account |

|||||

|

Dr. |

|

Cr |

|||

|

Particulars |

Lokesh |

Azad |

Particulars |

Lokesh |

Azad |

|

|

|

|

By Balance b/d |

50,000 |

30,000 |

|

|

|

|

By Interest on Capital |

3,000 |

1,800 |

|

|

|

|

By Partner's Salaries |

|

2,500 |

|

To Balance c/d |

57,170 |

37,080 |

By Profit and Loss Appropriation A/c |

4,170 |

2,780 |

|

|

|

|

|

|

|

|

|

57,170 |

37,080 |

|

57,170 |

37,080 |

|

|

|

|

|

|

|

Solution NUM 7

|

Profit and Loss Appropriation Account |

|||||||

|

Dr. |

|

Cr. |

|||||

|

Particulars |

|

Amount Rs. |

Particulars |

|

Amount Rs. |

||

|

|

|

|

By Profit and Loss A/c |

|

40,000 |

||

|

To Partner's Salary |

|

|

Interest on Drawings |

|

|

||

|

|

Maneesh |

|

4,800 |

|

Maneesh |

800 |

|

|

|

|

|

|

Girish |

700 |

1,500 |

|

|

To Partner's commission |

|

|

|

|

|

||

|

Girish [(40,000 - 4,800) × 10%] |

|

3,520 |

|

|

|

||

|

|

|

|

|

|

|

||

|

To Interest on Capital |

|

|

|

|

|

||

|

|

Mannesh |

7,000 |

|

|

|

|

|

|

|

Girish |

5,600 |

12,600 |

|

|

|

|

|

|

|

|

|

|

|

||

|

To Profit transferred to A/c |

|

|

|

|

|

||

|

|

Maneesh's Current |

10,290 |

|

|

|

|

|

|

|

Girish's Current |

10,290 |

20,580 |

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

||

|

|

|

41,500 |

|

|

41,500 |

||

|

|

|

|

|

|

|

||

Accounting for Partnership : Basic Concepts Exercise 99

Solution NUM 8

|

Profit and Loss Appropriation Account |

||||

|

Dr. |

|

Cr. |

||

|

Particulars |

Amount Rs. |

Particulars |

Amount Rs. |

|

|

To Profit transferred to |

|

By Profit and Loss A/c |

40,000 |

|

|

|

Ram's Capital (WN 1) |

18,750 |

(Net Profit) |

|

|

|

Raj's Capital (WN 1) |

11,250 |

|

|

|

|

George's Capital |

10,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

40,000 |

|

40,000 |

|

|

|

|

|

|

|

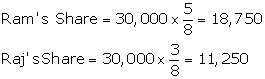

Working Note:

1. Calculation of Ram and Raj share in profit:

|

|

Rs. |

|

Profit for the year |

40,000 |

|

Less: George share in profit |

10,000 |

|

Remaining share in profit |

30,000 |

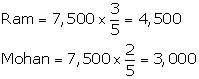

The remaining share in profit should be shared between Ram and Raj in 5:3 (PSR) ratio.

Solution NUM 9

|

Profit and Loss Appropriation Account for the year 31st March, 2016 |

||||

|

Dr. |

|

Cr. |

||

|

Particulars |

Amount Rs. |

Particulars |

Amount Rs. |

|

|

To Profit transferred to |

|

By Profit and Loss A/c |

40,000 |

|

|

|

Amann's Capital 16000 |

16,000 |

|

|

|

|

Babita's Capital (16,000 - 2,000) |

14,000 |

|

|

|

|

Suresh's Capital (8,000 + 2,000) |

10,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

40,000 |

|

40,000 |

|

|

|

|

|

|

|

|

Profit and Loss Appropriation Account for the year 31st March, 2017 |

||||

|

Dr. |

|

Cr. |

||

|

Particulars |

Amount Rs. |

Particulars |

Amount Rs. |

|

|

To Profit transferred to |

|

By Profit and Loss A/c |

60,000 |

|

|

|

Amann's Capital |

24,000 |

|

|

|

|

Babita's Capital |

24,000 |

|

|

|

|

Suresh's Capital |

12,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

60,000 |

|

40,000 |

|

|

|

|

|

|

|

Solution NUM 10

|

Profit and Loss Appropriation Account |

|||||||

|

Dr. |

|

Cr. |

|||||

|

Particulars |

|

Amount Rs. |

Particulars |

|

Amount Rs. |

||

|

To Interest on Capital |

|

|

By Profit and Loss A/c |

|

1,50,000 |

||

|

|

Simmi |

1,500 |

|

|

|

|

|

|

|

Sonu |

3,000 |

4,500 |

By Interest on Drawings |

|

|

|

|

|

|

|

|

Simmi |

600 |

|

|

|

To Partner's Salary |

|

|

|

Sonu |

450 |

1,050 |

|

|

|

Simmi |

12,000 |

|

|

|

|

|

|

|

Sonu |

9,000 |

21,000 |

|

|

|

|

|

|

|

|

|

|

|

||

|

To Profit transferred to |

|

|

|

|

|

||

|

|

Simmi Current [1,25,550×3/4] |

94,162 |

|

|

|

|

|

|

|

Sonu's Current [1,25,550×1/4] |

31,388 |

1,25,550 |

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

||

|

|

|

1,51,050 |

|

|

1,51,050 |

||

|

|

|

|

|

|

|

||

|

Partner's Capital Account |

|||||

|

Dr. |

|

Cr |

|||

|

Particulars |

Simmi |

Sonu |

Particulars |

Simmi |

Sonu |

|

|

|

|

By Balance b/d |

30,000 |

60,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

To Balance c/d |

30,000 |

60,000 |

|

|

|

|

|

|

|

|

|

|

|

|

30,000 |

60,000 |

|

30,000 |

60,000 |

|

|

|

|

|

|

|

|

Partner's Current Account |

|||||

|

Dr. |

|

Cr |

|||

|

Particulars |

Simmi |

Sonu |

Particulars |

Simmi |

Sonu |

|

To Drawings |

20,000 |

15,000 |

By Balance b/d |

30,000 |

15,000 |

|

To Interest on Drawings |

600 |

450 |

By Interest on Capital |

1,500 |

3,000 |

|

|

|

|

By Partner's Salaries |

12,000 |

9,000 |

|

To Balance c/d |

1,17,062 |

42,938 |

By Profit and Loss Appropriation A/c |

94,162 |

31,388 |

|

|

|

|

|

|

|

|

|

1,37,662 |

58,388 |

|

1,37,662 |

58,388 |

|

|

|

|

|

|

|

Accounting for Partnership : Basic Concepts Exercise 100

Solution NUM 12

|

Profit and Loss Appropriation Account |

|||||||

|

Dr. |

|

Cr. |

|||||

|

Particulars |

|

Amount Rs. |

Particulars |

|

Amount Rs. |

||

|

To Interest on Capital |

|

|

By Profit and Loss A/c |

|

1,00,300 |

||

|

|

Ramesh |

9,600 |

|

|

|

|

|

|

|

Suresh |

7,200 |

16,800 |

By Interest on Drawings |

|

|

|

|

|

|

|

|

Ramesh |

2,000 |

|

|

|

To Partner's Salary |

|

|

|

Suresh |

2,500 |

4,500 |

|

|

|

Ramesh |

24,000 |

|

|

|

|

|

|

|

Suresh |

36,000 |

60,000 |

|

|

|

|

|

|

|

|

|

|

|

||

|

To Profit transferred to |

|

|

|

|

|

||

|

|

Ramesh Capital [28,000 ×4/7] |

16,000 |

|

|

|

|

|

|

|

Suresh Capital [28,000 × 3/7] |

12,000 |

28,000 |

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

||

|

|

|

1,04,800 |

|

|

1,04,800 |

||

|

|

|

|

|

|

|

||

|

Partner's Capital Account |

|||||

|

Dr. |

|

Cr |

|||

|

Particulars |

Ramesh |

Suresh |

Particulars |

Ramesh |

Suresh |

|

To Drawings |

40,000 |

50,000 |

By Balance b/d |

80,000 |

60,000 |

|

To Interest on Drawings |

2,000 |

2,500 |

By Interest on Capital |

9,600 |

7,200 |

|

|

|

|

By Partner's Salaries |

24,000 |

36,00 |

|

To Balance c/d |

87,600 |

62,700 |

By Profit and Loss Appropriation A/c |

16,000 |

12,000 |

|

|

|

|

|

|

|

|

|

1,29,600 |

1,15,200 |

|

1,29,600 |

1,15,200 |

|

|

|

|

|

|

|

Working Note:

1. Calculation of Profit-sharing Ratio.

Profit-sharing Ratio= Capital Ratio…. (Given)

|

Capital Ratio |

= |

Ramesh |

: |

Suresh |

|

|

|

80,000 |

: |

60,000 |

|

|

|

4 |

: |

3 |

Therefore, Profit-sharing Ratio= 4:3.

Solution NUM 13

|

Profit and Loss Appropriation Account |

||||||

|

Dr. |

|

Cr. |

||||

|

Particular |

|

Amount Rs. |

Particular |

|

Amount Rs. |

|

|

To Interest on Capital |

|

|

By Profit and Loss A/c |

|

16,700 |

|

|

|

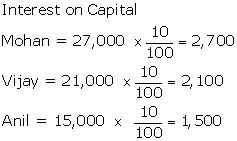

Sukesh |

2,000 |

|

(9,500+7,200) |

|

|

|

|

Vanita |

2,000 |

4,000 |

|

|

|

|

|

|

|

|

|

|

|

|

To Partner's Salary |

|

|

|

|

|

|

|

|

Vanita (600×12) |

|

7,200 |

|

|

|

|

|

|

|

|

|

|

|

|

To Profit transferred to |

|

|

|

|

|

|

|

|

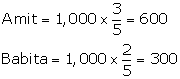

Sukesh Capital [5,500×3/5] |

3,300 |

|

|

|

|

|

|

Vanita Capital [5,500×2/5] |

2,200 |

5,500 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

16,700 |

|

|

16,700 |

|

|

|

|

|

|

|

|

|

|

Partner's Capital Account |

|||||

|

Dr. |

|

Cr |

|||

|

Particulars |

Sukesh |

Vanita |

Particulars |

Sukesh |

Vanita |

|

|

|

|

By Balance b/d |

40,000 |

40,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

To Balance c/d |

40,000 |

40,000 |

|

|

|

|

|

40,000 |

40,000 |

|

40,000 |

40,000 |

|

|

|

|

|

|

|

|

Partner's Current Account |

|||||

|

Dr. |

|

Cr |

|||

|

Particulars |

Sukesh |

Vanita |

Particulars |

Sukesh |

Vanita |

|

To Drawings |

10,850 |

8,150 |

By Balance b/d |

7,200 |

2,800 |

|

|

|

|

By Partner's Salaries |

|

7,200 |

|

|

|

|

By Profit and Loss Appropriation A/c |

3,300 |

2,200 |

|

To Balance c/d |

1,650 |

6,050 |

By Interest on Capital |

2,000 |

2,000 |

|

|

12,500 |

14,200 |

|

12,500 |

14,200 |

|

|

|

|

|

|

|

Solution NUM 14

Accounting for Partnership : Basic Concepts Exercise 101

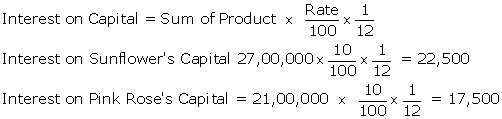

Solution NUM 15

|

Simple Interest Method |

|||

|

Sunflower |

|||

|

Period |

Capital |

|

|

|

1st April, 2016 to 30th September, 2016 |

2,50,000 |

|

12,500 |

|

1st October, 2016 to 31st March, 2017 |

2,00,000 |

|

10,000 |

|

Interest on Sunflower's Capital |

|

|

22,500 |

|

Pink Rose |

|||

|

Period |

Capital |

|

|

|

1st April, 2016 to 30th September, 2016 |

2,50,000 |

|

7,500 |

|

1st October, 2016 to 31st March, 2017 |

2,00,000 |

|

10,000 |

|

Interest on Pink Rose's Capital |

|

|

17,500 |

Alternative Method,

|

Product Method |

||

|

Sunflower |

||

|

1st April, 2016 to 30th September, 2016 |

2,50,000 × 6 |

15,00,000 |

|

1st October, 2016 to 31st March, 2017 |

2,00,000 × 6 |

12,00,000 |

|

Sum of Product |

|

27,00,000 |

|

Pink Rose |

||

|

1st April, 2016 to 30th September, 2016 |

1,50,000 × 6 |

9,00,000 |

|

1st October, 2016 to 31st March, 2017 |

2,00,000 × 6 |

12,00,000 |

|

Sum of Product |

|

21,00,000 |

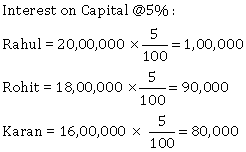

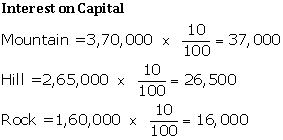

Solution NUM 16

Generally, interest on Capital is calculated on opening balance of Capital. If additional capital is not given then opening balance will be calculated as follow:

|

|

Mountain |

Hill |

Rock |

|

|

Closing Capital |

4,00,000 |

3,00,000 |

2,00,000 |

|

|

|

Add : Drawings |

20,000 |

15,000 |

10,000 |

|

|

Less : Profit(1:1:1) |

(50,000) |

(50,000) |

(50,000) |

|

Opening Capital |

3,70,000 |

2,65,000 |

1,60,000 |

|

Solution NUM 17

Note: In the question, both Partner's Capital Account and of Partner's Current Account is given, so it is clear that the capital of the partners is fixed. When capital account is fixed, interest on drawing, salary to partner, interest on capital, etc, will not affect the Partner's Capital Account. It will affect Partner's Current Account. Therefore, in this case, capital at the beginning (i.e. opening capital) and capital at the end (i.e. closing capital) of the year would remain constant. Thus, the interest on capital is calculated on fixed capital balances (given in the Balance Sheet of the question).

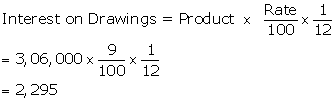

Solution NUM 18

|

Product Method |

||||

|

Period |

Months |

Amount |

Product= Drawing × Period |

|

|

1st May, 2017 to 31st March, 2018 |

11 |

12,000 |

12,000 × 11 = |

1,32,000 |

|

31st July, 2017 to 31st March, 2018 |

8 |

6,000 |

6,000 × 8 = |

48,000 |

|

30th September, 2017 to 31st March, 2018 |

6 |

9,000 |

9,000 × 6 = |

54,000 |

|

30th November, 2017 to 31st March, 2018 |

4 |

12,000 |

12,000 × 4 = |

48,000 |

|

1st January, 2018 to 31st March, 2018 |

3 |

8,000 |

8,000 × 3 = |

24,000 |

|

31st March, 2018 to 31st March, 2018 |

0 |

7,000 |

7,000 × 0 = |

0 |

|

|

Sum of Product |

3,06,000 |

||

Note: Interest on drawing is calculated by product method as drawings are made at different intervals and the amount of withdrawal is not uniform.

Accounting for Partnership : Basic Concepts Exercise 102

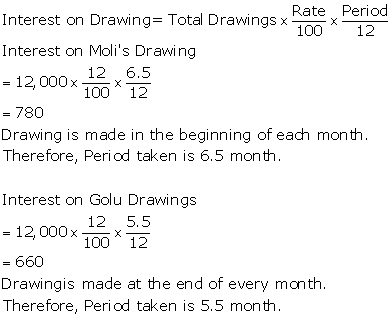

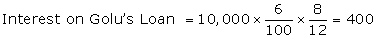

Solution NUM 19

Calculation of interest on drawings:

|

Profit and Loss Appropriation Account |

||||||

|

Dr. |

|

Cr. |

||||

|

Particulars |

|

Amount Rs. |

Particulars |

|

Amount Rs. |

|

|

To Interest on Capital |

|

|

By Profit and Loss Account |

|

20,550 |

|

|

|

Moli |

4,000 |

|

(20,950-400*) |

|

|

|

|

Goli |

2,000 |

6,000 |

|

|

|

|

|

|

|

|

By Interest on Drawings |

|

|

|

|

|

|

Moli |

780 |

|

|

|

|

|

|

Golu |

660 |

1,440 |

|

|

To Profit transferred to |

|

|

|

|

|

|

|

|

Moli's Capital [15,990 × 3/5] |

9,594 |

|

|

|

|

|

|

Golu's Capital [15,990 × 2/5] |

6,396 |

15,990 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

21,990 |

|

|

21,990 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Partner's Current Account |

|||||

|

Dr. |

|

Cr |

|||

|

Particulars |

Moli |

Golu |

Particulars |

Moli |

Golu |

|

To Drawings |

12,000 |

12,000 |

By Balance b/d |

40,000 |

20,000 |

|

To Interest on Drawing |

780 |

660 |

By Interest on Capital |

4,000 |

2,000 |

|

To Balance c/d |

40,814 |

15,736 |

By Profit and Loss Adjustment |

9,544 |

6,396 |

|

|

|

|

|

|

|

|

|

53,594 |

28,396 |

|

53,594 |

28,396 |

|

|

|

|

|

|

|

Note: Interest on partner's loan is a charge against profit and therefore it is should be recorded in Profit and Loss Account. Hence, it is deducted from the profit transferred to Profit and Loss Appropriation Account.

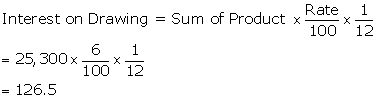

Solution NUM 20

Rakesh

|

Interest on Drawings |

||||

|

Period |

Month |

Amount of Drawing |

Product= Drawings × Period |

|

|

31st May, 2016 to 31st March, 2017 |

10 |

600 |

600 × 10 = |

6,000 |

|

30th June, 2016 to 31st March, 2017 |

9 |

500 |

500 × 9 = |

4,500 |

|

31st August, 2016 to 31st March, 2017 |

7 |

1,000 |

1,000 × 7= |

7,000 |

|

1st November, 2016 to 31st March, 2017 |

5 |

400 |

400 × 5 = |

2,000 |

|

31st December, 2016 to 31st March, 2017 |

3 |

1,500 |

1,500 × 3 = |

4,500 |

|

31st January, 2017 to 31st March, 2017 |

2 |

300 |

300 × 2 = |

600 |

|

1st March, 2017 to 31st March, 2017 |

1 |

700 |

700 × 1 = |

700 |

|

|

Sum of Product |

25,300 |

||

Rohan

Solution NUM 21

Solution NUM 22

Accounting for Partnership : Basic Concepts Exercise 103

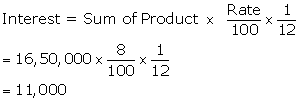

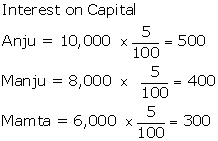

Solution NUM 23

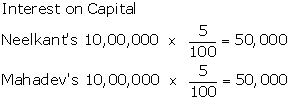

Interest on Capital

|

Raj |

|

|

|

|

Period |

Months |

Capital × Period= |

Product |

|

1st April, 2017 to 30th June, 2017 |

3 |

2,50,000 × 3 = |

7,50,000 |

|

1st July, 2017 to 31st March, 2018 |

9 |

1,00,000 × 9 = |

9,00,000 |

|

|

|

Sum of Product |

16,50,000 |

|

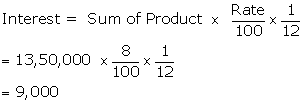

Neeraj |

|

|

|

|

Period |

Months |

Capital × Period |

Product |

|

1st April, 2017 to 30th June, 2017 |

3 |

1,50,000 × 3 = |

4,50,000 |

|

1st July, 2017 to 31st March, 2018 |

9 |

1,00,000 × 9 = |

9,00,000 |

|

|

|

Sum of Product |

13,50,000 |

Solution NUM 24

Solution NUM 25

|

Calculation of interest on Harish's drawings |

|||

|

Period |

Month |

Drawings × Period |

Product |

|

1st Feb, 17 to 31st Dec, 17 |

11 |

4,000 × 11 = |

44,000 |

|

1st May, 17 to 31st Dec, 17 |

8 |

10,000 × 8 = |

80,000 |

|

30th June, 17 to 31st Dec, 17 |

6 |

4,000 × 6 = |

24,000 |

|

31st Oct, 17 to 31st Dec, 17 |

2 |

12,000 × 2 = |

24,000 |

|

31st Dec, 17 to 31st Dec, 17 |

|

4,000 × 0 = |

0 |

|

|

Sum of Product |

1,72,000 |

|

Solution NUM 26

Solution NUM 27

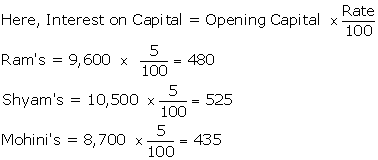

Interest on capital is calculated on the opening balance of capital.

Therefore, opening Capital:

|

|

Ram |

Shyam |

Mohan |

|

Capital as on March 31, 2015 (closing) |

24,000 |

18,000 |

12,000 |

|

Add: Drawings |

3,600 |

4,500 |

2,700 |

|

Less: Profit (3:2:1) |

(18,000) |

(12,000) |

(6,000) |

|

Capital as on April 01, 2014 (opening) |

9,600 |

10,500 |

8,700 |

Solution NUM 28

|

Profit and Loss Adjustment Account |

|||||||

|

Dr. |

|

Cr |

|||||

|

Particulars |

|

Amount Rs. |

Particulars |

|

Amount Rs. |

||

|

To Profit transferred to |

|

|

By Profit and Loss A/c |

|

36,000 |

||

|

|

Amit's Capital |

18,000 |

|

|

|

|

|

|

|

Less : Guarantee to Samiksha |

(1,200) |

16,800 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sunit's Capital |

12,000 |

|

|

|

|

|

|

|

Less : Guarantee to Samiksha |

(800) |

11,200 |

|

|

|

|

|

|

|

|

|

|

|

||

|

|

Samiksha Capital |

6,000 |

|

|

|

|

|

|

|

Add : Deficiency received from: |

|

|

|

|

|

|

|

|

Amit |

1,200 |

|

|

|

|

|

|

|

Sumit |

800 |

8,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

36,000 |

|

|

36,000 |

||

|

|

|

|

|

|

|

||

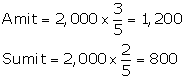

Working Note:

1. Calculation for guarantee to the partner

|

|

Amit |

Sumit |

Samiksha |

|

Guarantee to Samiksha |

|

|

8,000 |

|

Profit of Rs.36,000 (3:2:1) |

18,000 |

12,000 |

6,000 |

|

Deficiency in Samiksha Share |

|

|

2000 |

Deficiency in Samiskha share is to be borne by Amit and Sumit in 3:2 ratio (i.e., PSR).

Accounting for Partnership : Basic Concepts Exercise 104

Solution NUM 29

|

JOURNAL |

|||||

|

|

Particulars |

|

J.F. |

Debit |

Credit |

|

1. |

Profit and Loss A/c |

Dr. |

|

40,000 |

|

|

|

-----To Profit and Loss Appropriation A/c |

|

|

|

40,000 |

|

|

(Being profit transferred from Profit and loss A/c) |

|

|

|

|

|

|

|

|

|

|

|

|

2. |

Profit and Loss Appropriation A/c |

Dr. |

|

40,000 |

|

|

|

-----To Pinki's Capital A/c |

|

|

|

19,500 |

|

|

-----To Deepti's Capital A/c |

|

|

|

15,500 |

|

|

-----To Kaku's Capital A/c |

|

|

|

5,000 |

|

|

(Being profit distributed among Partner's) |

|

|

|

|

|

|

|

|

|

|

|

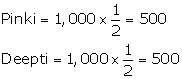

Working Note:

1. Calculation for guarantee to the partner

|

|

Pinki |

Deepti |

Kaku |

|

Guarantee to Kaku |

|

|

5,000 |

|

Profit of Rs.40,000 (5:4:1) |

20,000 |

16,000 |

4,000 |

|

Deficiency in Kaku Share |

|

|

1000 |

Deficiency in Kaku's share is to be borne by Pinki and Deepti Equally.

After adjustment of deficiency,

Pinki gets Rs.20,000 -Rs.500=Rs.19,500

Deepti gets Rs.16,000-Rs.500=Rs.15,500

Solution NUM 30

|

Profit and Loss Appropriation Account as on March 31,2016 |

|||||||

|

Dr. |

|

Cr |

|||||

|

Particulars |

|

Amount Rs. |

Particulars |

|

Amount Rs. |

||

|

To Profit transferred to |

|

|

By Profit and Loss A/c |

|

40,000 |

||

|

|

Abhay's Capital |

|

20,000 |

|

|

|

|

|

|

|

|

|

|

|

||

|

|

Siddharth's Capital |

12,000 |

|

|

|

|

|

|

|

Less : Guarantee to Kusum |

(2,000) |

10,000 |

|

|

|

|

|

|

|

|

|

|

|

||

|

|

Kusum's Capital |

8,000 |

|

|

|

|

|

|

|

Add : Deficiency received from: |

|

|

|

|

|

|

|

|

Siddharth |

2,000 |

10,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

40,000 |

|

|

40,000 |

||

|

|

|

|

|

|

|

||

|

Profit and Loss Appropriation Account as on March 31,2017 |

||||

|

Dr. |

|

Cr. |

||

|

Particulars |

Amount Rs. |

Particulars |

Amount Rs. |

|

|

To Profit transferred to |

|

By Profit and Loss A/c |

60,000 |

|

|

|

Abhay's Capital |

30,000 |

|

|

|

|

Siddharth's Capital |

18,000 |

|

|

|

|

Kusum's Capital |

12,000 |

|

|

|

|

|

|

|

|

|

|

60,000 |

|

60,000 |

|

Working Note:

1. For the year 2016, calculation for guarantee to the partner:

|

|

Abhay |

Siddharth |

Kusum |

|

Guarantee to Kusum |

|

|

10,000 |

|

Profit of Rs.40,000 (5:3:2) |

20,000 |

12,000 |

8,000 |

|

Deficiency in Kusum share |

|

|

2,000 |

Deficiency in Kusum's share is to be borne by Siddharth. Therefore, deficiency received from Siddharth is Rs.2,000

Solution NUM 31

|

Journal |

|||||

|

|

Particulars |

|

L.F. |

Dr. Rs. |

Cr. Rs. |

|

|

|

|

|

|

|

|

1. |

Profit and Loss A/c |

Dr. |

|

40,000 |

|

|

|

--------To Profit and Loss Appropriation A/c |

|

|

|

40,000 |

|

|

(Being profit transferred from Profit and loss A/c) |

|

|

|

|

|

|

|

|

|

|

|

|

2. |

Profit and Loss Appropriation A/c |

Dr |

|

35,000 |

|

|

|

-------- To Radha's Capital A/c |

|

|

|

16,600 |

|

|

-------- To Mary's Capital A/c |

|

|

|

13,400 |

|

|

-------- To Fatima's Capital A/c |

|

|

|

5,000 |

|

|

(Being profit distributed among Partner's) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

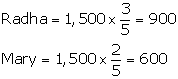

Working Note:

1. Calculation for guarantee to the partner:

|

|

Radha |

Mary |

Fatima |

|

Guarantee to Fatima |

|

|

5,000 |

|

Profit of Rs.35,000 (5:4:1) |

17,500 |

14,000 |

3,500 |

|

Deficiency in Fatima's share |

|

|

1,500 |

Deficiency in Fatima's share is to be borne by Radha and Mary in 3:2 ratio.

After adjustment of deficiency,

Radha gets Rs.17,500 -Rs.900=Rs.16,600

Mary gets Rs.14,000 -Rs.600=Rs.13,400

Solution NUM 33

Case (i)

|

Profit and Loss Appropriation Account as on March 31, 2015 |

|||||||

|

Dr. |

|

Cr |

|||||

|

Particulars |

|

Amount Rs. |

Particulars |

|

Amount Rs. |

||

|

To Profit transferred to |

|

|

By Profit and Loss A/c |

|

2,50,000 |

||

|

To Arun's Capital |

1,00,000 |

|

|

|

|

||

|

|

Less : Chintu's deficiency |

(10,000) |

90,000 |

|

|

|

|

|

|

|

|

|

|

|

||

|

To Bobby's Capital |

|

1,00,000 |

|

|

|

||

|

|

|

|

|

|

|

||

|

To Chintu's Capital |

50,000 |

|

|

|

|

||

|

|

Add : Deficiency received from: |

|

|

|

|

|

|

|

|

Arun |

10,000 |

60,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2,50,000 |

|

|

2,50,000 |

||

|

|

|

|

|

|

|

||

Working Note:

1. For the year, Calculation for guarantee to the partner:

|

|

Arun |

Boby |

Chintu |

|

Guarantee to Chintu |

|

|

60,000 |

|

Profit of Rs.2,50,000 (2:2:1) |

1,00,000 |

1,00,000 |

50,000 |

|

Deficiency in Chintu's share |

|

|

10,000 |

Deficiency in Chintu's share is to be borne by Arun. Therefore, deficiency received from Arun is Rs.10,000

Case (ii)

|

Profit and Loss Appropriation Account as on March 31,2015 |

||||

|

Dr. |

|

Cr. |

||

|

Particulars |

Amount Rs. |

Particulars |

Amount Rs. |

|

|

To Profit transferred to |

|

By Profit and Loss A/c |

3,60,000 |

|

|

|

Arun's Capital [3,60,000 × 2/5] |

1,44,000 |

|

|

|

|

Bobby's Capital [3,60,000 × 2/5] |

1,44,000 |

|

|

|

|

Chintu's Capital [3,60,000 × 1/5] |

72,000 |

|

|

|

|

3,60,000 |

|

3,60,000 |

|

|

|

|

|

|

|

Solution NUM 32

|

Profit and Loss Appropriation Account |

|||||||

|

Dr. |

|

Cr |

|||||

|

Particulars |

|

Amount Rs. |

Particulars |

|

Amount Rs. |

||

|

To Profit transferred to |

|

|

By Profit and Loss A/c |

|

30,000 |

||

|

|

X's Capital |

15,000 |

|

|

|

|

|

|

|

Less : Z's Deficiency |

(1,800) |

13,200 |

|

|

|

|

|

|

|

|

|

|

|

||

|

|

Y's Capital |

10,000 |

|

|

|

|

|

|

|

Less : Z's Deficiency |

(1,200) |

8,800 |

|

|

|

|

|

|

|

|

|

|

|

||

|

|

Z's Capital |

|

|

|

|

|

|

|

|

Add: Share of Deficiency borne by |

5,000 |

|

|

|

|

|

|

|

X |

1,800 |

|

|

|

|

|

|

|

Y |

1,200 |

8,000 |

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

30,000 |

|

|

|

||

|

|

|

|

|

|

|

||

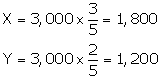

Working Note:

1. Calculation for guarantee to the partner:

|

|

X |

Y |

Z |

|

Guarantee to Z |

|

|

8,000 |

|

Profit of Rs.30,000 (3:2:1) |

15,000 |

10,000 |

5,000 |

|

Deficiency in Z's share |

|

|

3,000 |

Deficiency in Z's share is to be borne by X and Y in 3:2 ratio (i.e., PSR).

Solution NUM 34

|

Profit and Loss Appropriation Account as on March 31, 2017 |

|||||||

|

Dr. |

|

Cr |

|||||

|

Particulars |

|

Amount Rs. |

Particulars |

|

Amount Rs. |

||

|

To Profit transferred to |

|

|

By Profit and Loss A/c |

|

70,000 |

||

|

To Ashok Capital |

28,000 |

|

|

|

|

||

|

|

Less : Cheena's deficiency |

(3,000) |

25,000 |

|

|

|

|

|

|

|

|

|

|

|

||

|

To Brijesh's Capital |

28,000 |

|

|

|

|

||

|

|

Less : Cheena's deficiency |

(3,000) |

25,000 |

|

|

|

|

|

|

|

|

|

|

|

||

|

To Cheena's Capital |

14,000 |

|

|

|

|

||

|

|

Add : Deficiency received from: |

|

|

|

|

|

|

|

|

Ashok |

3,000 |

|

|

|

|

|

|

|

Brijesh |

3,000 |

20,000 |

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

70,000 |

|

|

70,000 |

||

|

|

|

|

|

|

|

||

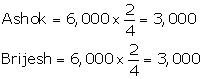

Working Note:

2. Calculation for guarantee to the partner:

|

|

Ashok |

Brijesh |

Cheena |

|

Guarantee to Cheena |

|

|

20,000 |

|

Profit of Rs.70,000 (2:2:1) |

28,000 |

28,000 |

14,000 |

|

Deficiency in Cheena's share |

|

|

6,000 |

Deficiency in Cheena's share is to be borne by Ashok and Brijesh in 2:2 ratio (i.e., PSR).

Accounting for Partnership : Basic Concepts Exercise 105

Solution NUM 35

|

Profit and Loss Appropriation Account as on March 31, 2017 |

||||||||

|

Dr. |

|

Cr |

||||||

|

Particulars |

|

|

Amount Rs. |

Particulars |

|

Amount Rs. |

||

|

To Interest on Capital |

|

|

|

By Profit and Loss A/c |

|

2,00,000 |

||

|

|

Ram |

|

50,000 |

|

|

|

|

|

|

|

Mohan |

|

25,000 |

|

|

|

|

|

|

|

Sohan |

|

20,000 |

95,000 |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

To Profit Transferred to |

|

|

|

|

|

|

||

|

|

Ram's Capital |

52,500 |

|

|

|

|

|

|

|

|

Less : Share of deficiency |

(4,500) |

48,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

Mohan's Capital |

35,000 |

|

|

|

|

|

|

|

|

Less : Share of deficiency |

(3,000) |

32,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

Sohan's Capital |

17,500 |

|

|

|

|

|

|

|

|

Add : Deficiency received from |

|

|

|

|

|

|

|

|

|

Ram |

4,500 |

|

|

|

|

|

|

|

|

Mohan |

3,000 |

25,000 |

1,05,000 |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

||

|

|

|

|

2,00,000 |

|

|

2,00,000 |

||

|

|

|

|

|

|

|

|

||

Working Note:

1. Calculation for guarantee to the partner:

|

|

Ram |

Mohan |

Sohan |

|

Guarantee to Sohan |

|

|

25,000 |

|

Profit for distribution Rs.1,05,000 (3:2:1) |

52,500 |

35,000 |

17,500 |

|

Deficiency in Sohan's share |

|

|

7,500 |

Deficiency in Sohan's share is to be borne by Ram and Mohan in 3:2 ratio (i.e., PSR).

Solution NUM 36

|

Profit and Loss Appropriation Account as on March 31, 2017 |

|||||||

|

Dr. |

|

Cr |

|||||

|

Particulars |

|

Amount Rs. |

Particulars |

|

Amount Rs. |

||

|

To Profit Transferred to |

|

|

By Profit and Loss |

|

75,000 |

||

|

|

Amit's Capital |

42,000 |

|

By Babita's Capital |

|

9,000 |

|

|

|

Less : Sona's share of deficiency |

(600) |

41,400 |

(Deficiency of Fees 25,000 - 16,000) |

|

|

|

|

|

|

|

|

|

|

||

|

|

To Babita's Capital |

28,000 |

|

|

|

|

|

|

|

Less : Sona's share of deficiency |

(400) |

27,600 |

|

|

|

|

|

|

|

|

|

|

|

||

|

|

To Sona's Capital |

14,000 |

|

|

|

|

|

|

|

Add : Deficiency received from: |

|

|

|

|

|

|

|

|

Amit |

600 |

|

|

|

|

|

|

|

Babita |

400 |

15,000 |

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

84,000 |

|

|

84,000 |

||

|

|

|

|

|

|

|

||

Working Note:

1. Calculation for guarantee to the partner:

|

|

Amit |

Babita |

Sona |

|

Guarantee to Sona |

|

|

15,000 |

|

Profit for distribution Rs.84,000 (3:2:1) |

42,000 |

28,000 |

14,000 |

|

Deficiency in Sona's share |

|

|

1,000 |

Deficiency in Sona's share is to be borne by Amit and Babita in 3:2 ratio (i.e., PSR).

Solution NUM 38

|

Old Ratio (2:2:1) Year |

Harry |

Porter |

Ali |

|

Total |

|

2014 - 15 |

(8,800) |

(8,800) |

(4,400) |

|

(22,000) |

|

2015 - 16 |

(9,600) |

(9,600) |

(4,800) |

|

(24,000) |

|

2016 - 17 |

(11,600) |

(11,600) |

(5,800) |

|

(29,000) |

|

Total Profit of 3 years in old ratio |

(30,000) |

(30,000) |

(15,000) |

|

(75,000) |

|

Distribution of 3 years profit in new Ratio (1:1:1) |

25,000 |

25,000 |

25,000 |

|

75,000 |

|

Adjusted Profit |

(5,000) |

(5,000) |

10,000 |

|

NIL |

|

Adjusting entry |

|||||

|

Date |

Particulars |

|

L.F. |

Dr. Rs. |

Cr. Rs. |

|

|

|

|

|

|

|

|

|

Harry's Capital A/c |

Dr. |

|

5,000 |

|

|

|

Porter's Capital A/c |

Dr. |

|

5,000 |

|

|

|

-------- To Ali's Capital A/c |

|

|

|

10,000 |

|

|

(Being profit adjusted due to change in profit sharing ratio) |

|

|

|

|

|

|

|

|

|

|

|

Solution NUM 37

|

Past Adjustment |

||||||

|

|

X |

Y |

Z |

|

Total |

|

|

Interest on Capital |

5,000 (700) 1,000 |

4,000 (500) 1,500 |

3,000 (300) NIL |

|

12,000 (1,500) 2,500 |

|

|

|

Less : Interest on Drawings Add : Partner's Salaries |

|||||

|

|

||||||

|

Right Distribution of 13,000 |

5,300 (7,800) |

5,000 (2,600) |

2,700 (2,600) |

|

13,000 (13,000) |

|

|

Less : Wrong distribution of 13,000 (3:1:1) |

||||||

|

|

(2,500) Dr. |

2,400 Cr. |

100 Cr. |

|

NIL |

|

Explanation:

Capital has credit balance if it decreases it will be debited and if it increases it will be credited.

Here X has wrongly taken excess Rs.2.500 and hence Rs.2.500 will be deducted from X capital Account i.e., debited. On the other hand, Y and Z have taken less than what they should have been taken hence capital account of Y and Z will be added i.e., credited.

|

Adjusting entry |

|||||

|

Date |

Particulars |

|

L.F. |

Dr. Rs. |

Cr. Rs. |

|

|

|

|

|

|

|

|

|

X's Capital A/c |

Dr. |

|

2,500 |

|

|

|

-------- To Y's Capital A/c |

|

|

|

2,400 |

|

|

-------- To Z's Capital A/c |

|

|

|

100 |

|

|

(Being profit adjusted among partners) |

|

|

|

|

|

|

|

|

|

|

|

Accounting for Partnership : Basic Concepts Exercise 106

Solution NUM 39

|

Adjustment of Profit |

|||||

|

|

Mannu's |

Shrishti |