Class 11-commerce NCERT Solutions Accountancy Part I Chapter 8: Bills of Exchange

Bills of Exchange Exercise 310

Solution SA 1

Cheques and Bills of exchange are the commonly used negotiable instruments.

Solution SA 2

|

Bills of Exchange |

Promissory Note |

|

A bill of exchange is an instrument in writing containing an unconditional order, signed by the maker directing a certain person to pay a certain amount of money only to, or to the order of a certain person or to the bearer of the instrument. |

A promissory note is an instrument in writing containing an unconditional undertaking signed by the maker to pay a certain sum of money only to, or to the order of a certain person or to the bearer of the instrument. |

|

There are three parties involved, namely drawer, drawee and payee. |

There are two parties involved, namely maker and payee. |

Solution SA 3

Essential features of bills of exchange are as follows:

- A bill of exchange is a written order to make payment

- It is an unconditional order to make payment by a person i.e. drawee

- The amount of bill of exchange and the date of payment are certain

- It is signed by the drawer of the bill

- It is accepted by the drawee by signing on it

- The amount specified in the bill of exchange is payable either on demand or on the expiry of a fixed period

- The amount specified in the bill is payable either to a certain person or to his order or to the bearer of the bill

- It is stamped as per legal requirements

Solution SA 4

There are three parties in a bill of exchange:

- Drawer is the person who makes the bill of exchange. She/he is a person who has granted credit to the person on whom the bill of exchange is drawn. The drawer is entitled to receive money from the drawee (acceptor).

- Drawee is the person on whom the bill of exchange is drawn for acceptance and to whom credit has been granted by the drawer. He/she is liable to pay money to the creditor/drawer.

- Payee is the person who receives the payment from the drawee. Usually the drawer and the payee are the same person.

Solution SA 5

The date calculated after adding 3 days of grace to the due date of a bill is called the date of maturity of a bill. It is to be noted that when a bill is to be payable on demand/at sight, then days of grace is not applicable. When the period of a bill is mentioned in days, the maturity of bill is calculated in days. Similarly, when the period of a bill is mentioned in months, the maturity of bill is calculated in months. In certain cases, when the maturity date of any bill falls on a public holiday, then the maturity date of the bill will be the previous business day.

Solution SA 6

When the drawee of the bill fails to make the payment on the maturity date of the bill, then the bill is said to have been dishonoured. Hence, liability of the acceptor is restored. Entries made for recording dishonour of the bill of exchange are as follows:

In the books of drawer

|

Drawee's A/c |

Dr. |

|

To Bills Receivable A/c |

|

|

(Being bill dishonoured) |

|

In the books of drawee

|

Bills Payable A/c |

Dr. |

|

To Drawer's A/c |

|

|

(Being bill dishonoured) |

|

Solution SA 7

There are two parties to a promissory note:

- Maker- The person who makes the note and undertakes to pay the amount.

- Payee- The person who receives the payment.

Solution SA 8

A bill of exchange is a written instrument which contains an unconditional order directing a person to pay a certain amount on an agreed date. In other words, it is drawn by the creditor on her/his debtors to make a payment of a certain amount on the mentioned date. Such a bill comes into existence after the consent of both the parties. A bill cannot come into existence without the acceptance of a debtor. Hence, the debtor of the bill has to accept the terms of the bill, sign the same and make it a legal document.

Solution SA 9

When the drawee of the bill fails to make the payment on the maturity date of the bill, then the bill is said to have been dishonoured. To have a legal proof of the dishonour, the bill gets noted by the notary public who is approved by the central/state government. The notary public charges fees called the noting charges for noting and protesting the bill of exchange of its dishonour.

Solution SA 10

When the drawee does not have enough funds to make the payment, he may approach the drawer and ask for an extension of time for the payment. If the drawer agrees, then a new bill is drawn which is known as renewal of bill. The new bill may include interest for the extended period.

Solution SA 11

|

Serial Number of Bill |

Date Received |

Date of Bill |

Received From Whom |

Drawer |

Acceptor |

Where payable |

Term |

Due date |

Ledger Folio |

Amount |

Cash Book Folio |

Remarks |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Solution SA 12

|

Serial Number of Bill |

Date of Bill |

Given To Whom |

Drawer |

Payee |

Payable Where |

Term of Bill |

Due Date |

Ledger Folio |

Amount Paid |

Date |

Cash Book Folio |

Remarks |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Solution SA 13

When the drawee of the bill pays off the amount of the bill before the maturity of the bill it is called retirement of the bill. Holder of the bill may give discount for such earlier payment which is called as 'rebate'.

Entry in the books of the holder of the bill

|

Cash A/c |

Dr. |

|

Rebate A/c |

Dr. |

|

To Bills Receivable A/c |

|

|

(Being bill amount received before maturity and rebate allowed for retirement of the bill) |

|

Entry in the books of the acceptor (drawee) of the bill

|

Bills Payable A/c |

Dr. |

|

To Cash A/c |

|

|

To Rebate A/c |

|

|

(Being bill paid and rebate received on retirement of the bill) |

|

|

|

|

Solution SA 14

If the drawee wishes to pay the bill before the due date of the bill to the holder and the holder accepts such request, then due to the early payment, the holder may give some discount to the drawee. Such a discount is termed as rebate.

Solution SA 15

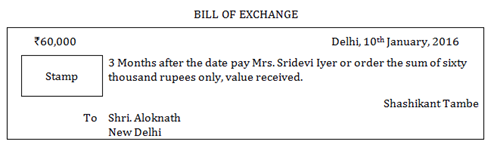

Performa of a Bill of exchange is given below.

Solution LA 1

According to Negotiable Instrument Act, 1981, "A bill of exchange is defined as an instrument in writing, containing an unconditional order, signed by the maker, directing a certain person to pay a certain sum of money only to, or to the order of, a certain person or to the bearer of the instrument."

As the definition mentions the bill is an unconditional order to pay i.e. no conditions should be applicable with respect to the payment and the drawee of the bill is obliged to pay the maker of the bill. This is one of the main features of a bill of exchange. All the conditions with respect to the bill, for example; the amount, the date of payment, the parties involved needs to be specified with clarity.

Solution LA 2

On the maturity of the bill, when the acceptor of the bill fails to make the payment, it is said that the bill is dishonoured. This restores the liability of the acceptor.

Entry in the books of drawer:

|

Drawee A/c |

Dr. |

|

-----------To Bills Receivable A/c |

|

|

(Being bill dishonoured) |

|

Entry in the books of drawee:

|

Bills Payable A/c |

Dr. |

|

-----------To Drawer A/c |

|

|

(Being bill dishonoured) |

|

Noting charges is the fee paid to the notary public for noting and protesting the bill of exchange of its dishonour.

Effect of Noting charges in the books of the drawer:

|

Drawee A/c |

Dr. |

|

-----------To Bills Receivable A/c |

|

|

-----------To Cash A/c (Noting charges) |

|

|

(Being bill dishonoured and Noting charges paid) |

|

In the books of drawee:

|

Bills Payable A/c |

Dr. |

|

Noting charges A/c |

Dr. |

|

-----------To Drawer A/c |

|

|

(Being bill dishonoured and Noting charges due) |

|

Solution LA 3

The procedure to calculate the date of maturity of a bill of exchange is given below.

- Determine the date on which the bill will be due.

- Add three days of grace to the due date of the bill. It is standard process to add days of grace.

- The date obtained after adding the three days to the due date is called the maturity date of the bill.

However, the application of the days of grace depend on the following situations:

- Days of grace are not applicable when a bill is payable 'at sight' or on demand.

- When the period of the bill is mentioned in months, the calculation of the maturity date will be in the terms of calendar month.

- When the period of the bill is mentioned in days, the calculation of the maturity date is also calculated in days including the date of payment but excluding the date of transaction.

- If the bill matures on a national holiday or Sunday, then the preceding business day becomes the maturity date of the bill.

- For example, if the maturity date of a bill is calculated as on 15th August, 2015 then the preceding day that is 14th August, 2015 will be considered as the maturity date.

- If the maturity day happens to be an emergency holiday declared under the Negotiable Instruments Act, 1881, then the next working day is to be considered as the maturity date.

Solution LA 4

|

Bills of Exchange |

Promissory Note |

|

It is an order to pay. |

It is a promise to pay. |

|

There are three parties involved, drawer, acceptor and payee. |

There are two parties involved, maker and payee. |

|

It is drawn by the creditor. |

It is drawn by the debtors. |

|

It needs acceptance by the drawee. |

Acceptance is not required. |

|

Drawer and payee may be the same. |

Promissor cannot be the payee. |

|

In case of dishonour of the bill, the bill may get noted. |

Noting is not necessary. |

Solution LA 5

When the drawee of the bill pays off the amount of the bill before the maturity of the bill it is called retirement of the bill. Holder of the bill may give discount for such earlier payment which is called as 'rebate'.

As the holder of the bill provides the rebate, it is a loss for the holder of the bill and hence it is debited in the books of the holder when payment is received.

|

Cash A/c |

Dr. |

|

Rebate A/c |

Dr. |

|

---------To Bills Receivable A/c |

|

|

(Being payment received and rebate allowed for early payment) |

|

The rebate is a gain for the drawee; so, it is credited in the books of the drawee.

|

Bills Payable A/c |

Dr. |

|

To Cash A/c |

|

|

To Rebate A/c |

|

|

(Being bill paid before the due date and rebate received for early payment) |

|

Solution LA 6

Bills receivable book is a special purpose book that is maintained to keep records of bills received from the debtors. It contains details such as acceptor's name, date of bill, due date and amount. for future references.

Benefits of maintaining the bill receivable book:

- Source of information: The general information related to the each of the bills i.e. the amount, due date and name of the drawee are recorded at one place and hence are easily accessible.

- Avoid fraud: As the details of all the bills are recorded at one place, possibility of fraud is reduced.

- Responsibility: The person who maintains the bills receivable book will also be responsible for any errors or omissions. Therefore, higher degree of accountability and responsibility exists. Also, if any error is detected, then it can be fixed quickly.

- Time saving: Recording of bills receivable through the bills receivable book takes lesser time than that of journal entry.

Solution LA 7

A bills payable book is a special purpose book, maintained to keep records of acceptance of bills, given to the creditors. It contains details of the amount, date of bill, due date and name of the drawer to whom acceptance is given for future references.

Benefits of Maintaining Bills Payable Book

- Source of information: The general information related to the each of the bills i.e. the amount, due date and name of the drawee are recorded at one place and hence are easily accessible.

- Avoid fraud: As the details of all the bills are recorded at one place, possibility of fraud is reduced.

- Time saving: Recording of bills receivable through the bills receivable book takes lesser time than that of journal entry.

- Responsibility: As the transactions are recorded by the same person errors if any can be easily detected and rectified. This leads to enhancement of responsibility and accountability of the accountant.

Solution NUM 1

|

Book of Rao Journal Entries |

|||||

|

Date |

Particulars |

L.F. |

Dr. Rs. |

Cr. Rs. |

|

|

2016 |

|

|

|

||

|

Jan 01 |

Reddy A/c |

Dr. |

10,000 |

|

|

|

|

----------To Sales A/c |

10,000 |

|||

|

|

(Being goods sold to Reddy) |

|

|||

|

|

|

|

|||

|

Jan 01 |

Cash A/c |

Dr. |

5,000 |

|

|

|

|

----------To Reddy A/c |

5,000 |

|||

|

|

(Being cash received from Reddy) |

|

|||

|

|

|

||||

|

Jan 01 |

Bills Receivable A/c |

Dr. |

5,000 |

|

|

|

|

----------To Reddy A/c |

5,000 |

|||

|

|

(Being bill received and accepted from Reddy for 30 days) |

|

|||

|

|

|

||||

|

Feb 03 |

Cash A/c |

Dr. |

5,000 |

|

|

|

|

----------To Bills Receivable A/c |

5,000 |

|||

|

(Being Reddy's acceptance met on due date) |

|||||

|

|

|

|

|

||

|

Books of Reddy Rao's Account |

|||||||

|

Dr. |

Cr. |

||||||

|

Date |

Particulars |

J.F. |

Amount Rs. |

Date |

Particulars |

J.F. |

Amount Rs. |

|

2016 |

2016 |

|

|

||||

|

Jan 01 |

To Cash A/c |

|

5,000 |

Jan01 |

By Purchases A/c |

|

10,000 |

|

Jan 01 |

To Bills Payable A/c |

|

5,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10,000 |

10,000 |

|||

Bills of Exchange Exercise 311

Solution NUM 2

|

Book of Parvati Journal |

||||||

|

Date |

Particulars |

L.F. |

Dr. Rs. |

Cr. Rs. |

||

|

2016 |

|

|

|

|||

|

Jan 01 |

Shankar A/c |

Dr. |

8,000 |

|

||

|

|

----------To Sales A/c |

8,000 |

||||

|

|

(Being goods sold to Shankar) |

|

||||

|

|

|

|

||||

|

Jan 01 |

Bills Receivable A/c |

Dr. |

8,000 |

|

||

|

|

----------To Shankar A/c |

8,000 |

||||

|

|

(Being promissory note received from Shankar for three months) |

|

||||

|

|

|

|

||||

|

Apr 05 |

Cash A/c |

Dr. |

8,000 |

|

||

|

|

----------To Bills Receivable A/c |

8,000 |

||||

|

|

(Being cash received for promissory note one day after the maturity date on account of holiday declared by govt.) |

|

|

|||

|

|

|

|

|

|||

|

Book of Shankar Journal |

|||||

|

Date |

Particulars |

L.F. |

Dr. Rs. |

Cr. Rs. |

|

|

2016 |

|

|

|

||

|

Jan 01 |

Purchases A/c |

Dr. |

8,000 |

|

|

|

|

----------To Parvati A/c |

8,000 |

|||

|

|

(Being goods purchased from Parvati) |

|

|||

|

|

|

|

|||

|

Jan 01 |

Parvati A/c |

Dr. |

8,000 |

|

|

|

|

----------To Bills Payable A/c |

8,000 |

|||

|

|

(Being promissory note for three months sent to Parvati) |

|

|||

|

|

|

||||

|

Apr 5 |

Bills Payable A/c |

Dr. |

8,000 |

||

|

----------To Cash A/c |

8,000 |

||||

|

(Being cash paid on maturity promissory note) |

|||||

Solution NUM 3

|

Book of Vishal Journal |

|||||

|

Date |

Particulars |

L.F. |

Dr. Rs. |

Cr. Rs. |

|

|

2016 |

|

|

|

||

|

Jan 05 |

Manju A/c |

Dr. |

7,000 |

|

|

|

|

----------To Sales A/c |

7,000 |

|||

|

|

(Being goods sold to Manju) |

|

|||

|

|

|

|

|||

|

Jan 05 |

Bills Receivable A/c |

Dr. |

7,000 |

|

|

|

|

----------To Manju A/c |

7,000 |

|||

|

|

(Being bill received with Manju's acceptance for two months) |

|

|||

|

|

|

|

|||

|

Jan 05 |

Bank A/c |

Dr. |

6,860 |

|

|

|

|

Discount A/c |

Dr. |

140 |

7,000 |

|

|

|

----------To Bills Receivable A/c |

|

|||

|

|

(Being bill receivable discounted with the bank @ 12 % p.a. for two months) |

|

|

||

Note: On payment of the bill, no entry will be made.

|

Book of Manju Journal |

|||||

|

Date |

Particulars |

L.F. |

Dr. Rs. |

Cr. Rs. |

|

|

2016 |

|

|

|

||

|

Jan 05 |

Purchases A/c |

Dr. |

7,000 |

|

|

|

|

----------To Vishal A/c |

7,000 |

|||

|

|

(Being goods purchased from Vishal) |

|

|||

|

|

|

|

|||

|

Jan 05 |

Vishal A/c |

Dr. |

7,000 |

|

|

|

|

----------To Bills Payable A/c |

7,000 |

|||

|

|

(Being bill accepted drawn by Vishal) |

|

|||

|

|

|

|

|

|

|

|

Mar08 |

Bills Payable A/c |

Dr. |

7,000 |

||

|

|

----------To Bank A/c |

7,000 |

|||

|

(Being amount of bill payable paid to bank on maturity) |

|||||

Solution NUM 4

|

Book of Jimmi Journal |

|||||

|

Date |

Particulars |

L.F. |

Dr. Rs. |

Cr. Rs. |

|

|

2016 |

|

|

|

||

|

Feb 01 |

John A/c |

Dr. |

15,000 |

|

|

|

|

----------To Sales A/c |

15,000 |

|||

|

|

(Being goods sold to John) |

|

|||

|

|

|

|

|||

|

Feb 01 |

Bank A/c |

Dr. |

5,000 |

|

|

|

|

----------To John A/c |

5,000 |

|||

|

|

(Being cheque received for Rs.5,000 from John) |

|

|||

|

|

|

|

|||

|

Feb 01 |

Bills Receivable A/c |

Dr. |

10,000 |

|

|

|

|

----------To John A/c |

10,000 |

|||

|

|

(Being bill received from John for 40 days) |

|

|

||

|

|

|

|

|||

|

Mar 11 |

Bill Sent for Collection A/c |

Dr. |

10,000 |

|

|

|

|

----------To Bills Receivable A/c |

|

10,000 |

||

|

|

(Being John's acceptance sent to bank for collection) |

|

|||

|

|

|

|

|||

|

Mar 16 |

Bank A/c |

Dr. |

10,000 |

|

|

|

|

----------To Bill Sent for Collection A/c |

10,000 |

|||

|

|

(Being John's acceptance met on due date and bank received the payment) |

|

|

||

|

Ledger John's Account |

|||||||

|

Dr. |

Cr. |

||||||

|

Date |

Particulars |

J.F. |

Amount Rs. |

Date |

Particulars |

J.F. |

Amount Rs. |

|

2016 |

|

2016 |

|

|

|||

|

Feb 01 |

To Sales A/c |

15,000 |

Feb 01 |

By Bank A/c |

5,000 |

||

|

Feb 01 |

By Bills Receivable A/c |

10,000 |

|||||

|

15,000 |

15,000 |

||||||

|

Book of John Journal |

|||||

|

Date |

Particulars |

L.F. |

Dr. Rs. |

Cr. Rs. |

|

|

2016 |

|

|

|

||

|

Feb 01 |

Purchases A/c |

Dr. |

15,000 |

|

|

|

|

----------To Jimmi A/c |

15,000 |

|||

|

|

(Being goods purchases from Jimmi) |

|

|||

|

|

|

|

|||

|

Feb 01 |

Jimmi A/c |

Dr. |

5,000 |

|

|

|

|

----------To Bank A/c |

5,000 |

|||

|

|

(Being cheque paid to Jimmi) |

|

|||

|

|

|

|

|||

|

Feb 01 |

Jimmi A/c |

Dr. |

10,000 |

|

|

|

|

----------To Bills Payable A/c |

10,000 |

|||

|

|

(Being bill draw accepted for 40 days) |

|

|

||

|

|

|

|

|||

|

Mar 16 |

Bills Payable A/c |

Dr. |

10,000 |

|

|

|

|

----------To Bank A/c |

|

10,000 |

||

|

|

(Being payment made on maturity of the bill to bank) |

|

|||

|

Ledger Jimmi's Account |

|||||||

|

Dr. |

Cr. |

||||||

|

Date |

Particulars |

J.F. |

Amount Rs. |

Date |

Particulars |

J.F. |

Amount Rs. |

|

2016 |

|

2016 |

|

|

|||

|

Feb 01 |

To Bank A/c |

5,000 |

Feb 01 |

By Purchases A/c |

15,000 |

||

|

Feb 01 |

To Bills Payable A/c |

10,000 |

|||||

|

15,000 |

15,000 |

||||||

Solution NUM 5

|

Books of Kartar Journal Entries |

||||||

|

Date |

Particulars |

L.F. |

Dr. Rs. |

Cr. Rs. |

||

|

2015 |

|

|

|

|

||

|

Jan 15 |

Bhagwan |

Dr. |

|

30,000 |

|

|

|

|

----------To Sales A/c |

|

|

30,000 |

||

|

|

(Being goods sold to Bhagwan) |

|

|

|

||

|

|

|

|

|

|

||

|

Jan 15 |

Bills Receivable A/c |

Dr. |

|

30,000 |

|

|

|

|

----------To Bhagwan A/c |

|

|

30,000 |

||

|

|

(Being three bills of Rs.10,000 each, received from Bhagwan the first bill for one month, second bill for two months and third bill for three months) |

|

|

|

|

|

|

|

|

|

|

|||

|

Jan 15 |

Ratna A/c |

Dr. |

|

10,000 |

|

|

|

|

----------To Bills Receivable A/c |

|

|

10,000 |

||

|

|

(Being the second bill endorsed to Ratna) |

|

|

|

||

|

|

|

|

|

|

||

|

Jan 15 |

Bank A/c |

Dr. |

|

9,850 |

|

|

|

|

Discount A/c |

Dr. |

|

150 |

|

|

|

|

----------To Bills Receivable A/c |

|

|

10,000 |

||

|

|

(Being bill discounted at 6% p.a.) |

|

|

|

||

|

|

|

|

|

|

||

|

Feb 18 |

Cash A/c |

Dr. |

|

10,000 |

|

|

|

|

----------To Bills Receivable A/c |

|

|

10,000 |

||

|

|

(Being the first bill met by Bhagwan, on due date) |

|

|

|

||

|

Bhagwan's Account |

|||||||

|

Dr. |

Cr. |

||||||

|

Date |

Particulars |

J.F. |

Amount Rs. |

Date |

Particulars |

J.F. |

Amount Rs. |

|

2015 |

|

2015 |

|

|

|||

|

Jan 15 |

To Sales A/c |

30,000 |

Jan 15 |

By Bills Receivable A/c |

30,000 |

||

|

30,000 |

30,000 |

||||||

|

Ratna's Account |

|||||||

|

Dr. |

Cr. |

||||||

|

Date |

Particulars |

J.F. |

Amount Rs. |

Date |

Particulars |

J.F. |

Amount Rs. |

|

2015 |

|

2015 |

|

|

|||

|

Jan 15 |

To Bills Receivable A/c |

10,000 |

Jan 31 |

By Balance c/d |

10,000 |

||

|

10,000 |

10,000 |

||||||

|

Bills Receivable Account |

|||||||

|

Dr. |

Cr. |

||||||

|

Date |

Particulars |

J.F. |

Amount Rs. |

Date |

Particulars |

J.F. |

Amount Rs. |

|

2015 |

|

2015 |

|

|

|||

|

Jan 15 |

To Bhagwan A/c |

30,000 |

Jan 15 |

By Ratna A/c |

10,000 |

||

|

Jan 15 |

By Bank A/c |

9,850 |

|||||

|

Jan 15 |

By Discount A/c |

150 |

|||||

|

Jan 15 |

By Cash A/c |

10,000 |

|||||

|

|

|

|

|

|

|

|

|

|

30,000 |

30,000 |

||||||

|

Cash Account |

|||||||

|

Dr. |

Cr. |

||||||

|

Date |

Particulars |

J.F. |

Amount Rs. |

Date |

Particulars |

J.F. |

Amount Rs. |

|

2015 |

|

2015 |

|

|

|||

|

Feb 18 |

To Bills Receivable A/c |

10,000 |

Feb 28 |

By Balance c/d |

10,000 |

||

|

10,000 |

10,000 |

||||||

|

Bank's Account |

|||||||

|

Dr. |

Cr. |

||||||

|

Date |

Particulars |

J.F. |

Amount Rs. |

Date |

Particulars |

J.F. |

Amount Rs. |

|

2015 |

|

2015 |

|

|

|||

|

Jan 15 |

To Bills Receivable A/c |

9,850 |

Jan 31 |

By Balance c/d |

9,850 |

||

|

9,850 |

9,850 |

||||||

|

Books of Bhagwan Journal Entries |

|||||

|

Date |

Particulars |

|

L.F. |

Dr. Rs. |

Cr. Rs. |

|

2015 |

|

|

|

|

|

|

Jan 15 |

Purchases A/c |

Dr. |

|

30,000 |

|

|

To Kartar A/c |

|

|

|

30,000 |

|

|

(Being good purchased from Kartar on Cr.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Jan 15 |

Kartar A/c |

Dr. |

|

30,000 |

|

|

To Bills Payable A/c |

|

|

|

30,000 |

|

|

(Being three bill Rs.10,000 each drawn by Kartar the first bill for one month, the second bill for two months and the third bill for three months, accepted and returned them to Kartar) |

|

|

|

|

|

|

|

|||||

|

Feb 18 |

Bills Payable A/c |

Dr. |

|

10,000 |

|

|

To Cash A/c |

10,000 |

||||

|

(Being first was paid on due date) |

|||||

|

Mar18 |

Bills Payable A/c |

Dr. |

|

10,000 |

|

|

To Bank A/c |

10,000 |

||||

|

(Being second bill was paid on due to Ratna) |

|||||

|

Apr 18 |

Bills Payable A/c |

Dr. |

|

10,000 |

|

|

To Bank A/c |

10,000 |

||||

|

(Being third bill was paid on due to bank) |

|||||

|

Kartar's Account |

|||||||

|

Dr. |

Cr. |

||||||

|

Date |

Particulars |

J.F. |

Amount Rs. |

Date |

Particulars |

J.F. |

Amount Rs. |

|

2015 |

|

2015 |

|

|

|||

|

Jan 15 |

To Bills Payable A/c |

30,000 |

Jan 15 |

By Purchases A/c |

30,000 |

||

|

|

|||||||

|

30,000 |

30,000 |

||||||

|

Bills Payable Account |

|||||||

|

Dr. |

Cr. |

||||||

|

Date |

Particulars |

J.F. |

Amount Rs. |

Date |

Particulars |

J.F. |

Amount Rs. |

|

2015 |

|

2015 |

|

|

|||

|

Feb 18 |

To Cash A/c |

10,000 |

Jan 15 |

By Kartar A/c |

30,000 |

||

|

Mar 18 |

To Bank A/c |

10,000 |

|||||

|

Apr 18 |

To Bank A/c |

10,000 |

|||||

|

30,000 |

30,000 |

||||||

|

Cash Account |

|||||||

|

Dr. |

Cr. |

||||||

|

Date |

Particulars |

J.F. |

Amount Rs. |

Date |

Particulars |

J.F. |

Amount Rs. |

|

2015 |

|

2015 |

|

|

|||

|

Feb28 |

To Balance c/d |

10,000 |

Feb 18 |

By Bills Payable A/c |

10,000 |

||

|

10,000 |

10,000 |

||||||

|

Bank Account |

|||||||

|

Dr. |

Cr. |

||||||

|

Date |

Particulars |

J.F. |

Amount Rs. |

Date |

Particulars |

J.F. |

Amount Rs. |

|

2015 |

|

2015 |

|

|

|||

|

Apr 31 |

To Balance c/d |

20,000 |

Mar18 |

By Bills Payable A/c |

10,000 |

||

|

Apr18 |

By Bills Payable A/c |

10,000 |

|||||

|

20,000 |

20,000 |

||||||

Solution NUM 6

As per the provisions of Negotiable Instrument Act, when the maturity date of any bill falls on a public holiday then the maturity date of the bill will be the previous business day.

20 days after Jan 01, 2016 is 21st Jan, 2016. Adding 3 days of grace, we get the maturity date as 24th Jan, 2016. Previous business day is 23rd Jan, 2016.

|

Book of Arun Journal Entries |

|||||

|

Date |

Particulars |

L.F. |

Dr. Rs. |

Cr. Rs. |

|

|

2016 |

|

|

|

||

|

Jan 01 |

Sunil A/c |

Dr. |

30,000 |

|

|

|

|

---------To Sales A/c |

30,000 |

|||

|

|

(Being goods sold to Sunil) |

|

|||

|

|

|

|

|||

|

Jan 01 |

Cash A/c |

Dr. |

14,700 |

|

|

|

|

Discount Allowed A/c |

Dr. |

300 |

|

|

|

|

---------To Sunil A/c |

15,000 |

|||

|

|

(Being half of the amount due from Sunil was received and allowed him 2% cash discount) |

|

|

||

|

|

|

|

|||

|

Jan 01 |

Bills Receivable A/c |

Dr. |

15,000 |

|

|

|

|

---------To Sunil A/c |

15,000 |

|||

|

|

(Being promissory note received for balance amount due from Sunil) |

|

|

|

|

|

|

|

|

|||

|

Jan 23 |

Cash A/c |

Dr. |

15,000 |

|

|

|

|

---------To Bills Receivable A/c |

15,000 |

|||

|

|

(Being cash received from Sunil one day before the maturity date due to public holiday) |

|

|

||

|

Book of Sunil Journal Entries |

|||||

|

Date |

Particulars |

L.F. |

Dr. Rs. |

Cr. Rs. |

|

|

2016 |

|

|

|

||

|

Jan01 |

Purchases A/c |

Dr. |

30,000 |

|

|

|

|

---------To Arun A/c |

30,000 |

|||

|

|

(Being goods purchased from Arun) |

||||

|

Jan 01 |

Arun A/c |

Dr. |

15,000 |

||

|

---------To Cash A/c |

14,700 |

||||

|

---------To Discount Received A/c |

300 |

||||

|

(Being half amount due to Arun paid by cheque and 2% discount allowed by him) |

|||||

|

Jan 01 |

Arun A/c |

Dr. |

15,000 |

||

|

---------To Bills Payable A/c |

15,000 |

||||

|

(Being promissory note issued in favour of Arun for twenty days) |

|||||

|

Jan 23 |

Bills Payable A/c |

Dr. |

15,000 |

||

|

---------To Cash A/c |

15,000 |

||||

|

(Being promissory note met one day before the maturity day) |

|||||

Solution NUM 7

Case i: When the bill was retained by Darshan till the date of its maturity

|

Books of Darshan Journal Entries |

|||||

|

Date |

Particulars |

L.F. |

Dr. Rs. |

Cr. Rs. |

|

|

2016 |

|

|

|

||

|

Jan 08 |

Varun A/c |

Dr. |

40,000 |

|

|

|

|

---------To Sales A/c |

40,000 |

|||

|

|

(Being goods sold to Varun) |

|

|||

|

|

|

|

|||

|

Jan 08 |

Bills Receivable A/c |

Dr. |

40,000 |

|

|

|

|

---------To Varun A/c |

40,000 |

|||

|

|

(Being Varun's acceptance received) |

|

|||

|

|

|

|

|||

|

Mar 11 |

Cash A/c |

Dr. |

40,000 |

|

|

|

|

---------To Bills Receivable A/c |

40,000 |

|||

|

|

(Being bill met on due date) |

|

|

||

|

|

Varun A/c |

|

|

||

|

Book of Varun Journal Entries |

|||||

|

Date |

Particulars |

L.F. |

Dr. Rs. |

Cr. Rs. |

|

|

2016 |

|

|

|

||

|

Jan 08 |

Purchases A/c |

Dr. |

40,000 |

|

|

|

|

---------To Darshan A/c |

40,000 |

|||

|

|

(Being goods bought from Darshan) |

|

|||

|

|

|

|

|||

|

Jan 08 |

Darshan A/c |

Dr. |

40,000 |

|

|

|

|

To Bills Payable A/c |

40,000 |

|||

|

|

(Being bill of two months accepted for Darshan) |

|

|

||

|

|

|

|

|||

|

Mar 11 |

Bills Payable A/c |

Dr. |

40,000 |

||

|

To Cash A/c |

40,000 |

||||

|

(Being Varun cleared his acceptance on the due date) |

|||||

Case ii: When Darshan immediately discounted the bill @ 6% p.a. with his bank.

|

Book of Darshan Journal Entries |

|||||

|

Date |

Particulars |

L.F. |

Dr. Rs. |

Cr. Rs. |

|

|

2016 |

|

|

|

||

|

Jan 08 |

Varun A/c |

Dr. |

40,000 |

|

|

|

|

---------To Sales A/c |

40,000 |

|||

|

|

(Being goods sold to Varun) |

|

|||

|

|

|

|

|||

|

Jan 08 |

Bills Receivable A/c |

Dr. |

40,000 |

|

|

|

|

---------To Varun |

40,000 |

|||

|

|

(Being B/R received from Varun for two months) |

|

|

||

|

|

|

|

|||

|

Jan08 |

Bank A/c |

Dr. |

39,600 |

||

|

Discount A/c |

Dr. |

400 |

|||

|

---------To Bills Receivable A/c |

40,000 |

||||

|

(Being bill discounted with the bank @ 6 % p.a.) |

|||||

|

Book of Varun Journal Entries |

|||||

|

Date |

Particulars |

L.F. |

Dr. Rs. |

Cr. Rs. |

|

|

2016 |

|

|

|

||

|

Jan 08 |

Purchases A/c |

Dr. |

40,000 |

|

|

|

|

---------To Darshan A/c |

40,000 |

|||

|

|

(Being goods bought from Darshan) |

|

|||

|

|

|

|

|||

|

Jan 08 |

Darshan A/c |

Dr. |

40,000 |

|

|

|

|

---------To Bills Payable A/c |

40,000 |

|||

|

|

(Being bill of two month accepted for darshan) |

|

|

||

|

|

|

|

|||

|

Mar 11 |

Bills Payable A/c |

Dr. |

40,000 |

||

|

---------To Bank A/c |

40,000 |

||||

|

(Being Varun cleared his acceptance on the due date) |

|||||

Case iii: When the bill was endorsed immediately by Darshan in favour of his Cr. or Suresh.

|

Book of Darshan Journal Entries |

|||||

|

Date |

Particulars |

L.F. |

Dr. Rs. |

Cr. Rs. |

|

|

2016 |

|

|

|

||

|

Jan 08 |

Varun A/c |

Dr. |

40,000 |

|

|

|

---------To Sales A/c |

40,000 |

||||

|

(Being goods sold to Varun) |

|

||||

|

|

|

||||

|

Jan 08 |

Bills Receivable A/c |

Dr. |

40,000 |

|

|

|

---------To Varun A/c |

40,000 |

||||

|

(Being Varun's acceptance received for two months) |

|

|

|||

|

|

|

||||

|

Jan 08 |

Suresh A/c |

Dr. |

40,000 |

||

|

---------To Bills Receivable A/c |

40,000 |

||||

|

(Being Varun's acceptance endorsed in favour of Suresh) |

|||||

|

Book of Varun Journal Entries |

|||||

|

Date |

Particulars |

L.F. |

Dr. Rs. |

Cr. Rs. |

|

|

2016 |

|

|

|

||

|

Jan 08 |

Purchases A/c |

Dr. |

40,000 |

|

|

|

|

---------To Darshan A/c |

40,000 |

|||

|

|

(Being goods bought from Darshan) |

|

|||

|

|

|

|

|||

|

Jan 08 |

Darshan A/c |

Dr. |

40,000 |

|

|

|

|

---------To bills payable A/c |

40,000 |

|||

|

|

(Being bill drawn by Darshan accepted for two months) |

|

|

||

|

|

|

|

|||

|

Mar 11 |

Bills Payable A/c |

Dr. |

40,000 |

||

|

---------To Cash A/c |

40,000 |

||||

|

(Being bills paid to holder of bill) |

|||||

Case iv: When three days before its maturity, the bill was sent by Darshan to his bank for collection.

|

Book of Darshan Journal Entries |

|||||

|

Date |

Particulars |

L.F. |

Dr. Rs. |

Cr. Rs. |

|

|

2016 |

|

|

|

||

|

Jan 08 |

Varun A/c |

Dr. |

40,000 |

|

|

|

|

---------To Sale A/c |

40,000 |

|||

|

|

(Being goods sold to Varun) |

|

|||

|

|

|

|

|||

|

Jan 08 |

Bills Receivable A/c |

Dr. |

40,000 |

|

|

|

|

---------To Varun A/c |

40,000 |

|||

|

|

(Being Varun's acceptance received two months) |

|

|

||

|

|

|

|

|||

|

Mar 08 |

Bill sent for Collection A/c |

Dr. |

40,000 |

||

|

---------To Bills Receivable A/c |

40,000 |

||||

|

(Being bills send for collection send to the bank) |

|||||

|

Mar 11 |

Bank A/c |

Dr. |

40,000 |

||

|

---------To Bill sent for collection |

40,000 |

||||

|

(Being bill sent for collection realised) |

|||||

|

Book of Varun Journal Entries |

|||||

|

Date |

Particulars |

L.F. |

Dr. Rs. |

Cr. Rs. |

|

|

2016 |

|

|

|

||

|

Jan 08 |

Purchases A/c |

Dr. |

40,000 |

|

|

|

|

---------To Darshan A/c |

40,000 |

|||

|

|

(Being goods bought from Darshan) |

|

|||

|

|

|

|

|||

|

Jan 08 |

Darshan A/c |

Dr. |

40,000 |

|

|

|

|

---------To Bills Payable A/c |

40,000 |

|||

|

|

(Being bill drawn by Darshan accepted for two months) |

|

|

||

|

|

|

|

|||

|

Mar 11 |

Bills Payable A/c |

Dr. |

40,000 |

||

|

---------To Bank A/c |

40,000 |

||||

|

(Being bill paid to the bank) |

|||||

Bills of Exchange Exercise 312

Solution NUM 8

|

Book of Bansal Traders Journal Entries |

|||||

|

Date |

Particulars |

L.F. |

Dr. Rs. |

Cr. Rs. |

|

|

2016 |

|

|

|

||

|

Dec 21 |

Mohan Traders A/c |

Dr. |

900 |

|

|

|

|

---------To Sales A/c |

900 |

|||

|

|

(Being goods sold to Mohan Traders list price Rs.1,000 at 10% trade discount) |

|

|

||

|

|

|

|

|||

|

Dec 21 |

Bills Receivable A/c |

Dr. |

900 |

|

|

|

|

---------To Mohan Traders A/c |

900 |

|||

|

|

(Being promissory note received from Mohan Traders payable after 30 days) |

|

|

||

|

|

|

|

|||

|

Dec 26 |

Mohan Traders A/c |

Dr. |

1,080 |

|

|

|

|

---------To Sales A/c |

|

1,080 |

||

|

(Being goods sold to Mohan Traders list price Rs.1,200 at 10% trade discount) |

|||||

|

Dec 26 |

Bills Receivable A/c |

Dr. |

1,080 |

||

|

---------To Mohan Traders A/c |

1,080 |

||||

|

(Being promissory note received from Mohan Traders) |

|||||

|

Dec 26 |

Bank A/c |

Dr. |

1,069 |

||

|

Discount A/c |

Dr. |

11 |

|||

|

---------To Bills Receivable A/c |

1,080 |

||||

|

(Being promissory note discounted from the bank) |

|||||

|

Dec 28 |

Mohan Traders A/c |

Dr. |

1,800 |

||

|

---------To Sales A/c |

1,800 |

||||

|

(Being sold to Mohan Traders list price Rs.2,000 at 10% trade discount) |

|||||

|

Dec 28 |

Bills Receivable A/c |

Dr. |

1,800 |

||

|

--------To Mohan Traders A/c |

1,800 |

||||

|

(Being promissory note received from Mohan Traders) |

|||||

|

Dec 28 |

Dream Soaps A/c |

Dr. |

1,900 |

||

|

--------To Bills Receivable A/c |

1,800 |

||||

|

--------To Discount Received A/c |

100 |

||||

|

(Being promissory note of Rs.1,800 send to Dream Soap in full settlement of amount due to him) |

|||||

|

Dec31 |

Mohan Traders A/c |

Dr. |

4,500 |

||

|

---------To Sales A/c |

4,500 |

||||

|

(Being goods sold to Mohan trade list price Rs.5,000 at 10% trade discount) |

|||||

|

Dec 31 |

Bills Receivable A/c |

Dr. |

4,500 |

||

|

---------To Mohan Traders A/c |

4,500 |

||||

|

(Being promissory note received from Mohan Traders for 30 days) |

|||||

| 2017 | |||||

|

Jan 23 |

Cash A/c |

Dr. |

900 |

||

|

---------To Bills Receivable A/c |

900 |

||||

|

(Being promissory note issued on Dec. 21, 2005 was met on maturity) |

|||||

|

Jan 25 |

Bill Sent for Collection A/c |

Dr. |

4,500 |

||

|

---------To Bills Receivable A/c |

4,500 |

||||

|

(Being promissory note issued on Dec. 31, 2005 send for collection to bank) |

|||||

|

Feb 02 |

Bank A/c |

Dr. |

4,500 |

||

|

---------To Bill Sent for Collection A/c |

4,500 |

||||

|

(Being bank got payment of bill send for collection on due date) |

|||||

|

In the books of Bansal Traders Mohan Trader's Account |

|||||||

|

Dr. |

Cr. |

||||||

|

Date |

Particulars |

J.F. |

Amount Rs. |

Date |

Particulars |

J.F. |

Amount Rs. |

|

2016 |

|

2016 |

|

|

|||

|

Dec 21 |

To Sales A/c |

900 |

Dec 21 |

By Bills Receivable A/c |

900 |

||

|

Dec 26 |

To Sales A/c |

1,080 |

Dec 26 |

By Bills Receivable A/c |

1,080 |

||

|

Dec 28 |

To Sales A/c |

1,800 |

Dec 28 |

By Bills Receivable A/c |

1,800 |

||

|

Dec 31 |

To Sales A/c |

4,500 |

Dec 31 |

By Bills Receivable A/c |

4,500 |

||

|

8,280 |

8,280 |

||||||

|

Books of Mohan Trader's Journal Entries |

|||||

|

Date |

Particulars |

L.F. |

Dr. Rs. |

Cr. Rs. |

|

|

2016 |

|

|

|

||

|

Dec 21 |

Purchases A/c |

Dr. |

900 |

|

|

|

|

---------To Bansal Traders A/c |

900 |

|||

|

|

(Being goods bought Bansal Trader's list price Rs.1,000 at 10% trade discount) |

|

|

||

|

|

|

|

|||

|

Dec 21 |

Bansal Traders A/c |

Dr. |

900 |

|

|

|

|

---------To Bills Payable A/c |

900 |

|||

|

|

(Being promissory note issued to Bansal Traders) |

|

|

||

|

|

|

|

|||

|

Dec 26 |

Purchases A/c |

Dr. |

1,080 |

|

|

|

|

---------To Bansal Traders A/c |

|

1,080 |

||

|

(Being goods bought from Bansal Traders list price Rs.1,200 at10% trade discount) |

|||||

|

Dec 26 |

Bansal Traders A/c |

Dr. |

1,080 |

||

|

---------To Bills payable A/c |

1,080 |

||||

|

(Being promissory note issued to Bansal Traders) |

|||||

|

Dec 28 |

Purchases A/c |

Dr. |

1,800 |

||

|

---------To Bansal Traders |

1,800 |

||||

|

(Being goods bought from Bansal Traders list price Rs.2,000 at 10% trade discount) |

|||||

|

Dec 28 |

Bansal Traders A/c |

Dr. |

1,800 |

||

|

---------To Bills Payable A/c |

1,800 |

||||

|

(Being promissory note issued to Bansal Traders) |

|||||

|

Dec 31 |

Purchases A/c |

Dr. |

4,500 |

||

|

---------To Bansal Traders A/c |

4,500 |

||||

|

(Being goods bought from Bansal Traders of list price Rs.5,000 at 10% trade discount) |

|||||

|

Dec 31 |

Bansal Traders A/c |

Dr. |

4,500 |

||

|

---------To Bills Payable A/c |

4,500 |

||||

|

(Being promissory note issued to Bansal Traders) |

|||||

| 2017 | |||||

|

Jan 23 |

Bills Payable A/c |

Dr. |

900 |

||

|

---------To Cash A/c |

900 |

||||

|

(Being the first note discharged on its due date) |

|||||

|

Jan 28 |

Bill Payable A/c |

Dr. |

1,080 |

||

|

---------To Bank A/c |

1,080 |

||||

|

(Being the second promissory note discharged on its due date) |

|||||

|

Jan 30 |

Bills Payable A/c |

Dr. |

1,800 |

||

|

---------To Cash A/c |

1,800 |

||||

|

(Being the third promissory discharged by paying Rs.1,800 to dream soaps) |

|||||

|

Feb 02 |

Bills Payable A/c |

Dr. |

4,500 |

||

|

---------To Bank A/c |

4,500 |

||||

|

(Being the fourth promissory note discharged by paid Rs. 4,500 to bank) |

|||||

|

In the book of Mohan Traders Bansal Trader's Account |

|||||||

|

Dr. |

Cr. |

||||||

|

Date |

Particulars |

J.F. |

Amount Rs. |

Date |

Particulars |

J.F. |

Amount Rs. |

|

2016 |

|

2016 |

|

|

|||

|

Dec 21 |

To Bills Payable A/c |

900 |

Dec 21 |

By Purchases A/c |

900 |

||

|

Dec 26 |

To Bills Payable A/c |

1,080 |

Dec 26 |

By Purchases A/c |

1,080 |

||

|

Dec 28 |

To Bills Payable A/c |

1,800 |

Dec 28 |

By Purchases A/c |

1,800 |

||

|

Dec 31 |

To Bills Payable A/c |

4,500 |

Dec 31 |

By Purchases A/c |

4,500 |

||

|

|

|

|

|

|

|

|

|

|

8,280 |

8,280 |

||||||

Solution NUM 9

Case i: When the bill was retained by Ravinderan with him till the date of its maturity

|

Book of Ravinderan Journal Entries |

|||||

|

Date |

Particulars |

L.F. |

Dr. Rs. |

Cr. Rs. |

|

|

2016 |

|

|

|

||

|

Feb 01 |

Narayanan A/c |

Dr. |

25,000 |

|

|

|

|

---------To Sales A/c |

25,000 |

|||

|

|

(Being goods sold to Narayanan) |

|

|||

|

|

|

|

|||

|

Feb 01 |

Bills Receivable A/c |

Dr. |

25,000 |

|

|

|

|

---------To Narayanan A/c |

25,000 |

|||

|

|

(Being Narayanan's acceptance received for 30 days) |

|

|||

|

|

|

|

|||

|

Mar 06 |

Narayanan A/c |

Dr. |

25,000 |

|

|

|

|

---------To Bills Receivable A/c |

|

25,000 |

||

|

|

(Being Narayanan failed to meet his acceptance and bill dishonoured) |

|

|||

|

Book of Narayanan Journal |

||||||

|

Date |

Particulars |

L.F. |

Dr. Rs. |

Cr. Rs. |

||

|

2016 |

|

|

|

|||

|

Feb 01 |

Purchases A/c |

Dr. |

25,000 |

|

||

|

|

---------To Ravinderan A/c |

25,000 |

||||

|

|

(Being goods bought from Ravinderan) |

|

||||

|

|

|

|

||||

|

Feb 01 |

Ravinderan A/c |

Dr. |

25,000 |

|

||

|

|

---------To Bills Payable A/c |

25,000 |

||||

|

|

(Being Ravinderan's bill accepted) |

|

||||

|

|

|

|

||||

|

Mar 05 |

Bills Payable A/c |

Dr. |

25,000 |

|

||

|

|

------To Ravinderan A/c |

|

25,000 |

|||

|

|

(Being bill dishonoured on maturity) |

|

||||

Case ii: When the bill was discounted by Ravinderan immediately with his bank @ 6% p.a.

|

Book of Ravinderan Journal |

|||||

|

Date |

Particulars |

L.F. |

Dr. Rs. |

Cr. Rs. |

|

|

2016 |

|

|

|

||

|

Feb 01 |

Narayanan A/c |

Dr. |

25,000 |

|

|

|

|

---------To Sales A/c |

25,000 |

|||

|

|

(Being goods sold to Narayanan) |

|

|||

|

|

|

|

|||

|

Feb 01 |

Bills Receivable A/c |

Dr. |

25,000 |

|

|

|

|

---------To Narayanan A/c |

25,000 |

|||

|

|

(Being Narayanan's acceptance received) |

|

|||

|

|

|

|

|||

|

Feb 01 |

Bank A/c |

Dr. |

24,877 |

|

|

|

|

Discounting Charges A/c |

Dr. |

123 |

||

|

---------To Bills Receivable A/c |

25,000 |

||||

|

|

(Being Narayanan's acceptance got discounted with bank @ 6% p.a for 30 days) |

|

|||

|

|

|||||

|

Mar 06 |

Narayanan A/c |

Dr. |

25,000 |

||

|

---------To Bank A/c |

|

25,000 |

|||

|

(Being Narayanan's acceptance dishonoured) |

|

||||

|

Book of Narayanan Journal |

|||||

|

Date |

Particulars |

L.F. |

Dr. Rs. |

Cr. Rs. |

|

|

2016 |

|

|

|

||

|

Feb 01 |

Purchases A/c |

Dr. |

25,000 |

|

|

|

|

---------To Ravinderan A/c |

25,000 |

|||

|

|

(Being goods bought from Ravinderan) |

|

|

||

|

|

|

|

|||

|

Feb 01 |

Ravinderan A/c |

Dr. |

25,000 |

|

|

|

|

---------To Bills payable A/c |

25,000 |

|||

|

|

(Being Ravinderan's bill accepted) |

|

|||

|

|

|

|

|||

|

Mar 06 |

Bills Payable A/c |

Dr. |

25,000 |

||

|

---------To Ravinderan A/c |

|

25,000 |

|||

|

(Being dishonoured on maturity) |

|

||||

Case iii: When the bill was endorsed to his Cr. or Ganeshan.

Book of Ravinderan

Journal

|

Date |

Particulars |

L.F. |

Dr. Rs. |

Cr. Rs. |

|

|

2016 |

|

|

|

||

|

Feb 01 |

Narayanan A/c |

Dr. |

25,000 |

|

|

|

|

-------To Sales A/c |

25,000 |

|||

|

|

(Being goods sold Narayanan) |

|

|||

|

|

|

|

|||

|

Feb01 |

Bills Receivable A/c |

Dr. |

25,000 |

|

|

|

|

---------To Narayanan A/c |

25,000 |

|||

|

|

(Being Narayanan's acceptance received) |

||||

|

Feb 01 |

Ganeshan A/c |

Dr. |

25,000 |

||

|

---------To Bills Receivable A/c |

25,000 |

||||

|

(Being Narayanan's acceptance endorsed in favour of Ganeshan) |

|||||

|

|

|

|

|||

|

Mar 06 |

Narayanan A/c |

Dr. |

25,000 |

||

|

---------To Ganeshan A/c |

|

25,000 |

|||

|

(Being Narayanan's acceptance dishonoured) |

|

|

Book Narayanan Journal |

||||||

|

Date |

Particulars |

L.F. |

Dr. Rs. |

Cr. Rs. |

||

|

2016 |

|

|

|

|||

|

Feb 01 |

Purchases A/c |

Dr. |

25,000 |

|

||

|

|

---------To Ravinderan A/c |

25,000 |

||||

|

|

(Being goods bought Ravinderan) |

|

||||

|

|

|

|

||||

|

Feb 01 |

Ravinderan A/c |

Dr. |

25,000 |

|

||

|

|

---------To Bills Payable A/c |

25,000 |

||||

|

|

(Being Ravinderan's accepted received) |

|

||||

|

Mar 06 |

Bills Payable A/c |

Dr. |

25,000 |

|||

|

---------To Ravinderan A/c |

|

25,000 |

||||

|

(Being Ravinderan's bill dishonoured on due date) |

|

|||||

Case iv: When the bill was sent by Ravinderan to his bank for collection a few days before it maturity.

Books of Ravinderan

Journal

|

Date |

Particulars |

L.F. |

Dr. Rs. |

Cr. Rs. |

|

|

2016 |

|

|

|

||

|

Feb 01 |

Narayanan A/c |

Dr. |

25,000 |

|

|

|

|

---------To Sales A/c |

25,000 |

|||

|

|

(Being goods sold to Narayanan) |

|

|||

|

|

|

|

|||

|

Feb 01 |

Bills Receivable A/c |

Dr. |

25,000 |

|

|

|

|

---------To Narayanan A/c |

25,000 |

|||

|

|

(Being Narayanan's acceptance received) |

||||

|

Feb 01 |

Bills Sent for Collection A/c |

Dr. |

25,000 |

||

|

---------To Bills Receivable A/c |

25,000 |

||||

|

(Being bill Send to bank for collection) |

|||||

|

Mar 06 |

Narayanan A/c |

Dr. |

25,000 |

||

|

---------To Bills Sent for Collection A/c |

|

25,000 |

|||

|

(Being bill got dishonoured) |

|

|

Book of Narayanan Journal |

|||||

|

Date |

Particulars |

L.F. |

Dr. Rs. |

Cr. Rs. |

|

|

2016 |

|

|

|

||

|

Feb 01 |

Purchases A/c |

Dr. |

25,000 |

|

|

|

|

---------To Ravinderan A/c |

25,000 |

|||

|

|

(Being bought goods from Ravinderan) |

|

|||

|

|

|

|

|||

|

Feb 01 |

Ravinderan A/c |

Dr. |

25,000 |

|

|

|

|

---------To Bills Payable A/c |

25,000 |

|||

|

|

(Being Ravinderan's bill accepted) |

||||

|

Mar 06 |

Bills Payable A/c |

Dr. |

25,000 |

||

|

---------To Ravinderan A/c |

|

25,000 |

|||

|

(Being Ravinderan's bill dishonoured) |

|

||||

Solution NUM 10

|

Books of Ravi Journal |

|||||

|

Date |

Particulars |

L.F. |

Dr. Rs. |

Cr. Rs. |

|

|

2016 |

|

|

|

||

|

Feb 13 |

Sudershan A/c |

Dr. |

40,000 |

|

|

|

|

---------To Sales A/c |

40,000 |

|||

|

|

(Being goods sold to Sudershan) |

|

|||

|

|

|

|

|||

|

Feb 13 |

Bills Receivable A/c |

Dr. |

40,000 |

|

|

|

|

---------To Sudershan A/c |

40,000 |

|||

|

|

(Being four bills from Sudershan received: the first for Rs.5,000, the second bill for Rs.10,000, the third bill for Rs.12,000 and the fourth bill for Rs.13,000) |

|

|

||

|

|

|

|

|||

|

Feb 13 |

Bank A/c |

Dr. |

4,975 |

|

|

|

|

Discount A/c |

Dr. |

25 |

|

|

|

|

---------To Bills Receivable A/c |

5,000 |

|||

|

|

(Being the first bill discounted with bank at 6% p.a. for 1 month) |

|

|||

|

|

|

||||

|

Feb 13 |

Mustaq A/c |

Dr. |

10,200 |

||

|

---------To Bills Receivable A/c |

10,000 |

||||

|

---------To Discount Received A/c |

200 |

||||

|

(Being the second bill endorsed to Mustaq in full settlement of amount Rs.10,200 due to him) |

|||||

|

Mar 02 |

Bills Sent for Collection A/c |

Dr. |

13,000 |

||

|

---------To Bills Receivable A/c |

13,000 |

||||

|

(Being the forth bill send to bank for collection) |

|||||

|

Mar 07 |

Sudershan A/c |

Dr. |

13,000 |

||

|

---------To Bill Sent for Collection A/c |

13,000 |

||||

|

(Being the fourth bill dishonoured on due date) |

|||||

|

Mar 07 |

Sudershan A/c |

Dr. |

81 |

||

|

---------To Interest A/c |

81 |

||||

|

(Being interest due on the fourth bill Rs.13,000 for 19 days at 12% p.a.) |

|||||

|

Mar 10 |

Cash A/c |

Dr. |

13,081 |

||

|

---------To Sudershan A/c |

13,081 |

||||

|

(Bing cash received from Sudershan) |

|||||

|

Mar 16 |

Sudershan A/c |

Dr. |

5,000 |

||

|

---------To Bank A/c |

5,000 |

||||

|

(Being the first bill dishonoured) |

|||||

|

Mar 16 |

Sudershan A/c |

Dr. |

50 |

||

|

---------To Interest A/c |

50 |

||||

|

(Being interest due on amount Rs.5,000 at 12% for one month) |

|||||

|

Mar 19 |

Cash A/c |

Dr. |

5,050 |

||

|

---------To Sudershan A/c |

5,050 |

||||

|

(Being Sudershan paid the amount due on account dishonoured of the first bill plus interest) |

|||||

|

Mar 28 |

Sudershan A/c |

Dr. |

10,000 |

||

|

Discount Received A/c |

Dr. |

200 |

|||

|

---------To Mustaq A/c |

10,200 |

||||

|

(Being second bill dishonoured, which had endorsed in favour of Mustaq) |

|||||

|

Mar 28 |

Sudershan A/c |

Dr. |

132 |

||

|

---------To Interest A/c |

132 |

||||

|

(Being interest charges at 12% on the amount due on account of dishonour of the second bill Rs.10,000) |

|||||

|

Apr 01 |

Cash A/c |

Dr. |

10,132 |

||

|

---------To Sudershan A/c |

10,132 |

||||

|

(Being received cash from Sudershan for the second bill along with interest) |

|||||

|

May 16 |

Sudershan A/c |

Dr. |

12,000 |

||

|

---------To Bills Receivable A/c |

12,000 |

||||

|

(Being the third bill dishonoured on due date) |

|||||

|

May 16 |

Sudershan A/c |

Dr. |

360 |

||

|

---------To Interest A/c |

360 |

||||

|

(Being interest at 12% for 3 months charged on the amount due on account of dishonour the third bill Rs.12,000) |

|||||

|

May 19 |

Cash A/c |

Dr. |

12,360 |

||

|

---------To Sudershan A/c |

12,360 |

||||

|

(Being cash received from Sudershan for the third bill along with interest 12% p.a.) |

|||||

|

Ledger Sundershan's Account |

|||||||

|

Dr. |

Cr. |

||||||

|

Date |

Particulars |

J.F. |

Amount Rs. |

Date |

Particulars |

J.F. |

Amount Rs. |

|

2016 |

|

2016 |

|

|

|||

|

Feb 13 |

To Sales A/c |

40,000 |

Feb 13 |

By Bills Receivable A/c |

40,000 |

||

|

Mar 07 |

To Bill sent for Collection A/c |

13,000 |

Mar 10 |

By Cash A/c |

13,081 |

||

|

Mar 07 |

To Interest A/c |

81 |

Mar 19 |

By Cash A/c |

5,050 |

||

|

Mar 16 |

To Bank A/c |

5,000 |

Apr 01 |

By Cash A/c |

10,132 |

||

|

Mar 16 |

To Interest A/c |

50 |

May 19 |

By Cash A/c |

12,360 |

||

|

Mar 28 |

To Mustaq A/c |

10,000 |

|||||

|

Mar 28 |

To Interest A/c |

132 |

|||||

|

May 16 |

To Bills Receivable A/c |

12,000 |

|||||

|

May 16 |

To Interest A/c |

360 |

|||||

|

|

|

|

|

|

|

|

|

|

80,623 |

80,623 |

||||||

|

Mustaq's Account |

|||||||

|

Dr. |

Cr. |

||||||

|

Date |

Particulars |

J.F. |

Amount Rs. |

Date |

Particulars |

J.F. |

Amount Rs. |

|

2016 |

|

2016 |

|

|

|||

|

Feb 13 |

To Bills Receivable A/c |

10,000 |

Mar 28 |

By Sudershan A/c |

10,000 |

||

|

Feb 13 |

To Discount Received A/c |

200 |

Mar 28 |

By Discount Received A/c |

200 |

||

|

10,200 |

10,200 |

||||||

|

Book of Sudershan Journal |

|||||

|

Date |

Particulars |

L.F. |

Dr. Rs. |

Cr. Rs. |

|

|

2016 |

|

|

|

||

|

Feb13 |

Purchases A/c |

Dr. |

40,000 |

|

|

|

---------To Ravi A/c |

40,000 |

||||

|

(Being goods bought from Ravi) |

|

||||

|

|

|

||||

|

Feb13 |

Ravi A/c |

Dr. |

40,000 |

|

|

|

---------To Bills Payable A/c |

40,000 |

||||

|

(Being four bills drawn by Ravi accepted: the first second for Rs.5,000, payable after one month, the second for Rs.10,000, payable after 40 days, the third for Rs.12,000 payable after 3 month and the fourth for Rs.13,000 payable after 19 days) |

|

|

|||

|

|

|

||||

|

Mar 07 |

Bills Payable A/c |

Dr. |

13,000 |

||

|

---------To Ravi A/c |

13,000 |

||||

|

(Being the fourth bill dishonoured) |

|||||

|

Mar 07 |

Interest A/c |

Dr. |

81 |

||

|

---------To Ravi A/c |

81 |

||||

|

(Being interest charged for the fourth bill at 12% p.a.) |

|||||

|

Mar 10 |

Ravi A/c |

Dr. |

13,081 |

||

|

---------To Cash A/c |

13,081 |

||||

|

(Bing cash paid to Ravi for amount of dishonour of the fourth bill along with interest at 12% p.a. for 19 days) |

|||||

|

Mar 16 |

Bills Payable A/c |

Dr. |

5,000 |

||

|

---------To Ravi A/c |

5,000 |

||||

|

(Being the first bill dishonoured) |

|||||

|

Mar 16 |

Interest A/c |

Dr. |

50 |

||

|

---------To Ravi A/c |

50 |

||||

|

(Being interest at 12% p.a on the first bill for one month) |

|||||

|

Mar19 |

Ravi A/c |

Dr. |

5,050 |

||

|

---------To Cash A/c |

5,050 |

||||

|

(Being cash paid to Ravi amount due on account of dishonour of the first bill along with interest at 12% p.a. for one month) |

|||||

|

Mar 28 |

Bills Payable A/c |

Dr. |

10,000 |

||

|

---------To Ravi A/c |

10,200 |

||||

|

(The second bill dishonoured) |

|||||

|

Mar 28 |

Interest A/c |

Dr. |

132 |

||

|

---------To Ravi A/c |

132 |

||||

|

(Being interest charges at 12% p.a. for 40 days on the second bill) |

|||||

|

Apr 01 |

Ravi A/c |

Dr. |

10,132 |

||

|

---------To Cash A/c |

10,132 |

||||

|

(Being cash paid to Ravi for amount due on account of dishonour of the second bill along with interest at 12% p.a. for 40 days) |

|||||

|

May 16 |

Bills Payable A/c |

Dr. |

12,000 |

||

|

---------To Ravi A/c |

12,000 |

||||

|

(Being the third bill dishonoured) |

|||||

|

May 16 |

Interest A/c |

Dr. |

360 |

||

|

---------To Cash A/c |

360 |

||||

|

(Being interest at 12% p.a. for 3 months on third bill) |

|||||

|

May 19 |

Ravi A/c |

Dr. |

12,360 |

||

|

---------To Cash A/c |

12,360 |

||||

|

(Being cash paid for amount due on account of dishonour of the third bill along with interest 12% p.a. for 3 months) |

|||||

|

Book of Mustaq Journal |

|||||

|

Date |

Particulars |

L.F. |

Dr. Rs. |

Cr. Rs. |

|

|

2016 |

|

|

|

||

|

Feb13 |

Bills Receivable A/c |

Dr. |

10,000 |

|

|

|

|

Discount Allowed A/c |

Dr. |

200 |

||

|

---------To Ravi A/c |

10,200 |

||||

|

|

(Being bills receivable received from Ravi and allowed discount) |

|

|||

|

|

|

|

|||

|

Mar 28 |

Ravi A/c |

Dr. |

10,200 |

||

|

---------To Bills Receivable A/c |

10,000 |

||||

|

---------To Discount Received A/c |

200 |

||||

|

(Being bill dishonoured) |

|||||

|

Book of Bank Journal |

|||||

|

Date |

Particulars |

L.F. |

Dr. Rs. |

Cr. Rs. |

|

|

2016 |

|

|

|

||

|

Mar02 |

Bills Receivable A/c |

Dr. |

13,000 |

|

|

|

---------To Bills sent for Collection A/c |

13,000 |

||||

|

|

(Being bills received from Ravi for collection) |

|

|||

|

|

|

|

|||

|

Mar 07 |

Bills sent for Collection A/c |

Dr. |

13,000 |

||

|

---------To Bills Receivable A/c |

13,000 |

||||

|

(Being bill dishonoured) |

|||||

Bills of Exchange Exercise 313

Solution NUM 11

|

Book of Neha Journal |

|||||

|

Date |

Particulars |

L.F. |

Dr. Rs. |

Cr. Rs. |

|

|

2016 |

|

|

|

||

|

Jan 01 |

Muskan A/c |

Dr. |

20,000 |

|

|

|

|

---------To Sales A/c |

20,000 |

|||

|

|

(Being goods sold to Muskan) |

|

|||

|

|

|

|

|||

|

Jan 01 |

Bills Receivable A/c |

Dr. |

20,000 |

|

|

|

|

---------To Muskan A/c |

20,000 |

|||

|

|

(Being Muskan's acceptance received) |

|

|||

|

|

|

|

|||

|

Feb 04 |

Cash A/c |

Dr. |

19,800 |

|

|

|

|

Rebate on bill A/c |

Dr. |

200 |

|

|

|

---------To Bills Receivable A/c |

20,000 |

||||

|

(Being Muskan's acceptance retired one month before maturity and allowed rebate at 12% p.a.) |

|||||

|

Book of Muskan Journal |

|||||