CBSE Class 12-commerce Answered

what is the treatment of this retirememt question :-

1. investment fluctuation fund is given in liabilities side of balance sheet :- Rs.1200

2. Investment at cost is given in assets side of balance sheet :- Rs.5000

EXTRA INFORMATION : -

Investment flactuation fund be brought to Rs.500

Asked by mahendraprasad74 | 11 Oct, 2019, 05:02: PM

Investment fluctuation reserve is a type of fund which is kept aside for any fall in the value of investments. In case if the value of investments falls below the book value, such fall is first adjusted against the Investment fluctuation reserve and if any balance reserve is left after reducing such fall, then it is distributed among the partners.

Answered by Surabhi Gawade | 12 Oct, 2019, 10:05: AM

Application Videos

Concept Videos

CBSE 12-commerce - Accountancy

Asked by joymotibarman | 15 Jan, 2024, 02:15: PM

CBSE 12-commerce - Accountancy

Asked by divyanshmaheshwari2003 | 04 Nov, 2023, 05:06: PM

CBSE 12-commerce - Accountancy

Asked by deepamonidas1234 | 21 Sep, 2023, 09:14: PM

CBSE 12-commerce - Accountancy

Asked by officialpaperio.man | 31 Jan, 2022, 09:14: AM

CBSE 12-commerce - Accountancy

Asked by swapnil292001 | 08 Nov, 2020, 11:22: AM

CBSE 12-commerce - Accountancy

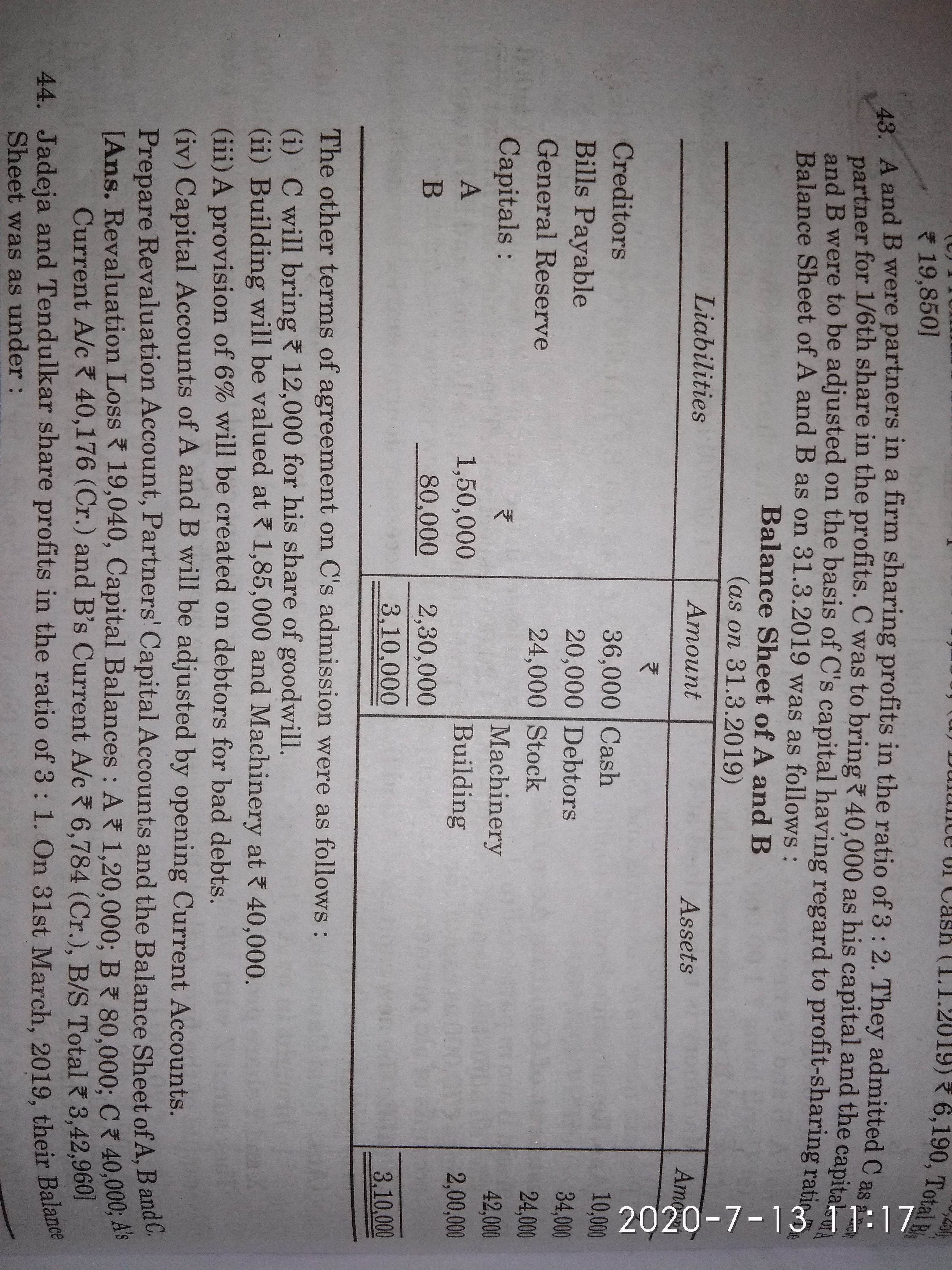

Asked by raksha2sanubth | 13 Jul, 2020, 11:22: AM

CBSE 12-commerce - Accountancy

Asked by raksha2sanubth | 13 Jul, 2020, 11:19: AM

CBSE 12-commerce - Accountancy

Asked by sonowalabhilash | 02 Jul, 2020, 09:46: AM

CBSE 12-commerce - Accountancy

Asked by simarjiv10 | 24 Jun, 2020, 11:25: PM