Class 9 MAHARASHTRA STATE TEXTBOOK BUREAU Solutions Maths Chapter 6 - Financial Planning

Financial Planning Exercise 6.1

Solution 1

Let Alka's monthly income be Rs. x.

Since, Alka spends 90% of the money that she receives every month.

∴ Amount spent by Alka = 90% of x

Now, Savings = Income - Expenditure

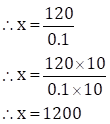

∴ 120 = x - 0.9x

∴120 = 0.1 x

Thus, Alka gets Rs. 1200 monthly.

Solution 2

Original capital borrowed by Sumit = Rs. 50000

Sumit suffered a loss of 20% in his food products business in the first year.

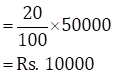

∴ Loss suffered in the first year = 20% of 50000

Remaining capital = Original capital - loss suffered

= 50000- 10000

= Rs. 40000

Sumit invested the remaining capital i.e. Rs. 40,000 in a new sweets business and he made a profit of 5%.

∴ Profit made in sweets business = 5% of 40000

New capital with Sumit after the profit in new sweets business

= 40000 + 2000

= Rs. 42000

Since, the new capital is less than the original capital, we can conclude that Sumit suffered a loss.

Total loss on original capital = Original capital - New capital

= 50000 - 42000

= Rs. 8000

Solution 3

Let the monthly income of Nikhil be Rs x.

Since, Nikhil invested 14% in shares and deposited 3% in a bank.

∴ Total investment = (14% + 3%) of x

= 17% of x

Nikhil spent 5% on his children's education and used 40% for his daily expenses.

∴ Total expenditure = (5% + 40%) of x

= 45% of x

Amount left with Nikhil = Income - (Total investment + Total expenditure)

Since, amount left with Nikhil is 19,000

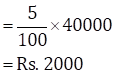

∴ 19000 = x - (0.17x + 0.45x)

∴ 19000 = x - 0.62x ,

∴ 19000 = 0.38x

∴ The monthly income of Nikhil is Rs. 50000.

Solution 4

For Mr. Sayyad:

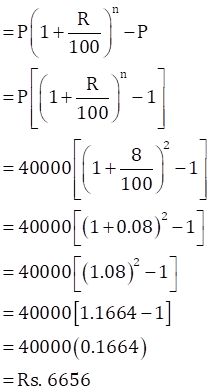

P = Rs. 40000, R = 8%, n = 2 years

Compound interest (I) = Amount (A) - Principal (P)

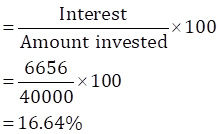

∴ Mr. Sayyad's percentage of profit Interest

For Mr. Fernandes

Amount invested in mutual fund = Rs. 120000

Amount received after 2 years = Rs. 192000

∴ Profit earned by Mr. Fernandes

= Amount received - Amount invested

= 192000- 120000

= Rs. 72000

∴ Mr. Fernandes percentage of profit Profit earned

= 60%

∴ Investment of Mr. Fernandes turned out to be more profitable.

Solution 5

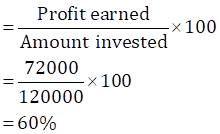

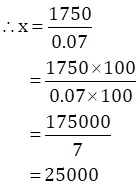

Let the actual income of Sameera be Rs. x.

Sameera spent 90% of her income and donated 3%.

∴ Sameera's total expenditure

= (3% + 90%) of x

= 93% of x

Now, Savings = Income - Expenditure

∴ 1750 = x - 0.93x

∴ 1750 = 0.07x

∴ The actual income of Sameera is Rs. 25000.

Financial Planning Exercise 6.2

Solution 1

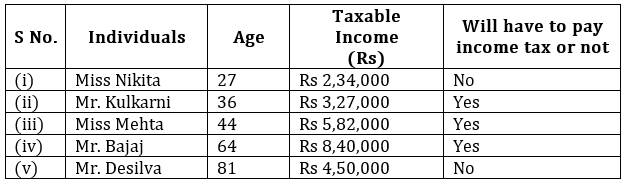

(i)

Miss Nikita's age = 27 years < 60 years

Miss Nikita's income = Rs. 2,34,000

Miss Nikita's income is below the basic exemption limit of Rs. 2,50,000.

∴ Miss Nikita will not have to pay income tax.

(ii)

Mr. Kulkarni's age 36 years < 60 years

Mr. Kulkarni's income = Rs. 3,27,000

Mr. Kulkarni's income is above the basic exemption Limit of Rs.2,50,000.

∴ Mr. Kulkarni will have to pay income tax.

(iii)

Miss Mehta's age = 44 years < 60 years

Miss Mehta's income = Rs. 5,82,000

Miss Mehta's income is above the basic exemption limit of Rs.2,50,000.

∴ Miss Mehta will have to pay income tax.

(iv)

Mr. Bajaj's age = 64 years (Age 60 to 80 years)

Mr. Bajaj's income = Rs. 8,40,000

Mr. Bajaj's income is above the basic exemption Limit of Rs.3,00,000.

∴ Mr. Bajaj will have to pay income tax.

(v)

Mr. Desilva's age = 81 years > 80 years

Mr. Desilva's income = Rs. 4,50,000

Mr. Desilva's income is below the basic exemption limit of Rs. 5,00,000.

∴ Mr. Desilva will not have to pay income tax.

Solution 2

Mr. Kartarsingh's monthly income is Rs. 42,000

Mr. Kartarsingh's yearly income = 42,000 × 12 = Rs. 5,04,000

Mr. Kartarsingh's investment

= GPF + NSC

= (3000 x 12)+ 15,000

= 36,000 + 15,000

=Rs. 51,000

Donation to PM's relief fund = Rs. 12, 000

∴ Taxable income

= yearly income - (investment + donation)

= 5,04,000 - (51,000 + 12,000)

= 5,04,000 - 63,000

= Rs. 4,41,000

Mr. Kartarsingh income falls in the slab 2,50,001 to 5,00,000.

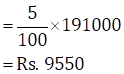

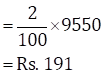

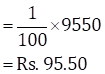

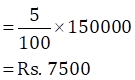

∴ Income tax = 5% of (Taxable income - 250000)

= 5% of (4,41,000 - 2,50,000)

Education cess = 2% of income tax

Secondary and Higher Education cess = 1% of income tax

Total income tax = Income tax + Education cess + Secondary and higher education cess

= 9550 + 191 + 95.50

= Rs. 9836.50

∴ Mr. Kartarsingh's income tax is Rs. 9836.50.

Financial Planning Exercise Problem set 6

Solution 1(i)

(A)

For different types of investments, the maximum permissible amount under section 80C of income tax Rs. 1,50,000.

Solution 1(ii)

(B)

A person has earned his income during the financial year 2017-18. Then his assessment year is 2018-19.

Solution 2

Let the income of Shekhar be Rs. x.

Since, Shekhar spends 60% of his income.

∴ Shekhar's expenditure = 60% of x

∴ Amount remaining with Shekhar = (100 - 60)% of x

= 40% of x

Now, he donates Rs. 300 to an orphanage from the balance left with him.

∴ Amount left with Shekhar = 0.4x - 300

Now, the amount left with him is Rs. 3200.

∴ 3200 = 0.4x - 300

∴ 0.4x = 3500

![]()

∴ The income of Mr. Shekhar is Rs. 8750.

Solution 3

For Mr. Hiralal:

Amount invested in mutual fund = Rs. 2,15,000

Amount received = Rs. 3,05,000

∴ Mr. Hiralal's profit = Amount received - Amount invested

= 305000 - 215000

= Rs. 90000

Mr. Hiralal's percentage of profit

![]()

= 41.86%

For Mr. Ramniklal:

P =Rs. 140000, R = 8%, n = 2 years

∴ Compound interest (I) = A - P

= 140000 [(1 + 0.08)2 - 1]

= 140000 [ (1.08)2 - 1]

= 140000(1.1664 - 1)

= 140000 x 0.1664

= Rs. 23296

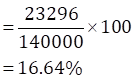

∴ Mr. Ramniklal's percentage of profit

∴ The percentage gains of Mr. Hiralal and Mr. Ramniklal are 41.86% and 16.64% respectively, and hence, Mr. Hiralal's investment was more profitable.

Solution 4

Here, P = 24000 + 56000 = Rs. 80000, R = 7.5%, n = 3 years

Total amount after 3 years

= 80000 (1 + 0.075)3

= 80000 (1.075)3

= 80000 × 1.242297

= 99383.76

∴ The total amount after 3 years is Rs. 99383.76.

Solution 6

Let the income of Kailash be Rs. x.

Kailash spends 85% of his income.

∴ Kailash's expenditure = 85% of x

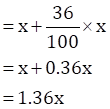

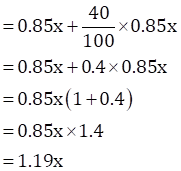

Kailash's income increased by 36%.

∴ Kailash's new income = x + 36% of x

Kailash's expenses increased by 40%.

∴ Kailash's new expenditure = 0.85x + 40% of 0.85x

∴ Kailash's new saving = Kailash's new income - Kailash's new expenditure

= 1.36x - 1.19x

= 0.17x

Percentage of Kailash's new saving

![]()

= 12.5%

∴ Kailash saves 12.5% of his new earning.

Solution 7

Let the annual income of Ramesh, Suresh and Preeti be Rs x, Rs. y and Rs. z respectively.

Since, total income of Ramesh, Suresh and Preeti = Rs. 8,07,000

∴ x + y + z = 807000 … (I)

Now, the percentages of their expenses are 75%, 80% and 90% respectively.

∴ Savings of Ramesh = (100 - 75)% of x

= 25% of x

![]()

∴ Savings of Ramesh ![]() …

(II)

…

(II)

Savings of Suresh = (100 - 80)% of x

= 20% of y

![]()

∴ Savings of Suresh ![]() …

(III)

…

(III)

Savings of Preeti = (100 - 90)% of x

= 10% of z

![]()

∴ Savings of Preeti ![]() …

(IV)

…

(IV)

Ratio of their savings = 16 : 17 : 12

Let the common multiple be k.

Savings of Ramesh = Rs. 16 k … (Given)

![]()

∴ x = 64k … (V)

Savings of Suresh = Rs. 17 k … (Given)

![]()

∴ y = 85k … (VI)

Savings of Preeti = Rs. 12 k … (Given)

![]()

∴ z = 120k … (VII)

From (I), (V), (VI) and (VII), we get

64k + 85k + 120k = 807000

∴ 269k = 807000

∴ k = 807000/269

∴ k = 3000

∴ Annual saving of Ramesh = 16k

= 16 × 3000

= Rs. 48,000

Annual saving of Suresh = 17k

= 17 × 3000

= Rs. 51,000

Annual saving of Preeti = 12k

= 12 × 3000

= Rs. 36,000

∴ The annual savings of Ramesh, Suresh and Preeti are Rs. 48,000, Rs. 51,000 and Rs. 36,000 respectively.

Solution 8

(i)

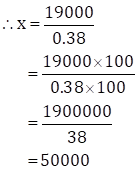

Mr. Kadam is 35 years old and his taxable income is Rs. 13,35,000.

Mr. Kadam's income is more than Rs. 10,00,000.

∴ Income tax = Rs. 1,12,500 + 30% of (taxable income - 10,00,000)

= Rs. 1,12,500 + 30% of (13,35,000 - 10,00,000)

![]()

= 112500 + 100500

= Rs. 213000

Education cess = 2% of income tax

= 2100 × 213000

= Rs. 4260

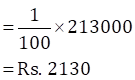

Secondary and Higher Education cess

= 1% of income tax

Total income tax

= Income tax + Education cess + Secondary and higher education cess

= 213000 + 4260 + 2130

= Rs. 2,19,390

∴ Mr. Kadam will have to pay income tax of Rs. 2,19,390.

(ii)

Mr. Khan's taxable income = Rs. 4,50,000 and his age = 65 years

So, Mr. Khan's income falls in the slab Rs. 3,00,001 to Rs. 5,00,000.

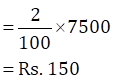

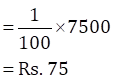

∴ Income tax

= 5% of (taxable income - 300000)

= 5% of (450000 - 300000)

Education cess = 2% of income tax

Secondary and Higher Education cess

= 1 % of income tax

Total income tax = Income tax + Education cess + Secondary and higher education cess

= 7500+ 150 + 75

= Rs. 7725

∴ Mr. Khan will have to pay income tax of Rs. 7725.

(iii)

Miss Varsha's taxable income = Rs. 2,30,000 and her age = 26 years

∴ The yearly income of Miss Varsha is less than Rs. 2,50,000.

Hence, Miss Varsha will not have to pay income tax.

Solution 5

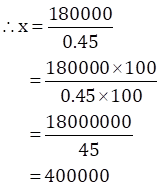

Let the income of Mr. Manohar be Rs. x.

Amount given to elder son = 20% of x

Amount given to younger son = 30% of x

Total amount given to both sons = (20 + 30)% of x = 50% of x

Amount remaining with Mr. Manohar

= (100 - 50)% of x

= 50% of x

He gave 10% of the balance income as donation to a school.

Amount donated to school

= 10% of 0.5x

∴ Amount remaining with Mr. Manohar after donating to school

= 0.5x - 0.05x

= 0.45x

Mr. Manohar still had 1,80,000 for himself after donating to school.

∴ 180000 = 0.45x

∴ The income of Mr. Manohar is Rs. 4,00,000.