Class 11-commerce NCERT Solutions Accountancy Part I Chapter 4: Recording of Transactions - II

Recording of Transactions - II Exercise 152

Solution SA 1

Transactions are recorded directly from source documents in the cash book, so there is no need to record transactions in the journal book. Further, on the basis of the cash transactions recorded in the cash book, cash and bank balances can be determined, and so there is no need to prepare cash account (which is a part of ledger) separately. Thus, the cash book serves the purpose of both journal as well as ledger.

The need to record transactions in the journal book ceased to exist as the transactions are recorded directly from source documents in the cash book. A ledger is simply a collection of credit/debit and balances. However, in a cash book, cash and transactions can be determined just on the basis of cash transactions recorded in it. Thus, the cash book serves the purpose of both journal and a ledger.

Solution SA 2

The cash deposits or withdrawals from bank i.e. transactions recorded both on the credit and the debit side can be termed as a contra entry. Transactions which effect both cash and bank balances are indicated by the contra entry. The transactions are recorded in the bank column on the receipt side (Dr.) side and in the cash column on the payment (Cr.) side, on the day of the deposit to the bank. A contra entry is denoted by 'C' in the ledger folio column.

Solution SA 3

All the transactions relating to any small business can be recorded in one book or a journal. However, as the business expands, recording each and every transaction can be a Herculean task, To simplify it, the journals were divided into special journals or special purpose books. Following were the special purpose books:

i. Cash book

ii. Purchases book

iii. Purchases return book

iv. Sales book

v. Sales return book

vi. Journal proper

These special purpose books made accounting work easier and economical.

Solution SA 4

Every organisation needs to keep a record of even the smallest expenses such as on telegrams, postage, conveyance and few others. Such kind of expenses may also be termed as petty expenses. Large organisations, who want to minimise the burden on the accounting, apart from their cashier, appoints petty cashier to maintain a record of the petty expenses. These petty expenses are recorded in the petty cash book which is maintained by the petty cashier.

A petty cash book may be maintained by ordinary system or by imprest system are as follows:

- A petty cash book is prepared using the ordinary system. In this, petty cashier is given an appropriate amount of cash and after spending the whole amount, he submits the accounts to the cashier.

- A petty cash book is prepared using the imprest system. In this, an imprest amount, a fixed amount is given to the cashier at the start of a certain period. This imprest amount is used up to make the small payments. By the end of the period, the cashier gets a reimbursement for the amount paid. Thus, the cashier will have a full imprest amount at the start of the next period.

Solution SA 5

Posting is the process of transferring the business transactions from cash book/journal to ledgers.

All the transactions are first recorded in the journal and subsequently transferred to their respective accounts.

Solution SA 6

All the transactions relating to any small business can be recorded in one book or a journal. However, as the business expands, recording each and every transaction through journal entry can be a Herculean task, To simplify and in order to save time and effort, the journals were divided into special journals or special purpose books. These special purpose books infused higher degree of accountability to the accountants for the specific subsidiary journal assigned to them and made it easier, economical.

Subsidiary journals are, thus, maintained for the following purposes:

- Work is divided to enhance efficiency and effectiveness

- Saves time and efforts while recording the transactions

- Records transactions of similar nature

Solution SA 7

|

Return Inwards |

Return Outwards |

|

Goods sold to the customers, are returned by them. |

Goods purchased are returned to the suppliers. |

|

It has debit balance. |

It has credit balance. |

|

It is deducted from sales in the trading account. |

It is deducted from purchases in the trading account. |

|

Credit note is prepared by the seller. |

Debit note is prepared by the buyer. |

|

It reduces the payment from the debtors. |

It reduces the payment made to the creditors. |

|

It is also termed as sales returns. |

It is also termed as purchases returns. |

Solution SA 8

All the transactions recorded in the journal and is later transferred to a ledger. A ledger has each page or folio pointing to different account number. This ledger folio number corresponding to that account is then entered in the folio column in the journal. This helps in easily locating the account in the ledger. This ensures that all entries are posted and thus saves time in rechecking and recording.

Solution SA 9

|

Trade Discount |

Cash Discount |

|

It is allowed when goods are purchased or sold. |

It is allowed at the time of payment. |

|

It is recorded in a invoice/bill but not in the books. |

It is recorded in the discount column of the Cash Book's debit side, if allowed, and credit side, if received. |

|

It is allowed to increase sale. |

It is allowed for earlier payment. |

|

It is deducted from the price-list of the goods. |

It is not deducted from the price-list of the goods. |

Solution SA 10

The process of preparing ledger from Journal can be explained with the help of an example. Let us suppose that machinery is purchased from Mr. X, so, the journal entry will be:

|

Machinery A/c |

Dr. |

35,000 |

|

|

To Mr. X Account |

|

|

35,000 |

In this example, Machinery Account is debited and Mr. X Account is credited. Let us understand the process of preparing ledger from the journal entry.

Account which is debited in the entry:

Step 1: Identify the account in ledger that is debited, i.e., 'Machinery Account'.

Step 2: Enter date in the debit side of the 'Machinery Account' in the 'Date' column.

Step 3: Enter the name of the account as 'Mr. X Account' (which is credited in the entry) in the 'Particulars' column in the debit side of the Machinery Account.

Step 4: Enter the page number of the journal, where the entry is recorded in the 'J.F.' (journal folio) column.

Step 5: Post the corresponding amount in the 'Amount' column, which is recorded against 'Machinery Account' in the journal entry.

Account which is credited in entry:

Step 1: Identify the account in ledger that is credited, i.e., 'Mr. X Account'.

Step 2: Enter date in the credit side of 'Mr. X Account' in the 'Date' column.

Step 3: Enter the name of the account as 'Machinery Account' (which is debited in the entry) in the 'Particulars' column in the credit side of the 'Machinery Account'.

Step 4: Enter the page number of the journal where the entry is recorded in the 'J.F.' (journal folio) column.

Step 5: Post the corresponding amount in the 'Amount' column, which is recorded against 'Mr. X Account' in the journal entry.

Solution SA 11

A petty cash book is prepared using the imprest system. In this, an imprest amount, a fixed amount is given to the cashier at the start of a certain period. This imprest amount is used up to make the small payments. By the end of the period, the cashier gets a reimbursement for the amount paid. Thus, the cashier will have a full imprest amount at the start of the next period.

For example, if the main cashier gives an imprest amount of Rs.3000 to the petty cashier on May 01, 2014 and at the end of the month the petty expenses amount spent by the petty cashier sums up to be Rs.2500. In this case, Rs.2500 will be reimbursed, so, that on June 01, 2014, the petty cashier will have Rs.3,000 at his disposable to meet petty expenses for the next month.

Solution LA 1

The need for drawing up the special purpose book is given below:

- Easy posting of similar natured transactions: Posting becomes a lot easier if we are able to record similar transactions at one place as most of the businesses have similar and repetitive transactions.

- Comprehensive information at one place: All transaction information related to purchases, sales, cash receipts and payments are easily available and is hassle-free.

- Quick and efficient recording: It is a time consuming process to record all the transactions in a journal. If there are separate books, then recording of transactions can be done more efficiently and timely. So, the need of special purpose book arises.

- Economical: It is more economical as recording through the special purpose books saves time and also enhances the efficiency of accountants and clerks.

Solution LA 2

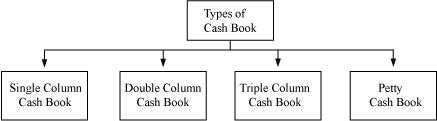

Cash book is a book of original entry which it records all transactions related to payments of cash, receipts and deposits in and withdrawals from a bank on a monthly basis. Cash book also serves the purpose of both journal and a ledger.

- Single Column Cash Book: A single column cash book contains one column of amount on both sides i.e. one in the debit side and other on the credit side. In this, cash transactions are recorded in a chronological order. All cash receipts are recorded on the debit side of the cash book, while side all cash payments are recorded on the credit side.

- Double Column Cash Book: A double column cash book contains two columns of amount, namely cash column and bank column on both sides. On the left side, the payments to the bank were recorded and the right side had all the payments/withdrawals from the bank.

Cash Book

|

Dr. |

|

|

|

|

|

|

|

|

Cr. |

|

Date |

Particulars |

L.F. |

Cash Rs. |

Bank Rs. |

Date |

Particular |

L.F. |

Cash Rs. |

Bank Rs. |

|

|

|

|

|

|

|

|

|

|

|

- Triple Column Cash Book: In a triple column Cash Book, there are three columns of amount namely, cash, bank and discount. Discount allowed and discount received are recorded in the discount column. While in the debit side, discount allowed is recorded along with the receipts, either in cash or through cheque; whereas, in the credit side, discount received is recorded, along with the payments made either in cash or by issuing cheques.

- Petty Cash Book: Large organisations, who want to minimise the burden on the accounting, apart from their cashier, appoints petty cashier to maintain a record of the petty expenses. These petty expenses are recorded in the petty cash book which is maintained by the petty cashier.

Solution LA 3

The cash deposits or withdrawals from bank i.e. transactions recorded both on the credit and the debit side can be termed as a contra entry. Transactions which effect both cash and bank balances are indicated by the contra entry. The transactions are recorded/showed in the bank column on the receipt side (Dr.) and in the cash column on the payment (Cr.) side, on the day of the deposit to the bank. A contra entry is denoted by 'C' in the ledger folio column.

For example, Rs.500 cash was deposited into the bank. This transaction increases the bank amount on one hand and on the other hand, reduces the cash balance. In this entry, on the debit side of the cash book, 'Cash' will be recorded with a balance of Rs.500 in the bank column and on the credit side of the cash book, 'Bank' will be recorded with a balance of Rs.500 in the cash column. This entry is a contra entry as it affects both cash and bank balance together. The contra entries are denoted by 'C'.

Some transactions which lead to contra entry are given below.

- Opening a bank account

- Depositing cash into bank

- Withdrawal from bank

These transactions are recorded in a double column Cash Book as given below.

|

Dr. |

|

|

|

|

|

|

|

|

Cr. |

|

Date |

Particulars |

L.F. |

Cash Rs. |

Bank Rs. |

Date |

Particulars |

L.F. |

Cash Rs. |

Bank Rs. |

|

|

|

|

|

|

|

|

|

|

|

Recording of Transactions - II Exercise 153

Solution LA 4

Every organisation needs to keep a record of even the smallest expenses such as on telegrams, postage, conveyance and few others. Such kind of expenses may also be termed as petty expenses. Large organisations, who want to minimise the burden on the accounting, apart from their cashier, appoints petty cashier to maintain a record of the petty expenses. These petty expenses are recorded in the petty cash book which is maintained by the petty cashier.

A petty cash book is prepared using the imprest system. In this, an imprest amount, a fixed amount is given to the cashier at the start of a certain period. This imprest amount is used up to make the small payments. By the end of the period, the cashier gets a reimbursement for the amount paid. Thus, the cashier will have a full imprest amount at the start of the next period.

The performance of petty cash book is given below.

Petty Cash book

|

Receipts Rs. |

Date |

V. No.

|

Particulars |

Total Payment Rs. |

Analysis of Payments |

|||

|

|

|

|

|

|

Stationery |

Conveyance |

Telephone and Telegram |

Miscellaneous |

Advantages of Petty Cash Book:

- Error free and control efficiency: All the recorded transactions are audited at the end of the period by the main cashier.

- Saves time: Saves time of the main cashier in recording the transactions.

- Easy posting: Entries are recorded under separate headings, which makes posting easier and quicker.

Solution LA 5

All the transactions relating to any small business can be recorded in one book or a journal. However, as the business expands, recording each and every transaction through journal entry can be a Herculean task, To simplify and in order to save time and effort, the journals were divided into special journals or special purpose books. These special purpose books infused higher degree of accountability to the accountants for the specific subsidiary journal assigned to them and made it easier and economical.

The advantages of sub-division of journal are:

- Work divided to enhance efficiency and effectiveness: If there is large number of transactions, multiple entries are to be entered into the journal which will be a tough task. Sub-dividing the journals will be flexible and will enable different accountants to work on different books at a time.

- Sense of accountability: These special purpose books infuse higher degree of accountability to the accountants for the specific subsidiary journal assigned to them.

- Saves time and efforts: The subsidiary books were brought in place in order to reduce an accountant's time spent on gathering and recording transactions all together in a single journal. Here, work and the journals are divided so as to save time and efforts.

- Records transactions of similar nature: Special purpose books are assigned to record transactions of similar nature so as to get a ready and easy access to such information. Also, any information regarding any transactions can be easily located in a subsidiary book as compared to a journal.

Solution LA 6

At the end of each accounting period, quarterly, monthly, weekly or fortnightly, the net effect of each amount in the accounts specified in the ledger are balanced and calculated. When the two sides, the credit and the debit, are balanced, it is termed as balancing of an account. The difference between the two sides is calculated and the side which is falling short of reaching the total is mentioned. 'Balance c/d' is written against the difference amount which will be written on the debit side, if the credit exceeds the debit, known as credit balance and 'Balance b/d' on the credit side, if the debit exceeds the credit, known as debit balance.

Solution NUM 1

CASH BOOK

|

Dr. |

|

|

|

|

|

|

Cr. |

|

Date |

Receipts |

L.F. |

Amount Rs. |

Date |

Payments |

L.F. |

Amount Rs. |

|

2016 |

|

|

|

2016 |

|

|

|

|

Dec 01 |

To Balance b/d |

|

12,000 |

Dec 07 |

By Rent A/c |

|

2,000 |

|

Dec 05 |

To Bhanu A/c |

|

4,000 |

Dec 10 |

By Purchases A/c |

|

6,000 |

|

Dec 15 |

To Sales A/c |

|

9,000 |

Dec 18 |

By Stationery A/c |

|

300 |

|

|

|

|

|

Dec 22 |

By Rahul A/c |

|

2,000 |

|

|

|

|

|

Dec 28 |

By Salary A/c |

|

1,000 |

|

|

|

|

|

Dec 30 |

By Rent A/c |

|

500 |

|

|

|

|

|

Dec 31 |

By Balance c/d |

|

13,200 |

|

|

|

|

25,000 |

|

|

|

25,000 |

|

2017 |

|

|

|

2017 |

|

|

|

|

Jan 1 |

To Balance b/d |

|

13,200 |

|

|

|

|

Solution NUM 2

CASH BOOK

|

Dr. |

|

|

|

|

|

|

Cr. |

|

Date |

Receipts |

L.F. |

Amount Rs. |

Date |

Payments |

L.F. |

Amount Rs. |

|

2016 |

|

|

|

2016 |

|

|

|

|

Nov 01 |

To Balance b/d |

|

12,500 |

Nov 04 |

By Hari A/c |

|

600 |

|

Nov 12 |

To Amit A/c |

|

1,960 |

Nov 07 |

By Purchases A/c |

|

800 |

|

Nov 16 |

To Sales A/c |

|

800 |

Nov 20 |

By Manish A/c |

|

590 |

|

|

|

|

|

Nov 25 |

By Cartage A/c |

|

100 |

|

|

|

|

|

Nov 30 |

By Salary A/c |

|

1,000 |

|

|

|

|

|

Nov 30 |

By Balance c/d |

|

12,170 |

|

|

|

|

15,260 |

|

|

|

15,260 |

|

Dec 1 |

To Balance b/d |

|

12,170 |

|

|

|

|

Solution NUM 3

CASH BOOK

|

Dr. |

|

|

|

|

|

|

Cr. |

|

Date |

Receipts |

L.F. |

Amount Rs. |

Date |

Payments |

L.F. |

Amount Rs. |

|

2017 |

|

|

|

2017 |

|

|

|

|

Dec 01 |

To Balance b/d |

|

7,750 |

Dec 04 |

By Sonu A/c |

|

45 |

|

Dec 15 |

To Prakash A/c |

|

960 |

Dec 08 |

By Purchases A/c |

|

600 |

|

Dec 20 |

To Sales A/c |

|

500 |

Dec 25 |

By S. Kumar A/c |

|

1,200 |

|

|

|

|

|

Dec 30 |

By Rent A/c |

|

600 |

|

|

|

|

|

Dec 31 |

By Balance c/d |

|

6,765 |

|

|

|

|

9,210 |

|

|

|

9,210 |

|

2018 |

|

|

|

2018 |

|

|

|

|

Jan 1 |

To Balance b/d |

|

6,765 |

|

|

|

|

Solution NUM 4

CASH BOOK

|

Dr. |

|

|

|

|

|

|

|

|

Cr. |

|

Date |

Particulars |

L.F. |

Cash |

Bank |

Date |

Particulars |

L.F. |

Cash |

Bank |

|

2016 |

|

|

|

|

2016 |

|

|

|

|

|

Dec 01 |

To Capital A/c |

|

80,000 |

|

Dec 04 |

By Bank A/c |

C |

50,000 |

|

|

Dec 04 |

To Cash A/c |

C |

|

50,000 |

Dec 15 |

By Purchases A/c |

|

8,000 |

|

|

Dec 10 |

To Rahul A/c |

|

1,000 |

|

Dec 22 |

By Purchases A/c |

|

|

10,000 |

|

Dec 30 |

To Bank A/c |

C |

2,000 |

|

Dec 25 |

By Shyam A/c |

|

20,000 |

|

|

|

|

|

|

|

Dec 30 |

By Cash A/c |

C |

|

2,000 |

|

|

|

|

|

|

Dec 31 |

By Rent A/c |

|

|

1,000 |

|

|

|

|

|

|

Dec 31 |

By Balance c/d |

|

5,000 |

37,000 |

|

|

|

|

83,000 |

50,000 |

|

|

|

83,000 |

50,000 |

|

2017 |

|

|

|

|

2017 |

|

|

|

|

|

Jan 1 |

To Balance b/d |

|

5,000 |

37,000 |

|

|

|

|

|

Recording of Transactions - II Exercise 154

Solution NUM 5

CASH BOOK

|

Dr. |

|

|

|

|

|

|

|

|

Cr. |

|

Date |

Particulars |

L.F. |

Cash |

Bank |

Date |

Particulars |

L.F. |

Cash |

Bank |

|

2016 |

|

|

|

|

2016 |

|

|

|

|

|

Dec 01 |

To Capital A/c |

|

1,20,000 |

|

Dec 03 |

By Bank A/c |

C |

50,000 |

|

|

Dec 03 |

To Cash A/c |

C |

|

50,000 |

Dec 10 |

By Sushmita A/c |

|

20,000 |

|

|

Dec 06 |

To Dinker A/c |

|

20,000 |

|

Dec 14 |

By Bank A/c |

C |

20,000 |

|

|

Dec 14 |

To Cash A/c |

C |

|

20,000 |

Dec 20 |

By Cartage A/c |

|

500 |

|

|

Dec 22 |

To Rani A/c |

|

12,000 |

|

Dec 30 |

By Drawings A/c |

|

2000 |

|

|

Dec 27 |

To Commission A/c |

|

5,000 |

|

Dec 31 |

By Balance b/d |

|

64,500 |

70,000 |

|

|

|

|

1,57,000 |

70,000 |

|

|

|

1,57,000 |

70,000 |

|

2017 |

|

|

|

|

2017 |

|

|

|

|

|

Jan 1 |

To Balance b/d |

|

64,500 |

70,000 |

|

|

|

|

|

Solution NUM 6

M/s Ambika Traders

CASH BOOK

|

Dr. |

|

|

|

|

|

|

|

|

Cr. |

|

Date |

Particulars |

L.F. |

Cash |

Bank |

Date |

Particulars |

L.F. |

Cash |

Bank |

|

2017 |

|

|

|

|

2017 |

|

|

|

|

|

Jul 01 |

To Capital A/c |

|

50,000 |

|

Jul 03 |

By Bank A/c |

C |

30,000 |

|

|

Jul 03 |

To Cash A/c |

C |

|

30,000 |

Jul 05 |

By Purchases A/c |

|

10,000 |

|

|

Jul 15 |

To Rohan A/c |

|

7,000 |

|

Jul 10 |

By Office Machine A/c |

|

5,000 |

|

|

Jul 18 |

To Sales A/c |

|

8,000 |

|

Jul 20 |

By Bank A/c |

C |

7,000 |

|

|

Jul 20 |

To Cash A/c |

C |

|

7,000 |

Jul 22 |

By Cartage A/c |

|

|

500 |

|

|

|

|

|

|

Jul 25 |

By Drawings A/c |

|

2,000 |

|

|

|

|

|

|

|

Jul 30 |

By Rent A/c |

|

|

1,000 |

|

|

|

|

|

|

Jul 30 |

By Balance c/d |

|

11,000 |

35,500 |

|

|

|

|

65,000 |

37,000 |

|

|

|

65,000 |

37,000 |

|

Aug 1 |

To Balance b/d |

|

11,000 |

35,500 |

|

|

|

|

|

Solution NUM 7

CASH BOOK

|

Dr. |

|

|

|

|

|

|

|

|

Cr. |

|

Date |

Particulars |

L.F. |

Cash |

Bank |

Date |

Particulars |

L.F. |

Cash |

Bank |

|

2017 |

|

|

|

|

2017 |

|

|

|

|

|

Jul 01 |

To Balance b/d |

|

7,500 |

|

Jul 01 |

By Balance b/d (Overdraft) |

|

|

3,500 |

|

Jul 05 |

To Sales A/c |

|

7,000 |

|

Jul 03 |

By Wages A/c |

|

200 |

|

|

Jul 10 |

To Cash A/c |

C |

|

4,000 |

Jul 10 |

By Bank A/c |

C |

4,000 |

|

|

|

|

|

|

|

Jul 15 |

By Purchases A/c |

|

|

2,000 |

|

|

|

|

|

|

Jul 20 |

By Rent A/c |

|

500 |

|

|

|

|

|

|

|

Jul 25 |

By Drawings A/c |

|

|

400 |

|

|

|

|

|

|

Jul 30 |

By Salaries A/c |

|

1,000 |

|

|

Jul 30 |

To Balance c/d (overdraft) |

|

|

1,900 |

Jul 30 |

Balance c/d |

|

8,800 |

|

|

|

|

|

14,500 |

5,900 |

|

|

|

14,500 |

5,900 |

|

Aug 1 |

To Balance b/d |

|

8,800 |

|

Aug 1 |

By Balance b/d (Overdraft) |

|

|

1,900 |

Recording of Transactions - II Exercise 155

Solution NUM 8

CASH BOOK

|

Dr. |

|

|

|

|

|

|

|

|

Cr. |

|

Date |

Particular |

L.F. |

Cash |

Bank |

Date |

Particular |

L.F. |

Cash |

Bank |

|

2017 |

|

|

|

|

2017 |

|

|

|

|

|

Jan 01 |

To Balance b/d |

|

3,500 |

|

Jan 01 |

By Balance b/d |

|

|

2,300 |

|

Jan 10 |

To Sales A/c |

|

8,000 |

|

Jan 03 |

By Purchases A/c |

|

1,200 |

|

|

Jan 15 |

To Cash A/c |

C |

|

6,000 |

Jan 05 |

By Wages A/c |

|

200 |

|

|

Jan 22 |

To Sales A/c |

|

|

2,000 |

Jan 15 |

By Bank A/c |

C |

6,000 |

|

|

|

|

|

|

|

Jan 25 |

By Rent A/c |

|

|

1,200 |

|

|

|

|

|

|

Jan 28 |

By Drawings A/c |

|

|

1,000 |

|

|

|

|

|

|

Jan 31 |

By Purchases A/c |

|

|

1,000 |

|

|

|

|

|

|

Jan 31 |

By Balance c/d |

|

4,100 |

2,500 |

|

|

|

|

11,500 |

8,000 |

|

|

|

11,500 |

8,000 |

|

Feb 1 |

To Balance b/d |

|

4,100 |

2,500 |

|

|

|

|

|

Solution NUM 9

CASH BOOK

|

Dr. |

|

|

|

|

|

|

|

|

Cr. |

|

Date |

Particulars |

L.F. |

Cash |

Bank |

Date |

Particulars |

L.F. |

Cash |

Bank |

|

2017 |

|

|

|

|

2017 |

|

|

|

|

|

Aug 01 |

To Balance c/d |

|

17,500 |

5,000 |

Aug 03 |

By Purchases A/c |

|

3,000 |

|

|

Aug 08 |

To Sales A/c |

|

7,000 |

|

Aug 12 |

By Purchases A/c |

|

|

20,000 |

|

Aug 10 |

To Cheque in hand A/c (Jasmeet) |

|

|

10,000 |

Aug 15 |

By Establishment Expenses A/c |

|

|

1,000 |

|

Aug 18 |

To Sales A/c |

|

7,000 |

|

Aug 20 |

By Bank A/c |

C |

10,000 |

|

|

Aug 20 |

To Cash A/c |

C |

|

10,000 |

Aug 24 |

By Trade Expenses A/c |

|

500 |

|

|

Aug 27 |

To Commission A/c |

|

|

6,000 |

Aug 29 |

By Rent A/c |

|

2,000 |

|

|

|

|

|

|

|

Aug 30 |

By Drawings A/c |

|

1,200 |

|

|

|

|

|

|

|

Aug 31 |

By Salaries A/c |

|

6,000 |

|

|

|

|

|

|

|

Aug 31 |

By Balance c/d |

|

8,800 |

10,000 |

|

|

|

|

31,500 |

31,000 |

|

|

|

31,500 |

31,000 |

|

2017 |

|

|

|

|

2017 |

|

|

|

|

|

Sept 1 |

To Balance b/d |

|

8,800 |

10,000 |

|

|

|

|

|

Note:

Cheque received from Jasmeet on 5th August, 2017 will be recorded in Journal Proper:

|

|

|

Rs. |

Rs. |

|

Cheque in Hand A/c |

Dr. |

10,000 |

|

|

To Jasmeet A/c |

|

|

10,000 |

|

(Being cheque received from Jasmeet not yet deposited) |

|

|

|

When the above cheque is deposited into bank (i.e., 10th August, 2017) it will be recorded in debit column of Bank.

Solution NUM 10

M/s Ruchi Traders

CASH BOOK

|

Dr. |

|

|

|

|

|

|

|

|

Cr. |

|

Date |

Particulars |

L.F. |

Cash Rs. |

Bank Rs. |

Date |

Particular |

L.F. |

Cash Rs. |

Bank Rs. |

|

2017 |

|

|

|

|

2017 |

|

|

|

|

|

Jul 01 |

To Balance b/d |

|

1,354 |

7,560 |

Jul 05 |

By Purchases A/c |

|

|

6,000 |

|

Jul 03 |

To Sales A/c |

|

2,300 |

|

Jul 12 |

By Trade expenses A/c |

|

700 |

|

|

Jul 08 |

To Sales A/c |

|

10,000 |

|

Jul 18 |

By Motor car A/c |

|

|

15,000 |

|

Jul 15 |

To Sales A/c |

|

|

20,000 |

Jul 25 |

By Manisha A/c (Dishonoured) |

|

|

10,000 |

|

Jul 20 |

To Manisha A/c |

|

|

10,000 |

Jul 28 |

By Rent A/c |

|

2,000 |

|

|

Jul 22 |

To Sales A/c |

|

7,000 |

|

Jul 29 |

By Telephone Expenses A/c |

|

|

500 |

|

|

|

|

|

|

Jul 31 |

By Drawings A/c |

|

2,000 |

|

|

|

|

|

|

|

Jul 31 |

By Balance c/d |

|

15,954 |

6,060 |

|

|

|

|

20,654 |

37,560 |

|

|

|

20,654 |

37,560 |

|

2017 |

|

|

|

|

2017 |

|

|

|

|

|

Aug 1 |

To Balance b/d |

|

15,954 |

6,060 |

|

|

|

|

|

Recording of Transactions - II Exercise 156

Solution NUM 11

Petty Cash Book

|

Amount Received Rs. |

Date |

Particulars |

Voucher No. |

Amount Paid Rs. |

Analysis of Payments |

|||||

|

Telephone and Telegram |

Postage |

Conveyance |

Refreshment |

Cartage |

Miscellaneous |

|||||

|

2,000 |

Jan 01 |

To Cash A/c |

|

|

|

|

|

|

|

|

|

|

Jan 01 |

By Cartage A/c |

|

50 |

|

|

|

|

50 |

|

|

|

Jan 02 |

By STD charges A/c |

|

40 |

40 |

|

|

|

|

|

|

|

Jan 02 |

By Bus fare A/c |

|

20 |

|

|

20 |

|

|

|

|

|

Jan 03 |

By Postage A/c |

|

30 |

|

30 |

|

|

|

|

|

|

Jan 04 |

By Refreshment for employees A/c |

|

80 |

|

|

|

80 |

|

|

|

|

Jan 06 |

By Courier charges A/c |

|

30 |

|

30 |

|

|

|

|

|

|

Jan 08 |

By Refreshment of customer A/c |

|

50 |

|

|

|

50 |

|

|

|

|

Jan 10 |

By Cartage A/c |

|

35 |

|

|

|

|

35 |

|

|

|

Jan 15 |

By Taxi fare to manager A/c |

|

70 |

|

|

70 |

|

|

|

|

|

Jan 18 |

By Stationery A/c |

|

65 |

|

|

|

|

|

65 |

|

|

Jan 20 |

By Bus fare A/c |

|

10 |

|

|

10 |

|

|

|

|

|

Jan 22 |

By Fax Charges A/c |

|

30 |

30 |

|

|

|

|

|

|

|

Jan 25 |

By Telegrams charges A/c |

|

35 |

35 |

|

|

|

|

|

|

|

Jan 27 |

By Postage Stamps A/c |

|

200 |

|

200 |

|

|

|

|

|

|

Jan 29 |

By Repairs on Furniture A/c |

|

105 |

|

|

|

|

|

105 |

|

|

Jan 30 |

By Laundry expenses A/c |

|

115 |

|

|

|

|

|

115 |

|

|

Jan 31 |

By Miscellaneous expenses A/c |

|

100 |

|

|

|

|

|

100 |

|

|

|

|

|

1,065 |

105 |

260 |

100 |

130 |

85 |

385 |

|

|

Jan 31 |

By Balance c/d |

|

935 |

|

|

|

|

|

|

|

2,000 |

|

|

|

2,000 |

|

|

|

|

|

|

|

935 |

Feb 01 |

To Balance b/d |

|

|

|

|

|

|

|

|

|

1,065 |

Feb 02 |

To Cash A/c |

|

|

|

|

|

|

|

|

Solution NUM 12

Petty Cash Book

|

Amount received Rs. |

Date |

Particulars |

Voucher No. |

Amount paid |

Analysis of payments |

||||

|

Stationery |

Conveyance |

Cartage |

Postage |

miscellaneous |

|||||

|

|

2017 |

|

|

|

|

|

|

|

|

|

500 |

Jan 24 |

To Cash A/c |

|

|

|

|

|

|

|

|

|

Jan 24 |

By Stationery A/c |

|

100 |

100 |

|

|

|

|

|

|

Jan 25 |

By Bus fare A/c |

|

12 |

|

12 |

|

|

|

|

|

Jan 25 |

By Cartage A/c |

|

40 |

|

|

40 |

|

|

|

|

Jan 26 |

By Taxi fare A/c |

|

80 |

|

80 |

|

|

|

|

|

Jan 27 |

By Wages to casual labour A/c |

|

90 |

|

|

|

|

90 |

|

|

Jan 29 |

By Postage A/c |

|

80 |

|

|

|

80 |

|

|

|

|

|

|

402 |

100 |

92 |

40 |

80 |

90 |

|

|

Jan 30 |

By Balance c/d |

|

98 |

|

|

|

|

|

|

500 |

2017 |

|

|

500 |

|

|

|

|

|

|

98 |

Jan 31 |

To Balance b/d |

|

|

|

|

|

|

|

|

402 |

Jan 31 |

To Cash A/c |

|

|

|

|

|

|

|

Solution NUM 13

Books of M/s. Gupta Traders

Purchases Book

|

Date |

Invoice No. |

Name of Supplier (Accounts to be credited) |

L.F. |

Details Rs. |

Amount Rs. |

|

2017 |

|

|

|

|

|

|

July 1 |

20041 |

Rahul Traders |

|

|

|

|

|

|

40 Registers @ Rs.60 each |

|

2,400 |

|

|

|

|

80 Gel Pens @ Rs.15 each |

|

1,200 |

|

|

|

|

50 Note books @ Rs.20 each |

|

1,000 |

|

|

|

|

|

|

4,600 |

|

|

|

|

Less: Trade discount 10% |

|

460 |

4,140 |

|

|

|

|

|

|

|

|

July 15 |

1132 |

Global Stationers |

|

|

|

|

|

|

40 Ink Pads @ Rs.8 each |

|

320 |

|

|

|

|

50 Files @ Rs.10 each |

|

500 |

|

|

|

|

20 Colour Books @ Rs.20 each |

|

400 |

|

|

|

|

|

|

1,220 |

|

|

|

|

Less: Trade discount 5% |

|

61 |

1,159 |

|

|

|

|

|

|

|

|

July 25 |

1111 |

Mumbai Traders |

|

|

|

|

|

|

10 Paper Rim @ Rs.100 per rim |

|

1,000 |

|

|

|

|

400 Drawing Sheets @ Rs.3 each |

|

1,200 |

|

|

|

|

20 Packet water colour @ Rs.40 per packet |

|

800 |

3,000 |

|

July 31 |

|

Purchases A/c Dr. |

|

|

8,299 |

Note:

Purchase of Furniture from Lamba Furniture is not recorded in Purchase Book as furniture is not considered goods for M/s Gupta Traders. According to transactions M/s Gupta Traders deal in stationery and not in furniture.

Recording of Transactions - II Exercise 157

Solution NUM 14

Books of M/s. Bansal Electronics

Sales book

|

Date |

Invoice No. |

Name of Customers (Accounts to be Debited ) |

L.F. |

Details |

Amount Rs. |

|

2014 |

|

|

|

|

|

|

Sept 1 |

4321 |

Amit Traders |

|

|

|

|

|

|

20 Pocket Radio @70 per radio. |

|

1,400 |

|

|

|

|

2.T.V set, BandW (6'') @ Rs. 800 per T.V. |

|

1,600 |

3,000 |

|

|

|

|

|

|

|

|

Sept 10 |

4351 |

Arun Electronics |

|

|

|

|

|

|

5 T.V. sets (20'') BandW@ Rs.3,000 per T.V. |

|

15,000 |

|

|

|

|

2 T.V. sets (21'') colour @ Rs.4800 per T.V. |

|

9,600 |

24,600 |

|

|

|

|

|

|

|

|

Sept 22 |

4399 |

Handa Electronics |

|

|

|

|

|

|

10 Tape recorders @ Rs.600 each |

|

6,000 |

|

|

|

|

5 Walkman @ Rs.300 each |

|

1,500 |

7,500 |

|

|

|

|

|

|

|

|

Sept 28 |

4430 |

Harish Traders |

|

|

|

|

|

|

10 Mixer Juicer Grinder @ Rs.800 each |

|

8,000 |

8,000 |

|

Sept 30 |

|

Sales A/c Cr. |

|

|

43,100 |

Solution NUM 15

Purchases Return Book

|

Date |

Debit Note no. |

Name of Supplier (Account to be debited ) |

|

L.F. |

Amount Rs. |

|

2017 |

|

|

|

|

|

|

April 05 |

|

M/s Kartik Traders |

|

|

1,200 |

|

April 10 |

|

Sahil Pvt. Ltd. |

|

|

2,500 |

|

April 17 |

|

M/s Kohinoor Traders |

|

|

|

|

|

|

List Price |

2,000 |

|

|

|

|

|

Less: 10% Trade discount |

200 |

|

1,800 |

|

April 28 |

|

M/s Handa Traders |

|

|

550 |

|

|

|

|

|

|

|

|

April 31 |

|

Purchase Return A/c |

Cr. |

|

6,050 |

Recording of Transactions - II Exercise 158

Solution NUM 16

Books of M/s. Bansal Electronics

Sales Return Book

|

Date |

Credit Note no. |

Name of Customer (Account to be Credited ) |

L.F. |

Amount Rs. |

|

2017 |

|

|

|

|

|

July 04 |

|

M/s Gupta Traders |

|

1,500 |

|

July 10 |

|

M/s Harish Traders |

|

800 |

|

July 18 |

|

M/s Rahul Traders |

|

1,200 |

|

July 28 |

|

Sushil Traders |

|

1,000 |

|

July 30 |

|

Sales Return A/c Dr. |

|

4,500 |

Solution NUM 17

Journal

Purchases Book

|

Date |

Invoice No. |

Name of Supplier (Account to be credited) |

|

L.F. |

Amount Rs. |

|

2017 |

|

|

|

|

|

|

Feb 04 |

|

Kushal Traders |

|

|

2,480 |

|

Feb 14 |

|

Kunal Traders |

|

|

5,200 |

|

Feb 17 |

|

Naresh |

|

|

4,060 |

|

Feb 24 |

|

Kirit and Co. |

5,700 |

|

|

|

|

|

Less : trade discount 10% |

(570) |

|

5,130 |

|

|

|

|

|

|

|

|

Feb 28 |

|

Purchases A/c |

Dr. |

|

16,870 |

Sales Book

|

Date |

Invoice No. |

Name of Customer (Accounts to be debited ) |

|

L.F. |

AmountRs. |

|

2017 |

|

|

|

|

|

|

Feb 01 |

|

Sachin |

|

|

5,000 |

|

Feb 06 |

|

Manish traders |

|

|

2,100 |

|

Feb 10 |

|

Mukesh |

|

|

3,300 |

|

Feb25 |

|

Shri Chand |

6,600 |

|

|

|

|

|

Less: 5% Trade discount |

(330) |

|

6,270 |

|

Feb 26 |

|

Ramesh Brothers |

|

|

4,000 |

|

|

|

|

|

|

|

|

Feb 28 |

|

Sales A/c Cr. |

|

|

20,670 |

Sales Return Book

|

Date |

Credit Note no. |

Name of Customer (Account to be Credited) |

L.F. |

Amount Rs. |

|

2017 |

|

|

|

|

|

Feb 07 |

|

Sachin |

|

600 |

|

Feb 22 |

|

Mukesh |

|

250 |

|

Feb 28 |

|

Ramesh Brothers |

|

500 |

|

|

|

|

|

|

|

Feb 28 |

|

Sales Return A/c Dr. |

|

1,350 |

Purchases Return Book

|

Date |

Debit Note no. |

Name of supplier (Account to be debited ) |

|

L.F. |

Amount Rs. |

|

2017 |

|

|

|

|

|

|

Feb 08 |

|

Kushal Traders |

|

|

280 |

|

Feb 20 |

|

Kunal Traders |

|

|

200 |

|

Feb 28 |

|

Kirit and Co. |

1000 |

|

|

|

|

|

Less: 10% Trade Discount |

(100) |

|

900 |

|

|

|

|

|

|

|

|

Feb 28 |

|

Purchase Return A/c |

Cr. |

|

1,380 |

Journal Proper

|

Date |

Particulars |

|

L.F. |

Debit Rs. |

Credit Rs. |

|

2017 |

|

|

|

|

|

|

Feb 15 |

Furniture A/c |

Dr. |

|

3,200 |

|

|

|

To Tarun A/c |

|

|

|

3,200 |

|

|

(Being furniture purchased from tarun) |

|

|

|

|

Ledger

Purchase Account

|

Dr. |

|

|

|

|

|

|

Cr. |

|

Date |

Particulars |

J.F. |

Amount Rs. |

Date |

Particulars |

J.F. |

Amount Rs. |

|

2017 |

|

|

|

2017 |

|

|

|

|

Feb 28 |

To Sundries as per Purchases Book |

|

16,870 |

|

|

|

|

|

|

|

|

|

Feb 28 |

By Balance c/d |

|

16,870 |

|

|

|

|

16,870 |

|

|

|

16,870 |

Sales Account

|

Dr. |

|

|

|

|

|

|

Cr. |

|

Date |

Particulars |

J.F. |

Amount Rs. |

Date |

Particulars |

J.F. |

Amount Rs. |

|

2017 |

|

|

|

2017 |

|

|

|

|

|

|

|

|

Feb 28 |

By Sundries as per Sales Book |

|

20,670 |

|

Feb 28 |

To Balance c/d |

|

20,670 |

|

|

|

|

|

|

|

|

20,670 |

|

|

|

20,670 |

Sales Return Account

|

Dr. |

|

|

|

|

|

|

Cr. |

|

Date |

Particulars |

J.F. |

Amount Rs. |

Date |

Particulars |

J.F. |

Amount Rs. |

|

2017 |

|

|

|

2017 |

|

|

|

|

Feb 28 |

To Sundries as per Sales Return Book |

|

1,350 |

|

|

|

|

|

|

|

|

|

Feb 28 |

By Balance c/d |

|

1,350 |

|

|

|

|

1,350 |

|

|

|

1,350 |

Purchases Return Account

|

Dr. |

|

|

|

|

|

|

Cr. |

|

Date |

Particulars |

J.F. |

Amount Rs. |

Date |

Particulars |

J.F. |

Amount Rs. |

|

2017 |

|

|

|

2017 |

|

|

|

|

|

|

|

|

Feb 28 |

By Sundries as per Purchases Book |

|

1,380 |

|

Feb 28 |

To Balance c/d |

|

1,380 |

|

|

|

|

|

|

|

|

1,380 |

|

|

|

1,380 |

Sachin's Account

|

Dr. |

|

|

|

|

|

|

Cr. |

|

Date |

Particulars |

J.F. |

Amount Rs. |

Date |

Particulars |

J.F. |

Amount Rs. |

|

2017 |

|

|

|

2017 |

|

|

|

|

Feb 01 |

To Sales A/c |

|

5,000 |

Feb 07 |

By Sales Return A/c |

|

600 |

|

|

|

|

|

Feb 28 |

By Balance c/d |

|

4,400 |

|

|

|

|

5,000 |

|

|

|

5,000 |

Kushal Traders' Account

|

Dr. |

|

|

|

|

|

|

Cr. |

|

Date |

Particulars |

J.F. |

Amount Rs. |

Date |

Particulars |

J.F. |

Amount Rs. |

|

2017 |

|

|

|

2017 |

|

|

|

|

Feb 08 |

To Purchases Return A/c |

|

280 |

Feb 04 |

By Purchases A/c |

|

2,480 |

|

Feb 28 |

To Balance c/d |

|

2,200 |

|

|

|

|

|

|

|

|

2,480 |

|

|

|

2,480 |

Manish Traders' Account

|

Dr. |

|

|

|

|

|

|

Cr. |

|

Date |

Particulars |

J.F. |

Amount Rs. |

Date |

Particulars |

J.F. |

Amount Rs. |

|

2017 |

|

|

|

2017 |

|

|

|

|

Feb 06 |

To Sales A/c |

|

2,100 |

|

|

|

|

|

|

|

|

|

Feb 28 |

By Balance c/d |

|

2,100 |

|

|

|

|

2,100 |

|

|

|

2,100 |

Mukesh's Account

|

Dr. |

|

|

|

|

|

|

Cr. |

|

Date |

Particulars |

J.F. |

Amount Rs. |

Date |

Particulars |

J.F. |

Amount Rs. |

|

2017 |

|

|

|

2017 |

|

|

|

|

Feb 10 |

To Sales A/c |

|

3,300 |

Feb 22 |

By Sales Return A/c |

|

250 |

|

|

|

|

|

Feb 28 |

By Balance c/d |

|

3,050 |

|

|

|

|

3,300 |

|

|

|

3,300 |

Kunal Traders' Account

|

Dr. |

|

|

|

|

|

|

Cr. |

|

Date |

Particulars |

J.F. |

Amount Rs. |

Date |

Particulars |

J.F. |

Amount Rs. |

|

2017 |

|

|

|

2017 |

|

|

|

|

Feb 20 |

To Purchase Return A/c |

|

200 |

Feb 14 |

By Purchases A/c |

|

5,200 |

|

Feb 28 |

To Balance c/d |

|

5,000 |

|

|

|

|

|

|

|

|

5,200 |

|

|

|

5,200 |

Furniture Account

|

Dr. |

|

|

|

|

|

|

Cr. |

|

Date |

Particulars |

J.F. |

Amount Rs. |

Date |

Particulars |

J.F. |

Amount Rs. |

|

2017 |

|

|

|

2017 |

|

|

|

|

Feb 15 |

To Tarun A/c |

|

3,200 |

|

|

|

|

|

|

|

|

|

Feb 28 |

By Balance c/d |

|

3,200 |

|

|

|

|

3,200 |

|

|

|

3,200 |

Tarun's Account

|

Dr. |

|

|

|

|

|

|

Cr. |

|

Date |

Particulars |

J.F. |

Amount Rs. |

Date |

Particulars |

J.F. |

Amount Rs. |

|

2017 |

|

|

|

2017 |

|

|

|

|

|

|

|

|

Feb 15 |

By Furniture A/c |

|

3,200 |

|

Feb 28 |

To Balance c/d |

|

3,200 |

|

|

|

|

|

|

|

|

3,200 |

|

|

|

3,200 |

Naresh's Account

|

Dr. |

|

|

|

|

|

|

Cr. |

|

Date |

Particulars |

J.F. |

Amount Rs. |

Date |

Particulars |

J.F. |

Amount Rs. |

|

2017 |

|

|

|

2017 |

|

|

|

|

|

|

|

|

Feb 17 |

By Purchases A/c |

|

4,060 |

|

Feb 28 |

To Balance c/d |

|

4,060 |

|

|

|

|

|

|

|

|

4,060 |

|

|

|

4,060 |

Kirit and Co. Account

|

Dr. |

|

|

|

|

|

|

Cr. |

|

Date |

Particulars |

J.F. |

Amount Rs. |

Date |

Particulars |

J.F. |

Amount Rs. |

|

2017 |

|

|

|

2017 |

|

|

|

|

Feb 28 |

To Purchases Return A/c |

|

900 |

Feb 24 |

By Purchases A/c |

|

5,130 |

|

Feb 28 |

To Balance c/d |

|

4,230 |

|

|

|

|

|

|

|

|

5,130 |

|

|

|

5,130 |

Shri Chand and Co. Account

|

Dr. |

|

|

|

|

|

|

Cr. |

|

Date |

Particulars |

J.F. |

Amount Rs. |

Date |

Particulars |

J.F. |

Amount Rs. |

|

2017 |

|

|

|

2017 |

|

|

|

|

Feb 25 |

To Sales A/c |

|

6,270 |

|

|

|

|

|

|

|

|

|

Feb 28 |

By Balance c/d |

|

6,270 |

|

|

|

|

6,270 |

|

|

|

6,270 |

Ramesh's Account

|

Dr. |

|

|

|

|

|

|

Cr. |

|

Date |

Particulars |

J.F. |

Amount Rs. |

Date |

Particulars |

J.F. |

Amount Rs. |

|

2017 |

|

|

|

2017 |

|

|

|

|

Feb 26 |

To Sales A/c |

|

4,000 |

Feb 28 |

By Sales Return A/c |

|

500 |

|

|

|

|

|

Feb 28 |

By Balance c/d |

|

3,500 |

|

|

|

|

4,000 |

|

|

|

4,000 |

Solution NUM 18

Books of M/s Marble traders

|

Date |

Particulars |

|

L.F. |

Debit Rs. |

Credit Rs. |

|

2017 |

|

|

|

|

|

|

April 1 |

Cash A/c |

Dr. |

|

6,000 |

|

|

|

Bank A/c |

Dr. |

|

12,000 |

|

|

|

Bills receivable A/c |

Dr. |

|

7,000 |

|

|

|

Stock A/c |

Dr. |

|

5,400 |

|

|

|

Rahul's A/c |

Dr. |

|

9,700 |

|

|

|

Himanshu's A/c |

Dr. |

|

10,000 |

|

|

|

To Ramesh's A/c |

|

|

|

3,000 |

|

|

To Bill's payable A/c |

|

|

|

2,000 |

|

|

To Capital A/c (balancing figure ) |

|

|

|

45,100 |

|

|

(Being balance brought from last year) |

|

|

|

|

|

|

|

|

|

|

|

|

April 01 |

Manish A/c |

Dr. |

|

3,000 |

|

|

|

To Sales A/c |

|

|

|

3,000 |

|

|

(Being Goods sold to Manish) |

|

|

|

|

|

|

|

|

|

|

|

|

Apr 02 |

Purchases A/c |

Dr. |

|

8,000 |

|

|

|

To Ramesh A/c |

|

|

|

8,000 |

|

|

(Being goods purchased from Ramesh) |

|

|

|

|

|

|

|

|

|

|

|

|

Apr 03 |

Cash A/c |

Dr. |

|

9,200 |

|

|

|

Discount Allowed A/c |

Dr. |

|

500 |

|

|

|

To Rahul A/c |

|

|

|

9,700 |

|

|

(Being cash received from Rahul and discount allowed) |

|

|

|

|

|

|

|

|

|

|

|

|

Apr 05 |

Cash A/c |

Dr. |

|

4,000 |

|

|

|

To Himanshu A/c |

|

|

|

4,000 |

|

|

(Being cash received from Himanshu) |

|

|

|

|

|

|

|

|

|

|

|

|

Apr 06 |

Ramesh A/c |

Dr. |

|

6,000 |

|

|

|

To Bank A/c |

|

|

|

6,000 |

|

|

(Being cheque issued to Ramesh) |

|

|

|

|

|

|

|

|

|

|

|

|

Apr 08 |

Rent A/c |

Dr. |

|

1,200 |

|

|

|

To Bank A/c |

|

|

|

1,200 |

|

|

(Being rent paid by cheque) |

|

|

|

|

|

|

|

|

|

|

|

|

Apr 10 |

Cash A/c |

Dr. |

|

3,000 |

|

|

|

To Manish A/c |

|

|

|

3,000 |

|

|

(Being cash received from Manish) |

|

|

|

|

|

|

|

|

|

|

|

|

Apr 12 |

Cash A/c |

Dr. |

|

6,000 |

|

|

|

To Sales A/c |

|

|

|

6,000 |

|

|

(Being goods sold for cash) |

|

|

|

|

|

|

|

|

|

|

|

|

Apr 14 |

Ramesh A/c |

Dr. |

|

1,000 |

|

|

|

To Purchase Return A/c |

|

|

|

1,000 |

|

|

(Being goods returned to Ramesh) |

|

|

|

|

|

|

|

|

|

|

|

|

Apr 15 |

Ramesh A/c |

Dr. |

|

4,000 |

|

|

|

To Cash A/c |

|

|

|

3,700 |

|

|

To Discount Received A/c |

|

|

|

300 |

|

|

(Being Cash paid to Ramesh and discount received) |

|

|

|

|

|

|

|

|

|

|

|

|

Apr 18 |

Kushal A/c |

Dr. |

|

10,000 |

|

|

|

To Sales A/c |

|

|

|

10,000 |

|

|

(Being goods sold to Kushal) |

|

|

|

|

|

|

|

|

|

|

|

|

Apr 20 |

Trade Expenses A/c |

Dr. |

|

200 |

|

|

|

To Cash A/c |

|

|

|

200 |

|

|

(Being trade expenses paid) |

|

|

|

|

|

|

|

|

|

|

|

|

Apr 21 |

Drawings A/c |

Dr. |

|

1000 |

|

|

|

To Cash A/c |

|

|

|

1000 |

|

|

(Being cash withdrawn for personal use) |

|

|

|

|

|

|

|

|

|

|

|

|

Apr 22 |

Sales Return A/c |

Dr. |

|

1200 |

|

|

|

To Kushal |

|

|

|

1200 |

|

|

(Being Kushal retrun goods) |

|

|

|

|

|

|

|

|

|

|

|

|

Apr 24 |

Cash A/c |

Dr. |

|

6000 |

|

|

|

To Kushal A/c |

|

|

|

6000 |

|

|

(Being cash recived from Kushal) |

|

|

|

|

|

|

|

|

|

|

|

|

Apr 26 |

Stationery A/c |

Dr. |

|

100 |

|

|

|

To cash |

|

|

|

100 |

|

|

(Being stationery paid ) |

|

|

|

|

|

|

|

|

|

|

|

|

Apr 27 |

Postage A/c |

Dr. |

|

60 |

|

|

|

To cash A/c |

|

|

|

60 |

|

|

(Being postage charges paid) |

|

|

|

|

|

|

|

|

|

|

|

|

Apr 28 |

Salaries A/c |

Dr. |

|

2500 |

|

|

|

To cash A/c |

|

|

|

2500 |

|

|

(Being salary paid) |

|

|

|

|

|

|

|

|

|

|

|

|

Apr 29 |

Purchase A/c |

Dr. |

|

7000 |

|

|

|

To Sheetal Traders |

|

|

|

7000 |

|

|

(Being goods purchased from Sheetal Traders) |

|

|

|

|

|

|

|

|

|

|

|

|

Apr 30 |

Kirit A/c |

Dr. |

|

6000 |

|

|

|

To sales A/c |

|

|

|

6000 |

|

|

(Being goods sold to Kirit) |

|

|

|

|

|

|

|

|

|

|

|

|

Apr 30 |

Purchases A/c |

Dr. |

|

5000 |

|

|

|

To Handa Traders |

|

|

|

5000 |

|

|

(Being goods Purchase from Handa Traders) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

|

|

1,35,060 |

1,35,060 |

Ledger

Cash Account

|

Dr. |

|

|

|

|

|

|

Cr. |

|

Date |

Particulars |

J.F. |

Amount Rs. |

Date |

Particulars |

J.F. |

Amount Rs. |

|

2017 |

|

|

|

2017 |

|

|

|

|

Apr 01 |

To Balance b/d |

|

6,000 |

Apr 15 |

By Ramesh A/c |

|

3,700 |

|

Apr 03 |

To Rahul A/c |

|

9,200 |

Apr 20 |

By Trade Expenses A/c |

|

200 |

|

Apr 05 |

To Himanshu A/c |

|

4,000 |

Apr 21 |

By Drawing A/c |

|

1,000 |

|

Apr 10 |

To Manish A/c |

|

3,000 |

Apr 26 |

By Stationery A/c |

|

100 |

|

Apr 12 |

To Sales A/c |

|

6,000 |

Apr 27 |

By Postage A/c |

|

60 |

|

Apr 15 |

To Kushal A/c |

|

6,000 |

Apr 28 |

By Salaries A/c |

|

2,500 |

|

|

|

|

|

Apr 30 |

By Balance c/d |

|

26,640 |

|

|

|

|

34,200 |

|

|

|

34,200 |

Bank Account

|

Dr. |

|

|

|

|

|

|

Cr. |

|

Date |

Particulars |

J.F. |

Amount Rs. |

Date |

Particulars |

J.F. |

Amount Rs. |

|

2017 |

|

|

|

2017 |

|

|

|

|

Apr 01 |

To Balance b/d |

|

12,000 |

Apr 06 |

By Ramesh A/c |

|

6,000 |

|

|

|

|

|

Apr 08 |

By Rent A/c |

|

1,000 |

|

|

|

|

|

Apr 30 |

By Balance c/d |

|

4,800 |

|

|

|

|

12,000 |

|

|

|

12,000 |

Bills Receivable Account

|

Dr. |

|

|

|

|

|

|

Cr. |

|

Date |

Particulars |

J.F. |

Amount Rs. |

Date |

Particulars |

J.F. |

Amount Rs. |

|

2017 |

|

|

|

2017 |

|

|

|

|

Apr 01 |

To Balance b/d |

|

7,000 |

|

|

|

|

|

|

|

|

|

Apr 30 |

By Balance c/d |

|

7,000 |

|

|

|

|

7,000 |

|

|

|

7,000 |

Stock Account

|

Dr. |

|

|

|

|

|

|

Cr. |

|

Date |

Particulars |

J.F. |

Amount Rs. |

Date |

Particulars |

J.F. |

Amount Rs. |

|

2017 |

|

|

|

2017 |

|

|

|

|

Apr 01 |

To Balance b/d |

|

5,400 |

|

|

|

|

|

|

|

|

|

Apr 30 |

By Balance c/d |

|

5,400 |

|

|

|

|

5,400 |

|

|

|

5,400 |

Rahul's Account

|

Dr. |

|

|

|

|

|

|

Cr. |

|

Date |

Particulars |

J.F. |

Amount Rs. |

Date |

Particulars |

J.F. |

Amount Rs. |

|

2017 |

|

|

|

2017 |

|

|

|

|

Apr 01 |

To Balance b/d |

|

9,700 |

Apr 03 |

By Cash A/c |

|

9,200 |

|

|

|

|

|

Apr 03 |

By Discount allowed A/c |

|

500 |

|

|

|

|

9,700 |

|

|

|

9,700 |

Himanshu's Account

|

Dr. |

|

|

|

|

|

|

Cr. |

|

Date |

Particulars |

J.F. |

Amount Rs. |

Date |

Particulars |

J.F. |

Amount Rs. |

|

2017 |

|

|

|

2017 |

|

|

|

|

Apr 01 |

To Balance b/d |

|

10,000 |

Apr 05 |

By Cash A/c |

|

4,000 |

|

|

|

|

|

Apr 30 |

By Balance c/d |

|

6,000 |

|

|

|

|

10,000 |

|

|

|

10,000 |

Ramesh's Account

|

Dr. |

|

|

|

|

|

|

Cr. |

|

Date |

Particulars |

J.F. |

Amount Rs. |

Date |

Particulars |

J.F. |

Amount Rs. |

|

2017 |

|

|

|

2017 |

|

|

|

|

Apr 06 |

To Bank A/c |

|

6,000 |

Apr 01 |

By Balance b/d |

|

3,000 |

|

Apr 14 |

To Purchase return A/c |

|

1,000 |

Apr 02 |

By Purchases A/c |

|

8,000 |

|

Apr 15 |

To Cash A/c |

|

3,700 |

|

|

|

|

|

Apr 15 |

To Discount Received A/c |

|

300 |

|

|

|

|

|

|

|

|

11,000 |

|

|

|

11,000 |

Bills payable Account

|

Dr. |

|

|

|

|

|

|

Cr. |

|

Date |

Particulars |

J.F. |

Amount Rs. |

Date |

Particulars |

J.F. |

Amount Rs. |

|

2017 |

|

|

|

2017 |

|

|

|

|

|

|

|

|

Apr 01 |

By Balance b/d |

|

2,000 |

|

Apr 30 |

To Balance c/d |

|

2,000 |

|

|

|

|

|

|

|

|

2,000 |

|

|

|

2,000 |

Capital Accounts

|

Dr. |

|

|

|

|

|

|

Cr. |

|

Date |

Particulars |

J.F. |

Amount Rs. |

Date |

Particulars |

J.F. |

Amount Rs. |

|

2017 |

|

|

|

2017 |

|

|

|

|

|

|

|

|

Apr 01 |

By Balance b/d |

|

45,100 |

|

Apr 30 |

To Balance c/d |

|

45,100 |

|

|

|

|

|

|

|

|

45,100 |

|

|

|

45,100 |

Manisha's Accounts

|

Dr. |

|

|

|

|

|

|

Cr. |

|

Date |

Particulars |

J.F. |

Amount Rs. |

Date |

Particulars |

J.F. |

Amount Rs. |

|

2017 |

|

|

|

2017 |

|

|

|

|

|

|

|

|

Apr 01 |

By Manisha A/c |

|

3,000 |

|

|

|

|

|

Apr 12 |

By Cash A/c |

|

6,000 |

|

|

|

|

|

Apr 18 |

By Kushal A/c |

|

10,000 |

|

Apr 30 |

To Balance c/d |

|

25,000 |

Apr 30 |

By Kirit A/c |

|

6,000 |

|

|

|

|

25,000 |

|

|

|

25,000 |

Purchases Account

|

Dr. |

|

|

|

|

|

|

Cr. |

|

Date |

Particulars |

J.F. |

Amount Rs. |

Date |

Particulars |

J.F. |

Amount Rs. |

|

2017 |

|

|

|

2017 |

|

|

|

|

Apr 02 |

To Ramesh A/c |

|

8,000 |

|

|

|

|

|

Apr 29 |

To Sheetal traders A/c |

|

7,000 |

|

|

|

|

|

Apr 30 |

To Handa traders A/c |

|

5,000 |

Apr 30 |

By Balance c/d |

|

20,000 |

|

|

|

|

20,000 |

|

|

|

20,000 |

Discount Allowed Account

|

Dr. |

|

|

|

|

|

|

Cr. |

|

Date |

Particulars |

J.F. |

Amount Rs. |

Date |

Particulars |

J.F. |

Amount Rs. |

|

2017 |

|

|

|

2017 |

|

|

|

|

Apr 03 |

To rahul A/c |

|

500 |

|

|

|

|

|

|

|

|

|

Apr 30 |

By Balance c/d |

|

500 |

|

|

|

|

500 |

|

|

|

500 |

Rent account

|

Dr. |

|

|

|

|

|

|

Cr. |

|

Date |

Particulars |

J.F. |

Amount Rs. |

Date |

Particulars |

J.F. |

Amount Rs. |

|

2017 |

|

|

|

2017 |

|

|

|

|

Apr 08 |

To Bank A/c |

|

1,200 |

|

|

|

|

|

|

|

|

|

Apr 30 |

By Balance c/d |

|

1,200 |

|

|

|

|

1,200 |

|

|

|

1,200 |

Discount received

|

Dr. |

|

|

|

|

|

|

Cr. |

|

Date |

Particulars |

J.F. |

Amount Rs. |

Date |

Particulars |

J.F. |

Amount Rs. |

|

2017 |

|

|

|

2017 |

|

|

|

|

|

|

|

|

Apr 15 |

By Ramesh A/c |

|

300 |

|

Apr 30 |

To Balance c/d |

|

300 |

|

|

|

|

|

|

|

|

300 |

|

|

|

300 |

Kushal's account

|

Dr. |

|

|

|

|

|

|

Cr. |

|

Date |

Particulars |

J.F. |

Amount Rs. |

Date |

Particulars |

J.F. |

Amount Rs. |

|

2017 |

|

|

|

2017 |

|

|

|

|

Apr 18 |

To sales A/c |

|

10,000 |

Apr 22 |

By Sales return A/c |

|

1,200 |

|

|

|

|

|

Apr 24 |

By Cash A/c |

|

6,000 |

|

|

|

|

|

Apr 30 |

By Balance c/d |

|

2,800 |

|

|

|

|

10,000 |

|

|

|

10,000 |

Trade Expenses account

|

Dr. |

|

|

|

|

|

|

Cr. |

|

Date |

Particulars |

J.F. |

Amount Rs. |

Date |

Particulars |

J.F. |

Amount Rs. |

|

2017 |

|

|

|

2017 |

|

|

|

|

Apr 20 |

To cash A/c |

|

200 |

|

|

|

|

|

|

|

|

|

Apr 30 |

By Balance c/d |

|

200 |

|

|

|

|

200 |

|

|

|