Class 10 MAHARASHTRA STATE TEXTBOOK BUREAU Solutions Maths Chapter 4 - Financial Planning

Financial Planning Exercise Ex. 4.1

Solution 1

Rate of GST is given 12%

Now, Rate of CGST

= Rate of SGST = ![]()

![]()

∴ Rate of CGST = Rate of SGST = 6%

Solution 2

Given: Rate of CGST = 9%

Since, Rate of CGST = Rate of SGST

∴ Rate of SGST = 9%

Rate of GST = Rate of CGST + Rate of SGST

= 9% + 9%

= 18%

∴ Rate of GST = 18%

Solution 3

Taxable value of 1 tin = Rs. 2800 … (Given)

∴ Taxable value of 2 tins = 2 × 2800 = Rs. 5600

Now, Rate of GST = 28% … (Given)

∴ Rate of CGST = Rate of SGST = 14 %

CGST = 14% of taxable value

∴ CGST = Rs. 784

∴ SGST = CGST = Rs. 784

∴ The amount of CGST and SGST charged in the tax invoice is Rs. 784 each.

Solution 4

Taxable value of a wrist watch belt = Rs 586 … (Given)

Also, Rate of GST = 18%

∴ GST = 18% of taxable value

∴ GST = Rs 105.48

∴ Amount paid by customer = Taxable value of wrist watch belt + GST

= 586+ 105.48

= Rs 691.48

∴ The price of the belt for the customer is Rs 691.48.

Solution 5

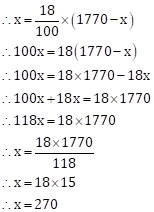

Let the amount of GST be Rs x.

Total value of a remote-controlled toy car = Rs 1770 … (Given)

∴ Taxable value of remote controlled toy car = Rs (1770 - x)

Rate of GST = 18% … (Given)

∴ GST = 18% of taxable value

∴ GST = Rs 270

∴ Taxable value of remote controlled toy car = Rs (1770 - x)

= Rs (1770 - 270)

= Rs 1500

But, CGST = SGST ![]()

![]()

∴Taxable value of toy car is Rs 1500 and CGST and SGST is Rs 135 each.

Solution 6

(1)

Rate CGST = 14% … (Given)

Since, Rate of SGST = Rate of CGST

∴ Rate of SGST = 14%

(2)

Rate of GST on AC = Rate of CGST + Rate of SGST

= 14% + 14%

= 28%

∴ Rate of GST on AC is 28%.

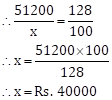

(3)

Let the taxable value of AC be Rs. 100.

Since, GST = 28% of taxable value = Rs. 28

∴ Cost of AC with GST is Rs. 128.

For the total value of Rs. 128, the taxable value is Rs. 100.

Let the taxable value be Rs. x for the total value of Rs. 51200.

Now, ![]()

∴ Taxable value of AC is Rs. 40000.

(4)

Total amount of GST = 28% of taxable value

∴ Total GST = Rs. 11200

(5)

∴ Amount of CGST = Rs. 5600

(6)

Amount of SGST = Amount of CGST = Rs. 5600

∴ Amount of SGST is Rs. 5600.

Solution 7

Printed price of washing machine = Rs. 40,000

Rate of discount = 5% … (Given)

Amount of discount = 5% of printed price

∴ Taxable value = Printed price - Discount

= 40000 - 2000

= Rs. 38000

Now, Rate of GST = 28% … (Given)

∴ Rate of CGST = 14% and Rate of SGST = 14%

CGST = 14% of taxable value

∴ CGST = Rs. 5320

∴ SGST = CGST = Rs. 5320

Purchase price of washing machine

= Taxable value + CGST + SGST

= 38000 + 5320 + 5320

= Rs. 48,640

∴ Purchase price of washing machine is Rs. 48640. Amount of CGST and SGST in tax invoice is Rs. 5320 each.

Financial Planning Exercise Ex. 4.2

Solution 1

Output tax (Tax collected at the time of sale) = Rs. 1,22,500 … (Given)

Input tax (Tax paid at the time of purchase) = Rs. 1,00,500 … (Given)

∴ ITC (Input Tax credit) = Rs. 1,00,500

∴ GST payable = Output tax - ITC

= 1,22,500 - 1,00,500

= Rs. 22,000

∴ GST payable by Chetana stores is Rs. 22,000.

Solution 2

Output tax = Rs. 14,750 … (Given)

Input tax = Rs. 12,500 … (Given)

∴ ITC for Nazama = Rs. 12,500.

∴ GST payable = Output tax - ITC

= 14750 - 12500

= Rs. 2250

∴ Amount of ITC to be claimed is Rs. 12,500 and amount of GST payable is Rs. 2250.

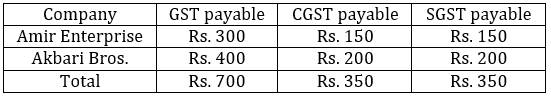

Solution 3

For Amir Enterprise:

Output tax = Rs. 4100

Input tax = Rs. 3800

∴ ITC for Amir enterprise = Rs. 3800.

∴ GST payable = Output tax - ITC

= 4100 - 3800

= Rs. 300

For Akbari Bros.:

Output tax = Rs. 4500

Input tax = Rs. 4100

∴ ITC for Akbari Bros = Rs. 4100.

GST payable = Output tax - ITC

= 4500 - 4100

= Rs. 400

∴ CGST payable = Rs. 200

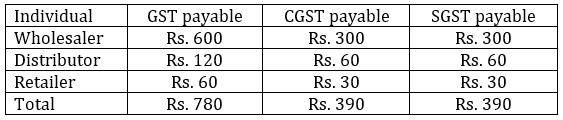

∴ Statement of GST payable at every stage of trading is as follows:

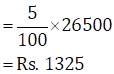

Solution 4

For Malik Gas Agency:

Output tax = 5% of 26500

Input tax = 5% of 24500

∴ ITC for Malik Gas Agency = Rs. 1225.

∴ GST payable = Output tax - ITC

= 1325 - 1225

= Rs. 100

∴ CGST = UTGST

∴ The GST to be paid at the rate of 5% is Rs. 100 and hence, CGST and UTGST paid for the transaction is Rs. 50 each.

Solution 5

Output tax = 18% of 10,000

∴ CGST = SGST ![]()

∴ Amount of CGST and SGST shown in the tax invoice issued is Rs. 900 each.

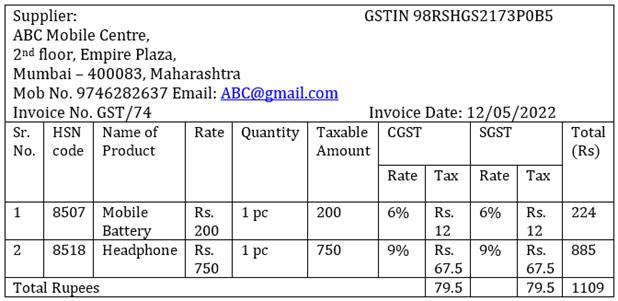

Solution 6

Rate of Mobile Battery = Rs. 200 … (Given)

CGST = 6% of 200

∴ CGST = SGST = Rs. 12

Rate of Headphone = Rs. 750 … (Given)

Cost = 9% of 750

∴ CGST = SGST = Rs. 67.5

Tax invoice of goods purchase is as follows:

Solution 7

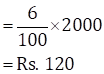

Cost of 100 Pencil boxes = 20 × 100

= Rs. 2000

CGST = 6% of 2000

∴ CGST = SGST = Rs. 120

Cost of 50 Jigsaw Puzzles = 100 × 50

= Rs. 5000

CGST = 6% of 5000

CGST = SGST = Rs. 300

Financial Planning Exercise Ex. 4.3

Solution 1

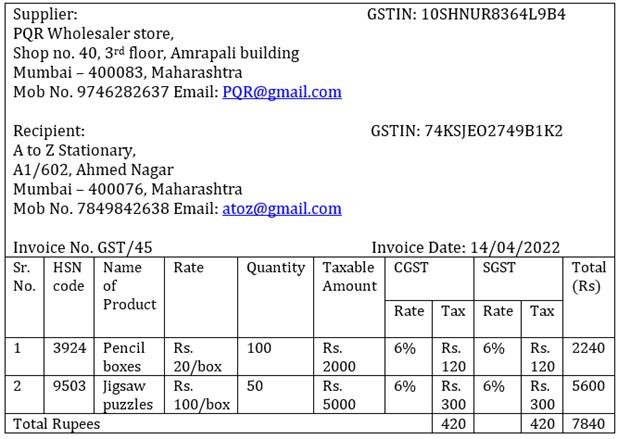

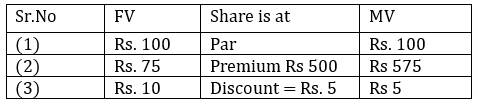

(1)

Here, share is at par

∴ MV = FV

∴ MV = Rs. 100

(2)

Here, Premium = Rs. 500, MV = Rs. 575

∴ FV + Premium = MV

∴ FV + 500 = 575

∴ FV = 575 - 500

∴ FV = Rs. 75

(3)

Here, FV = Rs. 10, MV = Rs. 5

∴ FV > MV

∴ Share is at discount.

Now, FV - Discount = MV

∴ 10 - Discount = 5

∴ 10 - 5 = Discount

Discount = Rs. 5

Solution 2

Here, MV = Rs. 80, FV = Rs. 100,

Number of shares = 50, Rate of dividend = 20%

∴ Sum invested = Number of shares × MV

= 50 × 80

= Rs. 4000

Dividend per share = 20% of FV

∴ Total dividend of 50 shares = 50 × 20 = Rs. 1000

Now, rate of return ![]()

∴ Rate of return on investment is 25%.

Solution 3

For company A:

FV = Rs. 2, premium = Rs. 18,

Number of shares = 200

∴ MV = FV+ Premium

= 2 + 18

= Rs. 20

Sum invested = Number of shares × MV

= 200 × 20

= Rs. 4000

For company B:

MV = Rs. 500, Number of shares = 45

Sum invested = Number of shares × MV

= 45 × 500

= Rs. 22,500

For company C:

MV = Rs. 10,540, Number of shares = 1

∴ Sum invested = Number of shares × MV

= 1 × 10540

= Rs. 10,540

∴ Total investment of Joseph

= Investment for company A + Investment for company B + Investment for company C

= 4000 + 22,500 + 10,540

= Rs. 37040

∴ Total investment done by Joseph is Rs. 37,040.

Solution 4

Here, FV = Rs. 5, Premium = Rs. 20,

Sum invested = Rs. 20,000

∴ MV = FV + Premium

= 5 + 20

= Rs. 25

∴ MV = Rs. 25

Now, sum invested = Number of shares × MV

∴ Number of shares ![]()

∴ Smt. Deshpande got 800 shares for Rs. 20,000.

Solution 5

Here, FV = Rs. 100, MV = Rs. 120

Dividend = 7%, Number of shares = 150

∴ Sum invested = Number of shares × MV

= 150 × 120

= Rs. 18000

Dividend per share = 7% of FV

∴ Total dividend of 150 shares = 150 × 7 = Rs. 1050

Now, rate of return ![]()

∴ Rate of return on investment is 5.83%.

Solution 6

Let the face value of share be Rs. x.

For company A:

MV = Rs. 80, Dividend = 16%

∴ Dividend = 16% of FV

Now, rate of return ![]()

For company B:

MV = Rs. 120, Dividend = 20%

∴ Dividend = 20% of FV

Now, rate of return ![]()

∴ Rate of return is more for company A.

So, investment in company A is profitable.

Financial Planning Exercise Ex. 4.4

Solution 1

Here, MV = Rs. 200, Brokerage = 0.3%

Brokerage = 0.3% of MV

∴ Purchase value of the share = MV + Brokerage

= 200 + 0.6

= Rs. 200.60

∴ Purchase value of the share is Rs. 200.60.

Solution 2

Here, MV = Rs. 1000, Brokerage = 0.1%

∴ Brokerage = 0.1 % of MV

∴ Brokerage = Rs. 1

∴ Selling value of the share = MV - Brokerage

= 1000 - 1

= Rs. 999

∴ Amount received after the sale is Rs. 999.

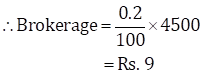

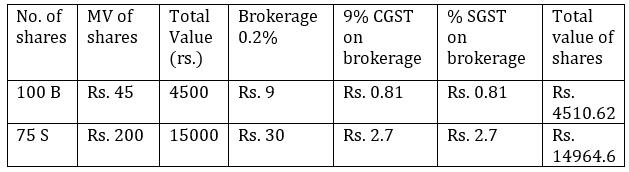

Solution 3

For buying shares:

Number of shares = 100

MV of one share = Rs. 45

∴ Total value = 100 × 45 = Rs. 4500

Now, Brokerage = 0.2% of total value

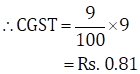

CGST = 9% of brokerage

But, SGST = CGST

∴ SGST = Rs. 0.81

∴ Purchase value of shares

= Total value + Brokerage + CGST + SGST

= 4500 + 9 + 0.81 + 0.81

= Rs. 4510.62

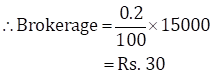

For selling shares:

Number of shares = 75

MV of one share = Rs. 200

∴ Total value = 75 × 200 = Rs. 15000

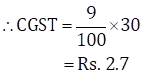

Now, Brokerage = 0.2% of total value

CGST = 9% of brokerage

But, SGST = CGST

∴ SGST = Rs. 2.7

∴ Purchase value of shares

= Total value - (Brokerage + CGST + SGST)

= 15000 - (30 + 2.7 + 2.7)

= 15000 - 35.4

= Rs. 14964.6

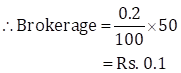

Solution 4

Here,

Face value of a share = Rs. 100

MV = Rs. 50

Selling price of shares = Rs. 4988.20

Rate of brokerage = 0.2%

Rate of GST = 18%

∴ Brokerage = 0.2% of MV

Now, GST = 18% of brokerage

Selling price of one share = MV - (Brokerage + GST)

= 50 - (0.1 + 0.018)

= 50 - 0.118

= Rs. 49.882

![]()

∴ Smt. Desai sold 100 shares.

Solution 5

For purchasing shares:

FV = Rs. 50, Number of shares = 200, Premium = Rs. 100

Now, MV of 1 share = FV + premium

= 50 + 100

= Rs. 150

∴ MV of 200 shares = 200 × 150 = Rs. 30,000

∴ Mr. D'souza invested amount

= MV of 200 shares + brokerage

= 30,000 + 20

= Rs. 30,020

For selling shares:

Rate of dividend = 50%, FV = Rs. 50, Brokerage = Rs. 20

Also, Number of shares = 200

∴ Dividend per share = 50% of FV

∴ Dividend of 200 shares = 200 × 25 = Rs. 5,000

Now, 100 shares are sold at a discount of Rs. 10.

∴ Selling price of 1 share = FV - discount

= 50 - 10

= Rs. 40

∴ Selling price of 100 shares = 100 × 40 = Rs. 4000

∴ Amount obtained after selling 100 shares

= selling price - brokerage

= 4000 - 20

= Rs. 3980

Also, remaining 100 shares are sold at premium of Rs. 75.

∴ Selling price of 1 share = FV + premium

= 50 + 75

= Rs, 125

∴ Selling price of 100 shares = 100 × 125 = Rs. 12,500

∴ Amount obtained after selling remaining 100 shares

= Selling price - Brokerage

= 12,500 - 20

= Rs. 12,480

∴ Mr D'souza income = 5000 + 3980 + 12480 = Rs. 21460

Now, Mr D'souza invested amount > income

∴ Mr D'souza incurred a loss.

∴ Loss = amount invested - income

= 30020 - 21460

= Rs. 8560

∴ Mr. D'souza incurred a loss of Rs. 8560.

Financial Planning Exercise Problem Set 4A

Solution 1(1)

(C)

Rate of GST on essential commodities is 0%.

Solution 1(2)

(B)

The tax levied by the central government for trading within state is CGST.

Solution 1(3)

(D)

GST system was introduced in our country from 1st July 2017.

Solution 1(4)

(B)

Rate of SGST = ½ × Rate of GST = 9%

Solution 1(5)

(A)

In the format of GSTIN there are 15 alpha-numerals.

Solution 1(6)

(B)

When a registered dealer sells goods to another registered dealer under GST, then this trading is termed as B2B.

Solution 2

Printed price of showpiece = Rs. 25,000 … (Given)

Rate of discount = 10% … (Given)

∴ Amount of discount = 10% of printed price

∴ Taxable value = Printed price - discount

= 25,000 - 2500

= Rs. 22,500

Rate of GST = 28% … (Given)

∴ Rate of CGST = 14% and Rate of SGST = 14%

∴ CGST = 14% of taxable value

∴ CGST = SGST = Rs. 3150

∴ Total amount of tax invoice

= Taxable value + CGST + SGST

= 22500 + 3150 + 3150

= Rs. 28,800

∴ The total amount shown in the tax invoice is Rs. 28,800, and the amount of CGST and SGST is Rs. 3150 each.

Solution 3

Printed price of the dress = Rs. 1000 … (Given)

Rate of discount = 5% … (Given)

∴ Amount of discount = 5% of printed price

∴ Taxable value = Printed price - discount

= 1000 - 50

= Rs. 950

Rate of GST = 5% … (Given)

∴ GST = 5% of taxable value

∴ GST = Rs. 47.5

Purchase price of the dress

= Taxable value + GST

= 950 + 47.5

= Rs. 997.50

∴ Purchase price of the dress for the customer is Rs. 997.50.

Solution 4

Taxable amount of cotton clothes = Rs. 2.5 lacs … (Given)

Rate of GST = 5% … (Given)

∴ GST = 5% of taxable amount

∴ Trader of Rajkot has to pay GST of Rs. 12,500.

Solution 5

Cost price of solar panels = Rs. 85,000 … (Given)

Selling price of solar panels = Rs. 90,000 … (Given)

Rate of GST = 5% … (Given)

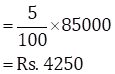

∴ Output tax = 5% of 90000

Also, Input tax = 5% of 85000

∴ ITC = Rs. 4250.

∴ GST payable = Output tax - ITC

= 4500 - 4250

= Rs. 250

∴ GST payable = Rs. 250

∴ ITC of Smt. Malhotra is Rs 4250 and amount of GST payable by her is Rs. 250.

Solution 6

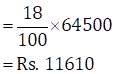

Taxable value = Rs. 64,500 … (Given)

Rate of GST = 18% … (Given)

∴ Output tax = 18% of 64500

Input tax = Rs. 1550 … (Given)

∴ GST payable = Output tax - ITC

= 11610 - 1550

∴ GST payable = Rs. 10060

SGST = CGST ![]()

∴ Amount of ITC is Rs. 1550. Amount of CGST and SGST payable by the company is Rs. 5030 each.

Solution 7

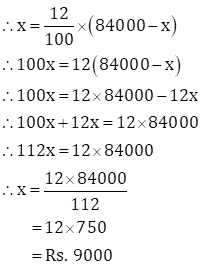

Let the amount of GST be charged Rs x.

Price of walky talky with GST = Rs. 84,000 … (Given)

∴ Taxable value of walky talky = Rs. (84,000 - x)

Now, as the rate of GST is 12%

∴ GST = 12% of taxable value

∴ GST = Rs. 9000

∴ Taxable value of walky talky

= Rs. (84000 - x)

= Rs. (84000 - 9000)

= Rs. 75,000

Now, SGST = CGST ![]()

∴ Amount of state and central GST charged by the dealer is Rs. 4,500 each. Also, taxable value of the set is Rs. 75,000.

Solution 8

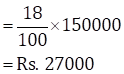

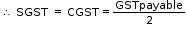

Taxable amount = Rs. 1,50,000, Rate of GST = 18%

Taxable amount for retailer = Rs. 1,80,000

Taxable amount for customer = Rs. 2,20,000

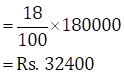

For wholesaler:

∴ Output tax = 18% of 180000

Input tax = 18% of 1,50,000

∴ GST payable = Output tax - ITC

= 32400 - 27000

= Rs. 5400

For retailer:

Output tax = 18% of 2,20,000

Input tax = 18% of 1,80,000 = Rs. 32400

∴ ITC = Rs. 32400

GST payable = Output tax - ITC

= 39600 - 32400

= Rs. 7200

∴ SGST = CGST ![]()

GST payable at each stage of trading are as follows:

Solution 9

(1)

For Anna Patil:

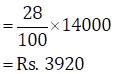

Output tax = 28% of 14,000

∴ CGST = SGST ![]()

∴ Amount of CGST and SGST shown in the tax invoice issued by Anna Patil is Rs. 1960 each.

(2)

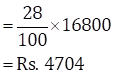

For Shopkeeper in Vasai:

Output tax = 28% of 16,800

∴ CGST = SGST ![]()

∴ Amount of CGST and SGST charged by the shopkeeper in Vasai is Rs. 2352 each.

(3)

ITC = Rs. 3920

GST payable by shopkeeper in Vasai

= Output tax - ITC

= 4704 - 3920

= Rs. 784

∴ CGST = SGST ![]()

∴ Amount of CGST and SGST paid by the shopkeeper in Vasai is Rs. 392 each.

Solution 10

(1)

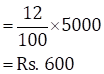

For wholesaler:

Output tax = 12% of 5000

For Distributor:

Output Tax = 12% of 6000

∴ ITC = Rs. 600

∴ GST payable = Output tax - ITC

= 720 - 600

= Rs. 120

For Retailer:

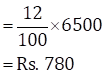

Output tax = 12 % of 6500

∴ ITC = Rs. 720

∴ GST payable = Output tax - ITC

= 780 - 720

= Rs. 60

Statement of GST payable at each stage of trading:

(2)

ITC for consumer = Rs. 780

∴ Amount paid by consumer

= taxable value + ITC

= 6500 + 780

= Rs. 7280

∴ Amount paid by the consumer is Rs. 7280.

(3)

B2B = Wholesaler to Distributor

B2B = Distributor to Retailer

B2C = Retailer to Consumer

Financial Planning Exercise Problem Set 4B

Solution 1(1)

Face value = Rs. 100

Market value = Rs. 75

Since, FV > MV

∴ Share is at a discount

∴ Discount = 100 - 75 = Rs. 25

Solution 1(2)

Face value = Rs. 10

∴ Dividend ![]()

Solution 1(3)

Net asset value of one unit = Rs. 10.65

Amount required to buy 500 such units = 10.65 × 500 = Rs. 5325

Solution 1(4)

Rate of GST on brokerage = 18%

Solution 1(5)

To find the cost of one share at the time of buying the amount of Brokerage and GST is to be added to the MV of share.

Solution 2

Given: Face Value of share = Rs. 100, Premium = Rs. 30, brokerage = 0.3%

Now, MV = FV + Premium

= 100 + 30

= Rs. 130

Brokerage = 0.3% of MV

Purchase price of a share = MV + Brokerage

= 130 + 0.39

= Rs. 130.39

∴ Purchase price of a share is Rs. 130.39.

Solution 3

Given: Number of shares = 50, FV = Rs. 100, MV = Rs. 180, Rate of dividend = 40%

∴ Sum invested = Number of shares × MV

= 50 × 180

= Rs. 9000

Dividend per share = 40% of FV

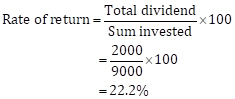

∴ Total dividend on 50 shares = 50 × 40 = Rs. 2000

∴ Rate of return on investment is 22.2%.

Solution 4

Given: FV = Rs. 100, number of shares = 300, discount = Rs. 30

MV of 1 share = FV - Discount

= 100 - 30

= Rs. 70

∴ MV of 300 shares = 300 × 70 = Rs. 21,000

∴ Amount received is Rs. 21,000.

Solution 5

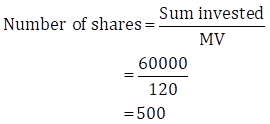

Given: FV = Rs. 100, MV = Rs. 120, Sum invested = Rs. 60,000

∴ Number of shares received was 500.

Solution 6

For purchasing shares:

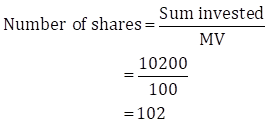

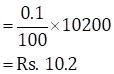

Given: Sum invested = Rs. 10,200, MV = Rs. 100, Brokerage = 0.1%

Brokerage = 0.1% of sum invested

∴ Purchase value of 102 shares

= Sum invested + brokerage

= 10200 + 10.2

= Rs. 10210.2

For selling shares:

60 shares sold at MV of Rs. 125.

∴ MV of 60 shares = 125 × 60 = Rs. 7500

Brokerage = 0.1% of sum invested

∴ Sale value of 60 shares = 7500 - 7.5 = Rs. 7492.5

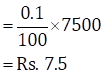

Now, remaining shares = 102 - 60 = 42

But 42 shares sold at MV of Rs. 90.

∴ MV of 42 shares = 42 × 90 = Rs. 3780

∴ Brokerage ![]()

∴ Sale value of 42 shares = 3780 - 3.78 = Rs. 3776.22

Total sale value = 7492.5 + 3776.22 = Rs. 11268.72

Since, Purchase value < Sale value

∴ Profit is gained.

∴ Profit = Sale value - Purchase value

= 11268.72 - 10210.2

= Rs. 1058.52

∴ Smt. Mita Agrawal gained a profit of Rs. 1058.52.

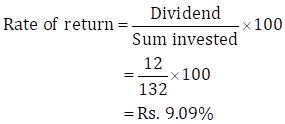

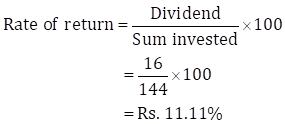

Solution 7

For company A:

FV = Rs. 100, MV = Rs. 132, Rate of dividend = 12%

∴ Dividend = 12% of FV

For company B:

FV = Rs. 100, MV = Rs. 144, Rate of dividend = 16%

∴ Dividend = 16% of FV

∴ Rate of return for company B is more.

So, investment in company B is more profitable.

Solution 8

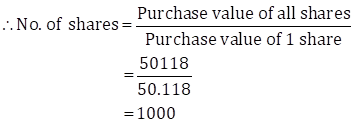

Given: FV = Rs. 100, MV = Rs. 50, Purchase value of shares = Rs. 50118,

Rate of brokerage = 0.2%, Rate of GST = 18%

Now, Brokerage = 0.2% of MV

GST = 18% of brokerage

Purchase value of shares = MV + Brokerage + GST

= 50 + 0.1 + 0.018

= Rs. 50.118

∴ 1000 shares were purchased for Rs. 50,118.

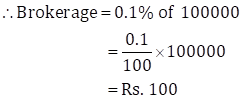

Solution 9

Given: Sale value = Rs. 30500, Purchased value = Rs. 69650, Brokerage = 0.1%, Rate of GST = 18%

Total amount = sale value + Purchase value

= 30350 + 69650

= Rs. 1,00,000

Rate of Brokerage = 0.1 %

∴ GST = 18 % of brokerage

Total expenditure on brokerage and tax = 100 + 18 = Rs. 118

∴ Total expenditure on brokerage and tax is Rs. 118.

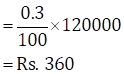

Solution 10

Given: FV = Rs. 100, Number of shares = 100, MV = Rs. 1200,

Brokerage = 0.3%, Rate of GST = 18%

(1)

Sum invested = Number of shares × MV

= 100 × 1200

= Rs. 1,20,000

∴ Net amount paid for 100 shares is Rs. 1,20,000.

(2)

Brokerage = 0.3% of sum invested

∴ Brokerage paid on sum invested is Rs. 360.

(3)

GST = 18% of brokerage

∴ GST paid on brokerage is Rs. 64.80.

(4)

Total amount paid for 100 shares

= Sum invested + Brokerage + GST

= 1,20,000 + 360 + 64.80

= Rs. 1,20,424.80

∴ Total amount paid for 100 shares is Rs. 1,20,424.80.

Solution 11

For purchasing shares:

Given: FV = Rs. 100, MV = Rs. 660, Number of shares = 22, Rate of brokerage = 0.1%

Now, Sum invested = MV × Number of shares

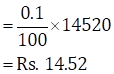

∴ Sum invested = 660 × 22 = Rs. 14,520

Brokerage = 0.1 % of sum invested

∴ Amount invested for 22 shares

= Sum invested + Brokerage

= 14520 + 14.52

= Rs. 14534.52

For dividend:

Rate of dividend = 20%

∴ Dividend per share = 20 % of FV

∴ Dividend of 22 shares = 20 × 22 = Rs. 440

For selling shares:

Given: MV = Rs. 650, Rate of brokerage = 0.1%

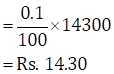

∴ MV of 22 shares = 22 × 650 = Rs. 14300

Brokerage = 0.1% of 14300

Smt. Anagha's income

= Dividend + MV of 22 shares - Brokerage

= 440 + 14300 - 14.30

= Rs. 14725.7

Since, income >amount invested

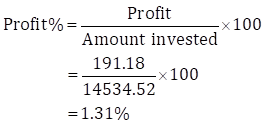

∴ Profit is gained.

Now, Profit = Income - Amount invested

= 14725.7 - 14534.52

= Rs. 191.18

∴ Percentage of profit in the share trading is 1% (nearest integer).