CBSE Class 11 Commerce Accountancy Free Doubts and Solutions

CBSE - XI Commerce - Accountancy

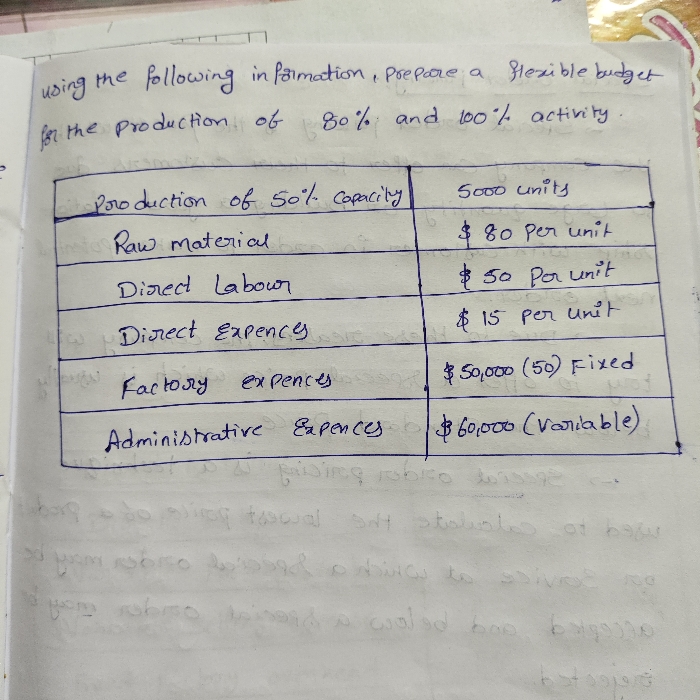

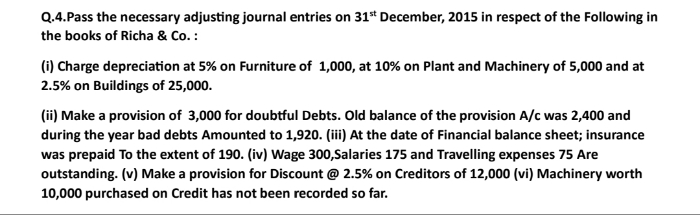

solve this question

CBSE - XI Commerce - Accountancy

Prepare trial balance from following information Rawat's capital Rs 60,000, Rohan (creditor) Rs 20,000, Rahul (debtors) Rs 82,000,sales Rs 70,000, goodwill Rs 17,000, bills receivable Rs 5,000, cash in hand Rs 3,000, stock (opening balance) Rs 43,000

CBSE - XI Commerce - Accountancy

nhi smj aa rha h

CBSE - XI Commerce - Accountancy

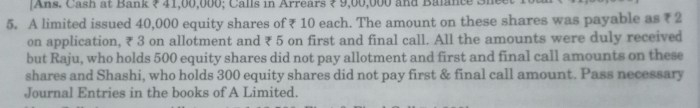

A limited issued 40000 equity shares of rupees 10 each the amount on these shares was payable as rupees 2 on Application rupees 3 on allotment rupees 5 on first and final call all amounts were duly received but Raju who holds 500 equity shares did not pay allotment and first and final call amounts on these shares and Shashi who holds 300 equity shares did not pay first and final call amounts pass journal entries

CBSE - XI Commerce - Accountancy

only question number 3

CBSE - XI Commerce - Accountancy

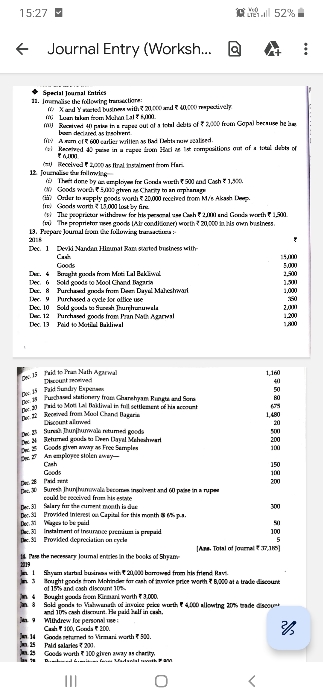

considered the following transaction & recorded them into appropriate special journal for the month of 2017

CBSE - XI Commerce - Accountancy

wages paid by mohan for installation of machine should be debited to:

CBSE - XI Commerce - Accountancy

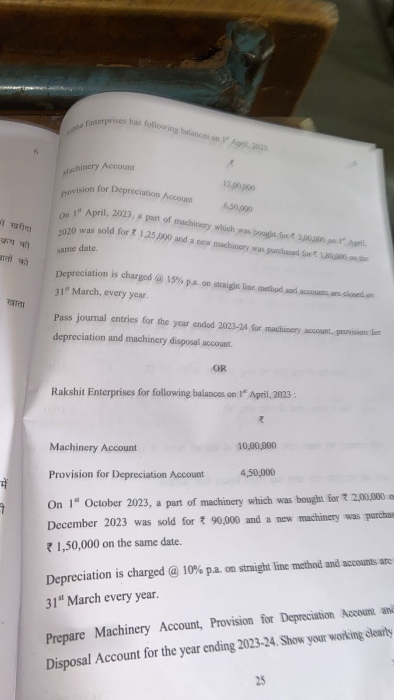

I want it's answer

Browse free questions and answers Chapters

- 1 Introduction to Accounting

- 2 Bank Reconciliation Statement

- 3 Financial Statements I

- 4 Application of Computers in Accounting

- 5 Basic Accounting Terms

- 6 Theory Base of Accounting, Accounting Standards and International Financial Reporting Standards (IFRS)

- 7 Bases of Accounting

- 8 Accounting Equation

- 9 Accounting Procedures - Rules of Debit and Credit

- 10 Origin of Transactions - Source Documents and Preparation of Vouchers

- 11 Journal

- 12 Ledger

- 13 Special Purpose Books I - Cash Book

- 14 Special Purpose Books II - Other Books

- 15 Trial Balance

- 16 Depreciation

- 17 Provisions and Reserves

- 18 Accounting for Bills of Exchange

- 19 Rectification of Errors

- 20 Financial Statements of Sole Proprietorship

- 21 Adjustments in Preparation of Financial Statements

- 22 Accounts from Incomplete Records - Single Entry System