Class 12-commerce NCERT Solutions Accountancy Chapter 5: Accounting Ratios

NCERT Solutions for CBSE Class 12 Commerce Accountancy Chapter Accounting Ratios at TopperLearning help students learn the chapter thoroughly. The solutions not only explain the exercise questions but also the unit-wise and page-wise questions. The detailed notes by our subject experts help students perform well in the CBSE board exams and competitive exams. For better learning and for practice, students can refer to our revision notes, video lessons, textbook solutions, past years’ papers, sample papers, MCQs, MIQs etc.

Accounting Ratios Exercise 232

Solution SA 1

Ratio analysis is a method of financial analysis. It explains the relationship between various items of the Balance Sheet and Income Statements. It helps in determining profitability, operational efficiency, solvency etc. of a firm. It may be expressed as a fraction, proportion, percentage or in times. Ratio analysis provides vital information to various accounting users regarding the financial position and feasibility and performance of a firm. It also helps to lay down the framework for decision making and policy designing by the management.

Solution SA 2

Accounting ratios are classified in the following two ways:

- Traditional Classification

- Functional Classification

- Traditional Classification: This classification is based on financial statements, i.e. Profit and Loss Account and Balance Sheet. Traditional classification further segregates accounting ratios on the basis of the accounts to which the elements of a ratio belong. On the basis of accounts of financial statements, traditional classification segregates accounting ratios as

a. Income Statement Ratios: These are ratios whose elements belong only to the Trading and Profit and Loss Account such as Gross Profit Ratio etc.

b. Balance Sheet Ratios: These are ratios whose elements belong only to the Balance Sheet such as Current Ratio, Debt Equity Ratio etc.

c. Composite Ratios: These are ratios whose elements belong to the Trading and Profit and Loss Account as well as to the Balance Sheet such as Debtors Turnover Ratio etc.

- Functional Classification: This classification shows the functional need and purpose of calculating ratio. The basic grounds to compute ratio is to ascertain liquidity, solvency, financial performance and profitability of a business. Therefore, functional classification classifies various accounting ratios as

a. Liquidity Ratio: These ratios are calculated to find short-term solvency.

b. Solvency Ratio: These ratios are calculated to find long-term solvency.

c. Activity Ratio: These ratios are calculated for measuring operational efficiency and efficacy of operations. These ratios relate to sales or cost of goods sold.

d. Profitability Ratio: These ratios are calculated to evaluate the financial performance and financial viability of the business.

Solution SA 3

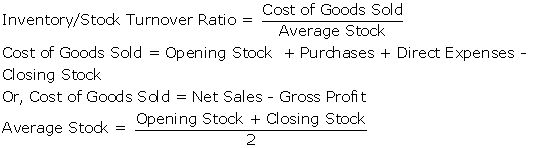

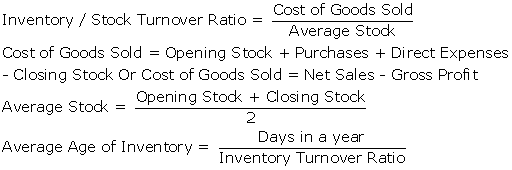

a. Inventory Turnover Ratio: This ratio is computed to ascertain the competence with which the stock is used. This ratio is based on the relationship between cost of goods sold and average stock kept during the year.

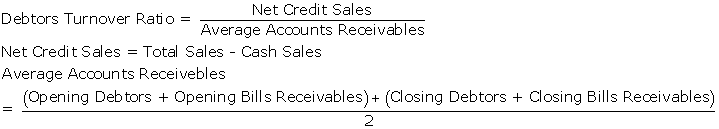

b. Debtors Turnover Ratio or Trade Receivables Turnover Ratio: This ratio is computed to ascertain the pace at which the amount is collected from debtors. It establishes the relationship between net credit sales and average accounts receivables.

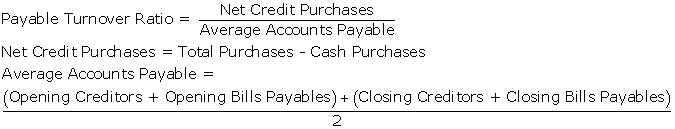

c. Trade Payables Turnover Ratio: It is also known as Creditors Turnover Ratio. It is computed to determine the pace at which the amount is paid to creditors. It determines the relationship between net credit purchases and average accounts payables.

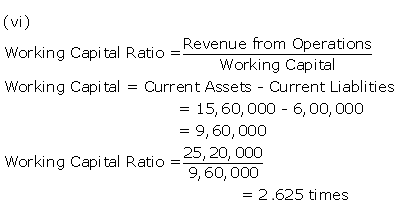

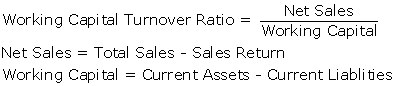

d. Working Capital Turnover Ratio: This ratio is computed to determine how competently the working capital is employed in making sales. It determines the relationship between net sales and working capital.

Solution SA 4

The liquidity of a business firm is measured by its ability to pay its long-term obligations. Long-term obligations include payments of principal amount and interest on its respective due date. Long-term solvency of any business can be calculated on the basis of the following ratios:

a. Debt-Equity Ratio: It represents the relationship between borrowed funds and owner's funds. Lower the debt-equity ratio, higher will be the degree of security to the lenders. Therefore, low debt-equity ratio implies that the company can easily meet its long-term obligations.

![]()

b. Total Assets to Debt Ratio: It represents the relationship between total assets and long-term loans. A high total assets to debt ratio implies that more assets are financed by the owner's fund and the company can easily meet its long-term obligations. Thus, a higher ratio implies more security to the lenders.

![]()

c. Interest Coverage Ratio: This ratio represents the relationship between the amount of profit consumed for paying interest and the amount of interest payable. A high interest coverage ratio implies that the company can easily meet all its interest obligations out of its profit.

![]()

Solution SA 5

Inventory Turnover Ratio: This ratio is computed to ascertain the competence with which the stock is used. This ratio is based on the relationship between cost of goods sold and average stock kept during the year.

It shows the rate at which the stock is turned into sales or the number of times the stock is turned into sales during the year. In other words, this ratio reveals the average time for which the inventory is held by the firm.

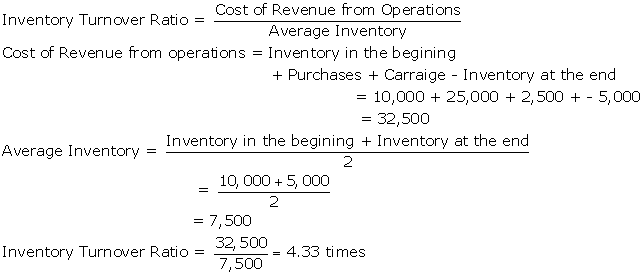

Solution NUM 1

Accounting Ratios Exercise 233

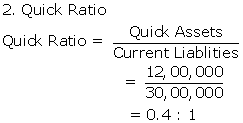

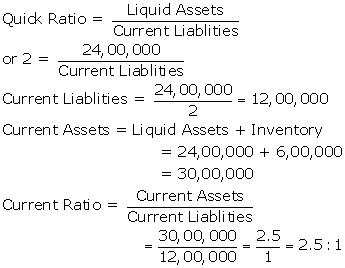

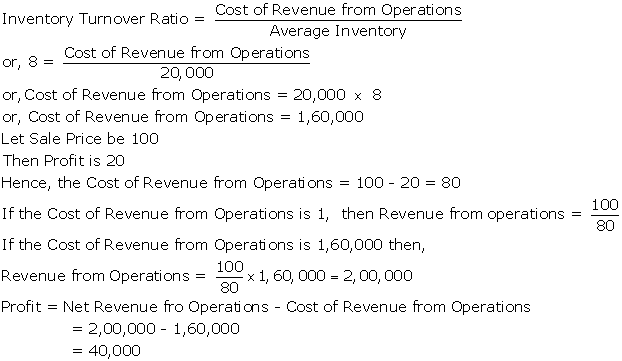

Solution NUM 2

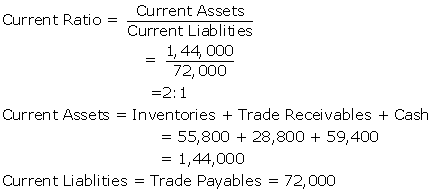

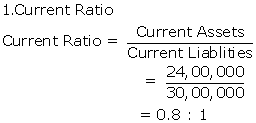

Current Assets= Inventories + Trade Receivables + cash + Short term Loans and Advances

=12,00,000 + 9,00,000 + 2,28,000 + 72,000

=24,00,000

Current Liabilities= Trade Payables+ Short term Borrowings+ Short term Provision

= 23,40,000 + 6,00,000 + 60,000

= 30,00,000

Quick Assets = Trade Receivables + Cash + Short term Loans and Advances

= 9,00,000 + 2,28,000 + 72,000

= 12,00,000

Accounting Ratios Exercise 234

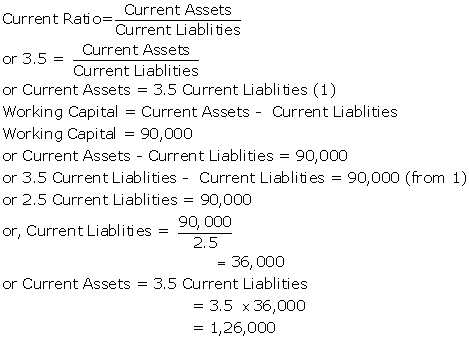

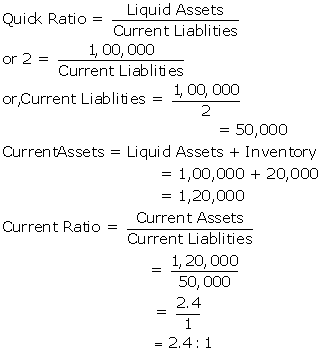

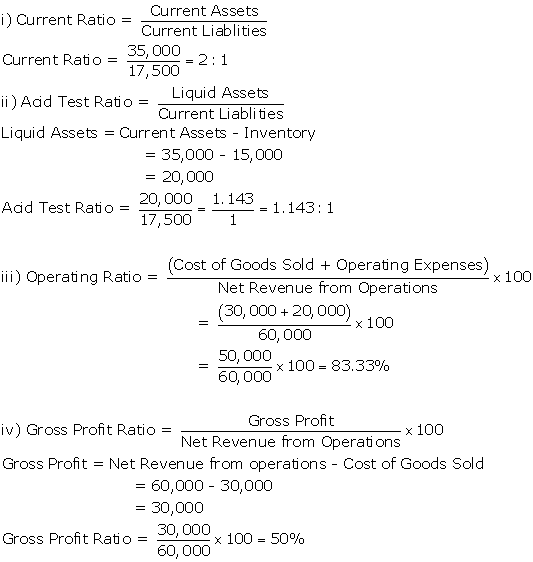

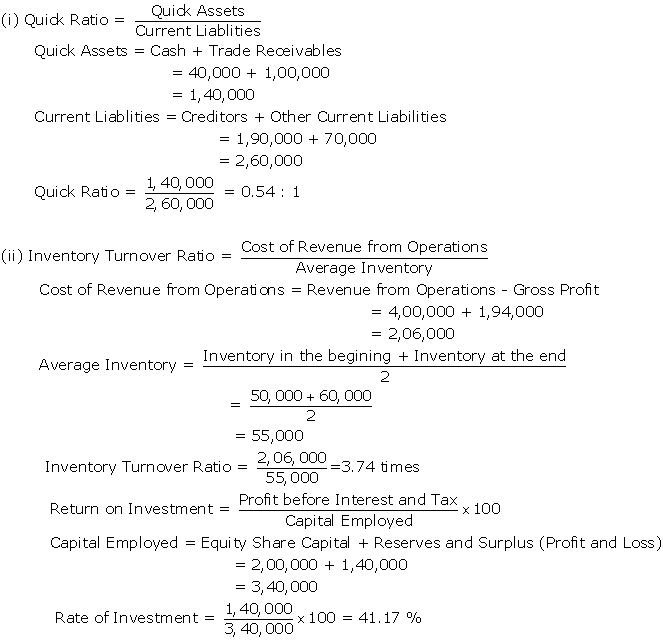

Solution NUM 3

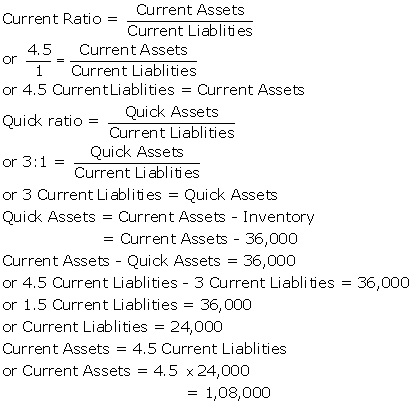

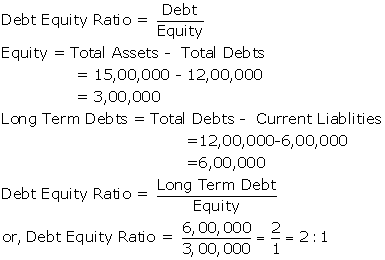

Solution NUM 4

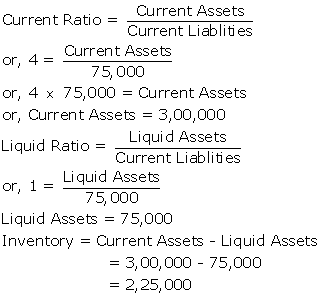

Solution NUM 5

Solution NUM 6

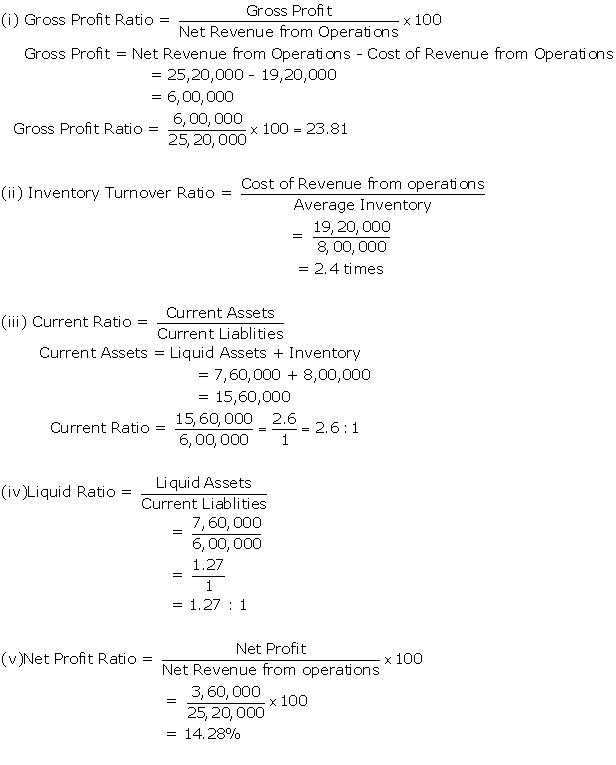

Solution NUM 7

Solution NUM 8

Solution NUM 9

Solution NUM 10

Solution NUM 11

Note: Presuming that figure of Rs.7,60,000 does not include the value of stock.

Accounting Ratios Exercise 235

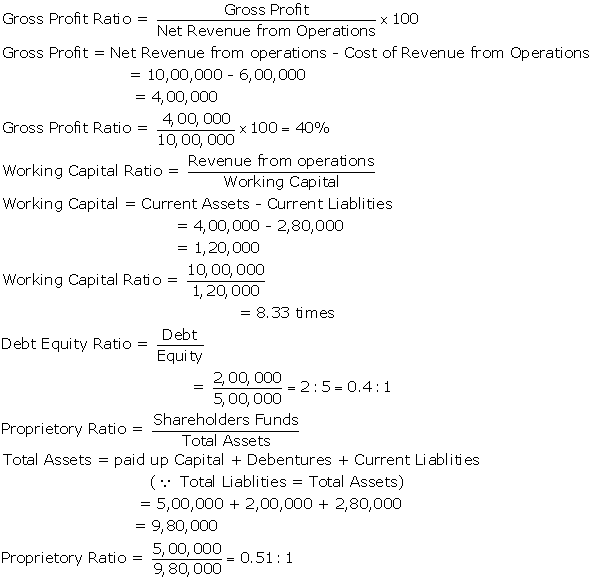

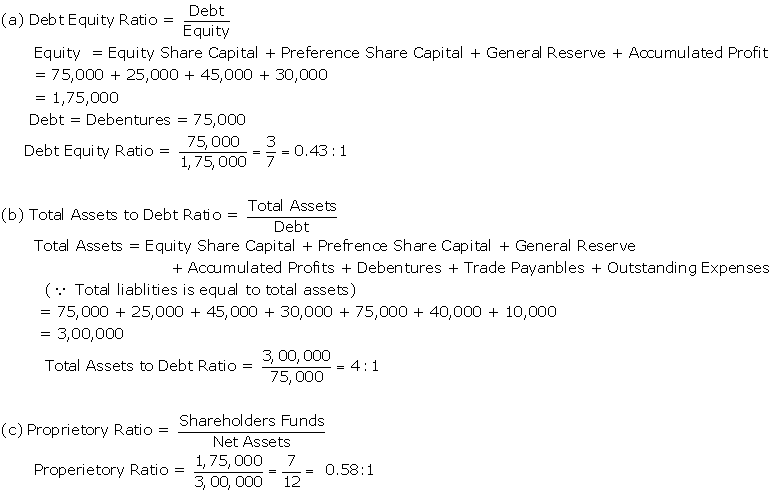

Solution NUM 12

Solution NUM 13

Solution NUM 14

Solution NUM 15

Accounting Ratios Exercise 236

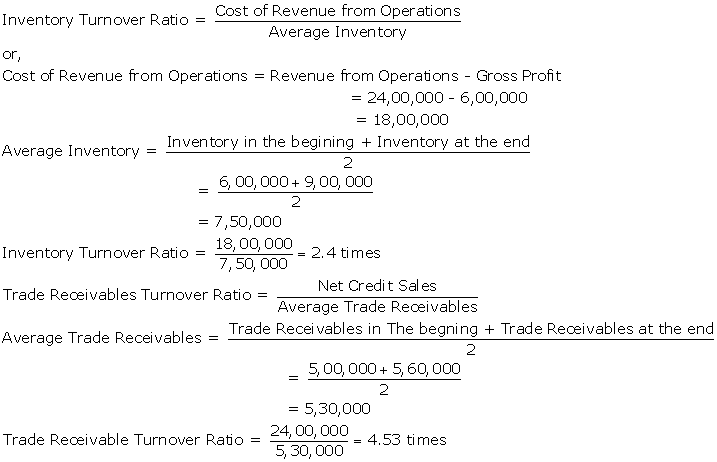

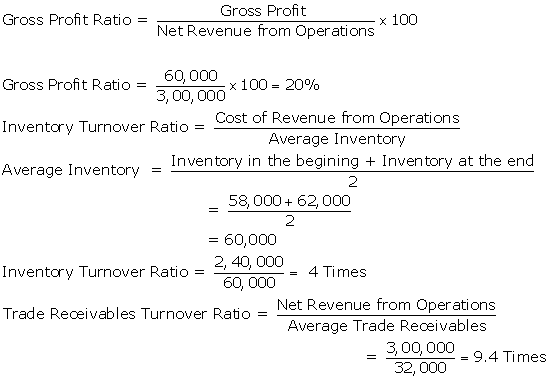

Solution NUM 16

Note:All sales are credit sales assumed.

Solution NUM 17

Note:

- We have assumed Revenue from Operations to be revenue generated from credit sales.

- No information is given in the question about opening and closing balance of trade receivable. Hence, trade receivables given in the Balance Sheet is assumed to be Average Trade Receivables.

Accounting Ratios Exercise 237

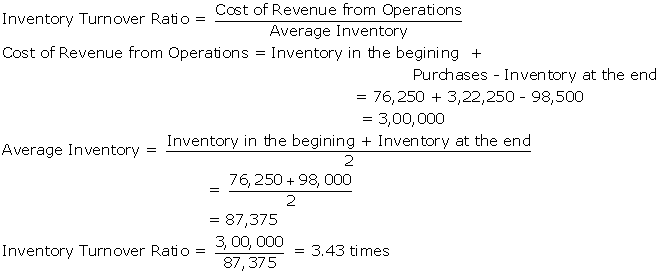

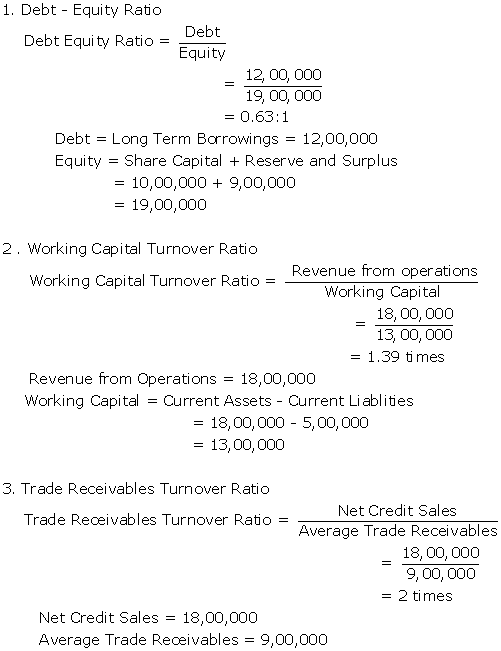

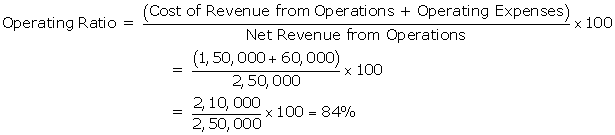

Solution NUM 18

Solution NUM 19

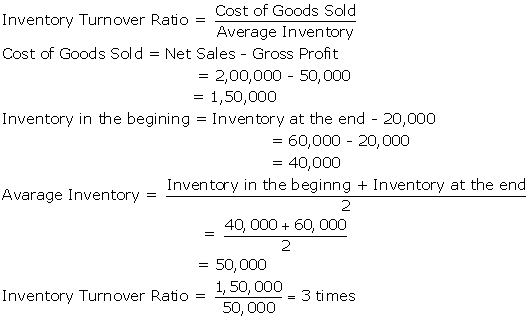

Solution NUM 20

Solution NUM 21

Note: No information is given in the question about opening and closing balance of Inventory. Hence, inventory given in the question is assumed to be Average Inventory.

Accounting Ratios Exercise 238

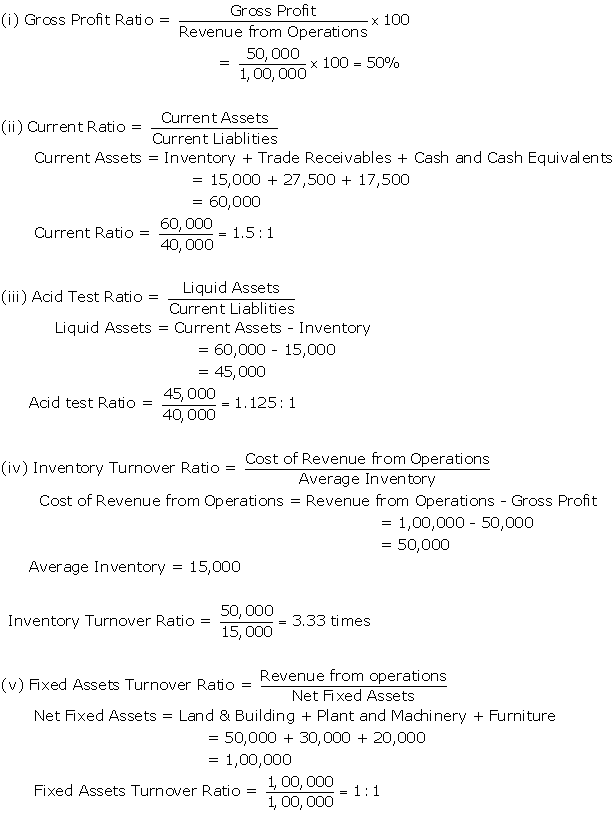

Solution NUM 22

Note: No information is given in the question about opening and closing balance of trade receivable. Hence, trade receivables given in the question is assumed to be Average Trade Receivables.