Class 11-commerce NCERT Solutions Accountancy Part II Chapter 10: Financial Statements

Financial Statements Exercise 411

Solution NUM 1

|

Books of M/s. Rahul Sons. Trading A/c for the year ending 31st March 2017 |

|||||

|

Dr. |

|

|

|

|

Cr. |

|

Particulars |

|

Rs. |

Particulars |

|

Rs. |

|

To Opening Stock |

|

50,000 |

By Sales |

1,80,000 |

|

|

To Purchases |

1,75,000 |

|

Less: Sales Returns |

(3,000) |

1,77,000 |

|

Less: Purchase Returns |

(2,000) |

1,73,000 |

By Closing Stock |

|

32,000 |

|

To Wages |

|

3,000 |

By Gross Loss c/d |

|

17,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2,26,000 |

|

|

2,26,000 |

|

|

|

|

|

|

|

|

Profit and Loss A/c for the year ending 31st March 2017 |

|||||

|

Dr. |

|

|

|

|

Cr. |

|

Particulars |

|

Rs. |

Particulars |

|

Rs. |

|

To Gross Loss b/d |

|

17,000 |

By Discount Received |

|

500 |

|

To Salary |

8,000 |

|

By Commission Received |

4,000 |

|

|

Add: Outstanding Salary |

1,000 |

9,000 |

Less: Advance Commission |

(1,000) |

3,000 |

|

To Discount Allowed |

|

1,000 |

|

|

|

|

To Insurance |

3,200 |

|

By Rent |

6,000 |

|

|

Less: Insurance Prepaid |

(800) |

2,400 |

Add: Rent Receivable |

2,000 |

8,000 |

|

To Rent Rates and Taxes |

|

4,300 |

By Net Loss c/d |

|

43,189 |

|

To Trade Expenses |

|

1,500 |

|

|

|

|

To Bad-Debts |

2,000 |

|

|

|

|

|

Add: Further Bad-Debts |

1,000 |

|

|

|

|

|

Add: New Provision |

4,050 |

|

|

|

|

|

Less: Old Provision |

(2,500) |

4,550 |

|

|

|

|

To Discount on Debtors |

|

1,539 |

|

|

|

|

To Postage |

|

300 |

|

|

|

|

To Telegram Expenses |

|

200 |

|

|

|

|

To Depreciation on Building |

|

6,600 |

|

|

|

|

To Repair and Renewals |

|

1,600 |

|

|

|

|

To Travelling Expenses |

|

4,200 |

|

|

|

|

To Legal Fees |

|

500 |

|

|

|

|

|

|

54,689 |

|

|

54,689 |

|

|

|

|

|

|

|

|

Balance Sheet As on 31st March 2017 |

|||||

|

Liabilities |

Rs. |

Assets |

Rs. |

||

|

Capital |

3,00,000 |

|

Debtors |

82,000 |

|

|

Less: Net loss |

(43,189) |

Less: Further Bad-debts |

(1,000) |

||

|

Less: Drawings |

(32,000) |

2,24,811 |

Less: New Provision |

(4,050) |

|

|

Bills payable |

22,000 |

Less: Discount on Debtors |

(1,539) |

75,411 |

|

|

Loan |

34,800 |

Bills Receivable |

50,000 |

||

|

Advance Commission |

1,000 |

Buildings |

1,10,000 |

||

|

Outstanding Salary |

1,000 |

Less: 6% Depreciation |

(6,600) |

1,03,400 |

|

|

Rent Receivable |

2,000 |

||||

|

Prepaid insurance |

800 |

||||

|

Closing Stock |

32,000 |

||||

|

Furniture and fittings |

20,000 |

||||

|

2,83,611 |

2,83,611 |

||||

Financial Statements Exercise 412

Solution NUM 2

|

M/s Green Club Ltd. Trading A/c for the year ending 31st March 2017 |

|||||

|

Dr. |

|

|

|

|

Cr. |

|

Particulars |

|

Rs. |

Particulars |

|

Rs. |

|

To Opening Stock |

|

35,000 |

By Sales |

2,50,000 |

|

|

To Purchases |

1,25,000 |

|

Less: Sales Returns |

(25,000) |

2,25,000 |

|

Less: Purchase Returns |

(6,000) |

1,19,000 |

By Closing Stock |

|

10,000 |

|

To Wages |

3,000 |

|

|

|

|

|

Less: Prepaid Wages |

(1,000) |

2,000 |

|

|

|

|

To Gross Profit c/d |

|

79,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

2,35,000 |

|

|

2,35,000 |

|

|

|

|

|

|

|

|

Profit and Loss A/c for the year ending 31st March 2017 |

|||||

|

Dr. |

|

|

|

Cr. |

|

|

Particulars |

|

Rs. |

Particulars |

Rs. |

|

|

To Bad Debts |

3,500 |

|

By Gross Profit b/d |

79,000 |

|

|

Add: Further Bad-debts |

1,500 |

|

By Interest on Accrued Investment |

1,155 |

|

|

Add: New Provision |

2,910 |

|

By Discount |

1,000 |

|

|

Less: Old Provision |

(4,500) |

3,410 |

By Interest Received |

5,400 |

|

|

To Discount on Debtors |

|

2,280 |

|

|

|

|

To Postage and Telegram |

|

600 |

|

|

|

|

To Salary |

|

12,300 |

|

|

|

|

To Rent and Rates |

|

1,000 |

|

|

|

|

To Packing and Transport |

|

500 |

|

|

|

|

To General Expenses |

|

400 |

|

|

|

|

To Insurance |

|

4,000 |

|

|

|

|

To Discount |

|

3,500 |

|

|

|

|

To Depreciation on Machinery |

|

1,000 |

|

|

|

|

To Lighting and Heating |

|

5,000 |

|

|

|

|

To Net Profit c/d |

|

52,565 |

|

|

|

|

|

|

|

|

|

|

|

|

|

86,555 |

|

86,555 |

|

|

|

|

|

|

|

|

|

Balance Sheet as on 31st March 2017 |

|||||

|

Liabilities |

Rs. |

Assets |

Rs. |

||

|

Creditors |

10,000 |

Cash in hand |

20,000 |

||

|

Bills Payable |

20,000 |

Cash at bank |

40,000 |

||

|

Capital |

75,000 |

||||

|

Add: Net profit |

52,565 |

1,27,565 |

Debtors |

50,000 |

|

|

Less: Further Bad-Debts |

(1,500) |

||||

|

Less: New provision |

(2,910) |

||||

|

Less: Discount on Debtors |

(2,280) |

43,310 |

|||

|

Investment |

23,100 |

||||

|

Add: Interest on Investment |

1,155 |

24,255 |

|||

|

Machinery |

20,000 |

||||

|

Less: Depreciation |

(1,000) |

19,000 |

|||

|

Prepaid Wages |

1,000 |

||||

|

Closing Stock |

10,000 |

||||

|

1,57,565 |

1,57,565 |

||||

Financial Statements Exercise 413

Solution NUM 3

|

M/s Runway Shine Ltd. Trading A/c for the year ending 31st March 2017 |

|||||

|

Dr. |

|

|

|

|

Cr. |

|

Particulars |

|

Rs. |

Particulars |

|

Rs. |

|

To Opening Stock |

|

50,000 |

By Sales |

2,50,000 |

|

|

To Purchases |

1,50,000 |

|

Less: Return Inwards |

(2,000) |

2,48,000 |

|

Less: Return Outwards |

(4,500) |

1,45,500 |

By Closing Stock |

|

32,500 |

|

To Carriage Inwards |

|

4,500 |

|

|

|

|

To Wages |

2,400 |

|

|

|

|

|

Add: Outstanding Wages |

100 |

2,500 |

|

|

|

|

To Gross Profit c/d |

|

78,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2,80,500 |

|

|

2,80,500 |

|

|

|

|

|

|

|

|

Profit and Loss A/c for the year ending 31st March 2017 |

||||

|

Dr. |

|

|

|

Cr. |

|

Particulars |

|

Rs. |

Particulars |

Rs. |

|

To Carriage Outward |

|

400 |

By Gross Profit b/d |

78,000 |

|

To Printing and Stationery |

|

4,500 |

By Interest Received |

3,500 |

|

To Discount |

|

400 |

By Discount Received |

400 |

|

To Bad Debts |

1,500 |

|

By Interest Received on Investment |

1,600 |

|

Add: Further Bad Debts |

1,000 |

|

|

|

|

Add: New Provision |

2,600 |

5,100 |

|

|

|

To Discount on Debtors |

|

500 |

|

|

|

To Insurance |

|

2,500 |

|

|

|

To Postage and telegraphs |

|

400 |

|

|

|

To Commission |

|

200 |

|

|

|

To Interest |

1,000 |

|

|

|

|

Add: outstanding Interest |

200 |

1,200 |

|

|

|

To Repair |

|

440 |

|

|

|

To Lighting Charges |

|

500 |

|

|

|

To Telephone Charges |

|

100 |

|

|

|

To Depreciation on motor car |

|

1,250 |

|

|

|

To Net profit c/d |

|

66,010 |

|

|

|

|

|

|

|

|

|

|

|

83,500 |

|

83,500 |

|

|

|

|

|

|

|

Balance Sheet as on 31st March 2017 |

|||||

|

Liabilities |

Rs. |

Assets |

Rs. |

||

|

Capital |

1,00,000 |

Cash in Hand |

77,800 |

||

|

Add: Net profit |

66,010 |

1,66,010 |

Add: Interest Received |

1,600 |

79,400 |

|

Creditors |

1,25,000 |

Cash at Bank |

60,800 |

||

|

Bills payable |

6,040 |

Investment |

32,000 |

||

|

Outstanding interest |

100 |

Debtors |

53,000 |

||

|

Outstanding Wages |

200 |

Less: Further bad debts |

(1,000) |

||

|

Less: New Provision |

(2,600) |

||||

|

Less: Discount on Debtors |

(500) |

48,900 |

|||

|

Motor Car |

25,000 |

||||

|

Less: Depreciation |

(1,250) |

23,750 |

|||

|

Bills receivable |

20,000 |

||||

|

Closing Stock |

32,500 |

||||

|

2,97,350 |

2,97,350 |

||||

Financial Statements Exercise 414

Solution NUM 4

|

Trading A/c for the year ending 31st March 2017 |

|||||

|

Dr. |

|

|

|

|

Cr. |

|

Particulars |

|

Rs. |

Particulars |

|

Rs. |

|

To Opening Stock |

|

50,000 |

By Sales |

3,50,000 |

|

|

To Purchases |

1,25,500 |

|

Less: Return |

(2,000) |

3,48,000 |

|

Less: Return Outwards |

(2,500) |

1,23,000 |

By Closing Stock |

|

40,000 |

|

To Carriage |

|

100 |

|

|

|

|

To Power |

|

3,900 |

|

|

|

|

To Gross Profit c/d |

|

2,11,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

3,88,000 |

|

|

3,88,000 |

|

|

|

|

|

|

|

|

Profit and Loss A/c for the year ending 31st March 2017 |

|||||

|

Dr. |

|

|

|

|

Cr. |

|

Particulars |

|

Rs. |

Particulars |

|

Rs. |

|

To General Expenses |

|

2,000 |

By Gross Profit b/d |

|

2,11,000 |

|

To Insurance |

|

12,400 |

By Rent |

|

5,000 |

|

To Bad Debts |

2,000 |

|

By Interest |

|

2,000 |

|

Add: Provision for Bad Debts |

1,625 |

3,625 |

By Accrued Interest on Loan |

|

150 |

|

To Light and Water |

|

1,200 |

|

|

|

|

To Trade Expenses |

2,000 |

|

|

|

|

|

Add: Outstanding Trade Expenses |

300 |

2,300 |

|

|

|

|

To Salary and Wages |

5,400 |

|

|

|

|

|

Add: Outstanding Salary |

500 |

5,900 |

|

|

|

|

To Depreciation on Building |

|

3,440 |

|

|

|

|

To Depreciation on Machinery |

|

1,725 |

|

|

|

|

To Net profit c/d |

|

1,85,560 |

|

|

|

|

|

|

2,18,150 |

|

|

2,18,150 |

|

|

|

|

|

|

|

|

Balance Sheet as on 31st March 2017 |

|||||

|

Liabilities |

Rs. |

Assets |

Rs. |

||

|

Capital |

3,00,000 |

Cash in Hand |

21,200 |

||

|

Add: Net Profit |

1,85,560 |

Cash at Bank |

12,000 |

||

|

Less: Drawings |

(10,000) |

4,75,560 |

Freehold Land |

3,20,000 |

|

|

Patents |

1,20,000 |

||||

|

Creditors |

25,000 |

Sundry Debtors |

32,500 |

||

|

Bills payable |

1,71,700 |

Less: Provision for bad debts |

(1,625) |

30,875 |

|

|

Outstanding Trade Expenses |

300 |

||||

|

Outstanding Salary |

500 |

Building |

86,000 |

||

|

Less: Depreciation |

(3,440) |

82,560 |

|||

|

Machinery |

34,500 |

||||

|

Less: Depreciation |

(1,725) |

32,775 |

|||

|

Motor vehicle |

10,500 |

||||

|

Loan |

3,000 |

||||

|

Add: Interest on Loan |

150 |

3,150 |

|||

|

Closing Stock |

40,000 |

||||

|

6,73,060 |

6,73,060 |

||||

|

- |

|||||

Working Note:

Calculation the Outstanding interest on loan

Loan = 3,000

Interest = 15%

Months (1/9/2016 to 31/12/2016) = 4 months

![]()

Financial Statements Exercise 415

Solution NUM 5

|

Trading A/c for the year ending 31st March 2017 |

|||||

|

Dr. |

|

|

|

|

Cr. |

|

Particulars |

|

Rs. |

Particulars |

|

Rs. |

|

To Opening Stock |

|

25,000 |

By Sales |

2,76,000 |

|

|

To Purchases |

1,80,000 |

|

Less: Return Inwards |

(7,000) |

2,69,000 |

|

Less: Return Outwards |

(2,000) |

1,78,000 |

By Closing Stock |

|

45,000 |

|

To Wages |

|

10,000 |

|

|

|

|

To Freight |

|

4,000 |

|

|

|

|

To Gross Profit c/d |

|

97,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

3,14,000 |

|

|

3,14,000 |

|

|

|

|

|

|

|

|

Profit and Loss A/c for the year ending 31st March 2017 |

||||

|

Dr. |

|

|

|

Cr. |

|

Particulars |

Rs. |

Particulars |

|

Rs. |

|

To Trade Expenses |

2,400 |

By Gross Profit |

|

97,000 |

|

To Printing and Stationery |

2,000 |

By Old Provision for Bad Debts |

4,000 |

|

|

To Rent Rates and Taxes |

5,000 |

Less: Bad Debts |

(1,000) |

|

|

To Discount Allowed |

2,000 |

Less: New Provision |

(1,600) |

1,400 |

|

To Depreciation on Motor Car |

5,100 |

|

|

|

|

To Depreciation on Furniture and F. |

1,000 |

|

|

|

|

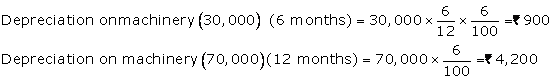

To Depreciation on P and M (70,000) |

4,200 |

|

|

|

|

To Depreciation on P and M (30,000) |

900 |

|

|

|

|

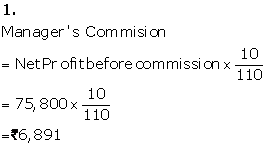

To Net Profit Before Manager's Commission |

75,800 |

|

|

|

|

|

|

|

|

|

|

|

98,400 |

|

|

98,400 |

|

|

|

|

|

|

|

To Manager's Commission |

6,891 |

By Balance b/d |

|

75,800 |

|

To Net Profit After Commission |

68,909 |

|

|

|

|

|

|

|

|

|

|

|

75,800 |

|

|

75,800 |

|

|

|

|

|

|

|

Balance Sheet as on 31st March 2017 |

|||||

|

Liabilities |

Rs. |

Assets |

Rs. |

||

|

Capital |

2,00,000 |

Cash in Hand |

6,000 |

||

|

Add: Net Profit |

68,909 |

|

Sundry Debtors |

80,000 |

|

|

Less: Drawings |

(20,000) |

2,48,909 |

Less: New Provision |

(1,600) |

78,400 |

|

O/S Manager's Commission |

|

6,891 |

|||

|

Bank Overdraft |

|

12,000 |

Furniture and Fixtures |

20,000 |

|

|

Creditors |

|

60,000 |

Less: 5% Depreciation |

(1,000) |

19,000 |

|

Bills Payable |

|

15,400 |

|||

|

Plant and Machinery |

1,00,000 |

||||

|

Less: 6%Depreciation (WN 2) |

(4,200) |

||||

|

Less: 6%Depreciation (WN 2) |

(900) |

94,900 |

|||

|

Bills Receivable |

14,000 |

||||

|

Investments |

40,000 |

||||

|

Motor Car |

51,000 |

||||

|

Less: 10% Depreciation |

(5,100) |

45,900 |

|||

|

Closing Stock |

45,000 |

||||

|

3,43,200 |

3,43,200 |

||||

Working Notes:

2.

Out of the machinery of Rs.1,00,000, Rs.30,000 worth of machinery purchased on 01/07/2011 . Therefore, the depreciation on this machinery will be for 6 months at 6% p.a.

Note: In the NCERT book, Gross Profit is given as Rs.1,01,000. But as per the solution Gross Profit is Rs.97,000.

Financial Statements Exercise 416

Solution NUM 6

|

Trading A/c |

|||||

|

Dr. |

|

|

|

|

Cr. |

|

Particulars |

|

Rs. |

Particulars |

|

Rs. |

|

To Opening Stock |

|

75,550 |

By Sales |

1,00,000 |

|

|

To Purchases |

75,000 |

|

Less: Sales Inwards |

(6,000) |

94,000 |

|

Less: Return Outwards |

(4,500) |

70,500 |

By Closing Stock |

|

35,000 |

|

To Freight |

|

2,250 |

By Gross Loss c/d |

|

19,300 |

|

|

|

|

|

|

|

|

|

|

1,48,300 |

|

|

1,48,300 |

|

|

|

|

|

|

|

|

Profit and Loss A/c |

|||||

|

Dr. |

|

|

|

|

Cr. |

|

Particulars |

|

Rs. |

Particulars |

|

Rs. |

|

To Gross Loss b/d |

|

19,300 |

By Discount |

|

3,500 |

|

To Bad Debts |

3,000 |

|

By Interest Received |

|

11,260 |

|

Add: Further Bad-Debts |

1,000 |

|

By Interest on Drawings |

|

814 |

|

Add: New Provision |

4,950 |

|

By Net Loss c/d |

|

27,482 |

|

Less: Old Provision |

(1,500) |

7,450 |

|

|

|

|

To Discount on Debtors |

|

1,881 |

|

|

|

|

To Trade Expenses |

|

2,500 |

|

|

|

|

To Printing and Stationery |

|

5,000 |

|

|

|

|

To Rent, Rates and Taxes |

3,450 |

|

|

|

|

|

Add: O/S Rent, Rates and Taxes |

200 |

3,650 |

|

|

|

|

To Depreciation on Furniture |

|

775 |

|

|

|

|

To Depreciation on Motor Car |

|

2,500 |

|

|

|

|

|

|

|

|

|

|

|

|

|

43,056 |

|

|

43,056 |

|

|

|

|

|

|

|

|

Balance Sheet |

|||||

|

Liabilities |

Rs. |

Assets |

Rs. |

||

|

Bills Payable |

|

85,550 |

Sundry Debtors |

100,000 |

|

|

Sundry Creditors |

|

25,000 |

Less: Further Debts |

1,000 |

|

|

Capital |

2,50,000 |

|

Less: New Provision |

4,950 |

|

|

Less: Net Loss |

(27,482) |

Less: Discount on Debtors |

1,881 |

92,169 |

|

|

Less: Drawings |

(13,560) |

|

|

|

|

|

Less: Interest on Drawings |

(814) |

2,08,144 |

Motor Car |

25,000 |

|

|

|

|

|

Less: 10% Depreciation |

(2,500) |

22,500 |

|

Outstanding Rent, Rates and Taxes |

|

200 |

|

|

|

|

Furniture and Fixtures |

15,500 |

|

|||

|

Less: 5% Depreciation |

(775) |

14,725 |

|||

|

Investments |

65,500 |

||||

|

Cash in Hand |

36,000 |

||||

|

Cash at Bank |

53,000 |

||||

|

Closing Stock |

35,000 |

||||

|

3,18,894 |

3,18,894 |

||||

Note: In the NCERT book, Gross Loss is given Rs.17,050 but as per the solution Gross Profit Total is Rs.19,300.

Financial Statements Exercise 417

Solution NUM 7

|

Trading A/c |

|||||

|

Dr. |

|

|

|

|

Cr. |

|

Particulars |

|

Rs. |

Particulars |

|

Rs. |

|

To Opening Stock |

|

2,26,000 |

By Sales |

6,80,000 |

|

|

To Purchases |

4,40,000 |

|

Less: Sales Inwards |

(10,000) |

6,70,000 |

|

Less: Return Outwards |

(15,000) |

4,25,000 |

By Closing Stock |

|

30,000 |

|

To Freight Inwards |

|

3,400 |

|

|

|

|

To Heat and Power |

|

8,000 |

|

|

|

|

To Gross Profit c/d |

|

37,600 |

|

|

|

|

|

|

|

|

|

|

|

|

|

7,00,000 |

|

|

7,00,000 |

|

|

|

|

|

|

|

|

Profit and Loss A/c |

|||||||

|

Dr. |

|

Cr. |

|||||

|

Particulars |

|

Rs. |

Particulars |

|

Rs. |

||

|

To Trade Expenses |

|

3,300 |

By Gross Profit b/d |

|

37,600 |

||

|

To Salary and Wages |

|

5,000 |

By Interest Received |

|

20,000 |

||

|

To Legal Expenses |

|

3,000 |

|

|

|

||

|

To Postage and Telegram |

|

1,000 |

|

|

|

||

|

To Bad Debts |

6,500 |

|

|

|

|

||

|

Add: New Provision |

1,250 |

7,750 |

|

|

|

||

|

To Depreciation on Building |

|

5,000 |

|

|

|

||

|

To Depreciation on Motor Van |

|

3,000 |

|

|

|

||

|

To Insurance |

3,500 |

|

|

|

|

||

|

Less: Unexpired Insurance |

(600) |

2,900 |

|

|

|

||

|

To Net Profit c/d |

|

26,650 |

|

|

|

||

|

|

|

|

|

|

|

||

|

|

|

57,600 |

|

|

57,600 |

||

|

|

|

|

|

|

|

||

|

To Manager's Commission payable |

|

1,269 |

By Balance b/d |

|

26,650 |

||

|

To Net Profit after Commission |

|

25,381 |

|

|

|

||

|

|

|

|

|

|

|

||

|

|

|

26,650 |

|

|

26,650 |

||

|

|

|

|

|

|

|

||

|

Balance sheet |

|||||

|

Liabilities |

Rs. |

Assets |

Rs. |

||

|

Capital |

3,50,000 |

Cash in Hand |

79,000 |

||

|

Add: Net profit |

25,381 |

Cash at Bank |

98,000 |

||

|

Less: Drawings |

75,000 |

3,00,381 |

Buildings |

1,00,000 |

|

|

Creditors |

50,000 |

Less: Depreciation |

5,000 |

95,000 |

|

|

Bills payable |

63,700 |

Motor van |

30,000 |

||

|

Manager's Commission Payable |

1,269 |

Less: Depreciation |

3,000 |

27,000 |

|

|

Sundry Debtors |

25,000 |

||||

|

Less: New provision |

1,250 |

23,750 |

|||

|

Investments |

40,000 |

||||

|

Machinery |

22,000 |

||||

|

Unexpired Insurance |

600 |

||||

|

Closing Stock |

30,000 |

||||

|

4,15,350 |

4,15,350 |

||||

Financial Statements Exercise 418

Solution NUM 8

|

Trading A/c |

|||||

|

Dr. |

|

|

|

|

Cr. |

|

Particulars |

|

Rs. |

Particulars |

|

Rs. |

|

To Opening Stock |

|

76,800 |

By Sales |

2,20,000 |

|

|

To Purchases |

1,50,000 |

|

Less: Sales Return |

(200) |

2,19,800 |

|

Less: Purchases Return |

(10,000) |

1,40,000 |

By Closing Stock |

|

20,000 |

|

To Carriage Inwards |

|

100 |

|

|

|

|

To Wages |

500 |

|

|

|

|

|

Less: Prepaid |

(40) |

460 |

|

|

|

|

To Coal, Gas and Water |

|

1,200 |

|

|

|

|

To Gross Profit c/d |

|

21,240 |

|

|

|

|

|

|

|

|

|

|

|

|

|

2,39,800 |

|

|

2,39,800 |

|

|

|

|

|

|

|

|

Profit and Loss A/c |

|||||

|

Dr. |

|

|

|

|

Cr. |

|

Particulars |

|

Rs. |

Particulars |

|

Rs. |

|

To Salary |

2,000 |

|

By Gross Profit b/d |

|

21,240 |

|

Add: Outstanding Salary |

100 |

2,100 |

By Discount |

|

1,260 |

|

To Bank Charges |

|

200 |

By Apprentice Premium |

|

5,230 |

|

To Trade Expenses |

|

3,800 |

|

|

|

|

To Rates and Taxes |

|

870 |

|

|

|

|

To Depreciation on Plant and M. |

|

2,000 |

|

|

|

|

To Depreciation on Land and B. |

|

1,200 |

|

|

|

|

To Provision for Doubtful Debts |

|

2,715 |

|

|

|

|

To Discount on Debtors |

|

1,548 |

|

|

|

|

To Net Profit c/d |

|

13,297 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

27,730 |

|

|

27,730 |

|

|

|

|

|

|

|

|

To Manager's Commission payable |

|

633 |

By Balance b/d |

|

13,297 |

|

To Net Profit after Commission |

|

12,664 |

|

|

|

|

|

|

|

|

|

|

|

|

|

13,297 |

|

|

13,297 |

|

|

|

|

|

|

|

|

Balance Sheet |

|||||

|

Liabilities |

Rs. |

Assets |

Rs. |

||

|

Capital |

1,01,110 |

Cash at Bank |

50,000 |

||

|

Add: Net profit |

12,664 |

Land and Buildings |

12,000 |

||

|

Less: Drawings |

(20,000) |

93,774 |

Less: Depreciation |

(1,200) |

10,800 |

|

Plant and machinery |

40,000 |

||||

|

Bills payable |

1,28,870 |

Less: Depreciation |

(2,000) |

38,000 |

|

|

Outstanding Salary |

100 |

Bills receivable |

24,500 |

||

|

Outstanding Manager's Commission |

633 |

Sundry Debtors |

54,300 |

||

|

Less: New provision |

(2,715) |

||||

|

Less: Discount on Debtors |

(1,548) |

50,037 |

|||

|

Cash in hand |

30,000 |

||||

|

Closing Stock |

20,000 |

||||

|

Prepaid Wages |

40 |

||||

|

2,23,377 |

2,23,377 |

||||

Financial Statements Exercise 419

Solution NUM 9

|

Trading A/c |

|||||

|

Dr. |

|

|

|

|

Cr. |

|

Particulars |

|

Rs. |

Particulars |

|

Rs. |

|

To Opening Stock |

|

22,800 |

By Sales |

|

72,670 |

|

To Purchases |

34,800 |

|

By Closing Stock |

|

10,000 |

|

Less: Purchases Return |

(2,430) |

32,370 |

|

|

|

|

To Carriage Inwards |

|

450 |

|

|

|

|

To Wages |

1,770 |

|

|

|

|

|

Add: Outstanding Wages |

500 |

2,270 |

|

|

|

|

To Factory Rent |

390 |

|

|

|

|

|

Less: Prepaid Rent |

(100) |

290 |

|

|

|

|

To Gas and Water |

|

240 |

|

|

|

|

To Octroi |

|

60 |

|

|

|

|

To Cleaning Charges |

|

940 |

|

|

|

|

To Gross Profit c/d |

|

23,250 |

|

|

|

|

|

|

82,670 |

|

|

82,670 |

|

|

|

|

|

|

|

|

Profit and Loss A/c |

|||||

|

Dr. |

|

|

|

|

Cr. |

|

Particulars |

|

Rs. |

Particulars |

|

Rs. |

|

To Office Rent |

|

820 |

By Gross Profit b/d |

|

23,250 |

|

To Insurance |

1,440 |

|

|

|

|

|

Add: Outstanding Insurance |

100 |

1,540 |

|

|

|

|

To Depreciation on Plant and Machinery |

|

180 |

|

|

|

|

To Salary |

1,590 |

|

|

|

|

|

Add: Outstanding Salary |

350 |

1,940 |

|

|

|

|

To Provision for Doubtful Debts |

|

480 |

|

|

|

|

To Depreciation on Building |

|

2,400 |

|

|

|

|

To Net Profit c/d |

|

15,890 |

|

|

|

|

|

|

23,250 |

|

|

23,250 |

|

|

|

|

|

|

|

|

Balance Sheet |

|||||

|

Liabilities |

Rs. |

Assets |

Rs. |

||

|

Capital |

42,000 |

Sundry Debtors |

9,600 |

||

|

Add: Net profit |

15,890 |

57,890 |

Less: New Provision |

(480) |

9,120 |

|

Sundry Creditors |

2,500 |

Building |

24,000 |

||

|

Bills payable |

15,600 |

Less: Depreciation |

(2,400) |

21,600 |

|

|

Outstanding Salary |

350 |

||||

|

Outstanding Wages |

500 |

Plant and machinery |

3,600 |

||

|

Outstanding Insurance |

100 |

Less: Depreciation |

(180) |

3420 |

|

|

Cash in Hand |

2,160 |

||||

|

Furniture |

20,540 |

||||

|

Patents |

10,000 |

||||

|

Closing Stock |

10,000 |

||||

|

Prepaid Factory Rent |

100 |

||||

|

76,940 |

76,940 |

||||

Note: In the NCERT book, Net Profit is given as Rs.15,895 and Balance Sheet total is given as Rs.76,945. But as per the solution Net Profit is Rs.15,890 and total of Balance Sheet is Rs.76,940.

Financial Statements Exercise 420

Solution NUM 10

|

Trading A/c |

|||||

|

Dr. |

|

|

|

|

Cr. |

|

Particulars |

|

Rs. |

Particulars |

|

Rs. |

|

To Opening Stock |

|

45,000 |

By Sales |

|

2,00,000 |

|

To Purchases |

80,000 |

|

By Closing Stock |

|

50,000 |

|

Less: Return Outwards |

(4,000) |

76,000 |

|

|

|

|

|

|

|

|

|

|

|

To Wages |

34,000 |

|

|

|

|

|

Add: Wages Outstanding |

50 |

34,050 |

|

|

|

|

|

|

|

|

|

|

|

To Gas and Fuel |

|

2,700 |

|

|

|

|

To Freight and Carriage |

|

3,500 |

|

|

|

|

To Factory Lighting |

|

5,000 |

|

|

|

|

To Gross Profit b/d |

|

83,750 |

|

|

|

|

|

|

2,50,000 |

|

|

2,50,000 |

|

|

|

|

|

|

|

|

Profit and Loss A/c |

||||

|

Dr. |

|

|

|

Cr. |

|

Particulars |

Rs. |

Particulars |

|

Rs. |

|

To Legal Expenses |

4,000 |

By Gross Profit b/d |

|

83,750 |

|

To Office Expenses |

3,000 |

|

|

|

|

To Depreciation on Machine |

12,000 |

|

|

|

|

To Depreciation on Building |

3,600 |

|

|

|

|

To Interest on Capital |

8,400 |

|

|

|

|

To Net Profit c/d |

52,750 |

|

|

|

|

|

83,750 |

|

|

83,750 |

|

|

|

|

|

|

|

Balance Sheet |

|||||

|

Liabilities |

Rs. |

Assets |

Rs. |

||

|

Capital |

2,10,000 |

Bank Balance |

11,000 |

||

|

Add: Interest on Capital |

8,400 |

Debtors |

70,300 |

||

|

Add: Net profit |

52,750 |

2,71,150 |

Cash in Hand |

1,200 |

|

|

Building |

60,000 |

||||

|

Bills payable |

6,500 |

Less: Depreciation |

(3,600) |

56,400 |

|

|

Creditors |

50,000 |

Machinery |

1,20,000 |

||

|

Outstanding Wages |

50 |

Less: Depreciation |

(12,000) |

1,08,000 |

|

|

Bills Receivable |

7,000 |

||||

|

Patent Right |

18,800 |

||||

|

Office Future |

5,000 |

||||

|

Closing Stock |

50,000 |

||||

|

3,27,700 |

3,27,700 |

||||

Financial Statements Exercise 421

Solution NUM 11

|

Trading A/c |

|||||

|

Dr. |

|

|

|

|

Cr. |

|

Particulars |

|

Rs. |

Particulars |

|

Rs. |

|

To Opening Stock |

|

10,000 |

By Sales |

80,000 |

|

|

To Purchases |

40,000 |

|

Less: Sales Return |

200 |

79,800 |

|

Less: Purchases Return |

600 |

39,400 |

By Closing Stock |

|

2,000 |

|

To Wages |

|

6,000 |

|

|

|

|

To Dock and Cleaning Charges |

|

4,000 |

|

|

|

|

To Gross Profit c/d |

|

22,400 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

81,800 |

|

|

81,800 |

|

|

|

|

|

|

|

|

Profit and Loss A/c |

||||||||

|

Dr. |

|

|

|

|

Cr. |

|||

|

Particulars |

Rs. |

Particulars |

|

Rs. |

||||

|

To Lighting |

500 |

By Gross Profit b/d |

|

22,400 |

||||

|

To Donations and Charity |

600 |

By Miscellaneous Income |

|

6,000 |

||||

|

To Interest on Capital |

2,000 |

By Rent |

2,000 |

|

||||

|

To Depreciation on Furniture |

565 |

Less: Unearned Rent |

100 |

1,900 |

||||

|

To Depreciation on Land and Machinery |

2,150 |

By Interest on Drawings |

|

140 |

||||

|

To Net Profit c/d |

24,985 |

By Interest on Investment |

|

360 |

||||

|

|

|

|

|

|

||||

|

|

|

|

|

|

||||

|

|

30,800 |

|

|

30,800 |

||||

|

|

|

|

|

|

||||

|

Balance Sheet |

|||||

|

Liabilities |

Rs. |

Assets |

Rs. |

||

|

Capital |

40,000 |

Debtors |

6,000 |

||

|

Add: Interest on Capital |

2,000 |

Cash |

3,000 |

||

|

Add: Net profit |

24,985 |

||||

|

Less: Drawings |

(2,000) |

Investment |

6,000 |

||

|

Less: Interest on drawings |

(140) |

64,845 |

Add: Interest on Investment |

360 |

6,360 |

|

Land and machinery |

43,000 |

||||

|

Creditors |

7,000 |

Less: Depreciation |

(2,150) |

40,850 |

|

|

Sales Tax Collected |

1,000 |

||||

|

Unearned Rent |

100 |

Patent |

4,000 |

||

|

Furniture |

11,300 |

||||

|

Less: Depreciation |

(565) |

10,735 |

|||

|

Closing Stock |

2,000 |

||||

|

72,945 |

72,945 |

||||

Note: In the NCERT book, Gross Profit is given Rs.21,900, Net Profit is given as Rs.25,185 and Balance Sheet total is given as Rs.71,185. But as per the solution Gross Profit is Rs.22,400, Net Profit is Rs.24,985 and total of Balance Sheet is Rs.72,945.

Financial Statements Exercise 422

Solution NUM 12

|

Trading A/c |

|||||

|

Dr. |

|

|

|

|

Cr. |

|

Particulars |

|

Rs. |

Particulars |

|

Rs. |

|

To Opening Stock |

|

16,000 |

By Sales |

1,12,000 |

|

|

To Purchases |

67,600 |

|

Less: Return Inwards |

(4,600) |

1,07,400 |

|

Less: Return Outwards |

(3,200) |

64,400 |

By Closing Stock |

|

15,000 |

|

To Carriage Inwards |

|

1,400 |

|

|

|

|

To Wages |

1,200 |

|

|

|

|

|

Add: Outstanding Wages |

200 |

1,400 |

|

|

|

|

To Gross Profit c/d |

|

39,200 |

|

|

|

|

|

|

|

|

|

|

|

|

|

1,22,400 |

|

|

1,22,400 |

|

|

|

|

|

|

|

|

Profit and Loss A/c |

|||||

|

Dr. |

|

|

|

|

Cr. |

|

Particulars |

|

Rs. |

Particulars |

|

Rs. |

|

To General Expenses |

|

2,400 |

By Gross Profit b/d |

|

39,200 |

|

To Insurance |

4,000 |

|

By Discount |

|

1,400 |

|

Less: Unexpired Insurance |

(1,000) |

3,000 |

By Commission |

|

1,800 |

|

To Scooter Expenses |

|

200 |

|

|

|

|

To Salary |

8,800 |

|

|

|

|

|

Add: Outstanding Salary |

1,800 |

10,600 |

|

|

|

|

To Interest on Capital |

|

2,500 |

|

|

|

|

To Depreciation on Scooter |

|

400 |

|

|

|

|

To Depreciation on Furniture |

|

520 |

|

|

|

|

To Net Profit c/d |

|

22,780 |

|

|

|

|

|

|

|

|

|

|

|

|

|

42,400 |

|

|

42,400 |

|

|

|

|

|

|

|

|

Balance Sheets |

|||||

|

Liabilities |

Rs. |

Assets |

Rs. |

||

|

Capital |

50,000 |

Cash in hand |

4,000 |

||

|

Add: Interest on Capital |

2,500 |

Scooter |

8,000 |

||

|

Add: Net profit |

22,780 |

75,280 |

Less: Depreciation |

400 |

7,600 |

|

Bank Overdraft |

10,000 |

Furniture |

5,200 |

||

|

Creditors |

16,000 |

Less: Depreciation |

520 |

4,680 |

|

|

Outstanding Salary |

1,800 |

Buildings |

65,000 |

||

|

Outstanding wages |

200 |

Debtors |

6,000 |

||

|

Unexpired Insurance |

1,000 |

||||

|

Closing Stock |

15,000 |

||||

|

1,03,280 |

1,03,280 |

||||

Financial Statements Exercise 423

Solution NUM 13

|

Trading A/c |

|||||

|

Dr. |

|

|

|

|

Cr. |

|

Particulars |

|

Rs. |

Particulars |

|

Rs. |

|

To Opening Stock |

|

42,300 |

By Sales |

1,12,500 |

|

|

To Purchases |

45,000 |

|

Less: Sales Return |

(2,385) |

1,10,115 |

|

Less: Purchases Return |

(1,440) |

43,560 |

By Closing Stock |

|

20,000 |

|

To Carriage |

|

2,700 |

|

|

|

|

To Wages |

11,215 |

|

|

|

|

|

Add: Outstanding Wages |

50 |

11,265 |

|

|

|

|

To Octroi |

|

530 |

|

|

|

|

To Gross Profit c/d |

|

29,760 |

|

|

|

|

|

|

|

|

|

|

|

|

|

1,30,115 |

|

|

1,30,115 |

|

|

|

|

|

|

|

|

Profit and Loss A/c |

|||||

|

Dr. |

|

|

|

|

Cr. |

|

Particulars |

|

Rs. |

Particulars |

|

Rs. |

|

To Salary |

25,470 |

|

By Gross Profit b/d |

|

29,760 |

|

Add: Outstanding Salary |

20 |

25,490 |

By Commission |

|

1,575 |

|

To Insurance Premium |

|

2,700 |

By Interest |

|

7,425 |

|

To Rent and Taxes |

|

2,160 |

By Interest on Drawings |

|

977 |

|

To Carriage Outwards |

|

1,485 |

By Net Loss c/d |

|

8,973 |

|

To General Expenses |

|

6,975 |

|

|

|

|

To Interest on Capital |

|

6,750 |

|

|

|

|

To Depreciation on P and M |

|

1,350 |

|

|

|

|

To Provision on Debtors |

|

1,800 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

48,710 |

|

|

48,710 |

|

|

|

|

|

|

|

|

Balance Sheet |

|||||

|

Liabilities |

Rs. |

Assets |

Rs. |

||

|

Capital |

67,500 |

||||

|

Add: Interest on Capital |

6,750 |

Plant and machinery |

27,000 |

||

|

Less: Net Loss |

(8,973) |

Less: Depreciation |

(1,350) |

25,650 |

|

|

Less: Drawings |

(19,530) |

Furniture |

6,750 |

||

|

Less: Interest on drawings |

(977) |

44,770 |

Debtors |

36,000 |

|

|

Less: 5% Provision |

(1,800) |

34,200 |

|||

|

Bank Overdraft |

24,660 |

Investment |

41,400 |

||

|

Creditors |

58,500 |

Closing Stock |

20,000 |

||

|

Outstanding wages |

50 |

||||

|

Salary Outstanding |

20 |

||||

|

1,28,000 |

1,28,000 |

||||

Solution NUM 14

|

Profit and Loss A/c (Extract) |

||||||

|

Dr. |

Cr. |

|||||

|

Particulars |

Rs. |

Particulars |

Rs. |

|||

|

To Bad Debts |

500 |

|

||||

|

Add: Further Bad Debts |

300 |

|||||

|

Add: New Provision |

3,020 |

|||||

|

Less: Old Provision |

(2,000) |

1,820 |

||||

|

Balance Sheet (Extract) |

|||||

|

Liabilities |

Rs. |

Assets |

Rs. |

||

|

Debtors |

30,500 |

||||

|

Less: Further Bad Debts |

(300) |

|

|||

|

Less: New Provision |

(3,020) |

27,180 |

|||

|

Debtors A/c |

||||||

|

Dr. |

Cr. |

|||||

|

Date |

Particulars |

Rs. |

Date |

Particulars |

Rs. |

|

|

2017 |

2017 |

|||||

|

31st Mar |

To Balance b/d |

30,500 |

31st Mar |

By Further Bad Debts A/c |

300 |

|

|

|

|

|

31st Mar |

By Provision for Doubtful Debts A/c |

3,020 |

|

|

|

|

|

31st Mar |

By Balance c/d |

27,180 |

|

|

|

|

|

|

|

||

|

|

|

30,500 |

|

30,500 |

||

|

|

|

|

||||

|

Bad Debts A/c |

|||||

|

Dr. |

Cr. |

||||

|

Date |

Particulars |

Rs. |

Date |

Particulars |

Rs. |

|

2017 |

2017 |

||||

|

31st Mar |

To Balance b/d |

500 |

31st Mar |

By Provision for Doubtful Debts A/c |

800 |

|

31st Mar |

To Sundry Debtors A/c |

300 |

|||

|

|

|

800 |

|

800 |

|

|

Provision for Doubtful Debts A/c |

||||||

|

Dr. |

Cr. |

|||||

|

Date |

Particulars |

Rs. |

Date |

Particulars |

Rs. |

|

|

2017 |

2017 |

|||||

|

31st Mar |

To Bad debts A/c |

800 |

1st April |

By Balance b/d (Old P.) |

2,000 |

|

|

31st Mar |

To Balance b/d (New P.) |

3,020 |

1st April |

By Profit and loss A/c (Bal. fig.) |

1,820 |

|

|

|

|

|

||||

|

3,820 |

3,820 |

|||||

Financial Statements Exercise 424

Solution NUM 15

|

Profit and Loss A/c |

||||||

|

Dr. |

Cr. |

|||||

|

Particulars |

Rs. |

Particulars |

Rs. |

|||

|

To Bad Debts A/c |

2,000 |

|

By Old Provision for Doubtful Debts |

5,000 |

||

|

Add: Further Bad Debts |

500 |

|

||||

|

Add: New Provision for Bad Debts |

2,385 |

4,885 |

|

|||

|

|

|

|

|

|||

|

To Provision for Bad Debts (Bal. fig.) |

|

115 |

|

|

||

|

|

|

|

|

|||

|

|

|

5,000 |

|

5,000 |

||

|

|

|

|

|

|

|

|

|

Balance Sheet (Extract) |

|||||

|

Liabilities |

Rs. |

Assets |

Rs. |

||

|

|

|

Debtors |

80,000 |

|

|

|

|

|

Less: Further Bad Debts |

(500) |

|

|

|

|

|

Less: New Provision on Debtors |

(2,385) |

77,115 |

|

|

Bad Debts A/c |

||||||||

|

Dr. |

Cr. |

|||||||

|

Date |

Particulars |

Rs. |

Date |

Particulars |

Rs. |

|||

|

2017 |

2017 |

|||||||

|

31st Mar |

To Balance b/d |

2,000 |

31st Mar |

By Provision for Doubtful Debts A/c |

2,500 |

|||

|

31st Mar |

To Sundry Debtors A/c |

500 |

|

|

||||

|

|

|

2,500 |

|

2,500 |

||||

|

|

|

|

||||||

|

Provision for Bad Debts A/c |

|||||||

|

Dr. |

Cr. |

||||||

|

Date |

Particulars |

Rs. |

Date |

Particulars |

Rs. |

||

|

2017 |

2017 |

||||||

|

31st Mar |

To Bad Debts A/c |

2,500 |

31st Mar |

By Balance b/d (Old P.) |

5,000 |

||

|

|

|

|

|||||

|

31st Mar |

To Balance b/d (New P.) |

2,385 |

|||||

|

31st Mar |

To Profit and loss A/c (bal. fig.) |

115 |

|||||

|

|

|

||||||

|

|

|

||||||

|

|

|

5,000 |

|

5,000 |

|||

|

|

|

|

|||||

Note: In this case, the old provision exceeds the sum total of bad debts and the new provision.

There, the balancing figure is Rs.115 and is calculated as Rs.2,500 + Rs.2,385 - Rs.5,000 = Rs.115