Class 12-commerce NCERT Solutions Accountancy Chapter 1: Accounting for Share Capital

NCERT Solutions for CBSE Class 12 Commerce Accountancy Chapter Accounting for Share Capital at TopperLearning help students understand all the topics from the chapter. These solutions not only provide solutions to the exercise questions but also explain every unit. The exercises are solved page-wise for better understanding of answers and related concepts. These exercises not only help when preparing for the board exams but also when preparing for the competitive exams. Students can also refer to our revision notes, video lessons, textbook solutions, past years’ papers, sample papers, MCQs, MIQs etc. to learn and practise better.

Accounting for Share Capital Exercise 65

Solution SA 1

A public company is a company which offers a part of its ownership by issuing shares, debentures, bonds and securities to the public through the stock market. There must be at least seven members to form a public company. No restriction has been prescribed on the maximum number of members. There must be at least three directors in the company but not more than fifteen. The word 'Limited' is used as part of the name. According to the Companies Act, 1956, a public company is a company which

- Is not a private company

- Has a minimum paid up capital of Rs.5,00,000 or such higher paid up capital, as may be prescribed

- Is a private company, being a subsidiary of a company which is not a private company. A public company should not be understood as a publicly-owned company, as the latter is exclusively owned and controlled by the government

A public company can be divided into two types:

- Listed Company: A company whose shares are listed and traded in the stock exchange such as Gujarat Gas, Tata Motors, Reliance etc.

- Unlisted Company: A company whose shares are not listed in the stock exchange and thus these shares cannot be traded in the stock exchange.

Solution SA 2

A private limited company is a company which is limited by shares or by guarantee by its members. It is a company which has a minimum paid up share capital of Rs.1,00,000. According to the Companies Act, 1956, a private limited company has the following characteristics:

- It restricts the right to transfer its shares, if any.

- There must be at least two and a maximum of 50 members (excluding current and former employees) to form a private company.

- It prohibits application from the general public to subscribe to its shares or debentures.

- It cannot invite or accept deposits from persons other than its members, directors and their relatives. Unlike a public company, a private limited company cannot issue its shares or debentures to the general public at large as shares of these companies are not traded in the stock exchange.

Solution SA 3

A company may forfeit shares if the shareholder fails to pay the allotment money or any subsequent calls due on shares. Before forfeiture, the company must give a clear 14-day notice to the shareholder informing him/her about the non-payment of the amount due. Even after the notice, if the shareholder does not pay the due, then the company forfeits the shares allotted to him/her and strikes off the name from the register of shareholders.

Solution SA 4

When a shareholder fails to pay the allotment money or any subsequent calls on its due date, the company expects that the shareholder will pay the money due in the later stages (or calls). Such amount of money which is being paid at the later stages is termed calls-in-arrears. The company will deduct calls-in-arrears from the total capital called up to show net paid up capital in the balance sheet.

Solution SA 5

Companies whose shares are listed on the stock exchange for public trading such as Tata Motors, Gujarat Gas, Reliance etc. are called listed companies. These companies are also called quoted companies. The listing of securities (shares) helps the investor to find out increase/decrease in the value of their investment in a concerned listed company. This gives sufficient indication to potential investors about the goodwill of the company and facilitates them to take various investment decisions and to measure the viability of their investment in a company.

Solution SA 6

According to Section 78 of the Companies Act, 1956, the amount of securities premium can be utilised by the company:

- In paying up unissued shares of the company to be issued to members (shareholders) of the company as fully paid bonus share

- In writing off the preliminary expenses of the company

- In writing off the expenses of or the commission paid or discount allowed on any issue of shares or debentures of the company

- In paying up the premium which is to be payable on redemption of any redeemable preference shares or of any debentures of the company

- To buy-back its own shares u/s 77A

Solution SA 7

The amount paid in advance, i.e. before the due date, is known as calls-in-advance. A shareholder pays the whole amount or a part of the amount of shares before it becomes due, i.e. before the company calls for it.

Solution SA 8

The minimum amount which must be subscribed by the public when shares are issued is termed minimum subscription. According to the Companies Act, 1956, the minimum subscription of shares cannot be less than 90% of the issue price. The company cannot allot shares to its applicants if the minimum subscription is not received and shall immediately refund the entire application money received.

Accounting for Share Capital Exercise 66

Solution NUM 1

|

Books of Anish Ltd. Journal |

|||||

|

Date |

Particulars |

|

L.F. |

Debit Rs. |

Credit Rs. |

|

|

Bank A/c |

Dr. |

|

9,00,000 |

|

|

|

---------To Equity Share Capital A/c |

|

|

|

9,00,000 |

|

|

(Being Application money received on application for 30,000 equity shares @ Rs.30 per share |

|

|

|

|

|

|

|

|

|

|

|

|

|

Equity Share Application A/c |

Dr. |

|

9,00,000 |

|

|

|

---------To Equity Share Capital A/c |

|

|

|

9,00,000 |

|

|

(Being share application money transferred to share capital) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Equity Share Allotment A/c |

Dr. |

|

15,00,000 |

|

|

|

---------To Equity Share Capital A/c |

|

|

|

15,00,000 |

|

|

(Being allotment money due on 30,000 shares @ Rs.50 per share) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Bank A/c |

Dr. |

|

15,00,000 |

|

|

|

---------To Equity Share Allotment A/c |

|

|

|

15,00,000 |

|

|

(Being allotment money received 30,000 shares @ Rs.50 per share) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Equity Share First and Final Call A/c |

Dr. |

|

6,00,000 |

|

|

|

---------To Equity Share Capital A/c |

|

|

|

6,00,000 |

|

|

(Being first and final call due on 30,000 shares @ Rs.20 per share) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Bank A/c |

Dr. |

|

6,00,000 |

|

|

|

--------To Equity Share First and Final Call A/c |

|

|

|

6,00,000 |

|

|

(Being first and final call money received for 30,000 shares @ Rs.20 per share) |

|

|

|

|

|

|

|

|

|

|

|

Solution NUM 2

|

Books of Adarsh Control Device Ltd. Journal |

|||||

|

Date |

Particulars |

|

L.F. |

Debit Rs. |

Credit Rs. |

|

|

Equity Share Application A/c |

Dr. |

|

90,000 |

|

|

|

---------To Equity Share Capital A/c |

|

|

|

90,000 |

|

|

(Being Application money received on application for 30,000 equity share @ Rs.3 per share transferred to share capital) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Equity Share Allotment A/c |

Dr. |

|

1,20,000 |

|

|

|

---------To Equity Share Capital A/c |

|

|

|

1,20,000 |

|

|

(Being allotment money due on 30,000 shares @ Rs.4 per share) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Equity Share First and Final Call A/c |

Dr. |

|

90,000 |

|

|

|

---------To Equity Share Capital A/c |

|

|

|

90,000 |

|

|

(Being first and final call due on 30,000 shares @ Rs.3 per share) |

|

|

|

|

|

|

|

|

|

|

|

|

Cash Book ( Bank Column) |

|||||||

|

Date |

Particulars |

J.F. |

Rs. |

Date |

Particulars |

J.F. |

Rs. |

|

|

To Equity Share Application A/c |

|

90,000 |

|

|

|

|

|

|

To Equity Share Allotment A/c |

|

1,20,000 |

|

|

|

|

|

|

To Equity Share First and Final Call A/c |

|

90,000 |

|

|

|

|

|

|

|

|

|

|

By Balance c/d |

|

3,00,000 |

|

|

|

|

3,00,000 |

|

|

|

3,00,000 |

Solution NUM 3

|

Books of Software Solution India Ltd. Journal |

|||||

|

Date |

Particulars |

|

L.F. |

Debit Rs. |

Credit Rs. |

|

|

Equity Share Application A/c |

Dr. |

|

12,00,000 |

|

|

|

---------To Equity Share Capital A/c |

|

|

|

8,00,000 |

|

|

---------To Equity Share Allotment A/c |

|

|

|

4,00,000 |

|

|

(Being application money transferred to equity share capital for 20,000 shares @ Rs.40 and Rs.4,00,000 is adjusted toward allotment) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Equity Share Allotment A/c |

Dr. |

|

6,00,000 |

|

|

|

---------To Equity Share Capital A/c |

|

|

|

6,00,000 |

|

|

(Being equity share allotment money due on 20,000 shares @ Rs.30 per share) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Equity Share First and Final Call A/c |

Dr. |

|

6,00,000 |

|

|

|

---------To Equity Share Capital A/c |

|

|

|

6,00,000 |

|

|

(Being equity share first and final call due on 20,000 shares @ Rs.30 per share) |

|

|

|

|

|

|

|

|

|

|

|

|

Cash Book ( Bank Column) |

|||||||

|

Date |

Particulars |

J.F. |

Rs. |

Date |

Particulars |

J.F. |

Rs. |

|

|

To Equity Share Application A/c |

|

12,80,000 |

|

By Equity Share Application A/c |

|

80,000 |

|

|

To Equity Share Allotment A/c |

|

2,00,000 |

|

|

|

|

|

|

To Equity Share First and Final Call A/c |

|

6,00,000 |

|

|

|

|

|

|

|

|

|

|

By Balance c/d |

|

20,00,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

20,80,000 |

|

|

|

20,80,000 |

Working Note:

|

Amount due on Allotment for 20,000 shares @ Rs.30 per share |

6,00,000 |

|

Less: Adjusted on application 10,000 shares @ Rs.40 each |

(4,00,000) |

|

Money to be received on Allotment |

2,00,000 |

Solution NUM 4

|

Books of Rupak Ltd. Journal |

|||||

|

Date |

Particulars |

|

L.F. |

Debit Rs. |

Credit Rs. |

|

|

Share Application A/c |

Dr. |

|

2,00,000 |

|

|

|

---------To Share Capital A/c |

|

|

|

2,00,000 |

|

|

(Being Application money for 10,000 shares transferred to share capital account) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Share Allotment A/c |

Dr. |

|

3,00,000 |

|

|

|

---------To Share Capital A/c |

|

|

|

3,00,000 |

|

|

(Being allotment money due on 10,000 shares @ Rs.30 per share) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Share First Call A/c |

Dr. |

|

2,50,000 |

|

|

|

---------To Share Capital A/c |

|

|

|

2,50,000 |

|

|

(Being first call due on 10,000 share @Rs.25 per share) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Calls in Arrears A/c |

Dr. |

|

5,000 |

|

|

|

---------To Share First Call A/c |

|

|

|

5,000 |

|

|

(Being call in arrears on 200 shares @ Rs.25 per share) |

|

|

|

|

|

Cash Book (Bank Column) |

|||||||

|

Date |

Particulars |

J.F. |

Rs. |

Date |

Particulars |

J.F. |

Rs. |

|

|

To Share Application A/c |

|

2,00,000 |

|

|

|

|

|

|

To Share Allotment A/c |

|

3,00,000 |

|

|

|

|

|

|

To Share First Call A/c |

|

2,45,000 |

|

|

|

|

|

|

To Calls in Advance A/c |

|

12,500 |

|

By Balance c/d |

|

7,57,500 |

|

|

|

|

|

|

|

|

|

|

|

|

|

7,57,500 |

|

|

|

7,57,500 |

Working Note:

|

Money due on First Call for 10,000 shares @ 25 each |

2,50,000 |

|

Less: Calls in Arrear for 200 shares @ Rs.25 per Share |

(5,000) |

|

Money Received on First Call |

2,45,000 |

|

Add: Calls received in advance on 500 shares @ Rs.25 per share |

12,500 |

|

|

2,57,500 |

Solution NUM 5

|

Books of Mohit Glass Ltd. Journal |

|||||

|

Date |

Particulars |

L.F. |

Debit Rs. |

Credit Rs. |

|

|

|

Bank A/c |

Dr. |

|

7,20,000 |

|

|

|

---------To Share Application A/c |

|

|

|

7,20,000 |

|

|

(Being application money received on application for 24,000 shares @ Rs.30 per Share) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Share Application A/c |

Dr. |

|

7,20,000 |

|

|

|

---------To Share Capital A/c (Bank column) |

|

|

|

6,00,000 |

|

|

---------To Bank A/c |

|

|

|

1,20,000 |

|

|

(Being share application of 20,000 shares @ Rs.30 transferred to share capital account and the balance returned) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Share Allotment A/c |

Dr. |

|

8,00,000 |

|

|

|

---------To Share Capital A/c |

|

|

|

6,00,000 |

|

|

---------To Share Premium A/c |

|

|

|

2,00,000 |

|

|

(Being allotment money due on 20,000 shares @ Rs.40 per share including Rs.10 for Premium) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Bank A/c |

Dr. |

|

|

|

|

|

---------To Share Allotment A/c |

|

|

8,00,000 |

|

|

|

(Being allotment money received on 20,000 shares @ Rs.40 per Share) |

|

|

|

8,00,000 |

|

|

|

|

|

|

|

|

|

Share First Call A/c |

Dr. |

|

4,00,000 |

|

|

|

---------To Share Capital A/c |

|

|

|

4,00,000 |

|

|

(Being first call due on 20,000 shares @ Rs.20 per share) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Bank A/c |

Dr. |

|

4,00,000 |

|

|

|

---------To Share First Call A/c |

|

|

|

4,00,000 |

|

|

(Being first call money received on 20,000 shares @ Rs.20 per Share) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Share Final Call A/c |

Dr. |

|

4,00,000 |

|

|

|

---------To Share Capital A/c |

|

|

|

4,00,000 |

|

|

(Being final call money due on 20,000 shares @ Rs.20 per Share) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Bank A/c |

Dr. |

|

4,00,000 |

|

|

|

---------To Share Final Call A/c |

|

|

|

4,00,000 |

|

|

(Being final call money received on 20,000 shares @ Rs.20 per Share) |

|

|

|

|

|

|

|

|

|

|

|

Solution NUM 6

|

Books of A Ltd. Journal |

|||||

|

Date |

Particulars |

|

L.F. |

Debit Rs. |

Credit Rs. |

|

|

Equity Share Application A/c |

Dr. |

|

3,00,000 |

|

|

|

10% Preference Share Application A/c |

Dr. |

|

6,00,000 |

|

|

|

---------To Equity Share Capital A/c |

|

|

|

3,00,000 |

|

|

---------To10% Preference Share Capital A/c |

|

|

|

6,00,000 |

|

|

(Being application money transferred to Equity share capital ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Equity Share Allotment A/c |

Dr. |

|

5,00,000 |

|

|

|

10% Preference Share Allotment A/c |

Dr. |

|

8,00,000 |

|

|

|

---------To Equity Share Capital A/c |

|

|

|

3,00,000 |

|

|

---------To Securities Premium A/c |

|

|

|

2,00,000 |

|

|

---------To 10% Preference Share Capital A/c |

|

|

|

8,00,000 |

|

|

(Being amount due on allotment) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Equity Share First and Final Call A/c |

Dr. |

|

4,00,000 |

|

|

|

10% Preference Share First and Final Call A/c |

Dr. |

|

6,00,000 |

|

|

|

---------To Equity Share Capital A/c |

|

|

|

4,00,000 |

|

|

---------To 10% Preference Share Capital A/c |

|

|

|

6,00,000 |

|

|

(Being amount on first and final call due) |

|

|

|

|

|

Cash Book (Bank Column) |

|||||||

|

Date |

Particulars |

J.F. |

Rs. |

Date |

Particulars |

J.F. |

Rs. |

|

|

To Equity Share Application A/c |

|

3,00,000 |

|

|

|

|

|

|

To 10% Preference share Application A/c |

|

6,00,000 |

|

|

|

|

|

|

To Equity Share Allotment A/c |

|

5,00,000 |

|

|

|

|

|

|

To 10% Preference share Allotment A/c |

|

8,00,000 |

|

By Balance c/d |

|

32,00,000 |

|

|

To Equity Share First and Final Call A/c |

|

4,00,000 |

|

|

|

|

|

|

To 10% Preference share First and Final Call A/c |

|

6,00,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

32,00,000 |

|

|

|

32,00,000 |

Accounting for Share Capital Exercise 68

Solution NUM 11

|

Books of Naman Ltd Journal |

|||||

|

Date |

Particulars |

|

L.F. |

Debit Rs. |

Credit Rs. |

|

|

Bank A/c |

Dr. |

|

5,00,000 |

|

|

|

---------To Share Application A/c |

|

|

|

5,00,000 |

|

|

(Being Share Application money received on application for 20,000 shares @ Rs.25 each) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Share Application A/c |

Dr. |

|

5,00,000 |

|

|

|

---------To Share Capital A/c |

|

|

|

5,00,000 |

|

|

(Being share application money of 20,000 shares @ Rs.25 each transferred to Share Capital Account) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Share Allotment A/c |

Dr. |

|

6,00,000 |

|

|

|

---------To Share Capital A/c |

|

|

|

6,00,000 |

|

|

(Being share allotment money due on 20,000 share @ Rs.30 each) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Bank A/c |

Dr |

|

5,94,000 |

|

|

|

---------To Share Allotment A/c |

|

|

|

5,94,000 |

|

|

(Being allotment money received for 19,800 shares @ Rs.30 per share) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Share First Call A/c |

Dr. |

|

5,00,000 |

|

|

|

---------To Share Capital A/c |

|

|

|

5,00,000 |

|

|

(Being first call money due on 20,000 share @ Rs.25 per share) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Bank A/c |

Dr. |

|

4,92,500 |

|

|

|

---------To Share First call A/c |

|

|

|

4,92,500 |

|

|

(Being first call received @ Rs.25 per share for 19,700 shares) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Share Final call A/c |

Dr. |

|

4,00,000 |

|

|

|

---------To Share Capital A/c |

|

|

|

4,00,000 |

|

|

(Being final call money due on 20,000 shares @ 20 per share) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Bank A/c |

Dr. |

|

3,94,000 |

|

|

|

---------To Share Final call A/c |

|

|

|

3,94,000 |

|

|

(Being final call received @ Rs.20 per share for 19,700 share and 300 share failed to pay the call) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Share Capital A/c |

Dr. |

|

30,000 |

|

|

|

---------To Share Forfeiture A/c (200×25+100×55) |

|

|

|

10,500 |

|

|

---------To Share Allotment A/c (200× 30) |

|

|

|

6,000 |

|

|

---------To Share First call A/c (300× 25) |

|

|

|

7,500 |

|

|

---------To Share Final call A/c (300×20) |

|

|

|

6,000 |

|

|

(Being 300 share Forfeited) |

|

|

|

|

|

|

|

|

|

|

|

Alternatively, it can be solved by debiting calls in Arrears Account

|

Books of Naman Ltd Journal |

|||||

|

Date |

Particulars |

|

L.F. |

Debit Rs. |

Credit Rs. |

|

|

Bank A/c |

Dr. |

|

5,00,000 |

|

|

|

---------To Share Application A/c |

|

|

|

5,00,000 |

|

|

(Being Share Application money received on application for 20,000 shares @ Rs. 25 each) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Share Application A/c |

Dr. |

|

5,00,000 |

|

|

|

---------To Share Capital A/c |

|

|

|

5,00,000 |

|

|

(Being share application money of 20,000 shares@ Rs.25 each transferred to Share Capital Account) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Share Allotment A/c |

Dr. |

|

6,00,000 |

|

|

|

---------To Share Capital A/c |

|

|

|

6,00,000 |

|

|

(Being share allotment money due on 20,000 share @ Rs.30 each) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Bank A/c |

Dr. |

|

5,94,000 |

|

|

|

Call in Arrears A/c |

Dr. |

|

6,000 |

|

|

|

---------To Share Allotment A/c |

|

|

|

6,00,000 |

|

|

(Being allotment money received for 19,800 share @ Rs.30 per share and 200 share failed to pay the allotment) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Share First Call A/c |

Dr. |

|

5,00,000 |

|

|

|

---------To Share Capital A/c |

|

|

|

5,00,000 |

|

|

(Being first call money due on 20,000 shares @ Rs.25 per share) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Bank A/c |

Dr. |

|

4,92,500 |

|

|

|

Call in Arrears A/c |

Dr. |

|

7,500 |

|

|

|

---------To Share First call A/c |

|

|

|

5,00,000 |

|

|

(Being first call money for 19,700 shares @ Rs.25 each received except 300 share) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Share Final call A/c |

Dr. |

|

4,00,000 |

|

|

|

---------To Share Capital A/c |

|

|

|

4,00,000 |

|

|

(Being share final call money due on 20,000 shares @ Rs.20 per share) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Bank A/c |

Dr. |

|

3,94,000 |

|

|

|

Calls in Arrears A/c |

Dr. |

|

6,000 |

|

|

|

---------To Share Final call A/c |

|

|

|

4,00,000 |

|

|

(Being share final call money received for 19,700 share @Rs.20 per share except 300 shares) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Share Capital A/c |

Dr. |

|

30,000 |

|

|

|

---------To Share Forfeiture A/c (200×25+100×55) |

|

|

|

10,500 |

|

|

---------To Calls in Arrears A/c |

|

|

|

19,500 |

|

|

(Being 300 shares forfeited on account failed to pay the money due) |

|

|

|

|

|

|

|

|

|

|

|

Working Note:

1. Forfeited Amount

|

Amount on application (300 share @Rs.25 each) |

7,500 |

|

Amount on allotment (100 share @Rs.30 each) |

3,000 |

|

|

10,500 |

Solution NUM 12

|

Books of Krishna Ltd Journal |

|||||

|

Date |

Particulars |

|

L.F. |

Debit Rs. |

Credit Rs. |

|

|

Bank A/c |

Dr. |

|

4,50,000 |

|

|

|

---------To Share Application A/c |

|

|

|

4,50,000 |

|

|

(Being Share Application money received on application for 15,000 shares @ Rs.30 per share) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Share Application A/c |

Dr. |

|

4,50,000 |

|

|

|

---------To Share Capital A/c |

|

|

|

4,50,000 |

|

|

(Being share application money of 15,000 shares transferred to Share Capital Account) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Share Allotment A/c |

Dr. |

|

7,50,000 |

|

|

|

---------To Share Capital A/c |

|

|

|

6,00,000 |

|

|

---------To Securities Premium A/c |

|

|

|

1,50,000 |

|

|

(Being share allotment money due on 15,000 shares @ Rs.50 per share including Rs.10 securities premium due) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Bank A/c |

Dr. |

|

7,42,500 |

|

|

|

---------To Share Allotment A/c |

|

|

|

7,42,500 |

|

|

(Being allotment money received for 14,850 share @ Rs.150 share failed to pay the money due) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Share First and Final Call A/c |

Dr. |

|

4,50,000 |

|

|

|

---------To Share Capital A/c |

|

|

|

4,50,000 |

|

|

(Being first call money due on 15,000 shares @ Rs.30 per share due) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Bank A/c |

Dr. |

|

4,45,500 |

|

|

|

---------To Share First and Final Call A/c |

|

|

|

4,45,500 |

|

|

(Being First and Final Call received for 14,850 share @ Rs.30 per share and 150 share failed to pay amount due) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Share Capital A/c (150 × 100) |

Dr. |

|

15,000 |

|

|

|

Share Premium A/c (150 × 10) |

Dr. |

|

1,500 |

|

|

|

---------To Share Allotment A/c(150 × 50) |

|

|

|

7,500 |

|

|

---------To Share First and Final Call A/c (150 × 30) |

|

|

|

4,500 |

|

|

---------To Share Forfeiture A/c (150 × 30) |

|

|

|

4,500 |

|

|

(Being 150 shares forfeiture for non- payment of share allotment and share first and final call) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Bank A/c |

Dr. |

|

18,000 |

|

|

|

---------To Share Capital A/c |

|

|

|

15,000 |

|

|

---------To Securities premium A/c |

|

|

|

3,000 |

|

|

(Being 150 share of Rs.100 each reissued @ Rs.120 to Neha) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Share Forfeiture A/c |

Dr. |

|

4,500 |

|

|

|

---------To Capital Reserve A/c |

|

|

|

4,500 |

|

|

(Being balance of share forfeiture account transferred to capital reserve account) |

|

|

|

|

Note: We have assumed the reissued price as Rs.120 per Share.

Solution NUM 13

|

Books of Arushi Computers Ltd. Journal |

|||||

|

Date |

Particulars |

|

L.F. |

Debit Rs. |

Credit Rs. |

|

|

Bank A/c |

Dr. |

|

2,00,000 |

|

|

|

---------To Share Application A/c |

|

|

|

2,00,000 |

|

|

(Being share application money received for 10,000 shares @ Rs.20 per share) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Share Application A/c |

Dr. |

|

2,00,000 |

|

|

|

---------To Share Capital A/c |

|

|

|

2,00,000 |

|

|

(Being share application money of 10,000 shares transferred to Share Capital Account) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Share Allotment A/c |

Dr. |

|

3,00,000 |

|

|

|

Discount on Issue of Share A/c |

Dr. |

|

1,00,000 |

|

|

|

---------To Share Capital A/c |

|

|

|

4,00,000 |

|

|

(Being allotment money due on 10,000 shares @ Rs.30 per share excluding discount Rs. 10) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Bank A/c |

Dr. |

|

3,00,000 |

|

|

|

---------To Share Allotment A/c |

|

|

|

3,00,000 |

|

|

(Being share allotment money received for 10,000 shares @ Rs.30 share) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Share First Call A/c |

Dr. |

|

3,00,000 |

|

|

|

---------To Share Capital A/c |

|

|

|

3,00,000 |

|

|

(Being share first call money due on 10,000 share @ Rs.30 per share) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Bank A/c |

Dr. |

|

3,00,000 |

|

|

|

---------To Share First Call A/c |

|

|

|

3,00,000 |

|

|

(Being Share First Call received for 10,000 share @ Rs.30 per share and 30 per share) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Share Final Call A/c |

Dr. |

|

1,00,000 |

|

|

|

---------To Share Capital A/c |

|

|

|

1,00,000 |

|

|

(Being final call money due on 10,000 shares @ Rs.10 per share) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Bank A/c |

Dr. |

|

98,000 |

|

|

|

---------To Share Final Call A/c |

|

|

|

98,000 |

|

|

(Being final call money received for 9800 shares @ Rs.10 per share and 200 share failed to pay) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Share Capital A/c (200× 100) |

Dr. |

|

20,000 |

|

|

|

---------To Share Final Call A/c (200× 10) |

|

|

|

2,000 |

|

|

---------To Discount on Issue of Share A/c (200× 10) |

|

|

|

2,000 |

|

|

---------To Share Forfeiture A/c (200× 80) |

|

|

|

16,000 |

|

|

(Being 200 shares forfeited for non- payment of final call Rs.10 par share) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Bank A/c (150×75) |

Dr. |

|

11,250 |

|

|

|

Discount on Issue of Share A/c (150×10) |

Dr. |

|

1,500 |

|

|

|

Share Forfeiture A/c (150×15) |

Dr. |

|

2,250 |

|

|

|

---------To Share Capital A/c (150×100) |

|

|

|

15,000 |

|

|

(Being 150 forfeiture share reissued at Rs.100 per share for Rs.75) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Share Forfeiture A/c |

Dr. |

|

9,750 |

|

|

|

---------To Capital Reserve A/c |

|

|

|

9,750 |

|

|

(Being balance of 150 reissue shares after adjustment transferred to capital reserve account) |

|

|

|

|

Working Notes:

Amount Transferred to Capital Reserve A/c

|

Amount credited to Share Forfeiture |

Rs.80 per share |

|

|

|

Less: Amount debited to Share Forfeiture |

Rs.15 per share |

|

Balance after adjustment |

Rs.65 per share |

|

Amount transferred to Capital Reserve Account

= Balance per share after adjustment x Number of shares reissued

= Rs.65 × Rs.150 per share

= Rs.9,750

Solution NUM 14

|

Books of Raunak Cotton Ltd. Journal |

|||||

|

Date |

Particulars |

|

L.F. |

Debit Rs. |

Credit Rs. |

|

|

Bank A/c |

Dr. |

|

2,00,000 |

|

|

|

---------To Share Application A/c |

|

|

|

2,00,000 |

|

|

(Being Share Application money received on application for 10,000 shares) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Share Application A/c |

Dr. |

|

2,00,000 |

|

|

|

---------To Share Capital A/c |

|

|

|

1,20,000 |

|

|

---------To Share Allotment A/c |

|

|

|

40,000 |

|

|

---------To Bank A/c |

|

|

|

40,000 |

|

|

(Being share application money adjusted) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Share Allotment A/c |

Dr. |

|

3,00,000 |

|

|

|

---------To Share Capital A/c |

|

|

|

1,80,000 |

|

|

---------To Securities Premium A/c |

|

|

|

1,20,000 |

|

|

(Being share allotment money due) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Bank A/c |

Dr. |

|

2,47,000 |

|

|

|

---------To Share Allotment A/c |

|

|

|

2,47,000 |

|

|

(Being allotment money received except 300 shares) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Share First Call A/c |

Dr. |

|

1,80,000 |

|

|

|

---------To Share Capital A/c |

|

|

|

1,80,000 |

|

|

(Being first call money due) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Bank A/c |

Dr. |

|

1,57,500 |

|

|

|

---------To Share First Call A/c |

|

|

|

1,57,500 |

|

|

(Being First Call received except 750 (300+450 shares)) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Share Final Call A/c |

Dr. |

|

1,20,000 |

|

|

|

---------To Share Capital A/c |

|

|

|

1,20,000 |

|

|

(Being final call money is due) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Bank A/c |

Dr. |

|

1,05,000 |

|

|

|

---------To Share Final Call A/c |

|

|

|

1,05,000 |

|

|

(Being share final call money received except 750 shares) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Share Capital A/c (750 × 100) |

Dr. |

|

75,000 |

|

|

|

Share Premium A/c (300 × 20) |

Dr. |

|

6,000 |

|

|

|

---------To Share Allotment A/c |

|

|

|

13,000 |

|

|

---------To Share First Call A/c (750 × 30) |

|

|

|

22,500 |

|

|

---------To Share Final Call A/c (750 × 20) |

|

|

|

15,000 |

|

|

---------To Share Forfeiture A/c |

|

|

|

30,500 |

|

|

(Being 750 share forfeited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Bank A/c |

Dr. |

|

60,000 |

|

|

|

Share Forfeiture A/c |

Dr. |

|

15,000 |

|

|

|

---------To Share Capital A/c |

|

|

|

75,000 |

|

|

(Being forfeiture share reissue @ Rs.80 per share) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Share Forfeiture A/c |

Dr. |

|

15,500 |

|

|

|

---------To Capital Reserve A/c |

|

|

|

15,500 |

|

|

(Being forfeiture account transferred to capital reserve) |

|

|

|

|

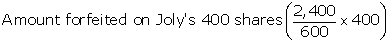

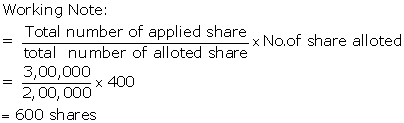

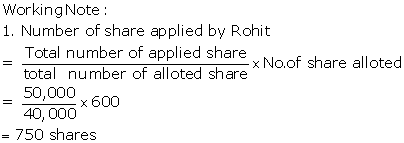

Working Note:

2. Call in arrears by Rohit on allotment

|

Money received on Application |

(400×20) |

8,000 |

|

----- Less: Transferred to share capital |

(300×20) |

(6,000) |

|

Excess adjusted on allotment |

|

2,000 |

|

|

|

|

|

Allotment due |

(300×50) |

15,000 |

|

------Less: Excess adjustment on allotment |

|

(2,000) |

|

Call in arrear |

|

13,000 |

4. Share Forfeiture amount

|

Amount on application |

|

|

|

|

300×20 |

6,000 |

|

|

450×20 |

9,000 |

|

Excess amount received from Robit for allotment on pro-rata basis |

|

2,000 |

|

Amount received on Allotment by Kartika |

|

13,500 |

|

|

|

30,500 |

Accounting for Share Capital Exercise 67

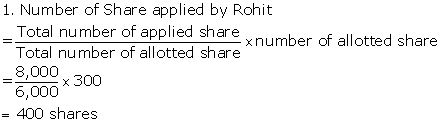

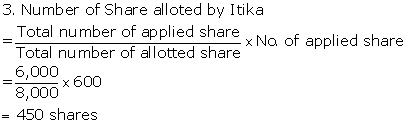

Solution NUM 7

|

Books of Eastern Company Limited Journal |

|||||

|

Date |

Particulars |

|

L.F. |

Debit Rs. |

Credit Rs. |

|

|

Share Application A/c |

Dr. |

|

1,80,000 |

|

|

|

---------To Share Capital A/c |

|

|

|

1,50,000 |

|

|

---------To Share Allotment A/c |

|

|

|

30,000 |

|

|

(Being Share Application money for 50,000 shares transferred to Share Capital Account and the excess money transferred to Share Allotment Account) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Share Allotment A/c |

Dr. |

|

2,50,000 |

|

|

|

---------To Share Capital A/c |

|

|

|

1,00,000 |

|

|

---------To Share Premium A/c |

|

|

|

1,50,000 |

|

|

(Being allotment money due on 50,000 shares @ Rs.5 per share including Rs.3 Security premium) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Share First Call A/c |

Dr. |

|

1,50,000 |

|

|

|

---------To Share Capital A/c |

|

|

|

1,50,000 |

|

|

(Being first call due on 50,000 shares @ Rs.3 per share) |

|

|

|

|

|

Cash Book (Bank Column) |

|||||||

|

Date |

Particulars |

J.F. |

Rs. |

Date |

Particulars |

J.F. |

Rs. |

|

|

To Share Application A/c |

|

1,80,000 |

|

|

|

|

|

|

To Share Allotment A/c |

|

2,20,000 |

|

|

|

|

|

|

To Share First Call A/c |

|

1,49,700 |

|

By Balance c/d |

|

5,49,700 |

|

|

|

|

|

|

|

|

|

|

|

|

|

5,49,700 |

|

|

|

5,49,700 |

|

Eastern Company Limited |

||

|

Balance Sheet |

||

|

Particulars |

Note No. |

Rs. |

|

I. Equity and Liabilities |

|

|

|

1. Shareholders' Fund |

|

|

|

a. Share capital |

1 |

3,99,700 |

|

b. Reserve and Surplus |

2 |

1,50,000 |

|

2. Non - Current Liabilities |

|

|

|

3. Current Liabilities |

|

|

|

Total |

|

5,49,700 |

|

II. Assets |

|

|

|

1. Non-Current Assets |

|

|

|

2. Current Assets |

|

|

|

a. Cash and Cash Equivalents |

3 |

5,49,700 |

|

Total |

|

5,49,700 |

NOTES TO ACCOUNT

|

Note No. |

Particulars |

|

Rs. |

|

1 |

Share Capital |

|

|

|

|

Authorized Share Capital |

|

|

|

|

-----1,00,000-Share of Rs.10 each |

|

10,00,000 |

|

|

Issued share Capital |

|

|

|

|

-------50,000 share of Rs.10 each |

|

5,00,000 |

|

|

Subscribed, Called-up and paid-up Share Capital |

|

|

|

|

-------50,000 Share of Rs.10 each, Rs. 8 Called-up |

4,00,000 |

|

|

|

-------Less : Calls-in-Arrears |

300 |

3,99,700 |

|

|

|

|

|

|

2 |

Reserve and Surplus |

|

|

|

|

-------Securities Premium |

|

1,50,000 |

|

|

|

|

|

|

3 |

Cash and Cash Equivalents |

|

|

|

|

-------Cash at Bank |

|

5,49,700 |

Note: In order to solve this question, applicants of category C have been assumed as 5000 instead of 500 and allotment to the applicants of this category has been taken as 2000 in place of 200.

Solution NUM 8

|

Books of Sumit Machine Ltd. Journal |

|||||

|

Date |

Particulars |

|

L.F. |

Debit Rs. |

Credit Rs. |

|

|

Bank A/c |

Dr. |

|

12,50,000 |

|

|

|

---------To Share Application A/c |

|

|

|

12,50,000 |

|

|

(Being Share Application money received on application for 50,000 shares @ Rs.25 per share) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Share Application A/c |

Dr. |

|

12,50,000 |

|

|

|

---------To Share Capital A/c |

|

|

|

12,50,000 |

|

|

(Being share application money of 50,000 shares transferred to Share Capital Account) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Share Allotment A/c |

Dr. |

|

20,00,000 |

|

|

|

Discount on Issue of Shares A/c |

Dr. |

|

2,50,000 |

|

|

|

---------To Share Capital A/c |

|

|

|

22,50,000 |

|

|

(Being share allotment money due on 50,000 shares @ Rs.40 each at discount of 5) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Bank A/c |

Dr |

|

20,00,000 |

|

|

|

---------To Share Allotment A/c |

|

|

|

20,00,000 |

|

|

(Being allotment money received for 50,000 shares @ Rs.40 per share) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Share First and Final Call A/c |

Dr. |

|

15,00,000 |

|

|

|

---------To Share Capital A/c |

|

|

|

15,00,000 |

|

|

(Being share first and final call due on 50,000 shares @ Rs.30 per share) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Bank A/c |

Dr. |

|

14,88,000 |

|

|

|

Calls in Arrears A/c |

Dr. |

|

12,000 |

|

|

|

---------To Share First and Final call A/c |

|

|

|

15,00,000 |

|

|

(Being first and final call received except 400 share) |

|

|

|

|

|

Sumit Machine Ltd. |

||

|

Balance Sheet |

||

|

Particulars |

Note No. |

Rs. |

|

I. Equity and Liabilities |

|

|

|

1. Shareholders' Fund |

|

|

|

a. Share capital |

1 |

49,88,000 |

|

2. Non - Current Liabilities |

|

|

|

3. Current Liabilities |

|

|

|

Total |

|

49,88,000 |

|

II. Assets |

|

|

|

1. Non-Current Assets |

|

|

|

a. Other Non-Current Assets |

2 |

2,50,000 |

|

2. Current Assets |

|

|

|

a. Cash and Cash Equivalents |

3 |

47,38,000 |

|

Total |

|

49,88,000 |

NOTES TO ACCOUNT

|

Note No. |

Particulars |

|

Rs. |

|

1 |

Share Capital |

|

|

|

|

Authorized Share Capital |

|

|

|

|

-------Share of Rs.100 each |

|

|

|

|

Issued share Capital |

|

|

|

|

-------50,000 share of Rs.100 each |

|

50,00,000 |

|

|

Subscribed, Called-up and paid-up Share Capital |

|

|

|

|

-------50,000 Share of Rs. 100 each, |

50,00,000 |

|

|

|

Less : Calls-in-Arrears |

12,000 |

49,88,000 |

|

|

|

|

|

|

2 |

Other Non-Current Assets |

|

|

|

|

-------Discount on Issue of Share |

|

2,50,000 |

|

|

|

|

|

|

3 |

Cash and Cash Equivalents |

|

|

|

|

-------Cash at Bank |

|

47,38,000 |

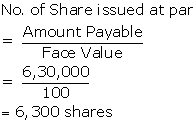

Solution NUM 9

Case (a)

|

Books of Kumar Ltd. Journal |

|||||

|

Date |

Particulars |

|

L.F. |

Debit Rs. |

Credit Rs. |

|

|

Sundry Assets A/c |

Dr. |

|

6,30,000 |

|

|

|

---------To Bhanu Oil Ltd A/c |

|

|

|

6,30,000 |

|

|

(Being assets purchased from bhanu oil ltd.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Bhanu Oli Ltd A/c |

Dr. |

|

6,30,000 |

|

|

|

---------To Share Capital A/c |

|

|

|

6,30,000 |

|

|

(Being 6,300 shares issued at par to bhanu ltd.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Bhanu Oil Ltd A/c |

Dr. |

|

6,30,000 |

|

|

|

Discount on Issue of Share A/c |

Dr. |

|

70,000 |

|

|

|

---------To Share Capital A/c |

|

|

|

7,00,000 |

|

|

(Being 7,000 shares issued at 10% discount) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Bhanu Oil Ltd A/c |

Dr |

|

6,30,000 |

|

|

|

---------To Share Capital A/c |

|

|

|

5,25,000 |

|

|

---------To Securities Premium A/c |

|

|

|

1,05,000 |

|

|

(Being 5,250 shares are issued at 20% premium) |

|

|

|

|

|

|

|

|

|

|

|

Case (b)

|

Journal |

|||||

|

Date |

Particulars |

|

L.F. |

Debit Rs. |

Credit Rs. |

|

|

Sundry Assets A/c |

Dr. |

|

6,30,000 |

|

|

|

---------To Bhanu Oil Ltd A/c |

|

|

|

6,30,000 |

|

|

(Being assets purchases from bhanu oli ltd.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Bhanu Oil Ltd A/c |

Dr. |

|

6,30,000 |

|

|

|

Discount on Issue of Share A/c |

Dr. |

|

70,000 |

|

|

|

---------To Share Capital A/c |

|

|

|

7,00,000 |

|

|

(Being 7,000 shares issued at 10% discount to bhanu ltd, in consideration of assets purchased) |

|

|

|

|

|

|

|

|

|

|

|

Case (c)

|

Journal |

|||||

|

Date |

Particulars |

|

L.F. |

Debit Rs. |

Credit Rs. |

|

|

Sundry Assets A/c |

Dr. |

|

6,30,000 |

|

|

|

---------To Bhanu Oil Ltd A/c |

|

|

|

6,30,000 |

|

|

(Being assets purchased from bhanu oil ltd.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Bhanu Oil Ltd A/c |

Dr |

|

6,30,000 |

|

|

|

---------To Share Capital A/c |

|

|

|

5,25,000 |

|

|

---------To Securities Premium A/c |

|

|

|

1,05,000 |

|

|

(Being 5,250 shares are issued at 20% premium to bhanu ltd. in consideration of assets purchased) |

|

|

|

|

|

|

|

|

|

|

|

Solution NUM 10

|

Book of Bansal Heavy Machine Ltd Journal |

|||||

|

Date |

Particulars |

|

L.F. |

Debit Rs. |

Credit Rs. |

|

|

Machinery A/c |

Dr. |

|

3,20,000 |

|

|

|

---------To Cash A/c |

|

|

|

50,000 |

|

|

---------To Handa Traders A/c |

|

|

|

2,70,000 |

|

|

(Being machine purchased from Handa Traders paid Rs.50,000 in cash immediately) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Handa Traders A/c |

Dr |

|

2,79,000 |

|

|

|

Discount on Issue of Share A/c |

Dr. |

|

30,000 |

|

|

|

---------To Share Capital A/c |

|

|

|

3,00,000 |

|

|

(Being 3,000 shares issued at Rs.90 face value of Rs.100 each to handa traders in consideration of amount due to him for machinery purchased) |

|

|

|

|

|

|

|

|

|

|

|

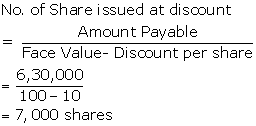

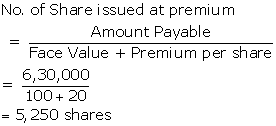

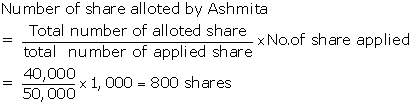

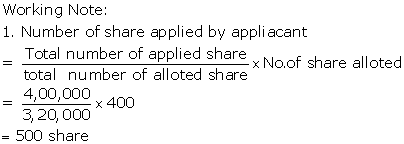

Working Note:

![]()

Accounting for Share Capital Exercise 69

Solution NUM 15

|

Books of Himalaya Company Ltd. Journal |

|||||

|

Date |

Particulars |

|

L.F. |

Debit Rs. |

Credit Rs. |

|

|

Bank A/c |

Dr. |

|

4,80,000 |

|

|

|

---------To Share Application A/c |

|

|

|

4,80,000 |

|

|

(Being share application money received for 1,60,000 shares @ Rs.3 per share) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Share Application A/c |

Dr. |

|

4,80,000 |

|

|

|

---------To Equity Share Capital A/c |

|

|

|

3,60,000 |

|

|

---------To Share Allotment A/c |

|

|

|

1,20,000 |

|

|

(Being share application for 1,20,000 shares @ Rs.3 per share transferred to Share Capital Account and remaining amount adjusted to allotment) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Share Allotment A/c |

Dr. |

|

6,00,000 |

|

|

|

---------To Equity Share Capital A/c |

|

|

|

3,60,000 |

|

|

---------To Securities Premium A/c |

|

|

|

2,40,000 |

|

|

(Being share allotment money due on 1,20,000 shares @ Rs.5 per share including Rs.2 Securities Premium) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Bank A/c |

Dr |

|

4,80,000 |

|

|

|

---------To Share Allotment A/c |

|

|

|

4,80,000 |

|

|

(Being share allotment for 1,20,000 shares @ Rs.5 per share received) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Share First Call A/c |

Dr. |

|

2,40,000 |

|

|

|

---------To Equity Share Capital A/c |

|

|

|

2,40,000 |

|

|

(Being first call due on 1,20,000 shares @ Rs.2 per share) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Bank A/c |

Dr. |

|

2,30,000 |

|

|

|

---------To Share First call A/c |

|

|

|

2,30,000 |

|

|

(Being first call received on 1,15,200 shares @ Rs.2 per share and 4,800 share failed to pay) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Share Final Call A/c |

Dr. |

|

2,40,000 |

|

|

|

---------To Equity Share Capital A/c |

|

|

|

2,40,000 |

|

|

(Being share final call due 1,20,000 shares @ Rs.2 per share) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Bank A/c |

Dr. |

|

2,30,400 |

|

|

|

---------To Share Final call A/c |

|

|

|

2,30,400 |

|

|

(Being share final call received on 1,15,200 shares @ Rs.2 per share and 4,800 share failed to pay) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Equity Share Capital A/c ( 4,800× 10) |

Dr. |

|

48,000 |

|

|

|

---------To Share First call A/c ( 4,800× 2) |

|

|

|

9,600 |

|

|

---------To Share Final call A/c ( 4,800× 2) |

|

|

|

9,600 |

|

|

---------To Share Forfeiture A/c ( 4,800× 6) |

|

|

|

28,800 |

|

|

(Being 4,800 shares forfeited for the non- payment of first call and final call) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Bank A/c |

Dr. |

|

33,600 |

|

|

|

Share Forfeiture A/c |

Dr. |

|

14,400 |

|

|

|

---------To Equity Share Capital A/c |

|

|

|

48,000 |

|

|

(Being 4,800 shares reissued@ Rs.7 per share, fully paid up) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Share Forfeiture A/c |

Dr. |

|

14,400 |

|

|

|

---------To Capital Reserve A/c |

|

|

|

14,400 |

|

|

(Being share forfeiture balance of 4,800 shares transferred to capital reserve account) |

|

|

|

|

|

Himalaya Company Limited |

||

|

Balance Sheet |

||

|

Particulars |

Note No. |

Rs. |

|

I. Equity and Liabilities |

|

|

|

1. Shareholders' Fund |

|

|

|

a. Share capital |

1 |

12,00,000 |

|

b. Reserve and Surplus |

2 |

2,54,400 |

|

2. Non - Current Liabilities |

|

|

|

3. Current Liabilities |

|

|

|

Total |

|

14,54,400 |

|

II. Assets |

|

|

|

1. Non-Current Assets |

|

|

|

2. Current Assets |

|

|

|

a. Cash and Cash Equivalents |

3 |

14,54,400 |

|

Total |

|

14,54,400 |

NOTES TO ACCOUNT

|

Note No. |

Particulars |

|

Rs. |

|

1 |

Share Capital |

|

|

|

|

Authorized Share Capital |

|

|

|

|

-------Share of Rs. 10 each |

|

|

|

|

Issued share Capital |

|

|

|

|

-------1,20,000 share of Rs. 10 each |

|

12,00,000 |

|

|

Subscribed, Called-up and paid-up Share Capital |

|

|

|

|

-------1,20,000 Share of Rs. 10 each, |

|

12,00,000 |

|

|

|

|

|

|

2 |

Other Non-Current Assets |

|

|

|

|

-------Securities Premium |

2,40,000 |

|

|

|

-------Capital Reserve |

14,400 |

2,54,400 |

|

|

|

|

|

|

3 |

Cash and Cash Equivalents |

|

|

|

|

-------Cash at Bank |

|

14,54,400 |

Solution NUM 16

|

Books of Books of Prince Limited Journal |

|||||

|

Date |

Particulars |

|

L.F. |

Debit Rs. |

Credit Rs. |

|

|

Bank A/c |

Dr. |

|

6,00,000 |

|

|

|

---------To Share Application A/c |

|

|

|

6,00,000 |

|

|

(Being share application money received for 3,00,000 shares @ Rs.2 per share) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Share Application A/c |

Dr. |

|

6,00,000 |

|

|

|

---------To Share Capital A/c |

|

|

|

4,00,000 |

|

|

---------To Share Allotment A/c |

|

|

|

2,00,000 |

|

|

(Being share application for 2,00,000 shares transferred to Share Capital Account and the balance adjusted on allotment) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Share Allotment A/c |

Dr. |

|

10,00,000 |

|

|

|

---------To Share Capital A/c |

|

|

|

4,00,000 |

|

|

---------To Securities Premium A/c |

|

|

|

6,00,000 |

|

|

(Being allotment money due on 2,00,000 shares @ Rs.5 per share including Premium Rs.3 per share) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Bank A/c ( 6,00,000 - 2,00,000- 1,600) |

Dr |

|

7,98,400 |

|

|

|

---------To Share Allotment A/c |

|

|

|

7,98,400 |

|

|

(Being allotment money received) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Share First Call A/c |

Dr. |

|

6,00,000 |

|

|

|

---------To Share Capital A/c |

|

|

|

6,00,000 |

|

|

(Being share first call due on 2,00,000 shares @ Rs.3 per share) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Bank A/c (6,00,000-1,200-1,800) |

Dr. |

|

5,97,000 |

|

|

|

---------To Share First call A/c |

|

|

|

5,97,000 |

|

|

(Being first call money received) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Share Capital A/c |

Dr. |

|

2,800 |

|

|

|

Share Premium A/c |

Dr. |

|

1,200 |

|

|

|

---------To Share Forfeiture A/c |

|

|

|

1,200 |

|

|

---------To Share Allotment A/c |

|

|

|

1,600 |

|

|

---------To Share First call A/c |

|

|

|

1,200 |

|

|

(Being 400 share forfeiture after first call) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Share Second Call A/c |

Dr. |

|

5,98,800 |

|

|

|

---------To Share Capital A/c |

|

|

|

5,98,800 |

|

|

(Being final call money due on 1,99,600 shares @ Rs.3 per share) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Bank A/c (5,98,800-1,800) |

Dr. |

|

5,97,000 |

|

|

|

---------To Share Second Call A/c |

|

|

|

5,97,000 |

|

|

(Being second call money received except on 600 share) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Share Capital A/c |

Dr. |

|

6,000 |

|

|

|

---------To Share Forfeiture A/c |

|

|

|

2,400 |

|

|

---------To Share First call A/c |

|

|

|

1,800 |

|

|

---------To Share Second Call A/c |

|

|

|

1,800 |

|

|

(Being 600 share forfeited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Bank A/c |

Dr. |

|

7,200 |

|

|

|

Share Forfeiture A/c |

Dr. |

|

800 |

|

|

|

---------To Share Capital A/c |

|

|

|

8,000 |

|

|

(Being 800 share reissued @ Rs.9 each) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Share Forfeiture A/c |

Dr. |

|

2,000 |

|

|

|

---------To Capital Reserve A/c |

|

|

|

2,000 |

|

|

(Being share forfeiture balance transferred to capital reserve ) |

|

|

|

|

|

Prince Limited |

||

|

Balance Sheet |

||

|

Particulars |

Note No. |

Rs. |

|

I. Equity and Liabilities |

|

|

|

1. Shareholders' Fund |

|

|

|

a. Share capital |

1 |

19,98,000 |

|

b. Reserve and Surplus |

2 |

6,01,600 |

|

2. Non - Current Liabilities |

|

|

|

3. Current Liabilities |

|

|

|

Total |

|

25,99,600 |

|

II. Assets |

|

|

|

1. Non-Current Assets |

|

|

|

2. Current Assets |

|

|

|

a. Cash and Cash Equivalents |

3 |

25,99,600 |

|

Total |

|

25,99,600 |

NOTES TO ACCOUNT

|

Note No. |

Particulars |

|

Rs. |

|

1 |

Share Capital |

|

|

|

|

Authorized Share Capital |

|

|

|

|

--------Share of Rs.10 each |

|

|

|

|

Issued share Capital |

|

|

|

|

--------2,00,000 share of Rs.10 each |

|

20,00,000 |

|

|

Subscribed, Called-up and paid-up Share Capital |

|

|

|

|

-------1,99,800 Share of Rs.10 each, |

|

19,98,000 |

|

|

|

|

|

|

2 |

Other Non-Current Assets |

|

|

|

|

-------Securities Premium |

5,98,800 |

|

|

|

-------Capital Reserve |

2,800 |

6,01,600 |

|

|

|

|

|

|

3 |

Cash and Cash Equivalents |

|

|

|

|

-------Cash at Bank |

|

25,99,600 |

|

Money received on Application (600×2) |

1,200 |

|

|

|

Less: Utilized on application (400×2) |

(800) |

|

Excess amount received |

400 |

|

|

Amount due on Allotment (400×5) |

2,000 |

|

|

|

Less: Excess amount received |

(400) |

|

Amount due on allotment |

1,600 |

|

2.Amount to be transferred to Capital Reserve

|

Amount forfeited on Mohit's 400 shares |

1,200 |

|

|

Amount forfeited on Joly's 600 shares-------2,400 |

1,600 |

|

|

|

2,800 |

|

|

|

Less: Discount allowed on 800 shares reissued |

(800) |

|

Amount to be transferred to Capital Reserve |

2,000 |

|

Accounting for Share Capital Exercise 71

Solution NUM 20

|

Books of Ashoka Limited Journal |

|||||

|

Date |

Particulars |

|

L.F. |

Debit Rs. |

Credit Rs. |

|

|

Share Capital A/c |

Dr. |

|

20,000 |

|

|

|

---------To Final Call A/c |

|

|

|

4,000 |

|

|

---------To Share Discount A/c |

|

|

|

4,000 |

|

|

---------To Share Forfeiture A/c |

|

|

|

12,000 |

|

|

(Being 1,000 Shares of Rs.20 per share forfeited for nonpayment of Share Final Call money @ Rs.4 per share)) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Bank A/c |

Dr. |

|

5,600 |

|

|

|

Discount on Issue of Share A/c (400×4) |

Dr. |

|

1,600 |

|

|

|

Share Forfeiture A/c |

Dr. |

|

800 |

|

|

|

---------To Share Capital A/c |

|

|

|

8,000 |

|

|

(Being 400 share @ Rs.20 per share reissued for Rs.14 per share fully paid-up) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Bank A/c |

Dr. |

|

4,000 |

|

|

|

---------To Share Capital A/c |

|

|

|

4,000 |

|

|

(Being 200 share @ Rs.20 per share reissued for Rs.20 per share fully paid up) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Share Forfeiture A/c |

Dr. |

|

6,400 |

|

|

|

---------To Capital Reserve A/c |

|

|

|

6,400 |

|

|

(Being balance of 600 share in share forfeiture account transferred to capital reserve account, after reissue) |

|

|

|

|

Balance in share forfeiture Account ( 12,000 - 800 - 6,400) = 4,800

Working Note:

For 400 share

|

Share forfeiture Account Credited |

Rs.12 per Share |

|

|

|

Less: Share forfeiture Account Debited |

Rs.2 per Share |

|

Amount transferred to Capital Reserve Account, after adjustment |

Rs. 10 per Share |

|

Amount of 400 share transferred to Capital Reserves Account, after Reissue

=400 share @ Rs. 10 per share

=Rs. 4,000

For 200 Share

|

Share forfeiture Account Credited |

Rs.12 per Share |

|

|

|

Less: Share forfeiture Account Debited |