Class 11-commerce NCERT Solutions Accountancy Part I Chapter 7: Depreciation, Provisions and Reserves

Depreciation, Provisions and Reserves Exercise 270

Solution SA 1

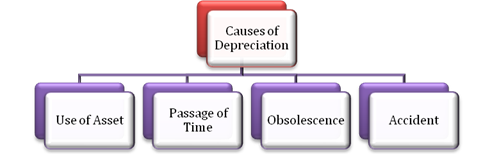

Depreciation means fall in book value of depreciable fixed asset because of

wear and tear of the asset

- passage/efflux of time

- obsolescence

- accident

A machinery costing Rs.1,00,000 and its useful life is 10 years; so, depreciation is calculated as:

Annual Depreciation per annum

= Cost of Asset-Estimated Scrap Value/Expected or Estimated life of Asset

=100000/10= Rs.10,000

Solution SA 2

The needs for providing depreciation are given below.

- To ascertain the correct profit or loss: Correct profit or loss can be ascertained when all the expenses and losses incurred for earning revenues are charged to Profit and Loss Account. Assets are used for earning revenues and its cost is charged in form of depreciation from Profit and Loss Account.

- To show true and fair view of financial statements: If depreciation is not charged, assets will be shown at higher value than their actual value in the balance sheet. Consequently, the balance sheet will not reflect true and fair view of financial statements.

- For ascertaining the accurate cost of production: Depreciation on the assets, which are engaged in production, is included in the cost of production. If depreciation is not charged, the cost of production is underestimated, which will lead to low selling price and thus leads to low profit.

- To provide funds for replacement of assets: Unlike other expenses, depreciation is non cash expense. So, the amount of depreciation debited to the profit and loss account will be retained in the business. These funds will be available for replacement of fixed assets when its useful life ends.

- To meet the legal requirement: To comply with the provisions of the Companies Act and Income Tax Act, it is necessary to charge depreciation.

Solution SA 3

- Use of asset: Because of constant use of the fixed assets there exists a normal wear and tear which leads to fall in the value of the assets.

- Passage of time: Whether assets are used or not, with the passage of time, its effective life will decrease.

- Obsolescence: Because of new technologies, innovations and inventions, assets purchased currently may become outdated later which leads to the obsolescence of fixed assets.

- Accident: An asset may lose its value due to mishaps such as a fire accident, theft or by natural calamities and they are permanent in nature.

Solution SA 4

-

Original cost of asset: The total cost of an asset is taken into consideration for ascertaining the amount of depreciation. The total cost of an asset include all expenses incurred up to the point the asset is ready for use like freight expenses and installation charges.

Total Cost= Purchase Price+ Freight Expenses+ Installation Charges.

- Estimated useful life: Every asset has its useful life other than its physical life in terms of number of years and units used by a business. The asset may exist physically but may not be able to produce the goods at a reasonable cost. For example, an asset is likely to lose its useful value within 15years, its useful life, i.e., life for purpose of accounting should be considered as only 15years.

-

Estimated scrap value: It is estimated as the net realisable value of an asset at the end of its useful life. It is deducted from the total cost of an asset and the difference is written off over the useful life of the asset. For example, Furniture acquired at Rs.1,30,000, its useful life is estimated to be 10years and it is estimated scrap value Rs.10,000.

Depreciation per annum= 1,30,000-10,000/10 years= 12,000

Solution SA 5

|

Straight Line Method |

Written Down Value Method |

|

Depreciation is calculated on the original cost of an asset. |

Depreciation is calculated on the reducing balance, i.e., the book value of an asset. |

|

Equal amount of depreciation is charged each year over the useful life of the asset. |

Diminishing amount of depreciation is charged each year over the useful life of the asset. |

|

Book value of the asset becomes zero at the end of its effective life. |

Book value of the asset can never be zero. |

|

It is suitable for the assets such as patents, copyright, land and buildings which have lesser possibility of obsolescence and lesser repair charges. |

It is suitable for assets which needs more repair in the later years such as plant and machinery and car. |

|

As depreciation remains same over the years but repair cost increases in the later years, there will be unequal effect over the life of the asset. |

As depreciation cost is high and repairs are less in the initial years but in the latter years the repair costs increase and depreciation cost decreases, there will be equal effect over the life of the asset. |

|

It is not recognised under the income tax act. |

It is recognised under the income tax act. |

Solution SA 6

The written down value method is most appropriate to overcome the burden of the profit and loss account because of high depreciation and repair costs over the years of the asset. The cost of depreciation reduces and the repair and maintenance expenses increase over the years. However, the entire burden will not get ease to the management.

Solution SA 7

The effects of depreciation on Profit and Loss Account are as follows:

- An increase in depreciation will be debited in the profit and loss account which reduces net profit.

- Hence total expenses increase which leads to an excess of debit over credit balance.

The effects of depreciation on Balance Sheet are as follows:

- The original cost or book value of the concerned asset gets reduced.

- The overall balance of asset's column in the balance sheet gets reduced.

Solution SA 8

|

Provision |

Reserve |

|

It is charge against profit. |

It is an appropriation of profit. |

|

It is created to meet a specific liability or contingencies. |

It is made for strengthening the financial position of the business. Some reserves are also mandatory under law. |

|

It is recorded on the debit side of profit and loss account. |

It is recorded on the credit side of the profit and loss appropriation account. |

|

It can be shown either (i) by way of deduction from the item on the assets side for which it is created, or (ii) in the liabilities side along with the current liabilities. |

It is shown on the liabilities side after capital. |

|

It cannot be utilized for dividend distribution. |

It can be utilized for dividend distribution. |

|

It is never invested outside the business. |

It can be invested outside the business. |

|

It reduces net profits. |

It reduces only divisible profit. |

Solution SA 9

Four examples of provision are given below.

- Provision for bad and doubtful debts

- Provision for discount on debtors

- Provision for depreciation

- Provision for tax

Four examples of reserve are given below.

- General reserve

- Capital redemption reserve

- Dividend equalisation reserve

- Debenture redemption reserve

Solution SA 10

|

Revenue Reserve |

Capital Reserve |

|

It is formed out of revenue profit which is earned from normal activities of business operations. |

It is formed out of capital profit which is a gain from other than normal activities of business operations, such as sale of fixed assets. |

|

It can be used for distribution of dividend. |

It cannot be used for distribution of dividend. |

|

It is created for increasing the financial position of the business. |

It is created for the purpose of the Companies Act. |

Solution SA 11

Examples of revenue reserve are as follows:

- General reserve

- Investment equalisation reserve

- Dividend equalisation reserve

- Debenture reserve

Examples of capital reserve are as follows:

- Issues of shares at premium

- Profit on forfeiture of shares

- Profit on sale of fixed assets

- Profit on redemption of debentures

Solution SA 12

|

Specific Reserve |

General Reserve |

|

It is created for specific purpose. |

It is not created for specific purpose. |

|

It is not available for any future contingencies or expansion of business. It is utilised only for that purpose for which it is created. |

It is available for any future contingencies or expansion of business. It strengthens the financial position. |

|

Dividend equalisation reserve, debenture redemption reserve, development rebate reserves. |

Contingency reserve and general reserve |

Solution SA 13

Secret reserves are created by overstating liabilities or understating assets which are not shown in the balance sheet. This will reduce tax liabilities, because the liabilities are overstated. It is created by management to avoid competition by reducing profit. Creation of secret reserve is not allowed by Companies Act, 1956 which requires full disclosure of all material facts and accounting policies while preparing final statements.

Solution LA 1

Depreciation means fall in book value of depreciable fixed asset because of

- wear and tear of the asset,

- passage/efflux of time,

- obsolescence, or

- accident.

The need for providing depreciation is:

- To ascertain the correct profit: Correct profit or loss can be ascertained when all the expenses and losses incurred for earning revenues are charged to Profit and Loss Account. Assets are used for earning revenues and its cost is charged in form of depreciation from Profit and Loss Account.

- To show true and fair view of the financial position: If depreciation is not charged, assets will be shown at higher value than their actual value in the balance sheet. Consequently, the balance sheet will not reflect true and fair view of financial statements.

- To retain, out of profit, funds for replacement: Unlike other expenses, depreciation is non cash expense. So, the amount of depreciation debited to the profit and loss account will be retained in the business. These funds will be available for replacement of fixed assets when its useful life ends.

- To ascertain correct cost of production: Depreciation on the assets, which are engaged in production, is included in the cost of production. If depreciation is not charged, the cost of production is underestimated, which will lead to low selling price and thus leads to low profit.

- To meet the legal requirement: To comply with the provisions of the Companies Act and Income Tax Act, it is necessary to charge depreciation.

The causes of depreciation are as stated below:

- Use of Asset i.e., wear and tear: Due to constant use of the fixed assets there exist a normal wear and tear that leads to fall in the value of the assets.

- Passage/Efflux of Time: Whether assets are used or not, with the passage of time, its effective life will decrease.

- Obsolescence: Due to new technologies, innovations and inventions, assets purchased today may become outdated by tomorrow which leads to the obsolescence of fixed assets.

- Accidents: An asset may lose its value due to mishaps such as a fire accident, theft or by natural calamities and they are permanent in nature.

Solution LA 2

The two methods of depreciation are

- Fixed percentage on original cost or straight line method

- Fixed percentage on diminishing balance or written down value method

Straight Line Method

According to this method, a fixed and equal amount is charged as depreciation for every accounting period during the life time of an asset. This method is based on the assumption of equal usage of time over asset's entire useful life. Hence, the amount of depreciation is same from period to period over the life of the asset.

Depreciation amount can be calculated by using the following formula:

If the asset has a residual value at the end of its useful life, the amount to be written of every year is as follows:

Depreciation = Cost of asset - Estimated net residual value / No. of years of expected life

If the annual depreciation amount is given then we can calculate the rate of depreciation as follows:

Rate of depreciation = Annual depreciation amount / Cost of asset * 100

Advantages of Straight Line Method

- Simple to calculate the depreciation amount

- Assets can be depreciated up to the estimated scrap value

- Easy to understand the amount of depreciation

- Every year, the same amount of depreciation is debited to profit and loss account, and hence the effect on profit and loss account will remain the same.

Disadvantages of Straight Line Method

- Interest on capital invested in assets is not provided in this method.

- Over the years, the work efficiency of assets decreases and repair expenses increases. Therefore, there is burden on the profit and loss account.

- Book value of the assets becomes zero but still the assets are used in the business.

Written Down Value Method

In this method depreciation is charged on the book value of the asset and the amount of depreciation reduces year after year. It implies that a fixed rate on the written down value of the asset is charged as depreciation every year over the expected useful life of the asset. The rate of depreciation is applicable to the book value but not to the cost of asset.

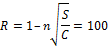

Rate of depreciation can be ascertained on the basis of cost, scrap value and useful life of the asset as follows:

Where, R is the rate of depreciation in percent, n is the useful life of the asset; S is the scrap value at the end of useful life and C is the cost of the asset.

Advantages of Written Down Value Method

- The profit and loss account of depreciation and repair expenses has same weightage throughout the useful life of asset because depreciation decreases with an increase in repair expenses.

- Since the benefits from asset keep on decreasing, the cost of asset is allocated rationally.

- This method is most favorable for those assets which require increased repairs and maintenance expenses over the years.

- This method is widely accepted under the Income Tax Act.

Disadvantages of Written Down Value Method

- The value of assets can never be zero even though it is discarded.

- In this method, it is difficult to calculate depreciation.

- There is no provision of interest on capital invested in use of assets.

Difference between Straight Line and Written Down Value Method

|

Straight Line Method |

Written Down Value Method |

|

Depreciation is calculated on the original cost of fixed asset |

Depreciation is calculated on the book value (i.e. original cost less depreciation) of fixed asset |

|

Amount of depreciation remains constant for all years |

Amount of depreciation keeps on decreasing year after year |

|

At the end of the useful life of an asset, the balance in the asset account will reduce to zero |

At the end of the useful life of an asset, the balance in the asset account will not reduce to zero |

|

It is not accepted by Income Tax Law |

It is accepted by Income Tax Law |

|

It is suitable for assets which get completely depreciated on the account of expiry of its useful life |

It is suitable for assets which require more and more repairs in the later stage of its useful life |

|

Rate of depreciation is easy to calculate |

Rate of depreciation is difficult to calculate |

Solution LA 3

The two methods of recording depreciation are as follows:

- When Depreciation is Charged or Credited to the Assets Account

In this method, depreciation is deducted from the asset value and charged (debited) to profit and loss account. Hence the asset value is reduced by the amount of depreciation.

|

Journal entries for recording under this method are as follows: |

|

|

Asset A/c |

Dr. |

|

------To Cash/Bank A/c (Being the asset purchased and the cost of an asset including installation expenses and freight) |

|

|

Depreciation A/c |

Dr. |

|

------To Asset A/c |

|

|

(Being the amount of depreciation charged) |

|

|

Profit and Loss A/c |

Dr. |

|

------To Depreciation A/c |

|

|

(Being the depreciation amount transferred to profit and loss account) |

|

In the Balance sheet, asset appears at its written down value which is cost less depreciation charged till date. In this method, the original cost of an asset and the total amount of depreciation which has been charged cannot ascertain from this balance sheet.

- When Depreciation is Credited to Provision for Depreciation Account

In this method, depreciation is credited to the provision for depreciation account or accumulated depreciation account every year. Depreciation is accumulated in a separate account instead of adjusting into the asset account at the end of each accounting period. In the balance sheet, the asset will continue to appear at the original cost every year. Thus, the balance sheet shows the original cost of the asset and the total amount of depreciation charged on asset.

|

Journal entries for recording under this method are as follows: |

|

|

|

|

|

Asset A/c |

Dr. |

|

------To Cash/Bank/Vendor A/c (Being the asset purchased and the cost of an asset including installation expenses and freight) |

|

|

Depreciation A/c |

Dr. |

|

------To Provision for Depreciation A/c |

|

|

(Being the amount of depreciation charged) |

|

|

Profit and Loss A/c |

Dr. |

|

------To Depreciation A/c |

|

|

(Being the depreciation amount to transferred profit and loss account) |

|

Depreciation, Provisions and Reserves Exercise 271

Solution LA 4

-

Historical (Original) Cost of the Asset: The total cost of an asset is taken into consideration for ascertaining the amount of depreciation. The total cost of an asset include all expenses incurred up to the point the asset is ready for use like freight expenses and installation charges.

Total Cost =Purchase Price+ Freight Expenses+ Installation Charges.

-

Estimated Net Residual Value: It is estimated as the net realisable value of an asset at the end of its useful life. It is deducted from the total cost of an asset and the difference is written off over the useful life of the asset. For example, Furniture acquired at Rs.1,30,000, its useful life is estimated to be 10years and it is estimated scrap value Rs.10,000.

Depreciation p.a.= 1,30,000-10,000/10 Years = Rs.12,000

- Estimated Useful Life: Every asset has its useful life other than its physical life (in terms of number of years, units, etc.), used by a business. The asset may exist physically but may not be able to produce the goods at a reasonable cost. For example, an asset is likely to lose its useful value within 15years, its useful life, i.e., life for purpose of accounting should be considered as only 15years.

Solution LA 5

Types of Reserves

- Revenue Reserve: It is an amount set aside out of revenue profits for distribution of dividends. For example, general reserve, investment fluctuation fund, capital reserve and workmen compensation fund. It is not a charge against profit but it is appropriation of profit shown in the profit and loss account. It is beneficial for the smooth function of the business. The retention of profit in the form of reserves reduces the amount of profit to distribute among the business owners. This is further classified in to general reserve and specific reserve.

- General reserve means a reserve which is not maintained for specific purpose. It helps to strengthen the financial status of the business. It is also known as free reserve and contingency reserve.

- Specific reserve means a reserve which is maintained for specific purpose. For example, dividend equalisation reserve is created to maintain dividend rate. This reserve amount is utilised to maintain the rate dividend in the year of low profit. Likewise, the workmen compensation fund is maintained to provide claims of the workers, investment fluctuation fund is used at times of decline in the value of investment and debenture redemption reserve is used to provide funds for redemption of debentures.

- Capital Reserve: It is an amount set aside out of capital profits which is not available for distribution as dividend among the shareholders. It is used for writing capital losses/issue of bonus share in a company. Examples of capital reserves are

- Profit prior to incorporation

- Premium on issue of shares or debentures

- Profit on redemption of debenture

- Profit on forfeiture of share

- Profit on sale of fixed assets

- Capital redemption reserve

- Profit on revaluation of fixed assets and liabilities

Solution LA 6

Provision is an amount which is set aside by charging it to profit for the purpose of providing for any known liability or uncertain loss or expense. The amount of which cannot be determined with certainty is also referred to as provision. Few examples are provision for depreciation, provision for doubtful debts and provision for discount on bad debtors.

The main objective of provision is to account all expenses and losses. Through the creation of provision account, the amount of liability, losses and expenses are estimated and accounted for the accounting period. Therefore, the true profit and loss is ascertained, liabilities and assets are presented with correct values.

Importance of Provision

- To meet anticipated losses and liabilities: Provision is created to meet the anticipated losses and liabilities such as provision for doubtful debts, provision for discount on debtors and provision for taxation.

- To meet known losses and liabilities: Provision is created to meet known losses and liabilities such as provision for repairs and renewals.

- To present correct financial statements: To present a true and fair view of profit and financial statement, the business must maintain provision for known liabilities and losses.

Therefore, provision is necessarily to be created to ascertain the current income or profit. Also, it is considered as a charge against revenue or profits.

Accounting Treatment

Provision is a charge against the profit which is debited in the profit and loss account. In the balance sheet, the amount of provision may be shown on the asset side by deducting from the relevant asset or on the liability side along with the current liabilities.

- Treatment on asset side- Provision for doubtful debts is deducted from the amount of sundry debtors and the provision for depreciation is deducted from the relevant asset.

- Treatment on liability side- Provision for repairs and charges are shown along with the current liabilities.

Solution NUM 1

|

Books of Bajrang Marbles |

|||||||

|

Machinery Account |

|||||||

|

Dr. |

|

|

|

|

|

|

Cr. |

|

Date |

Particulars |

J.F. |

Amount Rs. |

Date |

Particulars |

J.F. |

Amount Rs. |

|

2010 |

|

|

|

2011 |

|

|

|

|

Apr 01 |

To Bank A/c |

|

3,00,000 |

Mar31 |

By Depreciation A/c |

|

28,000 |

|

|

|

|

|

Mar31 |

By Balance c/d |

|

2,72,000 |

|

|

|

|

3,00,000 |

|

|

|

3,00,000 |

|

2011 |

|

|

|

2012 |

|

|

|

|

Apr01 |

To Balance b/d |

|

2,72,000 |

Mar31 |

By Depreciation A/c |

|

28,000 |

|

|

|

|

|

Mar 31 |

By Balance c/d |

|

2,44,000 |

|

|

|

|

2,72,000 |

|

|

|

2,72,000 |

|

2012 |

|

|

|

2013 |

|

|

|

|

Apr 01 |

To Balance b/d |

|

2,44,000 |

Mar 31 |

By Depreciation A/c |

|

28,000 |

|

|

|

|

|

Mar 31 |

By Balance c/d |

|

2,16,000 |

|

|

|

|

2,44,000 |

|

|

|

2,44,000 |

|

2013 |

|

|

|

2014 |

|

|

|

|

Apr 01 |

To Balance b/d |

|

2,16,000 |

Mar 31 |

By Depreciation A/c |

|

28,000 |

|

|

|

|

|

Mar 31 |

By Balance c/d |

|

1,88,000 |

|

|

|

|

2,16,000 |

|

|

|

2,16,000 |

|

Depreciation Account |

|||||||

|

Dr. |

|

|

|

|

|

|

Cr. |

|

Date |

Particulars |

J.F. |

Amount Rs. |

Date |

Particulars |

J.F. |

Amount Rs. |

|

2011 |

|

|

|

2011 |

|

|

|

|

Mar 31 |

To Machinery A/c |

|

28,000 |

Mar 31 |

By Profit and Loss A/c |

|

28,000 |

|

|

|

|

28,000 |

|

|

|

28,000 |

|

2012 |

|

|

|

2012 |

|

|

|

|

Mar 31 |

To Machinery A/c |

|

28,000 |

Mar 31 |

By Profit and Loss A/c |

|

28,000 |

|

|

|

|

28,000 |

|

|

|

28,000 |

|

2013 |

|

|

|

2013 |

|

|

|

|

Mar 31 |

To Machinery A/c |

|

28,000 |

Mar 31 |

By Profit and Loss A/c |

|

28,000 |

|

|

|

|

28,000 |

|

|

|

28,000 |

|

2014 |

|

|

|

2014 |

|

|

|

|

Mar 31 |

To Machinery A/c |

|

28,000 |

Mar 31 |

By Profit and Loss A/c |

|

28,000 |

|

|

|

|

28,000 |

|

|

|

28,000 |

Working notes :

1. Calculation of annual depreciation

|

Depreciation p.a. |

= Cost-Scrap Value/Estimated Life of Assets(years) |

|

|

=(2,80,000+10,000+10,000)-20,000/10 |

|

|

= Rs.28,000 per annum |

--------------------

|

Books of Bajrang Marbles |

|||||||

|

Machinery Account |

|||||||

|

Dr. |

|

|

|

|

|

|

Cr. |

|

Date |

Particulars |

J.F. |

Amount Rs. |

Date |

Particulars |

J.F. |

Amount Rs. |

|

2010 |

|

|

|

2011 |

|

|

|

|

Apr 01 |

To Bank A/c |

|

3,00,000 |

Mar 31 |

By Balance c/d |

|

3,00,000 |

|

|

|

|

3,00,000 |

|

|

|

3,00,000 |

|

2011 |

|

|

|

2012 |

|

|

|

|

Apr 01 |

To Balance b/d |

|

3,00,000 |

Mar 31 |

By Balance c/d |

|

3,00,000 |

|

|

|

|

3,00,000 |

|

|

|

3,00,000 |

|

2012 |

|

|

|

2013 |

|

|

|

|

Apr 01 |

To Balance b/d |

|

3,00,000 |

Mar 31 |

By Balance c/d |

|

3,00,000 |

|

|

|

|

3,00,000 |

|

|

|

3,00,000 |

|

2013 |

|

|

|

2014 |

|

|

|

|

Apr 01 |

To Balance b/d |

|

3,00,000 |

Mar 31 |

By Balance c/d |

|

3,00,000 |

|

|

|

|

3,00,000 |

|

|

|

3,00,000 |

|

Provision for Depreciation Account |

|||||||

|

Dr. |

|

|

|

|

|

|

Cr. |

|

Date |

Particulars |

J.F. |

Amount Rs. |

Date |

Particulars |

J.F. |

Amount Rs. |

|

2011 |

|

|

|

2011 |

|

|

|

|

Mar 31 |

To Balance c/d |

|

28,000 |

Mar.31 |

By Depreciation A/c |

|

28,000 |

|

|

|

|

28,000 |

|

|

|

28,000 |

|

2012 |

|

|

|

2011 |

|

|

|

|

Mar 31 |

To Balance c/d |

|

56,000 |

Apr 01 |

By Balance b/d |

|

28,000 |

|

|

|

|

|

2012 |

|

|

|

|

|

|

|

|

Mar 31 |

By Depreciation A/c |

|

28,000 |

|

|

|

|

56,000 |

|

|

|

56,000 |

|

2013 |

|

|

|

2012 |

|

|

|

|

Mar 31 |

To Balance c/d |

|

84,000 |

Apr 01 |

By Balance b/d |

|

56,000 |

|

|

|

|

|

2013 |

|

|

|

|

|

|

|

|

Mar 31 |

By Depreciation A/c |

|

28,000 |

|

|

|

|

84,000 |

|

|

|

84,000 |

|

2014 |

|

|

|

2013 |

|

|

|

|

Mar 31 |

To Balance c/d |

|

1,12,000 |

Apr 01 |

By Balance b/d |

|

84,000 |

|

|

|

|

|

2014 |

|

|

|

|

|

|

|

|

Mar 31 |

By Depreciation A/c |

|

28,000 |

|

|

|

|

1,12,000 |

|

|

|

1,12,000 |

|

Depreciation Account |

|||||||

|

Dr. |

|

|

|

|

|

|

Cr. |

|

Date |

Particulars |

J.F. |

Amount Rs. |

Date |

Particulars |

J.F. |

Amount Rs. |

|

2011 |

|

|

|

2011 |

|

|

|

|

Mar 31 |

To Provision for Depreciation A/c |

|

28,000 |

Mar 31 |

By Profit and Loss A/c |

|

28,000 |

|

|

|

|

28,000 |

|

|

|

28,000 |

|

2012 |

|

|

|

2012 |

|

|

|

|

Mar 31 |

To Provision for Depreciation A/c |

|

28,000 |

Mar 31 |

By Profit and Loss A/c |

|

28,000 |

|

|

|

|

28,000 |

|

|

|

28,000 |

|

2013 |

|

|

|

2013 |

|

|

|

|

Mar 31 |

To Provision for Depreciation A/c |

|

28,000 |

Mar 31 |

By Profit and Loss A/c |

|

28,000 |

|

|

|

|

28,000 |

|

|

|

28,000 |

|

2014 |

|

|

|

2014 |

|

|

|

|

Mar 31 |

To Provision for Depreciation A/c |

|

28,000 |

Mar 31 |

By Profit and Loss A/c |

|

28,000 |

|

|

|

|

28,000 |

|

|

|

28,000 |

Solution NUM 2

|

Books of Ashok Ltd. |

|||||||

|

Machinery Account |

|||||||

|

Dr. |

|

|

|

|

|

|

Cr. |

|

Date |

Particulars |

J.F. |

Amount Rs. |

Date |

Particulars |

J.F. |

Amount Rs. |

|

2010 |

|

|

|

2010 |

|

|

|

|

Jul01 |

To Bank A/c |

|

1,20,000 |

Dec 31 |

By Depreciation A/c |

|

4,500 |

|

|

|

|

|

Dec 31 |

By Balance c/d |

|

1,15,500 |

|

|

|

|

1,20,000 |

|

|

|

1,20,000 |

|

2011 |

|

|

|

2011 |

|

|

|

|

Jan 01 |

To Balance b/d |

|

1,15,500 |

Dec 31 |

By Depreciation A/c |

|

9,000 |

|

|

|

|

|

Dec 31 |

By Balance c/d |

|

1,06,500 |

|

|

|

|

1,15,500 |

|

|

|

1,15,500 |

|

2012 |

|

|

|

2012 |

|

|

|

|

Jan 01 |

To Balance b/d |

|

1,06,500 |

Dec 31 |

By Depreciation A/c |

|

9,000 |

|

|

|

|

|

Dec 31 |

By Balance c/d |

|

97,500 |

|

|

|

|

1,06,500 |

|

|

|

1,06,500 |

|

2013 |

|

|

|

|

|

|

|

|

Jan 01 |

To Balance b/d |

|

97,500 |

|

|

|

|

|

Depreciation Account |

|||||||

|

Dr. |

|

|

|

|

|

|

Cr. |

|

Date |

Particulars |

J.F. |

Amount Rs. |

Date |

Particulars |

J.F. |

Amount Rs. |

|

2010 |

|

|

|

2010 |

|

|

|

|

Dec 31 |

To Machinery A/c |

|

4,500 |

Dec 31 |

By Profit and Loss A/c |

|

4,500 |

|

|

|

|

4,500 |

|

|

|

4,500 |

|

2011 |

|

|

|

2011 |

|

|

|

|

Dec 31 |

To Machinery A/c |

|

9,000 |

Dec 31 |

By Profit and Loss A/c |

|

9,000 |

|

|

|

|

9,000 |

|

|

|

9,000 |

|

2012 |

|

|

|

2012 |

|

|

|

|

Dec 31 |

To Machinery A/c |

|

9,000 |

Dec 31 |

By Profit and Loss A/c |

|

9,000 |

|

|

|

|

9,000 |

|

|

|

9,000 |

Working Notes :

1. Calculation of annual depreciation

|

Depreciation p.a. |

= Cost-Scrap Value/Estimated Life of Asset (Years) |

|

|

= (1,08,000+12,000)-12,000/12 Years |

|

|

=Rs.9,000 per annum |

Solution NUM 3

|

Books of Reliance Ltd |

|||||||

|

Machinery Account |

|||||||

|

Dr. |

|

|

|

|

|

|

Cr. |

|

Date |

Particulars |

J.F. |

Amount Rs. |

Date |

Particulars |

J.F. |

Amount Rs. |

|

2011 |

|

|

|

2011 |

|

|

|

|

Oct 01 |

To Bank A/c |

|

84,000 |

Dec 31 |

By Balance c/d |

|

84,000 |

|

|

|

|

84,000 |

|

|

|

84,000 |

|

2012 |

|

|

|

2012 |

|

|

|

|

Jan 01 |

To Balance b/d |

|

84,000 |

Dec 31 |

By Balance c/d |

|

84,000 |

|

|

|

|

84,000 |

|

|

|

84,000 |

|

2013 |

|

|

|

2013 |

|

|

|

|

Jan 01 |

To Balance b/d |

|

84,000 |

Dec 31 |

By Balance c/d |

|

84,000 |

|

|

|

|

84,000 |

|

|

|

84,000 |

|

Provisions for Depreciation Account |

|||||||

|

Dr. |

|

|

|

|

|

|

Cr. |

|

Date |

Particulars |

J.F. |

Amount Rs. |

Date |

Particulars |

J.F. |

Amount Rs. |

|

2011 |

|

|

|

2011 |

|

|

|

|

Dec 31 |

To Balance c/d |

|

1,316 |

Dec 31 |

By Depreciation A/c |

|

1,316 |

|

|

|

|

1,316 |

|

|

|

1,316 |

|

2012 |

|

|

|

2012 |

|

|

|

|

Dec 31 |

To Balance c/d |

|

6,583 |

Jan 01 |

By Balance b/d |

|

1,316 |

|

|

|

|

|

Dec 31 |

By Depreciation A/c |

|

5,267 |

|

|

|

|

6,583 |

|

|

|

6,583 |

|

2013 |

|

|

|

2013 |

|

|

|

|

Dec 31 |

To Balance c/d |

|

11,850 |

Jan 01 |

By Balance b/d |

|

6,583 |

|

|

|

|

|

Dec 31 |

By Depreciation A/c |

|

5,267 |

|

|

|

|

11,850 |

|

|

|

11,850 |

|

|

|

|

|

2013 |

|

|

|

|

|

|

|

|

Jan.01 |

By Balance b/d |

|

11,850 |

Working notes:

|

Calculation of annual depreciation |

|

|

Depreciation p.a. |

=Cost-Scrap Value/Estimated Life of Asset (years) |

|

|

=(56,000+28,000)-5,000/15 |

|

|

=Rs.5,267 per annum |

|

Calculation of annual depreciation |

|

|

Depreciation p.a. |

=Cost-Scrap Value/Estimated Life of Asset (years) |

|

|

=(56,000+28,000)-5,000/15 |

|

|

=Rs.5,267 per annum |

|

Scrap Value |

= Salvage Value- estimated cost to recover the salvage value |

|

|

=Rs.6,000-Rs.1,000 |

|

|

=Rs.5,000 |

Solution NUM 4

|

Books of Berlia Ltd. |

||||||||

|

Machinery Account (Original Cost Method) |

||||||||

|

Dr. |

|

|

|

|

|

|

|

Cr. |

|

Date |

Particulars |

J.F. |

Amount Rs. |

Date |

Particulars |

|

J.F. |

Amount Rs. |

|

2015 |

|

|

|

2015 |

|

|

|

|

|

Jul 01 |

To Bank A/c |

|

85,000 |

Dec 31 |

By Depreciation A/c |

|

|

|

|

|

(56,000 + 24,000 + 5,000) |

|

|

|

Machine 1 (6m) |

4,250 |

|

4,250 |

|

|

|

|

|

Dec 31 |

By Balance c/d |

|

|

80,750 |

|

|

|

|

85,000 |

|

|

|

|

85,000 |

|

|

|

|

|

|

|

|

|

|

|

2016 |

|

|

|

2016 |

|

|

|

|

|

Jan 01 |

To Balance b/d |

|

80,750 |

Dec 31 |

By Depreciation A/c |

|

|

|

|

Sep 01 |

To Bank A/c |

|

2,60,000 |

|

Machine 1 |

8,500 |

|

|

|

|

(2,50,000 + 10,000) |

|

|

|

Machine 2 (4m) |

8,667 |

|

17,167 |

|

|

|

|

|

Dec 31 |

By Balance c/d |

|

|

3,23,583 |

|

|

|

|

3,40,750 |

|

|

|

|

3,40,750 |

|

2017 |

|

|

|

2017 |

|

|

|

|

|

Jan 01 |

To Balance b/d |

|

3,23,583 |

Dec 31 |

By Depreciation A/c |

|

|

|

|

|

|

|

|

|

Machine 1 |

8,500 |

|

|

|

|

|

|

|

|

Machine 2 |

26,000 |

|

34,500 |

|

|

|

|

|

Dec 31 |

By Balance c/d |

|

|

2,89,083 |

|

|

|

|

3,23,583 |

|

|

|

|

3,23,583 |

|

2018 |

|

|

|

2018 |

|

|

|

|

|

Jan 01 |

To Balance b/d |

|

2,89,083 |

Dec 31 |

By Depreciation A/c |

|

|

|

|

|

|

|

|

|

Machine 1 |

8,500 |

|

|

|

|

|

|

|

|

Machine 2 |

26,000 |

|

34,500 |

|

|

|

|

|

Dec 31 |

By Balance c/d |

|

|

2,54,583 |

|

|

|

|

2,89,083 |

|

|

|

|

2,89,083 |

|

Depreciation Account |

|||||||

|

Dr. |

|

|

|

|

|

|

Cr. |

|

Date |

Particulars |

J.F. |

Amount Rs. |

Date |

Particulars |

J.F. |

Amount Rs. |

|

2015 |

|

|

|

2015 |

|

|

|

|

Dec 31 |

To Machinery A/c |

|

4,250 |

Dec 31 |

By Profit and Loss A/c |

|

4,250 |

|

|

|

|

4,250 |

|

|

|

4,250 |

|

2016 |

|

|

|

2016 |

|

|

|

|

Dec 31 |

To Machinery A/c |

|

17,167 |

Dec 31 |

By Profit and Loss A/c |

|

17,167 |

|

|

|

|

17,167 |

|

|

|

17,167 |

|

2017 |

|

|

|

2017 |

|

|

|

|

Dec 31 |

To Machinery A/c |

|

34,500 |

Dec 31 |

By Profit and Loss A/c |

|

34,500 |

|

|

|

|

34,500 |

|

|

|

34,500 |

|

2018 |

|

|

|

2018 |

|

|

|

|

Dec 31 |

To Machinery A/c |

|

34,500 |

Dec 31 |

By Profit and Loss A/c |

|

34,500 |

|

|

|

|

34,500 |

|

|

|

34,500 |

Working Notes :

|

Calculation of Annual Depreciation

|

|

|

1. |

Depreciation (p.a.) on Machinery Purchased on July 01,2015 |

|

|

Depreciation p.a.=Cost-Scrap Value/Estimated Life of Asset (years) |

|

|

-=(56,000+24,000+5,000)*10% |

|

|

=Rs.8,500 per annum |

|

2. |

Depreciation on Machinery purchased on July 01, 2015 for the year 2015 (6 month) |

|

|

=Rs.8,500p.a. *6/12 |

|

|

=Rs.4,250 |

|

3. |

Depreciation (p.a.) Machinery purchased on September 01,2016 |

|

|

Depreciation p.a.=Cost-Scrap Value/Estimated Life of Asset (years) |

|

|

=(2,50,000+10,000)*10% |

|

|

=Rs.26,000 per annum |

|

4. |

Depreciation on Machinery purchased on September 01,2016 for the year 2016 (4 month) |

|

|

=Rs.26,000*4/12 |

|

|

=Rs.8667 |

|

Books of Berlia Ltd. |

||||||||

|

Machinery Account (Written Down value method) |

||||||||

|

Dr. |

|

|

|

|

|

|

|

Cr. |

|

Date |

Particulars |

J.F. |

Amount Rs. |

Date |

Particulars |

|

J.F. |

Amount Rs. |

|

2015 |

|

|

|

2015 |

|

|

|

|

|

Jul 01 |

To Bank A/c |

|

85,000 |

Dec 31 |

By Depreciation A/c |

|

|

4,250 |

|

|

(56,000 + 24,000 + 5,000) |

|

|

Dec 31 |

By Balance c/d |

|

|

80,750 |

|

|

|

|

85,000 |

|

|

|

|

85,000 |

|

2016 |

|

|

|

2016 |

|

|

|

|

|

Jan 01 |

To Balance b/d |

|

80,750 |

Dec 31 |

By Depreciation A/c |

|

|

|

|

Sep 01 |

To Bank A/c

|

|

|

|

|

|

|

|

|

|

(2,50,000+10,000) |

|

|

|

(80750*10%) |

8,075 |

|

|

|

|

|

|

|

|

Machine 2 (260,000*10%*4/12) |

8,667 |

|

16,742 |

|

|

|

|

|

Dec 31 |

By Balance c/d |

|

|

|

|

|

|

|

|

|

Machine 1 (80,750-8,075) |

72,675 |

|

|

|

|

|

|

|

|

Machine 2 (2,60,000-8,667) |

2,51,333 |

|

3,24,008 |

|

|

|

|

3,40,750 |

|

|

|

|

3,40,750 |

|

2017 |

|

|

|

2017 |

|

|

|

|

|

Jan 01 |

To Balance b/d |

|

3,24,008 |

Dec 31 |

By Depreciation A/c |

|

|

|

|

|

|

|

|

|

Machine 1 (72,675*10%) |

7,268 |

|

|

|

|

|

|

|

|

Machine 2 (2,51,333*10%) |

25,133 |

|

32,401 |

|

|

|

|

|

Dec 31 |

By Balance c/d |

|

|

|

|

|

|

|

|

|

Machine 1 (72,675-7,268) |

65,407 |

|

|

|

|

|

|

|

|

Machine 2 (2,51,333-25,133) |

2,26,200 |

|

2,91,607 |

|

|

|

|

3,24,008 |

|

|

|

|

3,24,008 |

|

2018 |

|

|

|

2018 |

|

|

|

|

|

Jan 01 |

To Balance b/d |

|

2,91,607 |

Dec 31 |

By Depreciation A/c |

|

|

|

|

|

|

|

|

|

Machine 1 (65,407*10%) |

6,541 |

|

|

|

|

|

|

|

|

Machine 2 (2,26,200*10%) |

22,620 |

|

29,161 |

|

|

|

|

|

Dec 31 |

By Balance c/d |

|

|

|

|

|

|

|

|

|

Machine 1 (65,407-6,541) |

58,866 |

|

|

|

|

|

|

|

|

Machine 2 (2,26,200-22,620) |

2,03,580 |

|

2,62,446 |

|

|

|

|

2,91,607 |

|

|

|

|

2,91,607 |

|

Depreciation Account |

|||||||

|

Dr. |

|

|

|

|

|

|

Cr. |

|

Date |

Particulars |

J.F. |

Amount Rs. |

Date |

Particulars |

J.F. |

Amount Rs. |

|

2015 |

|

|

|

2015 |

|

|

|

|

Dec 31 |

To Machinery A/c |

|

4,250 |

Dec 31 |

By Profit and Loss A/c |

|

4,250 |

|

|

|

|

4,250 |

|

|

|

4,250 |

|

2016 |

|

|

|

2016 |

|

|

|

|

Dec 31 |

To Machinery A/c |

|

16,742 |

Dec 31 |

By Profit and Loss A/c |

|

16,742 |

|

|

|

|

16,742 |

|

|

|

16,742 |

|

2017 |

|

|

|

2017 |

|

|

|

|

Dec 31 |

To Machinery A/c |

|

32,401 |

Dec 31 |

By Profit and Loss A/c |

|

32,401 |

|

|

|

|

32,401 |

|

|

|

32,401 |

|

2018 |

|

|

|

2018 |

|

|

|

|

Dec 31 |

To Machinery A/c |

|

29,161 |

Dec 31 |

By Profit and Loss A/c |

|

29,161 |

|

|

|

|

29,161 |

|

|

|

29,161 |

Depreciation, Provisions and Reserves Exercise 272

Solution NUM 5

|

Book of Ganga Ltd |

||||||||

|

Machinery Account |

||||||||

|

Dr. |

|

|

|

|

|

|

|

Cr. |

|

Date |

Particulars |

J.F. |

Amount Rs. |

Date |

Particulars |

|

J.F. |

Amount Rs. |

|

2014 |

|

|

|

2014 |

|

|

|

|

|

Jan 01 |

To Bank A/c (5,50,000 + 50,000) |

|

6,00,000 |

Dec 31 |

By Depreciation A/c |

|

|

|

|

Sept 01 |

To Bank A/c |

|

3,70,000 |

|

Machine 1 |

60,000 |

|

|

|

|

|

|

|

|

Machine 2 (4months) |

12,333 |

|

72,333 |

|

|

|

|

|

Dec 31 |

By Balance c/d |

|

|

8,97,667 |

|

|

|

|

9,70,000 |

|

|

|

|

9,70,000 |

|

2015 |

|

|

|

2015 |

|

|

|

|

|

Jan 01 |

To Balance b/d |

|

8,97,667 |

Dec 31 |

By Depreciation A/c |

|

|

|

|

May 01 |

To Bank A/c |

|

8,40,000 |

|

Machine 1 |

60,000 |

|

|

|

|

|

|

|

|

Machine 2 |

37,000 |

|

|

|

|

|

|

|

|

Machine 3 (8months) |

56,000 |

|

1,53,000 |

|

|

|

|

|

Dec 31 |

By Balance c/d |

|

|

15,84,667 |

|

|

|

|

17,37,667 |

|

|

|

|

17,37,667 |

|

2016 |

|

|

|

2016 |

|

|

|

|

|

Jan 01 |

To Balance b/d |

|

15,84,667 |

Dec 31 |

By Depreciation A/c |

|

|

|

|

|

|

|

|

|

Machine 1 |

60,000 |

|

|

|

|

|

|

|

|

Machine 2 |

37,000 |

|

|

|

|

|

|

|

|

Machine 3 |

84,000 |

|

1,81,000 |

|

|

|

|

|

Dec 31 |

By Balance c/d |

|

|

14,03,667 |

|

|

|

|

15,84,667 |

|

|

|

|

15,84,667 |

|

2017 |

|

|

|

2017 |

|

|

|

|

|

Jan 01 |

To Balance b/d |

|

14,03,667 |

Dec 31 |

By Depreciation A/c |

|

|

|

|

|

|

|

|

|

Machine 1 |

60,000 |

|

|

|

|

|

|

|

|

Machine 2 |

37,000 |

|

|

|

|

|

|

|

|

Machine 3 |

84,000 |

|

1,81,000 |

|

|

|

|

|

Dec 31 |

By Balance c/d |

|

|

12,22,667 |

|

|

|

|

14,03,667 |

|

|

|

|

14,03,667 |

|

Depreciation Account |

|||||||

|

Dr. |

|

|

|

|

|

|

Cr. |

|

Date |

Particulars |

J.F. |

Amount Rs. |

Date |

Particulars |

J.F. |

Amount Rs. |

|

2014 |

|

|

|

2014 |

|

|

|

|

Dec 31 |

To Machinery A/c |

|

72,333 |

Dec 31 |

By Profit and Loss A/c |

|

72,333 |

|

|

|

|

72,333 |

|

|

|

72,333 |

|

2015 |

|

|

|

2015 |

|

|

|

|

Dec 31 |

To Machinery A/c |

|

1,53,000 |

Dec 31 |

By Profit and Loss A/c |

|

1,53,000 |

|

|

|

|

1,53,000 |

|

|

|

1,53,000 |

|

2016 |

|

|

|

2016 |

|

|

|

|

Dec 31 |

To Machinery A/c |

|

1,81,000 |

Dec 31 |

By Profit and Loss A/c |

|

1,81,000 |

|

|

|

|

1,81,000 |

|

|

|

1,81,000 |

|

2017 |

|

|

|

2017 |

|

|

|

|

Dec 31 |

To Machinery A/c |

|

1,81,000 |

Dec 31 |

By Profit and Loss A/c |

|

1,81,000 |

|

|

|

|

1,81,000 |

|

|

|

1,81,000 |

Working Notes : Calculation of Annual Depreciation

|

Machinery I |

||

|

Original cost on 1Jan, 2014 (5,50,000+50,000)=6,00,000 |

||

|

10% Depreciation for 2014 |

60,000 |

|

|

10% Depreciation for 2015 |

60,000 |

|

|

10% Depreciation for 2016 |

60,000 |

|

|

10% Depreciation for 2017 |

60,000 |

2,40,000 |

|

Machinery II |

||

|

Original cost on 1Sep, 2014 =3,70,000 |

||

|

10% Depreciation for 2014 4months |

12,330 |

|

|

10% Depreciation for 2015 |

37,000 |

|

|

10% Depreciation for 2016 |

37,000 |

|

|

10% Depreciation for 2017 |

37,000 |

1,23,330 |

|

Machinery III |

||

|

Original cost on 1May, 2015 =8,40,000 |

||

|

10% Depreciation for 2015 8months |

56,000 |

|

|

10% Depreciation for 2016 |

84,000 |

|

|

10% Depreciation for 2017 |

84,000 |

2,24,000 |

|

Total |

|

5,87,330 |

|

Machinery Account |

|||||||

|

Dr. |

|

|

|

|

|

|

Cr. |

|

Date |

Particulars |

J.F. |

Amount Rs. |

Date |

Particulars |

J.F. |

Amount Rs. |

|

2014 |

|

|

|

2014 |

|

|

|

|

Jan 01 |

To Bank A/c (5,50,000 + 50,000) |

|

6,00,000 |

|

|

|

|

|

Sept 01 |

To Bank A/c |

|

3,70,000 |

Dec 31 |

By Balance c/d |

|

9,70,000 |

|

|

|

|

9,70,000 |

|

|

|

9,70,000 |

|

2015 |

|

|

|

2015 |

|

|

|

|

Jan 01 |

To Balance b/d |

|

9,70,000 |

|

|

|

|

|

May 01 |

To Bank A/c |

|

8,40,000 |

Dec 31 |

By Balance c/d |

|

18,10,000 |

|

|

|

|

18,10,000 |

|

|

|

18,10,000 |

|

2016 |

|

|

|

2016 |

|

|

|

|

Jan 01 |

To Balance b/d |

|

18,10,000 |

Dec 31 |

By Balance c/d |

|

18,10,000 |

|

|

|

|

18,10,000 |

|

|

|

18,10,000 |

|

2017 |

|

|

|

2017 |

|

|

|

|

Jan 01 |

To Balance b/d |

|

18,10,000 |

Dec 31 |

By Balance c/d |

|

18,10,000 |

|

|

|

|

18,10,000 |

|

|

|

18,10,000 |

|

Provision for Depreciation Account |

|||||||

|

Dr. |

|

|

|

|

|

|

Cr. |

|

Date |

Particulars |

J.F. |

Amount Rs. |

Date |

Particulars |

J.F. |

Amount Rs. |

|

2014 |

|

|

|

2014 |

|

|

|

|

Dec 31 |

To Balance c/d |

|

72,333 |

Dec 31 |

By Depreciation A/c |

|

72,333 |

|

|

|

|

72,333 |

|

|

|

72,333 |

|

2015 |

|

|

|

2015 |

|

|

|

|

|

|

|

|

Jan 01 |

By Balance b/d |

|

72,333 |

|

Dec 31 |

To Balance c/d |

|

2,25,333 |

Dec 31 |

By Depreciation A/c |

|

1,53,000 |

|

|

|

|

2,25,333 |

|

|

|

2,25,333 |

|

2016 |

|

|

|

2016 |

|

|

|

|

|

|

|

|

Jan 01 |

By Balance b/d |

|

2,25,333 |

|

Dec 31 |

To Balance c/d |

|

4,06,333 |

Dec 31 |

By Depreciation A/c |

|

1,81,000 |

|

|

|

|

4,06,333 |

|

|

|

4,06,333 |

|

2017 |

|

|

|

2017 |

|

|

|

|

|

|

|

|

Jan 01 |

By Balance b/d |

|

4,06,333 |

|

Dec 31 |

To Balance c/d |

|

5,87,333 |

Dec 31 |

By Depreciation A/c |

|

1,81,000 |

|

|

|

|

5,87,333 |

|

|

|

5,87,333 |

Solution NUM 6

|

Books of Azad Ltd. |

|||||||

|

Furniture Account |

|||||||

|

Dr. |

|

|

|

|

|

|

Cr. |

|

Date |

Particulars |

J.F. |

Amount Rs. |

Date |

Particulars |

J.F. |

Amount Rs. |

|

2014 |

|

|

|

2015 |

|

|

|

|

Oct 01 |

To Bank A/c |

|

4,50,000 |

Mar 31 |

By Balance c/d |

|

7,50,000 |

|

2013 |

|

|

|

|

|

|

|

|

Mar 01 |

To Bank A/c |

|

3,00,000 |

|

|

|

|

|

|

|

|

7,50,000 |

|

|

|

7,50,000 |

|

2015 |

|

|

|

2016 |

|

|

|

|

Apr 01 |

To Balance b/d |

|

7,50,000 |

Mar 31 |

By Balance c/d |

|

7,50,000 |

|

|

|

|

7,50,000 |

|

|

|

7,50,000 |

|

2016 |

|

|

|

2016 |

|

|

|

|

Apr 01 |

To Balance b/d |

|

7,50,000 |

July 01 |

By Furniture Disposal A/c |

|

4,50,000 |

|

|

|

|

|

2017 |

|

|

|

|

|

|

|

|

Mar 31 |

By Balance c/d |

|

3,00,000 |

|

|

|

|

7,50,000 |

|

|

|

7,50,000 |

|

|

|

||||||||

|

|

Accumulated Depreciation Account |

||||||||

|

Dr. |

|

Cr. |

|||||||

|

Date |

Particulars |

J.F. |

Amount Rs. |

Date |

Particulars |

|

J.F. |

Amount Rs. |

|

|

2015 |

|

|

|

2015 |

|

|

|

|

|

|

Mar 31 |

To Balance c/d |

|

37,500 |

Mar 31 |

By Depreciation A/c |

|

|

|

|

|

|

|

|

|

|

Furniture 1 (6 months) |

33,750 |

|

|

|

|

|

|

|

|

|

Furniture 2 (1 months) |

3,750 |

|

37,500 |

|

|

|

|

|

37,500 |

|

|

|

37,500 |

||

|

2016 |

|

|

|

2015 |

|

|

|

|

|

|

Mar 31 |

To Balance c/d |

|

1,44,376 |

Apr 01 |

By Balance b/d |

|

|

37,500 |

|

|

|

|

|

|

2016 |

|

|

|

|

|

|

|

|

|

|

Mar 31 |

By Depreciation A/c |

|

|

|

|

|

|

|

|

|

|

Furniture 1 |

62,438 |

|

|

|

|

|

|

|

|

|

Furniture 2 |

44,438 |

|

1,06,876 |

|

|

|

|

|

1,44,376 |

|

|

|

1,44,376 |

||

|

2016 |

|

|

|

2016 |

|

|

|

|

|

|

July 01 |

To Furniture Disposal A/c |

|

1,09,456 |

Apr 01 |

Balance b/d |

|

|

1,44,376 |

|

|

2017 |

|

|

|

July 01 |

By Depreciation A/c |

|

|

13,268 |

|

|

Mar 31 |

To Balance c/d |

|

85,960 |

2017 |

|

|

|

|

|

|

|

|

|

|

Mar 31 |

By Depreciation A/c |

|

|

37,772 |

|

|

|

|

|

1,95,416 |

|

|

|

1,95,416 |

||

|

Furniture Disposal Account |

|||||||

|

Dr. |

|

|

|

|

|

|

Cr. |

|

Date |

Particulars |

J.F. |

Amount Rs. |

Date |

Particulars |

J.F. |

Amount Rs. |

|

2016 |

|

|

|

2016 |

|

|

|

|

Jul 01 |

To Furniture A/c |

|

4,50,000 |

Jul 01 |

By Accumulated Depreciation A/c |

|

1,09,456 |

|

|

|

|

|

Jul 01 |

By Bank A/c |

|

2,25,000 |

|

|

|

|

|

Jul 01 |

By Profit and Loss A/c (Loss) |

|

1,15,544 |

|

|

|

|

4,50,000 |

|

|

|

4,50,000 |

Working Note : -

1. Calculation of Profit or Loss on sale of furniture.

|

Furniture 1 |

|

|

|

|

|

|

Years |

Opening Balance |

|

Depreciation |

|

Closing Balance

|

|

2014 - 2015 |

4,50,000 |

- |

33,750 (6 months) |

= |

4,16,250 |

|

2015 - 2016 |

4,16,250 |

- |

62,438 |

= |

3,53,812 |

|

2016 - 2017 |

3,53,812 |

- |

13,268 (3 months) |

= |

3,40,544 |

|

|

|

|

1,09,456 |

|

|

|

Particulars |

Rs. |

|

Balance as on July 01,2016 |

3,40,544 |

|

Less : Sale on July 01,2016 (Selling Price) |

2,25,000 |

|

Loss on sale of furniture |

1,15,544 |

Solution NUM 7

|

Books of M/s Lokesh Fabrics |

||||||||

|

Machinery Account |

||||||||

|

Dr. |

|

|

|

|

|

|

|

Cr. |

|

Date |

Particulars |

J.F. |

Amount Rs. |

Date |

Particulars |

|

J.F. |

Amount Rs. |

|

2011 |

|

|

|

2012 |

|

|

|

|

|

Apr 01 |

To Bank A/c |

|

1,00,000 |

Mar 31 |

By Depreciation A/c |

|

|

|

|

|

|

|

|

|

Machine 1 |

15,000 |

|

15,000 |

|

|

|

|

|

Mar 31 |

By Balance c/d |

|

|

85,000 |

|

|

|

|

1,00,000 |

|

|

|

|

1,00,000 |

|

2012 |

|

|

|

2013 |

|

|

|

|

|

Apr 01 |

To Balance b/d |

|

85,000 |

Mar 31 |

By Depreciation A/c |

|

|

|

|

July 01 |

To Bank A/c |

|

2,50,000 |

|

Machine 1 |

15,000 |

|

|

|

|

|

|

|

|

Machine 2 (9 months) |

28,125 |

|

43,125 |

|

|

|

|

|

Mar 31 |

By Balance c/d |

|

|

2,91,875 |

|

|

|

|

3,35,000 |

|

|

|

|

3,35,000 |

|

2013 |

|

|

|

2014 |

|

|

|

|

|

Apr 01 |

To Balance b/d |

|

2,91,875 |

Mar 31 |

By Depreciation A/c |

|

|

|

|

|

|

|

|

|

Machine 1 |

15,000 |

|

|

|

|

|

|

|

|

Machine 2 |

37,500 |

|

52,500 |

|

|

|

|

|

|

(i) 15,000, (ii)37,500 |

|

|

|

|

|

|

|

|

Mar 31 |

By Balance c/d |

|

|

2,39,375 |

|

|

|

|

2,91,875 |

|

|

|

|

2,91,875 |

|

2014 |

|

|

|

2015 |

|

|

|

|

|

Apr 01 |

To Balance b/d |

|

2,39,375 |

Mar 31 |

By Depreciation A/c |

|

|

|

|

|

|

|

|

|

Machine 1 |

15,000 |

|

|

|

|

|

|

|

|

Machine 2 |

37,500 |

|

52,500 |

|

|

|

|

|

Mar 31 |

By Balance c/d |

|

|

1,86,875 |

|

|

|

|

2,39,375 |

|

|

|

|

2,39,375 |

|

2015 |

|

|

|

2015 |

|

|

|

|

|

Apr 01 |

To Balance b/d |

|

1,86,875 |

Oct 01 |

By Depreciation A/c |

|

|

|

|

|

|

|

|

|

Machine 1 (6 months) |

7,500 |

|

7,500 |

|

|

|

|

|

Oct 01 |

By Machinery Disposal A/c |

|

|

32,500 |

|

|

|

|

|

2016 |

|

|

|

|

|

|

|

|

|

Mar 31 |

By Depreciation A/c |

|

|

|

|

|

|

|

|

|

Machine 2 |

37,500 |

|

37,500 |

|

|

|

|

|

Mar 31 |

By Balance c/d |

|

|

1,09,375 |

|

|

|

|

1,86,875 |

|

|

|

|

1,86,875 |

|

Machinery Disposal Account |

|||||||

|

Dr. |

|

|

|

|

|

|

Cr. |

|

Date |

Particulars |

J.F. |

Amount Rs. |

Date |

Particulars |

J.F. |

Amount Rs. |

|

2015 |

|

|

|

2015 |

|

|

|

|

Oct 01 |

To Machinery A/c |

|

32,500 |

Oct 01 |

By Bank A/c |

|

25,000 |

|

|

|

|

|

Oct 01 |

By Profit and Loss A/c (Loss) |

|

7,500 |

|

|

|

|

32,500 |

|

|

|

32,500 |

Working Note :

Calculation of Profit or Loss on sale of Machine sold on Oct 01,2015

|

Years |

Depreciation |

|

1 April - 31 March 2011-12 |

15,000 |

|

1 April - 31 March 2012-13 |

15,000 |

|

1 April - 31 March 2013-14 |

15,000 |

|

1 April - 31 March 2014-15 |

15,000 |

|

1April - 1 Oct 2015 |

7,500 |

|

|

67,500 |

|

Original cost |

1,00,000 |

|

Less : Accumulated depreciation for 4yrs and 6 months |

67,500 |

|

Book value of the Machine on Oct 01,2015 |

32,500 |

|

Less: Sale Proceeds |

25,000 |

|

Loss on Sale of Machinery |

7,500 |

Solution NUM 8

|

Books of Crystal Ltd. |

|||||||

|

Machinery Account |

|||||||

|

Dr. |

|

|

|

|

|

|

Cr. |

|

Date |

Particulars |

J.F. |

Amount Rs. |

Date |

Particulars |

J.F. |

Amount Rs. |

|

2015 |

|

|

|

2015 |

|

|

|

|

Jan 01 |

To Balance b/d (old) |

|

15,00,000 |

Apr 01 |

By Machinery Disposal A/c |

|

2,00,000 |

|

July01 |

To Bank A/c |

|

6,00,000 |

Dec 31 |

By Balance c/d |

|

19,00,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

21,00,000 |

|

|

|

21,00,000 |

|

Provision For Depreciation Account |

||||||||

|

Dr. |

|

|

|

|

|

|

|

Cr. |

|

Date |

Particulars |

J.F. |

Amount Rs. |

Date |

Particulars |

|

J.F. |

Amount Rs. |

|

2015 |

|

|

|

2015 |

|

|

|

|

|

Apr 01 |

To Machinery Disposal A/c |

|

1,30,000 |

Jan 01 |

By Balance b/d |

|

|

5,50,000 |

|

|

|

|

|

Apr 01 |

By Depreciation A/c |

|

|

|

|

|

|

|

|

|

Machine I Old (1 Jan, 2012) (3 months) |

10,000 |

|

10,000 |

|

|

|

|

|

Dec 31 |

By Depreciation A/c |

|

|

|

|

|

|

|

|

|

Machine I old (Balance) (15,00,000-2,00,000)*20% (13,00,000*20%) |

2,60,000 |

|

|

|

Dec 31 |

To Balance c/d |

|

7,50,000 |

|

Machine II (1 July, 2015) (6 months) |

60,000 |

|

3,20,000 |

|

|

|

|

8,80,000 |

|

|

|

|

8,80,000 |

Machinery Disposal Account

|

Dr. Cr. |

|||||||

|

Date |

Particulars |

J.F. |

Amount Rs. |

Date |

Particulars |

J.F. |

Amount Rs. |

|

2015 |

|

|

|

2015 |

|

|

|

|

Apr 01 |

To Machinery A/c |

|

2,00,000 |

Apr 01 |

By Provision for Depreciation A/c |

|

1,30,000 |

|

Apr 01 |

To Profit and Loss A/c (Profit) |

|

5,000 |

Apr 01 |

By Bank A/c |

|

75,000 |

|

|

|

|

2,05,000 |

|

|

|

2,05,000 |

Working Note :

Calculation of Profit or Loss on sale of Machine sold on April 01,2015

|

Years |

Opening Balance |

|

Depreciation |

|

Closing Balance |

|

2012 |

2,00,000 |

- |

40,000 |

= |

1,60,000 |

|

2013 |

1,60,000 |

- |

40,000 |

= |

1,20,000 |

|

2014 |

1,20,000 |

- |

40,000 |

= |

80,000 |

|

2015 |

80,000 |

- |

10,000 (3 months) |

= |

70,000 |

|

Accumulated Depreciation |

= |

1,30,000 |

|

|

|

|

Value on April 01, 2015 |

70,000 |

|

Less : - Sale on April 1, 2015 |

75,000 |

|

Profit and Sale of Machinery |

5,000 |

Solution NUM 9

|

Books of M/s Excel Computers |

||||||||

|

Computer Account |

||||||||

|

Dr. |

|

|

|

|

|

|

|

Cr. |

|

Date |

Particulars |

J.F. |

Amount Rs. |

Date |

Particulars |

|

J.F. |

Amount Rs. |

|

2010 |

|

|

|

2011 |

|

|

|

|

|

Apr 01 |

To Balance b/d (old) |

|

50,000 |

Mar 31 |

By Depreciation A/c |

|

|

|

|

July 01 |

To Bank A/c |

|

2,50,000 |

|

Old (1,20,000*10%) |

12,000 |

|

|

|

2011 |

|

|

|

|

Computer 1 (9 months) |

18,750 |

|

|

|

Jan 01 |

To Bank A/c |

|

30,000 |

|

Computer 2 (3months) |

750 |

|

31,500 |

|

|

|

|

|

Mar 31 |

By Balance c/d |

|

|

2,98,500 |

|

|

|

|

3,30,000 |

|

|

|

|

3,30,000 |

|

2011 |

|

|

|

2012 |

|

|

|

|

|

Apr 01 |

To Balance b/d |

|

2,98,500 |

Mar 31 |

By Depreciation A/c |

|

|

|

|

|

|

|

|

|

Old (1,20,000*10%) |

12,000 |

|

|

|

|

|

|

|

|

Computer 1 |

25,000 |

|

|

|

|

|

|

|

|

Computer 2 |

3,000 |

|

40,000 |

|

|

|

|

|

Mar 31 |

By Balance c/d |

|

|

2,58,500 |

|