Class 12-commerce NCERT Solutions Accountancy Chapter 4: Analysis of Financial Statements

NCERT Solutions for CBSE Class 12 Commerce Accountancy Chapter Analysis of Financial Statements at TopperLearning help students understand the topics from this chapter. These solutions not only explain every unit but also provide solutions to the exercises. The detailed notes can help students perform well in the CBSE board exams as well as the competitive exams. For better learning, revision and practice, students can refer to our revision notes, video lessons, textbook solutions, past years’ papers, sample papers, MCQs, MIQs etc.

Analysis of Financial Statements Exercise 186

Solution SA 1

Commonly used techniques of Financial Statement Analysis:

- Comparative Financial Statements

- Common Size Financial Statements

- Trend Analysis

- Ratio Analysis

- Cash Flow Statement

- Fund Flow Statement

The above listed techniques can be classified on the following basis:

A. On the basis of Comparison

- Inter-firm Comparison

- Comparative Statement (Balance Sheet, Profit and Loss Account) a

- Common Size Statement (of the same period)

- Ratio of Two or More Competitive Firms (of the same period)

- Cash Flow Statement of Two or More Competitive Firms

- Polygon, Bar Diagram

- Intra-firm Comparison

- Comparative Statement (Balance Sheet, Profit and Loss Account) a

- Common Size Statement (of the same period)

- Ratio of Two or More Competitive Firms (of the same period)

- Cash Flow Statement of Two or More Competitive Firms

- Polygon, Bar Diagram

- Horizontal Comparison

- Vertical Comparison

B. On the basis of Time

- Inter-period Comparison

- Comparative Statement (two or more periods)

- Cash Flow Statement (two or more periods)

- Cross Sectional (Intra period) Comparison

- Common Size Statement

- Ratio Analysis

C. Horizontal Analysis

- Time Series

- Bar Diagram

- Polygon

- Comparative Statement

- Ratio Analysis

D. Vertical Analysis

- Common Size Statement

- Pie Diagram

Solution SA 2

|

Basis of Difference |

Horizontal Analysis |

Vertical Analysis |

|

Meaning |

It is a comparison of an item of the financial statement of one period or periods to its corresponding item of the base accounting period. |

It is a comparison of items of the financial statement to the common item of the same accounting period. |

|

Purpose |

Its purpose is to find out the change in an item during an accounting period. The change is expressed either in absolute figures or in percentage or in both. |

Its purpose is to determine the proportion of item/items to the common item of the same accounting period. The change is expressed either in ratio or in percentage. |

|

Usefulness |

It shows growth or decline of the item. |

It helps in predicting and determining the future relative proportion of an item to the common item. |

Solution SA 3

Analysis and interpretation refers to a critical and detailed examination of financial statements. The main purpose of analysis and interpretation is to present financial data in a manner which is easily understandable and self-explanatory. This not only helps accounting users to assess the financial performance of the business over a period of time but also helps them in decision making and policy and financial designing process.

|

Vaibhavi Ltd. Comparative Statement as on 31 March 2013 and 2014 |

||||

|

Particulars |

2012-13 |

2013-14 |

Absolute Change |

% Change |

|

Sales Less: Cost of Goods Sold |

1,00,000 60,000 |

1,50,000 78,000 |

50,000 18,000 |

50 30 |

|

Gross Profit |

40,000 |

72,000 |

32,000 |

80 |

|

Less: Operating Expenses: |

|

|

|

|

|

Office and Administrative Exp. |

8,000 |

10,000 |

2,000 |

25 |

|

Selling and Distribution Exp. |

5,000 |

6,000 |

1,000 |

20 |

|

Operating Profit |

27,000 |

56,000 |

29,000 |

107.4 |

|

Add: Other Income |

3,000 |

4,800 |

1,800 |

60 |

|

Less: Non-operating Expenses |

4,000 |

4,800 |

800 |

20 |

|

Profit Before Interest and Tax |

26,000 |

56,000 |

30,000 |

115.38 |

|

Interest |

2,000 |

1,800 |

(200) |

(10) |

|

Profit before Tax |

24,000 |

54,200 |

30,200 |

125.83 |

|

Less: 50% Income Tax |

12,000 |

27,100 |

15,100 |

125.83 |

![]()

Interpretation:

- Sales of the company has increased by 50% during the year 2013-14, whereas the cost of goods sold has also increased but at a lesser rate. From this, we can conclude that the company has followed an efficient sales strategy, consequent of which the gross profit of the company has increased by 80% compared to the previous year (2012-13).

- In 2013-14, operating expenses have also increased, but on the contrary, operating profit has increased at a higher rate than the rate of operating expenses.

- Profit before interest and tax has also increased by 115.38% during these two years. This indicates the improvement in the operating efficiency of the company.

Solution SA 4

Financial analysis has a vast importance to various accounting users on various matters. Income statements, balance sheets and other financial data provide information about expenses, sources of income, profit or loss and help in examining the financial position of a business. These financial data are of no use until they are analysed. There are various tools and methods to analyse financial data such as ratio analysis and cash flow statements which make financial data to cater to the varying needs of various accounting users. Reasons in favour of financial analysis:

- It assists in evaluating the profit earning capacity and financial viability of a business.

- It assists in evaluating the long-term solvency of the business.

- It helps in evaluating the relative financial status of a firm in comparison to other competitive firms.

- It helps the management in the decision-making process, drafting various plans and in establishing an effective controlling system.

Solution SA 5

Financial statements which enable intra-firm and inter-firm comparisons of financial statements over a period of time are called comparative financial statements. These statements help accounting users to evaluate financial progress in relative terms. Comparative financial statements present financial data in a manner that is easily understandable and can be analysed without any ambiguity. Comparative financial statements enable meaningful comparisons only if the accounting policies and practices for the treatment of the items are the same over the period of study. Two comparative financial statements which are commonly prepared are

- Comparative Balance Sheet

- Comparative Income Statement

Solution SA 6

A common size statement represents the relationship between various items of financial statements and some common items (Net Sales and Total of Balance Sheet) in terms of percentage. Various items of trading and profit and loss account such as cost of goods sold, non-operating incomes and expenses are expressed in terms of percentage of net sales. Likewise, different items of the Balance Sheet such as Fixed Assets, Current Assets, Share Capital etc. are expressed in terms of percentage of Total of Balance Sheet. These percentage figures are easily comparable with those of previous years (i.e. intra-firm comparison) and with the figures of other firms in the same industry (i.e. inter-firm comparison) as well. Analyses based on these statements are commonly known as Vertical Analyses.

Commonly prepared common size statements are

- Common Size Balance Sheet

- Common Size Income Statement

Analysis of Financial Statements Exercise 188

Solution NUM 1

|

Comparative Balance Sheet as on March 31,2016 and 2017 |

||||

|

Particulars |

2016 Rs. |

2017 Rs. |

Absolute Change |

Percentage Change |

|

I. Equity and Liabilities |

|

|

|

|

|

1. Shareholder's Fund |

|

|

|

|

|

a. Equity Share Capital |

2,00,000 |

4,00,000 |

2,00,000 |

100 |

|

b. Reserves and Surplus |

1,00,000 |

1,50,000 |

50,000 |

50 |

|

2. Non-Current Liabilities |

|

|

|

|

|

a. Long term Borrowings |

2,00,000 |

3,00,000 |

1,00,000 |

50 |

|

3. Current Liabilities |

|

|

|

|

|

a. Short Term Borrowings |

50,000 |

70,000 |

20,000 |

40 |

|

b. Trade Payables |

30,000 |

60,000 |

30,000 |

100 |

|

c. Short Term Provisions |

20,000 |

10,000 |

(10,000) |

(50) |

|

d. Other Current Liabilities |

20,000 |

30,000 |

10,000 |

50 |

|

Total |

6,20,000 |

10,20,000 |

4,00,000 |

64.5 |

|

II. Assets |

|

|

|

|

|

1. Non-Current Assets |

|

|

|

|

|

a. Fixed Assets |

2,00,000 |

5,00,000 |

3,00,000 |

150 |

|

b. Non Current Investments |

1,00,000 |

1,25,000 |

25,000 |

25 |

|

2. Current Assets |

|

|

|

|

|

a. Current Investments |

60,000 |

80,000 |

20,000 |

33.3 |

|

b. Inventories |

1,35,000 |

1,55,000 |

20,000 |

14.8 |

|

c. Trade Receivables |

60,000 |

90,000 |

30,000 |

50 |

|

d. Short term Loans and Advances |

40,000 |

60,000 |

20,000 |

50 |

|

e. Cash and Cash Equivalents |

25,000 |

10,000 |

(15,000) |

(60) |

|

Total |

6,20,000 |

10,20,000 |

4,00,000 |

64.5 |

Solution NUM 2

|

Comparative Balance Sheet as on March 31,2016 and 2017 |

||||

|

Particulars |

2016 (Rs.) |

2017 (Rs.) |

Absolute Change |

Percentage Change |

|

I. Equity and Liabilities |

|

|

|

|

|

1. Shareholder's Fund |

|

|

|

|

|

a. Equity Share Capital |

3,00,000 |

4,00,000 |

1,00,000 |

33.3 |

|

b. Reserves and Surplus |

1,00,000 |

1,50,000 |

50,000 |

50 |

|

2. Non-Current Liabilities |

|

|

|

|

|

a. Long term Borrowings (Loan from IDBI) |

1,00,000 |

3,00,000 |

2,00,000 |

200 |

|

3. Current Liabilities |

|

|

|

|

|

a. Short Term Borrowings |

50,000 |

70,000 |

20,000 |

40 |

|

b. Trade Payables |

30,000 |

60,000 |

30,000 |

100 |

|

c. Short Term Provisions |

20,000 |

10,000 |

(10,000) |

(50) |

|

d. Other Current Liabilities |

1,00,000 |

1,10,000 |

10,000 |

10 |

|

Total |

7,00,000 |

11,00,000 |

4,00,000 |

57.14 |

|

II. Assets |

|

|

|

|

|

1. Non-Current Assets |

|

|

|

|

|

a. Fixed Assets |

2,20,000 |

4,00,000 |

1,80,000 |

81.8 |

|

b. Non Current Investments |

1,00,000 |

2,25,000 |

1,25,000 |

125 |

|

2. Current Assets |

60,000 |

80,000 |

|

|

|

a. Current Investments |

|

|

20,000 |

33.3 |

|

b. Inventories (stock) |

90,000 |

1,05,000 |

15,000 |

16.6 |

|

c. Trade Receivables |

60,000 |

90,000 |

30,000 |

50 |

|

d. Short term Loans and Advances |

85,000 |

1,00,000 |

15,000 |

17.65 |

|

e. Cash and Cash Equivalents |

85,000 |

1,00,000 |

15,000 |

17.65 |

|

|

|

|

|

|

|

Total |

7,00,000 |

11,00,000 |

4,00,000 |

57.14 |

Analysis of Financial Statements Exercise 189

Solution NUM 3

|

Comparative Income Statement as on March 31,2016 and 2017 |

|||||

|

Particulars |

Note No. |

2014 Rs. |

2015 Rs. |

Absolute Change |

Percentage Change |

|

1. Revenue from Operations |

|

2,16,000 |

92,000 |

(1,24,000) |

(57.4) |

|

2. Other Income |

|

10,000 |

20,000 |

10,000 |

100 |

|

3. Total Revenue (I + 2) |

|

2,26,000 |

1,12,000 |

(1,14,000) |

(50.44) |

|

4. Expenses |

|

|

|

|

|

|

a. Purchase of Stock- in- Trade |

|

80,000 |

1,40,000 |

60,000 |

75 |

|

b. Change in Inventories |

|

30,000 |

(60,000) |

(90,000) |

(300) |

|

c. Employee Benefit Expenses |

|

5,000 |

10,000 |

5,000 |

100 |

|

d. Finance Costs |

|

21,000 |

22,000 |

1,000 |

4.54 |

|

e. Depreciation and Amortization Expenses |

|

5,000 |

10,000 |

5,000 |

100 |

|

f. Other Expenses |

|

80,000 |

1,30,000 |

50,000 |

62.5 |

|

Total Expenses |

|

2,21,000 |

2,52,000 |

31,000 |

14.03 |

|

5. Profit before Tax (3-4) |

|

5,000 |

(1,40,000) |

(83,000) |

16.6 |

|

Less: Income Tax |

|

2,500 |

- |

(2,500) |

(100) |

|

6. Profit After Tax |

|

2,500 |

(1,40,000) |

(1,37,500) |

55 |

Working Notes:

- Calculation of Net Sales

Net Sales= Cost of Goods Sold + Gross Profit-Sales Returns

Or

Net Sales= Purchase + Manufacturing Expenses + Change in Inventory + Gross Profit - Sales Returns

Net Sales (2016)=80,000+20,000+30,000+90,000-4,000

= Rs.2,16,000

Net Sales (2017)=1,40,000+50,000-60,000-30,000-8,000

= Rs.92,000 - Calculation of Finance Cost

Finance Cost = Interest on short-term loans + Interest on 10% Debenture

Finance Cost (2016)=20,000+1,000=Rs.21,000

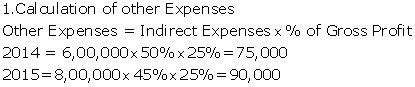

Finance Cost (2017)=20,000+2,000=Rs.22,000 - Calculation of other Expenses

Other Expenses=Freight Outward+ Carriage Outward +Loss on sale of office car

Other Expenses(2016)=10,000+10,000+60,000=Rs.80,000

Other Expenses(2017)=20,000+20,000+90,000=Rs.1,30,000

Solution NUM 4

|

Comparative Income Statement For the year ended March 31,2016 and 2017 |

|||||

|

Particulars |

Note No. |

2016 Rs. |

2017 Rs. |

Absolute Change |

Percentage Change |

|

1. Revenue from operations |

|

9,60,000 |

4,50,000 |

(5,10,000) |

(53.13) |

|

2. Other Income |

|

10,000 |

20,000 |

10,000 |

100 |

|

3. Total Revenue (1+2) |

|

9,70,000 |

4,70,000 |

(5,00,000) |

(51.55) |

|

4. Expenses |

|

|

|

|

|

|

a. Purchases of stock-in- Trade |

|

2,66,000 |

94,000 |

(1,72,000) |

(64.7) |

|

b. Change in Inventories |

|

(15,000) |

(40,000) |

(55,000) |

(366.7) |

|

c. Finance Costs |

|

25,000 |

20,000 |

(5,000) |

(20) |

|

d. Depreciation and Amortization Expenses |

|

20,000 |

20,000 |

- |

- |

|

e. Other Expenses |

|

30,000 |

40,000 |

10,000 |

33.33 |

|

Total Expenses |

|

3,26,000 |

1,34,000 |

(1,92,000) |

58.90 |

|

5. Profit before Tax (3-4) |

|

6,44,000 |

3,36,000 |

(3,08,000) |

47.83 |

|

Less: Income Tax |

|

3,22,000 |

1,34,400 |

(1,87,600) |

58.26 |

|

6. Profit After Tax |

|

3,22,000 |

2,01,600 |

1,20,000 |

37.39 |

- Calculation of Net Purchases and Change in Inventory

Net Purchase of Stock in Trade = Cash Purchase + Credit Purchase - Purchase Returns

2016=1,20,000+1,50,000-4,000=Rs.2,66,000

2017=40,000+60,000-60,000=Rs.94,000

Change in Inventory=Opening Stock-Closing Stock

2016=30,000-45,000=Rs.(15,000)

2017=60,000-1,00,000=Rs.(40,000) - Calculation of Finance Cost

Finance Cost = Interest on Bank Overdraft + Interest on Debentures

Finance Cost (2016) = 5,000+20,000=Rs.25,000

Finance Cost (2017)=0+20,000=Rs.20,000 - Calculation of Other Expenses

Other Expenses=Carriage outward + other operating expenses

Other Expenses(2016)=10,000+20,000=Rs.30,000

Other Expenses(2017)=30,000+10,000=Rs.40,000

Analysis of Financial Statements Exercise 190

Solution NUM 5

|

Comparative Income Statement For the year ended March 31,2016 and 2017 |

|||||

|

Particulars |

Note No. |

2016 Rs. |

2017 Rs. |

Percentage of Sales |

|

|

|

2014 |

2015 |

|||

|

1. Revenue from operations |

|

6,00,000 |

8,00,000 |

100 |

100 |

|

2. Other Income |

|

10,000 |

12,000 |

1.67 |

1.5 |

|

3. Total Revenue (1+2) |

|

6,10,000 |

8,12,000 |

101.67 |

101.5 |

|

4. Expenses |

|

|

|

|

|

|

a. Cost of Goods Sold |

|

4,28,0000 |

7,28,000 |

71.33 |

91 |

|

b. Other Expenses |

|

75,000 |

90,000 |

12.50 |

11.25 |

|

Total Expenses |

|

5,03,000 |

8,18,000 |

83.83 |

102.25 |

|

5. Profit before Tax (3-4) |

|

1,07,000 |

(6,000) |

17.83 |

(0.75) |

|

Less: Income Tax |

|

32,100 |

- |

5.53 |

- |

|

6. Profit After Tax |

|

74,900 |

(6,000) |

12,48 |

(0.75) |

Working Notes:

Solution NUM 6

|

Common Size Balance Sheet |

|||||||

|

Particulars |

Aditya Ltd. Rs. |

Anjali Ltd. Rs. |

% of Sales |

||||

|

|

|

|

Aditya Ltd. |

Anjali Ltd. |

|||

|

I. Equity and Liabilities |

|

|

|

|

|||

|

1. Shareholder's Fund |

|

|

|

|

|||

|

a. Equity Share Capital |

6,00,000 |

8,00,000 |

60 |

66.67 |

|||

|

b. Reserves and Surplus |

3,00,000 |

2,50,000 |

30 |

20.83 |

|||

|

2. Current Liabilities |

1,00,000 |

1,50,000 |

10 |

12.5 |

|||

|

Total |

10,00,000 |

12,00,000 |

100 |

100 |

|||

|

II. Assets |

|

|

|

|

|||

|

1. Non - Current Assets |

|

|

|

|

|||

|

a. Fixed Assets |

4,00,000 |

7,0,000 |

40 |

58.33 |

|||

|

2. Current Assets |

6,00,000 |

5,00,000 |

60 |

41.67 |

|||

|

Total |

10,00,000 |

12,00,000 |

100 |

100 |

|||