Class 12-commerce NCERT Solutions Economics Chapter 5: The Government: Budget and the Economy

The NCERT solutions for the CBSE Class 12 Commerce Economics chapter The Government: Budget and the Economy at TopperLearning can help students to perform well in the exams. The comprehensive answers help students not only to summarise the chapter for quick learning but also to write detailed answers in the exams. Along with the NCERT solutions, students can refer to our sample papers, past years’ papers, revision notes, video lessons etc.

The Government: Budget and the Economy Exercise 83

Solution 1

Goods which have the qualities of non-rivalry and non-excludability are called public goods. Non-excludability indicates that people cannot be excluded from enjoying the benefits of goods, whereas non-rivalry denotes that the consumption of goods by one person cannot affect the consumption of those goods by another person.

Reasons for providing public goods by the government:

- The private sector does not show interest in providing public goods as the benefits of these goods can be easily enjoyed by all individuals. This quality of public goods makes these goods not-marketable.

- As people cannot be excluded from using public goods, it becomes difficult for the private sector to provide these goods.

- Public goods are mainly necessity goods and important for the economic development of the nation, so they must be provided by the government.

Solution 2

Differences between revenue expenditure and capital expenditure:

|

Revenue expenditure |

Capital expenditure |

|

Does not generate assets for the government |

Generates assets for the government |

|

Liability of the government cannot be reduced by revenue expenditure |

Liability of the government can be reduced by capital expenditure |

|

Examples: Expenditure on the defence sector, paying interest payments |

Examples: Buying of shares, expenditure on building roads and highways |

Solution 3

Fiscal deficit is the difference between the government's total expenditure and total receipts without considering the borrowing.

The fiscal deficit indicates how much a government has to borrow from external and internal sources to fill the gap between expenditure and receipts.

The following formula describes fiscal deficit:

![]()

The fiscal deficit indicates the requirement of borrowings to meet its expenditure. In most developing nations, government expenditure is often more than its receipts. So, to fulfil the requirements of expenditure, governments have to borrow from external and internal sources.

Solution 4

Revenue deficit is the difference between revenue expenditure and revenue receipts of the government. On the other hand, fiscal deficit is the difference between the government's total expenditure and total receipts without considering the borrowing.

An increase in the fiscal deficit causes a rise in the revenue expenditure due to a rise in the interest payment.

An increase in the revenue expenditure causes a rise in the fiscal deficit as the gap between total expenditure and total receipts is filled by fiscal deficit.

Thus, there is a positive relationship between revenue deficit and fiscal deficit as they tend to push each other up.

Solution 5

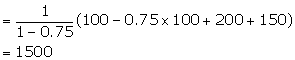

(a) The level of equilibrium income is calculated by considering the government investment, government purchases, net taxes and consumption level in the economy.

As given,

Investment = 200

Government purchases = 150

Net taxes = 100

Autonomous consumption expenditure = 100

Marginal propensity to consume = 0.75

Putting the above values in the below formula to calculate the equilibrium income level,

Thus, the equilibrium income level is 1500.

The value of the government expenditure multiplier is calculated by considering the changes in the income and government expenditure.

Thus, the value of government expenditure multiplier is 4.

(b) Value of tax multiplier is calculated by changes in the income level and the taxes.

Thus, the value of government tax multiplier is 3.

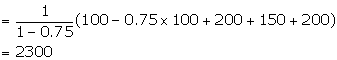

(c) If the government increases its expenditure by 200, then there will be an increase in the income equilibrium level.

So, the new income level is 2300. Change in the equilibrium level is calculated by considering the new income level and the old income level, i.e. 23000 - 1500 = 800.

The Government: Budget and the Economy Exercise 84

Solution 6

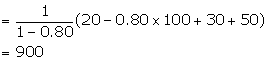

(a) The level of equilibrium income is calculated by considering the government investment, government purchases, net taxes and consumption level in the economy.

As given,

I= 30

G=50

TR=100

The equilibrium level of income=

Thus, the equilibrium income level is 900.

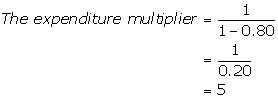

The expenditure multiplier is calculated by considering the propensity to spend.

Thus, the expenditure multiplier is 5.

(b) If the government increases its expenditure by 200, then there will be an increase in the income equilibrium level.

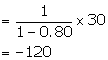

So, the new income level is 1050. The change in equilibrium level is calculated by considering the new income level and the old income level, i.e. 1050 - 900 = 150.

(c) Tax multiplier and changes in taxes are considered while calculating the effect of tax rate changes on the equilibrium.

Changes in income=

New equilibrium will be calculated by considering the old equilibrium and new equilibrium levels. Therefore, the new equilibrium level = 900 + (-120) = 780

Solution 7

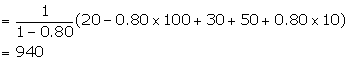

If the government increases its transfers by 10%, then there will be an increase in the income equilibrium level.

Equilibrium level of income =

Thus, the new equilibrium level will be 940 and the changes in income level is 40 (940 - 900).

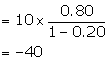

If the government increases its taxes by 10%, then there will be a decrease in the income equilibrium level.

Thus, the new equilibrium level will be reduced by -40 because of a rise in taxes.

The above results indicate that there will be a rise in the income level due to an increase in transfers and a decline in the equilibrium level due to an increase in taxes.

Solution 8

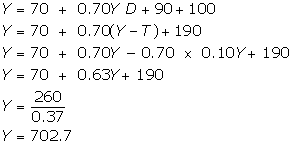

The following equation is used to calculate the income equilibrium level.

![]()

As given,

C = 70 + 0.70Y D

I = 90

G = 100

T = 0.10Y

Substituting the values in the equation,

Thus, the equilibrium income level will be 702.7.

Tax revenue at equilibrium is calculated by considering the tax multiplier and the equilibrium income level.

As given,

T = 0.10Y

Putting in the formula,

Tax revenue = 0.10 × 702.7

Tax revenue =70.27

Thus, the tax revenue is 70.27.

If the government tax revenue is more than the government expenditure, then there will be a deficit budget. Here, government spending (100) is more than tax revenue (70.27), so the government does not have a balanced budget.

Solution 9

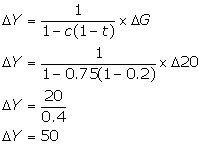

(a)

As given,

MPC = 0.75

Changes in professional income tax = 20%

Putting these values in the below formula,

If the government purchases increase by 20, then there will be an increase by 50 in the equilibrium level.

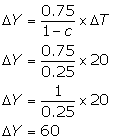

(b)

Thus, the new equilibrium level will be 60.

Solution 10

A tax multiplier will have a negative impact on the equilibrium level. A rise in taxes negatively affects the disposable income which finally recues the aggregate demand. On the contrary, increased government expenditure causes a rise in the aggregate demand.

The expenditure multiplier will have comparatively larger impacts on the economy than the tax multiplier. This shows that the tax multiplier is smaller in absolute value than the government expenditure multiplier.

Solution 11

Government deficit is the difference between government expenditure and government receipts of the government. On the other hand, government debt implies the liabilities of the government caused by mainly loans and advances taken from internal and external sources.

An increase in government deficit causes a rise in government debt. Government debt is likely to increase when there is an increase in government deficit.

Thus, there is a positive relationship between government deficit and government debt as they tend to push each other up.

Solution 12

Yes. Public debt imposes a burden on the economy. Public debt arises when the government borrows from external and internal sources for various purposes. The burden is created through the following ways:

Impositions of taxes: Taxes are imposed on individuals to reduce the burden of debt.

Government creates currency to reduce the burden of debt. However, this practice leads to higher inflation in the economy.

Burden on future generation: Public debt creates a huge burden on the future generation as they will have to repay the loans and advances taken by the government.

Solution 13

Fiscal deficit does not lead to inflation always. It can be increased when there is an increase in government expenditure and reduction in government taxes. In this situation, fiscal deficit is not inflationary.

At the initial stage, there might be chances that fiscal deficit would lead to inflationary saturation if the resources are not used properly.

If the market is not able to meet the increased demands, then there will be an increase in inflation.

Solution 14

Government deficit can be reduced in the following ways:

Reducing government expenditure: Deficit can be reduced by reducing government expenditure. Reduction in government expenditure can negatively affect the economic growth of developing nations like India.

Increasing government revenue: Deficit can be reduced by increasing taxes to increase the revenue. However, an increase in taxes leads to decrease in the disposable income and eventually a decline in the aggregate demand.

Disinvestment: Government can raise more money through disinvestment in public sector undertakings. This might lead to reduction in government assets.

Solution 15

Goods and Service Tax (GST) is the single comprehensive indirect tax, operational from 1 July 2017, on supply of goods and services, right from the manufacturer/ service provider to the consumer.

It is a destination based consumption tax with facility of Input Tax Credit in the supply chain. It is applicable throughout the country with one rate for one type of goods/service

Prior to the introduction of the GST tax regime imposed taxes not on the value added at each stage but on the total value of the commodity/service with minimal facility of utilisation of Input Tax Credit (ITC). The total value included taxes paid on intermediate goods/services. This amounted to cascading of tax.

With the introduction of GST, the tax is discharged at every stage of supply and the credit of tax paid at the previous stage is available for set off at the next stage of supply of goods and/or services. It is thus effectively a tax on value addition at each stage of supply.

Under GST, there are 6 (six) standard rates applied i.e. 0%, 3%,5%, 12%,18% and 28% on supply of all goods and/or services across the country.